24/7 Cryptocurrency News

SHIB, Binance Listings, & Market Recovery Spark Buzz

Published

3 days agoon

By

admin

The dynamic realm of crypto has closed another week, primarily with remarkable developments unfolding across the broader sector. While Shiba Inu (SHIB) saw remarkable community advancements, Binance unveiled a stockpile of token listings, sparking market discussions. Simultaneously, with the broader market showcasing signs of recovery as 2025 commences, this week proved to be buzzworthy.

So, let’s delve deeper into some of the top crypto market updates reported by CoinGape over the past week.

Shiba Inu (SHIB) Sees Notable Advancements

The renowned dog-themed meme coin Shiba Inu has emerged as the talk of the crypto market this week, witnessing a landmark development followed by constant token burns and a price upswing. The token’s lead developer, Shytoshi Kusama, confirmed that the TREAT token launch lies shortly ahead, sparking considerable optimism across the SHIB ecosystem.

Intriguingly, the launch remains much awaited by community participants, much touted to be a revolutionary endeavor. Simultaneously, the continuous SHIB burn has added to investor enthusiasm surrounding the digital asset. CoinGape spotlighted that the meme coin even eyes 45% gains ahead, primarily against the backdrop of Shiba Inu burn rate surge and strong market trends. Overall, market watchers optimistically eye the token, expecting imminent future gains.

Binance’s Crypto Listings Echo Buzz

On the other hand, crypto exchange giant Binance’s listing chronicles have garnered substantial attention this week. Notably, the leading crypto exchange expanded support for a stockpile of tokens.

CoinGape reported that Binance expanded trade offerings for DOGE, SHIB, and PEPE this week, sparking optimism over the coins’ future prices. Particularly, the platform’s P2P division expanded support for new trading pairs for the mentioned tokens in selected fiat zones across Africa.

Simultaneously, the exchange also unveiled major support for PHA and DF coins this week. Notably, Binance announced new perpetual contracts for Phala Network (PHA) and dForce (DF) tokens with up to 75x leverage, adding to its market chronicles.

Meanwhile, it’s also noteworthy that the exchange secured a major regulatory approval in Brazil this week. Binance has bagged regulatory approval from the Central Bank of Brazil, allowing it to acquire a licensed broker-dealer in the region. Overall, these chronicles have gained significant traction amid the exchange’s rising success, with investors optimistic about the future prices of the mentioned tokens amid enhanced offerings.

Crypto Market Recovery Sparks Hope

Simultaneously, Bitcoin and top cryptocurrency prices have shown signs of recovery as 2025 kicked off, sparking market discussions globally. BTC price witnessed gains worth 3% over the past seven days and closed the week at the $98K level. ETH price witnessed gains worth 8% over the past seven days to close the week at $3,647. Simultaneously, XRP’s price was noted to be up 10% weekly, closing at $2.402. As a response, market sentiments in Q1 2025 remain highly bullish.

Notably, the top cryptos enjoy renewed market interest, as also indicated by recent events. Microstrategy again announced plans to raise up to $2 billion in an effort to purchase more BTC.

Simultaneously, Ethereum whale accumulation amid the recent market dip saw a substantial rise. This saga has added another bullish tint to top crypto prices amid a broader market recovery.

In addition, the Ripple community saw notable developments, with bets of an XRP ETF soaring. CoinGape reported that Polymarket data flagged a 70% probability of a potential Ripple ETF approval in the U.S. This saga has garnered significant optimism toward the leading crypto.

Also, Ripple’s RLUSD stablecoin was recorded flipping its core rivals in 24-hour trading volume this week. Overall, the abovementioned news emerged as some of the most buzzworthy crypto market updates over the past week.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Web 4.0 – Blockchain and AI Will Usher In a More Humane and User-Friendly Web

Democrats Should Reverse Their Stance On Bitcoin

Ripple CEO Brad Garlinghouse Confirms Mar-a-Lago Meeting with Donald Trump

The Most Eye-Catching and Absurd AI Products Unveiled at CES 2025 So Far

Meet Jason Marquez: The Truck Driver Who made $750,000 on MicroStrategy

24/7 Cryptocurrency News

BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Published

39 minutes agoon

January 8, 2025By

admin

BlackRock’s iShares Bitcoin ETF (IBIT) recorded over $597 million in inflow on Tuesday. The BlackRock Bitcoin ETF saves the day for the bleeding crypto market after investors turned cautious with strong US JOLTS job openings and ISM Services PMI data.

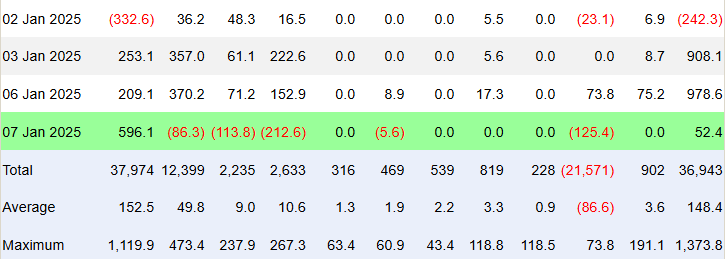

The spot Bitcoin ETF in the United States saw a net inflow of $53.46. Bitcoin ETFs by Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale recorded outflows.

BlackRock Bitcoin ETF Saw Inflow Despite Crypto Market Crash

BlackRock’s iShares Bitcoin ETF (IBIT) purchased 6,078 BTC worth $208.7 on January 7, while miners only mined 450 new BTCs. IBIT recorded an inflow of $597.18 million, as per Trader T data.

This makes the third consecutive inflow into IBIT despite a major selloff in the crypto market. Notably, US Bitcoin ETF saw an inflow of $978.6 million on Monday, sparking optimism as the flagship crypto soared past the $102K mark.

Meanwhile, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB saw outflow of $86.29 million, $113.85 million, and $212.55 million, respectively. Also, Franklin EZBC saw a $5.58 million in outflow.

Grayscale’s GBTC also witnessed an outflow of $125.45 million. Flows were zero for Invesco, Valkyrie, VanEck, and Grayscale Mini.

According to Farside Investors, the total net inflow for Bitcoin spot ETFs reached $52.4 million. The iShares Bitcoin Trust by BlackRock saw a net inflow of $596.1 million. Whereas, other ETFs experienced varying degrees of outflow.

Bitcoin and Crypto Market Crash On Macro Concerns

According to the U.S. Bureau of Labor Statistics, the JOLTS jobs openings increased by 259,000 to 8,098 million in November 2024, Also, ISM Services PMI came in higher than expected, which shows the resilience of the U.S. economy currently. This caused Bitcoin price to crash by more than 5%.

In fact, the US dollar index (DXY) holds its advance above 108.50 today, after a two-day low move that caused a recovery in Bitcoin price. Also, the 10-year US Treasury yield increased to a 35-week high of 4.68%. The strong US economic data reduced expectations for further rate cuts by the Federal Reserve.

Whereas, BTC price continues to fall despite better performance by BlackRock Bitcoin ETF. The price currently trades at $96,259. The 24-hour low and high are $96,132 and $102,022, respectively. Furthermore, the trading volume has decreased by 23% in the last 24 hours.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ripple CEO Brad Garlinghouse Confirms Mar-a-Lago Meeting with Donald Trump

Published

5 hours agoon

January 8, 2025By

admin

Ripple CEO Brad Garlinghouse revealed on social media that he recently had dinner with former President Donald Trump and Ripple’s Chief Legal Officer, Stuart Alderoty.

The meeting that happened at Trump’s Mar-a-Lago resort is an important beginning to the year 2025 for Ripple especially with the current changes happening in the cryptocurrency market.

Ripple CEO and CLO Meeting with Donald Trump

On Monday evening, Ripple CEO Brad Garlinghouse revealed his meeting with Donald Trump and Stuart Alderoty on the platform X (previously Twitter). “Had a great dinner last night with @realDonaldTrump & @s_alderoty. ”Great start to 2025!” he posted indicating that things are looking good for Ripple.

Stuart Alderoty, Ripple’s legal head, also commented on the event, joking about the dinner’s menu: “The beef bourguignon was really good.”

The dinner at Mar-a-Lago takes place at a time when Ripple has been building up its steam with wins against the U.S Securities and Exchange Commission (SEC) in court.In line with the optimism, crypto analysts have provided bullish signals for XRP, some of whom have forecasted a price surge to $3.

John Deaton Breaks Silence on Ripple CEO Meet Up

Ripple has recently come into the limelight for its legal victory against the SEC where the latter had alleged that the company and Garlinghouse sold unregistered securities via XRP. The lawsuit that lasted for more than two years concluded with the victory of Ripple, which opened up new possibilities for the future of the cryptocurrency market.

John E. Deaton, a pro XRP lawyer and following the case commented on X that Ripple’s win means that the company has remained unshaken. He also pointed to the SEC’s aggressive approach in the litigation process, which involved serving Garlinghouse with personal subpoenas to produce financial information.

”Ripple and Brad disclosed every XRP transaction that has ever taken place, but the SEC acted misconduct when it came to discovery,” Deaton said. However, Ripple has come out even stronger, suggesting that more positive outcomes are in the offing for the company and the sector as a whole.

Cynthia Lummis Chats With US SEC Potential Chairman

Ripple CEO, Brad Garlinghouse has also noted recent expansion of Ripple’s activities within the United States which shows that the focus has shifted back to the domestic market.He disclosed that three quarters of the new positions at Ripple are based in the United States, something that was not the case in the past given the company’s focus on the international market.

Furthermore, the company signed up more US business contracts in the last six weeks of the year 2024 than it had in the six months prior to that period.

The dinner comes after several meetings between politicians and crypto enthusiasts. U.S. Senator Cynthia Lummis, an advocate for blockchain technology, has also been engaging with Paul Atkins, the man expected to be named SEC chairman by President-elect Trump. These discussions focus on the need to reform the SEC’s rule making process and to advance the use of digital assets.

Ripple’s Growing Market Influence

Ripple is also coming up strongly in the blockchain space with new products being introduced. Ripple President Monica Long stated that the stablecoin, RLUSD, which was recently launched, is expected to be listed on multiple platforms.

At the same time, the company has joined Chainlink to work on the integration of secure and accurate pricing of RLUSD into the DeFi ecosystem.

In these developments, Ripple has witnessed a rise in its valuation due to the increased prices of XRP and the increasing adoption of its solutions. Ripple CEO Brad Garlinghouse has earlier stated that the $11 billion valuation of the company is quite dated given the current situation.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why BTC, ETH, DOGE, & Other Altcoins Fell

Published

9 hours agoon

January 7, 2025By

admin

The cryptocurrency market was in the red on Tuesday as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE) and other digital assets tanked. The crypto market crash happened at the same time as other risk-off events across the global financial market due to higher US treasury yields, a more hawkish Fed, and increased macroeconomic risk.

Why The Sudden Crypto Market Crash?

Rising U.S. Treasury Yields Trigger Risk-Off Sentiment

The crypto market has been declining today, and one of its leading causes was the increase in bond yields. The 10-year U.S. Treasury yield rose to 4.70%, with the 30-year and 5-year U.S. Treasury yields also up at 4.61% and 4.50%, respectively.

For context, higher bond yields make traditional investments more attractive, drawing capital away from riskier assets like cryptocurrencies. This shift also lead to further sell-off across other assets classes, including equities. The Nasdaq 100 dropped more than 1 percent and popular tech stocks including NVIDIA and Tesla suffered losses. For instance, Tesla stocks fell by 4.68% to $391.81 per share wiping off $19.24 of the share value.

2. Hawkish Federal Reserve Outlook Adds to Pressure

Moreover, the stance of the Federal Reserve’s monetary policy also played a big role in influencing investor perception. Minutes from the December meeting estimated lower interest rate cuts in 2025 than earlier projected.

The reports before the Fed minutes unveiled a robust labour market with job openings climbing to a six-month high. This led to a question of a possible continued inflation, which would mean a stricter monetary policy. In the past, tighter policies have been unfavorable to the cryptocurrencies as the higher interest rates make the cryptocurrencies unattractive.

Also, JOLTS job openings increased by 259,000 to 8.1 million in November 2024, which was the second straight month of growth. Professional services and finance were the best performers in the market. ISM Services PMI also pointed to the continuation of economic performance which stirred the fears of limited fed rate cuts in 2025.

3. Macro Uncertainty and Broader Economic Concerns

Uncertainty in the U.S. economy has heightened market volatility. Fiscal policies under President Donald Trump and the looming debt ceiling have created investor unease. Rising fiscal deficits and unclear Treasury strategies add to the concerns, further impacting market confidence.

Analysts, including Arthur Hayes, predict a short-term boost for crypto in Q1 2025 due to increased U.S. dollar liquidity. The Treasury’s spending could temporarily fuel gains for Bitcoin and Ethereum. However, the need to refill the Treasury General Account and April’s tax season could reverse these gains, leading to a crypto market crash.

Crypto-linked stocks like Coinbase and MicroStrategy have also suffered sharp declines. Rising bond yields and the Federal Reserve’s hawkish stance have intensified the sell-off. This downturn reflects the interconnected nature of global markets

BTC, ETH, DOGE, And Altcoins Price Action Amid Crypto Market Crash

The crypto market’s losses were pronounced, with major cryptocurrencies suffering steep declines and trading volumes surging amid the sell-off.

Bitcoin (BTC) price dropped 5.04% to $96,713, falling below the $100,000 psychological support level. The 24-hour trading volume rose 13% to $55.12 billion, indicating increased activity as traders reacted to the downturn. Its market capitalization declined to $1.91 trillion, reflecting the broader BTC bearish sentiment.

Meanwhile, Ethereum (ETH) was down by 8% to $3,394 after failing to hold the $3,600 level. Market capitalization of the company fell to $412.29 billion, while trading volume rose by 21% to $28.23 billion. Rising volatility indicated that the investors are more uncertain as compared to the previous periods in this environment.

Likewise, the value of XRP price declined by 5.66% to $2.29 as market capitalization fell by 6.03% to $131.29 billion. Nevertheless, the trading volume rose to $6.95 billion, which is 57.57% more, which shows increased activity.

The crypto market crash also affected top meme coins. Dogecoin (DOGE) recorded a 9.12% drop to $0.3546. Its market capitalization decreased to $52.3 billion, and trading volume soared 54% to $4.6 billion. The increase in trading activity reflected mixed reactions, ranging from profit-taking to panic-driven selling.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Web 4.0 – Blockchain and AI Will Usher In a More Humane and User-Friendly Web

Democrats Should Reverse Their Stance On Bitcoin

Ripple CEO Brad Garlinghouse Confirms Mar-a-Lago Meeting with Donald Trump

The Most Eye-Catching and Absurd AI Products Unveiled at CES 2025 So Far

Meet Jason Marquez: The Truck Driver Who made $750,000 on MicroStrategy

Why BTC, ETH, DOGE, & Other Altcoins Fell

Arbitrum Awards Biggest-Ever Foundation Grant to Lotte, the South Korean Megacorp

Bitcoin Layer 2 Foundations Should Buy Bitcoin For Their Treasuries

Bitwise CIO Reacts As Czech Republic Mulls Bitcoin Reserve

XRP Could Rocket 470% If History Repeats, SuperTrend Suggests

From Laser Eyes to Upside-Down Pics: The New Bitcoin Campaign to Flip Gold

WazirX hack victims to receive aid from new CoinSwitch fund

Why Tim Draper Sees BTC as the ‘Next Netflix’?

‘Hype Cycle’ To Last Another Four Months for This Altcoin Sector, According to Real Vision Analyst Jamie Coutts

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: