Avalanche price

3 Solana Rivals Ready to 100x After SOL ETF

Published

3 months agoon

By

admin

Solana price has surged this week, and the rising odds of a SOL ETF may push it higher this year. One way of taking advantage of SOL’s price action is to invest in top Solana rivals that could replicate its success this year. Let’s explore some of the best Solana competitors to buy and hold ahead of the approval.

Top Solana Rivals For 100x Gains

Some of the best Solana alternatives to invest in ahead of the Solana ETF approval are Avalanche (AVAX), Polkadot (DOT), and Chainlink (LINK). These coins may do well as Polymarket data shows that the odds of a SOL ETF approval are high.

Avalanche (AVAX)

Avalanche is one of the top Solana rivals with solid metrics in its ecosystem. Data shows that Avalanche has 419 DeFi dApps in its ecosystem compared to Solana’s 192. It is also a big name in the decentralized exchange (DEX) and non-fungible industries. Most importantly, Avalanche has a staking yield of 8% compared to Solana’s 7%.

AVAX price also has solid technicals now that it has formed a double-bottom pattern and a falling wedge. That is a sign that it will stage a strong comeback this year. Their argument is that the SEC may approve an AVAX ETF if it accepts a Solana ETF since the two are mostly similar.

Polkadot (DOT)

Polkadot is another quality blue-chip Solana rival to buy. The main reason is that the network is going through major changes this year. Some of these include making the DOT token the only coin for all its parachains. It will also reduce the number of staking days to 2 from 30 and introduce Ethereum Virtual Machine (EVM) compatibility.

Like with Avalanche, a SOL ETF approval means that the SEC will have no justification to approve a DOT fund. Another catalyst for the DOT price is that its chart pattern is similar to Solana’s with a double-bottom and a falling wedge. A DOT price rebound could see it soar to $11.65, up by 60% above the current level.

Chainlink (LINK)

Chainlink one of the top Solana rivals to buy because of its crucial role in the crypto industry. It provides its oracle solutions across most chains and has accumulated a total value secured of over $37 billion.

On top of this, it has a crucial role in the Real World Asset (RWA) tokenization industry and is always innovating. The amount of LINK tokens in exchanges has crashed, a sign that many investors are holding. It also has strong technicals, with analysts predicting that the LINK price will surge to $40 soon.

Other Good SOL ETF Rivals To Buy

The other popular Solana competitor that may jump amid their ETF approval hopes are Binance Coin (BNB), Cronos (CRO), Sui (SUI), Aptos, and Tron (TRX).

Frequently Asked Questions (FAQs)

There are rising odds that the SEC will approve a spot Solana ETF this year. Polymarket odds of this happening have risen to 76%.

A Solana ETF approval will raise the chance of popular coins like Polkadot, Chainlink, and Avalanche being approved.

Some top cryptocurrencies that may be approved are Ripple (XRP), Binance Coin (BNB), and Dogecoin.

crispus

Crispus is a seasoned Financial Analyst at CoinGape with over 12 years of experience. He focuses on Bitcoin and other altcoins, covering the intersection of news and analysis. His insights have been featured on renowned platforms such as BanklessTimes, CoinJournal, HypeIndex, SeekingAlpha, Forbes, InvestingCube, Investing.com, and MoneyTransfers.com.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Avalanche

AVAX To Soar 1,200%, Beat Bitcoin By 2029: Standard Chartered

Published

2 weeks agoon

April 3, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

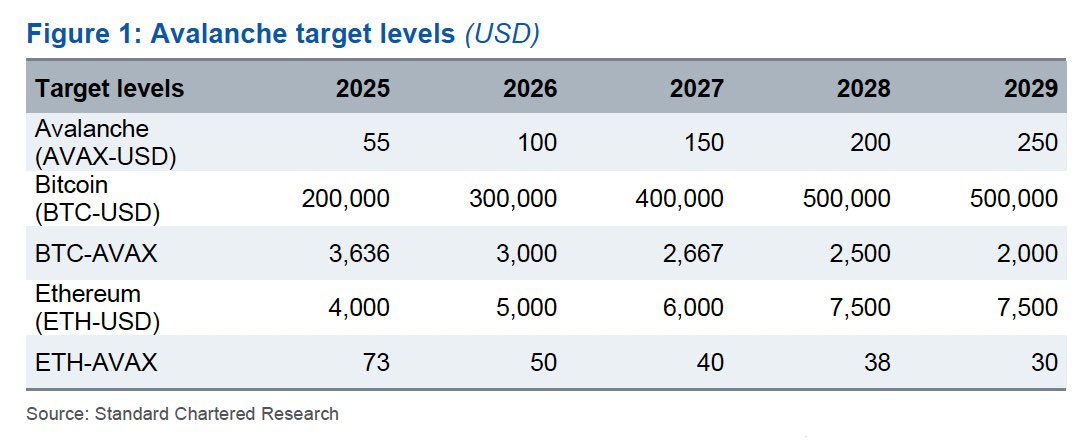

Global banking giant Standard Chartered published new five-year price projections for three leading cryptocurrencies: Avalanche (AVAX), Bitcoin (BTC), and Ethereum (ETH). According to these forecasts, Avalanche is poised to gain significant ground on both Bitcoin and Ethereum by 2029.

Ryan Rasmussen, Head of Research at Bitwise, drew attention to these ambitious targets via X. “Global banking giant Standard Chartered just published 5yr price targets for Bitcoin, Ethereum, and Avalanche,” Rasmussen wrote, pointing to a chart that outlined the bank’s estimates.

Standard Chartered expects Avalanche (AVAX) to reach $55 by the end of 2025, $100 by 2026, $150 by 2027, $200 by 2028, and ultimately $250 by the end of 2029. This projected growth represents a more than 1,200% increase from its current trading level of around $20.

Meanwhile, Bitcoin (BTC) updated its forecast and now projects BTC to appreciate from $200,000 in 2025 to $300,000 in 2026, followed by $400,000 in 2027, and finally hitting $500,000 in 2028—a level it is expected to maintain through 2029.

For Ethereum (ETH), Standard Chartered projects the token to hit $4,000 in 2025, $5,000 in 2026, $6,000 in 2027, and $7,500 by 2028, with no change anticipated in 2029. The forecast indicates steady but less dramatic growth relative to Avalanche.

Related Reading

In terms of comparative valuation, the bank provided ratio metrics to show how AVAX might perform against BTC and ETH. The BTC-to-AVAX ratio, which measures how many AVAX tokens equal one BTC, is expected to drop from 3,636 in 2025 to 2,000 in 2029.

This decreasing trend implies that AVAX will appreciate faster than Bitcoin over the period. Similarly, the ETH-to-AVAX ratio is projected to decline from 73 to 30 during the same timeframe, pointing to a similar outperformance against Ethereum.

Standard Chartered’s Bullish Case For Avalanche

Standard Chartered has initiated coverage of Avalanche, stating it expects AVAX to rise from its current price of roughly $20 to $250 by the end of 2029. “One positive of the tariff noise is that it gives us a chance to re-set and pick winners for the next upswing in digital asset prices,” said Geoffrey Kendrick, the bank’s global head of digital assets research, in an email to The Block on Wednesday, referencing his latest report. “And I think Avalanche will be another winner, perhaps the winner in EVM [Ethereum Virtual Machine] chains.”

Related Reading

Kendrick emphasized that Avalanche’s approach to scaling—particularly after its Etna upgrade, also known as Avalanche9000—positions the network for long-term success. Activated in December 2024, the Etna upgrade dramatically reduced the cost of launching subnets (which Avalanche now calls Layer 1 blockchains), slashing setup expenses from up to $450,000 to nearly zero.

Kendrick noted that these changes appear to be attracting new developer activity: “A quarter of Avalanche’s active subnets are now Etna-compatible, and developer numbers have jumped 40% since the upgrade.”

He also mentioned that some developers are migrating from Ethereum Layer 2 solutions to Avalanche due to its compatibility with Ethereum code and the lower overhead for launching new subnets or L1 chains. While fees on Avalanche can still run higher than certain Ethereum L2s like Arbitrum, Kendrick believes attracting completely new applications—especially in fields such as gaming and consumer-focused tools—will be critical to Avalanche’s growth.

“As a result, we see AVAX outperforming both Bitcoin and Ethereum in terms of relative price gains in the coming years,” Kendrick remarked, while noting Avalanche’s higher volatility levels compared to BTC.

At press time, BTC traded at $83,334.

Featured image created with DALL.E, chart from TradingView.com

Source link

Avalanche

Avalanche Holds Key Demand Zone – Analyst Sets $30 Target If Momentum Holds

Published

2 months agoon

February 15, 2025By

admin

Avalanche has faced relentless selling pressure since mid-December, wiping out over 60% of its value and erasing all the gains from the impressive November 2024 rally. The extended downtrend has left investors uncertain about its near-term prospects as the entire market struggles to regain footing amid ongoing volatility. However, recent price action is offering a glimmer of hope, as AVAX appears to be stabilizing and finding strong demand at crucial levels.

Related Reading

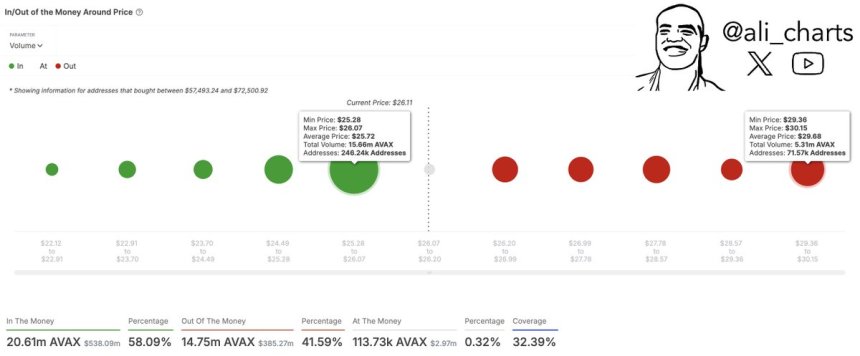

Top analyst Ali Martinez has shared key insights, highlighting a potential recovery scenario for Avalanche. According to Martinez, AVAX is holding above a critical demand zone between $25.30 and $26.10. This level is acting as a strong support, offering the foundation needed to shift market sentiment. If the price continues to hold above this zone, Avalanche could gain the momentum necessary for a recovery rally, with a target of $30 in sight.

The coming days will be pivotal for AVAX as investors watch closely for signs of strength or a potential breakdown. While the bearish sentiment from December lingers, this demand zone could be the launchpad for a turnaround, sparking renewed optimism among traders and long-term holders alike. Will Avalanche finally bounce back? Time will tell.

Avalanche Poised For A Recovery

Avalanche has been trading in a state of indecision, with bulls unable to push the price above the $27 mark and bears failing to drive it further down. This tug-of-war has kept the market in a tight range, leaving traders and investors uncertain about the next major move. While some analysts are optimistic about a potential recovery, others are warning of a continuation of the bearish trend that has plagued AVAX since mid-December.

Martinez shared critical insights on X, highlighting that Avalanche is holding above a key demand zone between $25.30 and $26.10. This level has acted as strong support over the past few days, preventing further downside and giving bulls an opportunity to stage a comeback.

According to Martinez, this demand zone could provide the momentum needed for a rally toward the $30 mark. However, the price must first clear the $27 level, which has proven to be a significant resistance point. If AVAX manages to break through this level, a rally could follow quickly.

The next few days will be crucial for Avalanche’s price action. Bulls need to reclaim the $27 mark to shift sentiment and attract more buyers. On the flip side, losing the key support zone could result in a continuation of the bearish trend, potentially taking AVAX into lower demand levels.

Related Reading

As the market watches closely, all eyes are on whether Avalanche can muster the strength for a recovery rally or succumb to further selling pressure. This indecision sets the stage for a potentially explosive move, and traders should remain cautious as the market finds its direction.

AVAX Price Testing Crucial Supply

Avalanche (AVAX) is trading at $26.7 following a 7% surge yesterday, signaling renewed efforts by bulls to regain control of price action. The $27 mark has emerged as a critical supply level, acting as a barrier to further upward movement. Bulls are currently focused on reclaiming this level, which has held the price down for several days. If AVAX can successfully push above the $27 mark and clear the $28 resistance, a recovery rally could gain momentum, potentially driving the price toward the $30 mark.

However, the current rally faces challenges as selling pressure remains strong at these key levels. Losing the $25 support zone would likely halt the recovery attempt and lead to further consolidation below the key supply range that AVAX is currently testing. A breakdown below $25 could bring Avalanche back into the $23-$24 demand zone, prolonging the uncertainty surrounding its short-term direction.

Related Reading

The coming days will be crucial in determining whether AVAX can sustain its recent gains and reverse its bearish trend. For now, bulls must build on yesterday’s momentum by reclaiming and holding the $27 mark as support. This would set the stage for a breakout above $28, shifting market sentiment in favor of a broader recovery rally.

Featured image from Dall-E, chart from TradingView

Source link

24/7 Cryptocurrency News

AVAX Price Eyes Rally As Avalanche Founder Draws Parallel To Bitcoin

Published

4 months agoon

December 26, 2024By

admin

The speculations over a potential AVAX price rally soared as Avalanche founder Emin Gun Sirer drew parallels to Bitcoin’s capped 21 million supply. Highlighting AVAX’s maximum supply of 715.74 million and its deflationary mechanism of burning transaction fees, Sirer contrasts it with Ethereum’s uncapped supply. This scarcity-driven approach positions it as a strong contender among digital assets, sparking investor confidence and raising hopes for a potential price surge in the near future.

AVAX Price Gains Attention As Founder Highlights Bitcoin-Like Supply Cap

On December 25, AVA Labs CEO and founder Emin Gun Sirer posted on X, emphasizing a critical aspect of Avalanche – its capped supply, which he likened to Bitcoin’s 21 million fixed limit. Unlike Ethereum, which has no maximum supply and currently has over 120 million coins in circulation, the Avalanche token has a total cap of 715.74 million coins. This scarcity, combined with Avalanche’s mechanism of burning all transaction fees, has sparked discussions about its potential impact on AVAX price growth over time.

Sirer explained that Bitcoin’s capped supply has been a cornerstone of its value, attracting long-term investors and fostering confidence in its deflationary nature. By adopting a similar model, Avalanche aims to position itself as a scarce digital asset with strong value-accrual dynamics. This deflationary mechanism could drive interest in capped-supply tokens.

Also, the comparison with Bitcoin positions Avalanche token as a unique player in the crypto market, offering scarcity alongside a robust ecosystem. These features could make it appealing to investors looking for long-term value, which in turn could boost the Avalanche price ahead. This is especially true in a market dominated by inflationary assets like Ethereum.

What’s Next For Avalanche?

The latest Avalanche price chart showed that the crypto declined 2% to $40.973. Its 24-hour low and high are are $40.08 and $41.84. The token market cap is $16.5 billion with $453 million of trading volume. Despite the recent decline, its market cap and rank suggest resilience and ongoing investor interest.

The expert said that the current price action indicates a bullish momentum ahead for the crypto. Highlighting $34.71 as a key support zone, the expert has shared a strong forecast for the crypto ahead. According to Rose, the AVAX price could target the brief $64.04 or $79.77 mark ahead.

Besides, Avalanche recently launched the Avalanche9000 upgrade. This aims to improve scalability and make launching subnets cheaper. The upgrade could increase network activity, boosting AVAX price in the future.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: