Donald Trump

Key Indicators for TRUMP Reveal Rising Selling Pressure

Published

2 months agoon

By

admin

U.S. President-elect Donald Trump’s TRUMP token has made quite a splash in the crypto market, rapidly becoming the 21st largest digital asset with a market cap of $11 billion in just two days.

The TRUMP/USDT pair has emerged as the most-traded pair over the past 24 hours on the leading exchange, Binance, representing 13.3% of the total exchange volume, according to Coingecko.

While this activity is thrilling, the bulls and those looking to join the market ahead of Donald Trump’s inauguration might want to exercise caution, as a key derivatives market indicator has diverged bearishly from the token’s rising futures open interest.

Open interest in TRUMP perpetual futures has increased by 6% in the past 24 hours, according to data source Velo Data. Although prices have retraced from $70 to $58 since the Asian hours, they remain up by 3%.

However, the perpetual futures cumulative volume delta, which reflects the difference between buying and selling volume, has dropped by over 1%, indicating a relative increase in selling volume. In other words, traders are either taking outright shorts or bearish bets or closing long positions.

Besides, the market for TRUMP looks overheated, with those holding long positions paying an annualized funding fee of over 170% to shorts to keep their positions open. If the market stops rallying, holding longs will become a burden, potentially spurring an unwinding of the bullish bets. That, in turn, could lead to a deeper price slide.

The chart shows most major cryptocurrencies have experienced a net selling in perpetual futures in the past 24 hours. Perhaps, market participants are fearing market-wide price losses in a classic “sell the fact” action following Trump’s inauguration.

Source link

You may like

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

Altcoins

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Published

9 hours agoon

March 28, 2025By

admin

A whale who previously won big on the Official Trump (TRUMP) memecoin booked a loss on the controversial asset over the weekend, according to the crypto tracker Lookonchain.

Lookonchain notes on the social media platform X that the whale spent $5 million worth of Circle’s stablecoin, USDC, to buy TRUMP right after President Donald Trump posted “I LOVE $TRUMP” on his social media platform Truth Social.

The whale then sold the TRUMP stash an hour later, booking a $207,000 loss.

However, the loss pales in comparison to gains the whale made earlier this year when it spent 1.09 million USDC to buy 5.97 million TRUMP and booked a $108 million profit, according to Lookonchain.

The president launched the Official Trump memecoin in mid-January, days before he took office. The asset has generated controversy in and out of crypto circles, raising questions of corruption in an already heavily questioned administration.

Even Ethereum (ETH) founder Vitalik Buterin said in January that political coins represented “vehicles for unlimited political bribery.”

In a February letter to the U.S. Department of Justice (DOJ) and the Office of Government Ethics, officials at the nonprofit consumer advocacy organization Public Citizen argued TRUMP could be a violation of federal law regulating gifts to government officials.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Dogecoin could rally in double digits on three conditions

Published

11 hours agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

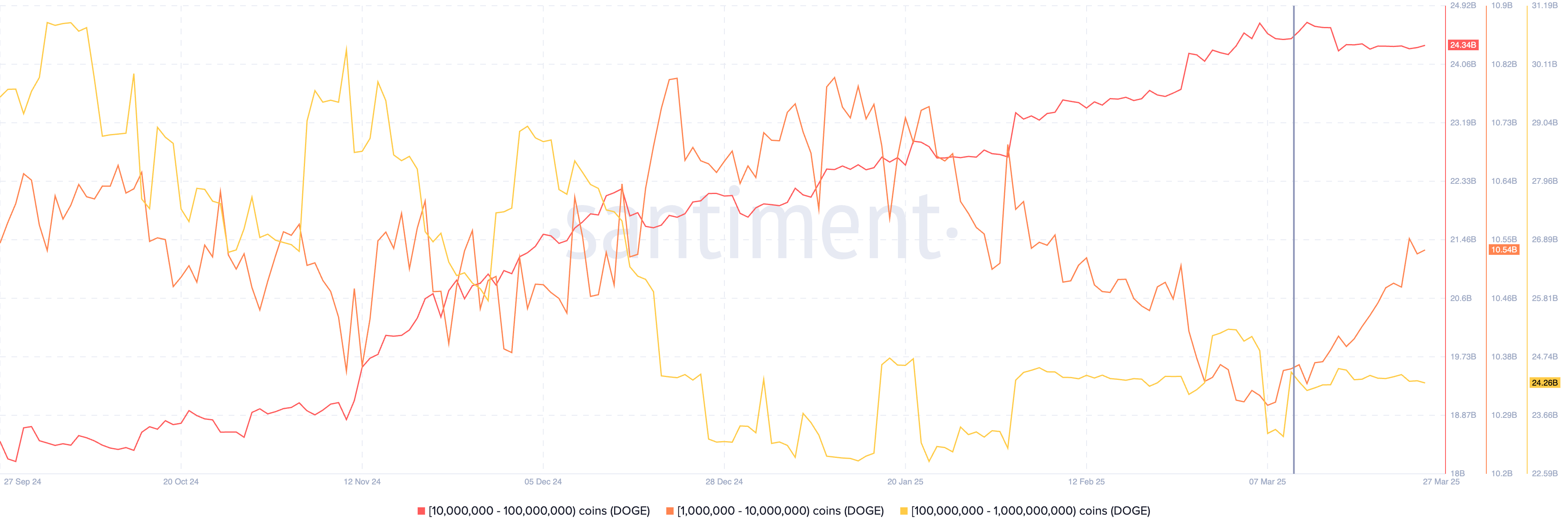

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitcoin

Bitcoin faces 70% odds of another drop as April tariff fears shake markets, Nansen says

Published

19 hours agoon

March 27, 2025By

admin

As the risk of tariff-related uncertainty persists into the second quarter, the crypto market could face another dip following the recent correction in March, analysts at Nansen say.

As the industry heads into April, Bitcoin (BTC) and the wider crypto market could be staring down another dip as uncertainty surrounding tariffs and U.S. trade policy might cause further volatility.

According to Nansen’s analysts, there’s a chance that the market may face another correction in the weeks after April 2. In fact, the researchers believe there’s a 70% likelihood that another price dip will occur after this date.

President Donald Trump had earlier promised to roll out new tariffs on April 2, calling it a key moment for the economy just weeks after the last round shook up markets and sparked recession worries.

In a recent interview with crypto.news, Aurelie Barthere, principal research analyst at Nansen, shared her outlook on the market, stating that after a brief correction following April 2, she expects the market to stabilize and pave the way for future growth.

“In my main scenario, 70% subjective likelihood, I expect another leg down in crypto prices after April 2 after we reached a local bottom in mid-March. After this second correction, I expect we will be bottoming for the rest of the year (continuation of the bull market and revisit of the ATHs for BTC).”

Aurelie Barthere

However, it’s not all doom and gloom for the crypto market. While another dip isn’t ruled out, Barthere suggests that after that correction, Bitcoin could rebound, benefiting from a supportive macro environment, including the growing adoption of crypto in the U.S. and a lack of recession signals. Still, Barthere remains cautious as for the remaining 30% “it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto,” she said.

“For the remaining 30%: it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto (in case of a recession, which is not my base case, I think the U.S. is just slowing from 3% to 1.5-2% growth).”

Aurelie Barthere

Uncertainty may last well into Q2

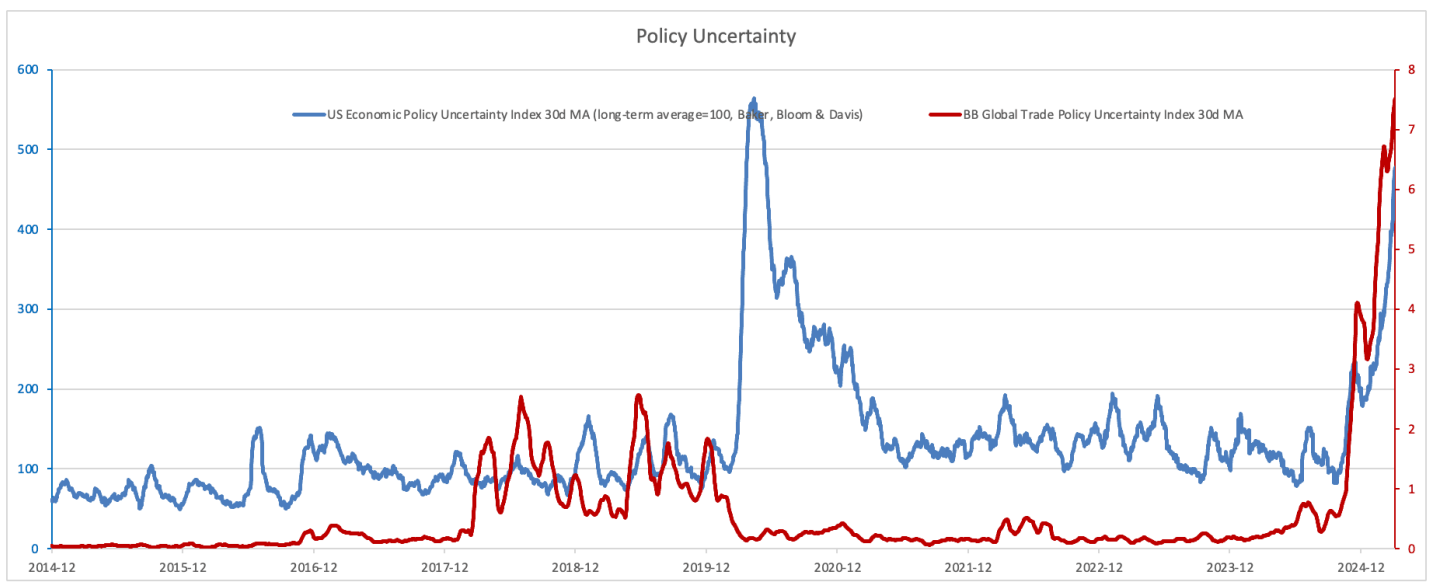

The tariff situation has been a significant driver of market volatility, with the U.S. policy uncertainty index reaching new highs. Trade discussions have become a key source of investor anxiety, but Nansen believes that uncertainty could peak soon.

As Treasury Secretary Bessent recently noted, many of the U.S. trading partners are already negotiating to lower their own trade barriers, which has helped to calm some fears. Even Trump recently hinted at potential tariff “exemptions” in certain circumstances. But as Barthere pointed out, while these talks may result in long-term growth benefits for the U.S., the lingering uncertainty may last well into Q2.

“Right now, I think that we are experiencing corrections within a crypto bull market. Why I see this as a bull market still: 1) Ongoing progress on crypto regulation and crypto institutionalization in the U.S., and 2) U.S. real growth has slowed but is not flashing ‘recession.’ Of course, this is my only main scenario, and I will continue to watch data and markets for signs that this is the correct reading.”

Aurelie Barthere

As Barthere put it, there’s a “50/50 chance that we’ve passed the peak of trade policy uncertainty,” adding that the true impact of these tariff negotiations might not be fully clear until mid-year. “We still see this peak uncertainty as more likely between April and June, especially with the start of U.S. tax cut package discussions,” she wrote in the research report.

The uncertainty, according to Nansen’s research, could trigger another short-term correction in both Bitcoin and U.S. equities.

No evidence of recession

Still, there’s reason for optimism. The report mentions that technicals are showing encouraging signs. “The dip is being bought, for BTC and for U.S. equities,” Barthere says, adding that spot Bitcoin ETFs recorded a “seven-day streak of net inflows, a first since crypto prices peaked.”

One way or the other, it’s clear that the market remains cautious. A lot of people are questioning whether the crypto bull run is still going strong or if we’re getting close to a peak. If history is any indication, times of economic uncertainty have often lined up with market downturns, making investors even more cautious.

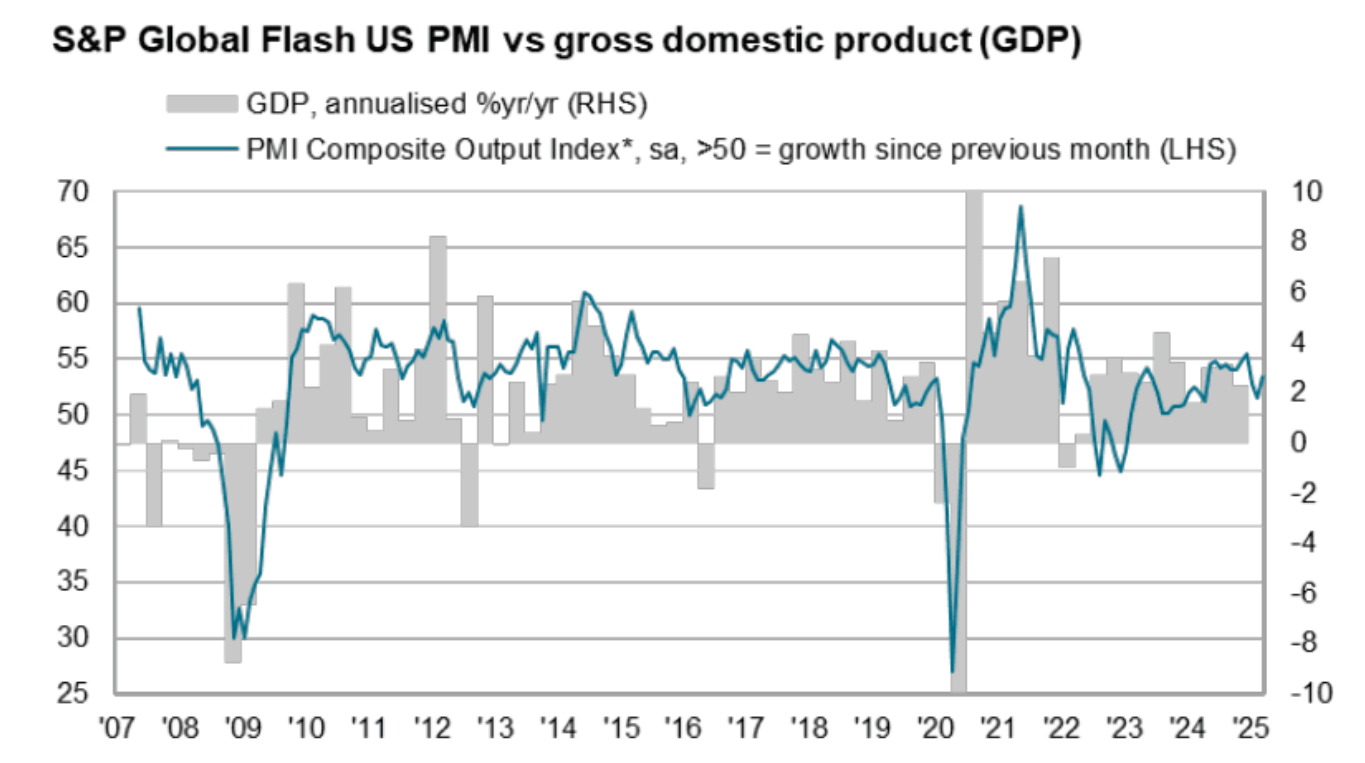

After market sentiment hit extreme fear last week, with some investment banks raising the U.S. recession probability to 40% this year, hard economic data has eased these concerns. The latest U.S. March flash PMI report shows a 53.5 score, the highest in three months, suggesting a 1.9% annual growth rate. However, the growth for the whole quarter is lower at 1.5% due to weaker data in January and February.

Barthere emphasized that so far, there’s no hard evidence of a recession as “most of the data weakness has been in sentiment indicators, while hard economic data has held up.” She added that “there is no evidence of recession at this stage, so no evidence that we have transitioned to a bear market.”

While the coming months may bring more ups and downs, Nansen’s report suggests that the overall bull market is still in play. As Barthere puts it, the market is “likely to see a correction, but then we’ll bottom out for the rest of the year and head towards new highs.”

Source link

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x