Bitwise

Dogecoin ETF moves closer as Bitwise files S-1 with the SEC

Published

3 months agoon

By

admin

Bitwise has submitted its official S-1 filing for a spot Dogecoin ETF, making its plans public with the SEC.

Bitwise has officially filed with the U.S. Securities and Exchange Commission to launch a Dogecoin (DOGE) exchange-traded fund (ETF). The company submitted an S-1 registration on Jan. 28, which formalizes its intention to offer a spot Dogecoin ETF.

Earlier, on Jan. 22, Bitwise had filed a registration in Delaware, signaling its plans to introduce the product. Bloomberg ETF analyst James Seyffart noted on X that while the filing had been anticipated, this step makes the proposal official with the SEC.

Bitwise is not the only asset manager who filed for a DOGE ETF. Earlier, on Jan. 21, Rex Shares and Osprey Funds, a firm that focuses on ETFs and ETNs, filed Form N1-A for DOGE and many other cryptos, including Official Trump (TRUMP), Solana (SOL), Bitcoin (BTC) and Ripple (XRP).

ETFs offer investors a range of benefits, including diversification, cost efficiency, liquidity, and transparency, making them a convenient way to manage investments. A Dogecoin ETF would provide investors with exposure to DOGE’s price movements in a regulated environment, without the need for crypto wallets or exchanges.

As per CoinDesk, Bitwise’s ETF was filed under the “33 Act” and Rex and Osprey under the “40 Act”, says Bloomberg ETF analyst Eric Balchunas.

This is the first ‘33 Act (a la $IBIT) doge filing. Rex has on e filed under 40 Act but that isn’t the same true blue physically backed structure

— Eric Balchunas (@EricBalchunas) January 28, 2025

The 40 Act’s primary distinguishing feature is that it imposes tighter SEC oversight and better governance and limits on riskier manoeuvres like leverage and short-selling, offering investors stronger protections. In contrast, the 33 Act is commonly utilized for speciality ETFs like commodity-based ETFs with less stringent regulatory requirements.

However, while a DOGE ETF would ease access for investors to gain exposure to DOGE without having to deal with crypto exchanges, it also raises eyebrows because meme coins often face criticism for their volatility.

On Jan. 16, Max Buwick of Burwick Law pointed out that meme coins are the “ultimate evolution of multi-level marketing scams”. Burwick believes meme coins prey on human desperation and is not backed by strong fundamentals. However, as CryptoQuant CEO puts it, Trump has convened a new era of meme coins, like it or not!

Source link

You may like

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Bitcoin ETF

Bitwise Debuts Option Income ETFs On Bitcoin Treasury Stocks: MSTR, MARA, COIN

Published

1 week agoon

April 5, 2025By

admin

Bitwise has introduced three new ETFs that provide yield-seeking investors with exposure to leading Bitcoin treasury companies, using a covered call strategy designed to capitalize on equity volatility while preserving Bitcoin-linked upside.

The funds include:

- $IMST, tracking Strategy (formerly MicroStrategy, ticker: MSTR), which currently holds 528,185 BTC.

- $IMRA, focused on MARA Holdings (MARA), a top-tier Bitcoin miner with 47,600 BTC in treasury.

- $ICOI, offering exposure to Coinbase (COIN), which holds 9,480 BTC and serves as a key on-ramp for institutional and retail Bitcoin adoption.

Each ETF employs an actively managed options overlay, writing out-of-the-money calls on the underlying equity while maintaining a long position. This approach is designed to deliver monthly income distributions—particularly attractive in today’s high-volatility environment—while retaining meaningful upside exposure to Bitcoin-linked companies.

While none of the funds directly hold Bitcoin, all three underlying equities are deeply intertwined with Bitcoin’s performance and trajectory. Strategy and Marathon are among the most prominent corporate holders of BTC, while Coinbase continues to serve as critical infrastructure for the broader ecosystem.

New Tools for Bitcoin-Aligned Capital Allocation

For corporate treasurers and institutional allocators who view Bitcoin as a long-term strategic asset, these new products represent a compelling way to gain indirect exposure while generating yield—especially in balance sheets that can’t yet directly hold BTC.

The rise of equity-based strategies like this is part of a broader shift. More public companies are actively integrating Bitcoin into their financial models, whether through direct holdings or through services and operations tied to Bitcoin mining, custody, or exchange infrastructure.

What Bitwise is offering is not just exposure, but a way to monetize volatility—something that Bitcoin-native companies experience more than most. Whether it’s MSTR stock reacting to Bitcoin’s price swings, MARA stock tracking mining difficulty and rewards, or Coinbase stock responding to changes in trading volume and regulatory sentiment, these equities are increasingly used as BTC proxies by sophisticated investors.

In recent months, institutional interest in Bitcoin ETFs, mining stocks, and companies with Bitcoin treasuries has intensified, and tools like IMST, IMRA, and ICOI provide a new angle on that demand. For companies already on a Bitcoin treasury path—or considering one—this evolution in capital markets infrastructure is notable.

What This Signals for Bitcoin Treasury Strategy

The launch of these ETFs reflects how Bitcoin is no longer just a spot asset—it’s now embedded in public equity strategy, yield generation, and portfolio construction.

Covered call structures won’t be right for every investor or treasury, but the signal is clear: the market is maturing around the idea that Bitcoin isn’t just to be held—it can be actively managed, structured, and monetized in new ways.

These new ETFs won’t replace direct holdings on a corporate balance sheet. But they may complement them—or offer a first step for firms exploring how to position around Bitcoin while still meeting traditional risk, yield, and reporting mandates.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

Source link

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

Bitcoin

Why Bitcoin Wins No Matter The Outcome Of Trump’s Trade War

Published

2 months agoon

February 5, 2025By

admin

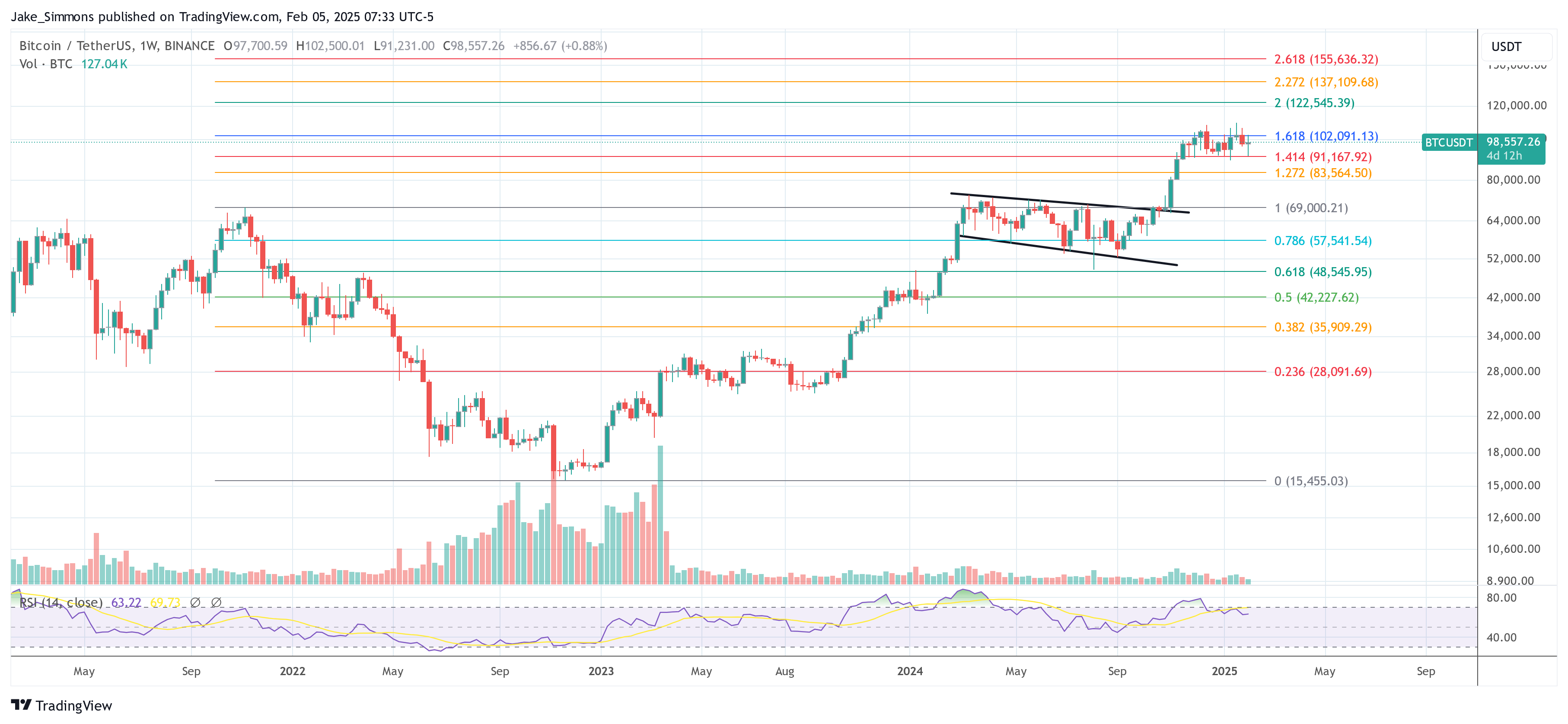

In an escalation of global economic friction, President Trump’s imposed tariffs have roiled financial markets this week, cutting across both equities, Bitcoin and cryptocurrencies. Yet a new memo from Bitwise Asset Management suggests that these headwinds might ultimately propel Bitcoin to new heights—regardless of whether Trump’s strategy succeeds or fails.

At the beginning of the week, the crypto market witnessed a severe sell-off. Bitcoin declined by about 5%, while Ethereum and XRP suffered even sharper losses—17% and 18%, respectively. The immediate catalyst was Trump’s imposition of a 25% tariff on most imports from Canada and Mexico, as well as a 10% tariff on China. In retaliation, those trading partners announced countermeasures of their own.

Related Reading

The US dollar reacted by jumping more than 1% against major currencies. That, combined with lingering weekend illiquidity in crypto markets, triggered a wave of forced liquidations as leveraged traders sold into the downdraft. According to Bitwise Chief Investment Officer Matt Hougan, as much as $10 billion in leveraged positions was wiped out in what he described as “the largest liquidation event in crypto’s history.”

Despite the dramatic price action, Bitwise’s Head of Alpha Strategies, Jeffrey Park, remains optimistic about Bitcoin’s trajectory. He points to two guiding ideas that shape his bullish thesis: the ‘Triffin Dilemma’ and President Trump’s broader aim to restructure America’s trade dynamics.

The Triffin Dilemma highlights the conflict between a currency serving as a global reserve—generating consistent demand and overvaluation—and the need to run persistent trade deficits to supply enough currency abroad. While this status allows the US to borrow cheaply, it also puts sustained pressure on domestic manufacturing and exports.

“Trump wants to get rid of the negatives, but keep the positives,” Park explains, suggesting that tariffs may be a negotiating tool to compel other nations to the table—reminiscent of the 1985 Plaza Accord, which devalued the dollar in coordination with other major economies.

The Two Scenarios: Bitcoin Wins, Fiat Loses

Park argues that Bitcoin stands to benefit under two distinct outcomes of Trump’s current trade policy:

Scenario 1: Trump Succeeds in Weakening the Dollar (While Keeping Rates Low)

If Trump can maneuver a multilateral agreement—akin to a ‘Plaza Accord 2.0’—to reduce the dollar’s overvaluation without boosting long-term interest rates, risk appetite among US investors could surge. In this environment, a non-sovereign asset like Bitcoin, free from capital controls and dilution, would likely attract additional inflows. Meanwhile, other nations grappling with the fallout of a weaker dollar might deploy fiscal and monetary stimulus to support their economies, potentially driving even more capital toward alternative assets like Bitcoin.

Related Reading

“If Trump can bully his way into the position, there’s no asset better positioned than bitcoin. Lower rates will spark the risk appetite of US investors, sending prices high. Abroad, countries will face weakened economies, and will turn to classic economic stimulus to compensate, leading again to higher bitcoin prices,” Park argues.

Scenario 2: A Prolonged Trade War And Massive Money Printing

If Trump fails to secure a broad-based deal and the trade war grinds on, global economic weakness would almost certainly invite extensive monetary stimulus from central banks. Historically, such large-scale liquidity injections have been bullish for Bitcoin, as investors seek deflationary and decentralized assets insulated from central bank policies

“And what if he fails? What if, instead, we get a sustained tariff war? Our high-conviction view is the resulting economic weakness will lead to money printing on a scale larger than we’ve ever seen. And historically, such stimulus has been extraordinarily good for bitcoin,” Park says..

At press time, BTC traded at $98,557.

Featured image created with DALL.E, chart from TradingView.com

Source link

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x