Eric Trump

They Didn't Take The Orange Pill, They Threw It Out

Published

2 months agoon

By

admin

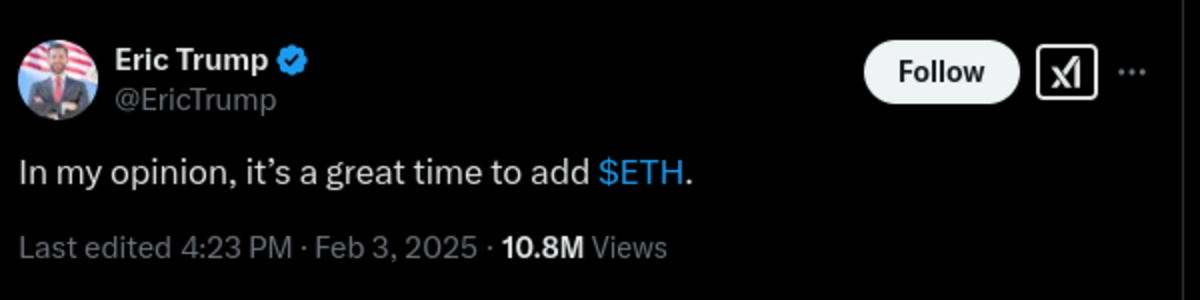

The son of the current President two days ago on Twitter told people it’s time to add Ethereum to their balance sheets. It is mind blowing to see this, given what this cycle represents for Ethereum.

For years people have been predicting the outcome we are seeing play out this cycle. Ethereum’s dominant use case has been as a platform for issuing other assets, and building applications focused on assets other than ether itself. This becoming the dominant use of the network has obvious implications for the necessity of the Ethereum network itself to operate these other applications and assets.

Bitcoiners have consistently pointed this out, and predicted that other cheaper and more centralized networks with the same functionality would eventually obsolete Ethereum, as the chief value proposition of the network in the market has proven not to be Ethereum or ether itself. That is exactly what we see playing out right now with Solana absorbing activity from Ethereum, for everything from memecoins to DEXes now.

This isn’t a new thesis, this isn’t some novel niche idea hidden from the light of day, it is something loudly predicted for half a decade or more. Yet the “orange pilled” son of the President is here publicly stating it’s time to add ETH.

I think this should in a very crystal clear manner demonstrate that none of the Trump family or new administration are “orange pilled” at all. All they have been shown is the opportunity to make money, and they will follow their incentives. That realistically leads to shitcoining.

Shitcoining is the most profitable short-term thing in this space. They will follow the path to easy money. I think this is the cold hard reality that some Bitcoiners don’t want to accept, people are in most cases not better than their incentives. We are not going to have some kind of grand spiritual “Bitcoin awakening” in government. We are just going to see the incentives we’ve watched play out in multiple cycles play out at a larger scale than we ever have before.

What’s amazing to me is how so many Bitcoiners thought sticking our nose into the government would go any other way. We opened the door, and the shit got dragged in behind us.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

Donald Trump

Eric Trump Joins Metaplanet’s Board Of Advisers

Published

6 days agoon

March 22, 2025By

admin

Metaplanet, Japan’s largest corporate bitcoin holder, has appointed Eric Trump to its newly formed strategic board of advisers. The move aims to advance Metaplanet’s bitcoin adoption mission as bitcoin gains mainstream traction.

Metaplanet announced the move on Friday, stating that Trump’s expertise and passion for bitcoin will help drive the company’s goals. As the son of U.S. President Donald Trump, Eric Trump has emerged as an influential voice supporting the growth bitcoin and the crypto industry.

JUST IN:

Japanese public company Metaplanet appoints Eric Trump as a strategic advisor to help drive Bitcoin adoption. pic.twitter.com/9UnAFzF5Ty

— Bitcoin Magazine (@BitcoinMagazine) March 21, 2025

The advisory board will also include other high-profile figures yet to be named, according to Metaplanet. The focus will be bringing together leaders in business, politics and technology to further bitcoin’s acceptance globally.

Metaplanet Representative Director Simon Gerovich welcomed Trump’s appointment, emphasizing his business acumen and enthusiasm for the bitcoin community. Gerovich said, “His business expertise and passion for BTC will help drive our mission forward as we continue building one of the world’s leading Bitcoin Treasury Companies.”

The Tokyo-based company has aggressively accumulated bitcoin reserves, now holding over 3,200 BTC worth approximately $267 million. Earlier in March, Metaplanet purchased 150 additional bitcoins at a value of $12.5 million.

Established in 1999, Metaplanet has shifted its focus to bitcoin investment and advocacy. The company trades on the Tokyo Stock Exchange and was previously known as Red Planet Japan.

Eric Trump has increasingly backed bitcoin and cryptos. He is involved with World Liberty Financial, a Trump family’s crypto venture. His father, Donald Trump, recently signed an executive order to launch a strategic bitcoin reserve.

With bitcoin going mainstream, Metaplanet is betting on crypto-friendly advisers like Trump to drive institutional adoption. Major corporations adding bitcoin to reserves could accelerate acceptance and solidify bitcoin as a sound corporate asset.

Source link

Altcoins

Eric Trump’s Ethereum Endorsement Fuels Crypto Buzz

Published

2 months agoon

February 4, 2025By

admin

After momentarily sliding below important support levels, Ethereum (ETH) is once again on the climb. After a significant change in market mood, the second-largest digital asset by market capitalization passed $2,900.

Related Reading

Interestingly, Eric Trump, the son of US President Donald Trump, weighed in on the situation, remarking that it is a strategic opportunity to acquire ETH.

Tariff Pause Sparks Market Rebound

Concerns over possible tariffs on Canada and Mexico rattled the crypto market earlier this week. Both Bitcoin and Ethereum fell significantly; Ethereum dropped momentarily to around $2,360. Still, the temporary suspension of the tariffs by Trump offered a breather, which raised investor confidence in risk assets including cryptocurrency.

In the wake of the announcement, Ethereum experienced a robust recovery, with a nearly 20% increase. Traders interpreted this as an invitation to re-enter the market, and ETH promptly reclaimed the $2,900 mark.

In my opinion, it’s a great time to add $ETH.

— Eric Trump (@EricTrump) February 3, 2025

Eric Trump’s Crypto Endorsement Raises Eyebrows

Eric Trump posted his optimistic view on Ethereum on social media. He first said, “In my opinion, it’s a great time to add $ETH. You can thank me later.” Although the subsequent section of his remarks was deleted, crypto investors saw resonance in his endorsement of Ethereum’s future development.

The Trump family has been progressively involved in the digital asset sector, particularly through their World Liberty Financial platform. This most recent statement serves to emphasize their involvement and potential long-term dedication to blockchain technology.

World Liberty Financial’s Significant Ethereum Transaction

World Liberty Financial recently made a substantial move in the crypto space, which has served to further fuel speculation. The firm transferred over $300 million in assets to Coinbase’s custody platform, according to blockchain analytics firm Spot On Chain. Furthermore, they acquired an additional 1,826 ETH for approximately $5 million and converted nearly 20,000 Lido Staked Ether (stETH) into ETH.

World Liberty Financial (@worldlibertyfi) moved $307.41M in 8 assets to #CoinbasePrime 6 hours ago—as part of treasury management and business operations.

Shortly after, the project unstaked 19,423 $stETH to $ETH and further spent 5M $USDC to buy 1,826 $ETH at $2,738.… https://t.co/Rp9NAFUs5N pic.twitter.com/5bfIvJma7U

— Spot On Chain (@spotonchain) February 4, 2025

These transactions indicate that the company is making preparations for the introduction of its “Earn and Borrow” lending protocol. Although the protocol is still in the process of being developed, the substantial transfers suggest that the platform could soon play a significant role in decentralized finance (DeFi).

Related Reading

Ethereum’s Prospects Still Remain Positive

As institutional interest is rising and the price of the top altcoin has recaptured higher levels, Ether remains a central focus in the crypto market. Macroeconomic changes, strategic investments, and political influence taken together provide an interesting dynamic for ETH’s future course.

Featured image from Gemini Imagen, chart from TradingView

Source link

24/7 Cryptocurrency News

Eric Trump Breaks Silence On $TRUMP Memecoin Amid Criticism and Dumps

Published

2 months agoon

January 19, 2025By

admin

Eric Trump has addressed the ongoing debate surrounding the $TRUMP memecoin, a cryptocurrency launched by President-elect Donald Trump. This follows reports of a whale trader profiting nearly $12 million from trading the token shortly after its release. The launch, which has triggered significant controversy, has drawn responses from financial experts, crypto enthusiasts, and ethics watchdogs.

Eric Trump’s Take on $TRUMP Memecoin

Eric Trump, the son of President-elect Donald Trump, commented on the $TRUMP memecoin’s rapid rise, calling it the “hottest digital meme on earth.” The $TRUMP token, launched late Friday, surged in value within hours, becoming a top trending topic in the cryptocurrency space.

According to CoinGecko, its market capitalization exceeded $5 billion by Saturday afternoon, with trading volumes surpassing $11 billion. The token’s price more than doubled, reaching over $27 within 24 hours of its launch.

The memecoin is owned primarily by CIC Digital LLC, a company tied to Donald Trump, which holds 80% of the token’s supply. With an estimated $20 billion in assets on paper under the current market price, the launch has raised questions about the intersection of Trump’s financial interests and his upcoming presidency.

Peter Schiff, an economist and Bitcoin skeptic, weighed in on the rapid rise of the $TRUMP token. “It took Bitcoin four years to reach a $5 billion market cap. $TRUMP did it in one day,” he wrote on X. Schiff sarcastically suggested creating a strategic reserve for the memecoin and requiring its inclusion in retirement accounts. However, the comments drew mixed reactions, with some dismissing the comparison between Bitcoin and a newly launched meme-based cryptocurrency.

Whale Trader Profits $11.8 Million Amid Market Activity

A significant transaction involving the $TRUMP memecoin occurred hours after its launch, catching the attention of blockchain analysts. A whale trader, who reportedly spent $12 million purchasing 860,895 tokens at $13.94, sold the holdings at $27.67. The transaction resulted in an $11.8 million profit, showcasing the high volatility of the token in its early trading hours.

This development has sparked concerns over the stability of the memecoin and the potential for market manipulation. Critics argue that speculative trading could harm smaller investors entering the market at inflated prices.

Prominent figures, including former White House communications director Anthony Scaramucci, criticized the event. Scaramucci called the launch “an alarming level of corruption,” suggesting it reflects poorly on the broader cryptocurrency industry.

Ethical Concerns Over Presidential Financial Ties

The timing of the $TRUMP memecoin launch has led to ethical questions, as it occurred just days before Donald Trump’s inauguration as president. Historically, presidents-elect have made efforts to distance themselves from business ventures to avoid perceived conflicts of interest. The Trump administration’s direct ties to the cryptocurrency have drawn scrutiny from ethics watchdogs.

Jordan Libowitz of Citizens for Responsibility and Ethics in Washington commented on the situation, stating, “This is a president-elect launching businesses alongside promises to deregulate industries where he stands to profit.” Trump has also faced criticism for promoting cryptocurrency-friendly policies during his campaign, including proposals to overhaul crypto regulations and have the federal government stockpile Bitcoin.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: