Altcoins

Trader Predicts Relief Rally for Altcoin Market, Says One Layer-1 Crypto Looking To Move Further Up

Published

2 months agoon

By

admin

An analyst known for calling the November 2021 crypto bull cycle top believes that the altcoin market is about to witness the return of bullish momentum.

Pseudonymous analyst Pentoshi tells his 857,000 followers on the social media platform X that he’s keeping a close watch on the OTHERS chart, an altcoin index that tracks the market cap of all crypto assets excluding Bitcoin (BTC), Ethereum (ETH) and stablecoins.

According to Pentoshi, OTHERS appears to be carving a local bottom at $250 billion and is now threatening to shatter its immediate resistance at $281 billion.

“Alts potential low time frame double bottom forming from $250 billion.

Still think we played this very well overall, and looking for it to go back toward $281 billion once again. Reclaim that and we get a nice move up for some actual relief.”

A double-bottom pattern is a bullish reversal structure indicating that an asset or index has formed a solid demand area and is setting the stage for an upside burst.

Pentoshi predicts that OTHERS can surge by about 15% if it takes out resistance at $281 billion.

“Looking better and better, the market has had numerous opportunities to sell off.

Potential lower high at $320 billion range. Again, that area is likely the most important to watch as well as $250 billion for the next major trend in my opinion.”

At time of writing, OTHERS is trading for $271.63 billion.

One altcoin on the trader’s radar is the native asset of the layer-1 protocol Injective (INJ). According to the analyst, INJ appears to be respecting its high time frame support at $14 and is looking for a bounce toward $17.58.

“Still looking good, hit $16 already, now looking for a move further up.”

At time of writing, INJ is worth $15.26.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

CryptoPunks NFT Sells for $6 Million in Ethereum—At a $10 Million Loss

SEC drops suit against Helium for alleged securities violations

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

Altcoins

World Liberty Financial To Airdrop USD1 Stablecoins to WLFI Holders, According to Governance Proposal

Published

23 hours agoon

April 10, 2025By

admin

The Trump family-adjacent decentralized finance (DeFi) project World Liberty Financial (WLFI) has proposed a stablecoin airdrop.

Last month, the DeFi project announced plans to launch a new stablecoin called USD1, which it says is pegged to the US dollar and backed by short-term government treasuries, dollar deposits and cash equivalents.

Now, World Liberty wants to test its on-chain airdrop feature by distributing a small amount of USD1 to all current WLFI token holders. In a new proposal, the project says the final exact amount will be based “on total eligible wallets and budget.”

Explains World Liberty,

“Testing the airdrop mechanism in a live setting is a necessary step to ensure smart contract functionality and readiness. This distribution also serves as a meaningful way to thank our earliest supporters and introduce them to USD1.”

World Liberty notes in the fine print on its website that President Donald Trump is not an officer, director, founder, or employee of the firm or any of its affiliates, but the company does name the president as the “Chief Crypto Advocate.”

World Liberty’s website also states that DT Marks DEFI LLC, an entity affiliated with Trump and some of his family members, holds 22.5 billion WLFI tokens and is entitled to receive fees from the project.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Why Isn’t XRP Skyrocketing? Expert Explains The Hidden Forces

Published

1 day agoon

April 9, 2025By

adminXRP prices dipped below $2 for the first time since December 2024 on Monday, even after a number of positive developments for the cryptocurrency.

The decline is surprising to many investors who had hoped recent good news would send its value higher. Market analyst Vincent Van Code attributes this underperformance to underlying economic issues and not with XRP itself.

Trump Tariffs Are Blamed For Crypto Market Decline

Van Code attributes the recent decline in cryptocurrencies to the tariffs imposed by US President Donald Trump on other nations.

The tariff situation is just a power play to utilize economic pressure to get better negotiating terms, said Van Code. He expects these trade tensions to be short-term and perhaps pave the way for the market to rebound in the near future.

Current #XRP prices are not aligned with recent @Ripple market announcenets, SEC case conclusion news, XRP US stockpile.

Do you think this is becuase XRP is not performing well?

I DONT! This is a global market downturn. Impacts across multiple markets, multiple countries, and…

— Vincent Van Code (@vincent_vancode) April 9, 2025

XRP Fundamentals Strong

Even after falling to $1.64 on April 7, XRP has shown a rebound by increasing to $1.82—a 10% increase. Van Code pointed out that Ripple and XRP’s fundamental strengths have not changed. They’re a hundred times better than a year ago when the SEC lawsuit was at its peak, he said.

The SEC-Ripple case resolution, potential inclusion in US digital asset reserves, and Ripple’s Hidden Road acquisition were all considered positive developments for the cryptocurrency.

Investment Strategy During Market Uncertainty

Van Code described his approach to today’s market condition, showing he buys such assets like XRP when sentiment is low but fundamentals remain in place.

He looks at weekly charts for larger decisions and uses hourly charts for intraday action. The market commentator termed XRP the “Fight Club” of cryptos because of its ability to withstand market action and stress.

Future Growth Drivers For XRP

Going forward, Van Code identified three key drivers to XRP adoption: regulation, corporate usage, and solid partnerships. He warned investors to avoid being influenced by short-term price fluctuations due to outside influences such as the tariff scenario.

The analyst said that he would only be jittery if XRP was the sole cryptocurrency that is dropping in value. He also stated that the current decline is part of a larger market trend and not particular to XRP.

The cryptocurrency market still responds to economic policy as investors look for indications that the tariff issue is resolved. Most XRP supporters are optimistic that as soon as these external pressures are gone, the price will more accurately reflect the good news surrounding Ripple and its currency.

Featured image from Unsplash, chart from TradingView

Source link

Altcoins

Bitcoin Dips Below $75K As Markets Tremble: What’s Goin On?

Published

4 days agoon

April 7, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

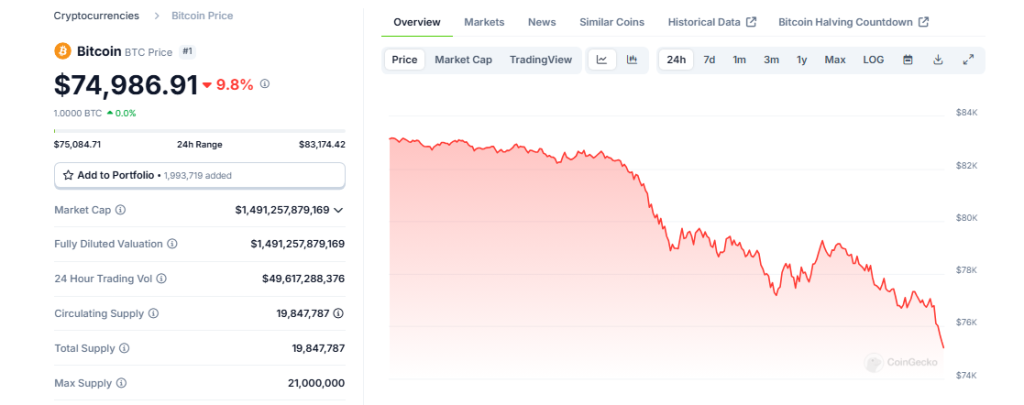

Bitcoin prices fell below $75,000 on Monday, April 7, the lowest since mid-March as investors reacted to US-China trade relations tensions escalating. The digital currency shed about 6% in 24 hours, CoinMarketCap data revealed, as part of a broader sell-off across both crypto and traditional markets.

Related Reading

US-China Trade War Triggers Market Panic

The sharp decline comes after US President Donald Trump’s recent imposition of tariff hikes and countermeasures by Beijing. The trade tensions sent shockwaves through world markets, with Wall Street suffering its worst fall since the COVID-19 pandemic. On Friday, April 4, the S&P 500 dropped 6%, the Dow Jones Industrial Average fell 5.5%, and the tech-heavy Nasdaq Composite fell 5.8%.

Market commentator Charles Gasparino cautioned on Twitter that “Monday is shaping up to be the ultimate pain day,” and that investors should prepare for further selling pressure as markets open this week. That forecast seems to be coming to fruition as Bitcoin is trading between $74,000 and $75,000, far lower than last week’s levels.

Breaking: One major market analyst just told me “Monday is shaping up to be the ultimate pain day.” Another: “Some really nice buys out there particularly in financials.” As they say disagreement makes a market! Story developing

— Charles Gasparino (@CGasparino) April 6, 2025

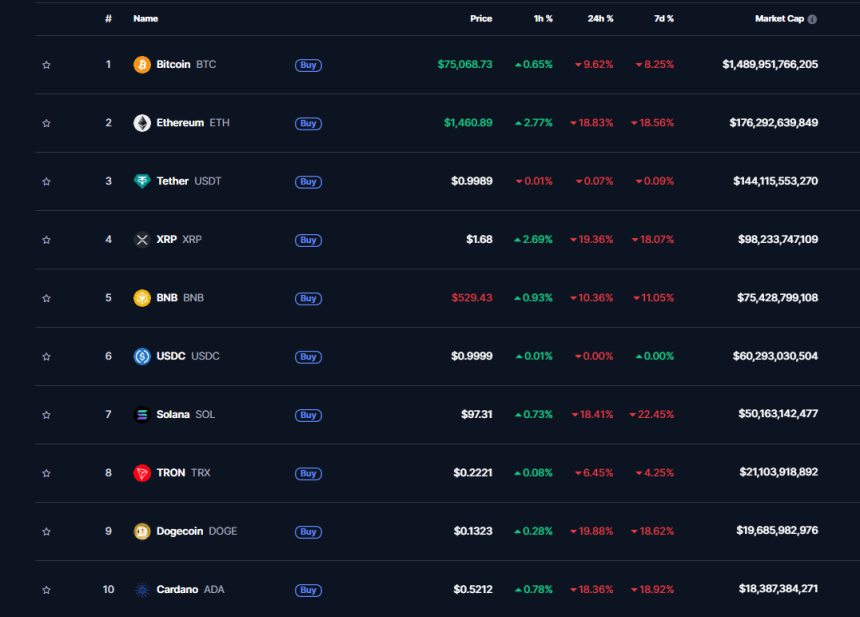

Ethereum And Altcoins Hit Harder Than Bitcoin

As Bitcoin lost heavily, other cryptocurrencies plunged even deeper. Ethereum, which is the second-largest cryptocurrency, by market cap, lost 13% – more than double the percentage drop of Bitcoin. Other well-known altcoins fell hard as well, with SOL and DOGE losing more than 10% in one day. ADA went down by 10.40%, while XRP and BNB lost 7% and 6%, respectively.

The worldwide cryptocurrency market capitalization is currently at $2.62 trillion as the majority of top coins fail to find support. Even with the price decline, Bitcoin’s 24-hour trading volume jumped to $26 billion – an 80% rise over the past 24 hours – indicating strong levels of market activity during the sell-off.

Investors Turn To Government Crypto Reserves For Potential Relief

There is a possible silver lining in market chaos. According to Edul Patel, CEO and co-founder at Mudrex, US government agencies will disclose their crypto assets today. “A huge confirmation could lead to a relief rally,” Patel said.

Related Reading

Market sentiment remains weak with the Fear and Greed Index inching towards what experts term “Extreme Fear.” This indicator implies that panicked selling has been controlling recent market trends instead of sound investment choice.

According to market observers’ reports, Bitcoin now has a crucial technical test. “Bitcoin must retake the $80,000 level or it will retest its prior all-time high around $74,000,” Patel further added. This prior all-time high, previously hailed as a milestone, is now a possible support level that traders wish will stop further price declines.

Featured image from Gemini Imagen, chart from TradingView

Source link

CryptoPunks NFT Sells for $6 Million in Ethereum—At a $10 Million Loss

SEC drops suit against Helium for alleged securities violations

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x