Ripple

XRP Price Gears Up—Can It Overcome Key Resistance Levels?

Published

1 month agoon

By

admin

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Source link

You may like

CryptoPunks NFT Sells for $6 Million in Ethereum—At a $10 Million Loss

SEC drops suit against Helium for alleged securities violations

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

Ripple

XRP Breaks Out Of Head-And-Shoulders Pattern — Eyes Move Toward $1.30

Published

2 days agoon

April 8, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

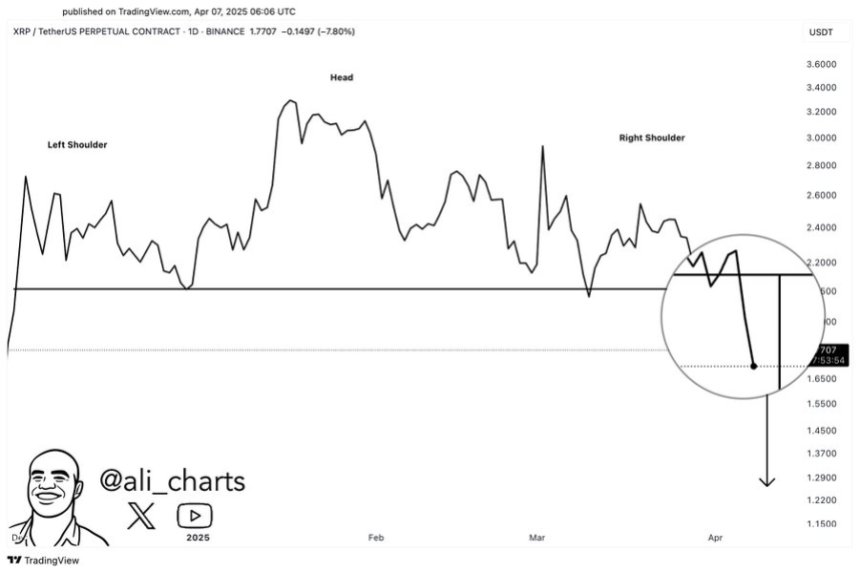

XRP is trading at critical levels after dropping below the $2 mark on Sunday, following a wave of panic selling across the crypto market. The move came as global financial markets reacted sharply to aggressive new U.S. tariffs, escalating trade tensions and sending risk assets tumbling. XRP, like many altcoins, has been hit hard by the volatility, with sentiment turning increasingly bearish.

Related Reading

Adding to the concern, top analyst Ali Martinez shared technical insights that point to further downside. According to Martinez, XRP is currently breaking out of a head-and-shoulders pattern — a classic bearish setup that often signals the beginning of a larger correction once the neckline is broken.

If the pattern plays out, XRP could be heading toward the $1.30 level, a key zone of historical demand and potential support. With market conditions already fragile and uncertainty growing, this pattern reinforces the bearish outlook for XRP in the short term.

Unless bulls can reclaim $2 and invalidate the breakdown, XRP may continue to bleed alongside the broader market. All eyes are now on how price behaves in the coming sessions, as traders assess the strength of this technical signal.

XRP Faces Bearish Outlook As Head-and-Shoulders Pattern Confirms Breakdown

XRP has now lost over 50% of its value since reaching its recent all-time high, and the market is showing no clear signs of stability. As fear spreads across both traditional and crypto markets, XRP remains under heavy pressure, with volatility intensifying in recent sessions. The broader landscape clouds with macroeconomic tension, particularly US tariffs that have triggered global trade concerns and sent risk assets into a tailspin.

The sentiment surrounding XRP is deeply divided. While some investors still believe that a broader market recovery could help XRP reclaim range highs, others remain skeptical. For now, price action supports the latter. Bulls have failed to defend the $2 mark — a critical psychological and technical level — and XRP has continued to trend lower.

Martinez added to the bearish narrative, sharing a technical breakdown on X that shows XRP is currently breaking out of a head-and-shoulders pattern. This formation is widely regarded as a bearish reversal signal, and Martinez suggests that the confirmed breakdown could send XRP tumbling toward the $1.30 level. That target aligns with historical demand and previous support zones, making it a likely destination if current momentum continues.

Unless bulls reclaim $2 quickly and invalidate the pattern, XRP may struggle to recover in the near term. With the broader market still unstable and high-risk assets under pressure, the bearish outlook for XRP appears to be gaining traction. The coming days will be critical as traders watch whether XRP stabilizes — or slips further into its current downtrend.

Related Reading

Bulls Struggle At $1.86 And Fight To Avoid Deeper Correction

XRP is trading at $1.86 after several days of struggling to reclaim higher levels, with selling pressure dominating price action. Bulls lost momentum once the price broke below the key $2 support, which had previously served as a psychological and technical floor. Since then, XRP has continued to slide, failing to generate enough buying volume to spark a meaningful recovery.

The current level around $1.86 is now acting as a short-term support zone, but it remains vulnerable. If XRP doesn’t hold above this area, sellers will likely push it toward the $1.50 region. This level marks a significant demand zone from previous market cycles and could act as the next stop in the event of continued bearish pressure.

Related Reading

On the flip side, if bulls can manage a swift rebound and push the price back above $2, it may trigger a short-term relief rally. Reclaiming that level would invalidate some of the recent bearish momentum and potentially set the stage for XRP to target higher resistance around $2.20 and beyond.

For now, XRP remains caught in a delicate spot — and what happens next will depend largely on whether buyers step in to defend the current support zone.

Featured image from Dall-E, chart from TradingView

Source link

Price analysis

Weekend Demand Weakens as BTC and ETH Traders Lose $50M in Liquidations

Published

5 days agoon

April 6, 2025By

admin

XRP price rebounds above $2 as BTC and ETH see $50M in liquidations, but derivatives trading metrics suggest weekend volume weakness may pressure altcoins lower.

Ripple (XRP) price holds $2 support as altcoins mirror Bitcoin’s resilience to Trade War Triggers

Ripple (XRP) price initially plunged to 30-day lows around $1.80 with hours after Trump announced sweeping tariffs during the liberation speech on Friday.

However, the momentum swung positive in recent days as BTC holds firm above $82,000 after China retaliatory 34% tariffs on Thursday, reinforcing investor confidence in the crypto markets as a crisis resistant asset class.

Ripple price rebounded 12.5% since Thursday, rising as as $2.15 at press time according to CoinMarketCap data.

As seen above, Ripple price continues to consolidate well-above the $2 mark, mirroring the likes of ETH, BTC and SOL, which have also defended key psychological support levels around $1,800, $80,000 and $110 respectively over the past week.

Meanwhile, top-ranked US stocks such as Apple, NVIDIA and Microsoft all recorded 15% losses a piece before the week’s trading closed on Friday.

Derivative Market Analysis: Crypto Buying Pressure Could Slow Down this Weekend

With top-ranked crypto assets including XRP all consolidating around key psychological price points this weekend, it signal market-wide buying support, amid capital inflows from investors exiting stocks amid US trade war tensions.

However, considering that US markets are now closed, the volume of transitional capital flows could slow down significant until pre-market trading begin.

Validating this stance, Coinglass derivatives market data shows evidence of short-term bearish trading signals.

Derivatives data from Coinglass reinforces this stance. Over the past 24 hours, crypto markets saw a total of $110.65 million in liquidations, with long positions accounting for $85.10 million—over 76% of the total.

Bitcoin and Ethereum alone alone recorded nearly $50 million combined, with BTC traders booking $36.32 million in liquidations, followed by Ethereum at $13.61 million.

The bearish imbalance, especially the outsized long wipeouts in the last 12 hours ($67.11M longs vs $13.48M shorts), points to a rising number of over-leveraged bullish positions being flushed out.

This suggests short-term exhaustion in buying momentum, increasing the likelihood of a minor pullback or sideways action through the weekend.

With high leverage being unwound and external demand on pause, weekend trading may turn defensive with XRP markets and other prominent altcoins.

Strategic altcoin traders woould watch for support retests, especially if funding rates begin to flip or volume declines further ahead of Monday’s open.

XRP Price Forecast: Bulls facing Resistance at $2.20, Amid Weekend Caution

As the week closes on April 5, XRP price forecast charts on TradingView reflect signs of short-term exhaustion following its rebound to $2.15.

Despite five consecutive green candles, XRP price remains below the 50-day EMA at $2.21 and the 100-day EMA at $2.28. This reflects supply-side pressure still outweighing momentum, even as bulls attempt a recovery from March’s lows.

Notably, the 200-day EMA near $1.95 is acting as a key anchor. A breach below this could trigger stop runs and reopen downside risk toward $1.80.

True Strength Index (TSI) remains in bearish territory at -0.80, yet is flattening, hinting that the selling momentum is decelerating. Volume has weakened across recent sessions, confirming the rally lacks conviction. A clear break above $2.22 would be required to invalidate near-term bearish bias.

Until that happens, XRP remains vulnerable to weekend drawdowns. Bulls must defend $1.95 or risk deeper losses into next week’s open. A close below $2.00 would reassert sellers’ control short-term.

Frequently Asked Questions (FAQs)

XRP is mirroring Bitcoin and Ethereum’s stability, with investor flows shifting from equities amid global trade war fears.

XRP rebounded 12.5% after Bitcoin defended $82,000, reinforcing crypto’s appeal as a safe-haven during trade tensions.

Only if XRP clears resistance at $2.22. Otherwise, weakening volume and leverage resets could lead to a pullback toward $1.95.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Price analysis

Paul Atkins “Conflict of Interest” Triggers $220M Withdrawals from Ripple Markets

Published

2 weeks agoon

March 30, 2025By

admin

Ripple (XRP) came close to slipping below the critical $2 mark on Saturday, only to see a modest recovery as bullish traders reclaimed the $2.15 level. Regulatory uncertainty surrounding SEC Chair nominee Paul Atkins sparked withdrawal from XRP derivatives markets, signalling more downside risks ahead.

Why Is Ripple (XRP) Price Going Down Today?

Ripple’ (XRP) latest downturn has been attributed to mounting concerns of “conflict of interest” over the nomination of Paul Atkins as SEC Chair under the Trump administration.

While Atkins has long been regarded as a crypto-friendly figure, opposition from U.S. Congress has raised fears of potential regulatory hurdles for Trump’s crypto plans and ongoing altcoin ETF filing reviews.

Recently, Ripple secured a major legal victory in its protracted battle with the SEC, bringing long-awaited closure to the case. However, uncertainty surrounding Atkins’ confirmation has cast a shadow over XRP price momentum.

As seen in the chart above, Ripple price tumbled a low as $2.06 on Saturday, before rebound towards the $2.15 level at the time of publication.

Atkins’ critics within Congress have expressed concerns over potential conflicts of interest, signaling broader resistance to pro-crypto policies.

If his confirmation is blocked, it could indicate a more hostile stance toward upcoming legislative initiatives—such as the proposed Crypto Strategic Reserve, which requires congressional approval for federal cryptocurrency acquisitions.

According to Polymarkets data, investors are now pricing 35% chance that the US SEC could approve XRP spot ETFs before July 31. Notably that figure has now declined 7% since the scrutiny around Trump’s SEC chair nominee, Paul Atkins began.

More significantly, investors worry that a less crypto-friendly successor could delay or outright reject altcoin ETFs, dealing a major setback to institutional adoption.

This uncertainty has contributed to XRP’s recent sell-offs, as market participants brace for potential regulatory headwinds.

Traders Withdraw $220M as Market Sentiment Deteriorates

XRP’s bearish trend has not been confined to spot market losses alone. In the derivatives sector, traders are aggressively unwinding their positions, signaling a broader loss of confidence in XRP’s short-term recovery prospects.

According to CryptoQuant, XRP’s open interest—a key indicator of futures market activity—has fallen sharply from $1.6 billion on March 19 to $1.48 billion at press time, reflecting a $220 million decline in just 10 days.

This mass exodus suggests that traders are moving to reduce their exposure rather than betting on a swift rebound.

Extended periods of large-scale withdrawals from open interest typically indicate persistent bearish momentum, as market participants either lock in profits or cut their losses ahead of further declines.

Unless broader sentiment shifts in favour of crypto regulation, XRP may continue facing selling pressure in the near term.

XRP Price Forecast: Bearish Breakdown or Rebound to $2.40?

XRP price is struggling to regain bullish momentum after falling below key moving averages, signalling potential downside risks.

The XRPUSDT daily chart depicted below reveals XRP is currently trading at $2.17, facing resistance from the 50-day SMA at $2.41 and the 100-day SMA at $2.51, as sellers remain firmly in control.

The declining trading volume further reinforces bearish sentiment, indicating weak demand at current levels.

The Bearish Breakout Probability is supported by the BBP (Balanced Bollinger Percentage) indicator, which sits at -0.3190, a sign of persistent downward pressure.

If XRP fails to reclaim the $2.20 support, the price could slide toward $2.00, a psychologically significant level that could trigger panic selling. A breakdown below this mark could open the floodgates for a further decline toward $1.80.

On the flip side, a bullish recovery scenario would require a decisive break above the $2.41 resistance.

This would invalidate the bearish outlook and potentially drive XRP toward $2.60, aligning with the 100-day SMA. However, without a surge in buying volume, XRP may remain vulnerable to further sell-offs.

Frequently Asked Questions (FAQs)

XRP’s decline is linked to uncertainty over SEC Chair nominee Paul Atkins, with investors fearing potential regulatory challenges for crypto assets.

Yes, approval of an XRP spot ETF could drive institutional demand andpush prices higher, but regulatory uncertainty remains a key risk.

Over $220 million in XRP derivatives positions have been closed in the past 10 days, reflecting weakening investor confidence.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

CryptoPunks NFT Sells for $6 Million in Ethereum—At a $10 Million Loss

SEC drops suit against Helium for alleged securities violations

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: