Bitcoin

Bitcoin Poised For A Q2 Recovery? Analyst Points 2017 Similarities

Published

2 weeks agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) attempts to reclaim the $84,000 barrier again, the flagship crypto risks closing the Month in red numbers. Some analysts suggest that BTC’s Q2 performance could mimic its 2017 rally.

Related Reading

Bitcoin Retests $84,000

A week ago, Bitcoin saw a star-of-week pump to retest the $88,000-$89,000 resistance zone. The flagship cryptocurrency surged to a two-week high of $88,765, hovering between the $85,000 to $88,000 price range for most of the week.

However, as the weekend approached, BTC lost its range, falling to $84,000 on Friday and continuing to dip over the next two days. Bitcoin saw an 8.2% weekly drop during the early Monday hours, hitting $81,278 before recovering.

After hitting its lowest price in two weeks, the largest crypto by market capitalization bounced from the range lows, nearing the key $84,000 barrier again. This zone has been a crucial resistance level since Bitcoin lost its post-November breakout range a month ago.

Since then, BTC has failed to maintain this level for significant periods. Amid the market correction, trader Daan Crypto Trades noted that Bitcoin has created another CME Gap, becoming the fifth consecutive week that a gap has been created due to price movement during the weekend, with all the previous ones being closed “relatively quickly.”

This week’s CME gap, between $82,500 and $84,100, was almost filled after this morning’s rally. However, analyst Rekt Capital pointed out, “BTC will need to rally more than that to try to seriously challenge for a reclaim of the recently lost Higher Low,” at around $85,000.

BTC To Consolidate For Longer?

Ted Pillows suggested BTC’s performance could see a Q2 recovery based on its 2017 price action. The analyst highlighted that during US president Donald Trump’s first term, Bitcoin’s “real rally” didn’t start until 2017’s second quarter.

Per the post, “BTC’s real gains during Trump’s first presidency started after Q1 2027. For the first two months, BTC just consolidated in a range similar to now.” Then, it started to gain momentum in April, pumping from $1,400 to $20,000 until December 2017.

Ted considers that if Bitcoin continues to follow its 2017 path, it could see a massive rally toward a new all-time high (ATH) later this year. It’s worth noting that Q2 has historically been mostly favorable for BTC, CoinGlass data shows.

Meanwhile, Rekt Capital also suggested that Bitcoin will likely continue consolidating a little bit longer after the recent price correction. The analyst pointed out that BTC failed to confirm its breakout from its triangular market structure.

He previously explained that, over the past six weeks, BTC has been consolidating between the two biggest bull market Exponential Moving Averages (EMAs), the 21-week and 50-week EMAs, in a “very similar fashion to mid-2021.”

Related Reading

The analyst added that in mid-2021, “Bitcoin didn’t break from this similar triangular market structure right away either, upside-wicking towards and into the 21-week EMA but ultimately rejecting from there to experience additional consolidation between the two EMAs.”

This could suggest that the flagship crypto “is sentenced to a bit more consolidation between the two EMAs” before attempting to “kickstart an uptrend continuation towards the Re-Accumulation Range Low of $93,500.”

As of this writing, Bitcoin is trading at $83,297, a 1% increase in the daily timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

You may like

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Bitcoin

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Published

30 minutes agoon

April 14, 2025By

admin

Bitcoin (BTC) proponent Michael Saylor has hinted the company he co-founded, Strategy (MSTR), may be set to announce an additional BTC purchase this week shortly after revealing it expects a net loss in the first quarter of the year over unrealized losses on its massive BTC holdings.

The company has added 80,785 BTC to its balance sheet since the beginning of the year after raising a total of $7.69 billion during the first quarter, with over half of that coming from common stock sales. Most, if not all, of those funds were used to buy bitcoin.

On Sunday, Saylor posted a BTC holdings tracker to X, a move that typically precedes a purchase announcement, commenting there are “no tariffs on orange dots.” The comment implies the company’s BTC purchases were unaffected by the reciprocal tariffs Donald Trump introduced earlier this month and the ensuing U.S.-China trade war.

The company paused its buying during the week ending April 6. Its crypto stash is currently worth roughly $44.59 billion, and was acquired for $35.63 billion.

Strategy currently holds 528,185 BTC bought at an average price of $67,458 according to Bitcointreasuries data equivalent to 2.515% of the cryptocurrency’s total supply.

Source link

ALCH

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Published

5 hours agoon

April 14, 2025By

admin

A closely followed crypto analyst believes one meme token operating on Solana (SOL) is in the early stages of a market recovery.

Pseudonymous analyst Altcoin Sherpa tells his 243,800 followers on the social media platform X that he’s bullish on the memecoin Bonk (BONK).

The trader shares a chart suggesting that BONK will face resistance at the $0.000012 level before printing a bullish higher low setup and rallying to his target above $0.0000145.

“BONK is looking strong in the short term, and should go higher. Should be a pullback around the 200 EMA (exponential moving average) on the four-hour chart but still, I think this has pulled back enough to where any buying down here is probably reasonable.”

At time of writing, BONK is worth $0.00001376.

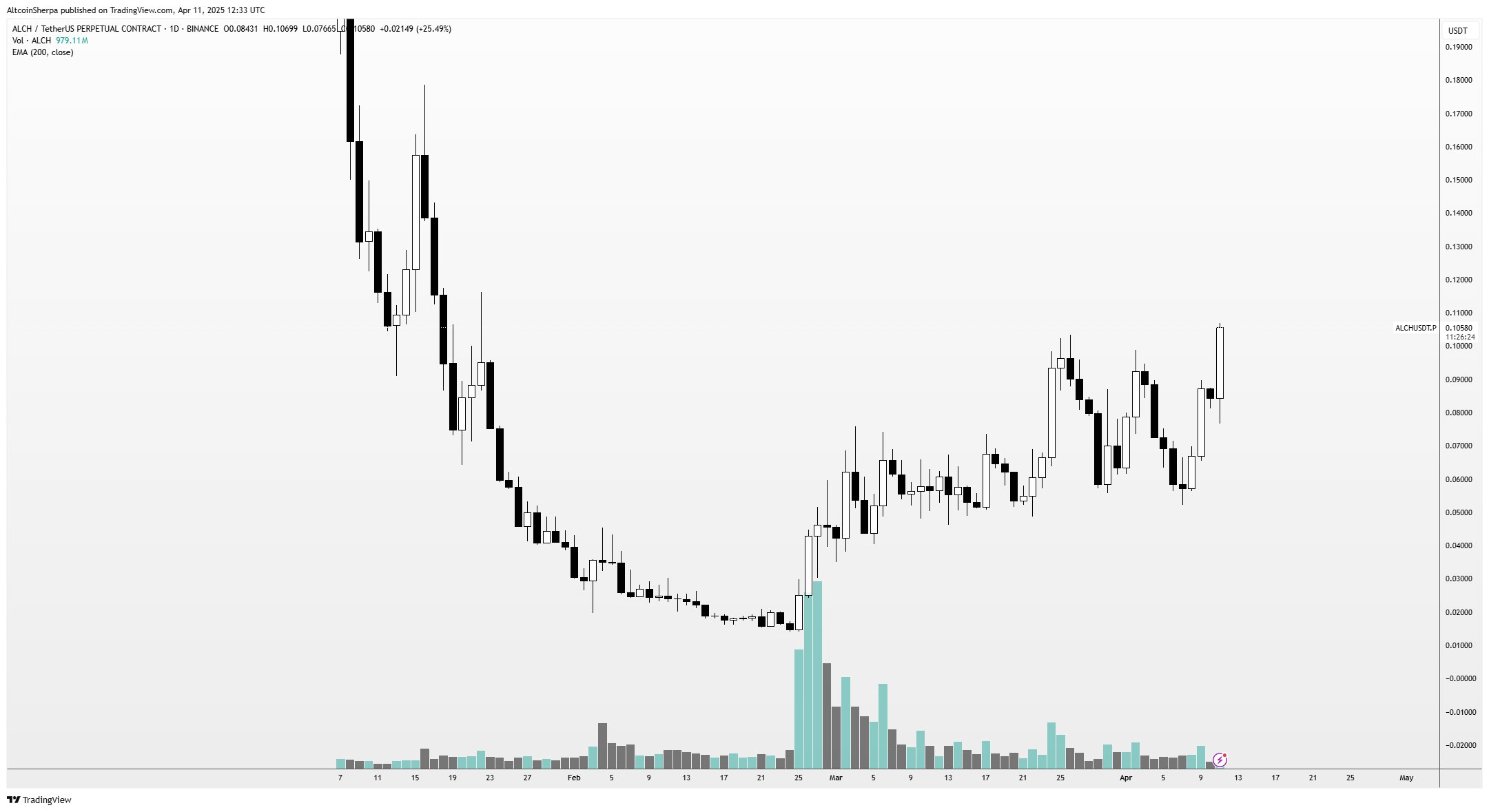

Turning to the low-cap altcoin Alchemist AI (ALCH), the analyst says the coin appears to be in an uptrend and that he’s waiting for potential dips to accumulate the asset.

ALCH is an artificial intelligence (AI)-based crypto project that allows users with no coding skills to generate codes by providing natural language descriptions.

Says Altcoin Sherpa,

“ALCH still seems like a really strong chart, don’t see it being mentioned much. I think it’s basically taken the place of ARC; a super volatile AI coin that moves 20% a day. Not in it but traded it a lot before; will look to buy dips.”

At time of writing, ALCH is the 431st-largest crypto asset by market cap, trading at $0.109.

Looking at Bitcoin, Altcoin Sherpa thinks that BTC will continue to consolidate within a large trading range in the short to mid-term.

“Expecting there is some sort of chop between $70,000-$90,000 over the next several weeks for BTC. Relative bottom probably in, but still some more consolidation to come.”

At time of writing, Bitcoin is trading for $85,366.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

24/7 Cryptocurrency News

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

Published

13 hours agoon

April 13, 2025By

admin

MicroStrategy is lacing up for a potential Bitcoin purchase after Michael Saylor flashed the tell-tale buy signal. The incoming purchase will be the company’s first in Q2 after pausing Bitcoin purchases at the start of April in an eyebrow-raising move.

Michael Saylor Flashes Bitcoin Buy Signal

MicroStrategy CEO Michael Saylor has dropped clues that the software company will continue its Bitcoin accumulation spree. In an X post, Saylor shared MicroStrategy’s portfolio tracker revealing the company’s Bitcoin holdings and valuations.

Michael Saylor’s previous posts sharing Microstrategy’s portfolio tracker over the weekend have resulted in purchases at the start of the week. Investors are lapping up Saylor’s portfolio tracker post and the accompanying caption as cues for a BTC purchase on Monday.

“No tariffs on Orange Dots,” said Saylor, taking a jibe at brewing tariff wars between the US and China.

MicroStrategy had previously halted its Bitcoin purchase spree at the start of April leading to a slump in MSTR price. At the time, there was significant chatter that MicroStrategy may be forced to offload its Bitcoin holdings to cover obligations following a dip in prices.

Per the portfolio tracker, MicroStrategy holds 528,185 BTC on its balance sheet valued at $44.7 billion. Michael Saylor hinting at a potential Bitcoin purchase follows a small dip in prices with BTC holding the $83K mark.

Will Bitcoin Price Rally?

Saylor’s hint at buying Bitcoin has triggered a small bump in prices as the top cryptocurrency surpassed $83K. However, an actual purchase will trigger a significant price action for BTC in line with previous accumulations.

MicroStrategy’s last Bitcoin purchase of 22,048 BTC jolted the markets in line with investors’ expectations. However, there are fears that macroeconomic events like the US-China tariff war may affect a potential BTC rally following MicroStrategy’s incoming purchase.

Bitcoin price has rebounded after a previous bloodbath, sparking fresh optimism in the markets. Crypto Joao Wedson predicts that Bitcoin is not out of the woods yet and a grim drop to $65K is still a possibility for the top cryptocurrency.

“We’re not ruling out the possibility of the price dipping below $65K, as several metrics point to that region as strong support – such as the True Market Mean Price and Alpha Price, both sitting exactly around $64,700,” said Wedson.

Crypto analyst Doctor Profit warns that a BTC price drop to these levels may force MicroStrategy to sell MSTR to avoid liquidation.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: