Bitcoin

A Manual Guide to Killing Bitcoin: The Eternal Return

Published

3 months agoon

By

admin

This article is featured in Bitcoin Magazine’s “The Halving Issue”. Click here to get your copy.

Every morning at 6am, in Punxsutawney, Pennsylvania, the cynic weatherman Phil Connors wakes up to experience the same day over and over and over again. Stuck in a time loop, Connors tries everything to get his life back to normal – he gets stabbed, shot, burned, frozen and electrocuted, only to wake up again the next day as if nothing had happened. Connors quickly comes to the only plausible conclusion: he must be a god.

Thinking ourselves to be undefeatable has never been a particularly smart strategy, in times of war or otherwise. If we believe in cosmology, from Nietzsche to Hinduism, time is a loop, and there is a finite realm of possibilities which infinitely repeat – the only thing that we can really do is change how we react. Unless we learn from our mistakes, we are doomed to experience the same things over and over again.

Though often priding ourselves in exceptional intellect – I’ve found Bitcoin early, I must be very smart – it seems that learning from mistakes comes hard even for the most seasoned ‘Bitcoin advocates’. Public discourse seems to have shifted from the discussion of technological challenges and limitations to Deutsche Bank afterwork chats – Anything is possible, we’ll just need returns to remain on track.

When Bitcoin was first discussed in German Parliament back in 2014, ‘experts’ highlighted the ease with which bitcoin payments could be deanonymized via network analysis, speaking to the risks of widespread bitcoin adoption to lead towards total financial surveillance. Today, ten years later, as Bitcoin has returned to German parliament, ‘experts’ have been exchanged for influencers proposing Bitcoin as CBDC alternatives. Current ‘Bitcoin political debates’ cannot help but remind us of Bart Simpson running in circles banging a pan on his head.

As we continue to close in on the opportunist’s echo chamber, we have successfully swapped academic debate for cheerleading squads. Things will go great so long as you’re willing to take your tits out. ‘We’re winning!’ has long become the prevalent meme – Between ETF approvals, stablecoin issuances, and possible nation state adoption we are so confident in Bitcoin’s success that we seem incapable of realizing that this is precisely how you lose. Arrogance comes before most declines, and its exploitation has always been by design. By sowing manic delusions of invincibility, even the most trained commander will lead their sheep to slaughter.

Groundhog Day

A long long time ago, in a galaxy far away, we plugged our computers into landlines to access the three great W’s. For anyone who didn’t live alone, this practice was often doomed to reap a fair amount of havoc – Get off the computer, mom is waiting for a phone call.

So we can all agree that that sucked. But, due to a lack of technological advancements and accessibility to communicate wirelessly across distances (think of your favorite mesh network here), it was the most convenient option we had. The only problem: it led to a monopoly on web access points lying with telecommunications providers. Fast forward 20 years, and we now know that telecom providers monitor, analyze, and report anything that we do on the internet to government authorities under the guise of national security. A technology thought invincible for the liberation of the people quickly turned into its biggest enemy.

Now we can’t really talk about the success (and downfall) of peer-to-peer technologies without talking about Linkin Park. Linkin Park’s music, then still Hybrid Theory, circulated widely on the first P2P music file sharing network Napster. Downloaded from other people’s computers, accessing Linkin Park’s music was completely free. Their first studio album, Hybrid Theory, yet remains one of the top five most sold records in the world with 15 Million copies sold in the first three weeks alone.

Napster was a real world internet revolution – And the music industry was furious. As people happily infected their devices with potential computer AIDS, bands, rappers, and singer songwriters like the Arctic Monkeys, Dispatch or EMINEM were building fanbases even before breaking their first big record releases, and the musical establishment wasn’t having it. When Metallica sued the P2P platform for copyright infringement, clearly unhappy that their cult status and its consequential returns felt threatened, peer-to-peer music file sharing did not exactly die, but was quickly incorporated into more corporate friendly formats – from buying music via iTunes to music streaming via Spotify.

While it seemed unimaginable to put a technology like Napster back into the box, convenience, again, became king. Today, the majority of listeners do not own the music that they listen to, but subscribe to corporate databases of which neither artists, labels nor producers profit. Instead, the big winner of the music file sharing industry again turned out to be surveillance. Just last week, when Spotify updated its cookie policy, a push notification let EU users know which 695 data brokers would gain access to their information. Downloading files like ClapYourHandsSayYeah.mp3.exe (RIP) clearly was risky business, but the risks of surveillance capitalism reach much farther than a trashed computer.

In essence, the same thing happened to search engines. Going online in the early days of the world wide web was like getting dropped off in the middle of Yellow Stone national park without a map. There were thousands of places to go, but you needed to know where they were. With comprehensive link collections, platforms like Yahoo, AskJeeves or Google offered tremendous value to those less versed in their way around the WWW. Instead of asking your peers where something cool on the internet was, you simply asked Google. But, with moving away from word-of–mouth formats, we ended up with what has today been termed the great enshittification. The first few links are paid affiliate sites, and the ones after that are those who figured out how to efficiently play Google’s SEO formats, of course all packed and tailored to your supposed needs. Today, Google is one of the most valuable surveillance companies in the world. A software meant to aid in the liberalization of free information essentially became a tool for censorship.

Again and again, thinking that ‘technology has won’ only exacerbated its demise. We choose what is comfortable now only to stab ourselves in the back down the road. And before you know it – BING! It’s the whistling belly button at the high school talent show as the weatherman strikes again. To put it bluntly: we’re fucking up.

It’s the Filters, Stupid

In today’s pop-culture Bitcoin discourse, ignorance runs rampant. Lightning works until it doesn’t, let’s spend millions to put the Dollar on Bitcoin; It’s called priorities babe, look it up.

When Ordinals hit Bitcoin – think of them what you will – we suddenly realized that we were in trouble. In the global south, people quickly became unable to transact non-custodially. All the people you’ve told to DCA suddenly saw themselves facing exorbitant transaction fees, unable to move their funds. For those valuing their privacy even for smaller spends, participating in coinjoin rounds turned prohibitively expensive. No matter where we look, we still have a scaling problem. This problem does not exist because of Ordinals. It exists because we were so convinced of winning that we lost track of keeping our ignorance in check.

Over the past four years, the majority was more concerned with furthering its own narrative – everything is awesome and Bitcoin is the bestest currency on earth – than facing uncomfortable truths. We then proceeded to respond with an exorbitant amount of shortsightedness: it’s the filters, stupid.

Filtering out Ordinals transactions is a short term solution for a long term problem. Sure, blocking arbitrary data on the blockchain will necessarily drive fees down, but if global Bitcoin adoption is what you want, you’re not doing yourself any favors by proposing selective solutions to systemic issues. The thing is that being angry at JPEGs is easy. Taking on problems that challenge the ‘greatness of Bitcoin’, which some appear to have turned into their whole personality, is not. For every tweet that claims for Bitcoin to bring world peace – clearly by pure magic, or what the Wall Street losers turned Bitcoin economists call some backwards form of game theory – a little of the system dies.

We do not need your hopium; We need real world solutions to real world problems. That includes laying down the crack pipe and talking about the uncomfortable stuff: we are not winning – we are doing the opposite, because our ‘long time preference’ reaches about as far as our investment portfolios. You can kill Bitcoin. And it’s easier than you’d think.

Embrace, Extend, Extinguish

Over the past few years, debates around Bitcoin ‘winning’ looked pretty much the same. Senators are embracing Bitcoin: see, we are winning. BlackRock is embracing Bitcoin: see, we are winning. First they ignore you, then they laugh at you, then they realize that all you want is a pat on the back before the policeman comes to take your toys away. The laughing hasn’t stopped, it just happens behind your back.

The most plausible death of Bitcoin would happen less in name than in its total incorporation, at a point where the technology is simply not yet ready for ‘mass adoption’ – just like we have killed all peer-to-peer technologies that came before it. The death of Bitcoin is not the death of the tech, but the death of its usability.

At the center of the death of Bitcoin, at least in essence, continues to stand the scaling debate. When Gigablocks were first proposed, it seemed fairly obvious that a blockchain that takes 10 years to sync will lack in decentralization. In came the Lightning Network, which seemed to solve all of our issues: Scaling off-chain, securing on-chain. Smart. Except that we can only fit around 5000 channel opening and closing transactions inside of a block – hardly enough to let 8 Billion people use Bitcoin non-custodially.

Unfortunately, that didn’t stop influencers – or really anyone – from proclaiming their Hail Mary of desperation; Scaling Bitcoin obviously is a problem for future me. Too high was the thrill of finally being able to sit at the corporate dinner table and smug the obligatory ‘I told you so’. Putting non-believers into their place simply had to come first; if Bitcoin doesn’t exist to feed our fragile egos and pump up our sad little bank accounts, what really was the point? Freedom, Carajo! Welcome to your involuntary conversion at the church of satoshi’s witnesses, where we drop speeches on saving the world from tyranny more often than Biden changes his diapers.

So here we are. Six years after we bought our first stickers at the Blockstream store – the only thing you were able to buy when the first Lightning implementations launched, besides beer – and we’re still scrambling. Instead of fostering broad discussions around covenant proposals, which do come with real trade-offs and risks, we are busy labeling anyone not willing to ossify a spook, while ossification at this point in Bitcoin will certainly be the surest way to kill it.

Sometime in the near future, we’ll wish ourselves back to a time of a few hundred vBytes in fees. By then, we will have no choice but to use Bitcoin custodially. Say goodbye to freedom money: Bitcoin as we know it will be dead, unless we stop making the same mistakes.

Source link

You may like

AI predicts one altcoin set to outperform XRP and Solana in 2025

BTC and Major Altcoins Pullback, SAND Soars 60%

Трамп обирає менеджера прокрипто-хедж-фонду Скотта Бессента на посаду міністра фінансів

Trump calls up crypto pals, Senator says sell gold for Bitcoin | Weekly Recap

Where to Invest in November End?

XRP Price Hits 3-Year High At $1.6

Bitcoin has surged past the $99,800 mark, setting another all-time high as it inches closer to the psychological $100,000 milestone. Despite briefly testing the level, BTC has yet to break through, leaving investors and analysts eagerly anticipating the next move. With demand remaining robust, the stage appears set for Bitcoin to push past this key barrier in the coming days.

Related Reading

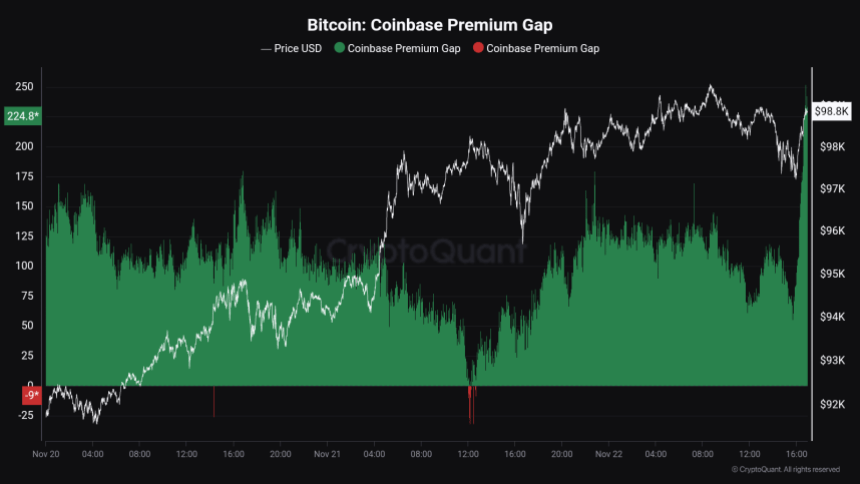

Recent data from CryptoQuant highlights a significant factor driving this rally: the Coinbase Premium Gap, which currently sits at $224. This metric, representing the price difference between Bitcoin on Coinbase and other global exchanges, signals strong buying activity from US Coinbase investors.

The relentless upward momentum has further solidified Bitcoin’s dominance in the crypto market, with many viewing the $100,000 level as a critical supply zone. While the price has yet to break through, the ongoing rally reflects a growing belief that Bitcoin’s parabolic bull phase is far from over. As the market approaches this pivotal moment, all eyes remain on BTC’s ability to sustain its momentum and claim new highs, setting the tone for the weeks ahead.

Bitcoin Price Action Remains Strong

Bitcoin has been in an “only up” phase since November 5, showing no signs of weakness as it consistently climbs to new heights. Even after failing to break above the $100,000 mark yesterday, price action remains incredibly strong. Bulls are firmly in control, and if Bitcoin holds above critical demand levels, the long-anticipated $100,000 milestone could be breached within hours.

CryptoQuant analyst Maartunn revealed that robust demand from US investors is a key driving force behind this rally. According to his data, the Coinbase Premium Gap—a metric that tracks the price difference between Bitcoin on Coinbase and other global exchanges—stands at $224.

This positive premium underscores US-based buying activity as a significant factor in the current bullish momentum. A high premium often suggests that investors on Coinbase are willing to pay a higher price than others, a strong indicator of heightened demand.

Related Reading

As the market watches closely, Bitcoin’s ability to maintain its upward trajectory hinges on staying above vital support levels. The psychological resistance at $100,000 remains formidable, but the unyielding appetite from US investors points to continued strength in the days ahead. With such solid fundamentals, many analysts believe Bitcoin is poised for another explosive rally once the $100,000 barrier is decisively cleared.

BTC Rally Is Only Starting

Bitcoin is trading at $98,800 after a failed breakout above the highly anticipated $100,000 mark. Despite this temporary setback, price action remains firmly bullish as BTC continues to hold above key demand levels, showing resilience and strength in the current market. The failure to retrace to lower prices indicates that bullish momentum is still intact, keeping investors optimistic about a potential breakthrough.

If BTC maintains its position above the critical $95,000 support level, the likelihood of a surge past the $100,000 psychological barrier increases significantly. Holding above this level would signal strong buyer interest and the potential for further upside, paving the way for Bitcoin to resume its upward trajectory in the near term.

Related Reading

However, if Bitcoin fails to hold above $95,000, a retrace to lower demand zones would confirm a short-term correction. Such a pullback could provide the necessary fuel for the next rally, as it would allow the market to consolidate before making another attempt at breaking the $100,000 mark.

For now, all eyes remain on Bitcoin’s ability to defend its key support levels as the market anticipates the next major move in this historic rally.

Featured image from Dall-E, chart from TradingView

Source link

Bitcoin

Senator Lummis wants to replenish Bitcoin reserves with gold

Published

1 day agoon

November 24, 2024By

admin

Republican Senator Cynthia Lummis says converting gold reserves into Bitcoin could strengthen the U.S. government’s finances.

In an interview with CNBC, Lummis suggested that the Federal Reserve sell some of its gold reserves, which were valued at 1970s prices, and use the proceeds to buy Bitcoin (BTC).

See the clip below.

Lummis, known for her bullish support of cryptocurrency, believes that creating a strategic Bitcoin reserve could strengthen the dollar’s position as the world’s reserve currency and reduce the country’s debt burden.

She also suggested that Bitcoin, which is edging toward $100,000, could provide high returns.

Bitcoin can be considered a “gold standard digital asset” and creating a strategic reserve would be an essential step in its implementation, Lummis explained.

“We have reserves at our 12 Federal Reserve banks, including gold certificates that could be converted to current fair market value. They’re held at their 1970s value on the books. And then sell them into bitcoin, that way we wouldn’t have to use any new dollars in order to establish this reserve.”

Senator Cynthia Lummis

With the Trump administration’s growing interest in cryptocurrencies, Lummis said that legislation for digital assets could begin to be developed in the coming years.

How the Bitcoin reserve works

The creation of the Bitcoin Strategic Reserve Fund is a comprehensive initiative meant to strengthen financial stability and protect the nation’s assets.

Explained: 🇺🇸 The Strategic Bitcoin Reserve

Breaking down the BITCOIN act — the bill introduced by Senator @CynthiaMLummis

– Buy 1m BTC over five years

– HODL for 20 years

– Proof of Reserves

– Protect Bitcoin property rightsTL;DR: 🚀🚀🚀 pic.twitter.com/snnWP59FBc

— Julian Fahrer (@Julian__Fahrer) November 19, 2024

The Bitcoin Strategic Reserve will also act as a secure financial mechanism that allows the government and other agencies to use Bitcoin as a long-term asset.

The reserve will include a decentralized storage network. By creating a decentralized network of secure Bitcoin storage facilities, the U.S. can protect assets from centralized risks and vulnerabilities. Storage facilities will be distributed across different regions, reducing dependence on one location.

Bitcoin purchase program

The government will implement a Bitcoin purchase program, and it is planning to purchase 200,000 BTC per year for five years. The overall goal is to increase Bitcoin’s strategic reserve to 1 million BTC. Purchases will be made regularly to avoid sharp price fluctuations and ensure consistency.

All purchased Bitcoin will be held in the reserve for at least 20 years.

In addition, all Bitcoins currently stored in other government agencies will be transferred to the strategic reserve, which will allow for centralization and efficient asset management. States can voluntarily participate in this reserve by opening segregated accounts to deposit or withdraw their Bitcoin assets as needed.

The initiative will be supported because government agencies cannot confiscate or seize the rights to legally owned Bitcoin assets. This will provide confidence and incentives for Americans to store their Bitcoins independently.

Bitcoin reserves will not solve the U.S. national debt problem

Avik Roy, president of the non-profit think tank Foundation for Research on Equal Opportunity (FREOPP), doubts that creating a strategic reserve in Bitcoin will help the U.S. overcome the debt crisis.

Speaking at the North American Blockchain Summit 2024 in Dallas, Avik Roy said that Lummis’s plan will not help cover the national debt, which has already grown to $35 trillion.

“The Bitcoin reserve is good but does not solve the problem. You still have to actually do the budgetary reforms to get us out of this $2 trillion a year of federal deficits.”

Avik Roy, FREOPP president

According to Roy, even with a Bitcoin reserve, the U.S. would still have to implement budgetary reforms to get the country out of its $2 trillion federal deficit annually.

The political scientist noted that the BTC reserve could ease tensions in the bond market by making it feel like the U.S. is not going broke. Roy is also concerned that the U.S. could abandon its BTC reserves in the future, similar to what happened with gold in the 1970s.

The argument against Lummis

Bitcoin as a reserve asset points to several other challenges, with the biggest being volatility. Bitcoin’s price fluctuations make it a risky reserve asset compared to stable options like gold.

After all, Bitcoin has experienced several notable crashes throughout its history.

- In June 2011, when the Mt. Gox exchange was hacked. Bitcoin’s price dropped from $32 to $0.01 in a single day, a nearly 99.9% collapse.

- December 2017 to February 2018: After hitting a peak of nearly $20,000, Bitcoin lost over 56% of its value within months.

- March 2020: During the onset of the COVID-19 pandemic, Bitcoin’s price fell nearly 46% in less than a month, dropping from $10,300 to about $5,600.

- May 2021: Bitcoin dropped over 40% in two weeks, from $58,000 to $34,700.

- November 2022: Following the collapse of the FTX exchange, Bitcoin experienced a 14% dip in a short period

Bitcoin is also typically associated with illicit activities and discreet purchases, which raises concerns about integrating it into national financial systems. Critics say it could also enable countries like Russia to bypass international sanctions, undermine global financial stability and create geopolitical tensions.

Trump’s crypto advisory board to create promised reserve

A number of cryptocurrency companies, including Ripple, Kraken, and Circle, are seeking a seat on President Donald Trump‘s promised crypto advisory board, as Reuters reports. They are eager to participate in his plans to overhaul U.S. policy.

During his campaign at a Bitcoin conference in Nashville in July, Trump promised to create a new council as part of a pro-crypto administration. Trump’s team is discussing how to organize and staff the council and which companies should be included.

Potential members include venture capital firm Paradigm and the crypto arm of venture giant Andreessen Horowitz, known as a16z.

“It’s being fleshed out, but I anticipate the leading executives from America’s bitcoin and crypto firms to be represented.”

David Bailey, CEO of Bitcoin Magazine

According to sources, the team is expected to advise on digital asset policy, work with Congress on cryptocurrency legislation, create the Bitcoin reserve promised by Trump, and collaborate with agencies like the Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Treasury Department. One source said law enforcement officials and former lawmakers may also be on the board.

Source link

Analyst

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Published

2 days agoon

November 23, 2024By

admin

A crypto analyst who accurately forecasted the Bitcoin price increase to the $99,000 All-Time High (ATH) has just released a more detailed analysis of his prediction. The analyst shared a chart highlighting crucial technical indicators and price movements that suggest the cryptocurrency could be gearing up for an even higher ATH.

Analyst Projects $105,000 As The Next Price Target

Weslad, a TradingView analyst, has raised his Bitcoin price forecast, predicting the next upside target at $105,764 as the crypto market bull run gains momentum. The analyst reported that BTC has officially entered the bull market phase, characterized by explosive price increases and positive market sentiment.

Related Reading

His recent bullish prediction of the Bitcoin price is grounded on a key technical pattern known as the “Ascending Channel,” which indicates a bullish trend continuation. This chart pattern consists of two upward-sloping trend lines drawn parallel to each other, representing the resistance and support price levels, respectively.

Despite his optimistic outlook for the BTC price, Weslad has revealed that investors should anticipate a corrective move toward the immediate buy-back zone, which would provide an optimal entry point for opportunistic buyers. The analyst has also shared a detailed price chart that highlights the bullish ascending channel and key price levels that Bitcoin could reach in the short-term and long-term.

Overview Of The Analyst’s Bitcoin Price Chart Analysis

In his 4-hour Bitcoin chart, Weslad visualizes the cryptocurrency’s price action within an ascending channel, highlighting that the BTC is moving upwards within two trendlines. The analyst has provided a detailed roadmap for his $105,764 bullish target for the Bitcoin price.

Weslad highlighted the price range between $91,000 and $92,000 as an “important demand zone,” which acts as strong support where buyers are likely to step in if BTC slips any further. He also revealed that the price level at $94,327.99 has been identified as an ”immediate buy-back zone,” which also serves as an optimal entry point if BTC experiences any corrective pullback in its price.

Related Reading

The analyst has also highlighted $97,537 as the “immediate profit target,” suggesting that traders may consider locking in profits at this critical short-term price level. He has also pinpointed the “mid-term target” for the Bitcoin price, highlighting that the $100,334 mid-term level is important for investors holding longer positions.

Lastly, Weslad has highlighted $105,764 as the “projected final target” for Bitcoin, indicating that this may be the ultimate target for the present market cycle. For BTC to reach this bullish price target, it would require only a modest 6.83% increase from its current value. As of writing, the price of Bitcoin is trading at $99,072, marking a 12.73% increase over the past seven days, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

AI predicts one altcoin set to outperform XRP and Solana in 2025

BTC and Major Altcoins Pullback, SAND Soars 60%

Трамп обирає менеджера прокрипто-хедж-фонду Скотта Бессента на посаду міністра фінансів

Trump calls up crypto pals, Senator says sell gold for Bitcoin | Weekly Recap

Where to Invest in November End?

XRP Price Hits 3-Year High At $1.6

Australia seeking advice on crypto taxation to OECD

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential