DeFi

AAVE flips key resistance as CEX outflows jump

Published

3 months agoon

By

admin

AAVE price pulled back on Tuesday, Sept. 24, as on-chain data showed an increase in centralized exchange outflows.

AAVE (AAVE), one of the best-performing DeFi assets recently, retreated to $164.5, down from this week’s high of $178. However, it remains 131% above its lowest level in July.

According to Nansen, AAVE had CEX outflows of over $6.35 million, a 4.96x increase from the recent average. CEX outflows are often seen as positive for a cryptocurrency, as they indicate that investors are moving their tokens to self-custody, signaling long-term holding.

Additional data shows that the top ten biggest accounts bought AAVE tokens worth over $8.4 million, compared to sales worth over $7.8 million. This suggests that more investors remain bullish on AAVE, hoping for a DeFi renaissance.

Meanwhile, according to DeFi Llama, AAVE has accumulated over $12.53 billion in assets, most of which are in its V3 version. Of these assets, $8.09 billion has been borrowed, and the network has collected over $260 million in fees in the last 12 months, making it one of the most profitable DeFi platforms.

AAVE’s future interest has also remained at an elevated level. Data by CoinGlass shows that daily open interest has stayed above $87 million since Aug. 15, reaching a high of $214 million on Sept. 11. Before that, its highest open interest was $124 million on Aug. 2.

AAVE just flipped a key resistance

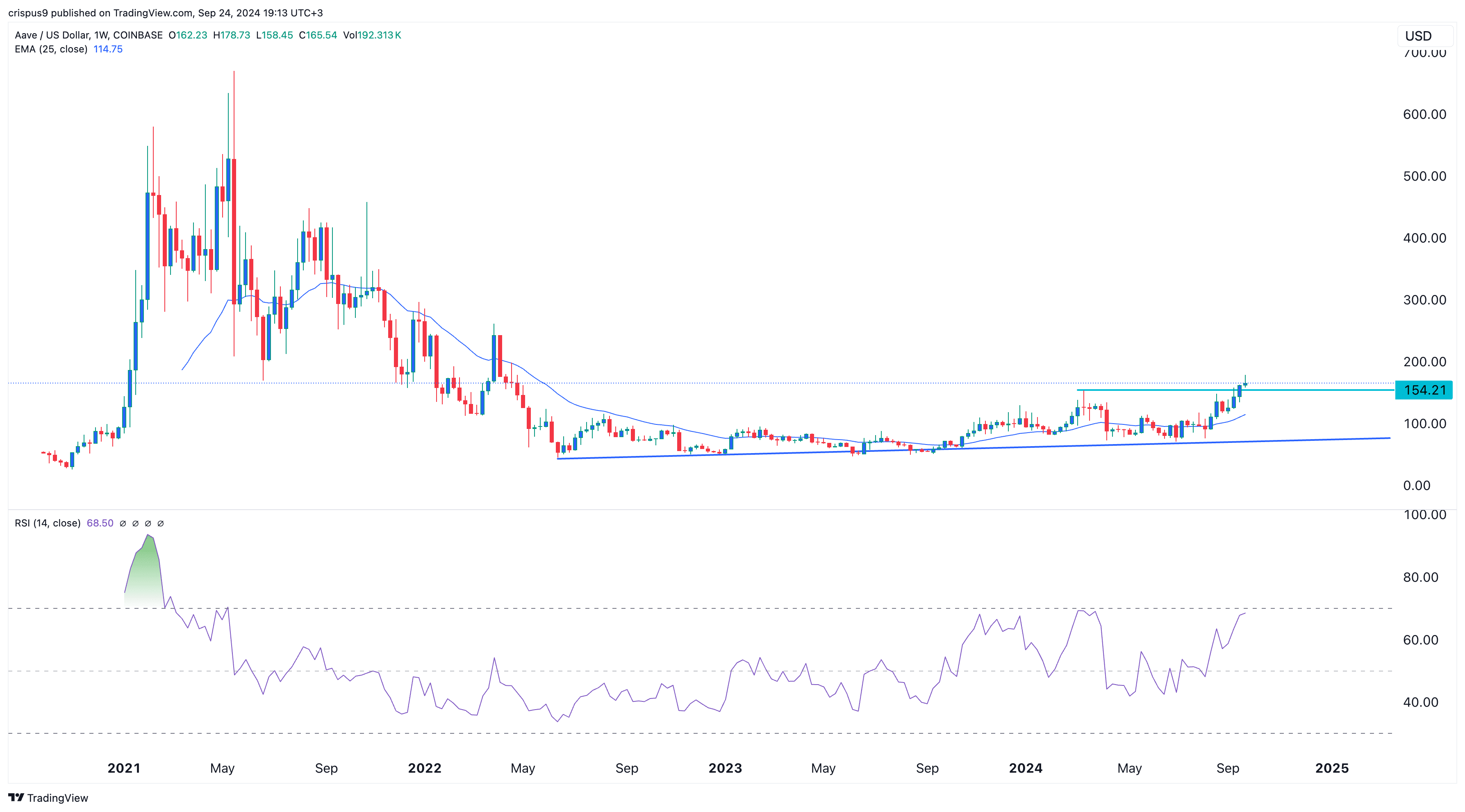

On the weekly chart, the AAVE token has been in a strong bullish trend over the past few weeks. It has remained above the ascending trendline that connects the lowest points since June 2022.

AAVE has also flipped the crucial resistance point at $154.21, its highest swing in March this year. It has jumped above the 25-week moving average, while the Relative Strength Index is approaching the overbought level.

Therefore, AAVE may continue its bull run, with buyers targeting the psychological level of $200.

Source link

You may like

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

DeFi

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

Published

20 hours agoon

December 22, 2024By

admin

There’s been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market.

Asset manager Hashnote’s USYC token zoomed over $1.2 billion in market capitalization, growing five-fold in size over the past three months, rwa.xyz data shows. It has toppled the $450 million BUIDL, issued by asset management behemoth BlackRock and tokenization firm Securitize, which was the largest product by size since April.

USYC is the token representation of the Hashnote International Short Duration Yield Fund, which, according to the company’s website, invests in reverse repo agreements on U.S. government-backed securities and Treasury bills held in custody at the Bank of New York Mellon.

Hashnote’s quick growth underscores the importance of interconnecting tokenized products with decentralized finance (DeFi) applications and presenting their tokens available as building blocks for other products — or composability, in crypto lingo — to scale and reach broader adoption. It also showcases crypto investors’ appetite for yield-generating stablecoins, which are increasingly backed by tokenized products.

USYC, for example, has greatly benefited from the rapid ascent of the budding decentralized finance (DeFi) protocol Usual and its real-world asset-backed, yield-generating stablecoin, USD0.

Usual is pursuing the market share of centralized stablecoins like Tether’s USDT and Circle’s USDC by redistributing a portion of revenues from its stablecoin’s backing assets to holders. USD0 is primarily backed by USYC currently, but the protocol aims to add more RWAs to reserves in the future. It has recently announced the addition of Ethena’s USDtb stablecoin, which is built on top of BUIDL.

“The bull market triggered a massive inflow into stablecoins, yet the core issue with the largest stablecoins remains: they lack rewards for end users and do not give access to the yield they generate,” said David Shuttleworth, partner at Anagram. “Moreover, users do not get access to the protocol’s equity by holding USDT or USDC.”

“Usual’s appeal is that it redistributes the yield along with ownership in the protocol back to users,” he added.

The protocol, and hence its USD0 stablecoin, has raked in $1.3 billion over the past few months as crypto investors chased on-chain yield opportunities. Another significant catalyst of growth was the protocol’s governance token (USUAL) airdrop and exchange listing on Wednesday. USUAL started trading on Binance on Wednesday, and vastly outperformed the shaky broader crypto market, appreciating some 50% since then, per CoinGecko data.

BlackRock’s BUIDL also enjoyed rapid growth earlier this year, driven by DeFi platform Ondo Finance making the token the key reserve asset of its own yield-earning product, the Ondo Short-Term US Government Treasuries (OUSG) token.

Source link

Aave

AAVE Dominates DeFi Lending – Metrics Reveal 45% Market Share

Published

1 week agoon

December 15, 2024By

admin

Aave (AAVE), the leading decentralized finance (DeFi) lending protocol, has captured the spotlight with an extraordinary surge of over 200% since November 5. Outperforming the broader market, AAVE has reached its highest levels since 2021, marking a remarkable recovery and reaffirming its dominance in the DeFi ecosystem.

Related Reading

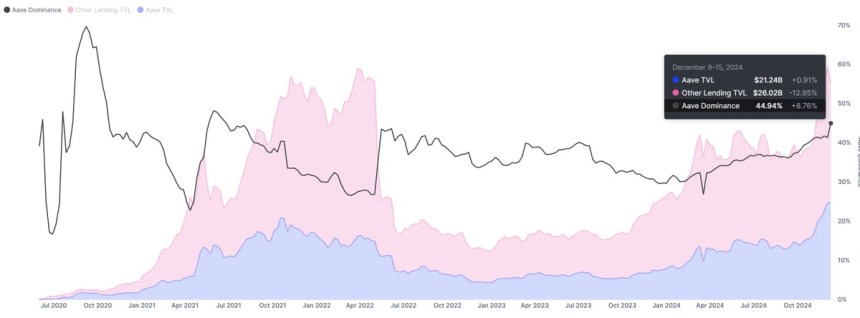

Key metrics from IntoTheBlock underscore AAVE’s unmatched position in the lending sector. With an impressive 45% market share, it remains the top choice for users seeking decentralized borrowing and lending solutions.

With AAVE trading at multi-year highs and on-chain data suggesting robust activity, the altcoin’s trajectory remains a focal point for investors and analysts alike. The question is whether the price can sustain this momentum and reach new all-time highs in the coming months.

AAVE Keeps Growing

Aave (AAVE) has shown consistent growth over the past year, solidifying its position as a market leader in the DeFi lending sector. Known for its innovative approach to creating non-custodial liquidity markets, Aave enables users to earn interest on supplied and borrowed assets at variable interest rates. This approach has made Aave a go-to protocol for decentralized borrowing and lending.

For years, Aave has been at the forefront of DeFi innovation, continually enhancing its platform and user experience. Its success is evident in its market dominance. Metrics from IntoTheBlock highlight Aave’s unrivaled leadership, boasting an impressive 45% market share in the DeFi lending space.

This dominance is further emphasized by Aave’s staggering total value locked (TVL), which stands at $21.2 billion—almost equal to the combined TVL of all other lending protocols.

Related Reading

Such figures underline Aave’s critical role in the DeFi ecosystem. Its established presence and robust infrastructure position it as a key player in the event of a broader DeFi resurgence. Should the sector heat up in the coming weeks, Aave is likely to attract significant attention from investors and traders.

Price Targets Fresh Supply Levels

Aave (AAVE) is currently trading at $366, following a surge to a multi-year high of $396 just hours ago. The altcoin continues its upward momentum as it approaches the critical $420 resistance level, a threshold last held in September 2021. This mark is seen as a pivotal area for AAVE’s next phase of price action, with many analysts expecting a significant reaction once tested.

If AAVE manages to hold its current levels and sustain the bullish momentum, the next logical target would be the $420 resistance zone. Breaking above this level could signal a continuation of its multi-month rally, setting the stage for even higher price targets as investor confidence builds.

On the downside, failure to maintain support above the $320–$340 range could lead to a broader correction. A move below this zone might push the price lower, erasing some of its recent gains and dampening bullish sentiment in the short term.

Related Reading

AAVE remains in a strong position for now, but traders are closely monitoring its price action near these key levels. Whether it can sustain its upward trajectory or faces a pullback will depend on its ability to break and hold above significant resistance zones.

Featured image from Dall-E, chart from TradingView

Source link

Blockchain

Dogeson, Shiro Neko, Orbit among Saturday’s largest gainers

Published

1 week agoon

December 15, 2024By

admin

Three coins have risen to the top of the leaderboard: The Dogeson, a playful nod to Elon Musk, his son and Dogecoin; Shiro Neko, a cat-themed token tied to gaming and NFTs; and Orbit, a space-inspired coin.

These tokens topped the gainers’ charts on Saturday night. Here’s a closer look at each.

Dogeson

The Dogeson (DOGESON), a Doge-inspired coin named after an edited photo Elon Musk posted of himself and his son, X Æ A-12, is up more than 90% at last check Saturday.

With a market cap reaching $146.6 million, the token is built on the Ethereum blockchain and has garnered attention for its narrative of a “space-bound Doge” — meshing humor with a decentralized finance (DeFi) theme.

Details about The Dogeson’s founding team or developers were not immediately clear.

Shiro Neko

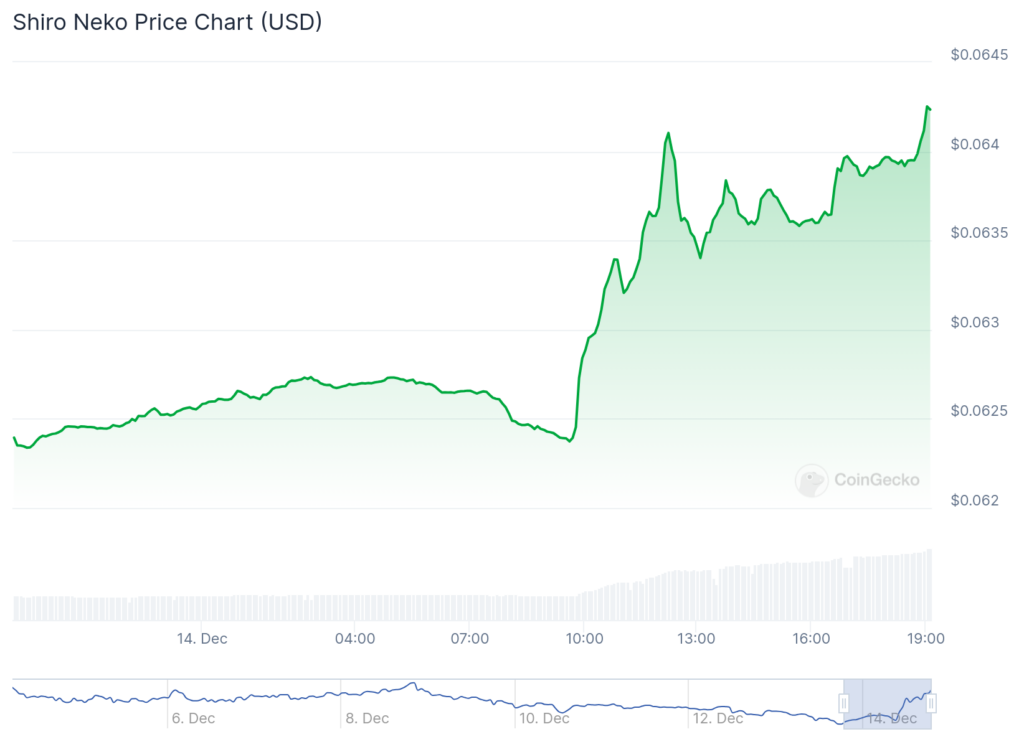

Shiro Neko (SHIRO) is a new cryptocurrency project that blends blockchain technology with play-to-earn (P2E) gaming.

Its ecosystem is built around a native token that can be used for in-game purchases, staking, and governance.

It’s up over 83% at last check, with a market cap of about $441 million.

The project emphasizes a community-driven approach, immersive gaming experiences, and collectible in-game assets, including NFTs. It aims to attract both gamers and crypto enthusiasts through competitive challenges and real-world rewards

Shiro Neko is also building on Shibarium, the Layer 2 blockchain for the Shiba Inu ecosystem, further anchoring itself in a popular crypto community. Additionally, the project is venturing into entertainment by launching an animated series featuring “Shiro” the cat.

The token recently had its Initial Exchange Offering (IEO) on Gate.io, with 88 billion tokens available for sale, representing 0.01% of its total supply of 1 quadrillion tokens.

This reflects a focus on early adoption and community-building in the crypto-gaming landscape.

Orbit

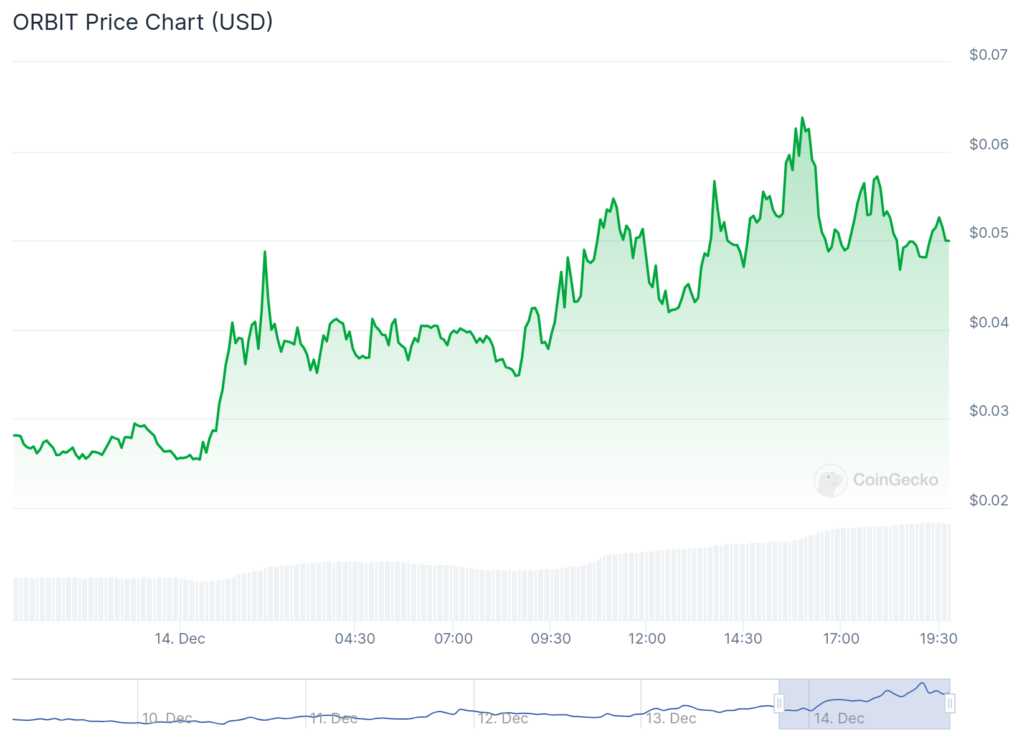

Orbit (ORBIT) was up 77.6% at last check Saturday, with a market cap of roughly $44 million.

Built on the Blast Chain, the native utility token of the Orbit Protocol serves multiple purposes including facilitating governance, incentivizing participants, and enabling staking for rewards.

The protocol also boasts a Total Value Locked (TVL) of over $6.4 million and a fixed total supply of 100 million.

As of now, ORBIT’s market performance shows significant price fluctuations, with a 24-hour range of $0.02543 and $0.06379.

Source link

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential