Aave

Aave price surges amid whale accumulation and V3.1 launch

Published

5 months agoon

By

admin

Decentralized finance protocol Aave is seeing a significant spike in whale activity as the market looks to bounce from the recent dump that pushed most altcoins to key support areas earlier this week.

On July 31, Lookonchain shared details indicating whales had aggressively accumulated Aave (AAVE) over the past two days. According to the data, whales withdrew over 58,848 AAVE worth $6.47 million from exchanges during this period.

In one instance, the whale address 0x9af4 withdrew 11,185 AAVE worth $1.23 million from Binance. Meanwhile, another address moved 21,619 AAVE worth over $2.38 million from the exchange and deposited the tokens into Aave.

These withdrawals followed an earlier transfer of 26,044 AAVE by the whale address 0xd7c5, which amounted to over $2.83 million withdrawn from Binance.

AAVE’s price surged by more than 7% in the past 24 hours amid buy-side pressure from these whales. Currently, the DeFi token trades around $111, having jumped more than 18% in the past week.

Recently, AAVE price increased by more than 8% after Aave founder Marc Zeller announced a fee switch proposal aimed at adopting a buyback program for AAVE tokens.

Aave v3.1 goes live

The total value locked in the Aave protocol currently stands at around $22 billion. According to DeFiLlama, about $19.9 billion is on Aave V3, while the V2 chain still holds about $1.9 billion in TVL and V1 about $14.6 million.

Aave Labs announced earlier in the day that Aave V3.1 had gone live across all networks with active Aave V3 instances.

The V3.1 version features enhancements set to improve the DeFi protocol’s overall security. Aave DAO governance approved the v3.1 improvements, which also include operational efficiency and usability for the network.

Meanwhile, Aave Labs recently outlined an ambitious roadmap for the project, with a 2030 vision for Aave V4 among other developments.

Source link

You may like

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Aave

AAVE Dominates DeFi Lending – Metrics Reveal 45% Market Share

Published

1 week agoon

December 15, 2024By

admin

Aave (AAVE), the leading decentralized finance (DeFi) lending protocol, has captured the spotlight with an extraordinary surge of over 200% since November 5. Outperforming the broader market, AAVE has reached its highest levels since 2021, marking a remarkable recovery and reaffirming its dominance in the DeFi ecosystem.

Related Reading

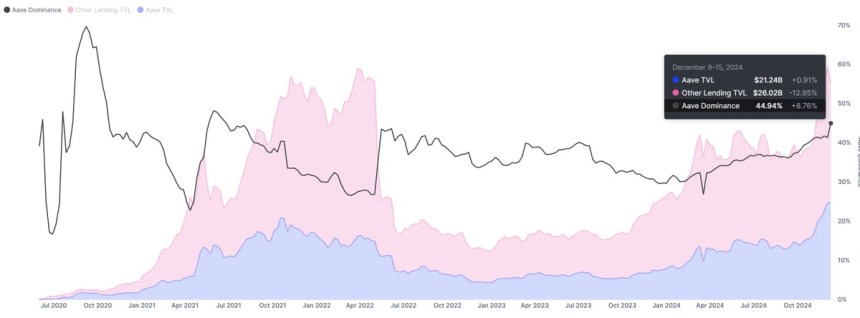

Key metrics from IntoTheBlock underscore AAVE’s unmatched position in the lending sector. With an impressive 45% market share, it remains the top choice for users seeking decentralized borrowing and lending solutions.

With AAVE trading at multi-year highs and on-chain data suggesting robust activity, the altcoin’s trajectory remains a focal point for investors and analysts alike. The question is whether the price can sustain this momentum and reach new all-time highs in the coming months.

AAVE Keeps Growing

Aave (AAVE) has shown consistent growth over the past year, solidifying its position as a market leader in the DeFi lending sector. Known for its innovative approach to creating non-custodial liquidity markets, Aave enables users to earn interest on supplied and borrowed assets at variable interest rates. This approach has made Aave a go-to protocol for decentralized borrowing and lending.

For years, Aave has been at the forefront of DeFi innovation, continually enhancing its platform and user experience. Its success is evident in its market dominance. Metrics from IntoTheBlock highlight Aave’s unrivaled leadership, boasting an impressive 45% market share in the DeFi lending space.

This dominance is further emphasized by Aave’s staggering total value locked (TVL), which stands at $21.2 billion—almost equal to the combined TVL of all other lending protocols.

Related Reading

Such figures underline Aave’s critical role in the DeFi ecosystem. Its established presence and robust infrastructure position it as a key player in the event of a broader DeFi resurgence. Should the sector heat up in the coming weeks, Aave is likely to attract significant attention from investors and traders.

Price Targets Fresh Supply Levels

Aave (AAVE) is currently trading at $366, following a surge to a multi-year high of $396 just hours ago. The altcoin continues its upward momentum as it approaches the critical $420 resistance level, a threshold last held in September 2021. This mark is seen as a pivotal area for AAVE’s next phase of price action, with many analysts expecting a significant reaction once tested.

If AAVE manages to hold its current levels and sustain the bullish momentum, the next logical target would be the $420 resistance zone. Breaking above this level could signal a continuation of its multi-month rally, setting the stage for even higher price targets as investor confidence builds.

On the downside, failure to maintain support above the $320–$340 range could lead to a broader correction. A move below this zone might push the price lower, erasing some of its recent gains and dampening bullish sentiment in the short term.

Related Reading

AAVE remains in a strong position for now, but traders are closely monitoring its price action near these key levels. Whether it can sustain its upward trajectory or faces a pullback will depend on its ability to break and hold above significant resistance zones.

Featured image from Dall-E, chart from TradingView

Source link

24/7 Cryptocurrency News

US Government Makes First AAVE Transaction In 8 Months

Published

2 months agoon

October 24, 2024By

admin

The US government has ignited a selloff scare for AAVE after initiating its first transaction for the token in 8 months. According to data insights from Arkham Intelligence, the US Government transaction features a total of $5.4 million.

Is the US Government Earning With Aave?

Per the data shared, the funds were originally secured from the Bitfinex Hacker as marked by Arkham Intelligence. However, the exact transactions remains partly unclear considering the funds are paid out in USDC.

According to comments from the community, one explanation for this is that the US government locked up the funds on Aave. Based on this, it started earning interest as a liquidity provider on the Decentralized Finance (DeFi) lending platform.

This is a developing story, please check back for updates!!!

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Aave

AAVE Price Eyes $200 as Whale Buying Sphere Hits Key Fibonacci Support

Published

2 months agoon

October 13, 2024By

admin

AAVE price displays a modest downtick of 0.83% during Sunday’s low volatility trading. The pullback temporarily stalled the current recovery but allowed buyers to replenish the bullish momentum before the next leap. Amid the formation of a bullish reversal pattern, the recently recorded whale buying positions AAVE price for a sustained rally.

AAVE Price Targets $200 as Whale Buying Spree Aligns with Fibonacci Support

According to Lookonchain analytics, a crypto whale recently bought 31,173 AAVE tokens worth around $4.8 million and deposited them into Aave. Shortly after, the whale borrowed around 2.7M GHO stablecoin from the Aave protocol and swapped them for USDC.

These stablecoins were deposited into the Coinbase exchange to acquire more AAVE, projecting a bullish outlook for this smart money. The use of GHO, a stablecoin associated with Aave, further showcases confidence in the Aave ecosystem.

A whale is going long on $AAVE.

The whale bought 31,173 $AAVE($4.8M) 9 hours ago and deposited it into #Aave.

Then he borrowed 2.7M $GHO from #Aave and swapped it to $USDC.

And deposited the $USDC into #Coinbase to buy more $AAVE.

Address:https://t.co/s8cD7dHTb5 pic.twitter.com/WuVkTIbj38

— Lookonchain (@lookonchain) October 13, 2024

The supply distribution metric from Santiment indicates that large holders with wallet sizes between 1 million to 10 million AAVE initiated a buying spree in August. This accumulation has now reached 4.17 million AAVE, highlighting strong whale activity.

This trend suggests increasing confidence among large investors in AAVE’s price potential, possibly hinting at further upside momentum in the market.

![Aave [on Ethereum]](https://coingape.com/wp-content/uploads/2024/10/Aave-on-Ethereum-AAVE-17.22.17-13-Oct-2024.png)

![Aave [on Ethereum]](https://coingape.com/wp-content/uploads/2024/10/Aave-on-Ethereum-AAVE-17.22.17-13-Oct-2024.png)

AAVE Hint Major Reversal Pattern Breakout

Following the early October sell-off, the AAVE price managed to stabilize above $135 support since last week. This support is reinforced by both the 50-day exponential moving average and the 38.2% Fibonacci retracement level, providing a solid foundation for a potential price reversal.

The 38.2% FIB is typically seen as an ideal pullback zone for buyers to regain control after a period of exhausted bullish momentum. The recent reversal has uplifted asset 12% up to trade at $152.5 and formed a bullish reversal pattern called a double bottom.

The chart setup resembles a ‘W’ letter and indicates a renewed bullish momentum for a breakout opportunity. If the pattern holds true, the AAVE price rally could breach the $154.8 neckline and drive a post-breakout rally to $180, followed by $200.

Alternatively, if the AAVE buyers fail to sustain a neckline breakout, the sellers could revert the price lower and seek support at the $115 level.

Frequently Asked Questions (FAQs)

Recent whale buying has significantly boosted confidence in AAVE, with large holders accumulating 4.17 million AAVE. This activity, aligned with key Fibonacci support, is pushing the price toward the $200 target.

The 38.2% Fibonacci retracement level has provided a key pullback zone, allowing buyers to regain control and pushing AAVE’s price recovery

AAVE has formed a double bottom pattern on the daily chart, which suggests a bullish reversal

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: