ADA

Analyst Predicts 8,500% Rally For Cardano To Reach $31 As Indicators Turn Bullish

Published

3 months agoon

By

admin

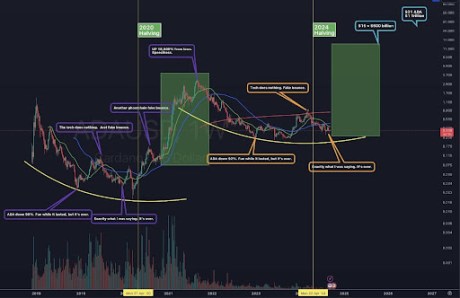

Since March, Cardano (ADA) has experienced recurring periods of significant price declines. However, crypto pundit Dan Gambardello, a popular analyst on the Crypto Capital Venture’s YouTube channel, predicts a potential bullish reversal based on an analysis of the weekly and daily charts.

Key Technical Indicators Support Bullish Outlook

According to the analyst in a recent video, ADA is poised for a significant breakout, potentially reaching around $31, representing a remarkable 8,500% increase from current levels. The analyst highlighted that the market has experienced “180 days of downside” since March, creating favorable conditions for this anticipated surge.

Related Reading

He further suggested that ADA could break its current cycle of lower highs and lower lows, citing key technical indicators, particularly the MACD (Moving Average Convergence Divergence) on the weekly chart, which is showing signs of a bullish crossover. “The macro momentum of Cardano is signaling its readiness to bottom,” he said, emphasizing the upward momentum of the MACD histogram since May.

However, he cautioned that ADA has yet to decisively move above the 20-day and 50-day moving averages. He warned that while testing key levels, the move could fail, advising patience until more price action confirms a true breakout. While some analysts view Dan Gamberdello projections as overly optimistic, crypto analyst Sssebi has offered a more conservative forecast.

He forecasts a rally of 20x to 30x for Cardano over the next year. Sssebi noted that Cardano current position mirrors its state during the last cycle, indicating a major rally may be imminent. He predicts that Cardano could hit a minimum price of $5 by 2025, with a possible peak of $10 during the height of the bull market.

Cautious Outlook For Cardano

However, not all analysts are as bullish. Trader “Lingrid” has adopted a more cautious perspective regarding Cardano (ADA), predicting a short-term pullback for the cryptocurrency. In a recent post, he noted that “ADAUSDT appears bearish on the daily timeframe,” forecasting a potential decline to $0.325 and suggesting that ADA may remain within the consolidation zone between $0.30 and $0.34 for an extended period.

Related Reading

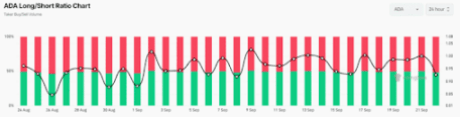

This negative outlook is further reinforced by the bearish on-chain metric. According to Coinglass, ADA’s Long/Short ratio currently stands at 0.926, indicating a prevailing bearish sentiment among traders.

Furthermore, its future open interest has declined by 3.8% in the last 24 hours and has been steadily falling. This suggests that traders are either liquidating their positions or hesitant to establish new ones.

At press time, ADA was trading near the $0.352 level and had experienced a modest price decline of 0.8% in the last 24 hours. During the same period, its trading volume had dropped by 18%, indicating lower participation from traders amid selling pressure.

Featured image created with Dall.E, chart from Tradingview.com

Source link

You may like

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

The crypto market shows signs of resurgence, offering investors lucrative opportunities. These four Altcoin to Hold stand out with potential for significant growth before 2025. Backed by promising fundamentals, they are strong contenders for a surge during the anticipated bull market.

Altcoins to Hold: XRP

XRP price has surged by 100% over the past month, reaching $2.24 during a strong market rally. Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC), which appears close to a favourable resolution, has significantly boosted investor confidence.

Market bulls are defending the $2.05–$2.20 support range, a key area attracting substantial buyer interest. Analysts suggest a break above $2.60 could lead to more upside momentum, with $3.00 as the next psychological target. XRP continues to shine as one of the top altcoins to hold before 2025.

DexBoss (DEBO)

DexBoss (DEBO), selling for $0.01 in its presale, is drawing attention from cryptocurrency enthusiasts. This memecoin stands out by combining humor with blockchain-based utility. Unlike typical short-lived memecoins, DexBoss offers a robust ecosystem featuring decentralized token swaps, staking opportunities, and exclusive NFT releases.

Its unique approach appeals to both speculative investors and long-term holders. DexBoss’s foundation of blockchain technology positions it as more than a fleeting trend. The coin’s diverse features make it an intriguing option for those seeking innovation and potential in the cryptocurrency market.

Sui (SUI)

Sui (SUI) price has risen to $4.59, marking a 2% surge and highlighting its growing market appeal. The Layer 1 blockchain platform is gaining recognition for delivering fast, private, and secure digital asset management making it altcoin to buy.

Known for its efficiency, Sui has seen a steady rise in Total Value Locked (TVL). Analysts view this momentum as a sign of investor confidence ahead of the anticipated 2025 altcoin season. With its innovative smart contract solutions, Sui continues positioning itself as a top contender among altcoins in the competitive blockchain ecosystem.

Dogecoin (DOGE)

Dogecoin (DOGE), a prominent meme-based cryptocurrency, recently recorded a significant price surge despite slight market corrections. The DOGE price has climbed 250% over the past year, trading at $0.332 at the time of writing. This remarkable growth underscores its rising popularity among investors and its appeal as a potential altcoin to hold before the anticipated 2025 alt season.

Notably, whale transactions involving Dogecoin have spiked, reflecting heightened activity among large holders. In late October, transactions exceeding $100,000 saw a sharp increase. This trend signals growing whale interest, which could further influence market dynamics and fuel continued momentum for DOGE’s price trajectory.

As crypto market dynamics shift, focusing on Altcoin to hold can yield substantial returns. These four assets offer growth potential, innovation, and community-driven resilience, making them a must-watch for 2025.

Frequently Asked Questions (FAQs)

XRP, DexBoss, Sui, and Dogecoin are top recommendations.

XRP shows bullish trends with potential legal clarity boosting confidence.

DexBoss offers utility through token swaps, staking, and NFTs.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ADA

Crypto Whales Gobble Up Nearly $149,600,000 Worth of Cardano and Large-Cap Memecoin in Just Two Days: Analyst

Published

1 week agoon

December 16, 2024By

admin

An on-chain analyst says deep-pocketed investors are loading up massive amounts of Cardano (ADA) and a top memecoin as the market went sideways for the past week.

Analyst Ali Martinez tells his 98,800 followers on the social media platform X that crypto whales accumulated $85.6 million worth of ADA in a couple of days.

“Cardano whales bought over 80 million ADA in 48 hours!”

At time of writing, ADA is trading for $1.07.

Martinez also says deep-pocketed investors snapped up $64 million worth of the large-cap memecoin Dogecoin (DOGE).

“Whales bought another 160 million Dogecoin DOGE in 24 hours!”

At time of writing, DOGE is worth $0.40.

In total, the crypto whales accumulated nearly $150 million worth of ADA and DOGE in just two days during the past week.

Turning to Bitcoin, Martinez says he’s looking at BTC‘s In/Out of the Money Around Price (IOMAP) metric. IOMAP classifies crypto addresses as either profiting, breaking even, or losing money – to determine support and resistance levels for BTC.

According to the analyst, Bitcoin has a fortress of support above $94,000 as millions of wallets accumulated millions of BTC around and above the price area.

“Bitcoin sits on top of a significant support wall between $94,300 and $100,250, where 2.25 million wallets bought over 2.18 million BTC.”

At time of writing, Bitcoin is trading for $101,946.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

ADA

Will Cardano Price Reach ATH If It Mirrors Its 2021 Rally?

Published

1 week agoon

December 13, 2024By

admin

Cardano price, a proof-of-stake cryptocurrency, has recently witnessed a significant price increase amid a broader market rally. The altcoin’s upward momentum reflects heightened investor interest, paralleling gains in other cryptocurrencies. With December promising further potential, ADA enthusiasts are speculating whether its price could revisit all-time highs, mirroring its impressive 2021 rally

Is Cardano Price to Reclaim Its ATH From the 2021 Bull Run?

Cardano price is regaining traction as bullish sentiment returns to the cryptocurrency market. The top altcoin shows signs of recovery, with its price reclaiming $3.10 and sparking optimism among investors. The market now watches closely as ADA aims to surpass its previous cycle’s all-time high.

Cardano’s all-time high was $3.10 on September 2, 2021. At the time of reporting, the cryptocurrency is still 63.71% below this peak. However, recent price movements suggest a growing potential for a breakout.

Market analysts attribute the renewed bullish momentum to the broader crypto rally. Several key altcoins, including Cardano, are benefiting from increased investor confidence. With the current trajectory, ADA could move closer to reclaiming its 2021 high if market conditions persist.

Crypto Analyst Eyes Bullish Break Out For ADA

A crypto analyst recently shared an intriguing insight on X post, highlighting Cardano’s potential growth trajectory. The tweet emphasized that ADA may soon achieve $3, $7, and $14 milestones, aligning with a broader market “super cycle.”

The post included a chart showcasing ADA’s significant price levels, framing the $14 mark as a pivotal milestone. It also highlighted a $500 billion market capitalization benchmark, suggesting a bullish perspective on Cardano’s future growth.

The Cardano milestones of $3, $7, and $14 do not look far at all when you open up a daily chart.

Super. Cycle. pic.twitter.com/NvSw0p7z4o

— Dan Gambardello (@cryptorecruitr) December 13, 2024

At the time of writing, the ADA price is trading at $1.08, marking a 3.66% decline in daily performance. Despite the dip, technical indicators suggest pivotal movements ahead for the Cardano token.

If the bullish trend gains momentum, the top altcoin could rally to the $2 mark, fueled by increasing trading activity and strong investor sentiment. A continuation of this bullish trajectory might propel the price to $3.10, mirroring its 2021 all-time high. However, if bearish forces dominate, ADA could retrace further to $1, potentially erasing recent gains.

The MACD indicator highlights a bearish crossover, with the signal line at 0.1209 and the MACD line at 0.0912. The Chaikin Money Flow (CMF) remains positive at 0.11, pointing to sustained buying interest despite price declines. This suggests that market participants are still optimistic about ADA’s long-term potential.

While Cardano’s recent momentum hints at the potential for a bullish breakout, its ability to reclaim the 2021 ATH will depend on sustained market confidence and overcoming bearish resistance.

Frequently Asked Questions (FAQs)

Cardano’s all-time high price is $3.10, reached on September 2, 2021.

Cardano’s price could potentially revisit its ATH if market conditions remain favorable.

If bullish momentum continues, Cardano could reach $2, potentially revisiting $3.10.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: