Arbitrum and Optimism Stay Strong Amid ETH Decline; Analysts Pick This Presale Token For 100x Gains

Published

4 months agoon

By

admin

The recent market downturn sent shockwaves into the crypto community, sparking a cascading selloff. Bitcoin (BTC) and Ethereum (ETH), the leading cryptocurrencies, along with the rest of the market, plummeted. However, Layer-2 tokens on Ethereum, notably Arbitrum (ARB) and Optimism (OP), have shown remarkable resilience.

Meanwhile, DTX Exchange (DTX), the rave of the moment, has captured the attention of analysts. The novel exchange-based token stands at the crossroads between TradFi and DeFi, setting it up for adoption and massive growth.

DTX Exchange (DTX): Poised for a 100x Jump Post-Launch

DTX Exchange (DTX) has been stirring quite a buzz in the ICO world, linked to its solid fundamentals and significant upside potential. It sets itself apart from established players by combining the best elements of centralized and decentralized exchanges.

In light of the above, it will be a hybrid protocol and a novel financial ecosystem, aiming to shake up the $10 billion global trading market. Further, it allows the trading of different asset classes, from traditional ones (stocks, bonds and forex) to DeFi tokens.

Top analysts project a 100x jump in value after its launch, making it a new project to keep on the radar. Meanwhile, at a token price of $0.04 in the second round of the ICO, it offers a good entry point and promises more gains than top coins like Arbitrum and Optimism.

Arbitrum (ARB): Reclaiming the $0.5 Support

Arbitrum (ARB), an Ethereum Layer-2 scaling solution, is one of the market’s top altcoins. It employs optimistic rollups, which improve speed, scalability and cost-efficiency.

However, it experienced a scare as the crypto market nosedived and Ethereum tumbled below $2,300. However, the Arbitrum price didn’t lose as much gain, showcasing remarkable strength. With bullish momentum back in the crypto space, ARB has reclaimed the $0.5 support.

The Arbitrum token is set to hit $1 in quarter three, placing it on the list of the best cryptos to invest in. This puts it within striking distance of its all-time high of $2.40, which it can potentially reclaim before the year’s end.

Optimism (OP): Eyes on a New Peak

Optimism (OP), one of the biggest scaling solutions for Ethereum, is a key player in the layer-two ecosystem. Besides its solid fundamentals, it is also a top altcoin. Similar to Arbitrum, it uses optimistic rollups to help scale Ethereum.

Despite the overall market downturn, it was one of the most resilient. And with a bounce unfolding, Optimism crypto resumes its upswing, maintaining the $1 support and gearing up for further gains. It is no surprise that savvy investors have been expanding their portfolios, already ahead of the curve.

Industry experts are bullish, predicting the Optimism token will rally past its March high of $4.85 at the peak of this bull cycle. Sweetening the deal is its current price, which presents a good entry.

Conclusion

Despite the notable decline in ETH’s price, Arbitrum and Optimism held strong. With a bounce unfolding, they have resumed their upswing. Meanwhile, analysts tip DTX Exchange for a 100x rally after its market debut.

Visit the official DTX Exchange (DTX) website for the latest updates and information.

Disclaimer

This article is a paid publication and does not have journalistic/ editorial involvement of CoinGape. CoinGape does not endorse/ subscribe to the contents of the article/advertisement and/or views expressed herein. Do your market research before taking any actions . The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

crime

Crypto cops record $8.2b in financial remedies for investors: SEC

Published

2 hours agoon

November 24, 2024By

admin

For all the complaints levied against the crypto-strict U.S. Securities and Exchange Commission (SEC), the agency successfully obtained orders for $8.2 billion in financial remedies for 2024.

This is despite a 26% decrease in total enforcement actions.

The successful prosecution of Terraform Labs helped the agency achieve this milestone. Once a jury verdict found Terraform Labs and founder Do Kwon liable for fraud, defendants agreed to a final judgment ordering them to pay more than $4.5 billion in penalties — the highest amount ever obtained by the SEC following a trial.

It accounted for more than half of the total monetary judgments, according to the details from the press release.

SEC’s 583 enforcement actions

The SEC’s enforcement efforts in 2024 showed significant shifts across multiple categories, with 583 total enforcement actions. This includes 431 stand-alone actions representing a 14% decrease, 93 follow-on administrative proceedings showing a 43% decrease, and 59 delinquent filing actions marking a 51% decline.

Despite the reduced number of cases, the financial impact reached these levels, combining $6.1 billion in disgorgement and prejudgment interest with $2.1 billion in civil penalties.

In the cryptocurrency sector, the SEC pursued several major cases, including charges against Silvergate Capital for misleading BSA/AML compliance disclosures and action against Barnbridge DAO for unregistered securities offerings.

The agency also tackled the HyperFund pyramid scheme involving $1.7 billion and the NovaTech fraud case affecting 200,000 investors. Notable first-time enforcement actions targeted relationship investment scams involving NanoBit and CoinW6 platforms.

The SEC’s Division of Enforcement won all five federal district court cases, including its crypto-related trial against Terraform Labs. This success extended to investor protection measures, with 124 individuals barred from serving as officers and directors of public companies.

SEC Chair Gary Gensler emphasized the Division’s role as a “steadfast cop on the beat,” while Acting Director Sanjay Wadhwa noted increased market participant cooperation and self-reporting.

The report somewhat justifies Gensler’s role as the top crypto enforcer. The outgoing SEC chair, set to resign on Jan. 20, faced harsh criticism from crypto enthusiasts and retail traders throughout his tenure for his regulatory approach.

And yet, the SEC distributed $345 million to harmed investors and processed a record 45,130 tips, complaints, and referrals, including over 24,000 whistleblower tips, resulting in $255 million in whistleblower awards.

The agency’s success in returning funds to investors has been substantial, with more than $2.7 billion distributed since fiscal year 2021.

But most of the actual scams were cyrpto 😬

— sean combs (@William48759211) November 22, 2024

Source link

24/7 Cryptocurrency News

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Published

3 hours agoon

November 24, 2024By

admin

Stellar price has seen a remarkable surge, climbing over 80% in the last 24 hours, rising to number one in the top gainers. The bullish momentum has pushed XLM from $0.302 to a peak of $0.55, as traders and analysts anticipate the possibility of the asset nearing the $1 mark.

Stellar Price Reaches $0.55 Amid Bullish Momentum

Stellar’s price rise reflects strong buying interest as it touched $0.55, marking a significant upward trend. After a period of consolidation around $0.40, the cryptocurrency broke through resistance levels, delivering impressive returns for investors.

Market participants have noted this upward movement as a sign of renewed confidence in the asset’s potential. However, the price also briefly retraced from its peak as it faced resistance at the $0.55 level, suggesting that $1 remains a potential milestone rather than an immediate outcome. Jed McCaleb, Stellar’s founder, has also added to the growing optimism surrounding the network.

In a recent statement, McCaleb commented on Stellar’s current momentum and its role in global financial systems. “Stellar is the most underrated and least understood crypto project,” McCaleb remarked, emphasizing its ability to facilitate real-world transactions and its high efficiency. He noted,

“The best and most impactful use of crypto is as digital money, and this is what Stellar is built for.”

Grayscale Stellar Lumens Trust Records 10% Asset Growth

Grayscale Investments LLC’s recent 10-K filing highlighted a 10% increase in the net assets of its Stellar Lumens Trust during the fiscal year ending September 2024.

Despite the challenges posed by XLM price fluctuations and management fees, the trust managed to grow its assets due to the addition of 34,875,230 XLM tokens valued at $3,923.

Trading activity around Stellar has surged, with derivatives markets experiencing substantial growth in both volume and open interest. The trading volume for XLM derivatives rose by 284.26%, reaching $8.98 billion, while open interest increased by 125.88% to $393.05 million.

The filing also outlined that the trust faced losses stemming from token depreciation earlier in the year, but these were offset by a robust recovery and asset inflows. The document underscores the growing institutional interest in Stellar as an investment vehicle, aligning with its recent market performance.

Analyst Predicts Multi-Year Price Pattern May Propel XLM to $3-$5

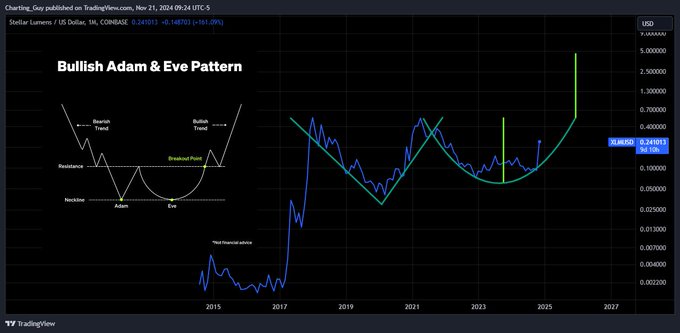

Cryptocurrency analysts have highlighted a multi-year price structure for Stellar, suggesting that it may be poised for further growth. A prominent market speculator, known as “Charting Guy,” recently shared a prediction that Stellar could achieve price targets between $3 and $5.

According to the analyst, XLM price has been forming a bullish “Adam and Eve” pattern on the monthly chart since 2017. This chart pattern is often associated with long-term upward momentum.

Charting Guy emphasized patience, indicating that the current rally could lead to substantial gains for long-term holders. A potential breakout from this pattern could result in a 930% to 1,617% increase from current levels, further reinforcing optimism in Stellar’s market trajectory.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Dogecoin

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Published

4 hours agoon

November 24, 2024By

admin

Some crypto enthusiasts speculate that the service, once live, might include transactions with some digital assets such as DOGE, given Musk’s long-standing affection for the token. Musk’s electric car company, Tesla, already accepts DOGE payments for some merchandise purchases in its online store.

Source link

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: