Bitcoin Magazine Pro

Are Bitcoin Whales Buying The Dip?

Published

4 months agoon

By

admin

Bitcoin’s recent price volatility has led many to wonder if large-scale bitcoin hodlers are taking advantage of price dips to accumulate more bitcoin. While some metrics may initially suggest an increase in long-term holdings, a closer examination reveals a more nuanced story, especially after the current prolonged period of choppy consolidation.

Are Long-Term Holders Accumulating?

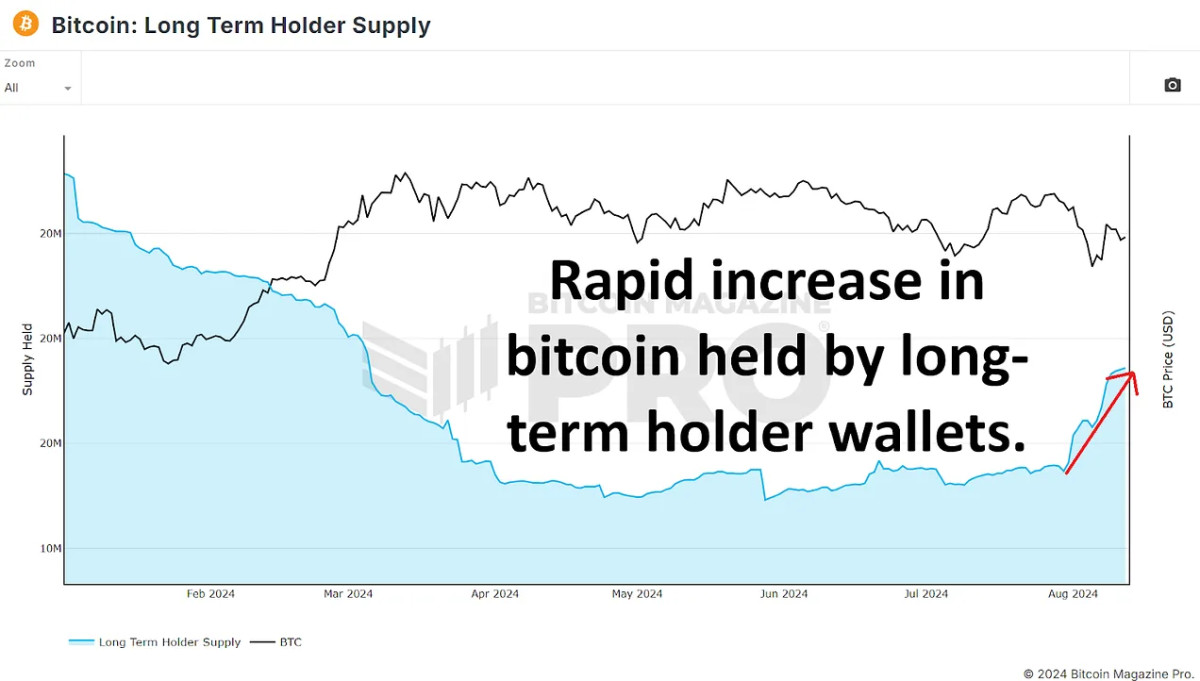

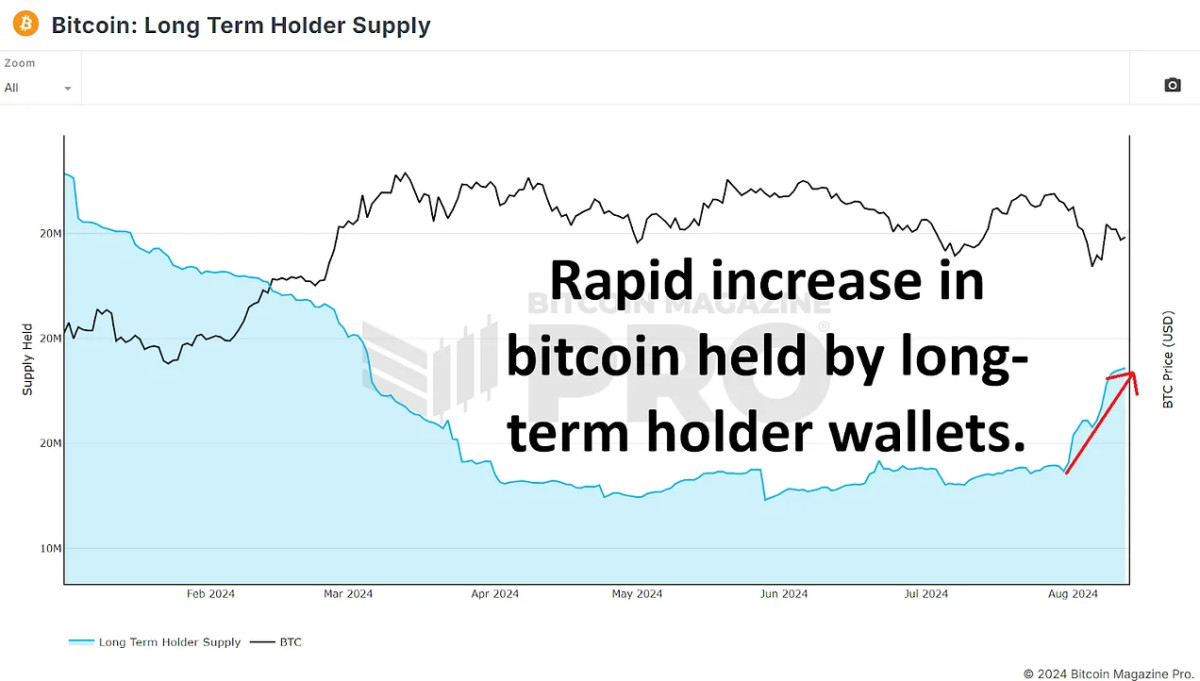

Upon initial observation, long-term Bitcoin holders are seemingly increasing their holdings. According to the Long Term Holder Supply, since July 30th, the amount of BTC held by long-term holders has increased from 14.86 million to 15.36 million BTC. This surge of around 500,000 BTC has led some to believe that long-term holders are aggressively buying the dip, potentially setting the stage for the next significant price rally.

However, this interpretation might be misleading. Long-term holders are defined as wallets that have held BTC for 155 days or more. This week we’ve just surpassed 155 days since our most recent all-time high. Therefore, it is likely that many short-term holders from that period have simply transitioned into the long-term category without any new accumulation occurring. These investors are now holding onto their BTC, hoping for higher prices. So in isolation, this chart does not necessarily indicate new buying activity from established market participants.

Coin Days Destroyed: A Contradictory Indicator

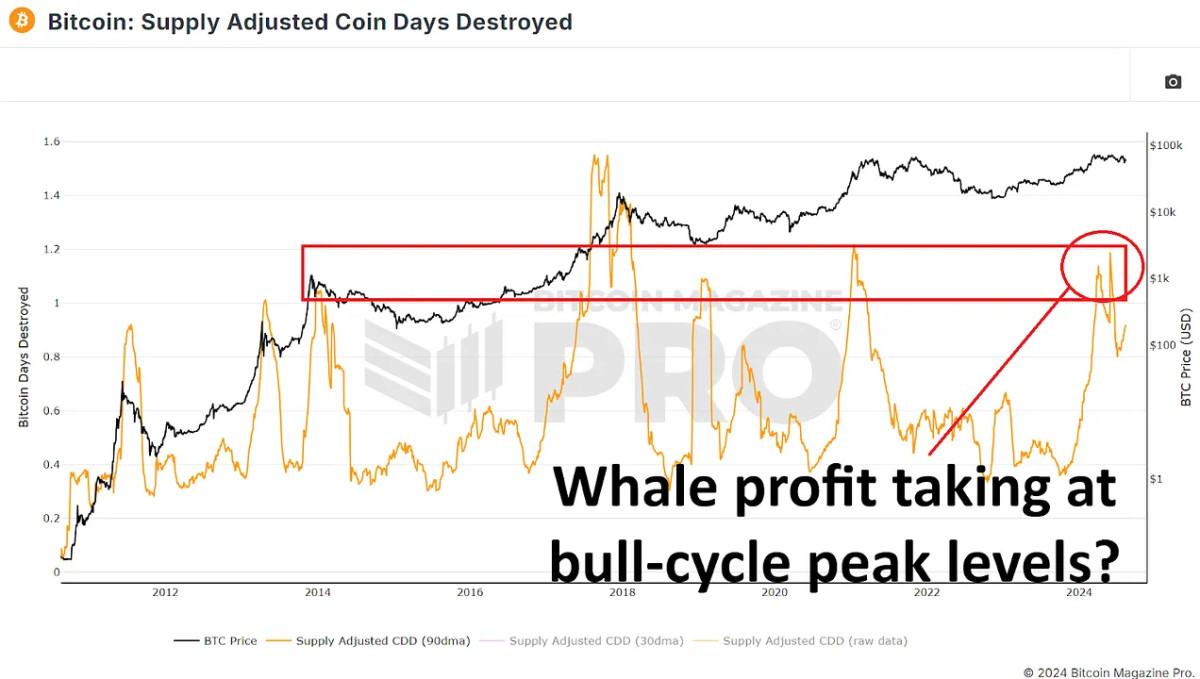

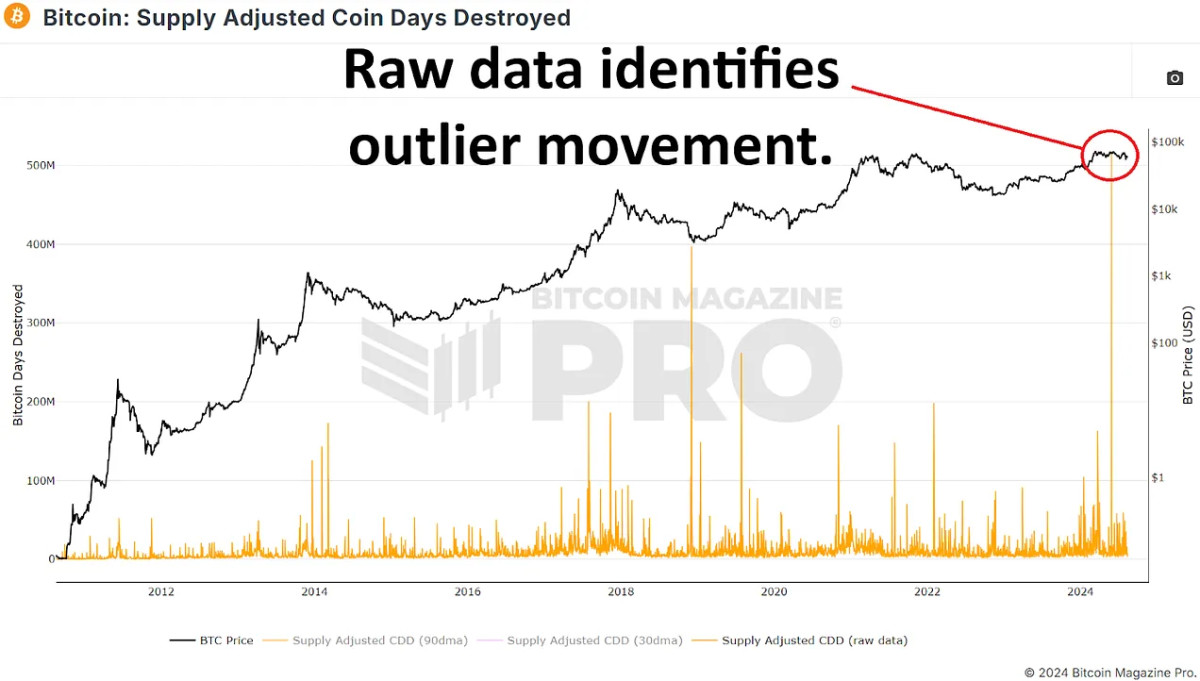

To further explore the behavior of long-term holders, we can examine the Supply Adjusted Coin Days Destroyed metric over the recent 155-day period. This metric measures the velocity of coin movement, giving more weight to coins that have been held for extended periods. A spike in this metric could indicate that long-term holders possessing a substantial amount of bitcoin are moving their coins, likely indicating more selling as opposed to accumulating.

Recently, we have seen a significant increase in this data, suggesting that long-term holders might be distributing rather than accumulating BTC. However, this spike is primarily skewed by a single massive transaction of around 140,000 BTC from a known Mt. Gox wallet on May 28, 2024. When we exclude this outlier, the data appears much more typical for this stage in the market cycle, comparable to periods in late 2016 and early 2017 or mid-2019 to early 2020.

The Behavior of Whale Wallets

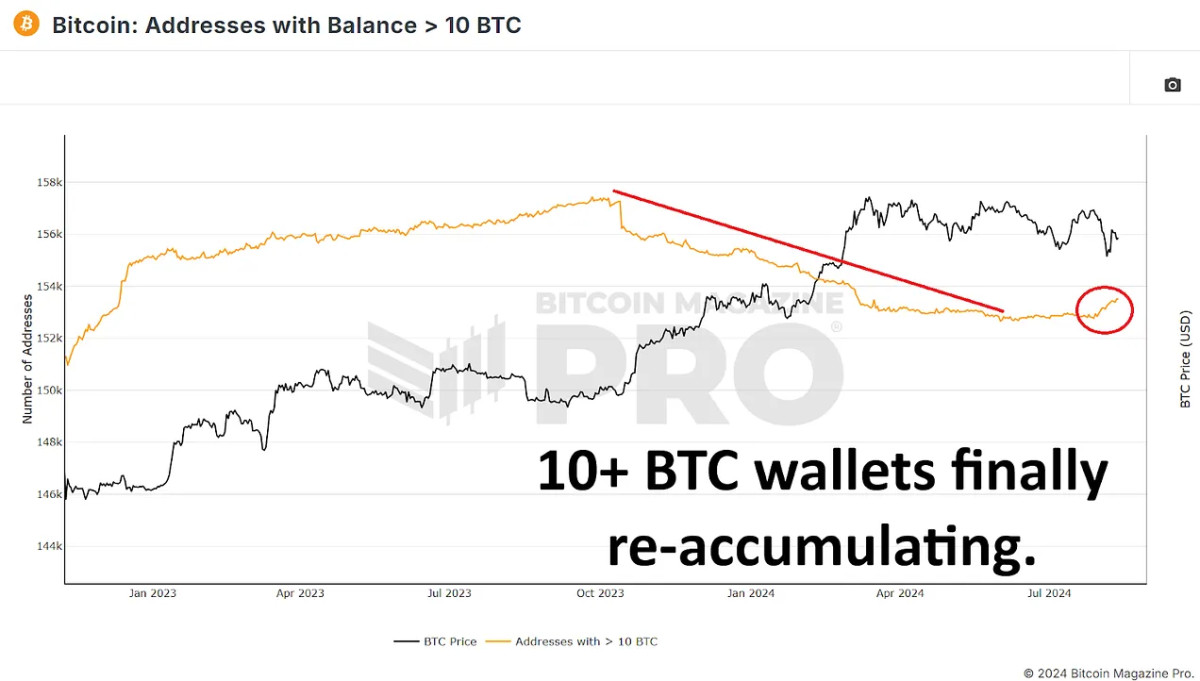

To determine whether whales are buying or selling bitcoin, analyzing wallets holding substantial amounts of coins is crucial. By examining wallets with at least 10 BTC (minimum of ~$600,000 at current prices), we can gauge the actions of significant market participants.

Since Bitcoin’s peak earlier this year, the number of wallets holding at least 10 BTC has slightly increased. Similarly, the number of wallets holding 100 BTC or more has also seen a modest rise. Considering the minimum threshold to be included in these charts, the amount of bitcoin accumulated by wallets holding between 10 and 999 BTC could account for tens of thousands of coins bought since our most recent all-time high.

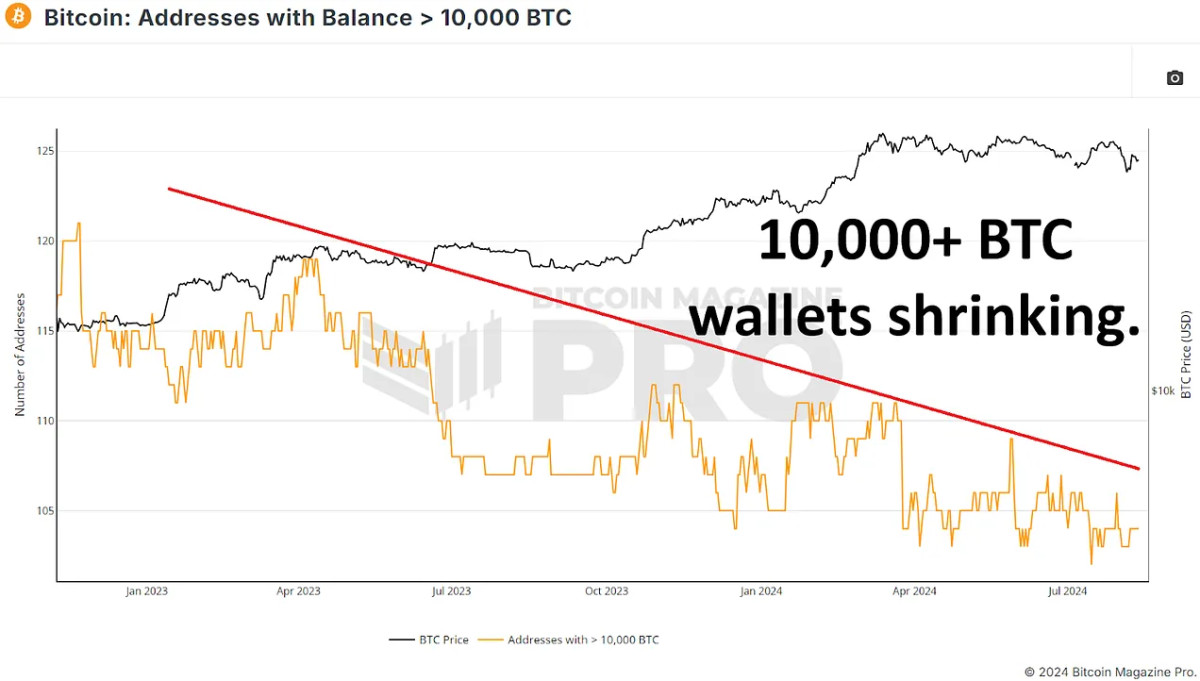

However, the trend reverses when we look at larger wallets holding 1,000 BTC or more. The number of these large wallets has decreased slightly, indicating that some major holders might be distributing their BTC. The most notable change is in wallets holding 10,000 BTC or more, which have decreased from 109 to 104 in the past months. This suggests that some of the largest bitcoin holders are likely taking some profit or redistributing their holdings across smaller wallets. However, considering most of these extremely large wallets will typically be exchanges or other centralized wallets it’s more likely these are a collection of trader and investor coins as opposed to any one individual or group.

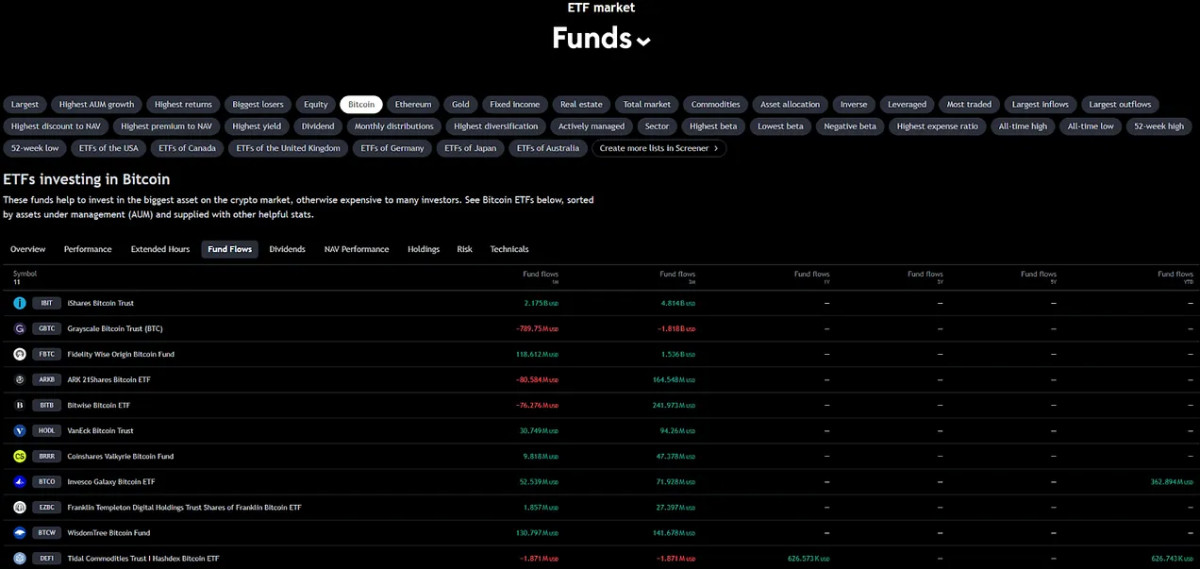

The Role of ETFs and Institutional Inflows

Since reaching a peak of $60.8 billion in assets under management (AUM) on March 14th, the BTC ETFs have seen an AUM decrease of around $6 billion, however when taking into account the price decrease of bitcoin since our all-time high, this roughly equates to an increase of approximately 85,000 BTC. While this is positive, the increase has only negated the amount of newly mined Bitcoin during the same period, also 85,000 BTC. ETFs have helped reduce selling pressure from miners and potentially from large holders but haven’t significantly accumulated enough to impact the price positively.

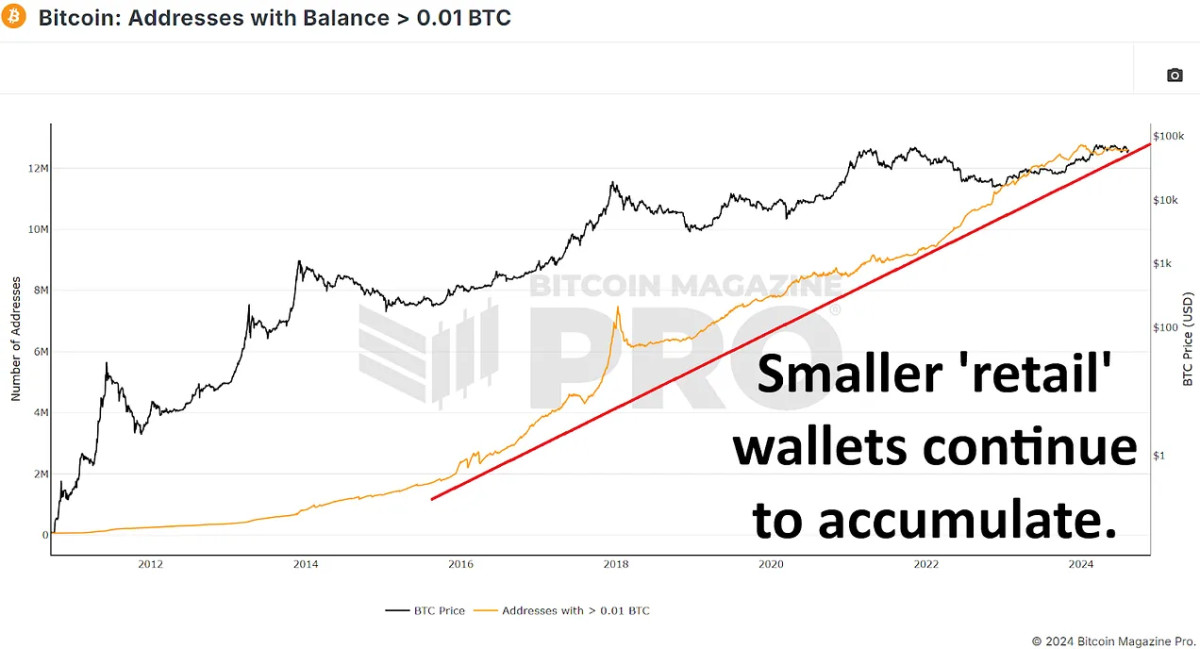

Retail Interest on the Rise

Interestingly, while big holders appear to be selling BTC, there has been a significant increase in smaller wallets – those holding between 0.01 and 10 BTC. These smaller wallets have added tens of thousands of BTC, showing increased interest from retail investors. There’s been a net change of around 60,000 bitcoin from 10+ BTC wallets to smaller than 10 BTC. This may seem alarming, but considering we typically see millions of bitcoin switch from large and long-term holders to new market participants throughout an entire bull cycle, this is not currently any cause for concern.

Conclusion

The narrative that whales have been accumulating bitcoin on dips and throughout this period of chopsolidation does not seem to be the case. While long-term holder supply metrics initially appear bullish, they largely reflect the transition of short-term holders into the long-term category rather than new accumulation.

The increase in retail holdings and the stabilizing influence of ETFs could provide a strong foundation for future price appreciation, especially if we see renewed institutional interest and continued retail inflows post halving, but is currently contributing little to any Bitcoin price appreciation.

The real question is whether the current distribution phase seizes and sets the stage for a new round of accumulation, which could propel Bitcoin to new highs in the coming months, or if this flow of old coins to newer participants continues and likely suppresses the potential upside for the remainder of our bull cycle.

🎥 For a more in-depth look into this topic, check out our recent YouTube video here: Are Bitcoin Whales Still Buying?

And don’t forget to check out our other most recent YouTube video here, discussing how we can potentially improve one of the best bitcoin metrics:

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Bitcoin Magazine Pro

Exploring Six On-Chain Indicators to Understand the Bitcoin Market Cycle

Published

2 days agoon

December 21, 2024By

admin

With Bitcoin now making six-figure territory feel normal and higher prices a seeming inevitability, the analysis of key on-chain data provides valuable insights into the underlying health of the market. By understanding these metrics, investors can better anticipate price movements and prepare for potential market peaks or even any upcoming retracements.

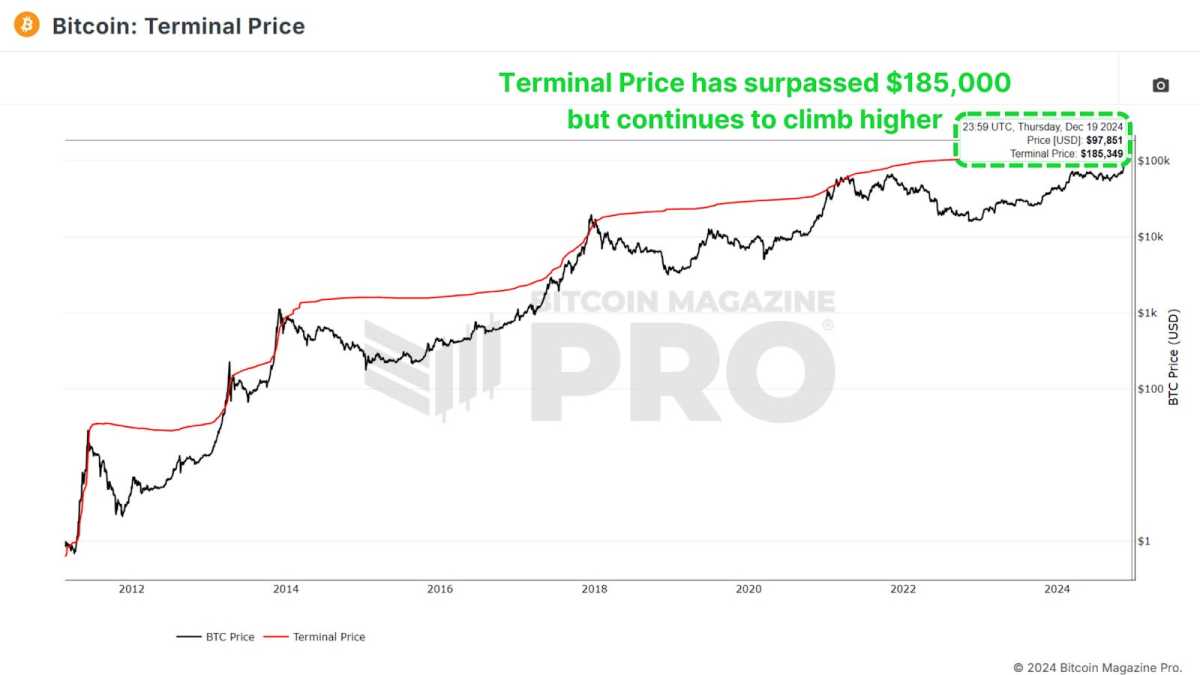

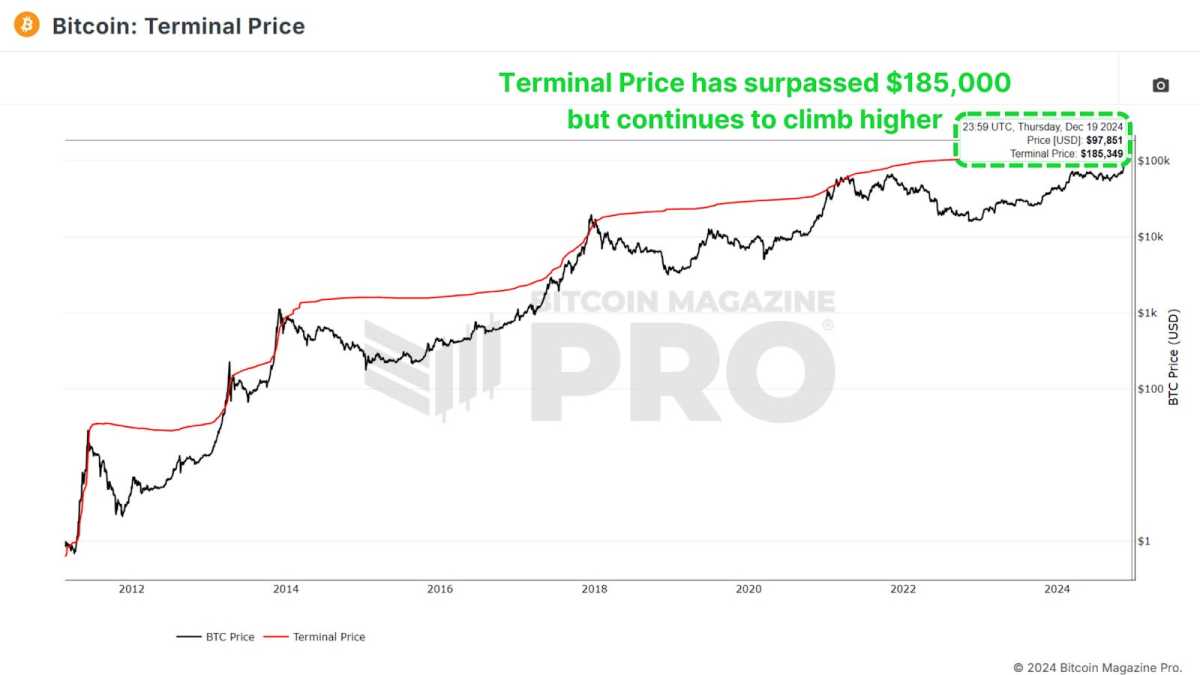

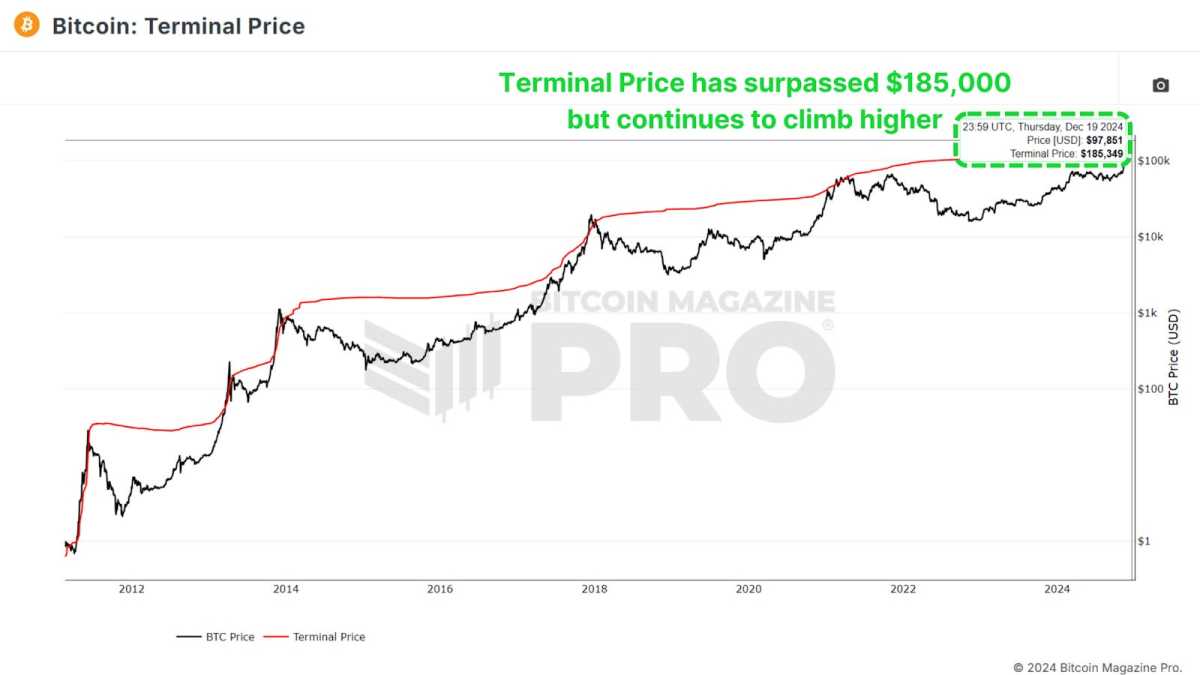

Terminal Price

The Terminal Price metric, which incorporates the Coin Days Destroyed (CDD) while factoring in Bitcoin’s supply, has historically been a reliable indicator for predicting Bitcoin cycle peaks. Coin Days Destroyed measures the velocity of coins being transferred, considering both the holding duration and the quantity of Bitcoin moved.

Currently, the terminal price has surpassed $185,000 and is likely to rise toward $200,000 as the cycle progresses. With Bitcoin already breaking $100,000, this suggests we may still have several months of positive price action ahead.

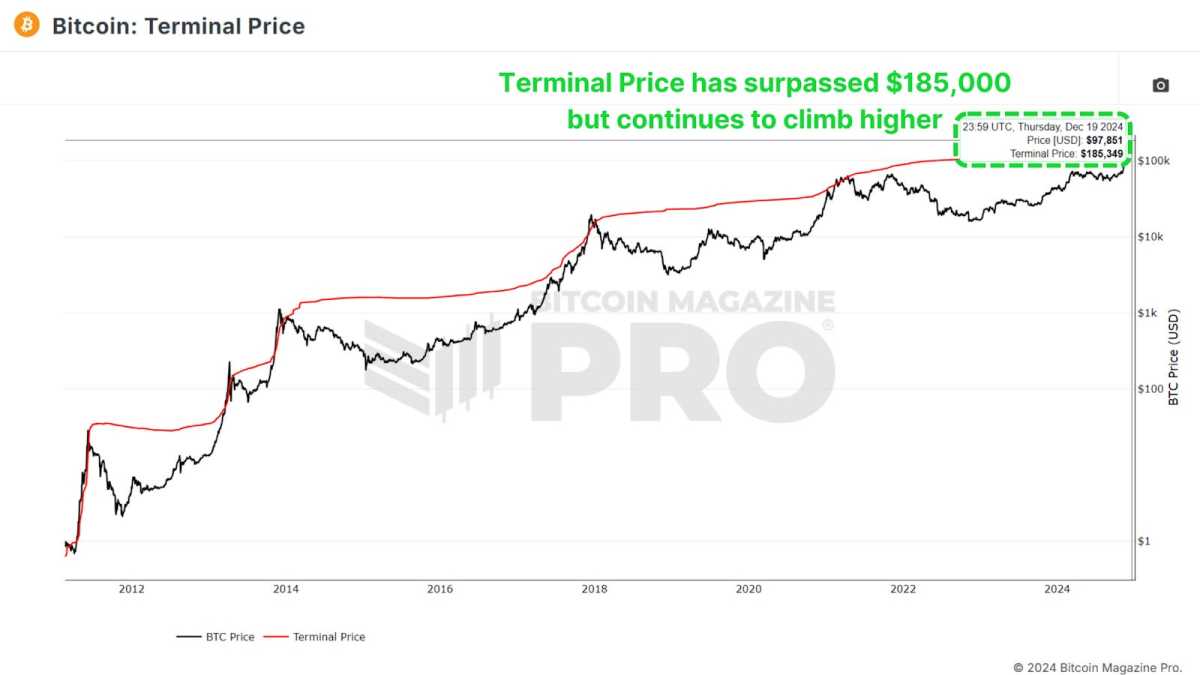

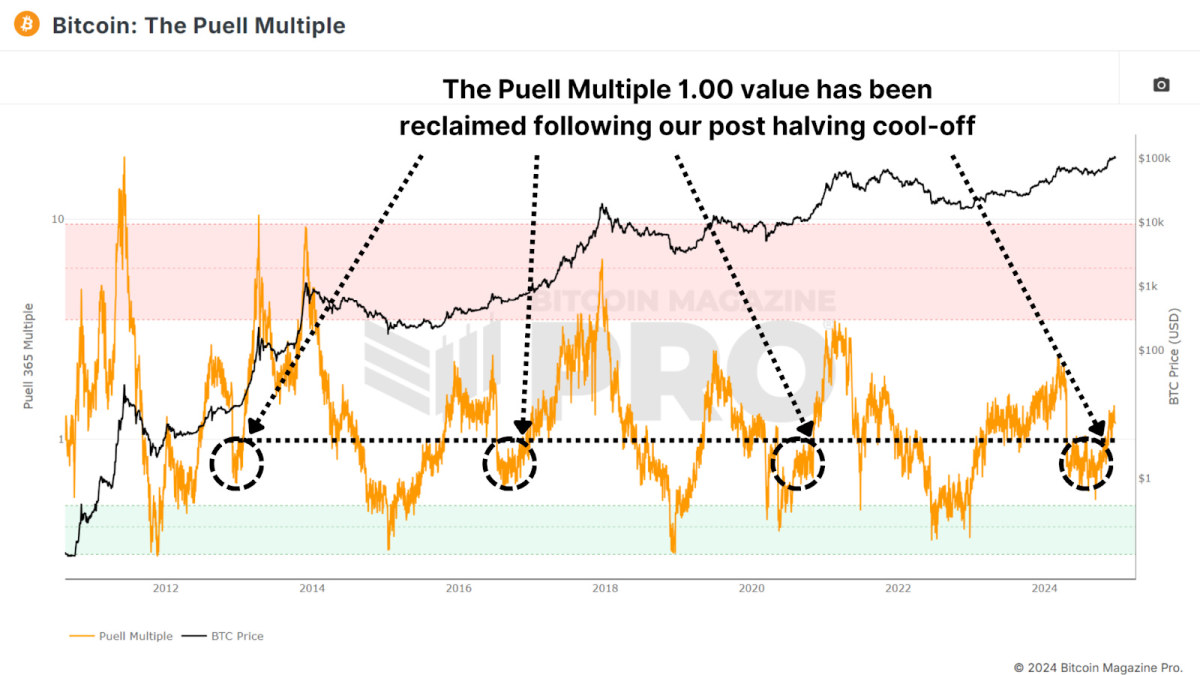

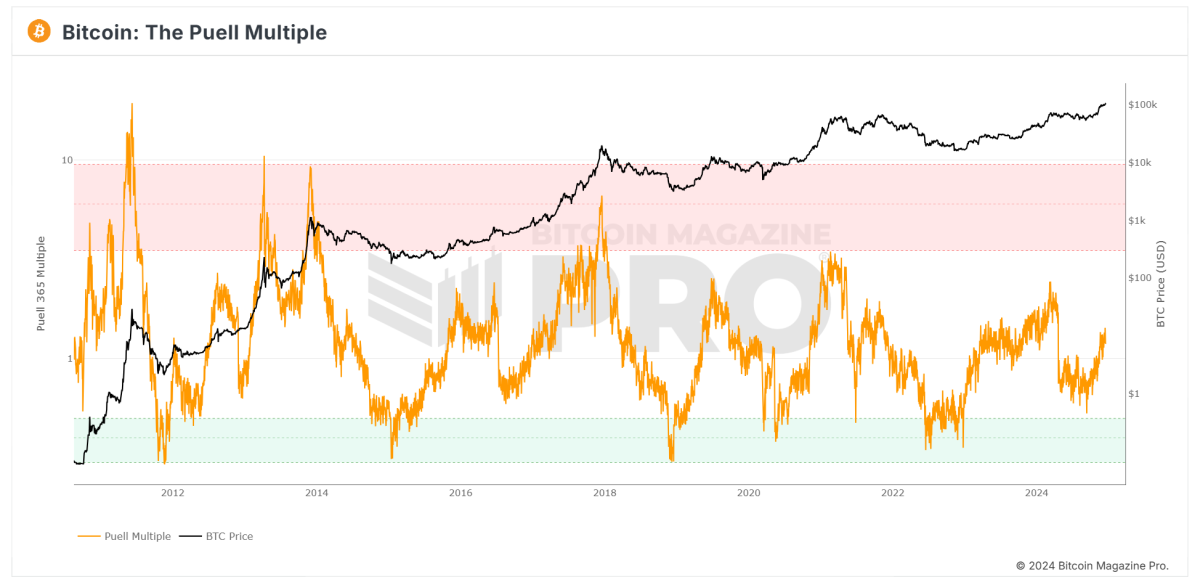

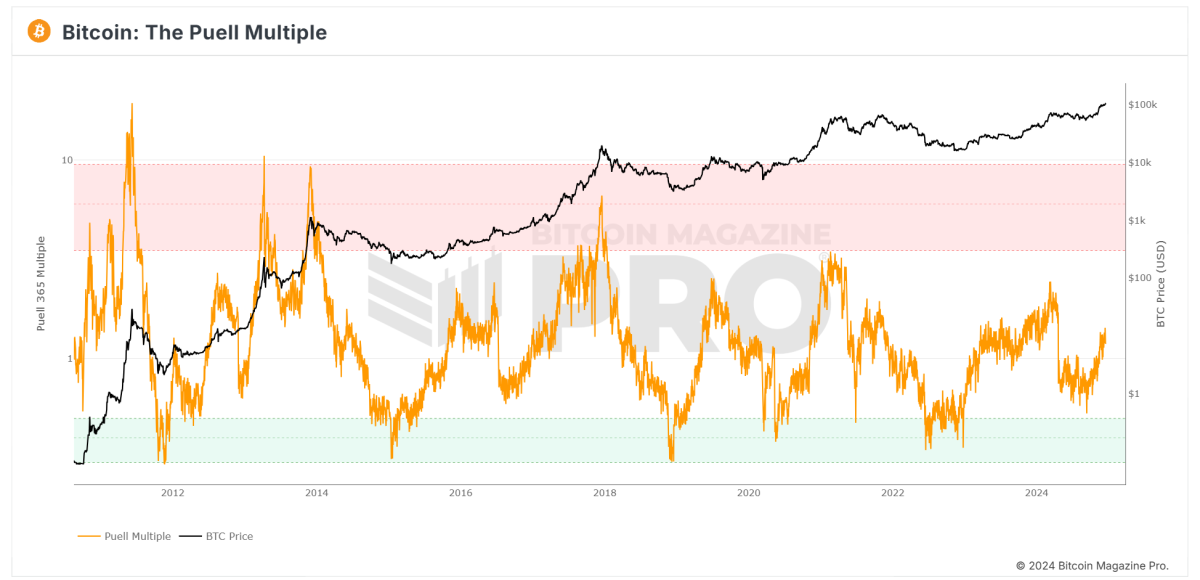

Puell Multiple

The Puell Multiple evaluates daily miner revenue (in USD) relative to its 365-day moving average. After the halving event, miners experienced a sharp drop in revenue, creating a period of consolidation.

Now, the Puell Multiple has climbed back above 1, signaling a return to profitability for miners. Historically, surpassing this threshold has indicated the later stages of a bull cycle, often marked by exponential price rallies. A similar pattern was observed during all previous bull runs.

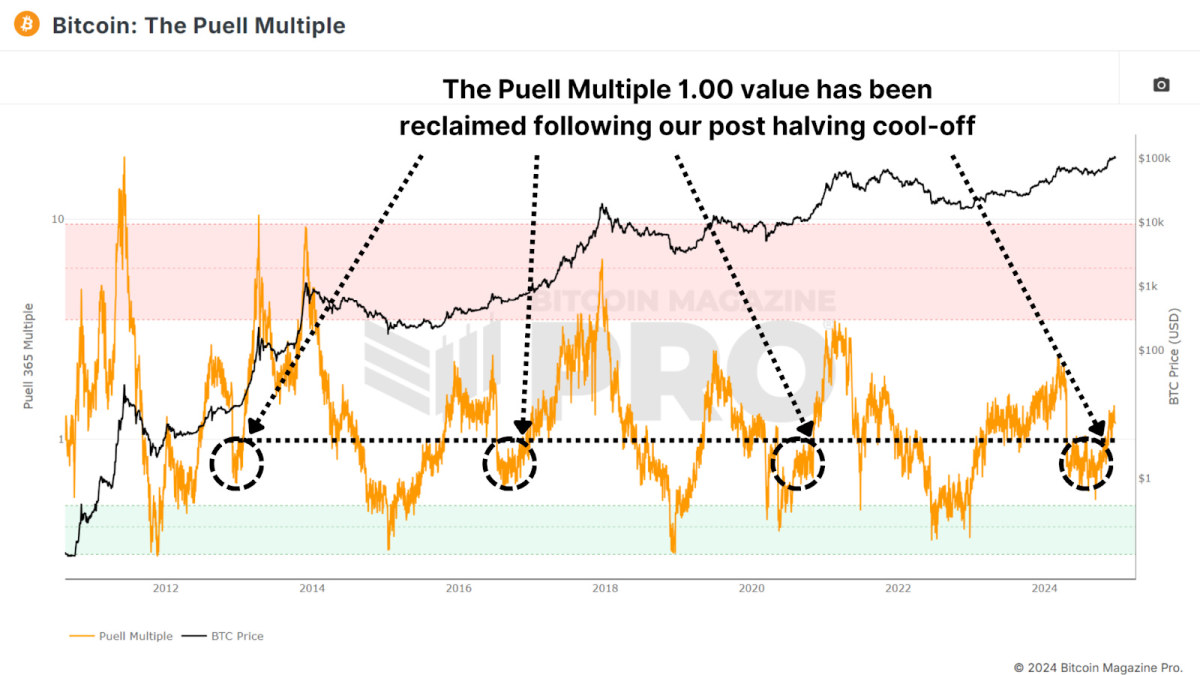

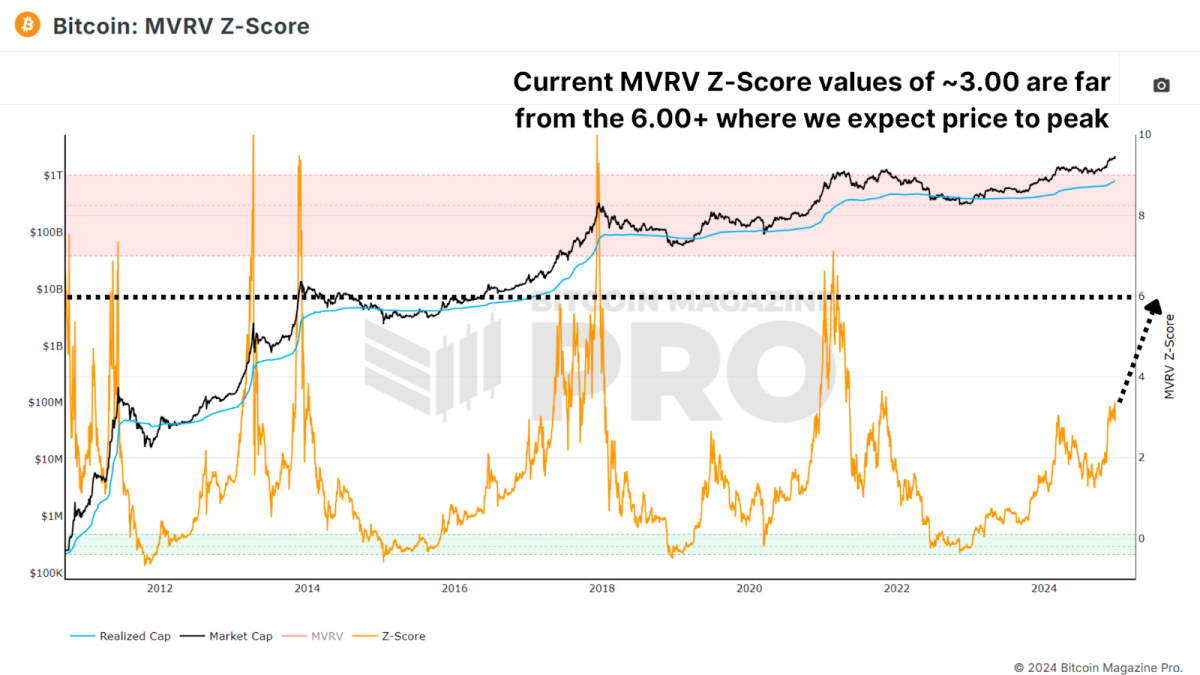

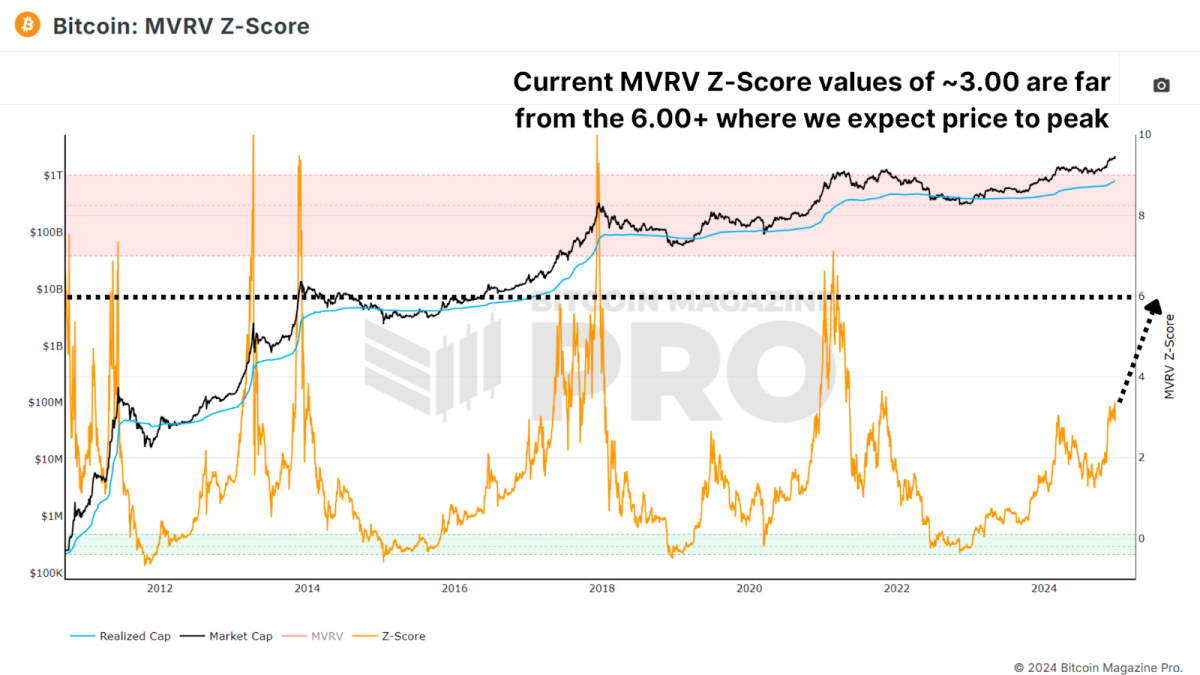

MVRV Z-Score

The MVRV Z-Score measures the market value relative to the realized value (average cost basis of Bitcoin holders). Standardized into a Z-Score to account for the asset’s volatility, it’s been highly accurate in identifying cycle peaks and bottoms.

Currently, Bitcoin’s MVRV Z-Score remains below the overheated red zone with a value of around 3.00, signaling that there’s still room for growth. While diminishing peaks have been a trend in recent cycles, the Z-Score suggests that the market is far from reaching a euphoric top.

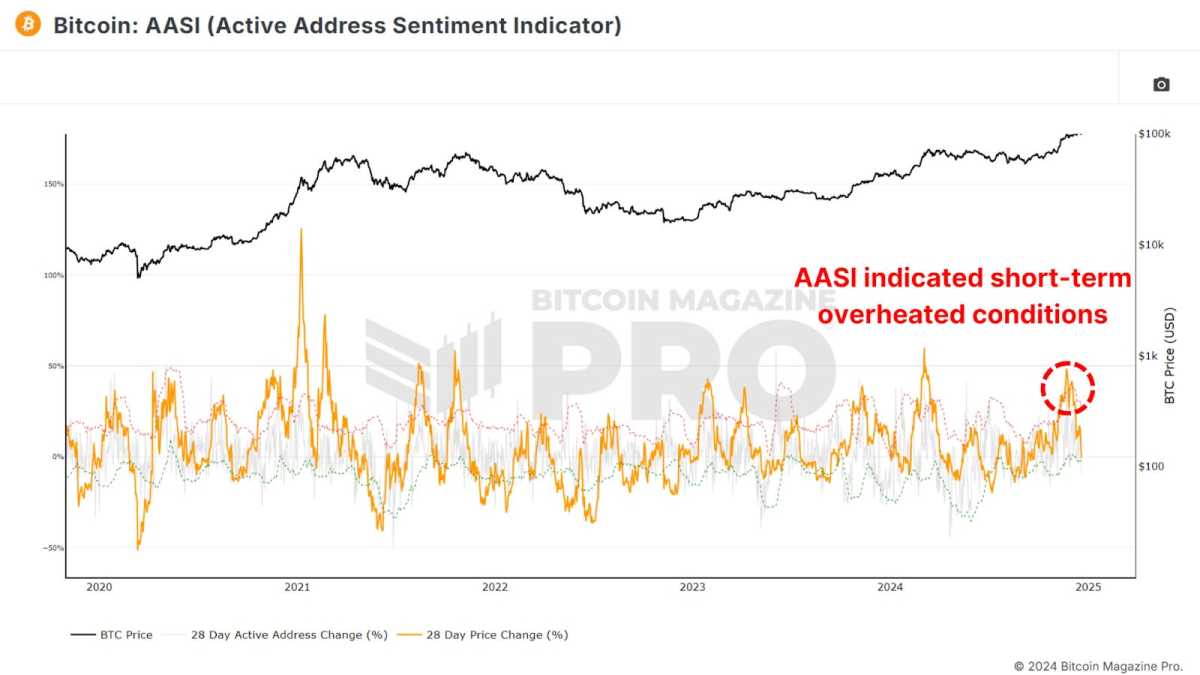

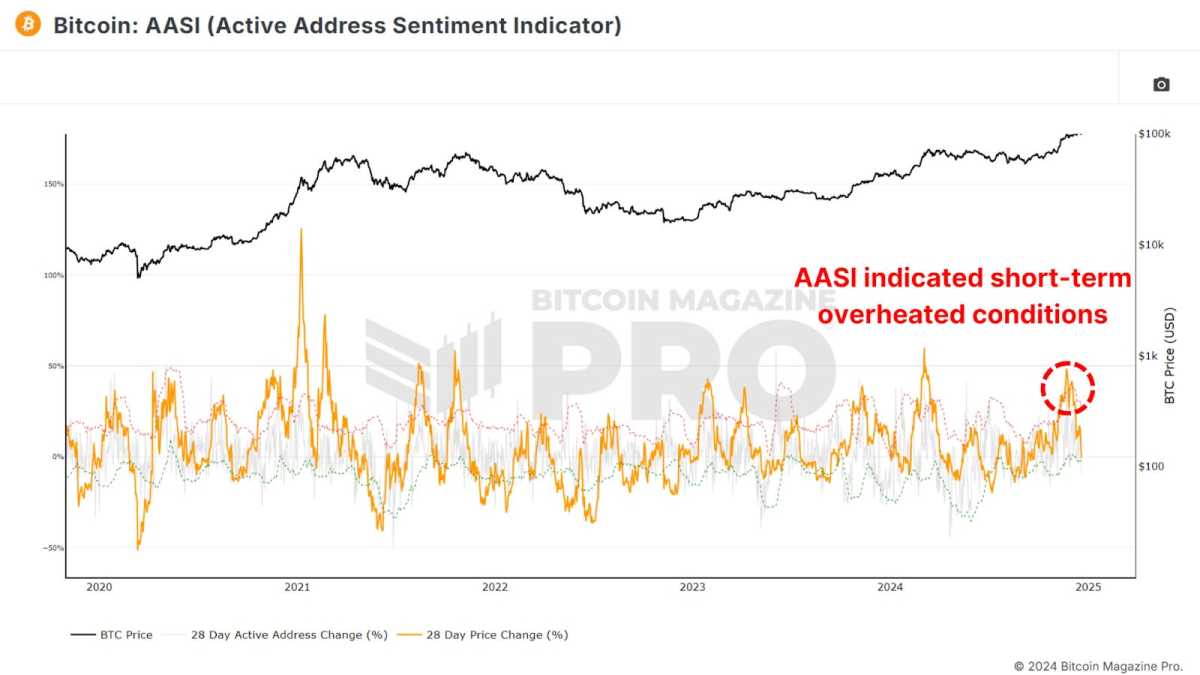

Active Address Sentiment

This metric tracks the 28-day percentage change in active network addresses alongside the price change over the same period. When price growth outpaces network activity, it suggests the market may be short-term overbought, as the positive price action may not be sustainable given network utilization.

Recent data shows a slight cooling after Bitcoin’s rapid climb from $50,000 to $100,000, indicating a healthy consolidation period. This pause is likely setting the stage for sustained long-term growth and does not indicate we should be medium to long-term bearish.

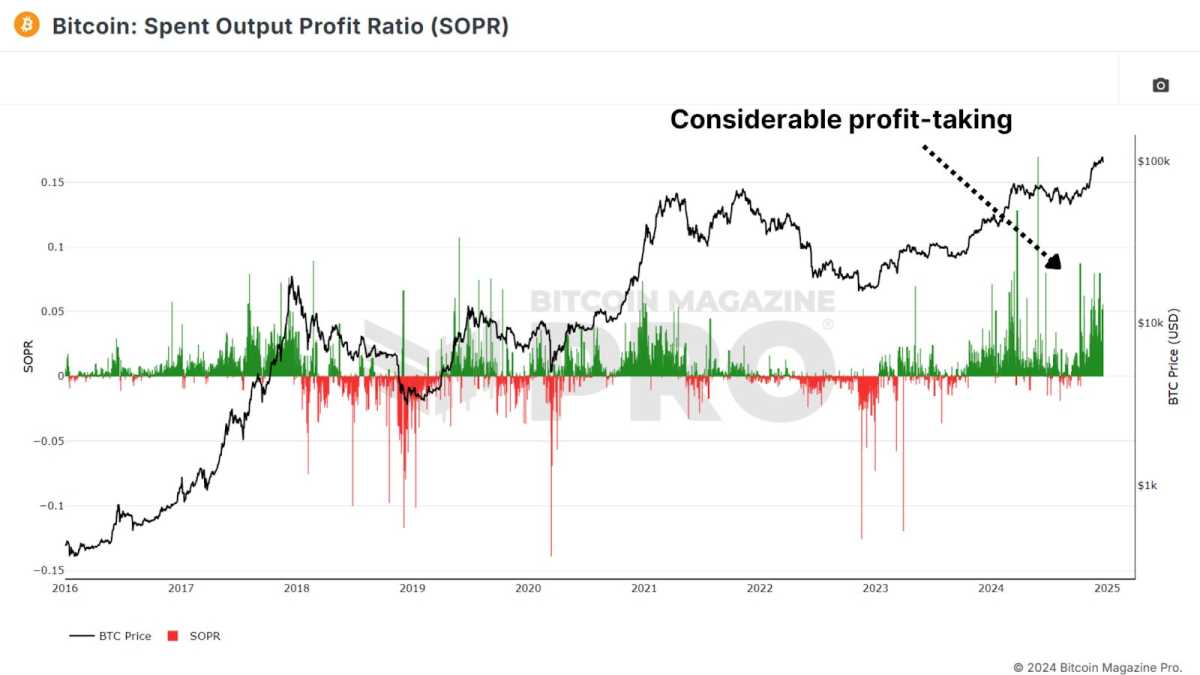

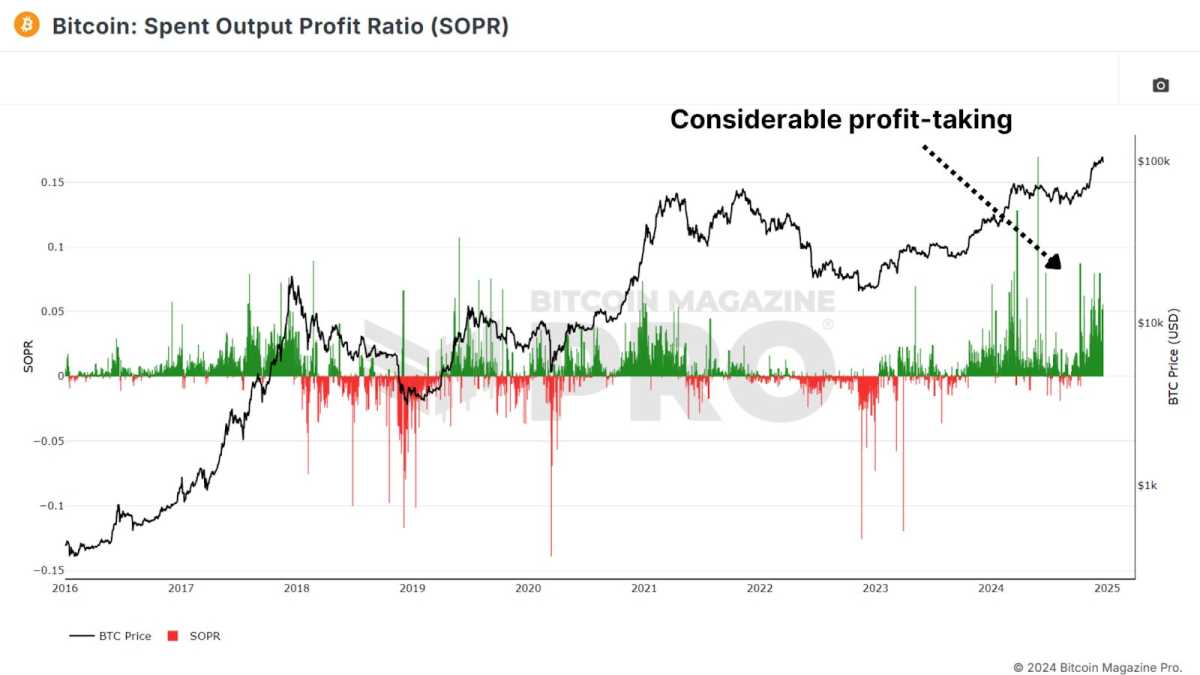

Spent Output Profit Ratio

The Spent Output Profit Ratio (SOPR) measures realized profits from Bitcoin transactions. Recent data shows an uptick in profit-taking, potentially indicating we are entering the latter stages of the cycle.

One caveat to consider is the growing use of Bitcoin ETFs and derivative products. Investors may be shifting from self-custody to ETFs for ease of use and tax advantages, which could influence SOPR values.

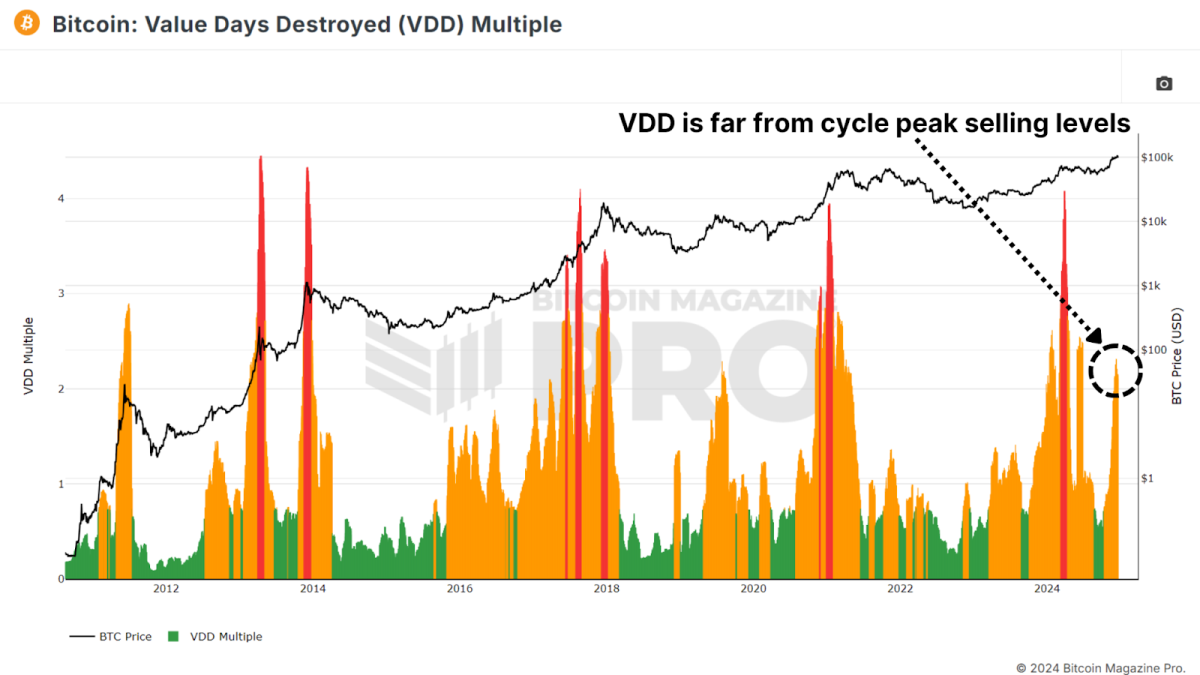

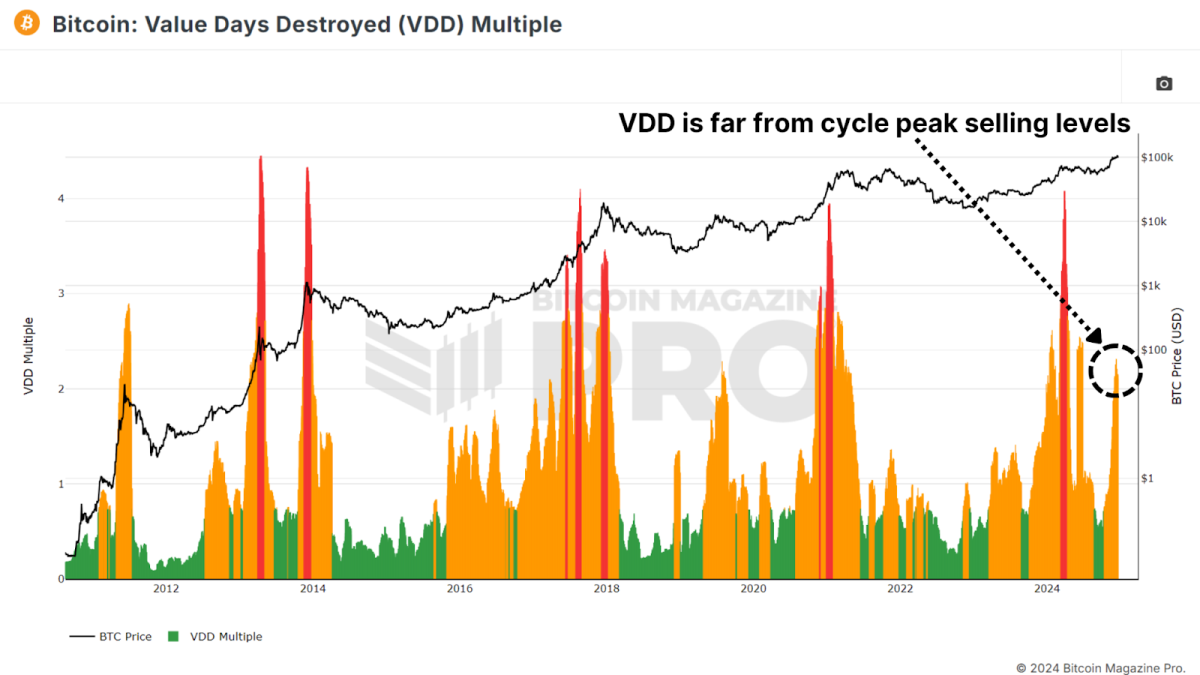

Value Days Destroyed

Value Days Destroyed (VDD) Multiple expands on CDD by weighting larger, long-term holders. When this metric enters the overheated red zone, it often signals major price peaks as the market’s largest and most experienced participants begin cashing out.

While Bitcoin’s current VDD levels indicate a slightly overheated market, history suggests it could sustain this range for months before a peak. For example, in 2017, VDD indicated overbought conditions nearly a year before the cycle’s top.

Conclusion

Taken together, these metrics suggest that Bitcoin is entering the latter stages of its bull market. While some indicators point to short-term cooling or slight overextension, most highlight substantial remaining upside throughout 2025. Key resistance levels for this cycle may emerge between $150,000 and $200,000, with metrics like SOPR and VDD providing clearer signals as we approach the peak.

For a more in-depth look into this topic, check out a recent YouTube video here: What’s Happening On-chain: Bitcoin Update

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin Magazine Pro

Exploring Five On-Chain Indicators to Understand the Bitcoin Market Cycle

Published

3 days agoon

December 20, 2024By

admin

With Bitcoin now making six-figure territory feel normal and higher prices a seeming inevitability, the analysis of key on-chain data provides valuable insights into the underlying health of the market. By understanding these metrics, investors can better anticipate price movements and prepare for potential market peaks or even any upcoming retracements.

Terminal Price

The Terminal Price metric, which incorporates the Coin Days Destroyed (CDD) while factoring in Bitcoin’s supply, has historically been a reliable indicator for predicting Bitcoin cycle peaks. Coin Days Destroyed measures the velocity of coins being transferred, considering both the holding duration and the quantity of Bitcoin moved.

Currently, the terminal price has surpassed $185,000 and is likely to rise toward $200,000 as the cycle progresses. With Bitcoin already breaking $100,000, this suggests we may still have several months of positive price action ahead.

Puell Multiple

The Puell Multiple evaluates daily miner revenue (in USD) relative to its 365-day moving average. After the halving event, miners experienced a sharp drop in revenue, creating a period of consolidation.

Now, the Puell Multiple has climbed back above 1, signaling a return to profitability for miners. Historically, surpassing this threshold has indicated the later stages of a bull cycle, often marked by exponential price rallies. A similar pattern was observed during all previous bull runs.

MVRV Z-Score

The MVRV Z-Score measures the market value relative to the realized value (average cost basis of Bitcoin holders). Standardized into a Z-Score to account for the asset’s volatility, it’s been highly accurate in identifying cycle peaks and bottoms.

Currently, Bitcoin’s MVRV Z-Score remains below the overheated red zone with a value of around 3.00, signaling that there’s still room for growth. While diminishing peaks have been a trend in recent cycles, the Z-Score suggests that the market is far from reaching a euphoric top.

Active Address Sentiment

This metric tracks the 28-day percentage change in active network addresses alongside the price change over the same period. When price growth outpaces network activity, it suggests the market may be short-term overbought, as the positive price action may not be sustainable given network utilization.

Recent data shows a slight cooling after Bitcoin’s rapid climb from $50,000 to $100,000, indicating a healthy consolidation period. This pause is likely setting the stage for sustained long-term growth and does not indicate we should be medium to long-term bearish.

Spent Output Profit Ratio

The Spent Output Profit Ratio (SOPR) measures realized profits from Bitcoin transactions. Recent data shows an uptick in profit-taking, potentially indicating we are entering the latter stages of the cycle.

One caveat to consider is the growing use of Bitcoin ETFs and derivative products. Investors may be shifting from self-custody to ETFs for ease of use and tax advantages, which could influence SOPR values.

Value Days Destroyed

Value Days Destroyed (VDD) Multiple expands on CDD by weighting larger, long-term holders. When this metric enters the overheated red zone, it often signals major price peaks as the market’s largest and most experienced participants begin cashing out.

While Bitcoin’s current VDD levels indicate a slightly overheated market, history suggests it could sustain this range for months before a peak. For example, in 2017, VDD indicated overbought conditions nearly a year before the cycle’s top.

Conclusion

Taken together, these metrics suggest that Bitcoin is entering the latter stages of its bull market. While some indicators point to short-term cooling or slight overextension, most highlight substantial remaining upside throughout 2025. Key resistance levels for this cycle may emerge between $150,000 and $200,000, with metrics like SOPR and VDD providing clearer signals as we approach the peak.

For a more in-depth look into this topic, check out a recent YouTube video here: What’s Happening On-chain: Bitcoin Update

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin Magazine Pro

What is the Bitcoin Puell Multiple Indicator and How Does It Work?

Published

5 days agoon

December 18, 2024By

admin

In the world of Bitcoin investing, understanding market cycles is key to identifying buying opportunities and spotting potential price peaks. One indicator that has stood the test of time in this regard is the Puell Multiple. Originally created by David Puell, this metric examines Bitcoin’s valuation through the lens of miner revenue, offering insights into whether Bitcoin might be undervalued or overvalued compared to its historical norms.

This article will explain what the Puell Multiple is, how to interpret it, and what the current reading on the chart suggests for investors. For a real-time look at this tool, check out the Puell Multiple chart on Bitcoin Magazine Pro.

What is the Puell Multiple?

The Puell Multiple is an indicator that compares Bitcoin miners’ daily revenue to its long-term average. Miners, as the “supply side” of Bitcoin’s economy, must sell portions of their BTC rewards to cover operational costs like energy and hardware. This makes miner revenue a critical factor influencing Bitcoin’s price dynamics.

How is the Puell Multiple Calculated?

The formula is simple:

Puell Multiple = Daily Issuance Value of BTC (in USD) ÷ 365-Day Moving Average of Daily Issuance Value

By comparing current miner revenues to their yearly average, the Puell Multiple identifies periods where miner profits are unusually high or low, signaling potential market tops or bottoms.

How to Read the Puell Multiple Chart

The Puell Multiple chart uses color zones to make interpretation straightforward:

- Red Zone (Overvaluation)

- When the Puell Multiple enters the red zone (above 3.4), it suggests miner revenues are significantly higher than usual.

- Historically, this has coincided with Bitcoin price peaks, indicating potential overvaluation.

- Green Zone (Undervaluation)

- When the Puell Multiple drops into the green zone (below 0.5), it signals that miner revenues are unusually low.

- These periods have historically aligned with Bitcoin market bottoms, offering prime buying opportunities.

- Neutral Zone

- When the Puell Multiple hovers between these levels, Bitcoin’s price is typically in a steady range relative to historical norms.

Current Insights: What is the Puell Multiple Telling Us?

Looking at the current Puell Multiple chart from Bitcoin Magazine Pro:

- The Puell Multiple (orange line) is trending upward but remains well below the red overvaluation zone.

- This suggests that Bitcoin is not yet in an overheated phase, where prices historically peak.

- At the same time, the metric is far above the green undervaluation zone, signaling we are no longer in a market bottom phase.

What Does This Mean for Investors?

The current Puell Multiple reading points to Bitcoin being in a mid-market cycle:

- Bullish Momentum: With the metric rising steadily, the market appears to be moving into a bullish phase, though it remains far from “overheated.”

- No Immediate Peak: The lack of a red zone reading suggests there may still be room for upside growth before a major correction.

Investors should monitor this chart closely in the coming months, particularly as Bitcoin approaches its next halving event in 2028, which could further influence miner revenues.

Why the Puell Multiple Matters for Bitcoin Investors

The Puell Multiple offers a unique perspective on Bitcoin’s market cycles by focusing on the supply side (miner revenue), rather than just demand. For long-term investors, this tool can be valuable for:

- Identifying Buying Opportunities: The green zone highlights periods of undervaluation.

- Spotting Market Peaks: The red zone has historically aligned with major price tops.

- Navigating Market Cycles: Combining the Puell Multiple with other indicators can help investors time their entries and exits more strategically.

Stay Ahead of the Market with Bitcoin Magazine Pro

For professional investors and Bitcoin enthusiasts looking to deepen their analysis, tools like the Puell Multiple chart on Bitcoin Magazine Pro provide essential insights into Bitcoin’s valuation trends.

By understanding the Puell Multiple and its historical significance, you can make informed decisions and better navigate Bitcoin’s unique market cycles.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential