atm

Australia seeking advice on crypto taxation to OECD

Published

5 months agoon

By

admin

Australia, with the world’s most significant number of crypto ATMs, seeks advice from an international organization on implementing crypto taxation.

The Organization of Economic Cooperations and Development (OECD), which has invented taxation on digital assets framework, was asked by the Department of Treasury to share input by next January.

The input of the consultations has focused on comparing two options of crypto taxation: implementing the OECD’s Crypto Asset Reporting Framework (CARF) into their law or customizing the policy approach.

CARF is a taxation transparency framework for the international authorities to collect tax-related information from the providers, including crypto-asset purchases and specific consumer data for $50k above transactions. Tax authorities could also share the information with other authorities to gain related information.

“The CARF improves visibility of income from crypto assets. This helps increase compliance with local tax laws and deter tax evasion,” the government on report.

The consultations seek advice on whether the government should follow the same rules as the OECD or implement its own to target specific data needed. If the Australian government implements its own, it could add or remove particular information fields based on the tax authority.

CARF would apply the Reporting Crypto Asset Providers to several crypto companies, including crypto exchanges, wallet providers, brokers, dealers, and ATM providers.

Australia’s growing crypto industry

The Australian government is aware that the crypto industry is growing. This is reflected in the relatively high crypto adoption among their people, with one-fifth of their population identified as crypto holders.

Australian crypto holders last year also gained a profit of up to $9,627 on average, or an increase of 17% from 2022 profit, according to a Swyftx report. The number of people going to invest in crypto in the next year is projected to boost to more than 2 million people.

According to CoinATMRadar, the crypto automatic teller machines (ATM) in Australia also share a big amount, estimated at around 3,3% of the market share in the world. The ATM has spread into Australia’s top cities, including Sydney (441), Melbourne (311), Brisbane (201), and Perth (140).

The government has recently sought advice regarding the central bank digital currency or digital dollar.

Source link

You may like

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

The Inverse Of Clown World”

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

3iQ and Figment to launch North America’s first Solana staking ETF

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

5 Biggest Ripple (XRP) Price Predictions for April 2025

atm

Bitcoin ATMs see 6% growth in 2024 amid renewed crypto interest

Published

3 months agoon

January 13, 2025By

admin

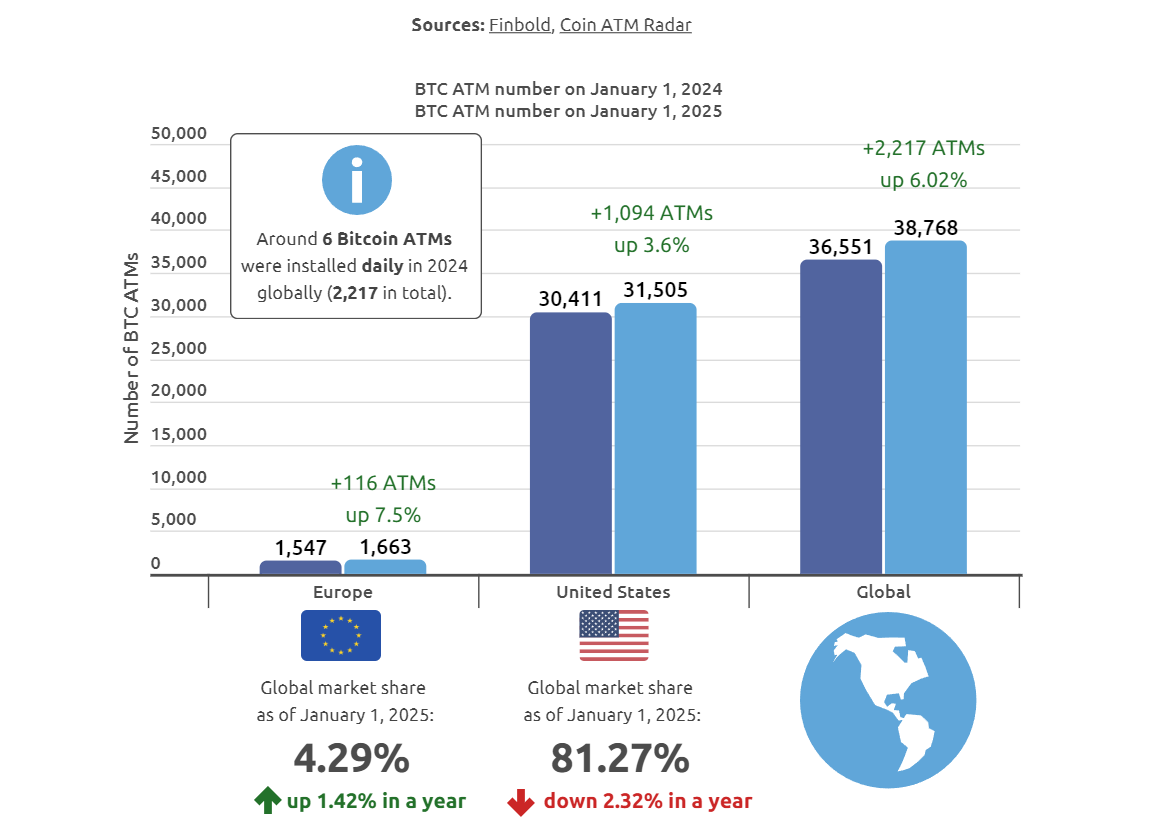

Bitcoin ATMs are popping up worldwide, with their numbers jumping 6% in 2024, showing how crypto is becoming more mainstream.

The number of Bitcoin ATMs keeps growing, making it easier for people to buy and sell cryptocurrencies. Recent reports show this trend is continuing. Just like regular ATMs, Bitcoin ATMs let you add cash to your crypto wallet, so the process is quick and simple.

So, what exactly are Bitcoin ATMs? These machines work like regular ATMs but are made for cryptocurrencies. Bitcoin (BTC) and sometimes other tokens can be bought using cash or a bank card. Some machines even allow selling crypto for cash, though the fees are usually higher than when buying.

The first Bitcoin ATM appeared in Vancouver, Canada, in 2013. It was a big moment for making crypto more accessible to the public. Since then, Bitcoin ATMs have grown rapidly, with over 37,500 machines in more than 70 countries. According to the latest research by Finbold, which cites data from Coin ATM Radar, 2024 was a standout year, with a 6% increase in the number of Bitcoin ATMs.

Bitcoin ATMs mainly landed in US

The U.S. is still the leader in Bitcoin ATMs, holding over 81% of the global market share. As of Jan. 13, there were more than 31,500 Bitcoin ATMs in the U.S., a gain of over 1,000 machines compared to the start of 2024. The global total hit 38,768, bouncing back from a dip in mid-2023 when the number dropped to around 33,000.

Europe has a smaller but growing presence in the Bitcoin ATM market. Although it’s not as big as the U.S., Europe’s number of ATMs has been steadily rising, even during crypto downturns, the report reads. In 2024, the region added 116 new machines, a 7.5% increase from 2023. This steady growth is unique, as many other regions saw declines during the crypto winter, the report notes.

Most of the ATM growth in 2024 happened in the first half of the year. By late April, 1,942 new machines were installed globally, averaging 485 machines a month between January and April. However, growth slowed down in the second half, with only 34 machines added per month between May and December. The slowdown came even though Bitcoin hit new all-time highs in November when its price neared $100,000.

Diverse regulatory approaches

In most places, Bitcoin ATMs are legal, though regulations vary. For example, in the U.S., they are regulated by the Financial Crimes Enforcement Network. Operators must register as money services businesses and follow AML and KYC rules for larger transactions. At the state level, operators often need a money transmitter license and must follow consumer protection laws like fee transparency and data security. Local zoning laws can also impact how crypto ATMs function.

Internationally, regulations around crypto ATMs vary by country, with the U.K.’s Financial Conduct Authority stepping up its oversight. In September 2024, crypto.news reported that London-based Olumide Osunkoya pleaded guilty to five offenses for running an illegal network of crypto ATMs across the U.K. This marked the country’s first conviction of its kind.

Earlier that year, in August, German authorities confiscated 13 crypto ATMs and seized nearly $28 million in cash from 35 locations across the country. The operation, led by BaFin, targeted machines operating without proper licenses, raising concerns about money laundering.

Bitcoin ATM scams surge, with older adults most affected

While most Bitcoin ATMs are run by legitimate companies, regulators are concerned they could be used for fraud or money laundering. New data from the Federal Trade Commission shows a huge rise in the amount of money consumers report losing to scams involving Bitcoin ATMs. Since 2020, the reported losses have nearly increased tenfold, reaching over $110 million in 2023.

The Federal Trade Commission also found that fraud losses linked to Bitcoin ATMs topped $65 million in the first half of 2024. People aged 60 and older were more than three times as likely to lose money to Bitcoin ATM scams compared to younger adults. Across all age groups, the median loss was an eye-watering $10,000. Most of the scams involved government impersonation, business impersonation, and tech support scams, the FTC said.

Source link

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

The Inverse Of Clown World”

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

3iQ and Figment to launch North America’s first Solana staking ETF

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

5 Biggest Ripple (XRP) Price Predictions for April 2025

Tokenization Firm Securitize Acquires MG Stover’s Digital Asset Fund Administration Unit

CleanSpark to start selling Bitcoin in ‘self-funding’ pivot

Dogecoin Whales Buy 800 Million DOGE in 48 Hours – Smart Money Or Bull Trap?

President Trump Executive Director Says U.S. Could Use Tariff Revenue To Build Strategic Bitcoin Reserve

Man Faces Six Years in Prison After Omitting $12,302,115 in CryptoPunk NFT Sales From Tax Filing

will this boost Bitcoin and altcoins?

Yen Surge, Soaring Bond Yields Could Threaten Bitcoin as BOJ Weighs Policy Shift

Ripple Whale Moves $63M As XRP Tops List for Spot ETF Approval

Bitcoin Cash (BCH) Gains 1% as Index Trades Flat

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x