BlockFi

Bankrupt crypto lender BlockFi to start creditor repayments in July

Published

5 months agoon

By

admin

Defunct cryptocurrency lending platform BlockFi is set to start repaying its creditors in July, 19 months after filing for bankruptcy.

Collapsed crypto lending platform BlockFi will start repaying its creditors in July, nearly two years after the firm filed for bankruptcy amid the dramatic collapse of the FTX crypto exchange.

In an X post on Thursday, the New Jersey-headquartered firm said the distributions will be processed “in batches in the coming months” via Coinbase, adding that eligible clients will receive a notification to the BlockFi account email on file. However, it clarified that non-U.S. clients remain unable to receive funds due to regulatory requirements, with no specified timeline for these repayments.

The distributions will be processed in batches in the coming months, and eligible clients will receive a notification to the BlockFi account email on file. Please note that non-US Clients are unable to receive funds at this time due to the regulatory requirements applicable to…

— BlockFi (@BlockFi) July 17, 2024

For those who are unable to open a Coinbase account, BlockFi earlier assured that all distributions “will be made in cash.”

In March, BlockFi announced it is unlikely to fully repay customers with interest-bearing accounts. The company had previously estimated that these customers might recover between 39.4% and 100% of their account value. The crypto lending giant filed for Chapter 11 protection in November amid market volatility and substantial exposure to the defunct crypto exchange FTX. Less than a year later, BlockFi emerged from bankruptcy and is now working on repaying its creditors.

Source link

You may like

Is Bitcoin Self-Custody Under Threat in Europe?

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

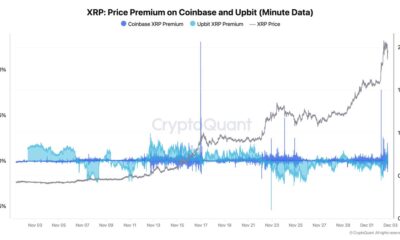

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

BlockFi

California permanently cuts off BlockFi’s license over bad lending practices

Published

3 weeks agoon

November 9, 2024By

admin

The California Department of Financial Protection and Innovation has permanently revoked BlockFi’s lending license following its bankruptcy and regulatory issues.

BlockFi, a crypto lending platform, collapsed in 2022 amid financial troubles tied to the downfall of crypto exchange FTX.

Today, we’re announcing we’ve revoked crypto lender BlockFi’s California Financing Law (CFL) license. BlockFi has agreed to a settlement that includes a revocation of its license and a cease-and-desist from harmful practices. More: https://t.co/gdi28TpY7H pic.twitter.com/S1uieLHbkP

— CA Department of Financial Protection & Innovation (@CaliforniaDFPI) November 8, 2024

BlockFi had extended a $400 million credit line to FTX, and FTX’s bankruptcy had ripple effects, contributing to BlockFi’s financial instability and eventual bankruptcy filing.

BlockFi’s rocky past

The DFPI’s revocation of BlockFi’s license stems from findings that the lender breached California’s Financing Law by failing to assess borrowers’ ability to repay and charging interest before loans were issued, according to a now-deleted DFPI press release.

BlockFi also did not provide required credit counseling and inaccurately disclosed loan terms, impacting borrowers’ credit scores and ability to access future loans.

In addition to the revocation, BlockFi reached a settlement with the DFPI, agreeing to stop unsafe practices. The regulator imposed a $175,000 fine, waiving the payment to focus on creditor repayments, per the release.

Source link

Trump’s Top SEC Chair Pick Paul Atkins Reluctant to Take Job: Source

Is Bitcoin Self-Custody Under Threat in Europe?

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

Altcoin Season To Face Challenges Ahead, CryptoQuant CEO Predicts

Crypto, Stocks and ‘Everything Bubble’ Still Has Room To Run, According to Analyst Jason Pizzino

This Cardano alternative expected to reach $1 in 2025, currently priced at $0.0259

Binance To Delist These Crypto In BTC Trading Pairs, What’s Next?

Polymarket Retains Loyal User Base a Month After Election, Data Shows

Coinbase CEO Brian Armstrong Sends Strong Message to Anti-Crypto Law Firms

Elon Musk’s $56 Billion Tesla Pay Deal Struck Down Again: Details

Bitcoin to Enter Final Bull Phase? Key Indicator Hints at Major Price Movement

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential