24/7 Cryptocurrency News

Binance Alerts Users To Malware Risks in Crypto Withdrawals

Published

3 months agoon

By

admin

Binance crypto exchange has issued a warning about an ongoing malware threat that manipulates cryptocurrency withdrawal addresses, posing significant financial risks to users. The exchange has observed an increase in such malicious activities, prompting a robust response to safeguard user transactions.

Binance Issues Alert on Malware Threats to Crypto Wallets

In a recent blog post, Binance detailed how the malware known as “Clipper” is affecting the crypto community. This malware intercepts and alters clipboard data to change cryptocurrency addresses copied by users during transactions.

As a result, funds intended for legitimate recipients are misdirected to addresses controlled by attackers. The security team at Binance has enhanced monitoring to detect and prevent these alterations.

Furthermore, the company has committed to educating its users about recognizing and mitigating such threats. The exchange emphasizes the importance of verifying the authenticity of wallet addresses before executing transactions. It advises double-checking addresses manually and avoiding the use of clipboard for transactions when possible.

Enhanced Security Measures and User Guidance

In addition, Binance has implemented several security measures in response to the rising threat from malicious software. One primary strategy is the blacklisting of suspicious addresses identified as part of the scam. This preventive measure has thwarted numerous transactions that would have resulted in unauthorized withdrawals.

The cryptocurrency exchange is also actively engaging with its user base, issuing notifications to those potentially affected by such malware. The exchange platform encourages users to report any suspicious activity immediately, enabling the security team to take swift action.

Moreover, the exchange recommends that users install and maintain reputable security software, which can provide an additional layer of defense by detecting and removing malware.

Preventative Strategies to Combat Crypto Scams

To combat the threat of this crypto scam, Binance advocates a proactive approach to online security. Users are urged to verify the sources of any downloadable apps or plugins, sticking to official and reputable outlets. Regular updates to security software can also help protect against the latest threats.

More so, this week, the American division of the crypto exchange, BinanceUS, partnered with digital asset custody firm Fireblocks. This collaboration aims to improve the security of customer assets against crypto scams using sophisticated wallet technologies.

Similarly, to combat crypto scams, the Commodity Futures Trading Commission (CFTC) launched educational collaborations with both federal and private entities to inform the public about prevalent scams, such as “pig butchering” and other deceptive schemes.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. His work includes notable contributions to Cryptopolitan and Coingape News Media, where he shares his insights on the latest developments in the cryptocurrency market. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

24/7 Cryptocurrency News

BTC Risks Falling To $20K If This Happens

Published

57 seconds agoon

December 23, 2024By

admin

Bitcoin News: A recent report from The Kobeissi Letter hints at a potential BTC crash to $20,000 in the coming few weeks. The report cited Bitcoin’s relation with the global monetary supply, saying that if the crypto continues to move in tandem, it could witness a massive dip ahead. Besides, it also comes amid highly volatile trading noted in the broader crypto market, with the flagship crypto falling below the $100K mark recently.

Bitcoin News: Why BTC Can Crash To $20K?

In the latest Bitcoin news, the crypto could face a significant correction, potentially dropping to $20,000 in the coming weeks, The Kobeissi Letter said. The report highlights Bitcoin’s historical tendency to mirror global money supply trends, suggesting a steep decline might be on the horizon. The analysis revealed a close relationship between Bitcoin prices and global monetary supply, with BTC often reacting with a 10-week lag.

As global money supply peaked at $108.5 trillion in October, Bitcoin hit an all-time high of $108,000 recently. However, a subsequent $4.1 trillion drop in money supply to $104.4 trillion, its lowest since August, raises concerns about Bitcoin’s near-term trajectory.

Meanwhile, The Kobeissi Letter raised concerns over the potential crash ahead. They noted, “If the relationship still holds, this suggests that Bitcoin prices could fall as much as $20,000 over the next few weeks.” Notably, this prediction comes amid heightened market volatility, with BTC recently slipping below the psychological $100K mark. Such movements have amplified fears of a broader selloff in the crypto market, which has already faced pressure from global economic uncertainties.

What’s Next For BTC Amid Bearish Sentiment?

The latest positive Bitcoin news and strong rally this year showcased its resilience but this potential correction could pause its bullish momentum. Traders and investors are now closely monitoring macroeconomic factors, including shifts in monetary supply, which could significantly impact BTC’s performance. However, the question remains whether Bitcoin will defy this predicted trend or align with historical patterns.

If the BTC crash occurs, it would mark a critical juncture for the cryptocurrency market, testing Bitcoin’s role as a safe haven in uncertain times. For context, Robert Kiyosaki has recently hinted towards a looming economic depression, while urging investors to buy Bitcoin amid the economic turmoil.

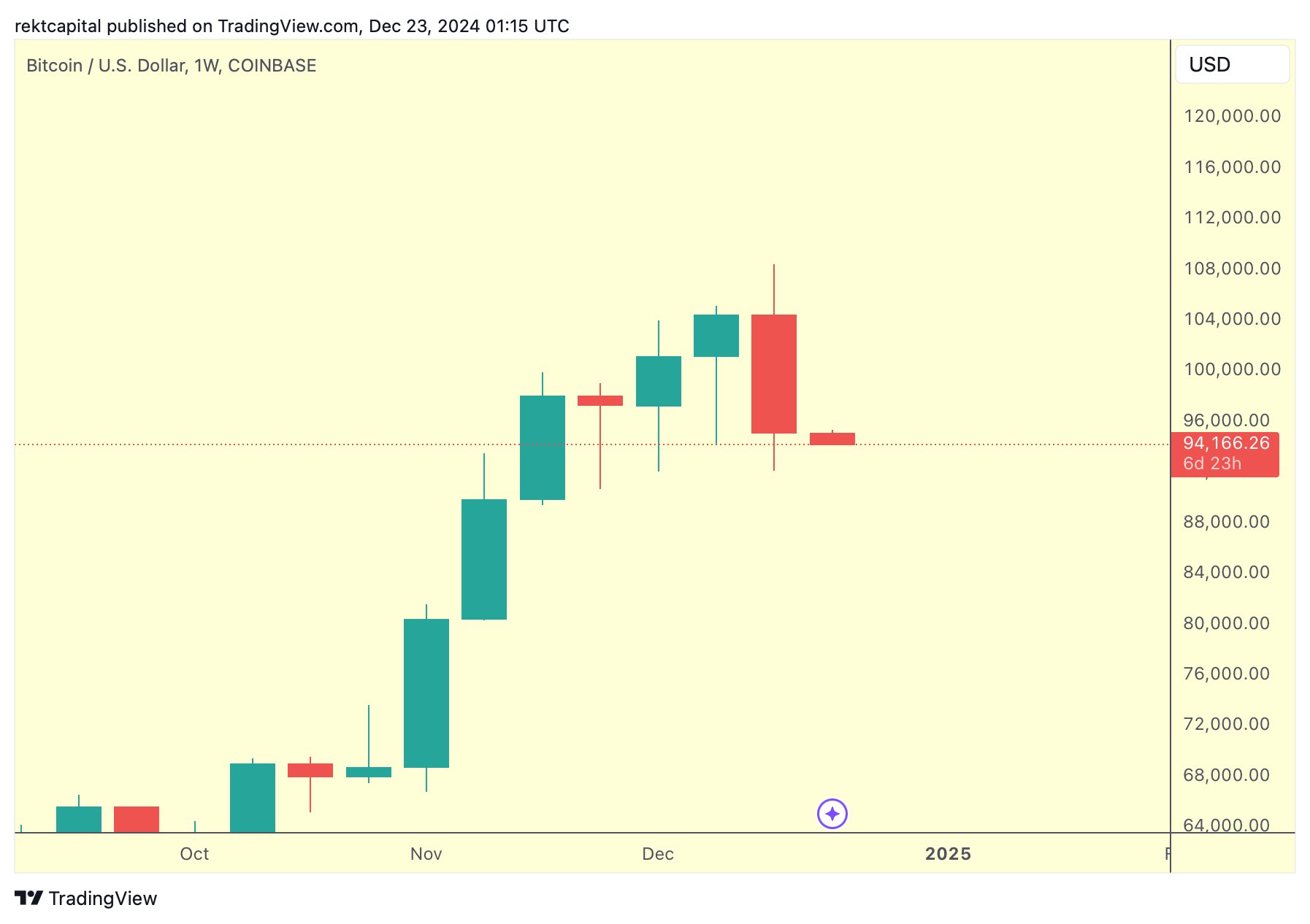

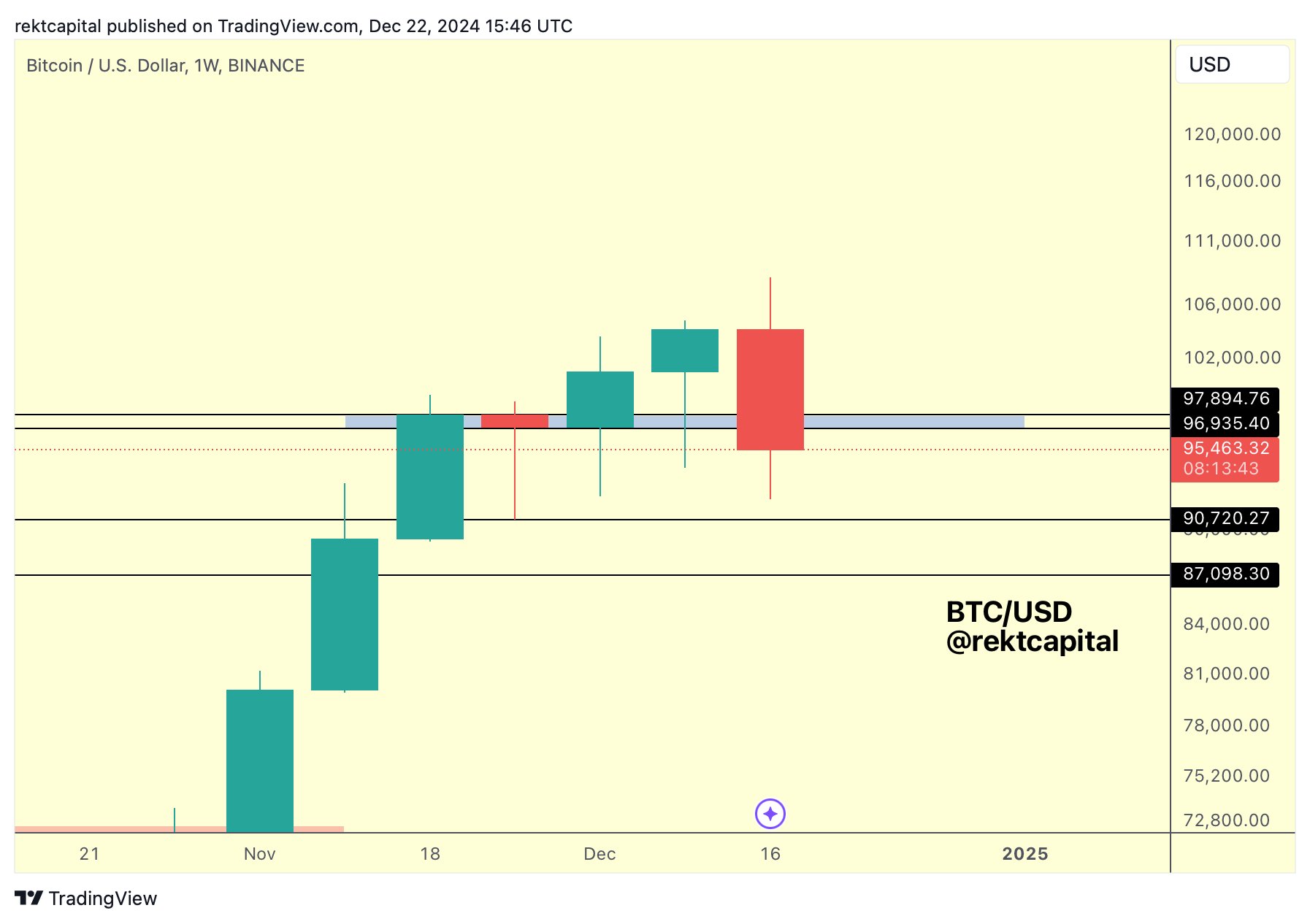

However, popular crypto market expert Rekt Capital also said that the crypto “has confirmed a Bearish Engulfing Candlestick formation”, highlighting the bearish momentum in the market.

In a separate post, the analyst said that BTC has lost its weekly support and its 5-week technical uptrend is over. Considering that, the expert warned about a potential multi-week correction for the crypto ahead.

However, despite that, the institutional interest remained strong for the crypto. For context, Matador has recently revealed its plan to buy $4.5 million in BTC this month. On the other hand, MicroStrategy also continued its buying trend, indicating strong market interest.

Meanwhile, BTC price today was down more than 1% to $94,430, while its one-day trading volume jumped nearly 34% to $54.39 billion. Notably, the crypto has touched a high of $97,217 over the last 24 hours. In addition, a recent Bitcoin price analysis highlights three potential reasons that could help in ending the bearish momentum ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Published

6 hours agoon

December 23, 2024By

admin

Rich Dad Poor Dad author Robert Kiyosaki has issued a stark warning while hinting towards an economic depression ahead. In a recent X post, the renowned author said that the global market crash has already started, as he predicted earlier, which indicates that the financial market might enter a “depression” phase. Notably, this comes as the crypto market records immense volatility, sparking concerns over what’s next for Bitcoin (BTC).

Robert Kiyosaki Hints At Economic Depression Ahead

Robert Kiyosaki, in a recent X post, has revealed a stark warning of a looming economic depression. The Rich Dad Poor Dad author warned that a global market crash has already begun, citing Europe, China, and the U.S. as regions facing significant downturns.

In his post, Kiyosaki urged caution, advising individuals to safeguard their finances and maintain their jobs. “Global crash has started. Europe, China, USA going down. Depression ahead?” he asked while emphasizing the enduring value of assets like gold, silver, and Bitcoin. He added, “For many people, crashes are the best times to get rich.”

This warning aligns with Kiyosaki’s earlier prediction of what he called the “biggest crash in history.” Earlier this month, he encouraged his followers to prepare for financial turmoil, stating, “Please be proactive and get rich… before the BOOMER’s go BUST.”

However, this recent comment from Robert Kiyosaki indicates his sustained confidence in BTC. As the crypto market faces heightened volatility, Bitcoin could emerge as a hedge against traditional market instability, he noted. Besides, it also indicates that the flagship crypto, alongside gold and silver, might continue to gain traction amid this economic turmoil.

What’s Next For BTC?

Bitcoin price today has continued its volatile trading, losing nearly 1.5% over the last 24 hours to $95,323. The crypto touched a high and low of $97,260 and $93,690 in the last 24 hours, showcasing the highly volatile scenario in the market.

In addition, the US Spot Bitcoin ETF also recorded significant outflow, with BlackRock Bitcoin ETF witnessing its largest outflux since its launch. This has weighed on the investors’ sentiment, sparking concerns over a waning institutional interest.

However, despite that, many experts remained confident on the asset’s future trajectory. For context, in a recent X post, Peter Brandt shared a new BTC price target, indicating his confidence in the digital asset.

On the other hand, institutions like Metaplanet have also continued to boost their BTC holdings. These moves indicates that the institutions, as well as many investors, are bullish towards the long-term potential of the crypto. Besides, as Robert Kiyosaki said, the recent dip also provides a buying opportunity to investors, which might further boost Bitcoin to its new ATH ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Published

9 hours agoon

December 23, 2024By

admin

Tron founder Justin Sun has been heavily offloading his ETH holdings with Ethereum price crashing 17% following the rejection at $4,000. Over the past 7 days, Sun has offloaded another 50% of his holdings worth $143 million. Market analysts predict that ETH price could further take a dip below $3,000 once again before resuming upside momentum.

Tron’s Justin Sun on ETH Selling Spree

Justin Sun is on a massive Ethereum selling spree since the coin resumed its upward journey after Donald Trump’s election win. This continued even until last week, when Tron founder offloaded $143 million worth of ETH causing Ethereum price to tank over 15% amid the crypto market crash.

Blockchain analytics firm Spot On Chain reported that Justin Sun redeemed 39,999 ETH (valued at $143 million) from liquid staking platforms Lido Finance and EtherFi. He subsequently deposited the entire amount into HTX.

Since November 10, as Ethereum price has trended upward, Sun has deposited a total of 108,919 ETH (worth $400 million) to HTX at an average price of $3,674. Notably, many of these deposits occurred near local price peaks.

Spot On Chain also revealed that Justin Sun currently has 42,904 ETH (valued at $139 million) in the process of unstaking from Lido Finance. The Tron founder might potentially send this funds to HTX later.

Ethereum Price Drop Below $3,000 Coming?

With Ethereum price losing its crucial support of $3,500, the market sentiment for the world’s largest altcoin has turned bearish. Last week, crypto market analysts turned bearish on Ethereum expecting the ETH price to drop $2,800 on selloff by whales.

Popular market analyst IncomeSharks stated that it was a “low-volume weekend,” for Ethereum following a volatile week for stocks. The analysts added that it won’t be the right time to sell.

The On-Balance Volume (OBV) indicator, a tool used to gauge buying and selling pressure, remains steady, oscillating within a channel. Recent Ethereum buyers are still in profit, providing some support for the market. However, the below chart shows that there’s still scope for Ethereum to take a dip to $3,000.

Prominent crypto analyst “I am Crypto Wolf” also highlighted a bullish outlook with a potential inverse head-and-shoulders (iHS) pattern. According to the analyst, Ethereum price chart is currently forming the “right shoulder” of the iHS continuation pattern.

This setup could provide the momentum needed to surpass the $4,000 resistance and aim for a $10,000 target by May. A breakout is anticipated by the end of January, though a retest of the $3,000 level remains a possibility before the rally takes off, he noted.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: