crypto tax

Binance asked to pay $86m in Indian Goods and Services Tax

Published

5 months agoon

By

admin

Binance has received a show-cause letter from the Directorate General of GST Intelligence of Ahmedabad to pay inr 722 crores, approximately $86 million USD, as goods and services tax.

According to a Times of India report, the DGGI, an agency operating under India’s Ministry of Finance to combat tax evasion, alleges that Binance is liable to pay GST as it had collected fees from Indian nationals using its platform.

Binance also reportedly failed to register under the GST framework, resulting in the recent scrutiny.

The GST is a comprehensive indirect tax levied on the manufacture, sale, and consumption of goods and services at the national level. Foreign entities operating in India are required to pay this tax if they offer their services to Indians and register under the GST framework.

Binance allegedly earned at least 4,000 crores, approximately $476 million, from transaction fees, a source told Times of India.

Investigations conducted by the DGGI revealed that the fees were deposited in an account controlled by Nest Services Limited, a Seychelles-based Binance subsidiary.

On top of this, the DGGI has also reached out to other companies in the Binance group, including those operating in the Cayman Islands and Switzerland.

In response, Binance has reportedly appointed a representative to engage with the agency to resolve the issue.

For the DGGI, this was the first instance where it issued a show cause of this nature to a cryptocurrency firm. However, the agency has previously cracked down on domestic cryptocurrency exchanges to thwart tax evasion.

During the 2022 investigation, the DGGI found that several crypto exchanges were responsible for 70 crores, approximately $8.34 million, in tax evasion.

Meanwhile, Binance is looking at a second hefty payment to be made to Indian regulators. In June, the nation’s Financial Intelligence Unit slapped the exchange with a $2.25 million fine for failing to register its operations.

Despite the fine, sources claimed that the exchange was considering returning to India as a compliant platform and was willing to pay the fine.

The exchange was banned in January but largely dominated the Indian market prior to that. When India implemented a 30% capital gains tax and a 1% TDS on crypto profits and trades, investors rushed to the platform to bypass the added costs.

Binance had initially made its foray into India by acquiring local crypto exchange WazirX. However, it later distanced itself, claiming the acquisition was not completed, right after India’s ED initiated a money laundering investigation against WazirX.

Source link

You may like

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Bitcoin

Early-Era US Bitcoin Investor Sentenced to Two Years in Prison for Underreporting Gains From BTC Sales

Published

1 week agoon

December 14, 2024By

admin

An ancient Bitcoin investor is going to spend the next two years in prison after underreporting his BTC gains, according to the U.S. Department of Justice (DOJ).

In a new press release, the DOJ says that Frank Richard Ahlgren III of Austin, Texas failed to accurately report the capital gains he earned after selling $3.7 million in Bitcoin.

He was sentenced Thursday to two years in prison for filing false tax returns.

The DOJ says that taxpayers are required to report any gains or losses from the sale of cryptocurrencies like Bitcoin.

Says Stuart Goldberg, the Acting Deputy Assistant Attorney General of the DOJ’s Tax Division,

“Frank Ahlgren III earned millions buying and selling Bitcoins. But instead of paying the taxes he knew were due, he lied to his accountant about the extent of a large portion of his gains, and sought to conceal another chunk of his profits through sophisticated techniques designed to obscure his transactions on the Bitcoin blockchain. That conduct today earned him a two-year sentence.”

Ahlgren made his first purchase of Bitcoin in 2011 and in 2015, he acquired about 1,366 BTC using top US crypto exchange Coinbase.

In October 2017, he sold about 640 BTC, each worth about $5,807 at the time, for a total of $3.7 million. He used most of the funds to buy a home in Park City, Utah.

But when he filed his 2017 tax return, he told his accountant he purchased the Bitcoin at a much higher price than he did, pretending his gains were less. He also sold BTC in 2018 and 2019 for over $650,000 but failed to report the sales.

According to the DOJ, Ahlgren’s false filings helped him avoid having to pay more than $1 million in taxes. In addition to his two-year prison term, Ahlgren is ordered to serve one year of supervised release and pay $1,095,031 in restitution to the United States.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

atm

Australia seeking advice on crypto taxation to OECD

Published

4 weeks agoon

November 25, 2024By

admin

Australia, with the world’s most significant number of crypto ATMs, seeks advice from an international organization on implementing crypto taxation.

The Organization of Economic Cooperations and Development (OECD), which has invented taxation on digital assets framework, was asked by the Department of Treasury to share input by next January.

The input of the consultations has focused on comparing two options of crypto taxation: implementing the OECD’s Crypto Asset Reporting Framework (CARF) into their law or customizing the policy approach.

CARF is a taxation transparency framework for the international authorities to collect tax-related information from the providers, including crypto-asset purchases and specific consumer data for $50k above transactions. Tax authorities could also share the information with other authorities to gain related information.

“The CARF improves visibility of income from crypto assets. This helps increase compliance with local tax laws and deter tax evasion,” the government on report.

The consultations seek advice on whether the government should follow the same rules as the OECD or implement its own to target specific data needed. If the Australian government implements its own, it could add or remove particular information fields based on the tax authority.

CARF would apply the Reporting Crypto Asset Providers to several crypto companies, including crypto exchanges, wallet providers, brokers, dealers, and ATM providers.

Australia’s growing crypto industry

The Australian government is aware that the crypto industry is growing. This is reflected in the relatively high crypto adoption among their people, with one-fifth of their population identified as crypto holders.

Australian crypto holders last year also gained a profit of up to $9,627 on average, or an increase of 17% from 2022 profit, according to a Swyftx report. The number of people going to invest in crypto in the next year is projected to boost to more than 2 million people.

According to CoinATMRadar, the crypto automatic teller machines (ATM) in Australia also share a big amount, estimated at around 3,3% of the market share in the world. The ATM has spread into Australia’s top cities, including Sydney (441), Melbourne (311), Brisbane (201), and Perth (140).

The government has recently sought advice regarding the central bank digital currency or digital dollar.

Source link

crypto tax

UAE and Switzerland lead as premier locations with no crypto tax, research finds

Published

2 months agoon

November 1, 2024By

admin

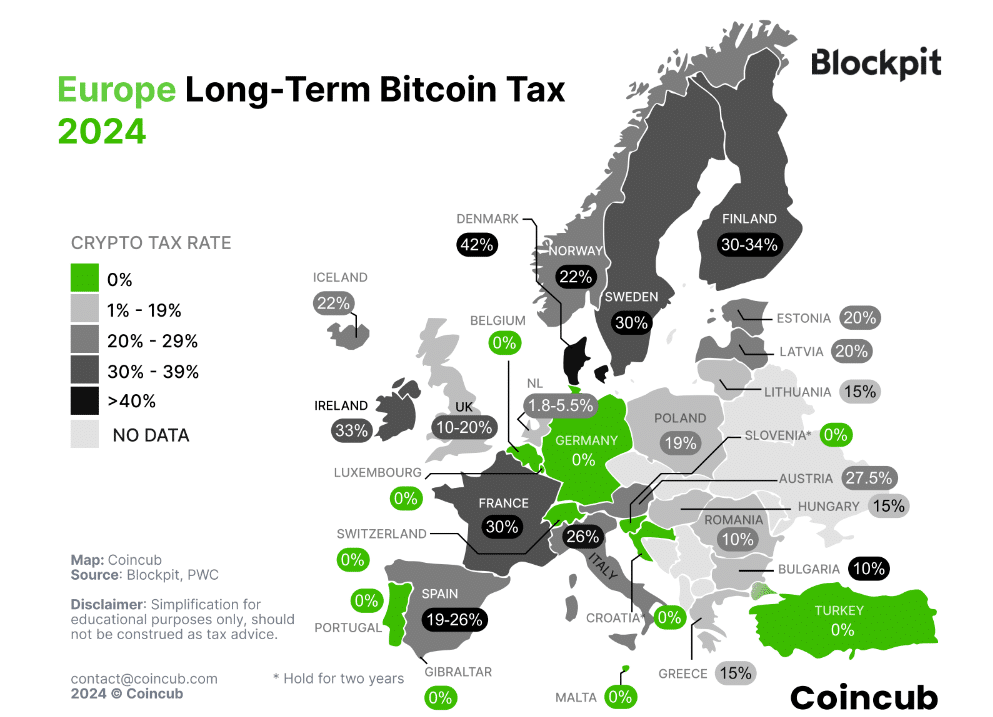

A recent research report by Coincub and Blockpit highlights how varying tax policies, from zero taxes in the UAE to high rates in the U.S., shape crypto investment strategies.

The crypto taxation landscape varies widely across the globe, as revealed by a research report from Blockpit and Coincub.

Data reveals that the UAE remains an attractive destination for crypto investors, with no personal income or capital gains tax on cryptocurrency gains for individuals. Similarly, Switzerland positions itself as a tax haven, offering zero personal income and capital gains tax on crypto gains.

In Europe, the situation is more mixed. While some nations provide favorable tax conditions for long-term holdings, others maintain elevated tax rates. For example, Denmark has one of the highest personal crypto tax rates globally, with up to 53% of long-term and short-term capital gains from crypto being taxed by the local watchdog.

The report notes that, on average, many European countries impose relatively high taxes on crypto gains, but the old continent “has the most tax breaks for long-term hodling your Bitcoin.”

Meanwhile, the United States has the highest total gains and average tax rates of 17.5% (long-term) and

23.5% (short-term), what could potentially bring in tax revenues approximately $1.87 billion, the analysts estimate. They warn that high taxation could “discourage investment,” pushing crypto activities underground, or force investors to relocate to more tax-friendly jurisdictions.

“Nations like Vietnam, Turkey, and Argentina might prioritize attracting crypto investment, fostering technological innovation, and providing alternatives to unstable local currencies over immediate tax collection.”

Blockpit

Analysts indicate that the global approach to crypto taxation is set to undergo significant changes starting in 2025, driven by international initiatives such as the Crypto-Asset Reporting Framework and the Tax Administration for the Reporting of Crypto-Asset Activities.

Developed by the Organization for Economic Co-operation and Development, CARF aims to enhance tax transparency and combat tax evasion by creating a global framework for reporting crypto transactions. In parallel, TARKA is designed to facilitate cooperation among tax authorities in the 48 participating countries, per the report.

Source link

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential