all time high

Bitcoin All Time High Has Been Postponed — Please HODL

Published

2 months agoon

By

admin

This is your captain speaking: Due to regulatory uncertainties regarding who will win the U.S. presidential election on Tuesday, Bitcoin’s price has fallen back to $70,000 under further notice — please HODL.

Okay now past the cringe, Bitcoin’s price nearly hit an all time high of above $73,770 earlier this week, falling just $200 short around $73,500. As I noted last week, markets had been pricing in a Trump victory, which would see his positive policies around Bitcoin and other financial markets be put into place.

Unfortunately though, just 4 days out from the election, there’s a feeling in the air that Kamala Harris may still win as she overtakes Trump in the odds of winning swing states Wisconsin and Michigan.

This race will be much closer than what the markets have predicted the last few weeks.

If Trump wins, many are expecting BTC to rise due to his favorable policies he has promised to implement. Bitcoin would be poised to grow significantly and even $800 billion bank Standard Chartered predicted $125,000 prices if Republicans can sweep the election.

If Harris wins on the other hand though, things could be different. Due to her having basically no policies around Bitcoin (let alone any good ones) voters can only assume she is going to continue the Democrats’ 4-year long attack on the Bitcoin industry.

It is pretty amazing that there isn’t even a public record, video or written, of her saying the word Bitcoin before. $700 billion wealth manager Bernstein said earlier this September that if Harris wins, the price of Bitcoin could drop to as low as $30,000.

I think guessing $30k Bitcoin prices is pretty hyperbolic, and that it won’t drop that much if she wins. But I do believe it would severely delay hitting a new all time high until at least next year. I would love to be wrong on that though.

As we head into this election, regardless of the outcome, I will be HODLing my bitcoin. While the price may fluctuate up or down heavily in the short term, it is still the best asset to own at times of uncertainty. And this is a time of uncertainty that will dictate massively the future of this industry in the US.

With that all said, a new all time high has been postponed until further notice — please HODL.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

all time high

Bitcoin May Hit $100,000 Faster Than Expected

Published

1 month agoon

November 14, 2024By

admin

It’s been just over seven days since Trump was re-elected as president of the United States, and bitcoin is up over $18,800 (25.3%) at the time of writing. And it’s currently steamrolling its way towards $100,000.

I cannot lie, this is all happening way faster than even I expected.

$100,000 has, for the last four years, been the magic number Bitcoiners have been laser-focused hitting. It felt like there was consensus among Bitcoiners during the 2021 bull run that we were guaranteed to hit this target. But alas, the 2021 bull run underperformed most people’s expectations, with bitcoin’s price only reaching a high of $69,000 (which in retrospect, was a great run considering the low of the previous bear market was ~$3,000), $100,000 bitcoin was put on hold. But now, we’re almost there.

I feel like the price of BTC loves to do the opposite of what everything thinks it will do. Just when everyone thinks bitcoin is going to rip forever, bitcoin’s price falls or stagnates and vice versa (which is why it might not be so safe to assume we’re going straight to $100,000 from here).

Even I’m guilty of this, as I’ve been telling myself for a long time that the battle for $100k is going to be extremely tough with the amount of sell pressure I was predicting there to be. I think $100k is a number at which traders, ETF buyers, and OG whales may take some profit and that it would be an uphill battle to get there. And it still very may well be, considering we are only at $93,000 currently. But since Trump won the election, there has been practically no sell pressure, and we’re slicing through new all time highs like a warm knife through butter.

Bitcoin is now up over $5,500 (6.22%) today alone. If Bitcoin continues this momentum, we could see $100,000 BTC literally any day now — including even today. Nothing is off the table. Throw all your models out the window, they’re all being broken by the buying pressure from these ETFs and those trying to front-run the U.S. government’s implementing a Strategic Bitcoin Reserve.

Bitcoin is on its path to taking on gold as a legit reserve asset. $100k is the next big milestone for bitcoin to hit along this journey, and it may just come faster than expected.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

all time high

Thank You Donald Trump for Bitcoin's All-Time High

Published

1 month agoon

November 12, 2024By

admin

Just as I called it a few weeks ago, the election was too big to rig. I said the outcome of the election would dictate when we see a new Bitcoin all-time high. My argument was that if Trump won, we would see Bitcoin rise to a six figure price and if Kamala won, BTC would have dumped hard.

But thankfully, pro-Bitcoin Donald Trump swept the election, winning all swing states and the popular vote. His anti-Bitcoin opponent lost in dramatic fashion, and now it’s off to the races for Bitcoin’s price. Even CNBC is reporting on this as the “post-election rally.”

Trump’s proposed policies for Bitcoin has propelled bitcoin’s price upward — it’s now up over 22% since last week. If Trump had lost, the price of BTC would have most likely plummeted due to Harris’ unfavorable policy around Bitcoin and overall horrible policy around financial markets in general — like wanting to tax unrealized gains.

Now, we’re past that, though, and we have a President-elect that is going to champion Bitcoin innovation, support the industry and has pledged to work with congress and the senate to approve and establish a Strategic Bitcoin Reserve. In addition to that, MicoStrategy is raising $42 billion to buy more bitcoin and Bitcoin ETFs are on an accumulation rampage (BlackRock’s ETF did $1 billion in volume in just 35 minutes this morning) — and it feels like no one is selling.

WE ARE GOING TO BUILD A STRATEGIC BITCOIN RESERVE 🇺🇸 🇺🇸 🇺🇸

— Senator Cynthia Lummis (@SenLummis) November 6, 2024

Oh, and on top of all that, Ross Ulbricht is going to be a free man on day one of Trump’s presidency. We are winning on every single front now.

So, thank you President Trump for saving us from the Democrats’ war on Bitcoin, from four more years of their continued attack on this industry and, of course, for bitcoin’s price making new all-time highs (we just hit $85,000! Let’s go!)

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

all time high

Can Bitcoin Now Make A New All-Time High

Published

2 months agoon

October 18, 2024By

admin

Bitcoin has been steadily climbing since crossing the $60,000 mark and is currently hovering closer to the $70,000 level, a price it hasn’t reached in months. With the market sentiment heating up, investors are wondering whether Bitcoin has the strength to reach new all-time highs or if it will struggle to break past key resistance levels.

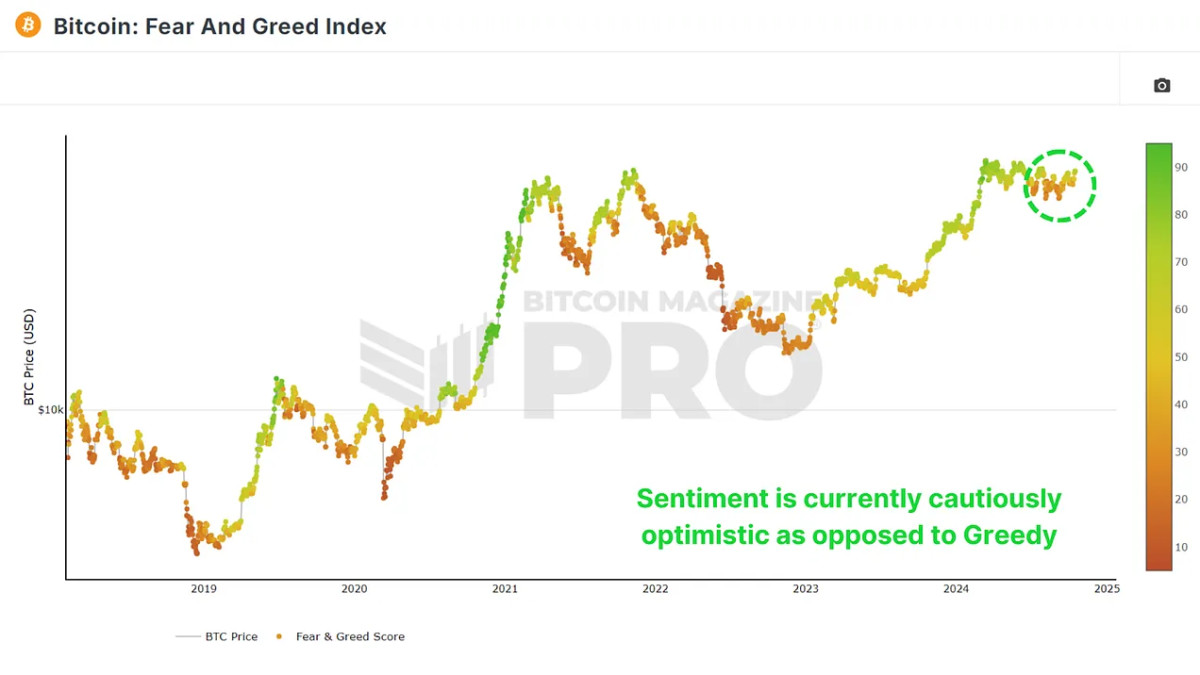

A Healthy Sentiment

The Fear and Greed Index is a useful tool for understanding market sentiment and how traders view the trajectory of Bitcoin. Currently, the index is at a “Greed” level of around 70, which is historically seen as a positive sign but still a fair distance from the extreme greed levels that could indicate a potential market top. This index measures emotions in the market, with lower levels indicating fear and higher levels suggesting greed. Typically, when the index surpasses the 90+ range, the market becomes overly bullish, raising concerns of overextension.

It’s important to note that last year, when the Fear and Greed Index reached similar levels, Bitcoin was trading at around $34,000. From there, it more than doubled to $73,000 over the following months.

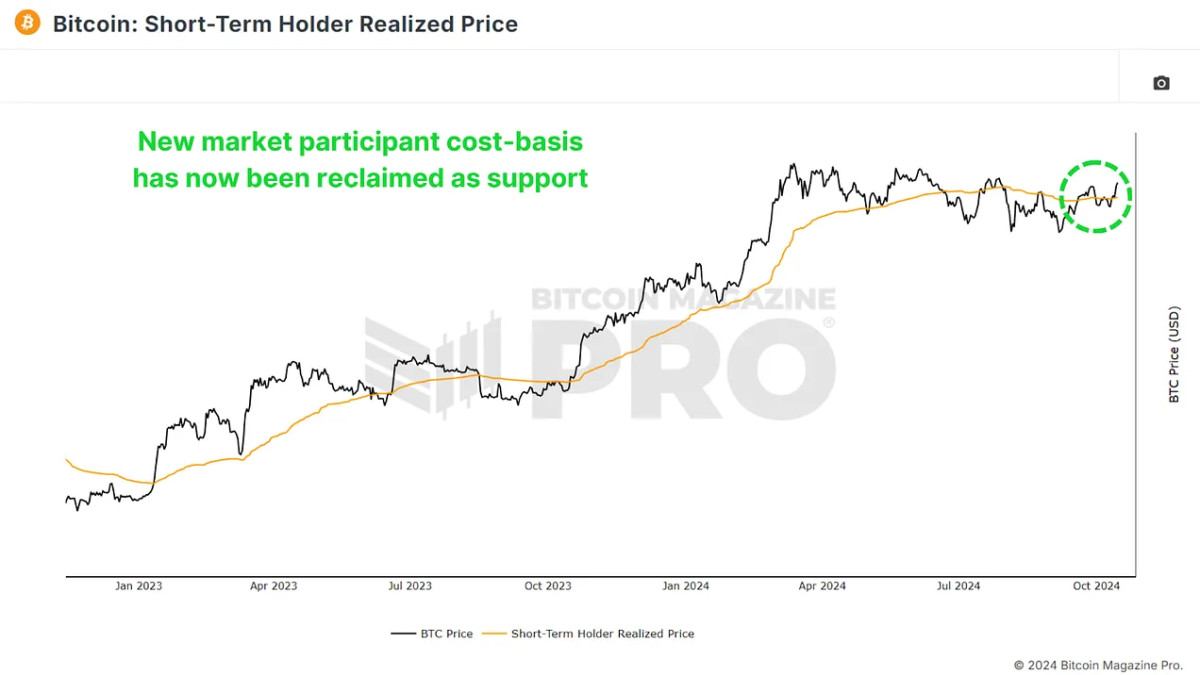

Key Support

The Short-Term Holder Realized Price measures the average price new Bitcoin investors have paid for their bitcoin. It’s crucial because it often acts as a strong support level during bull markets and as resistance during bear markets. Currently, this price sits around $62,000, and Bitcoin has managed to stay above it. This is a promising sign, as it shows that newer market participants are in profit, and Bitcoin is holding above a crucial support zone. Historically, breaking below this level has led to market weakness, so maintaining this support is key to any continued rally.

We’ve seen this dynamic in past cycles, especially during the 2016-2017 bull market, where Bitcoin retraced to this level several times before continuing its climb. If this trend holds, Bitcoin’s recent breakthrough could provide a foundation for further gains.

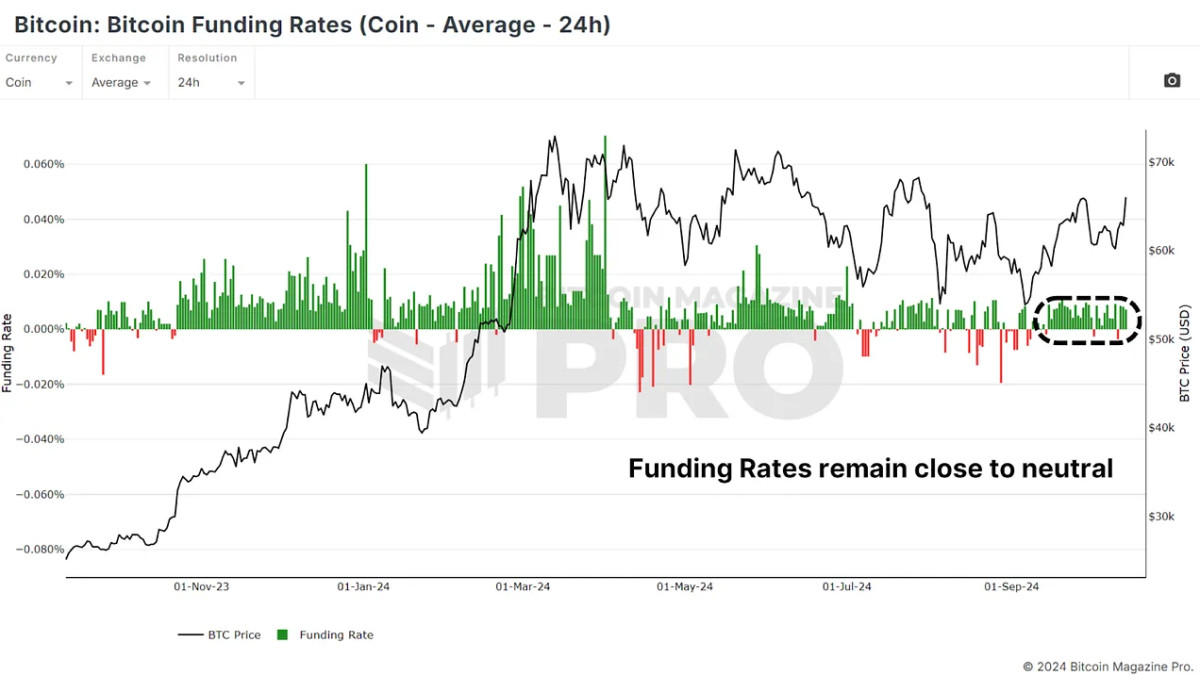

Stabilizing Market

One area that traders often watch is Funding Rates, which indicate the cost of holding long or short positions in Bitcoin futures. Over the past few months, funding rates have been volatile, swinging between overly optimistic long positions and overly bearish short positions. Thankfully, the market has now stabilized, with funding rates sitting at neutral levels. This is a healthy sign as it suggests traders aren’t overly leveraged in either direction.

In neutral territory, there’s less risk of a liquidation cascade, a common phenomenon when over-leveraged positions get wiped out, causing sharp market drops. As long as the funding rates remain stable, Bitcoin could have the breathing room it needs to continue rising without major volatility.

A Tough Path to $70,000 and Beyond

While the market sentiment and technicals suggest that Bitcoin is in a healthy place, there are still significant levels of resistance above. First, the current resistance trend line is one that Bitcoin has struggled to break. This downtrend line has been tested several times, but each time, Bitcoin has retraced after hitting it.

Beyond this, Bitcoin faces several additional barriers, such as $70,000. This level has acted as resistance in the past and represents a psychological level that traders will likely be watching closely. And above that the all-time high between $73,000 and $74,000. Breaking this would be a major bullish signal, but it could take several attempts before Bitcoin clears this level.

One positive technical element is the recent reclaim of the 200 daily moving average. A key level for investors to watch that had acted as resistance for BTC over the previous few months.

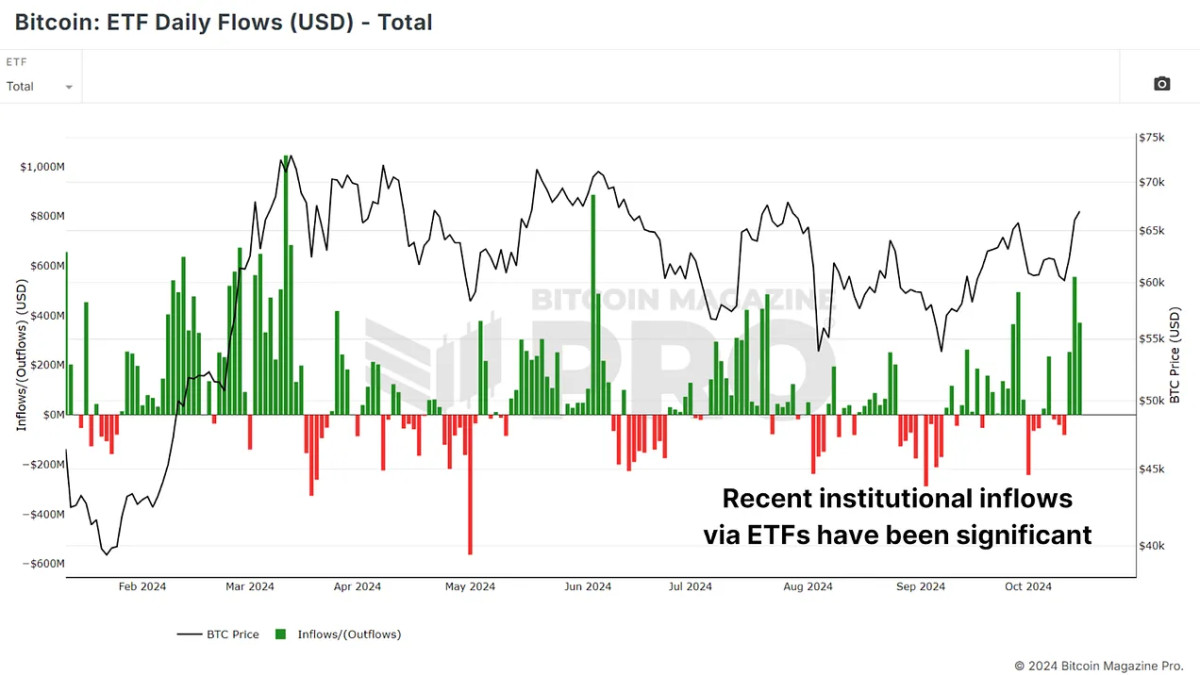

The Macro Environment: Institutional and ETF Inflows

Beyond technical indicators, the macro environment is increasingly favorable for Bitcoin. Institutional money continues to flow into Bitcoin Exchange-Traded Funds (ETFs). In the past few days, over $1 billion has flowed into Bitcoin ETFs, reflecting growing confidence in the asset. Over the past few weeks, we’ve seen hundreds of millions more in ETF inflows, signaling that smart money, particularly institutional investors, is bullish on Bitcoin’s future.

This is significant because institutional money tends to take a long-term view, providing a more stable base of support than retail speculation. Moreover, as equities and even gold have been gaining ground in recent months, Bitcoin appears to be lagging slightly behind. This could set the stage for Bitcoin to play catch-up, particularly if investors rotate from traditional assets into the more risk-on realm of Bitcoin.

Conclusion

Bitcoin’s price action, funding rates, and sentiment all suggest that the market is in a healthier place than it has been in months. Institutional inflows into ETFs and improving macro conditions add further bullish tailwinds. However, significant resistance lies ahead, and any rally will likely face challenges before Bitcoin can truly break out to new highs.

For a more in-depth look into this topic, check out a recent YouTube video here:

Can Bitcoin Now Make A New ATH

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential