Bitcoin

Bitcoin (BTC) Will Thrive Regardless of US Election Outcome, Says VanEck’s Matthew Sigel

Published

3 months agoon

By

admin

An analyst from one of the biggest asset managers in crypto says any result of the November election will end up being bullish for Bitcoin (BTC).

In a new report for VanEck, Matthew Sigel, the firm’s head of digital asset research, says that the US federal election will likely have a significant impact on the crypto space, but will be bullish for Bitcoin regardless of which party wins.

Sigel says that both Kamala Harris and Donald Trump are bullish for Bitcoin, with only nuanced implications for digital assets.

Sigel adds both candidates will likely maintain fiscal spending – or increase it – which could lead to further quantitative easing (QE), which has historically been bullish for the asset class.

Should Kamala Harris win the November election, Sigel sees Bitcoin outperforming the broader crypto market.

“Suppose Kamala Harris were to retain Gary Gensler as SEC Chair or align closely with the Elizabeth Warren wing of the Democratic Party when it comes to finance policy, which looks increasingly likely. In that case, the digital assets industry generally is expected to confront a tightening regulatory environment that would dampen institutional adoption of digital assets in the U.S., further restricting domestic entrepreneurial activity.

On Bitcoin alone, however, we would argue that a Kamala Harris presidency might be even better for Bitcoin than a second term for Trump because it would, in our view, accelerate many of the structural issues that drive Bitcoin adoption in the first place…

Should that happen, Bitcoin’s unique regulatory clarity will likely make it even more competitive than other digital assets.”

Conversely, Sigel says the firm believes that another four years of Donald Trump is “generally bullish for the entire crypto ecosystem” as the administration is likely to be more business-friendly, particularly to crypto, perhaps.

“Regardless of the election outcome, the trend of growing fiscal deficits and rising national debt will likely continue. This suggests a weakening of the U.S. dollar, a macroeconomic environment in which Bitcoin has historically thrived.”

At time of writing, Bitcoin is trading for $63,769, up 1.12% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

You may like

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

24/7 Cryptocurrency News

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Published

10 hours agoon

December 23, 2024By

admin

Rich Dad Poor Dad author Robert Kiyosaki has issued a stark warning while hinting towards an economic depression ahead. In a recent X post, the renowned author said that the global market crash has already started, as he predicted earlier, which indicates that the financial market might enter a “depression” phase. Notably, this comes as the crypto market records immense volatility, sparking concerns over what’s next for Bitcoin (BTC).

Robert Kiyosaki Hints At Economic Depression Ahead

Robert Kiyosaki, in a recent X post, has revealed a stark warning of a looming economic depression. The Rich Dad Poor Dad author warned that a global market crash has already begun, citing Europe, China, and the U.S. as regions facing significant downturns.

In his post, Kiyosaki urged caution, advising individuals to safeguard their finances and maintain their jobs. “Global crash has started. Europe, China, USA going down. Depression ahead?” he asked while emphasizing the enduring value of assets like gold, silver, and Bitcoin. He added, “For many people, crashes are the best times to get rich.”

This warning aligns with Kiyosaki’s earlier prediction of what he called the “biggest crash in history.” Earlier this month, he encouraged his followers to prepare for financial turmoil, stating, “Please be proactive and get rich… before the BOOMER’s go BUST.”

However, this recent comment from Robert Kiyosaki indicates his sustained confidence in BTC. As the crypto market faces heightened volatility, Bitcoin could emerge as a hedge against traditional market instability, he noted. Besides, it also indicates that the flagship crypto, alongside gold and silver, might continue to gain traction amid this economic turmoil.

What’s Next For BTC?

Bitcoin price today has continued its volatile trading, losing nearly 1.5% over the last 24 hours to $95,323. The crypto touched a high and low of $97,260 and $93,690 in the last 24 hours, showcasing the highly volatile scenario in the market.

In addition, the US Spot Bitcoin ETF also recorded significant outflow, with BlackRock Bitcoin ETF witnessing its largest outflux since its launch. This has weighed on the investors’ sentiment, sparking concerns over a waning institutional interest.

However, despite that, many experts remained confident on the asset’s future trajectory. For context, in a recent X post, Peter Brandt shared a new BTC price target, indicating his confidence in the digital asset.

On the other hand, institutions like Metaplanet have also continued to boost their BTC holdings. These moves indicates that the institutions, as well as many investors, are bullish towards the long-term potential of the crypto. Besides, as Robert Kiyosaki said, the recent dip also provides a buying opportunity to investors, which might further boost Bitcoin to its new ATH ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Published

12 hours agoon

December 23, 2024By

admin

Tokyo-listed Metaplanet has purchased another 9.5 billion yen ($60.6 million) worth of Bitcoin, pushing its holdings to 1,761.98 BTC.

Metaplanet, a publicly traded Japanese company, has acquired 619.7 Bitcoin as part of its crypto treasury strategy, paying an average of 15,330,073 yen per (BTC), with a total investment of 9.5 billion yen.

According to the company’s latest financial disclosure, Metaplanet’s total Bitcoin holdings now stand at 1,761.98 BTC, with an average purchase price of 11,846,002 yen (~$75,628) per Bitcoin. The company has spent 20.872 billion yen in total on Bitcoin acquisitions, the document reads.

The latest purchase is the largest so far for the Tokyo-headquartered company and comes just days after Metaplanet issued its 5th Series of Ordinary Bonds via private placement with EVO FUND, raising 5 billion yen (approximately $32 million).

The proceeds from this issuance, as disclosed earlier, were allocated specifically for purchasing Bitcoin. These bonds, set to mature in June 2025, carry no interest and allow for early redemption under specific conditions.

Metaplanet buys dip

The company also shared updates on its BTC Yield, a metric used to measure the growth of Bitcoin holdings relative to fully diluted shares. From Oct. 1 to Dec. 23, Metaplanet’s BTC Yield surged to 309.82%, up from 41.7% in the previous quarter.

Bitcoin itself has seen strong performance this year, climbing 120% and outperforming assets like the Nasdaq 100 and S&P 500 indices. However, it has recently pulled back from its all-time high of $108,427, trading at $97,000 after the Federal Reserve indicated only two interest rate cuts in 2025.

Despite the retreat, on-chain metrics indicate that Bitcoin is still undervalued based on its Market Value to Realized Value (MVRV-Z) score, which stands at 2.84 — below the threshold of 3.7 that historically signals an asset is overvalued.

Source link

Altcoin Season

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Published

16 hours agoon

December 23, 2024By

admin

The creators of the crypto analytics firm Glassnode are warning that altcoins could lose all bullish momentum following last week’s market correction.

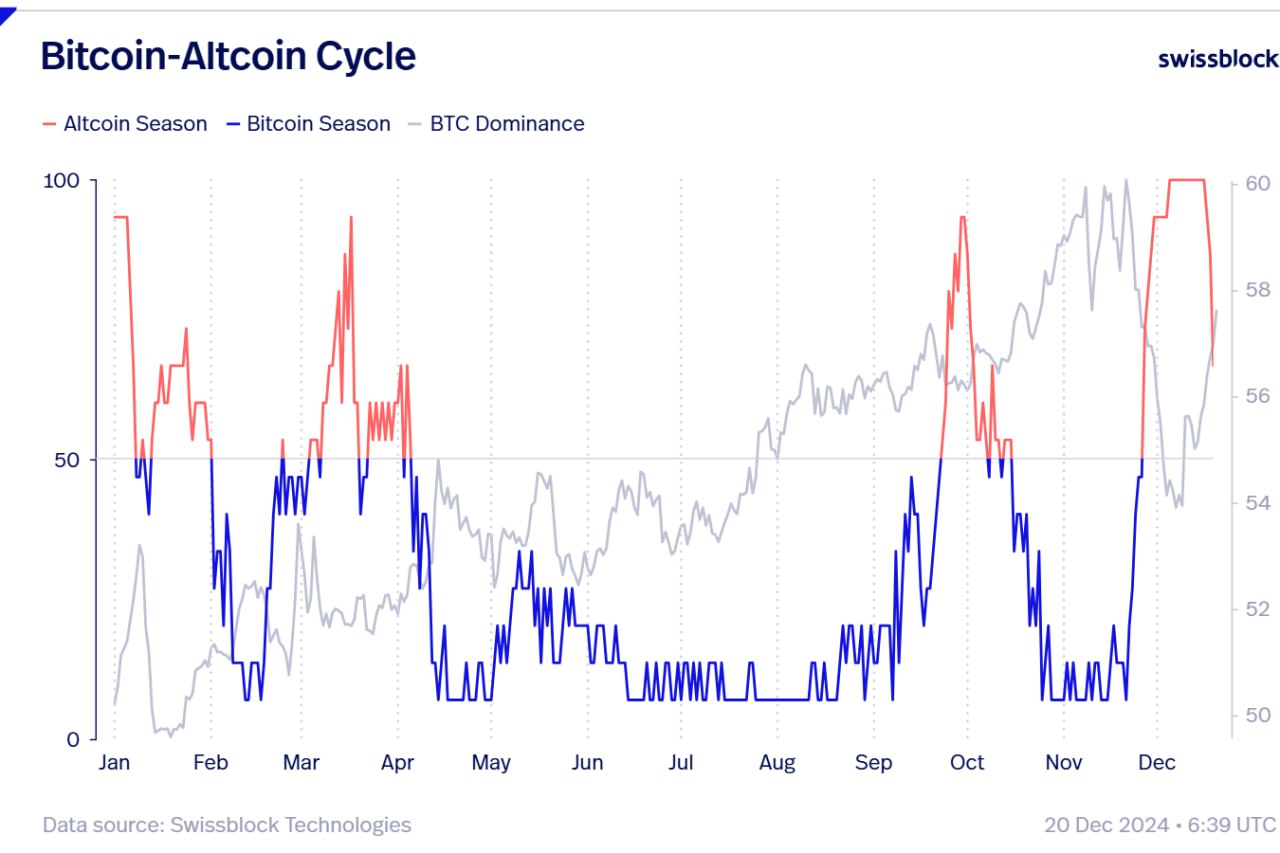

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,400 followers that “altcoin season,” which they say began in late November, could come to an abrupt end after alts witnessed deep pullbacks over the last seven days.

According to the Glassnode co-founders, traders and investors will likely have a risk-off approach on altcoins unless Bitcoin recovers a key psychological price point.

“Is This the End of Altcoin Season?

Bitcoin dominance is surging after dipping below $100,000, while altcoins are losing critical supports. Dominance has risen and resumed its upward trend, signaling a stronger BTC environment.

If BTC stabilizes above $100,00, we might see a pump in altcoins now in accumulation zones. Until then, Bitcoin appears poised to lead, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how much of the total crypto market cap belongs to BTC. In the current state of the market, a surging BTC.D suggests that altcoins are losing value faster than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

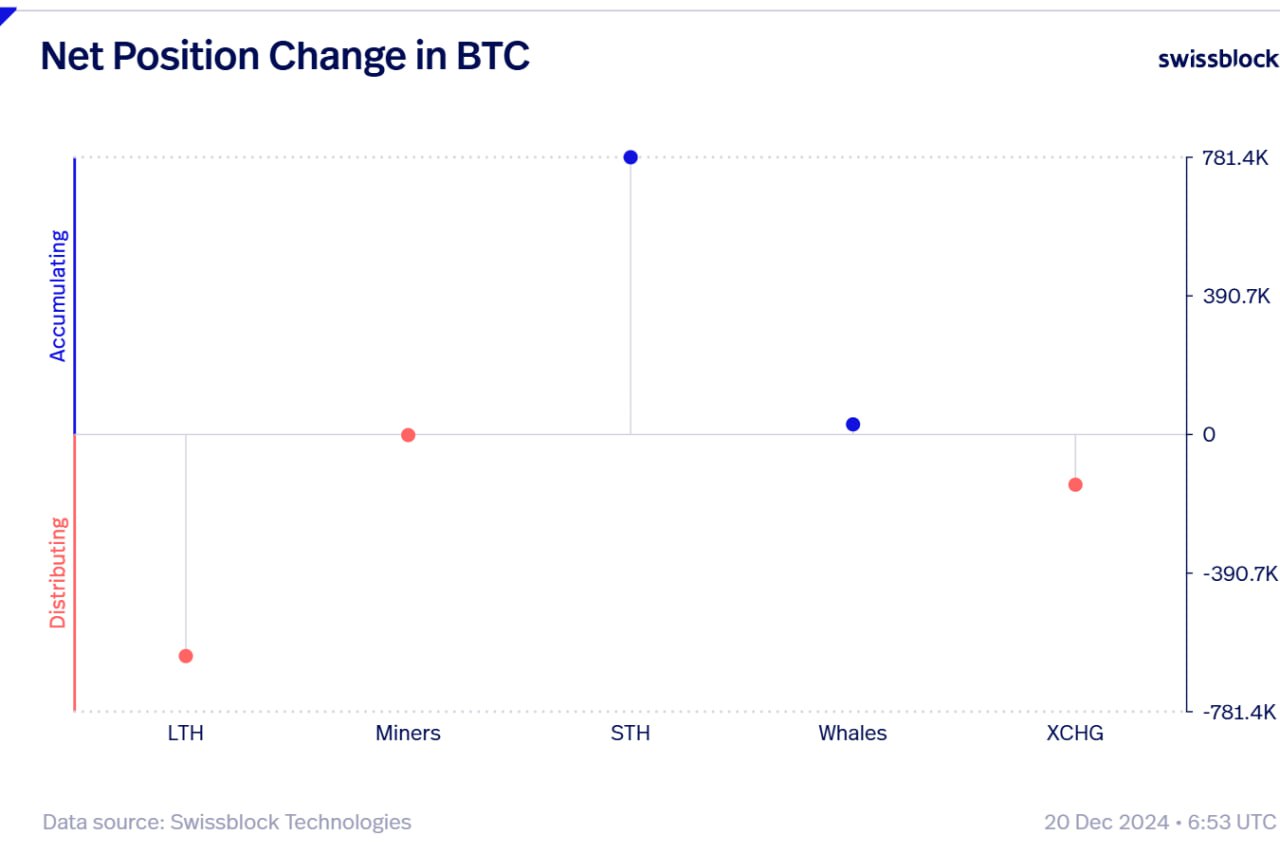

Looking at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as other investor cohorts pick up the slack.

“The Board Keeps Shifting.

As BTC continues flowing out of exchanges during this dip, long-term holders are exiting forcefully, while short-term holders step in without hesitation.

Whales quietly accumulate, miners remain neutral, and selling pressure has merely reshuffled the board.

New hands are absorbing the sales.”

At time of writing, Bitcoin is worth $97,246.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: