Bitcoin

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Published

5 months agoon

By

admin

Bitcoin has experienced wild price swings since Vice President Kamala Harris announced her candidacy for the U.S. Presidential election in July 2024.

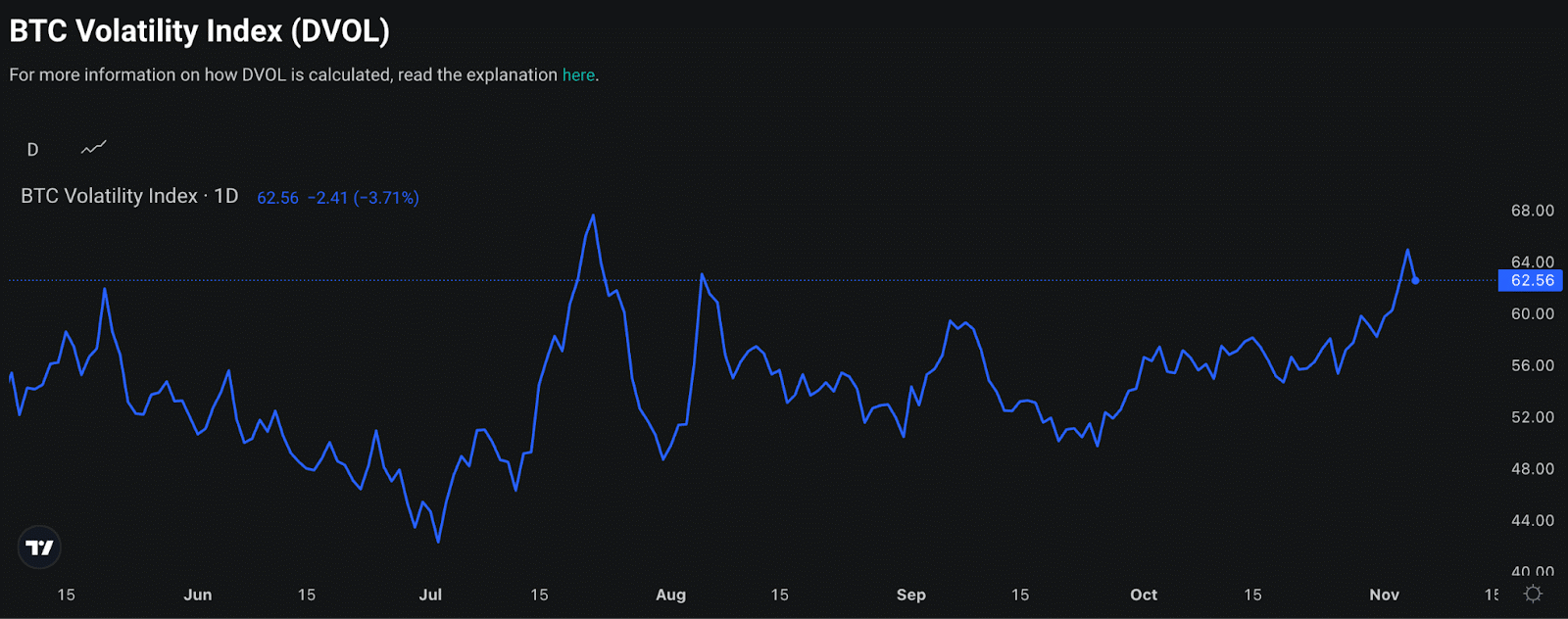

The largest cryptocurrency attempted to test its previous all-time high of $73,738 on Oct. 29, 2024, with no success. Traders expect higher volatility closer to elections and in the aftermath of the event. Crypto prediction markets like Polymarket and Kalshi provide insight into crypto traders’ views.

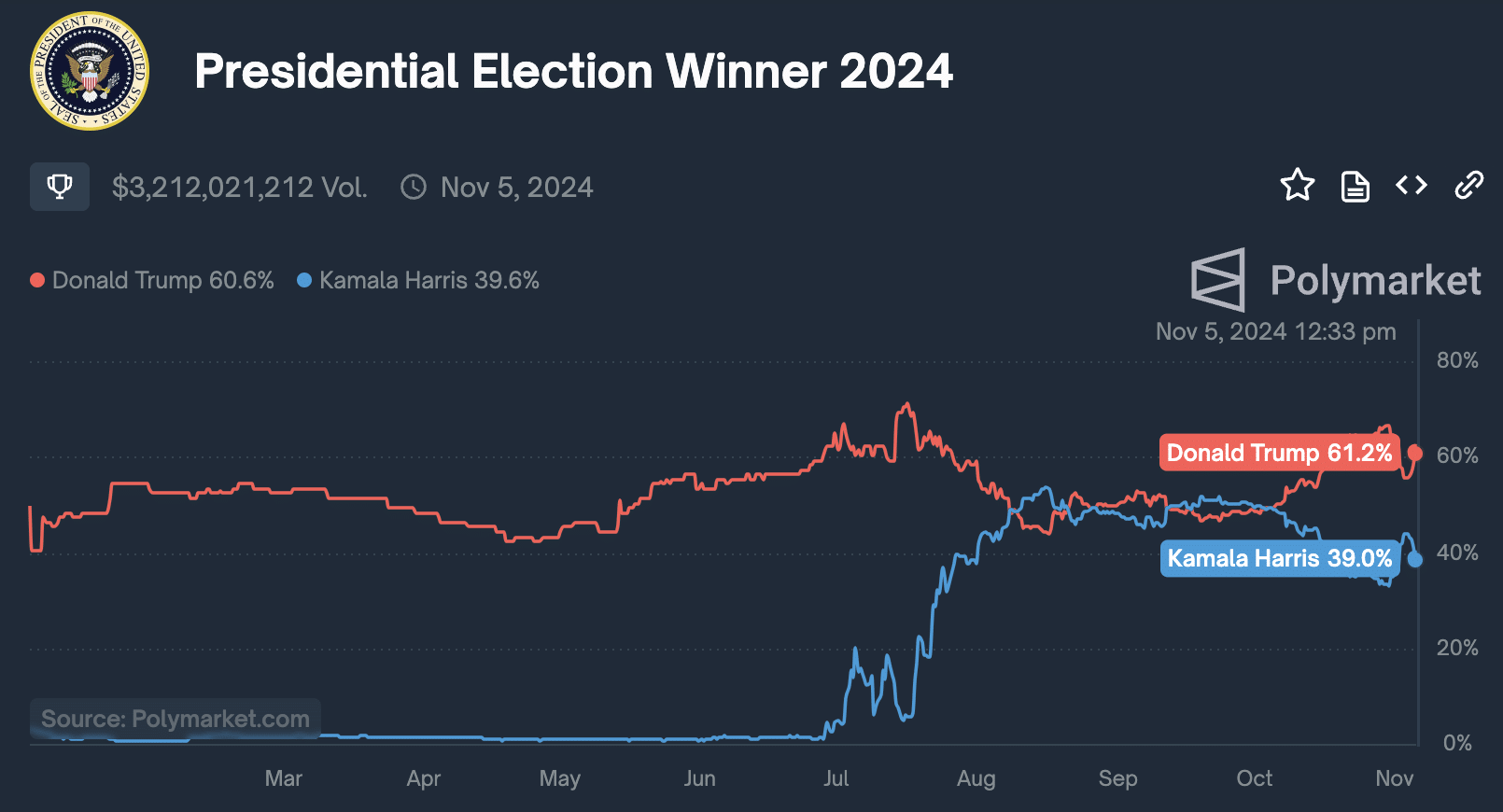

Polymarket sees about $3.21 billion in trading volume as participants wager on the winner of the November elections. Harris’ opponent, former U.S. President Donald Trump, is a clear favorite, with 61.1% bets in his favor, on Polymarket.

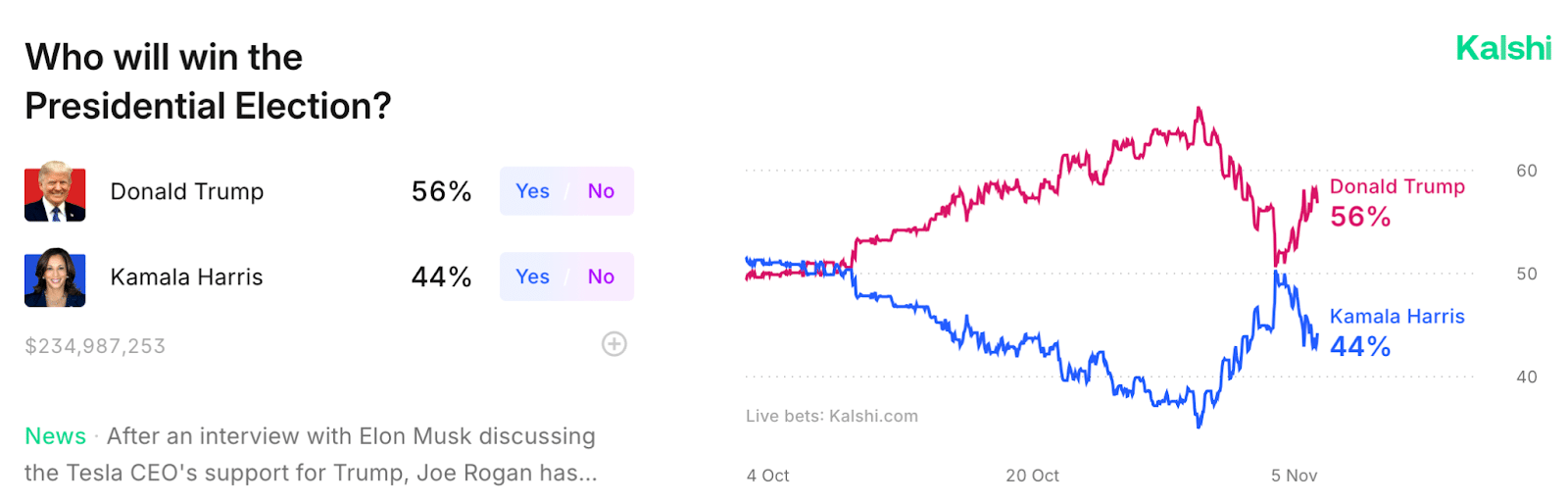

Kalshi, a prediction market regulated by the U.S. Commodity Futures Trading Commission places the odds of Trump’s win at 56.8% against Harris’ 43.2%. The betting contract has drawn $234.98 million as of November 5, 2024.

The efficacy of betting markets in predicting a winner in the election remains debatable, however it sheds light on the sentiment among crypto traders.

Trump rallied crypto traders’ support with his pro-crypto approach to regulation, and speech at the Nashville Bitcoin Conference. The former U.S. President shared his plans for a national Bitcoin reserve and proposed making the States a world leader in BTC mining. The former President’s plan is that the U.S. will hold 100% of the Bitcoin in its possession.

Harris’ “Opportunity Agenda for Black Men” is a proposal that reflects the Vice President’s stance on crypto, while much detail is left out, it points at a measured approach to the asset class.

U.S. markets won’t be open late on Tuesday, as states tally votes, however crypto is a major exception and a Trump win could push Bitcoin closer to the $80,000 level according to data from BTC derivatives markets.

Derivatives data points at a run to the range between $60k – $80k

Deribit’s Bitcoin Volatility Index shows a consistent rise in volatility since September 26, 2024, however the metric failed to see a major move like one noted during President Joe Biden’s exit from the Presidential election, in July, and the U.S. markets correction in August.

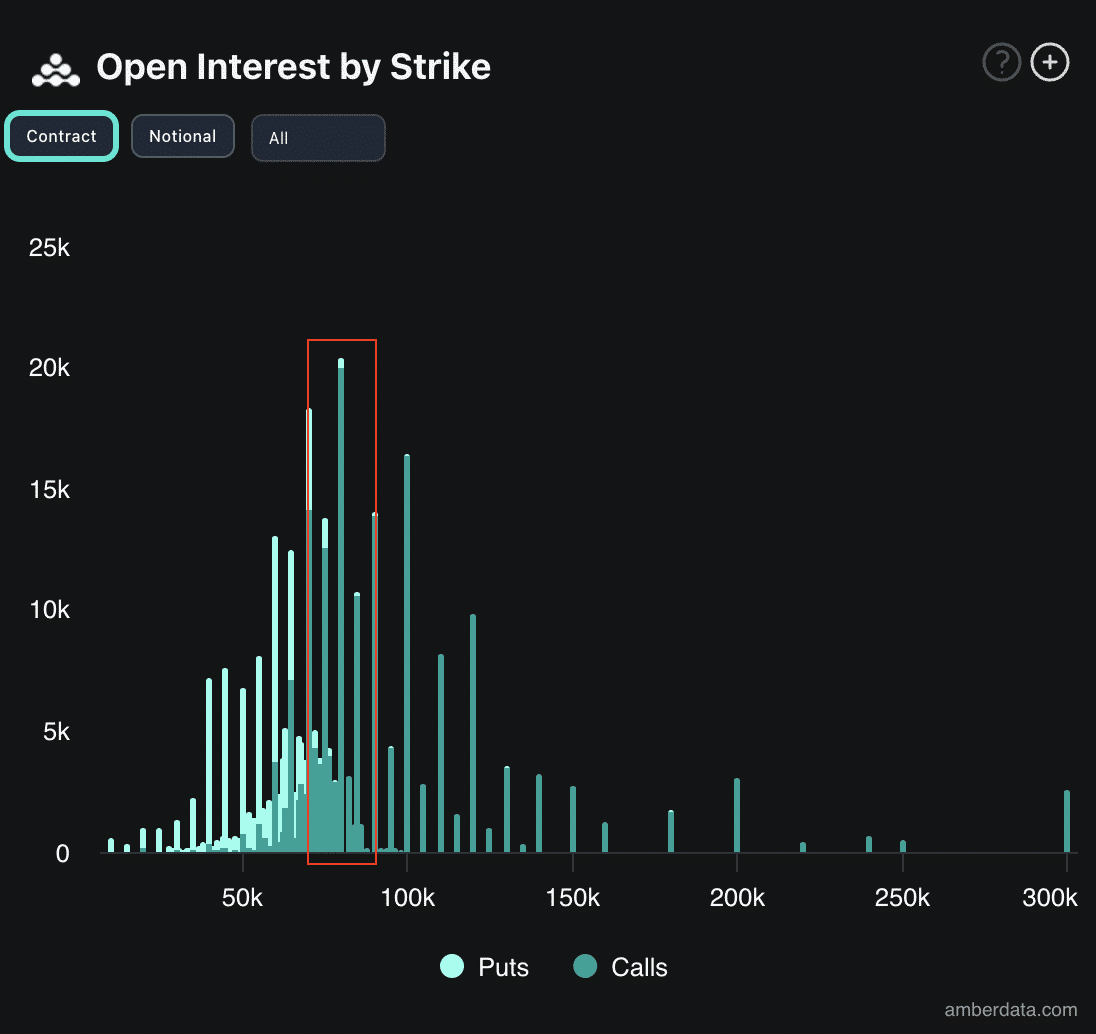

For the weeks following the elections, data from Deribit exchange highlights the $60,000 to $80,000 range, as the one that collects the peak open interest, or outstanding futures contracts for both bullish and bearish bets of traders.

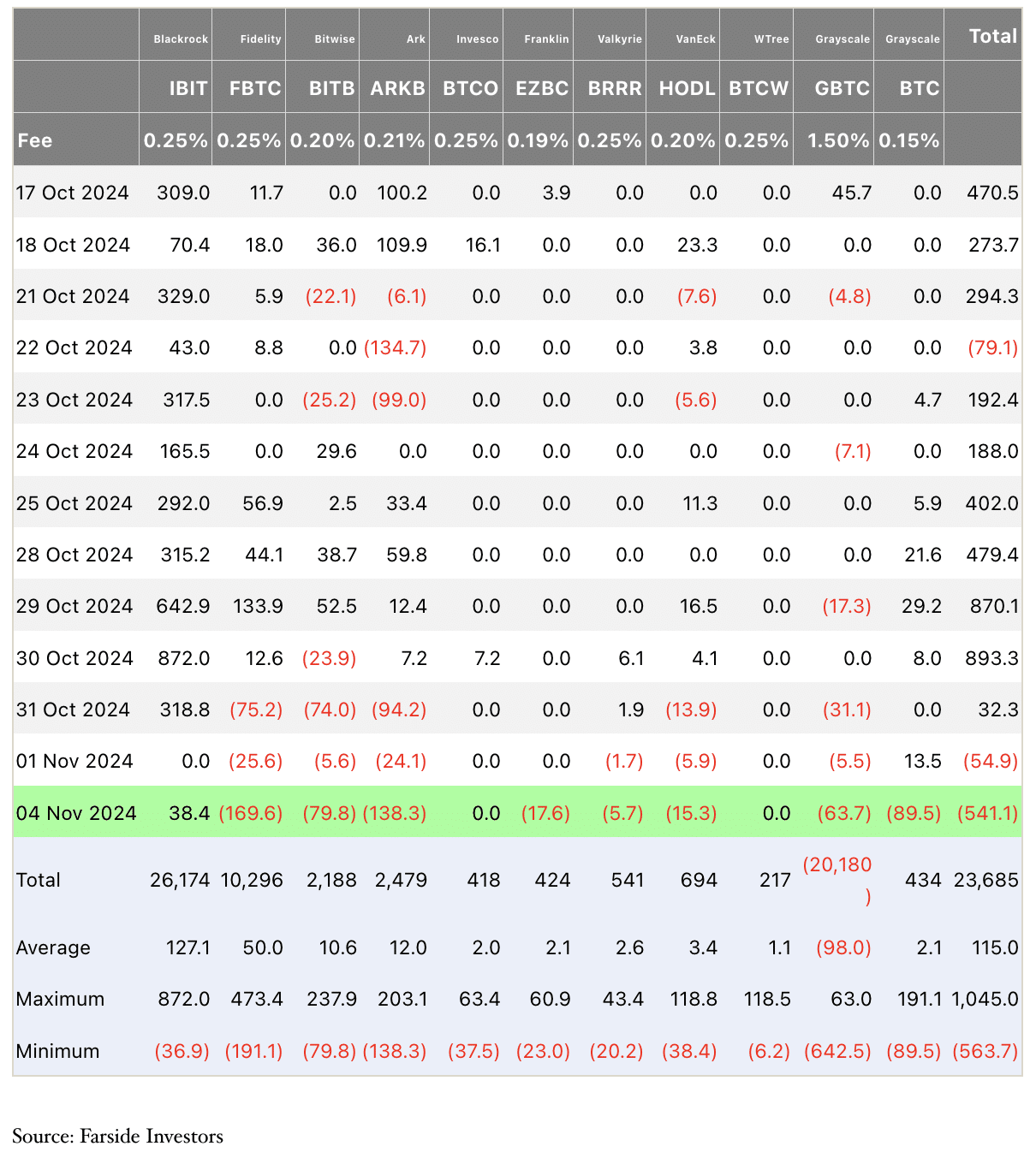

Bitcoin Spot Exchange Traded Fund inflow data from Farside Investors shows a net outflow of $541.10 million on Nov. 4. This marks the second consecutive day of institutional investors pulling capital from the asset, likely preparing for the volatility in the aftermath of the election.

Combining data from the prediction market and Farside Investors’ BTC ETF flows, it is observed that institutional investors expressed confidence in Bitcoin and increased their capital flow when the odds of a Trump win were higher, nearly 67%, on October 30. Bitcoin ETFs received a net of $893.3 million in inflows on the same day.

In March, (BTC) Bitcoin hit its all-time high of $73,738 in response to the large volume of capital inflow to U.S. based Spot Bitcoin ETFs. At the time of writing, on Tuesday, November 5, Bitcoin hovers around the $69,000 level, less than 10% away from the all-time high.

Technical analysis: Bitcoin eyes rally to new ATH

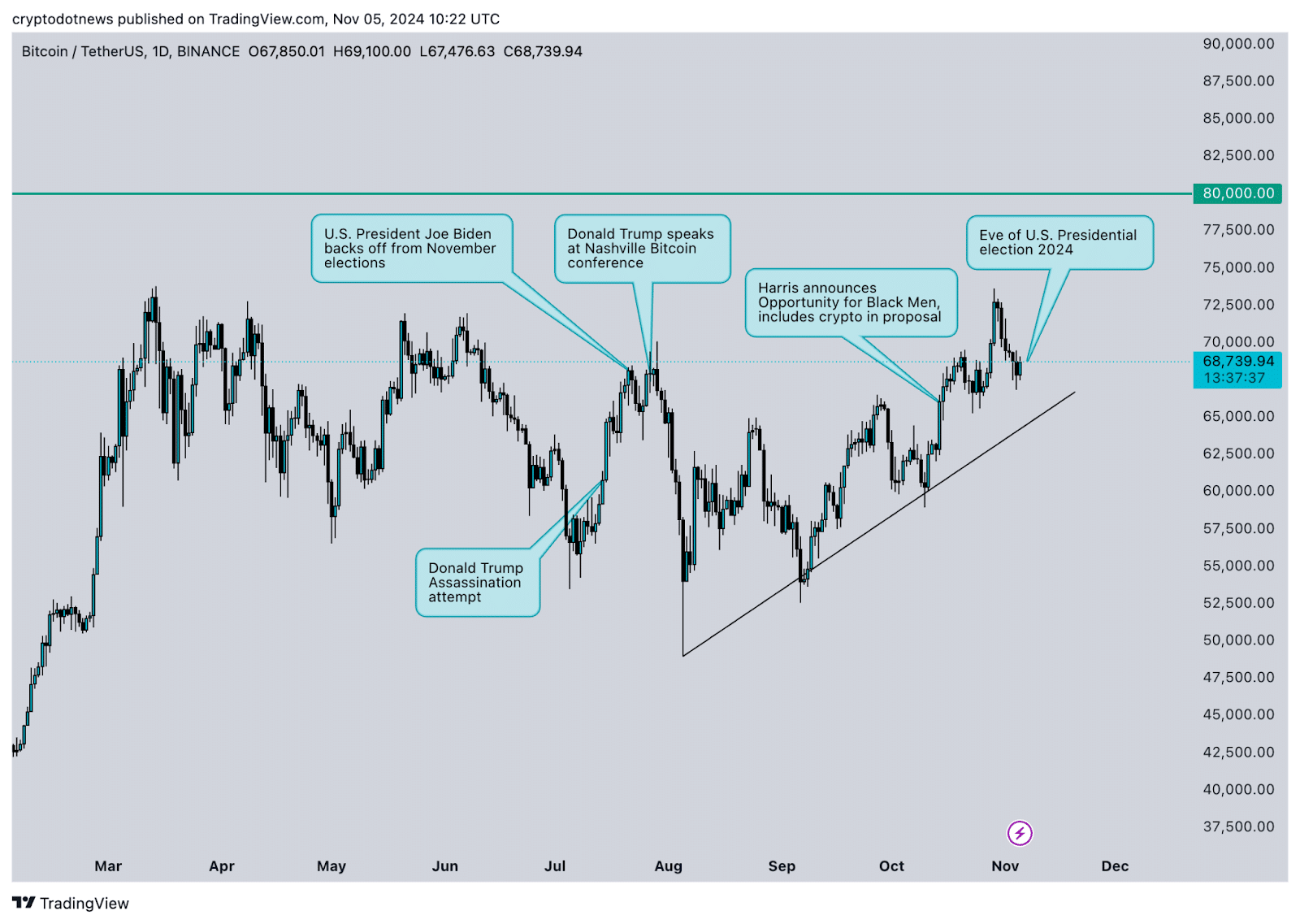

Key events since July 2024 have aided the price swings observed in Bitcoin. The BTC/USDT daily chart from TradingView shows BTC’s attempt to test its previous all-time high post Harris’s announcement of her proposal for crypto.

Derivatives data highlights the importance of the $60,000 to $80,000 range for Bitcoin price. The asset traded within this range throughout the events since July, with the exception of its August 5 decline to $49,000.

BTC is in a short-term uptrend, starting Aug. 5 and the token could extend its gains, forming higher highs and higher lows, post the eve of the elections, in the aftermath. Bitcoin’s previous all-time high at $73,738 is a key resistance and a successful break past this level could push BTC closer to its $80,000 target.

Bitcoin is still undervalued ahead of the election

Crypto.news talked to experts ti get insights on Bitcoin price.

“With the US Election taking place today, many believe that the price of crypto will be immediately swayed by the candidate who wins, since they have varying stances on the future of digital assets, with Trump historically being more inclusive of digital assets than Harris. While this may be true in the short term, traders should also consider that the price of crypto goes beyond what party directly supports and relies more heavily on policies they will implement around inflation, global political discourse, and the availability of investment opportunities within the digital assets space.”

BingX spokesperson

The BingX executive believes that the current cycle is one of the worst-performing ones, post the Bitcoin halving, leading to the belief that BTC is still undervalued.

“If we look at other market sentiment indicators, crypto-related stocks have been climbing, with MicroStrategy, and Robinhood both up in the month before today’s election. In general, the digital asset community should expect to see the price of digital assets rise solely based on historical indicators.”

“If the elected candidate is supportive of crypto, it could boost market confidence; if not, it could introduce some uncertainty. The uncertainty surrounding the election outcome could trigger market fluctuations. Investors should closely monitor election developments and market reactions and be prepared to manage risks accordingly.”

Ryan Lee, Chief Analyst at Bitget Research

“Politics is a secondary factor, and historical analysis suggests that one or two major catalysts typically drive bull markets.” Thielen explains how it would be absurd, “to assume that when Fed Chair Bernanke maintained low interest rates in 2011, your neighbor suddenly decided to use Bitcoin to buy contraband on the Silk Road exchange,” meaning looking for direct correlation between election outcomes and Bitcoin price reaction may be less than ideal.

Markus Thielen, CEO at 10x Research

The executive argues that the primary driver of the Bitcoin rally is the institutional adoption of BTC, sparked by BlackRock’s application for a Spot BTC ETF earlier this year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

analysts

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

Published

7 hours agoon

April 10, 2025By

admin

Tariffs and trade tensions could ultimately be positive for bitcoin (BTC) adoption in the medium term, asset manager Grayscale said in a research report Wednesday.

Higher tariffs result in stagflation— stagnant economic growth coupled with inflation — which is negative for traditional assets, but positive for scarce commodities such as gold, the report said.

Bitcoin is considered hard money, akin to digital gold, and is viewed as a modern store of value, the report noted.

Cryptocurrencies surged on Wednesday following President Donald Trump’s announcement of a 90-day pause on tariffs for countries that haven’t retaliated against the U.S.

“Trade tensions may put pressure on reserve demand for the U.S. Dollar, opening space for competing assets, including other fiat currencies, gold, and bitcoin,” Grayscale said.

Historical precedent suggests that dollar weakness and above-average inflation may persist, and bitcoin is likely to benefit from such a macro backdrop, the asset manager said.

“A rapidly improving market structure, supported by U.S. government policy changes” could help broaden bitcoin’s investor base, the report added.

Read more: Trump Administration Wants Weaker Dollar and That’s Positive for Bitcoin: Bitwise

Source link

Bitcoin

Jack Dorsey’s Block Launches Open Source Tools To Simplify Bitcoin Treasury Management

Published

23 hours agoon

April 9, 2025By

admin

Block announced it has released a new open source toolkit designed to help companies manage their Bitcoin treasury holdings more efficiently. The release includes a corporate Bitcoin holdings dashboard and a BTC-to-USD real-time price quote API, now available for all companies and developers via Block’s public GitHub repository under the Block Open Source initiative.

As Bitcoin adoption grows among institutional treasuries, businesses are seeking better tools to track and report their holdings. Block’s new dashboard directly addresses these needs, offering real-time visibility, simplicity, and adaptability.

The dashboard aims to help companies monitor the dollar value of their Bitcoin holdings through a user-friendly interface designed for both finance teams and executives. It integrates real-time pricing data via an open source BTC/USD quote API, with future plans for quarter-end historical lookup features to support financial reporting. Block has invited feedback and feature requests from the open source community via GitHub Issues.

Block further highlighted that companies are increasingly turning to Bitcoin for a variety of strategic reasons:

- Diversification: Adding Bitcoin alongside traditional treasury assets.

- Ecosystem support: Demonstrating alignment with Bitcoin innovation, particularly for crypto-forward businesses.

- Inflation hedge: Serving as a store of value in the face of fiat currency devaluation.

- Portfolio optimization: Aiming to enhance risk-adjusted returns.

The first working prototype of the dashboard was created by non-engineers using Block’s internal open source AI agent, called codename goose. The AI agent enabled non-technical teams to prototype tools rapidly, with engineers from Block’s Bitcoin Platform team joining later to finalize development. Codename goose also contributed to front-end development via automated coding assistance.

Block has long been a corporate leader in Bitcoin investment. Its Bitcoin Investment Memo from October 2020 and its Bitcoin Blueprint for Corporate Balance Sheets laid the foundation for businesses entering the crypto space. Block said it continues to purchase Bitcoin through a monthly dollar-cost averaging (DCA) program and updates its dashboard quarterly after earnings reports. Its live Bitcoin treasury dashboard can be viewed here.

With this release, Block emphasized that it aims to empower other companies to manage Bitcoin on their balance sheets more confidently and transparently, further accelerating mainstream adoption of the world’s leading digital asset.

Source link

Altcoin

Why Isn’t XRP Skyrocketing? Expert Explains The Hidden Forces

Published

1 day agoon

April 9, 2025By

adminXRP prices dipped below $2 for the first time since December 2024 on Monday, even after a number of positive developments for the cryptocurrency.

The decline is surprising to many investors who had hoped recent good news would send its value higher. Market analyst Vincent Van Code attributes this underperformance to underlying economic issues and not with XRP itself.

Trump Tariffs Are Blamed For Crypto Market Decline

Van Code attributes the recent decline in cryptocurrencies to the tariffs imposed by US President Donald Trump on other nations.

The tariff situation is just a power play to utilize economic pressure to get better negotiating terms, said Van Code. He expects these trade tensions to be short-term and perhaps pave the way for the market to rebound in the near future.

Current #XRP prices are not aligned with recent @Ripple market announcenets, SEC case conclusion news, XRP US stockpile.

Do you think this is becuase XRP is not performing well?

I DONT! This is a global market downturn. Impacts across multiple markets, multiple countries, and…

— Vincent Van Code (@vincent_vancode) April 9, 2025

XRP Fundamentals Strong

Even after falling to $1.64 on April 7, XRP has shown a rebound by increasing to $1.82—a 10% increase. Van Code pointed out that Ripple and XRP’s fundamental strengths have not changed. They’re a hundred times better than a year ago when the SEC lawsuit was at its peak, he said.

The SEC-Ripple case resolution, potential inclusion in US digital asset reserves, and Ripple’s Hidden Road acquisition were all considered positive developments for the cryptocurrency.

Investment Strategy During Market Uncertainty

Van Code described his approach to today’s market condition, showing he buys such assets like XRP when sentiment is low but fundamentals remain in place.

He looks at weekly charts for larger decisions and uses hourly charts for intraday action. The market commentator termed XRP the “Fight Club” of cryptos because of its ability to withstand market action and stress.

Future Growth Drivers For XRP

Going forward, Van Code identified three key drivers to XRP adoption: regulation, corporate usage, and solid partnerships. He warned investors to avoid being influenced by short-term price fluctuations due to outside influences such as the tariff scenario.

The analyst said that he would only be jittery if XRP was the sole cryptocurrency that is dropping in value. He also stated that the current decline is part of a larger market trend and not particular to XRP.

The cryptocurrency market still responds to economic policy as investors look for indications that the tariff issue is resolved. Most XRP supporters are optimistic that as soon as these external pressures are gone, the price will more accurately reflect the good news surrounding Ripple and its currency.

Featured image from Unsplash, chart from TradingView

Source link

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Top 4 Altcoins to Sell Before US-China Trade War Extends Beyond 125% Tariffs

OpenAI Countersues Elon Musk, Accuses Billionaire of ‘Bad-Faith Tactics’

81.6% of XRP supply is in profit, but traders in Korea are turning bearish — Here is why

Stablecoins Are ‘WhatsApp Moment’ for Money Transfers, a16z Says

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Bitcoin2 months ago

Bitcoin2 months agoHas The Bitcoin Price Already Peaked?