Altcoin

Bitcoin dominance ready to break multi-year support

Published

5 months agoon

By

admin

Bitcoin dominance is in the analyst’s eyes, which indicates another cycle of the cryptocurrency market, after it is dominating for a few months.

Bitcoin dominance, which measures the market capitalization of Bitcoin influence in the cryptocurrency market, has dropped to 56% or shrunk from 60% in the past month, according to the data from TradingView.

Analysts also projected that Bitcoin seems to dip below its long-standing support trend line, which refers to the key technical levels that record Bitcoin domination falling below a certain threshold.

“Bitcoin dominance looks so ready to break down through its multi-year support trend line,” analyst says on his X post on Dec. 02.

Ethereum domination also falls into 12.9% of the domination level, following the Bitcoin shrink. At the same time, the other’s crypto domination has surged to 31.5% or an increase from 28.1% in the past month.

The drop in biggest crypto dominance has significantly brought market sentiment, which indicates that the Altcoin season, also known as Altseason, is in here, an analyst says. It is indicated by the dominations that have broken 2-year support.

Altseason is a market situation in which Altcoins surged higher than Bitcoin as a prominent crypto in the world, as indicated by its drop in dominance.

Bitcoin dominance, followed by price surged

Bitcoin is also facing a massive trading day with $36.5 billion in volume, or an increase of 15.33% in a day. The price movement also went back to head the $100,000 price target, which, at the time of writing, Bitcoin price surged to $97,335, or an increase of 0.95%.

Source link

You may like

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

The Inverse Of Clown World”

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

3iQ and Figment to launch North America’s first Solana staking ETF

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

5 Biggest Ripple (XRP) Price Predictions for April 2025

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

2 days agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

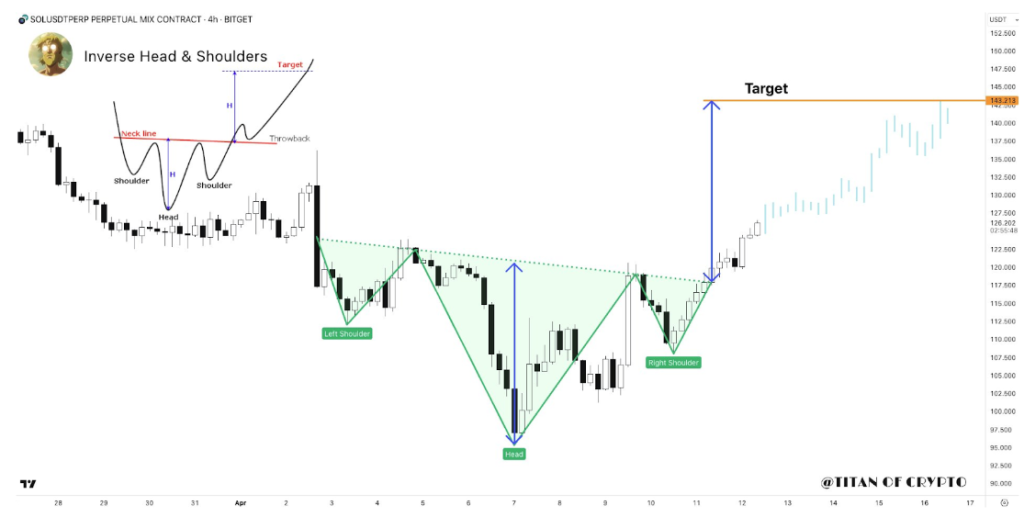

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

Altcoin

Is It Time For Altcoin Season? Bitcoin Dominance Rises To Major Rejection Zone

Published

4 days agoon

April 12, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

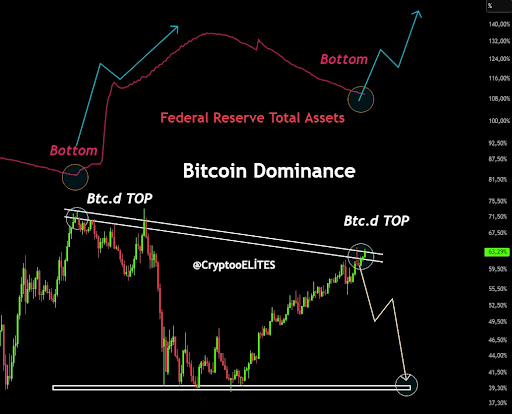

Crypto analyst El Crypto has raised the possibility of an altcoin season happening soon. The analyst alluded to Bitcoin’s dominance rising to a major rejection zone, which could be bullish for altcoins.

Altcoin Season May Be Imminent As Dominance Hits Major Rejection Zone

In an X post, El Crypto suggested that the altcoin season may be imminent as Bitcoin’s dominance hits a major resistance zone. He revealed that BTC’s dominance again touched a zone that has led to rejection every time in the last one and a half years. He added that the Stochastic Relative Strength Index (RSI) is also in the overbought area, while a bearish cross has now happened again.

Related Reading

Based on this, the analyst remarked that the market looks to be in for some fun, hinting at an altcoin season. Crypto analyst CryptoElites also affirmed that Bitcoin’s dominance has reached its peak. He further affirmed that next up is a massive altcoin rally, which will usher in the alt season.

In another X post, the crypto analyst alluded to the USDT and USDC dominance ratio. He claimed that the market was at a critical trend reaction point right now. CryptoElites then mentioned that if the stablecoins’ dominance breaks down, then the altcoin season will officially begin.

Crypto analyst Kevin Capital also looked to provide a bullish outlook towards the altcoin season. In an X post, he highlighted the global liquidity index overlaid with the Dogecoin price. In line with this, he remarked that it might be time for market participants to start paying attention to this.

So far, altcoins have been mirroring Bitcoin’s price action, suffering a similar downtrend amid the trade war. However, if the altcoin season were to kick into full gear, these altcoins could easily decouple from the flagship crypto and outperform. Ethereum is known to lead this altcoin season, but that may not be the case this time, as ETH has underperformed throughout this cycle.

Still Bitcoin Season For Now

Blockchain Center data shows that it is still Bitcoin season for now, as the flagship crypto continues to outperform most altcoins. In the past 90 days, only seven out of the top 50 coins have outperformed the flagship crypto. These coins include Mantra, GateToken, Monero, LEO, Tron, and FastToken.

Related Reading

For it to be altcoin season, 75% of the top 50 coins would need to outperform Bitcoin over the last 90 days. Although almost all coins have witnessed declines within this timeframe, BTC has suffered a 22% drop, which is less than what these altcoins have seen during this period.

At the time of writing, the Bitcoin price is trading at around $80,900, down over 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from iStock, chart from Tradingview.com

Source link

Altcoin

Sonic token eyes higher ground following a bullish engulfing impulse

Published

4 days agoon

April 12, 2025By

admin

Sonic token has caught the eye of traders after a powerful bullish move from support. With price now consolidating under key resistance, the next breakout could be just around the corner—here’s what the chart is telling us.

Sonic (S) token has shown some serious momentum lately, catching the attention of traders with a powerful bullish engulfing candle. With price now grinding against key technical levels, the next few moves could be crucial in determining whether we see continuation—or signs of a reversal.

Key points:

- Strong bullish engulfing candle from the value area low and daily support at $0.39

- Price consolidating just under point of control, hinting at vertical accumulation

- $0.52 liquidity target aligns with 0.618 Fibonacci and VWAP resistance

The recent price action on Sonic Token has been notably impulsive, starting with a strong bullish engulfing candle that formed right at the value area low. This region also aligned perfectly with daily support around $0.39, giving the move significant technical weight.

The surge was accompanied by a rising volume profile, confirming buyer interest and demand at that level. Following the push, price now finds itself consolidating near the point of control—typically a sign that the market is building a base, not reversing.

Potential vertical accumulation

If Sonic continues to trade above the point of control, this could signal the presence of vertical accumulation. This kind of price action, characterized by higher lows on the lower time frame within a compact trading range, often leads to further bullish continuation.

One critical area to watch is the resting liquidity around $0.52. This level stands out as an untapped high and a magnet for price, especially with the 0.618 Fibonacci level and VWAP resistance stacked just above it.

Reaching that $0.52 region makes both technical and psychological sense. The theory of liquidity suggests that markets seek out areas of uncollected orders. Once price had taken the lower-side liquidity and bounced hard, the next logical move is to target the highs.

That target also lines up with the value area high of the current range, meaning a tap of that level would complete a full range rotation from low to high. If Sonic starts distributing around that resistance area, that could mark the start of a longer consolidation phase.

Right now, the chart is still showing signs of strength. There are no clear signals of weakness, and vertical accumulation patterns tend to continue until exhaustion. While it’s smart to be cautious near resistance, prematurely shorting Sonic without a clear rejection could be risky. For now, the bulls are in control—and the $0.52 target remains in play until proven otherwise.

Source link

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

The Inverse Of Clown World”

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

3iQ and Figment to launch North America’s first Solana staking ETF

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

5 Biggest Ripple (XRP) Price Predictions for April 2025

Tokenization Firm Securitize Acquires MG Stover’s Digital Asset Fund Administration Unit

CleanSpark to start selling Bitcoin in ‘self-funding’ pivot

Dogecoin Whales Buy 800 Million DOGE in 48 Hours – Smart Money Or Bull Trap?

President Trump Executive Director Says U.S. Could Use Tariff Revenue To Build Strategic Bitcoin Reserve

Man Faces Six Years in Prison After Omitting $12,302,115 in CryptoPunk NFT Sales From Tax Filing

will this boost Bitcoin and altcoins?

Yen Surge, Soaring Bond Yields Could Threaten Bitcoin as BOJ Weighs Policy Shift

Ripple Whale Moves $63M As XRP Tops List for Spot ETF Approval

Bitcoin Cash (BCH) Gains 1% as Index Trades Flat

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x