Bitcoin ETF

Bitcoin ETF inflows surpass $3b, demand hits 6-month high

Published

2 months agoon

By

admin

October marked a strong month for U.S. spot Bitcoin ETFs, with over $3 billion in net inflows as demand reached its highest level in six months.

Over the past week, inflows into the 12 spot Bitcoin (BTC) exchange-traded funds pproached $1 billion, with four days of positive flows recorded during this period. The majority of these inflows originated from BlackRock’s IBIT, the largest ETF by net assets, which is nearing $24 billion in total inflows since its launch.

Despite strong inflows in the past week, the prior week proved even more bullish for U.S. spot Bitcoin ETFs. Starting with $555.86 million on Oct. 14, the funds experienced a five-day streak of inflows totaling over $2.13 billion. This marked the first time weekly inflows into Bitcoin ETFs have exceeded $2 billion since March 2024.

Following the strong inflows into the investment products over the past two weeks, the 12 Bitcoin ETFs have now surpassed over $3.07 billion in inflows in October.

Weekly inflows started strong on Oct. 21, with $294.29 million entering the funds, kicking off a seven-day inflow streak. Following a brief outflow of $79.09 million on Oct. 22, inflows resumed, with three consecutive positive days ending on Oct. 25.

The week’s final trading day reached a peak of $402 million in inflows, according to SoSoValue data.

None of the funds recorded outflows on Friday, Oct. 25, with BlackRock’s IBIT leading the lot once again. See below.

- BlackRock’s IBIT, $291.96 million, 10-day inflow streak.

- Fidelity’s FBTC, $56.95 million.

- ARK 21Shares’s ARKB, $33.37 million.

- VanEck’s HODL, $11.34 million.

- Grayscale Bitcoin Mini Trust, $5.92 million.

- Bitwise’s BITB, $2.55 million.

- Valkyrie’s BRRR, Invesco’s BTCO, Franklin Templeton’s EZBC, WisdomTree’s BTCW, Grayscale’s GBTC, and Hashdex’s DEFI saw zero flows.

Bitcoin ETF demand has hit six-month high

On Oct. 25, Ki Young Ju, founder and CEO of CryptoQuant, noted in an X post that the 30-day momentum indicator for spot Bitcoin ETF demand has reached a six-month high, levels last seen around the Bitcoin halving in April.

Further, net flows into these products also reached 65,962 BTC in the last 30 days, Ju added.

The demand is mostly being driven by retail investors as an earlier post from Ju suggests large investors accounted for approximately 20% of all U.S.-traded spot Bitcoin ETFs.

Nevertheless, the uptick in demand could soon see the total Bitcoin held in the 12 offerings surpass 1 million Bitcoin, according to Bloomberg analyst Eric Balchunas.

In an Oct. 24 X post, the analyst highlighted that these holdings are already 87% of the way to exceeding the amount held by Bitcoin’s anonymous creator, Satoshi Nakamoto, whose wallet holds 1.1 million Bitcoin. See below.

Not yet 10mo old and the ETFs are 97% of the way to holding 1 million btc, and 87% of the way to passing Satoshi as biggest. I’ll be presenting on this and much more at the Plan B conf in Lugano tmrw (10am, main stage). If you’re going, come say hi https://t.co/5NmhFANOpu

— Eric Balchunas (@EricBalchunas) October 24, 2024

At press time, Bitcoin was down 1.3%, exchanging hands at $67,007, while its market cap stood at $1.32 billion.

Source link

You may like

5 altcoins ready to surge 18,000% as Bitcoin aims for $150,000

Galaxy Research Predicts Dogecoin Price To Reach $1 In 2025

Bitcoin Price Retests Support Line After Crash Below $95,000, Here’s The Next Target

Michael Saylor Doesn’t Understand Bitcoin

Cardano and Solana lead institutional discussions, analysts spot a rising altcoin

Pro-XRP Lawyer John Deaton Comments On New Crypto Tax Rule

Bitcoin

Will Bitcoin ETFs Surpass 1 Million BTC Before 2025?

Published

2 weeks agoon

December 16, 2024By

admin

As Bitcoin continues to mature, one of the most telling indicators of its longevity and integration into the broader financial ecosystem is the rapid growth of Bitcoin Exchange-Traded Funds (ETFs). These products—offering mainstream, regulated exposure to Bitcoin—have garnered substantial inflows from both institutional and retail investors since their inception. According to data aggregated by Bitcoin Magazine Pro’s Cumulative Bitcoin ETF Flows Chart, Bitcoin ETFs have already accumulated more than 936,830 BTC, raising the question: Will these holdings surpass 1 million BTC before 2025?

The #Bitcoin ETFs have already accumulated 936,830 #BTC! 🏦

Will this surpass 1,000,000 BTC before 2025? 🪙

Let me know 👇 pic.twitter.com/UojJpJlC4P

— Bitcoin Magazine Pro (@BitcoinMagPro) December 16, 2024

The Significance of the 1 Million BTC Mark

Crossing the 1 million BTC threshold would be more than a symbolic milestone. It would indicate profound market maturity and long-term confidence in Bitcoin as a credible, institutional-grade asset. Such a large amount of Bitcoin locked up in ETFs effectively tightens supply in the open market, setting the stage for what could be a powerful catalyst for upward price pressure. As fewer coins remain available on exchanges, the market’s long-term equilibrium shifts—potentially raising Bitcoin’s floor price and reducing downside volatility.

The Trend Is Your Friend: Record-Breaking Inflows

The momentum is undeniable. November 2024 saw record inflows into Bitcoin ETFs, surpassing $6.562 billion—over $1 billion more than the previous month’s figures. This wave of capital inflow dwarfs the rate of new Bitcoin creation. In November alone, just 13,500 BTC were mined, while more than 75,000 BTC flowed into ETFs—5.58 times the monthly supply. Such an imbalance underscores the scarcity dynamics now in play. When demand vastly outpaces supply, the natural market response is upward price pressure.

A Chart of Insatiable Demand

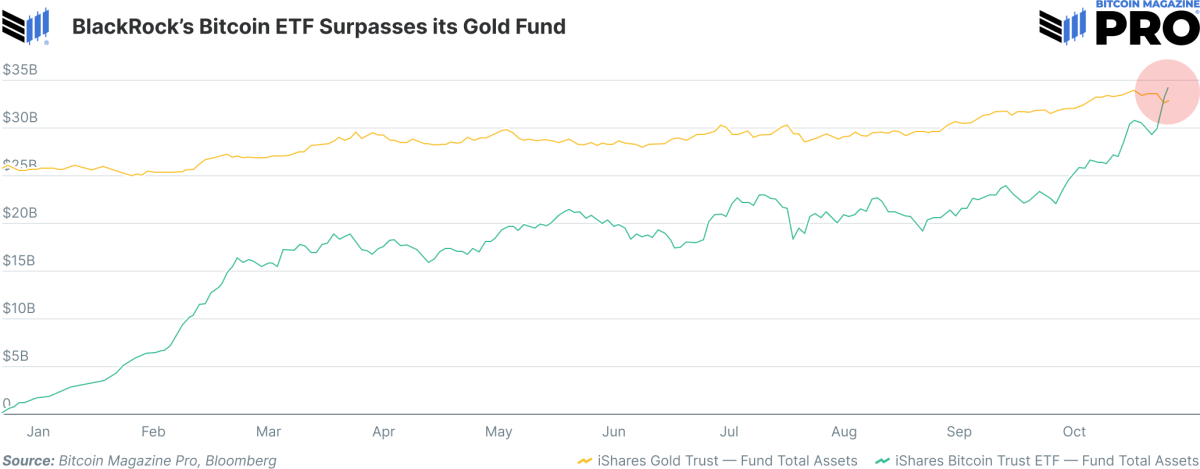

In a landmark moment, BlackRock’s Bitcoin ETF recently outpaced the company’s own iShares Gold Trust in total fund assets. This moment was captured visually in the November issue of The Bitcoin Report, revealing a clear shift in investor preference. For decades, gold sat atop the throne of “safe haven” assets. Today, Bitcoin’s emerging role as “digital gold” is validated by ever-growing institutional allocations. The appetite for Bitcoin-backed ETF products has become relentless, as both seasoned investors and new entrants acknowledge Bitcoin’s potential to serve as a cornerstone in diversified portfolios.

Long-Term Holding and Supply Shock

One key characteristic of Bitcoin ETF inflows is the long-term nature of these investments. Institutional buyers and long-term allocators are less likely to trade frequently. Instead, they acquire Bitcoin through ETFs and hold it for extended periods—years, if not decades. As this pattern continues, the Bitcoin held in ETFs becomes essentially removed from circulation. The result is a steady drip of supply leaving exchanges, pushing the market toward a potential supply shock.

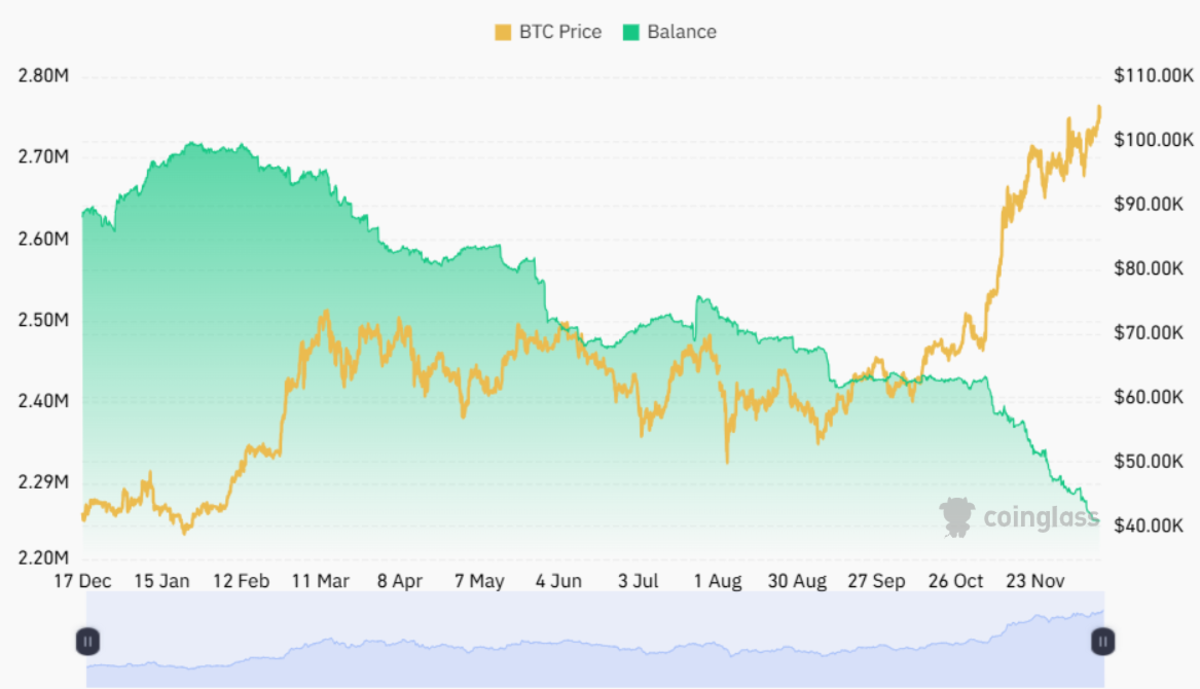

This trend is clearly illustrated by the latest data from Coinglass. Only about 2.25 million BTC currently remain on exchanges, highlighting a persistent decline in readily available supply. The chart below shows a divergence where Bitcoin’s price appreciation continues upward, while the exchange balances head down—an irrefutable signal of scarcity dynamics at work.

A Perfect Bitcoin Bull Storm and the March Toward $1 Million

These evolving dynamics have already propelled Bitcoin beyond the $100,000 milestone, and such achievements could soon feel like distant memories. As the market rationalizes a potential journey towards $1 million per BTC, what once seemed like a lofty dream now appears increasingly feasible. The “multiplier effect” in market psychology and price modeling suggests that once a large buyer comes into play, the ripple effects can cause explosive price surges. With ETFs continually accumulating, each major purchase may ignite a cascade of follow-on buying as investors fear missing out on the next leg up.

Incoming Trump Administration, the Bitcoin Act, and a U.S. Strategic Reserve

If current trends weren’t bullish enough, a new and potentially transformative scenario is brewing on the geopolitical stage. Incoming President-elect Donald Trump in 2025 has expressed support for the “Bitcoin Act,” a proposed bill directing the Treasury to establish a Strategic Bitcoin Reserve. The plan involves selling part of the U.S. government’s gold reserves to acquire 1 million BTC—about 5% of all currently available Bitcoin—and hold it for 20 years. Such a move would signal a seismic shift in U.S. monetary policy, placing Bitcoin on par with (or even ahead of) gold as a cornerstone of national wealth storage.

With ETFs already driving scarcity, a U.S. governmental move to secure a large strategic Bitcoin reserve would magnify these effects. Consider that only 2.25 million BTC are available on exchanges today. Should the United States aim to acquire nearly half of that in a relatively short timeframe, the supply-demand imbalances would become extraordinary. This scenario could unleash a hyper-bullish mania, pushing Bitcoin’s price into previously unthinkable territory. At that point, even $1 million per BTC might be viewed as rational, a natural extension of the asset’s role in global finance and national strategic reserves.

Conclusion: A Confluence of Bullish Forces

From near-term ETF inflows surpassing new issuance fivefold, to longer-term structural shifts like a potential U.S. Bitcoin reserve, the fundamentals are stacking in Bitcoin’s favor. The growing scarcity, combined with the multiplier effect of large buyers entering the market, sets the stage for exponential price appreciation. What was once considered unrealistic—a Bitcoin price of $1 million—now sits within the realm of possibility, underscored by tangible data and powerful economic forces at play.

The journey from today’s levels to a new era of Bitcoin price discovery involves more than just speculation. It’s supported by a tightening supply, unyielding demand, rising institutional acceptance, and even the potential imprimatur of the world’s largest economy. Against this backdrop, surpassing 1 million BTC in ETF holdings before 2025 may be just the beginning of a much larger story—one that could reshape global finance and reimagine the very concept of a reserve asset.

For the latest insights on Bitcoin ETF data, monthly inflows, and evolving market dynamics, explore Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

Put Options for BlackRock’s Bitcoin (BTC) ETF at $30, $35 See High Volume – What’s Happening?

Published

2 weeks agoon

December 16, 2024By

admin

Surging volumes in put options linked to BlackRock’s Nasdaq-listed spot bitcoin ETF (IBIT) could be interpreted as bearish sentiment. That’s not necessarily the case.

On Friday, more than 13,000 contracts of the $30 out-of-the-money (OTM) put option expiring May 16 changed hands as the ETF rose 1.7% to $57.91, according to data from Amberdata. Volume in the $35 put option expiring Jan. 16, 2026, topped 10,000 contracts.

Most of the activity probably stems from market participants looking to generate passive income through “cash-secured put selling” rather than outright purchase of the options as bearish bets, according to Greg Magadini, Amberdata’s director of derivatives.

A put seller, offering insurance against price drops in return for a premium, is obligated to purchase the underlying asset at a predetermined price on or before a specific expiration date. (That’s opposed to the buyer of the put, who has the right but not the obligation to sell the asset.)

That means savvy traders often write OTM puts to acquire the underlying asset at a lower price while pocketing the premium received by selling the put option. They do so by continuously maintaining the cash required to purchase the asset if the owner of the put option exercises their right to sell the asset.

Hence, the strategy is called “cash-secured” selling of puts. In IBIT’s case, sellers of the $35 put expiring in January 2026 will keep the premium if IBIT stays above that level until expiry. If IBIT drops below $35, the put sellers must buy the ETF at that price while keeping the premium received. The sellers of the $30 put expiring in May next year face a similar payoff scenario.

“The $35 Puts for Jan 2026 traded +10k contract with an IV range of 73.52% to 69.94%, VWAP at 70.75% suggests net selling from the street… potentially Cash Secured put selling flows (for traders who missed the rally),” Magadini said in a note shared with CoinDesk.

Saxo Bank’s analyst suggested cash-secured put selling as the preferred strategy in Nvidia early this year.

Calls are pricier than puts

Overall, IBIT call options, which offer an asymmetric upside to buyers, continue to trade pricer than puts.

As of Friday, call-put skews, with maturities ranging from five to 126 days, were positive, signaling relative richness of implied volatility for calls. The bullish sentiment is consistent with the pricing in options tied to bitcoin and trading on Deribit.

On Friday, IBIT recorded a net inflow of $393 million, representing the majority of the total inflow of $428.9 million across the 11 spot ETFs listed in the U.S, according to data tracked by Farside Investors.

Source link

Bitcoin

BlackRock’s Bitcoin (BTC) ETF Drops Most in 4 Months as Google Unveils Quantum Computing Chip Willow

Published

3 weeks agoon

December 10, 2024By

admin

BlackRock’s spot bitcoin (BTC) exchange-traded fund (ETF), tickered IBIT on Nasdaq, dropped on Tuesday as the overheated crypto market cooled and unfounded concern that bitcoin’s security might be compromised by quantum computing percolated across social media.

IBIT’s price fell 5.3% to $54.73, the biggest single-day drop since early August, according to data source Investing.com. The bitcoin price fell over 4%, hitting lows under $94,300, as overleveraged altcoin traders were liquidated, leading to bigger losses in the broader market.

While such pullbacks are typical in a bull market, Monday’s losses are noteworthy because they came alongside Google’s announcement of its Willow quantum-computing chip, which can solve in just five minutes a problem that would take the world’s fastest supercomputers 10 septillion years to process.

Several users on X expressed concerns that Willow could easily crack bitcoin’s complex math SHA-256, compromising the network. That’s because Willow has reached 105 qubits with improved error rates. Consider qubit a super-powerful version of a regular computer bit, which can only be a 0 or a 1. A qubit can be both 0 and 1, like a switch that can be on and off until it’s checked. This helps quantum computers process problems much faster than normal computers.

These concerns are unfounded, some experts said, because Willow is still not powerful enough to pose a risk.

“Willow has 105 qubits, which is great for quantum experiments but far from what’s needed to break Bitcoin’s encryption,” pseudonymous analyst and tech expert Cinemad Producer producer said on X. “Experts estimate you’d need about 1 million high-quality qubits to make a dent in Bitcoin’s security.”

In 2022, research from Universal Quantum, associated with the University of Sussex in the U.K., found that a quantum computer with a capacity of 1.9 billion qubits would be required to break bitcoin’s encryption.

Damage done?

Though it’s unclear whether the quantum FUD drove BTC and IBIT lower, the damage seems to have been done, according to technical charts.

While IBIT clocked a new high on Friday, the 14-day relative strength index (RSI), hinted at a bearish divergence, a warning that the rally is running out of steam.

Monday’s drop confirmed the bearish divergence, signaling deeper losses ahead, with support at $51.54, the Nov. 26 low. A move above Thursday’s high of $59.16 is needed to invalidate that outlook.

Source link

5 altcoins ready to surge 18,000% as Bitcoin aims for $150,000

Galaxy Research Predicts Dogecoin Price To Reach $1 In 2025

Bitcoin Price Retests Support Line After Crash Below $95,000, Here’s The Next Target

Michael Saylor Doesn’t Understand Bitcoin

Cardano and Solana lead institutional discussions, analysts spot a rising altcoin

Pro-XRP Lawyer John Deaton Comments On New Crypto Tax Rule

Release Date for Incarcerated Former FTX Exec Ryan Salame Moved Up by a Year

Debt: Bitcoin Is Not A Return To Stateless Money, It Is the First

DTX Exchange could be the next big thing with 3x potential while Ripple & Dogecoin bleed

Can Shiba Inu Price Skyrocket 60% As Short-term SHIB Holders Capitulate?

The Year in NFTs: Bitcoin Ordinals Boom, Airdrop Craze, and Brands Come and Go

How To Buy Bitcoin During Bull Market Dips

PENGU price prediction | Is Pudgy Penguins a good investment?

Binance Peer To Delist XRP and Litecoin (LTC), But There’s A Catch

Bitcoin (BTC) Kimchi Premium Spikes as South Korea’s Political Turmoil Weighs on Won

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential