Markets

Bitcoin ETFs Are Booming as BlackRock Shatters Records

Published

2 months agoon

By

admin

In case it wasn’t already obvious, Bitcoin exchange traded-funds (ETFs) are hot—with demand for the products smashing all expectations.

Data from Bloomberg shows that of the 575 ETFs launched this year, 14 of the top 30 products have been either new Bitcoin or Ethereum funds, with the top four spots owned by Bitcoin funds.

And in the past four years, of the 1,800 ETFs that started trading during that span, BlackRock’s iShares Bitcoin Trust is the biggest by far in terms of inflows, the data shows.

575 ETFs have now launched in 2024…

*14 of top 30* by inflows are either spot btc or eth ETFs.

Includes 6 of top 10.

There are also 2 MSTR-related ETFs in top 30.

Crypto appetite from tradfi is real. pic.twitter.com/DmD6f5zJ1P

— Nate Geraci (@NateGeraci) October 23, 2024

ETFs are popular investment vehicles that trade on stock exchanges. They allow investors to buy and sell shares that track the price of anything from the S&P 500 and gold to Bitcoin and real estate firms.

In January, the Securities and Exchange Commission (SEC) approved the Bitcoin products, allowing 10 such funds to start trading on American stock exchanges after a decade of denials.

The investment vehicles have been widely popular, attracting billions of dollars in months in flows. Last week, they collectively crossed the $20 billion mark—smashing expectations by taking just 10 months to do what gold ETFs did over five years.

The reason for the fast money, according to Bloomberg Intelligence ETF research analyst James Seyffart, is partly down to investors who had wanted to invest in Bitcoin for some time, but didn’t have a safe or easy way before the approval of the ETFs. Now that the ETFs are trading, that demand is rapidly entering the market.

“I think it was partly pent-up demand,” he told Decrypt. “But it’s also new demand as people are learning more.”

He added that traditional financial institutions are interested in the products too—including hedge funds involved in futures trading. “That has helped improve flows and demand,” he said, adding that hedge funds have been going long on the ETFs and then selling the futures contracts.

Massive institutions—including Morgan Stanley and Goldman Sachs—now have exposure to Bitcoin via the new products. The price of Bitcoin even hit a new all-time high in March following their approvals.

But the Ethereum counterparts haven’t had as much luck thus far. The SEC approved the ETFs for the second-biggest cryptocurrency—reluctantly, it appeared—in May. They haven’t done nearly as much in terms of inflows since trading began in July.

This is partially because Grayscale’s Grayscale Ethereum Trust (ETHE) previously operated like a closed-end fund rather than an ETF before July. Its subsequent conversion means that investors who previously had cash locked up in the fund have fast been redeeming shares—leading to massive outflows.

So far, $3 billion has left the fund, bringing the total flows for all nine Ethereum ETFs currently trading to negative $472.7 million, Farside data shows.

However, that doesn’t mean demand won’t pick up. Investors have thrown cash at the other products, and that could mean a turnaround is on the horizon.

“It’s just that the outflows from ETHE are overwhelming the inflows to these other [Ethereum] ETFs,” added Seyffart. “For now.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

DeFi

Solana beats Ethereum in a key metric 3 months in a row

Published

11 minutes agoon

December 23, 2024By

admin

Solana’s continued doing well in December, as meme coins helped it gain market share against Ethereum and other blockchains.

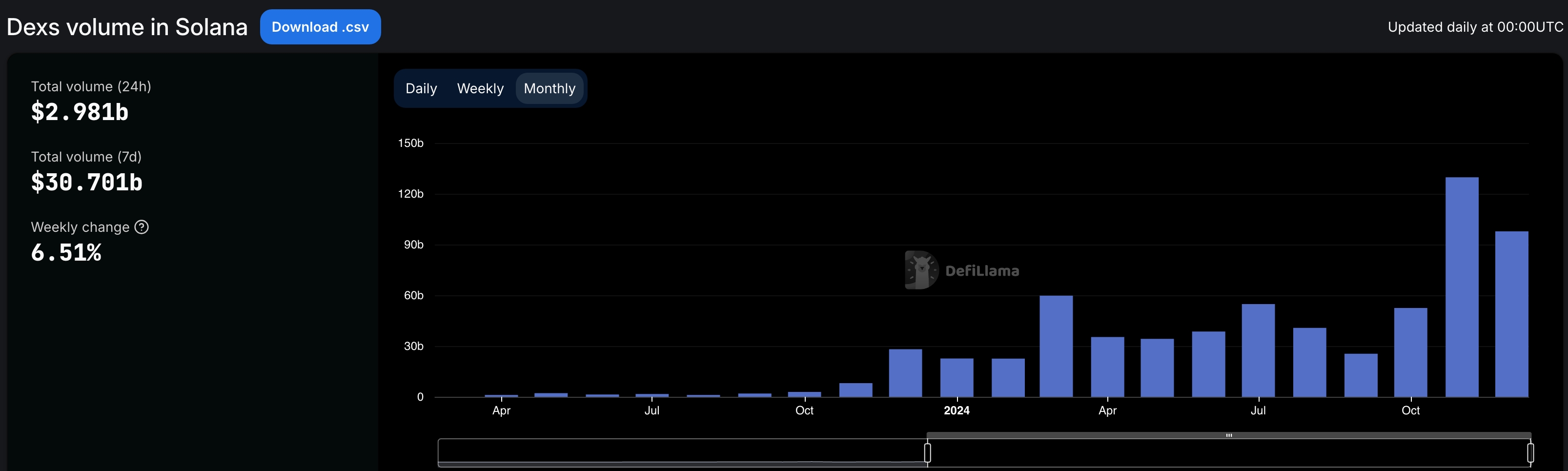

According to DeFi Llama, Solana’s (SOL) protocols in the decentralized exchange industry were the most active in December.

Its volume rose to over $97 billion, much higher than the $22.6 billion it handled in the same period last year.

Notably, it was the third consecutive month that Solana outperformed Ethereum (ETH), which has dominated the industry for years. Ethereum’s protocols had a volume of over $74 billion, while Base and Arbitrum handled $42 billion and $37 billion.

Solana also performed great in November, where its DEX networks had a volume of $129 billion, higher than Ethereum’s $70.6 billion. A month earlier, Solana handled volume of $52 billion, while Ethereum processed $41 billion.

Most of Solana’s DEX volume was because of Raydium (RAY), a network that handled coins worth $65 billion in the last 30 days. Orca handled $24 billion, while Lifinity, Pump, and Phoenix had volumes worth over $5.93 billion.

Solana’s DEX volume has jumped because of the meme coin industry, which has continued doing well this year. Solana has attracted thousands of meme coins this year, helped by the creation of Pump, the biggest token generator. All Solana meme coins have a market cap of over $14.1 billion, led by Bonk, Dogwifhat, Popcat, and Peanut the Squirrel.

This growth has been highly profitable for Solana and its native apps. All Solana native dApps generated a record $365 million in revenue in November, a record high. Similarly, according to TokenTerminal, Solana’s blockchain generated a record $725 million in fees in 2024, making it the third-most profitable chain after Ethereum and Tron.

Developers and users love Solana because of its substantially lower fees and higher throughput.

Base, the layer-2 network launched by Coinbase, has also been a big breakout star in 2024 as its total fees rose to over $82 million. It has become the biggest layer 2 network in the blockchain industry, with its DEX networks handling over $181 billion in assets, while its total value locked soared to $2 billion.

Source link

Crypto exchange

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Published

5 hours agoon

December 23, 2024By

admin

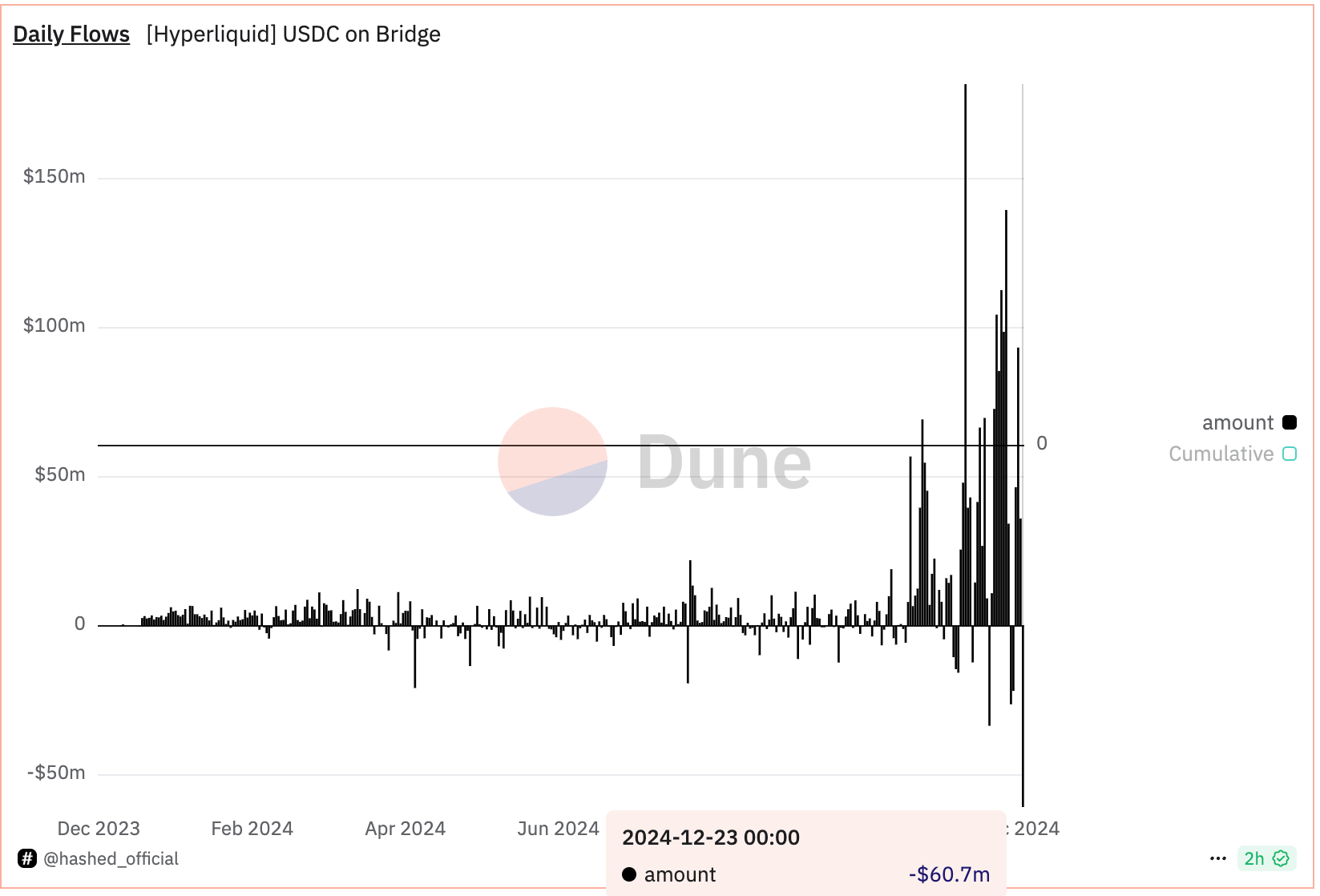

HyperLiquid, a layer-1 blockchain and decentralized exchange for perpetual futures (perps), has experienced a notable outflow of the USDC stablecoin amid speculation North Korean hackers are interacting with the platform, according to a post on X by pseudonymous observer Tay, known for tracking threats posed by to crypto protocols by the country.

A record $60 million of USDC fled the exchange by 10:00 UTC Monday, according to Hashed Official’s Dune-based tracker. USDC, the world’s second-largest dollar-pegged stablecoin, is used as collateral on HyperLiquid. The deposit bridge still holds $2.2 billion in USDC.

Addresses associated with hackers from the Democratic People’s Republic of Korea (DPRK) have accrued losses exceeding $700,000 while trading on HyperLiquid, Tay said. The transactions indicate the hackers are potentially familiarizing themselves with the platform’s inner workings to launch a malicious attack.

“DPRK doesn’t trade. DPRK tests,” Tay said.

CoinDesk contacted HyperLiquid on X for comments on the USDC outflows and potential threat from North Korea.

Tay said they reached out to the platform two weeks ago, offering help in countering a potential threat.

“I really want to emphasize that these are the most sophisticated and rapidly evolving of all of the DPRK threat groups. They are very creative and persistent. They also get their hands on 0days (such as the one Chrome patched today,” Tay’s message to the platform said.

HyperLiquid is the leading on-chain perpetuals exchange, commanding over 50% of the total on-chain perpetuals trading volume, which tallied $8.6 billion in the past 24 hours.

The platform debuted its token HYPE on Nov. 29. Since then, it has

surged over 600% to $28.6, briefly topping $10 billion in market capitalization. As of writing, HYPE was the 22nd largest digital asset in the world, according to Coingecko.

Source link

DeFi

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

Published

21 hours agoon

December 22, 2024By

admin

There’s been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market.

Asset manager Hashnote’s USYC token zoomed over $1.2 billion in market capitalization, growing five-fold in size over the past three months, rwa.xyz data shows. It has toppled the $450 million BUIDL, issued by asset management behemoth BlackRock and tokenization firm Securitize, which was the largest product by size since April.

USYC is the token representation of the Hashnote International Short Duration Yield Fund, which, according to the company’s website, invests in reverse repo agreements on U.S. government-backed securities and Treasury bills held in custody at the Bank of New York Mellon.

Hashnote’s quick growth underscores the importance of interconnecting tokenized products with decentralized finance (DeFi) applications and presenting their tokens available as building blocks for other products — or composability, in crypto lingo — to scale and reach broader adoption. It also showcases crypto investors’ appetite for yield-generating stablecoins, which are increasingly backed by tokenized products.

USYC, for example, has greatly benefited from the rapid ascent of the budding decentralized finance (DeFi) protocol Usual and its real-world asset-backed, yield-generating stablecoin, USD0.

Usual is pursuing the market share of centralized stablecoins like Tether’s USDT and Circle’s USDC by redistributing a portion of revenues from its stablecoin’s backing assets to holders. USD0 is primarily backed by USYC currently, but the protocol aims to add more RWAs to reserves in the future. It has recently announced the addition of Ethena’s USDtb stablecoin, which is built on top of BUIDL.

“The bull market triggered a massive inflow into stablecoins, yet the core issue with the largest stablecoins remains: they lack rewards for end users and do not give access to the yield they generate,” said David Shuttleworth, partner at Anagram. “Moreover, users do not get access to the protocol’s equity by holding USDT or USDC.”

“Usual’s appeal is that it redistributes the yield along with ownership in the protocol back to users,” he added.

The protocol, and hence its USD0 stablecoin, has raked in $1.3 billion over the past few months as crypto investors chased on-chain yield opportunities. Another significant catalyst of growth was the protocol’s governance token (USUAL) airdrop and exchange listing on Wednesday. USUAL started trading on Binance on Wednesday, and vastly outperformed the shaky broader crypto market, appreciating some 50% since then, per CoinGecko data.

BlackRock’s BUIDL also enjoyed rapid growth earlier this year, driven by DeFi platform Ondo Finance making the token the key reserve asset of its own yield-earning product, the Ondo Short-Term US Government Treasuries (OUSG) token.

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential