Bitcoin miners

Bitcoin Hashrate Hits All-Time High as Trump Vows to Boost Industry

Published

5 months agoon

By

admin

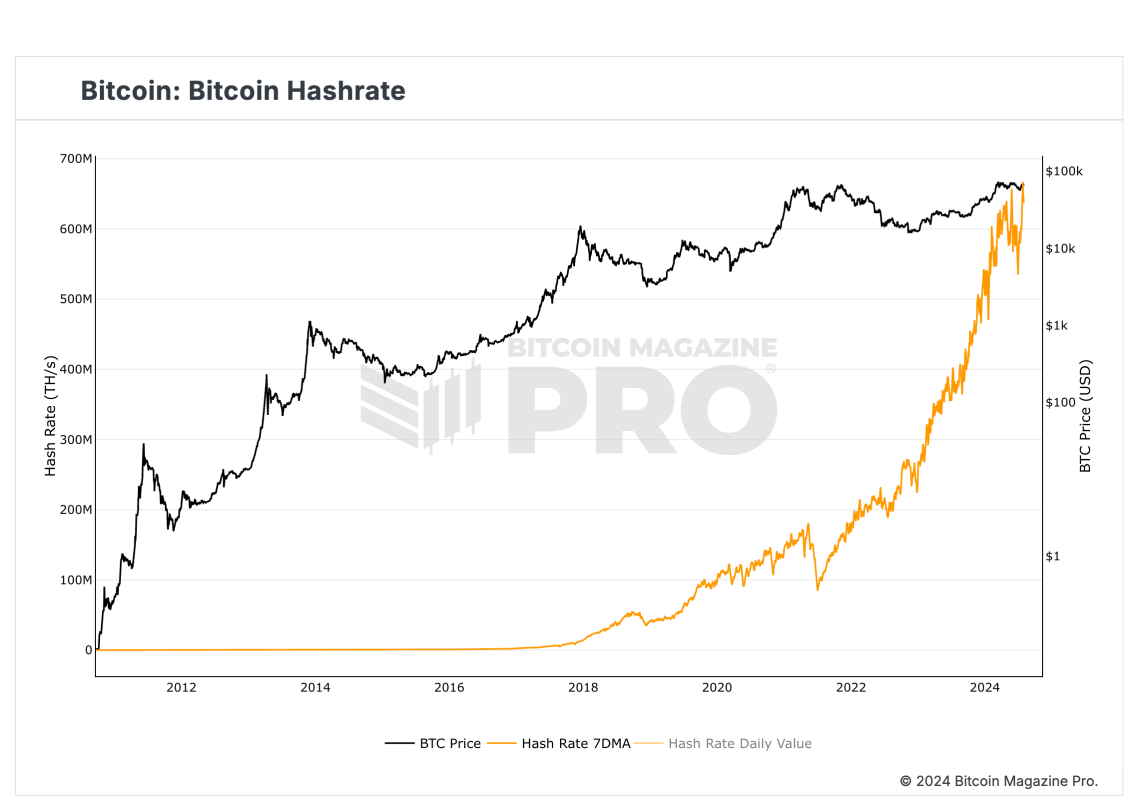

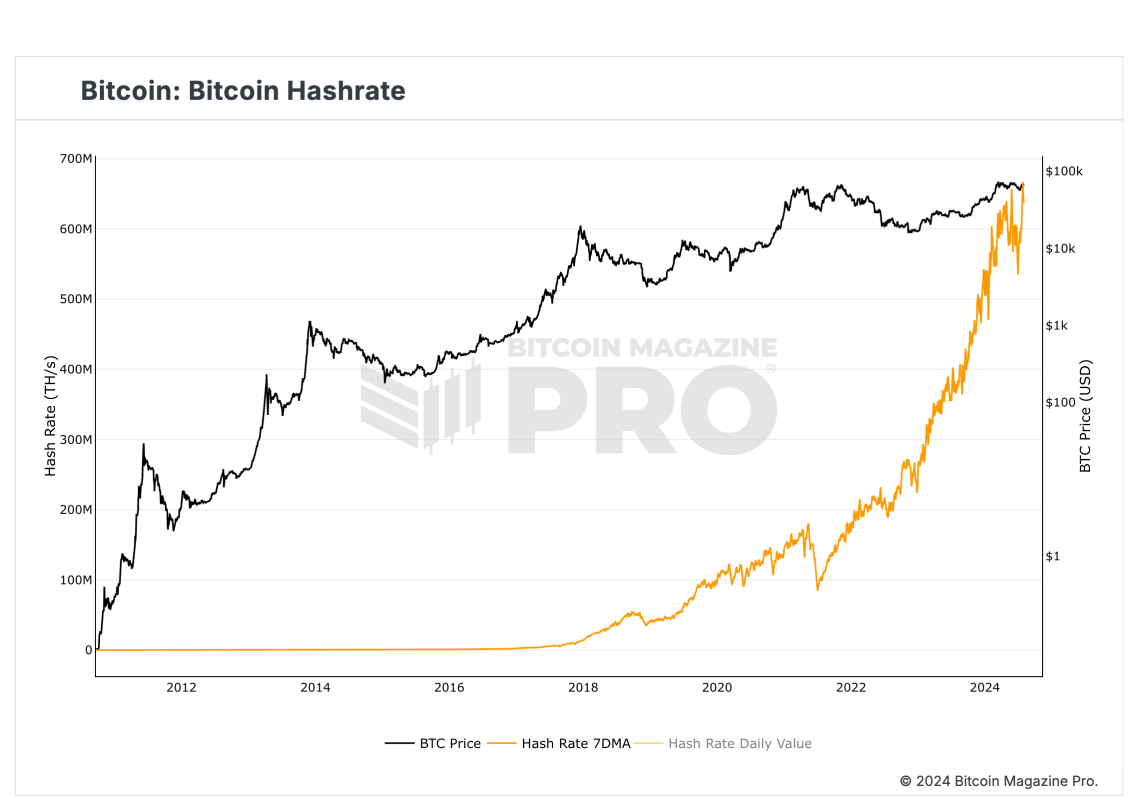

According to Bitcoin Magazine Pro, the 7-day average mining hash rate for Bitcoin has hit a new all-time high, surpassing 667 exahashes per second (EH/s) on July 26th during the Bitcoin 2024 conference. This tops the previous record of 657 EH/s set on May 26th.

This new all time high comes as Donald Trump announced his plans during the conference to support and boost the Bitcoin mining industry.

Major mining firms like Whatsminer and MicroBT are rolling out new powerful machines to capitalize on the hash rate boom. Whatsminer unveiled four new mining rigs and an upcoming solar mining container system. MicroBT introduced its M6XS+ miners, which can handle 190 to 450 terahash.

Riot Platforms also acquired Block Mining for $92.5 million to expand its hash rate and market reach. Miners are exploring AI integration and acquisition opportunities to navigate ongoing identity challenges.

The boost in miners’ revenue from Bitcoin’s rising price has cooled selling pressure and stabilized network activity. Outflows from miners remained under $10,000 per day in July compared to over $20,000 in March when BTC first hit $70,000.

Overall, Bitcoin’s climbing hashrate reflects a vote of confidence in its long-term viability. With major mining innovations and favourable politics boosting revenues, miners are aggressively expanding infrastructure to process transactions and secure the Bitcoin network.

Source link

You may like

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

Africa

Gridless Is Mining Bitcoin While Fostering Human Flourishing In Africa

Published

5 days agoon

December 18, 2024By

admin

Company Name: Gridless

Founders: Janet Maingi, Erik Hersman and Philip Walton

Date Founded: August 2022

Location of Headquarters: United States | Operations in Kenya, Malawi and Zambia

Number of Employees: 10

Website: https://gridlesscompute.com/

Public or Private? Private

Gridless doesn’t just mine bitcoin — it helps to facilitate the electrification of rural Africa, which is notably improving the lives of those who previously either didn’t have access to power or couldn’t afford it.

Gridless’ co-founder Janet Maingi explained to Bitcoin Magazine how the company’s facilities, which are based in Kenya, Malawi and Zambia, have a win-win-win effect for the company itself, the Bitcoin network and the communities that benefit from Gridless’ operations.

“Our mission is to mine Bitcoin profitably,” Maingi told Bitcoin Magazine. “But as we do this, we also do two other things: we push electrification out to the edge in Africa and we decentralize the Bitcoin network, which has historically been very centralized to North America and China.”

In just over two years, Gridless has set a new standard for the type of impact a Bitcoin mining company can have, showing the world that Bitcoin mining can have a symbiotic relationship with the communities it touches and that it can be a catalyst for human flourishing.

I sat down with Maingi in person in Kenya after this year’s Africa Bitcoin Conference to discuss the work she does and the impact it has on the communities it reaches.

A transcript of our conversation, edited for length and clarity, follows below.

Frank Corva: How does Gridless help to electrify Africa?

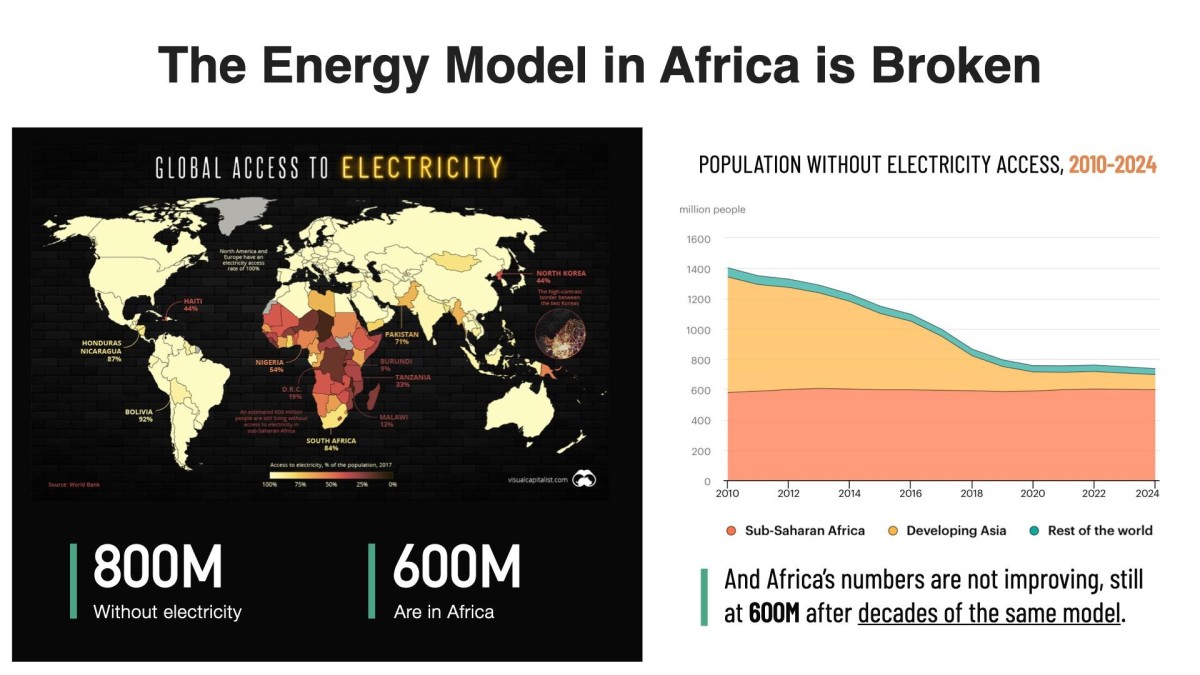

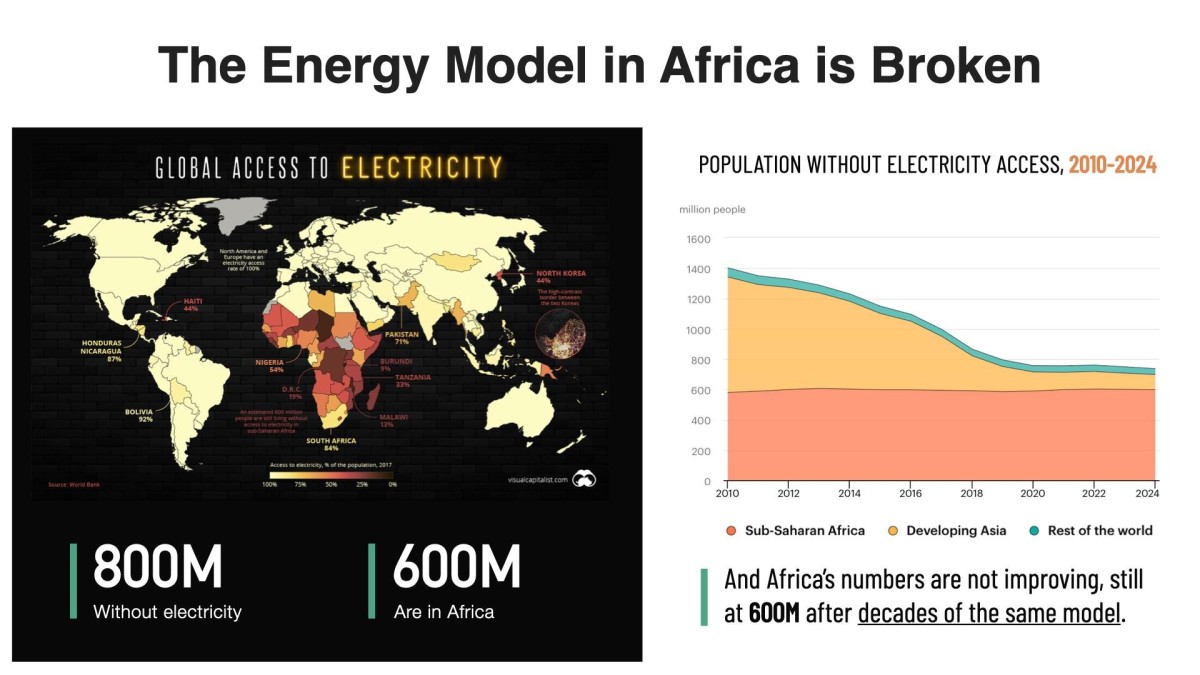

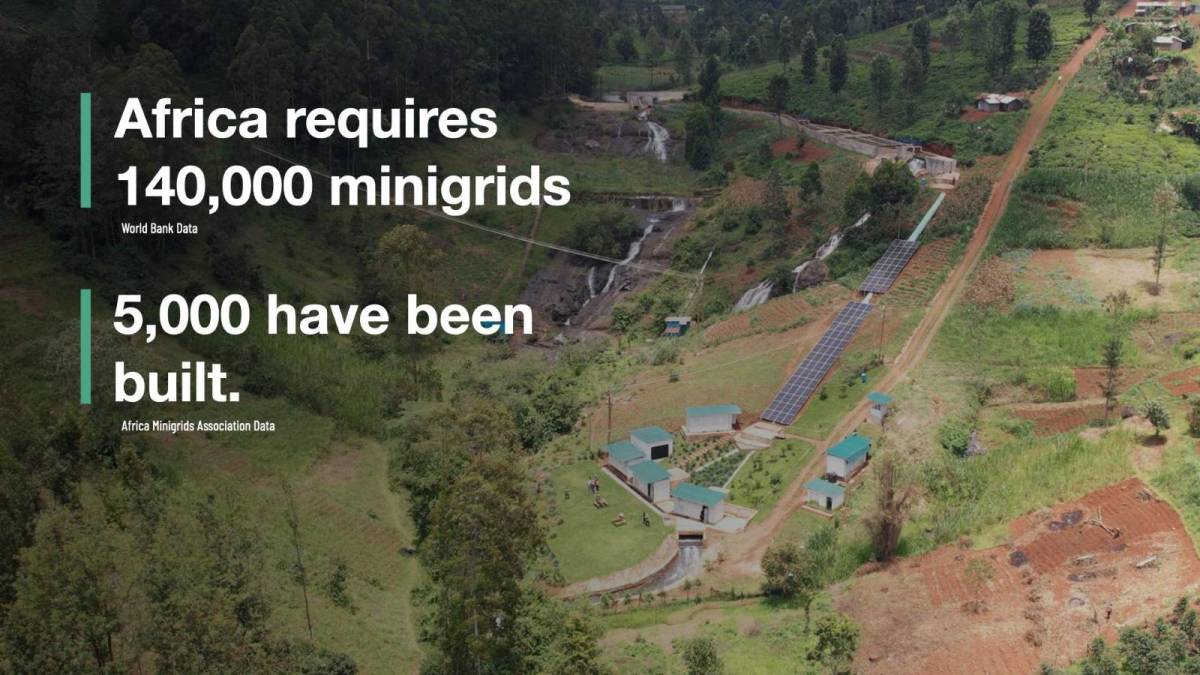

Janet Maingi: About 600 million Africans have no access to electricity. That’s about two-thirds of our population. The private sector has stepped in because the main grids do not reach everyone on the continent.

You’ll find that bigger cities like Nairobi or Mombasa have electricity, but if you go to rural Africa, people have no access to electricity because of distribution challenges.

So, the private sector came and started setting up mini-grids. Private companies have done the best they can with these mini-grids. However, they’re very capital intensive, and so there are struggles with fundraising. And even when you actually get them set up, the consumers around your area might not be very wealthy. They’re just living day-to-day. They may have to consider “Do I need electricity or do I need food?”

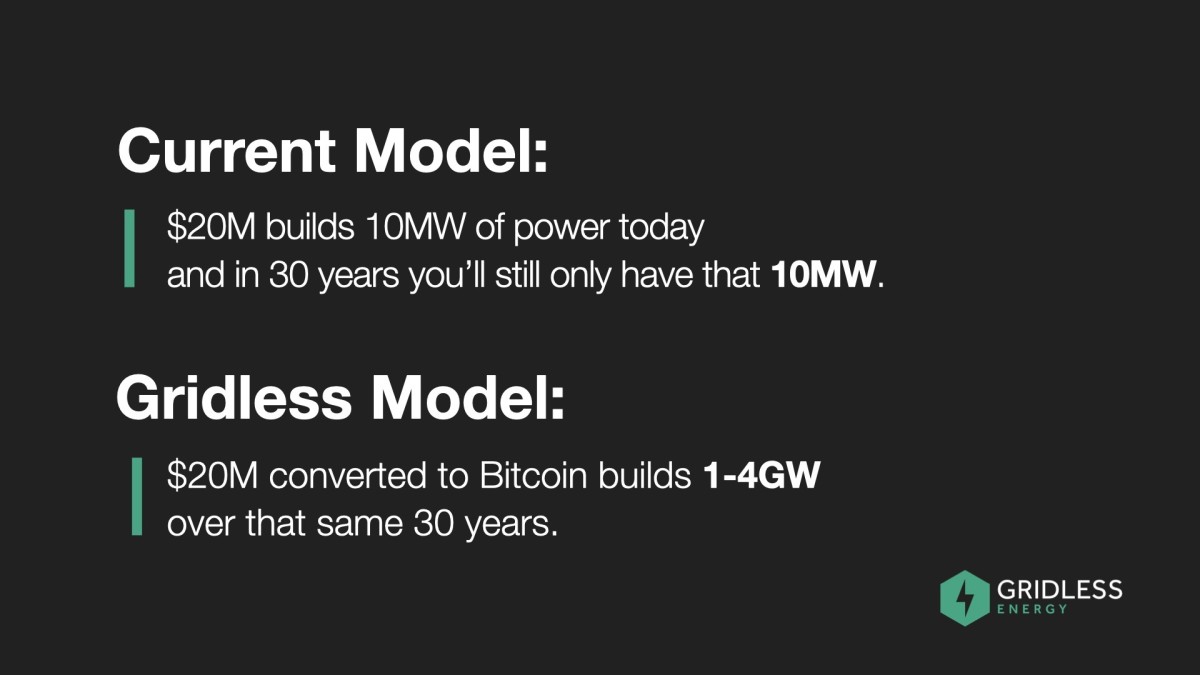

The companies that construct the mini-grids build power plants that use hydro energy. Let’s say they want to build one that produces one megawatt of energy, but the community only ends up using 200 kilowatts. There’s 800 kilowatts that they generated from the river, but for that 800 kilowatts, they get zero shillings, zero dollars, zero anything.

So, we at Gridless come in and say “That electricity that you’re not able to send to anyone, is what we want.” That’s what you call stranded power or wasted energy, and it’s what we want. So, we become your buyer of last resort.

We come and create an agreement to use that extra electricity, and from a revenue sharing perspective, we work together. It’s a win-win situation. Our data centers use that electricity to mine bitcoin.

But then the catalyzing of electrification comes in. When we’ve used that electricity, it’s become a source of revenue for the energy power plant. They were not making money on that electricity previously, and now they’re profiting from it.

What have we seen as the effect? One, they are able to extend their reach, to distribute electricity further. And secondly, some of them have been able to actually lower their prices. So, consumers who are within their reach but wouldn’t use the electricity because of the cost are suddenly saying, “Hey, hook me up. I can afford to pay for this now.”

Corva: So, in a sense, you’re subsidizing the rate of electricity.

Maingi: Yes, because we come in and use this power, the energy generator is able to give better prices and increase its reach. So, again, what does this mean? More homes getting lit, more small enterprises getting electricity, more factories getting powered and more health centers getting electricity. You can now imagine the upward spiral effect.

However, the challenge is that doing business in Africa is like an extreme sport.

Corva: Why is that?

Maingi: So, let’s start with just getting the equipment. The mining machines come from China, either from Bitmain or MicroBT, or you’ll get them from a company in the U.S., and the process of getting them into Africa can be painful.

We received a batch that came from the U.S. and it took us 60 something days just to get them into the country. This is from putting them on a ship to getting them here. This doesn’t include figuring out the logistics around getting the miners on site and going through pre-shipment inspection to make sure that they meet the Kenyan standards.

It’s a process that takes almost 120 days from start to end. If you’re running a business, and it takes you 120 days to get your product on the ground, it’s painful.

Secondly, these machines are designed to work very well in China or the U.S.

Conditions in Africa are different, though.

Corva: Does this have anything to do with air quality?

Maingi: Air quality, dust, heat. In Kenya, average temperatures range from 20 to 40 degrees Celsius. So, when you power those machines in an environment where the average temperature is 30 degrees Celsius, you can imagine the heat that they have to deal with.

And then there’s dust. When you get a pre-fitted container from China or somewhere, you discover that the designers just focus on inflow and outflow. But we realized we have issues with dust, so we have to put dust filters on the machines.

And then, in 2022, we learned when we set up the first site that, because of the lights on the miners, they attracted bugs. During the rainy season, the bugs could see the lights and flew into the fans and got mashed up — something nobody thought about.

Lastly, the containers initially were going to cost us $100,000 each, which was too much for us to be profitable. The math didn’t math, as we say. So, we sat down and designed our own container.

Corva: Amazing.

Maingi: Right? And that’s what we’ve been deploying at a quarter of the price. And then the advantage that came with being made in Kenya has allowed us to get passage through the COMESA (Common Market for Eastern and Southern Africa) region, without having to pay extra duties or taxes because it’s recognized as a COMESA product.

That also helped because, being made in Kenya, it’s very easy for us to move the containers around the COMESA region without having to pay extra taxes. We get a tax exemption. Even if the containers from China made sense, if we brought them to Kenya and I had to move them to Uganda, I would have to pay taxes to Uganda, too.

Any country you move foreign products to, you have to pay taxes again. So, it’s been hard, but good solutions have come out of the difficulties.

Have you heard of GAMA, the Green Africa Mining Alliance?

Corva: Yes.

Maingi: During the first Africa Bitcoin Mining Summit last year, we released a blueprint of the container we designed. So, anyone who wants to use it to build their own container using our blueprint can feel free to do so.

Where you need our support, we’ll be ready to guide you. That’s the whole thing about GAMA — How do we exploit our synergies? How do we benefit from one another? How do we find a young lady who wants to start mining and walk her through the journey of getting started?

Corva: Incredible. I want to go back to electrification in Africa. You mentioned earlier that you wanted to share some numbers.

Maingi: What I was saying is that there’s a ripple effect when we partner with the energy generator. We’ve been able to see more homes or households getting connections.

If you’ve been in rural Kenya or Africa, then you understand how one bulb can transform a life. I’ll use the example of children coming home from school. They have assignments and use these tiny paraffin lamps to study. The fumes from them are horrible for their health. But this is a child for whom there’s no plan B. The teacher expects this child to come back to school with her assignments completed. Not having electricity is not an excuse.

A guy once told me that sometimes, when his daughter is busy doing an assignment, the paraffin runs out. When the nearest gas station is almost four miles away, who is going to go and look for paraffin at that time? Nobody. Tough luck.

So, the child gets to school and is either in trouble because she didn’t do her assignments or is now lagging behind because now those quote unquote “are yout personal problems.” Because of that one bulb they now have, he was like, “My daughter is performing so well in school.” Then, health wise, all these visits they used to make to the hospital because she was breathing in the paraffin fumes no longer happen.

Corva: It seems you want to make my cry.

Maingi: No, there’s no crying. (Author’s note: This woman doesn’t play.) It’s a reality.

Then, in Zambia, I remember talking to women who were talking about childhood vaccinations. Between zero and three years, there are certain vaccinations recommended by the WHO that your kid needs to get — measles, polio, etc. — but the nearest health center that has them sometimes isn’t close.

So, you do your math, and you’re like, “I can’t afford bus fare to do this.” And so this disease sounds more serious, I’ll get my child the vaccination for that one, while this one I’ll pass on. But really all of them are important for children.

Now, Gridless is coming into Malawi and getting electricity providers to connect more homes in the Bondo area. Health centers are getting powered on, so more vaccines are available in more local health centers.

While before you used to say “Polio sounds serious, I’ll get my child that vaccine, but with measles, I don’t know who has died of that recently, so maybe, I won’t get my child that one,” now more people can get it.

Now, we will have a young generation who, we believe, as we keep doing this, is going to thrive. They’re going to grow. You’ll possibly get rid of childhood mortalities because these rural areas get electrified.

Corva: And bringing energy to these regions also helps support livelihoods I assume.

Maingi: Yes, of course. There’s a tea factory in Muranga, Kenya, which is in the highlands.

We partnered with the energy generator in the area and they were able to give the factory power. Now, their facilities are able to support the tea factory, which has two benefits: tea farmers can bring their tea to the factory, which means it doesn’t spoil on the farms because they can’t get it to point B in time and more employment has also been created just by that tea factory becoming an electrified space.

We keep saying why we know this will make a difference is because energy is a base of human progress.

Corva: There’s no such thing as an energy poor country that’s rich.

Maingi: If you look at the Maslow’s hierarchy of needs, it used to go food, shelter, clothing, but I put energy there. Energy is a basic need. It’s a must have for anybody to actually be allowed to live a decent life. For people to make a decent living, energy has to be in that math.

Corva: Is it true that you’ve recently created software that helps with energy demand response?

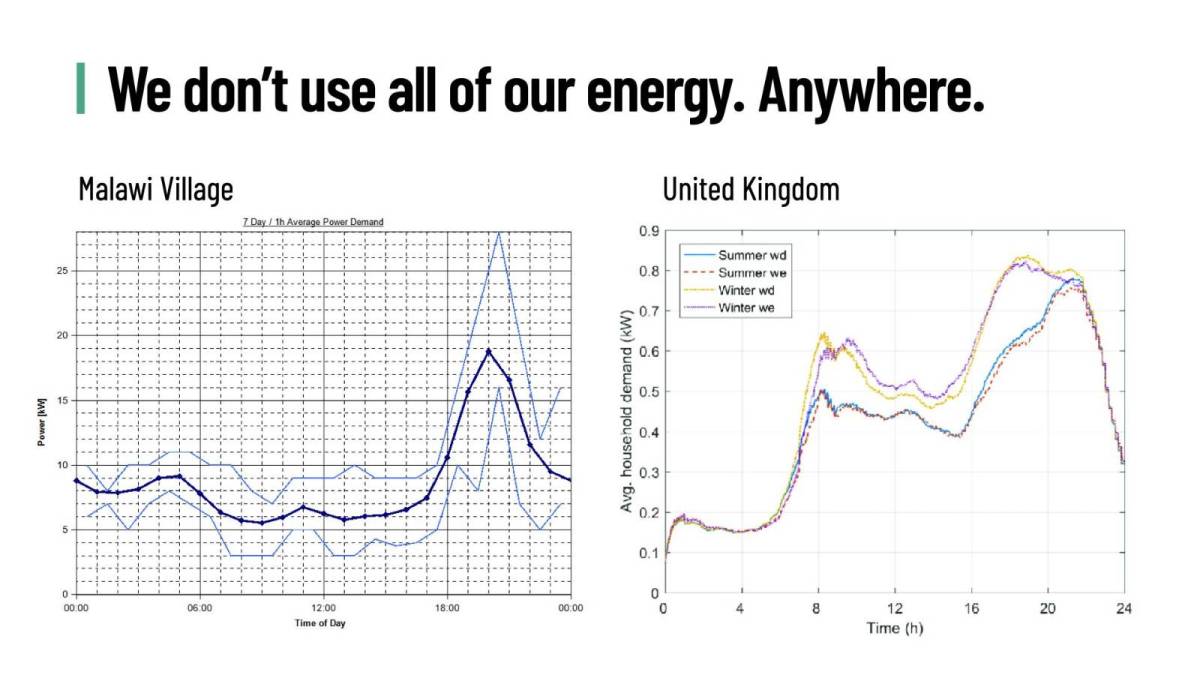

Maingi: Yes. We realized that we need to get more proactive in creating real-time demand response. Before, we were either reacting too late or too early to the power available.

Remember we’re the buyer of last resort, so communities come first and small businesses come second. For us to be able to live up to that promise, we had to make sure we weren’t sucking in electricity that was required by somebody else at that time.

So, let me paint a picture. In normal households, people wake up at 6 a.m., so there’s a surge of electricity. At that stage, our software gets a signal and reduces our consumption to meet the demand needed by the grid. Then, at 8 a.m., everybody goes to school and switches off their lights and there’s too much electricity in the grid. That’s when we power more mining machines.

We get the signal, power more machines, suck in the electricity and keep on going until maybe 6 p.m. when people have gotten back home and they need the electricity. Gridless turns down their machines and returns the electricity.

At 10 p.m. they all go to bed, and we power up more machines. This is all done with software we developed internally called Gridless OS. It allows for real-time demand response. It makes it so everybody gets what they need, and it stabilizes the grid.

Corva: Are you setting certain standards with Gridless that others are following in Africa or in other parts of the world?

Maingi: It’s set a trend that people are following. Sometimes you go to conferences and people keep referring to Gridless. That’s when you realize, “My God, this thing is bigger than we thought.” And so you start to understand how this has made a difference, that it doesn’t exist in a vacuum.

At the end of the day, everyone has different ways of mining bitcoin, and there’s a positive impact to the community whichever way you do it. Look at Bigblock Datacenter — Sebastian Gouspillou in the Congo — where they’re using the heat to dry cocoa for chocolate they sell. Think of what that has created for that economy.

Corva: I think Sebastian brought me to tears when I met him, too.

Maingi: What’s exciting for us and other players within this space is that we are the ones who understand our problems, and it’s exciting to see African companies deciding “Not only will I mine bitcoin profitably and decentralize the network, but there’ll be some benefit to our community, as well.”

Source link

Bitcoin

Bitcoin Miners Now In Selling Mode For A Year: Should You Be Concerned?

Published

6 days agoon

December 16, 2024By

admin

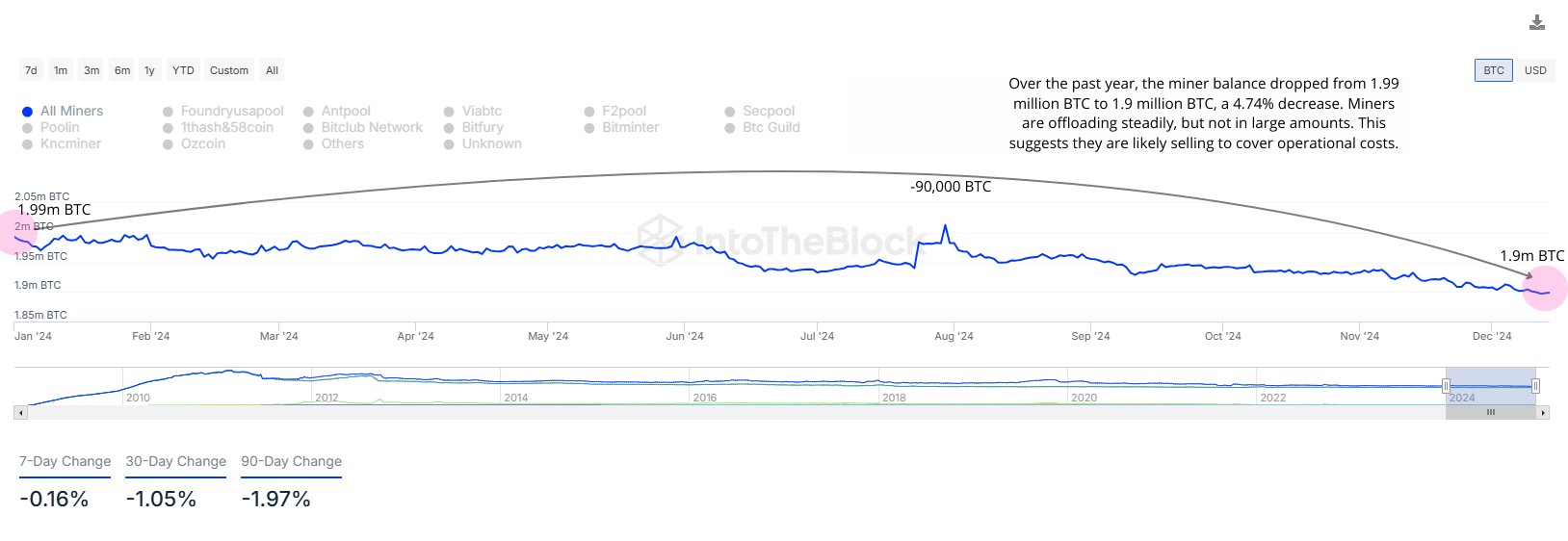

On-chain data shows that Bitcoin miners have been selling for around a year now. Here’s how much they have sold so far.

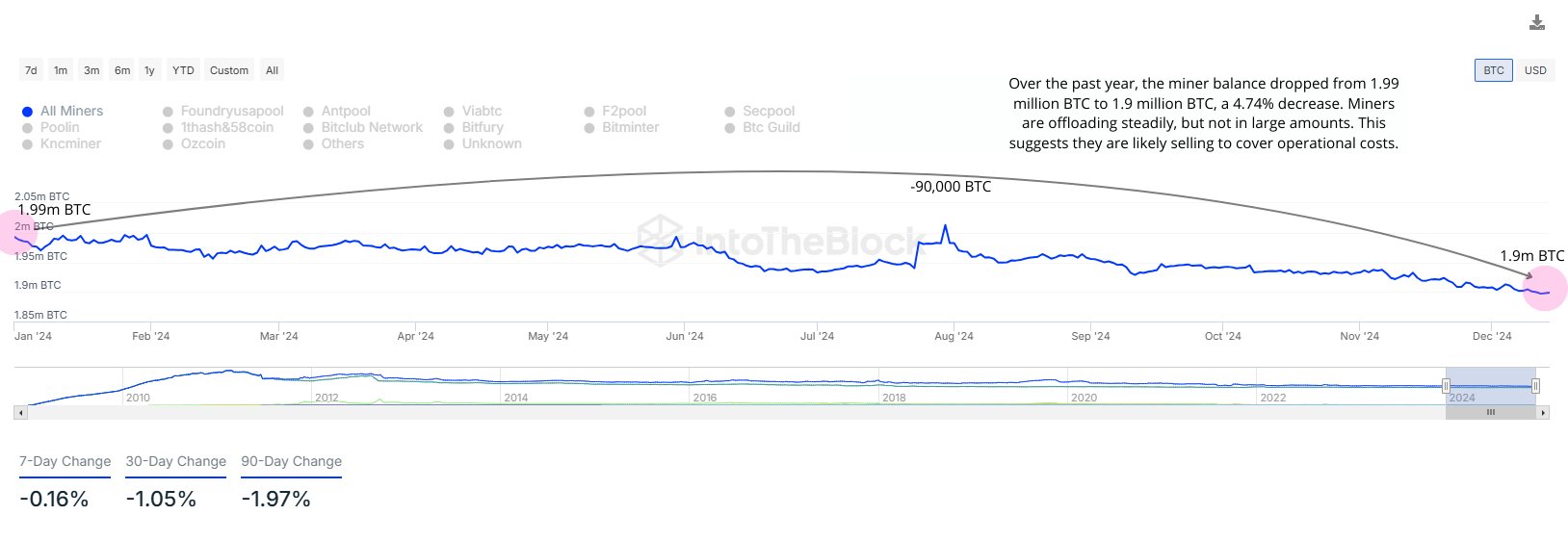

Bitcoin Miners Have Shed Over 4% Of Their Holdings In Past Year

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the BTC miners have been in net selling mode for a significant period of time. The on-chain metric of relevance here is the “miner reserve,” which keeps track of the total amount of coins that the miners as a whole are carrying in their wallets right now.

Related Reading

When the value of this indicator rises, it means the chain validators are adding a net number of tokens to their combined holdings. Such a trend can be a sign that this cohort is accumulating, which can naturally be bullish for the asset’s price.

On the other hand, the metric observing a decline suggests the miners are withdrawing coins from their addresses. The main reason why this group makes such transactions is for selling-related purposes, so this kind of trend can have a bearish impact on BTC.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past year:

As displayed in the above graph, the Bitcoin miner reserve has gone through a steady downtrend during this window. There have been some brief periods of deviation, but the overall trajectory has remained toward the downside.

Historically, the miners have had a presence as consistent sellers on the network. The reason behind this is the fact that these chain validators have constant running costs in the form of electricity bills, which they pay off by selling their BTC rewards for fiat.

Generally, though, despite being regular sellers, miners don’t pose too much of a threat to the price, as their selling tends to be of a scale that can readily be absorbed by the market. That said, the times that they do participate in a major selloff can be to watch out for.

During the start of this year, the Bitcoin miners held a total of 1.99 million BTC in their reserve. Today, the same metric stands at 1.90 million BTC, implying the miners have sold 90,000 BTC (about $9.3 billion at the current exchange rate) or 4.74% of their holdings.

Related Reading

This is a notable amount on its own, but when considering the context that this selling has come over some length of time rather than inside a narrow window, the selloff stops being too interesting.

“Miners are offloading steadily, but not in large amounts,” notes the analyst. “This suggests they are likely selling to cover operational costs.” As such, it’s possible that Bitcoin wouldn’t feel any major bearish effects from this miner selloff.

The miner reserve could still be to keep an eye on in the near future, however, as any sharp changes in the metric could potentially spell a new outcome for Bitcoin.

BTC Price

Bitcoin set a new all-time high beyond the $106,000 mark earlier in the day, but the coin appears to have seen a pullback since then as it’s now trading around $104,000.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

Source link

Bitcoin miners

Heat Your Home While Earning Bitcoin With Heatbit

Published

3 weeks agoon

December 4, 2024By

admin

Company Name: Heatbit

Founder: Alex Busarov

Date Founded: April 2020

Location of Headquarters: Remote

Number of Employees: 25

Website: https://heatbit.com/

Public or Private? Private

In early 2020, Alex Busarov was stuck in his Shanghai apartment during COVID. To quell his boredom, he ordered an Antminer S9, a Bitcoin mining machine, to toy around with.

After plugging it in, he quickly learned two things: Bitcoin miners are noisy and they run hot.

While Busarov saw the prior byproduct as an annoyance, he viewed the latter as an opportunity.

Fast-forward to the present day and Busarov and his team are preparing holiday shipments of bitcoin miners that run quietly and double as space heaters (as well as air purifiers) — the flagship product for his company, Heatbit.

What is more, Busarov has created a product that helps to decentralize Bitcoin’s hashrate, which has become dangerously centralized.

“The first kind of value that I saw in this was how to use energy for heating your home and mining Bitcoin at the same time, but then the mission started evolving as I realized the importance of the decentralization of Bitcoin mining,” Busarov told Bitcoin Magazine. “I think we’re enabling the most resilient infrastructure for Bitcoin to run on.”

How Heatbit Devices Work

Heatbit devices stand at 24 inches in height and 8 inches in diameter. They’re cylindrical in shape and have a sleek finish.

Getting started with a Heatbit device is “as difficult as it is to plug in a Dyson device,” according to Busarov.

After doing so, users need only download the Heatbit app and connect the device to WiFi to begin mining bitcoin.

Once the device is running, using no more energy than a Dyson space heater and making no more noise than a whirring sound at the volume of whisper, it points the hash power that it produces to a default mining pool, which is currently NiceHash and soon to be Luxor. Users will eventually also be able to choose their own mining pool or search for Bitcoin blocks without being part of a pool if they please.

“Basically, you can start without even knowing what a mining pool is,” explained Busarov. “But once you learn a little more or if you already know about mining pools, you just plug in the details for the mining pool you want to join, or solo mine.”

Busarov clarified that the functionality to choose your mining pool or to mine solo hasn’t been enabled for all users yet, but it will be in the near future.

“We don’t have any intention to lock users into a particular pool,” he said.

If the device runs 24/7, it mines approximately 700 sats per day, which equates to approximately 20,000 sats per month — about $20 per month as per bitcoin’s price at the time of writing.

The sats earned are held in a smart contract until the amount reaches a certain threshold (which is currently between $10 and $20 worth of bitcoin) before they’re deposited into the user’s wallet address on the Bitcoin base chain.

Busarov is aware that some users are concerned with Bitcoin fees rising, which is why he and his team are working on implementing Lightning.

“Lightning is definitely coming,” said Busarov. “It’s not enabled yet, but it’s coming.”

Decentralizing The Hashrate

As Busarov mentioned, it wasn’t his original intention in creating Heatbit devices to contribute to the decentralization of the Bitcoin hashrate. However, once he began considering just how centralized it is in some regards, he acknowledged this deeper dimension of Heatbit’s value proposition.

“When you have five big mining companies and 20 well-known mining locations, if you want to damage Bitcoin, you know those 20 locations, right?” cautioned Busarov.

“Also, if the price of Bitcoin goes down a lot, which happens sometimes, and the mining companies are overleveraged, they might not exist anymore,” added Busarov regarding the risk of major mining companies going bankrupt.

“But people will still use the heaters, because they’re not spending any extra money to mine this way. They will still use their miners because they’re not losing any money, which makes it the cheapest way to mine.”

At first thought, Busarov’s claim that the home miners he’s built can play a legitimate role in supporting the Bitcoin network seems a bit hyperbolic, especially considering the fact that the amount of hashrate Heatbit devices currently produce is infinitesimal compared to the amount that major mining companies produce.

However, when one considers the size of the home heater market, Busarov’s assertion seems a bit more believable.

“There’s about 200 million electric heaters being sold every year,” said Busarov, referring to the market Heatbit is looking to capture in the long run.

In the short term, though, Busarov understands that the buyers in that market don’t necessarily have the money for a space heater like a Heatbit, which retails for $799.

“Most people wouldn’t buy an $800 heater,” he explained. “We’re looking into making a more affordable version so that we can sell more.”

Prioritizing affordability has taken a back seat to focusing on quality and timeliness, however. Busarov and his team have been putting all of their efforts into making a durable and dependable device that they can ship with haste.

Built To Last, Ready To Ship

The current iteration of Heatbit devices is the product of a tremendous amount of R&D as well as the sourcing of quality parts from over 70 different suppliers.

In other words, Busarov and his team have built a device that can take a beating. (Not that you should beat your Heatbit device; we don’t condone home Bitcoin miner / home heater abuse here at Bitcoin Magazine.)

“Today, I was doing some testing of the devices for the latest batch,” said Busarov.

“I put one into the box and was literally throwing it around. I was throwing it like UPS or FedEx might, and I took it out to find that it didn’t break,” he added.

Busarov shared this information with a smile, one seemingly half born from my reaction to his account of how he tests the resiliency of his products and half derived from the faith that many in the Bitcoin community have come to have in him.

“When we started building, it was taking longer than expected,” explained Busarov, adding that he and his team were operating under pressure as customers had preordered devices.

“Some people would complain about a delay in shipping and ask for refunds, and we refunded the money, but then a lot of people said, ‘Hey, guys, you’re doing a great thing. We believe in you. Keep going,” he added.

“When people say something like that to you, you can’t stop. When there’s so much faith and trust that people place in you, that gives you so much energy and motivation to keep going.”

Keep going Busarov and his team did, eventually creating a dependable product that’s now ready to ship en masse.

The Future Of Heatbit

Busarov hopes that when major household appliance companies see what Heatbit has created, they become interested in building similar products.

“I think once we show that this is possible, more companies will come to it,” he said.

“It will start getting really interesting when companies like Dyson and Samsung and the major electronics companies start looking into this,” he added.

“Imagine Samsung starts producing home devices — not necessarily space heaters — but other home devices that do mine at scale.”

Busarov has also been keeping an eye on developments in the open source Bitcoin mining movement, and has been in touch with one of its leaders: Skot, the founder of Bitaxe. He’s looking at what he might be able to incorporate from that movement, while staying conscious of the fact that he’s building a consumer product for which safety is paramount.

“I really like the open source Bitcoin mining movement, and I hope we’ll be able to contribute to it,” said Busarov.

“That being said, we need to be careful, because heaters use a lot of power and it can be dangerous for people to just play with them,” he added.

As a final thought, Busarov reiterated that he doesn’t believe he’s simply building an innovative product for the average consumer, but that Heatbit is playing a role in shaping the future of Bitcoin mining.

“Bitcoin mining is not going to be about these huge warehouses using loads of energy and then these big companies having to sell the bitcoin they mine to pay for the energy they use and their operational costs,” he explained. “With home mining, you don’t have to sell any of the bitcoin you earn.”

Source link

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential