analysis

Bitcoin Magazine And Look Into Bitcoin Partner To Launch Enhanced Bitcoin Magazine Pro

Published

5 months agoon

By

admin

Bitcoin Magazine is thrilled to announce the launch of the newly enhanced Bitcoin Magazine Pro in partnership with Look Into Bitcoin. This strategic collaboration involves rebranding Look Into Bitcoin and relaunching it as Bitcoin Magazine Pro, bringing real-time data and market-leading chart intelligence to users while significantly enhancing the capabilities and reach of Bitcoin Magazine Pro.

“I’m thrilled to partner with the Bitcoin Magazine team, whom I’ve long admired, to build on the success that Look Into Bitcoin has achieved since its launch in 2019,” said Philip Swift, Founder and CEO of Look Into Bitcoin and now Managing Director of Bitcoin Magazine Pro. “Bitcoin Magazine Pro now goes beyond news information to provide all the relevant tools you need for Bitcoin investing: on-chain charts, macro data, bespoke chart alerts, and Tradingview scripts for real-time analysis that, when combined, give our users a huge edge in the market. Together, we’re ready to create incredible value for the Bitcoin Magazine Pro community.”

Prior to this partnership, Bitcoin Magazine Pro was the leading top-ranked Bitcoin-only newsletter on the Substack platform, publishing in-depth research on Bitcoin and traditional financial markets. This new partnership will significantly elevate the user experience by providing a comprehensive suite of Bitcoin on-chain and macro charts, advanced charting tools, and market-leading analysis.

The Bitcoin Magazine Pro platform now offers a wide range of features and services, including:

- Real-time Bitcoin charts and data: Stay updated with the latest market trends and movements.

- Advanced charting tools: Analyze the market with sophisticated charting tools.

- In-depth market analysis: Gain insights from regular expert videos and reports.

- Educational resources: Access a wealth of information on Bitcoin and blockchain technology.

- Customizable chart alerts and notifications: Set up alerts so you never miss a thing!

Mark Mason, International Publisher at Bitcoin Magazine, also commented on the partnership, stating, “It’s been an absolute delight to partner with Philip. As Bitcoin achieves more mainstream adoption and recognition, the need for real-time data insights and cutting-edge market intelligence analysis becomes more critical. This partnership will be integrated to support and complement all existing and future distribution channels, implementing Bitcoin Magazine Pro charts and data across our online, print, social, video, and events channels.”

To celebrate the launch of this partnership, users can receive a free 30-day trial of the new and improved Bitcoin Magazine Pro platform for a limited time. This trial provides full access to all the features and services, allowing users to experience the enhanced platform firsthand.

“This partnership will enable millions of people worldwide to make informed, data-driven decisions about Bitcoin,” Swift continued. “Stay tuned – the future of Bitcoin analysis just got brighter!”

For more information and to start your free trial, visit the Bitcoin Magazine Pro website here.

Source link

You may like

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

analysis

Will December Surpass November’s Record-Breaking Bitcoin Price Increase?

Published

3 weeks agoon

November 29, 2024By

admin

Bitcoin is closing out one of its most remarkable months in history, surging over $30,000 in November and marking a renewed bullish sentiment in the market. As we look ahead to December and beyond, investors are eager to understand whether Bitcoin’s momentum can sustain itself into 2025. With macroeconomic conditions, historical trends, and on-chain data aligning in Bitcoin’s favor, let’s analyze what’s happening and what it could mean for the future.

November’s Record-Breaking Performance

November 2024 wasn’t just any month for Bitcoin; it was historic. Bitcoin’s price rose from around $67,000 to nearly $100,000, an approximate 50% peak-to-trough increase, making it the best-performing month ever in terms of dollar increase. This rally rewarded long-term holders who endured months of consolidation after Bitcoin’s all-time high of $74,000 earlier in the year.

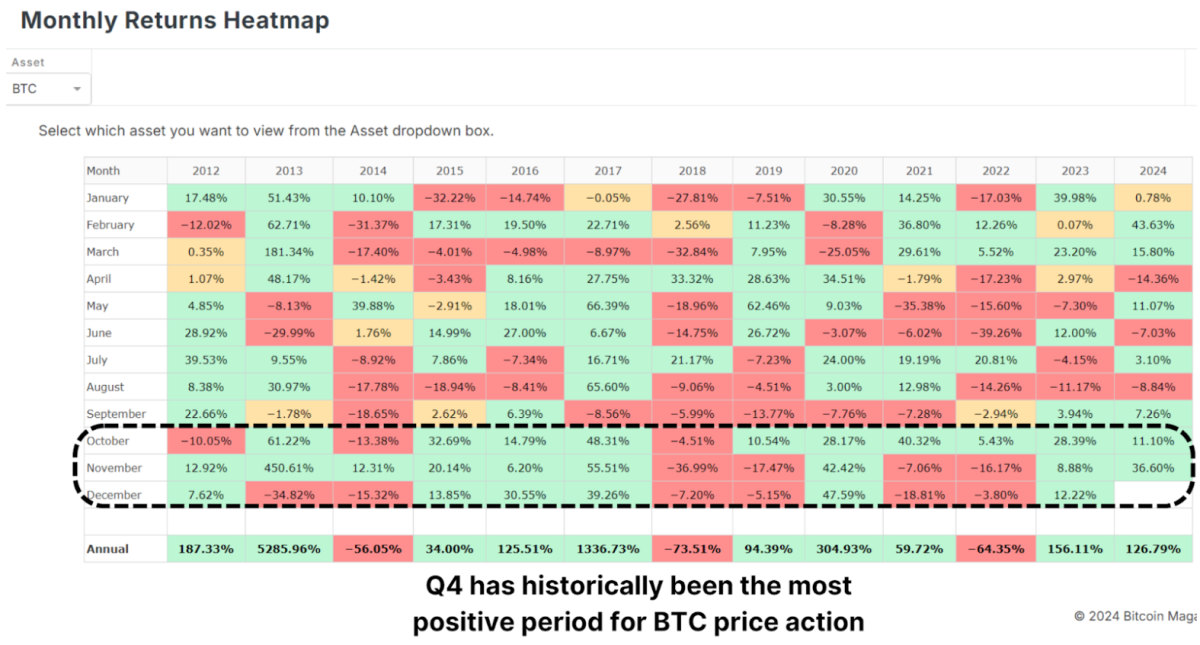

Historically, Q4 is Bitcoin’s strongest quarter, and November has often been a standout month. December, which has also performed well in past bull cycles, presents a promising outlook. But as with any rally, some short-term cooling might be expected.

The Role of the Dollar and Global Liquidity

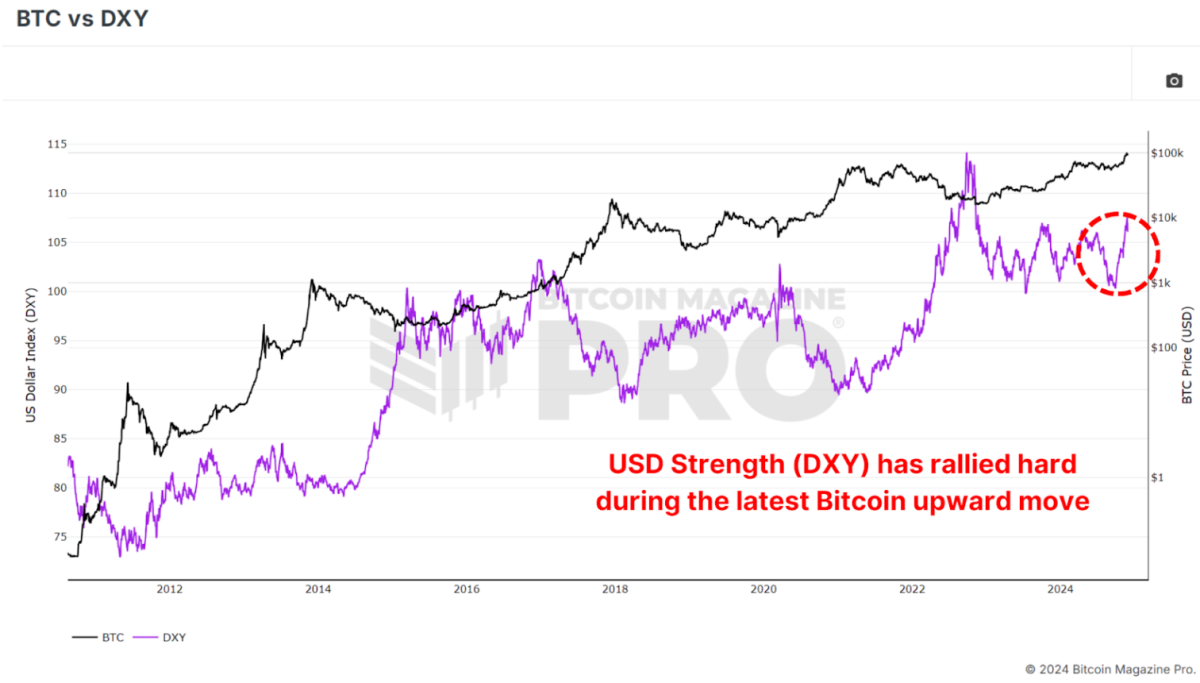

Interestingly, Bitcoin’s rise occurred against the backdrop of a strengthening U.S. Dollar Strength Index (DXY), a scenario that typically sees Bitcoin underperforming. Historically, Bitcoin and the DXY have maintained an inverse relationship: when the dollar strengthens, Bitcoin weakens, and vice versa.

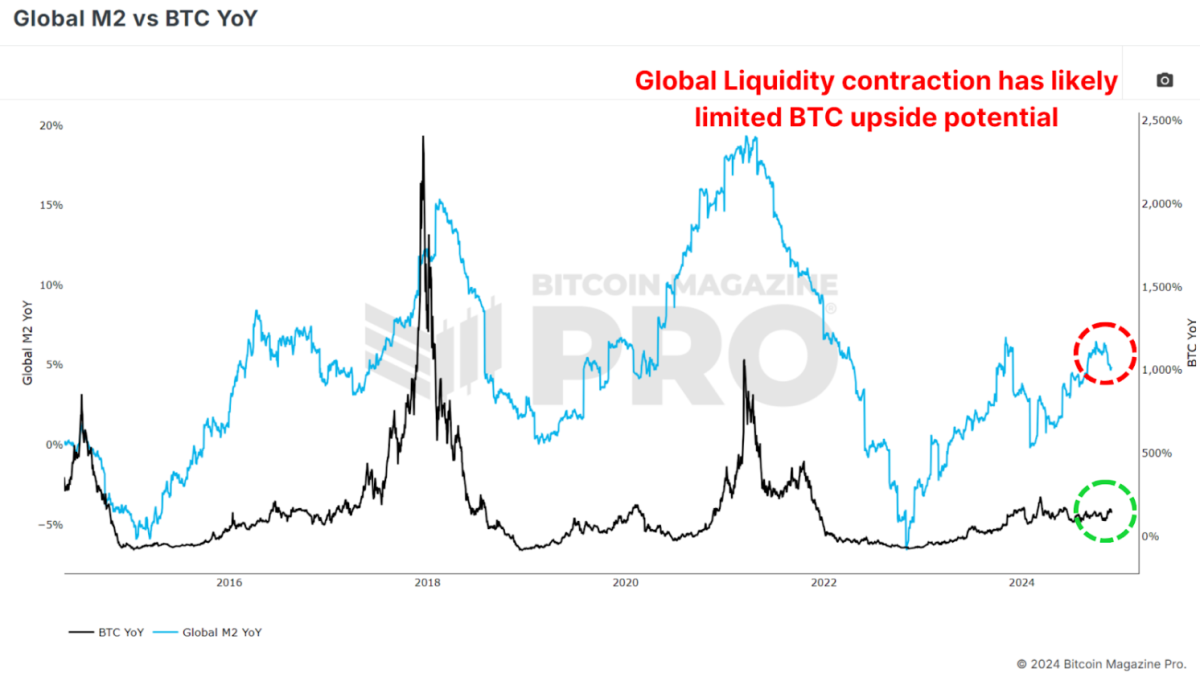

Similarly, the Global M2 money supply, another key metric, has shown a slight contraction recently. Bitcoin has historically correlated positively with global liquidity; thus, its current performance defies expectations. If liquidity conditions improve in the coming months, this could act as a powerful tailwind for Bitcoin’s price.

Parallels to Past Bull Cycles

Bitcoin’s current trajectory is strikingly similar to past bull markets, particularly the 2016–2017 cycle. That cycle began with gradual price increases before breaking key resistance levels and entering an exponential growth phase.

In 2017, Bitcoin’s price broke out from a key technical level of around $1,000, leading to a parabolic rally that peaked at $20,000, a 20x increase. Similarly, the 2020-2021 cycle saw Bitcoin rise from $20,000 to nearly $70,000 after breaking above the crucial YoY Performance threshold.

If Bitcoin can break out decisively from this historic level and above the key $100,000 resistance, we may witness a repeat of these explosive price movements as BTC enters its exponential phase of bullish price action.

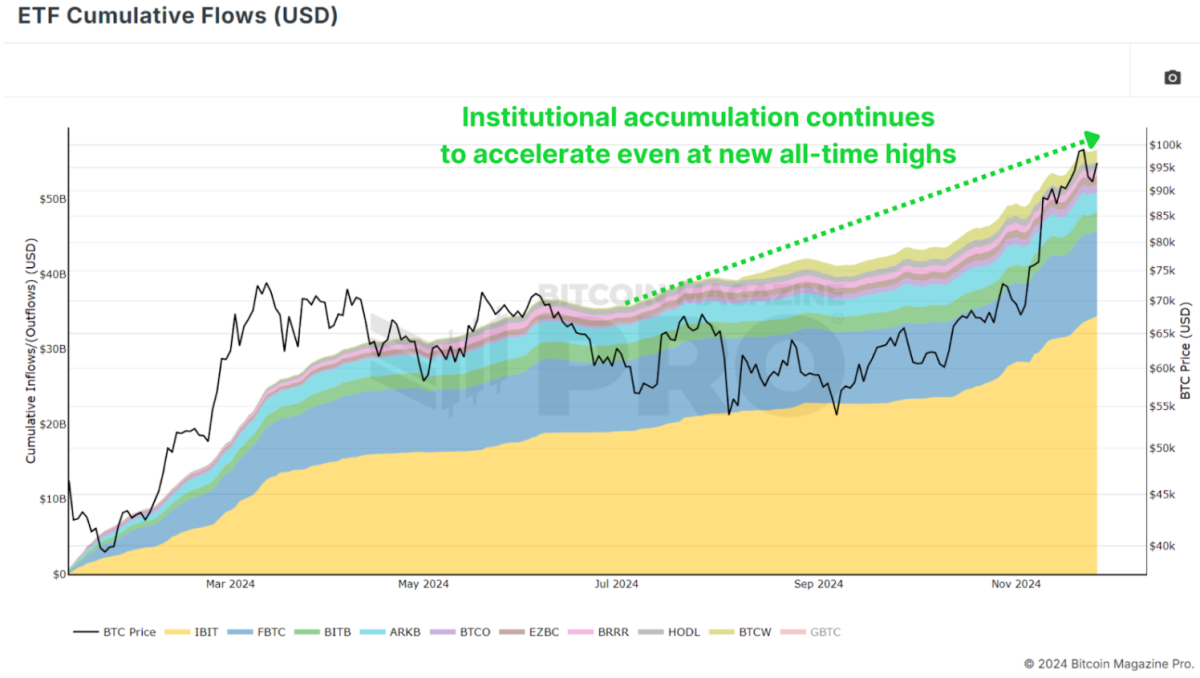

Institutional Adoption and Accumulation

A key factor underpinning Bitcoin’s strength is the continued accumulation by institutions. Bitcoin ETFs are adding billions of dollars worth of BTC to their holdings, and corporations like MicroStrategy have doubled down on their Bitcoin strategy, now holding close to 400,000 BTC. Even with BTC rallying to new all-time highs, ‘smart money’ is scrambling to accumulate as much as possible to ensure they’re not left behind.

This institutional demand indicates growing confidence in Bitcoin as a long-term store of value, even in volatile market conditions. Such accumulation also tightens the available supply, creating upward pressure on prices as demand increases.

Conclusion

While December has historically been a strong month for Bitcoin, short-term volatility could temper gains as the market digests November’s sharp rally. Although given the aggressive accumulation we’re witnessing from institutional participants anything is possible.

Longer-term, however, the outlook remains exceptionally bullish. The obvious level to watch is $100,000 as the next major milestone, which, if breached, could pave the way for a much larger rally in 2025. Bitcoin is entering one of its most exciting phases yet, with the stars seemingly aligning across macroeconomic, technical, and on-chain metrics.

For a more in-depth look into this topic, check out a recent YouTube video here: The BIGGEST Bitcoin Month EVER – So What Happens Next?

🎁 Black Friday: Our Biggest Ever Sale

The BEST saving of the year is here. Get 40% Off all our annual plans.

- Unlock +100 Bitcoin charts.

- Access Indicator alerts – so you never miss a thing.

- Private TradingView indicators of your favorite Bitcoin charts.

- Members-only Reports and Insights.

- Many new charts and features coming soon.

All for just $15/month with the Black Friday deal. This is our biggest sale all year.

UPGRADE YOUR BITCOIN INVESTING NOW

Don’t miss out! 👉 https://www.bitcoinmagazinepro.com/subscribe/

Source link

analysis

Bitcoin (BTC) Price and Hashrate Divergence May Set the Scene for a Potential Rally, Historical Data Shows

Published

3 months agoon

September 22, 2024By

admin

Consistent with this pattern, bitcoin has already shown signs of recovery, gaining about $9,000 since the local bottom on Sept. 6, representing a 15% increase in value. This divergence between bitcoin’s (BTC) price and its hash rate started to shape up in July and then persisted into early September, when the computing power of the network reached an all-time high of 693 exahashes per second (EH/s) on a seven-day moving average, while bitcoin’s price was near $54,000.

Source link

Altcoins

Altcoins Outperform Bitcoin (BTC) and Ether ((ETH) Following Fed Meeting Due to Poor Liquidity, Higher Beta

Published

3 months agoon

September 21, 2024By

admin

Total3, an index that tracks the market capitalization of the top 125 cryptocurrencies, excluding bitcoin and ether (ETH), was trading 5.68% higher since the central bank’s announcement that it would slash the Federal Funds rate by 50 basis points, according to data on TradingView. Bitcoin’s market cap, by contrast, rose only 4.4%.

Source link

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential