business

Bitcoin Miners Are Still Buying New Hardware Despite Headwinds—Here’s Why

Published

3 months agoon

By

admin

In the midst of shrinking revenues and rising operational costs, industry experts tell Decrypt that Bitcoin miners are continuing to invest in new, specialized hardware, displaying strong confidence in the future of the leading crypto network despite short-term struggles.

According to a Glassnode report released this week, Bitcoin’s hash rate—an essential measure of mining activity—remains near all-time highs, just 1% shy, even though revenues have plummeted.

The mining industry is currently facing a double challenge: increasing mining difficulty and declining transaction fee revenue. As the hash rate rises, so does the difficulty of mining and earning a BTC block reward, thus pushing production costs higher.

This, combined with cooling demand for high-fee transactions like those from Runes tokens and the NFT-like Ordinals, has squeezed miners’ profitability in recent months. Still, miners continue to invest in new ASIC hardware, in part due to the need to stay competitive in an environment where older machines are rapidly becoming obsolete.

One major factor driving this trend is improved energy efficiency in modern ASIC equipment, which helps miners manage operating costs.

Speaking with Decrypt, Illia Otychenko, lead analyst at crypto exchange CEX.IO, said that the energy efficiency of dedicated Bitcoin mining hardware “more than doubled” from 2018 to 2023, “significantly reducing the energy consumption per coin produced.”

This advancement allows miners to mitigate rising electricity costs and mining difficulty, keeping profitability intact even amid unfavorable market conditions.

While the price of Bitcoin remains relatively strong, transaction fee pressure has eased, further squeezing miners’ profits. With transaction fee revenue now a small fraction of what it once was, miners are leaning more heavily on block subsidies to sustain operations.

Interestingly, miners are now shifting their strategies in response to this revenue squeeze.

Historically, they sold the bulk of their mined Bitcoin to cover operational costs, but the report highlights that many are now retaining a portion of their mined supply in treasury reserves. Marathon Digital, for example, announced in July that it would adopt a “full HODL” strategy, saying it would no longer sell mined BTC. In fact, it has bought more from the market, as well.

Jeffrey Hu, head of investment research at HashKey Capital, sees this as a sign of confidence in Bitcoin’s long-term value.

“Miners retaining a portion of their mined supply suggests they are banking on future price appreciation,” Hu told Decrypt. “It’s a sign of confidence and could reduce selling pressure in the market, potentially supporting prices.”

However, Hu also cautions that this strategy comes with risks, particularly if miners are forced to sell reserves during downturns, which could exacerbate sell pressure.

Ryan Lee, chief analyst at Bitget Research, attributed the reasons behind the rising hash rate partly to the reintroduction of older mining rigs, which are becoming profitable again with Bitcoin’s price gains over the past year.

“Older machines are being brought back into operation as Bitcoin’s price makes previously unprofitable hardware viable. This, combined with new investments in more efficient machines, is driving the total hash rate higher,” says Lee.

He also points to recent regulatory support in regions like Russia, along with positive signals from figures like former President Donald Trump, who has come out in support of Bitcoin and the crypto industry amid his latest run to return to the White House. Such shifts have bolstered the hash rate by reducing market uncertainty, Hu noted.

While these factors help offset some of the revenue challenges, experts agree that miners need to explore alternative revenue streams to ensure long-term profitability. When Decrypt surveyed the mining landscape at Bitcoin 2024 in July, there was a sense that firms were weathering an “identity crisis” of sorts—but it’s one that could ultimately help them in the long run.

Livepeer co-founder and CEO Doug Petkanics suggested that Bitcoin miners are well-positioned to diversify into AI computing, which demands vast amounts of compute power.

“The demand for AI compute power is growing exponentially. With their existing energy and cooling infrastructure, miners could tap into this market by adding GPUs and providing a new revenue stream,” said Petkanics.

Diversification could be key to surviving the increasingly competitive landscape of the mining industry. Firms like Core Scientific and Bitdeer are among those who are providing computing power for AI needs to shore up potential shortcomings with their Bitcoin business.

Otychenko predicts further consolidation, with capital-rich miners outlasting smaller operations.

CleanSpark’s acquisition of GRIID for $155 million in June this year, is a prime example, boosting its hosting capacity as part of its growth strategy. Similarly, Bitfarms recently acquired Stronghold Digital Mining, while Riot Platforms has acquired a 19% stake in Bitfarms to influence its direction.

Companies like Marathon Digital also see future acquisition opportunities to secure low-cost energy and scalable infrastructure.

“We may see further mergers and acquisitions as larger miners absorb struggling competitors to expand their market share,” he notes. For those unable to adapt, the rising operational costs may prove unsustainable, leading to a shake-up in the industry.

Hu also points to the possibility of new financing products designed to protect miners from market volatility, as well as innovative ways for mining pools to generate additional revenue, such as merged mining for new layer-2 solutions on Bitcoin.

“The mining industry might also grow in regions like the Middle East, where natural resources and a rapidly growing crypto business present new opportunities,” he adds.

However, even with diversification, miners’ profitability remains heavily reliant on block rewards, which currently account for over 90% of their revenue.

“Transaction fees only become significant during fee spikes, as we saw with Runes and Ordinals, but such events are temporary,” Otychenko said. “Block rewards are still the main revenue driver.”

Lee echoed this sentiment, warning that miners will eventually need to rely more on transaction fees as block rewards diminish with each halving cycle. He predicted that Bitcoin’s price could surge during the next bull cycle, potentially reaching $150,000.

This would attract more retail participation in mining, as smaller players enter the market by purchasing older, more affordable machines.

“While larger miners may shift toward asset management,” Lee said, “retail miners could generate consistent cash flow if Bitcoin’s price continues to rise.”

Edited by Andrew Hayward and Ryan Ozawa

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

business

Foundation Introduces Passport Prime: Bitcoin Wallet And Data Security Device

Published

4 days agoon

December 20, 2024By

admin

On Wednesday, December 19, 2024, Foundation announced the release of its newest device, the Passport Prime.

Introducing Passport Prime – Your Personal Security Platform!

We’re thrilled to present Passport Prime, the world’s first personal security platform designed to secure your Bitcoin and your entire digital life.

Think: A Swiss Army Knife for your online security. pic.twitter.com/3HH2eG7vhU

— FOUNDATION (@FOUNDATIONdvcs) December 18, 2024

The device offers a broad range of features that not only help users secure the keys to their bitcoin but other digital information, as well.

Features

For starters, the Passport Prime offers the same bitcoin wallet capabilities as the company’s second generation Passport device, including multisig functionality and temporary seed phrases.

Beyond Bitcoin-related security, the Passport Prime also helps you to store other sensitive digital data.

Its 2FA Codes app lets users store 2FA codes offline, while its Security Keys app serves as a replacement for Yubikeys and allows users to create multiple security keys for use with NFC or USB.

What is more, the device offers an encrypted flash drive. Users can store up to 50 GB of data on the device. And as a means to keep your data private, the Airlock feature in the File Browser app lets users only access selected files when the device is plugged into a phone or computer.

The device also has its own custom operating system — KeyOS — which enables apps to run in their own sandboxes while the OS manages permissions.

Pushing The Hardware Wallet Industry Forward

Earlier this year, Foundation’s co-founder and CEO told Bitcoin Magazine he was looking to create the iPhone of Bitcoin hardware. The Passport Prime is the closest Foundation has come to this ideal yet.

“The hardware wallet industry has been coasting for years, failing to deliver any meaningful innovation and unable to respond to digital assets’ rapidly evolving utility and use cases,” said Zach Herbert, co-founder and CEO of Foundation in a press release.

“Wallets have become crypto’s weakest link: they are difficult to onboard to, complex to use, and increasingly insecure for a range of modern blockchain transactions,” he added.

“Passport Prime is the first device of its kind, a Personal Security Platform that’s fit for the future decentralized economy, making it simple to safeguard all your private keys in one offline device, and sign every kind of transaction or contract with complete peace of mind.”

Third-Party Apps Welcome

By approximately mid-2025, developers will be able to build third-party apps that will run on KeyOS. In other words, developers will be able to list their own apps in Foundation’s App Catalogue.

The first of these third-party apps will be produced by Cake Wallet and will enable users to more privately transact using Bitcoin, Monero and other cryptocurrencies.

Dynamic, Yet Simple and Secure

Foundation claims that setting up and using the Passport Prime will be easy, despite its various functionalities.

Users can set the device up using Envoy, Foundation’s native app that provides guidance for the set up process and that connects to the device via QuantamLink Bluetooth.

QuantamLink Bluetooth is enabled by a dedicated Bluetooth chip embedded in the Passport Prime that can only send and receive messages that are already encrypted using quantum-resistance technology.

Users can also back up their seed via a 2-of-3 Shamir Secret Sharing configuration splits the seed into three pieces — two stored on physical cards and one stored in the Envoy mobile app.

Details

The device will retail for $299 and ship by Q2 2025.

The device comes in two different colors — Arctic Copper and Midnight Bronze — and it’s both completely open-source and manufactured in the United States.

Learn more about the product here.

Source link

Bitcoin

Human Rights Foundation Donates 700,000,000 Satoshis To Fund Bitcoin Development And Projects

Published

4 days agoon

December 19, 2024By

admin

Today, the Human Rights Foundation (HRF) announced its most recent round of Bitcoin Development Fund grants, in a press release sent to Bitcoin Magazine.

700,000,000 satoshis (7 BTC) currently worth $706,000 at the time of writing, is being granted across 20 different projects around the world focusing on technical education for people living under authoritarian regimes, independent media outlets, decentralizing mining, and providing human rights groups with more private financial solutions — with a main areas of focus for these grants center around countries and regions in Latin America, Asia, and Africa.

While the HRF did not disclose how much money each project is receiving specifically, the following 20 projects are the recipients of today’s round of grants worth 7 BTC:

Stratum V2 Reference Implementation (SRI), an open-source software that decentralizes Bitcoin mining by enabling nodes to construct their own block templates. This helps promote solo mining, reduces reliance on large mining pools, and strengthens Bitcoin’s permissionless and censorship-resistant qualities. Funding will support developer bit-aloo’s full-time work on SRI, including benchmarking tools to evaluate the performance of Stratum V2, integration tests, codebase maintenance, and software documentation.

Public Pool, a free and open-source mining pool optimized for low hash rate devices (a mining device with limited computational power). Users can self-host a Stratum server and select their own block templates without relying on a third party. By making Bitcoin mining more accessible and decentralized, Public Pool strengthens the Bitcoin network. Funding will support hosting costs, hardware upgrades, and operational expenses.

Naiyoma, the first female Bitcoin Core developer from Africa. Hailing from Kenya, she is dedicated to fostering an open financial system rooted in transparency, freedom, and fairness. Her work focuses on reviewing pull requests (PRs), addressing bugs through new PRs, and improving Bitcoin Core’s codebase. Funds will support her full-time contributions to advancing Bitcoin Core.

Daniela Brozzoni, an experienced software developer. Previously, she contributed to the Bitcoin Development Kit (BDK), a software library that allows you to build cross-platform Bitcoin wallets. She is now shifting her focus to Bitcoin Core, where her work will be reviewing key pull requests (PRs), contributing to new features, and improving testing coverage. Through her efforts, Daniela aims to enhance Bitcoin’s decentralization, privacy, and resilience. This grant will support her full-time contributions to Bitcoin Core.

UX/UI Design for Bitcoin Core, redesign work by product designer Michael Haase that aims to bring the Bitcoin Core App to mobile devices (making it accessible beyond desktop use). This update will enable users to run nodes, access essential wallet features (such as Silent Payments and multisignature) directly on their phones, and improve their financial privacy. Funding will support the project’s design and development.

No BS Bitcoin, a newsdesk delivering the latest Bitcoin news and updates on open-source technologies in a clear and accessible format. Free from ads, tracking and paywalls, the platform consistently highlights privacy and freedom technologies essential for activists and citizens under authoritarian regimes. Funding will ensure the site’s continued operation, enable the hiring of an additional editor, and support the introduction of Nostr features (like Zaps and comments) to foster greater community engagement.

Tando, a new payment application co-founded by Sabina Gitau, empowering 54 million Kenyans to have the option to use Bitcoin for everyday transactions. By integrating with M-PESA, Kenya’s leading mobile payments system, Tando allows users to pay in Bitcoin via a Lightning wallet, while merchants receive Kenyan Shillings. The platform is KYC-free and has no fees, offering an affordable and private payment solution. Funds will help boost Tando’s liquidity, support a growing user base, and drive expansion across the African continent.

YakiHonne, a client for the decentralized Nostr protocol built by a team in East and Southeast Asia. It was developed by Wendy Ding to support free speech and promote Bitcoin payments across 170 countries. With innovative functionality and a blend of online and offline events, YakiHonne seeks to drive the adoption of decentralized social media. Funding will support smart widget development, relay network improvements, and influencer engagement to expand Nostr’s reach and impact.

SeedSigner Multi-language Support, a translation project by developer Ace to integrate multi-language functionality into the fully customizable, open-source SeedSigner hardware wallet. This will enhance accessibility for users worldwide and empower marginalized communities to achieve financial sovereignty through inexpensive and accessible self-custody. Funding will support the developer’s efforts to deliver a multi-language version of SeedSigner within the next year.

Vexl, a peer-to-peer Bitcoin trading application founded by Lea Petrasova to provide users with a private and Know-Your-Customer (KYC) free Bitcoin experience. By connecting users through their phone contacts, Vexl enables secure, direct Bitcoin transactions in a peer-to-peer manner. The app aims to make private Bitcoin usage more accessible while offering critical protection against authoritarian regimes. Funding will support Vexl’s growth, focusing on reaching African communities and driving improvements to its backend infrastructure.

Tomatech, a community focused on building a team of developers in India to advance Bitcoin infrastructure and Free and Open Source Software (FOSS) projects. By offering mentorship and training, it bridges the gap between education and practical experience. Additionally, its Goa-based cultural center and community space will foster a vibrant Bitcoin community through meetups, workshops, and residencies. Funding will support developer training, the creation of a developer hub, bounties and grants, and general operations.

Krux, open-source software that turns generic devices into hardware wallets for secure Bitcoin self-custody and transactions. It features air-gapped operations, key management and backups, an intuitive interface, and support for 10 languages. This project can help decentralize Bitcoin custody and safeguard freedom and property rights in authoritarian regimes. Funding will help developer Odudex further advance this innovative open-source project.

Iris, a Nostr web client created by developer Martti Malmi designed to make private and secure messaging simpler and safer. Using the MIT-licensed nostr-double ratchet library, it aims to improve protection for metadata and message content, ensuring conversations remain private—especially in surveillant environments. Funding will support hiring a developer to expand Iris’s features and functionality.

African UX Bitcoin Bootcamp, a program that empowers talented Bitcoin UX designers from authoritarian countries with the opportunity to attend the Africa Bitcoin Conference (ABC) for hands-on training and networking. Led by Bitcoin Design Foundation’s co-founder, Mogashni Naidoo, participants will receive on-ground training and test the usability of their products at ABC. Funds will cover the program expenses, including flights, accommodations, and logistics, ensuring accessibility for all participants.

Bitcoin History, a research project by Pete Rizzo dedicated to documenting and preserving key people, events, and materials (ie. photographs, videos, links, information) that shaped Bitcoin’s rise as a global monetary and human rights force. Focused on “the history of the future of money,” the project highlights Bitcoin’s role as a tool for financial freedom. The grant will support an additional researcher to investigate and document stories of Bitcoin’s use against authoritarian regimes.

Cashu-ts, the primary Software Development Kit (SDK) in the Cashu ecosystem developed by Gandlaf21. It simplifies wallet creation, integrates the latest protocol updates, and powers popular wallets (like Minibits, eNuts, and Nutstash). By enabling the development of secure, privacy-focused “digital cash” wallets, Cashu-ts plays a vital role in advancing the Cashu ecosystem and financial privacy. This grant will support the developers in maintaining and improving this essential library.

Unify, a Payjoin wallet developed by Fontaine to enhance privacy in Bitcoin transactions. Built using Nostr and Bitcoin Core, it leverages Payjoins to obscure transaction histories by enabling multiple parties to make collaborative payments (making Bitcoin inherently more private). This functionality is especially crucial for individuals navigating repressive regimes. Funding will support the developer’s full-time contributions, advancing Unify’s features and expanding its compatibility with other wallets.

The Financial Freedom Policy Coalition, a policy coalition founded by Venezuelan activist, Jorge Jraissati, brings together youth leaders, policymakers, and industry experts to promote economic opportunities for people living under authoritarian regimes. The coalition plans advocacy missions to educate policymakers on how Bitcoin can support human rights and create social benefits. Funds will cover the costs of organizing and running these missions.

Jon Atack, a Bitcoin Core contributor and Bitcoin Improvement Proposal (BIP) editor, recognized as one of the top all-time contributors to Bitcoin Core. As a dedicated developer, he plays a pivotal role in enhancing Bitcoin’s decentralization and robustness. Atack is also a staunch advocate for using Bitcoin and open-source software as tools to resist tyranny and advance global human rights. This grant will empower him to continue his vital contributions to Bitcoin development.

Brink, an organization committed to strengthening the Bitcoin protocol through research and development. Co-founded by Mike Schmidt, Brink supports Bitcoin protocol engineers with grants and offers training and mentorship to onboard new contributors to open-source development. This grant will cover operational expenses, ensuring continued support for open-source developers and the advancement of Bitcoin’s core infrastructure.

The HRF is a nonpartisan, nonprofit 501(c)(3) organization that promotes and protects human rights globally, with a focus on closed societies. The HRF continues to raise support for the Bitcoin Development Fund, and interested donors can find more info on how to donate here. Applications for grant support by the HRF can be submitted here.

Source link

Africa

Gridless Is Mining Bitcoin While Fostering Human Flourishing In Africa

Published

5 days agoon

December 18, 2024By

admin

Company Name: Gridless

Founders: Janet Maingi, Erik Hersman and Philip Walton

Date Founded: August 2022

Location of Headquarters: United States | Operations in Kenya, Malawi and Zambia

Number of Employees: 10

Website: https://gridlesscompute.com/

Public or Private? Private

Gridless doesn’t just mine bitcoin — it helps to facilitate the electrification of rural Africa, which is notably improving the lives of those who previously either didn’t have access to power or couldn’t afford it.

Gridless’ co-founder Janet Maingi explained to Bitcoin Magazine how the company’s facilities, which are based in Kenya, Malawi and Zambia, have a win-win-win effect for the company itself, the Bitcoin network and the communities that benefit from Gridless’ operations.

“Our mission is to mine Bitcoin profitably,” Maingi told Bitcoin Magazine. “But as we do this, we also do two other things: we push electrification out to the edge in Africa and we decentralize the Bitcoin network, which has historically been very centralized to North America and China.”

In just over two years, Gridless has set a new standard for the type of impact a Bitcoin mining company can have, showing the world that Bitcoin mining can have a symbiotic relationship with the communities it touches and that it can be a catalyst for human flourishing.

I sat down with Maingi in person in Kenya after this year’s Africa Bitcoin Conference to discuss the work she does and the impact it has on the communities it reaches.

A transcript of our conversation, edited for length and clarity, follows below.

Frank Corva: How does Gridless help to electrify Africa?

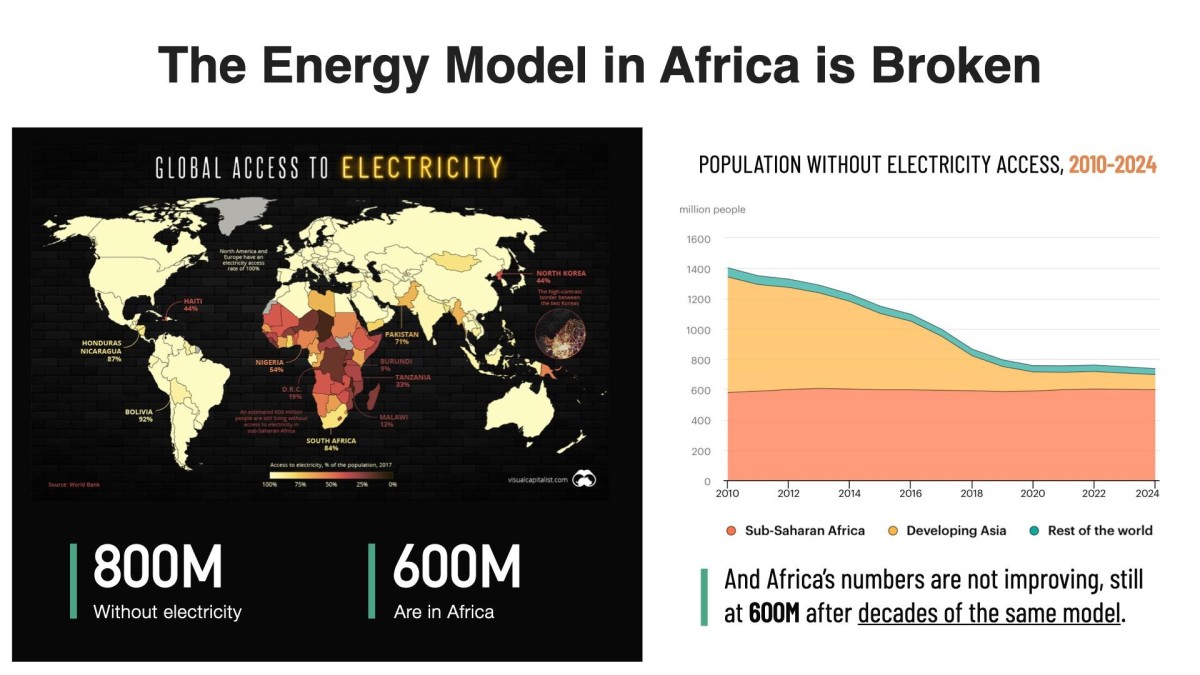

Janet Maingi: About 600 million Africans have no access to electricity. That’s about two-thirds of our population. The private sector has stepped in because the main grids do not reach everyone on the continent.

You’ll find that bigger cities like Nairobi or Mombasa have electricity, but if you go to rural Africa, people have no access to electricity because of distribution challenges.

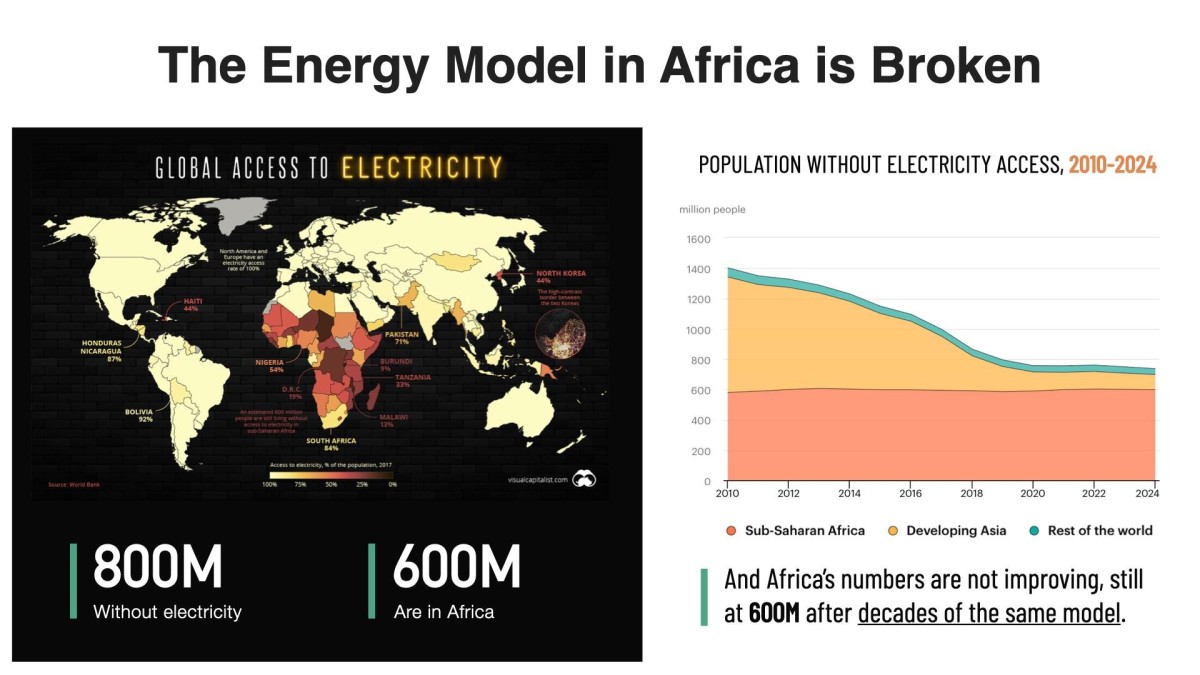

So, the private sector came and started setting up mini-grids. Private companies have done the best they can with these mini-grids. However, they’re very capital intensive, and so there are struggles with fundraising. And even when you actually get them set up, the consumers around your area might not be very wealthy. They’re just living day-to-day. They may have to consider “Do I need electricity or do I need food?”

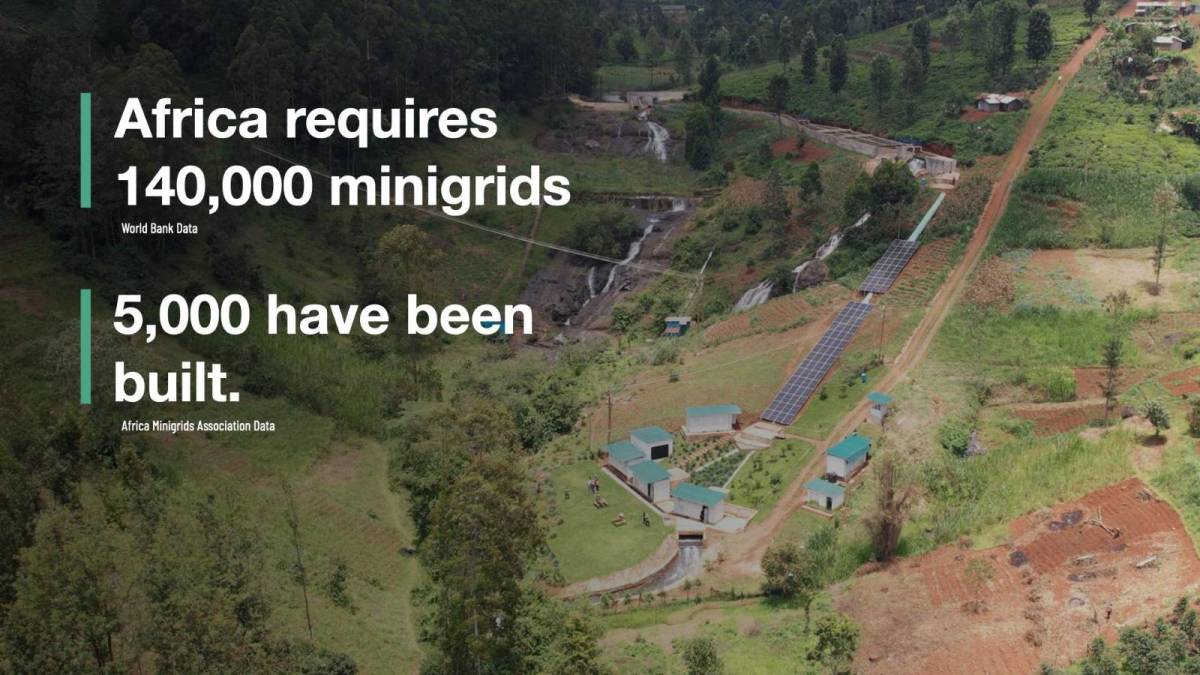

The companies that construct the mini-grids build power plants that use hydro energy. Let’s say they want to build one that produces one megawatt of energy, but the community only ends up using 200 kilowatts. There’s 800 kilowatts that they generated from the river, but for that 800 kilowatts, they get zero shillings, zero dollars, zero anything.

So, we at Gridless come in and say “That electricity that you’re not able to send to anyone, is what we want.” That’s what you call stranded power or wasted energy, and it’s what we want. So, we become your buyer of last resort.

We come and create an agreement to use that extra electricity, and from a revenue sharing perspective, we work together. It’s a win-win situation. Our data centers use that electricity to mine bitcoin.

But then the catalyzing of electrification comes in. When we’ve used that electricity, it’s become a source of revenue for the energy power plant. They were not making money on that electricity previously, and now they’re profiting from it.

What have we seen as the effect? One, they are able to extend their reach, to distribute electricity further. And secondly, some of them have been able to actually lower their prices. So, consumers who are within their reach but wouldn’t use the electricity because of the cost are suddenly saying, “Hey, hook me up. I can afford to pay for this now.”

Corva: So, in a sense, you’re subsidizing the rate of electricity.

Maingi: Yes, because we come in and use this power, the energy generator is able to give better prices and increase its reach. So, again, what does this mean? More homes getting lit, more small enterprises getting electricity, more factories getting powered and more health centers getting electricity. You can now imagine the upward spiral effect.

However, the challenge is that doing business in Africa is like an extreme sport.

Corva: Why is that?

Maingi: So, let’s start with just getting the equipment. The mining machines come from China, either from Bitmain or MicroBT, or you’ll get them from a company in the U.S., and the process of getting them into Africa can be painful.

We received a batch that came from the U.S. and it took us 60 something days just to get them into the country. This is from putting them on a ship to getting them here. This doesn’t include figuring out the logistics around getting the miners on site and going through pre-shipment inspection to make sure that they meet the Kenyan standards.

It’s a process that takes almost 120 days from start to end. If you’re running a business, and it takes you 120 days to get your product on the ground, it’s painful.

Secondly, these machines are designed to work very well in China or the U.S.

Conditions in Africa are different, though.

Corva: Does this have anything to do with air quality?

Maingi: Air quality, dust, heat. In Kenya, average temperatures range from 20 to 40 degrees Celsius. So, when you power those machines in an environment where the average temperature is 30 degrees Celsius, you can imagine the heat that they have to deal with.

And then there’s dust. When you get a pre-fitted container from China or somewhere, you discover that the designers just focus on inflow and outflow. But we realized we have issues with dust, so we have to put dust filters on the machines.

And then, in 2022, we learned when we set up the first site that, because of the lights on the miners, they attracted bugs. During the rainy season, the bugs could see the lights and flew into the fans and got mashed up — something nobody thought about.

Lastly, the containers initially were going to cost us $100,000 each, which was too much for us to be profitable. The math didn’t math, as we say. So, we sat down and designed our own container.

Corva: Amazing.

Maingi: Right? And that’s what we’ve been deploying at a quarter of the price. And then the advantage that came with being made in Kenya has allowed us to get passage through the COMESA (Common Market for Eastern and Southern Africa) region, without having to pay extra duties or taxes because it’s recognized as a COMESA product.

That also helped because, being made in Kenya, it’s very easy for us to move the containers around the COMESA region without having to pay extra taxes. We get a tax exemption. Even if the containers from China made sense, if we brought them to Kenya and I had to move them to Uganda, I would have to pay taxes to Uganda, too.

Any country you move foreign products to, you have to pay taxes again. So, it’s been hard, but good solutions have come out of the difficulties.

Have you heard of GAMA, the Green Africa Mining Alliance?

Corva: Yes.

Maingi: During the first Africa Bitcoin Mining Summit last year, we released a blueprint of the container we designed. So, anyone who wants to use it to build their own container using our blueprint can feel free to do so.

Where you need our support, we’ll be ready to guide you. That’s the whole thing about GAMA — How do we exploit our synergies? How do we benefit from one another? How do we find a young lady who wants to start mining and walk her through the journey of getting started?

Corva: Incredible. I want to go back to electrification in Africa. You mentioned earlier that you wanted to share some numbers.

Maingi: What I was saying is that there’s a ripple effect when we partner with the energy generator. We’ve been able to see more homes or households getting connections.

If you’ve been in rural Kenya or Africa, then you understand how one bulb can transform a life. I’ll use the example of children coming home from school. They have assignments and use these tiny paraffin lamps to study. The fumes from them are horrible for their health. But this is a child for whom there’s no plan B. The teacher expects this child to come back to school with her assignments completed. Not having electricity is not an excuse.

A guy once told me that sometimes, when his daughter is busy doing an assignment, the paraffin runs out. When the nearest gas station is almost four miles away, who is going to go and look for paraffin at that time? Nobody. Tough luck.

So, the child gets to school and is either in trouble because she didn’t do her assignments or is now lagging behind because now those quote unquote “are yout personal problems.” Because of that one bulb they now have, he was like, “My daughter is performing so well in school.” Then, health wise, all these visits they used to make to the hospital because she was breathing in the paraffin fumes no longer happen.

Corva: It seems you want to make my cry.

Maingi: No, there’s no crying. (Author’s note: This woman doesn’t play.) It’s a reality.

Then, in Zambia, I remember talking to women who were talking about childhood vaccinations. Between zero and three years, there are certain vaccinations recommended by the WHO that your kid needs to get — measles, polio, etc. — but the nearest health center that has them sometimes isn’t close.

So, you do your math, and you’re like, “I can’t afford bus fare to do this.” And so this disease sounds more serious, I’ll get my child the vaccination for that one, while this one I’ll pass on. But really all of them are important for children.

Now, Gridless is coming into Malawi and getting electricity providers to connect more homes in the Bondo area. Health centers are getting powered on, so more vaccines are available in more local health centers.

While before you used to say “Polio sounds serious, I’ll get my child that vaccine, but with measles, I don’t know who has died of that recently, so maybe, I won’t get my child that one,” now more people can get it.

Now, we will have a young generation who, we believe, as we keep doing this, is going to thrive. They’re going to grow. You’ll possibly get rid of childhood mortalities because these rural areas get electrified.

Corva: And bringing energy to these regions also helps support livelihoods I assume.

Maingi: Yes, of course. There’s a tea factory in Muranga, Kenya, which is in the highlands.

We partnered with the energy generator in the area and they were able to give the factory power. Now, their facilities are able to support the tea factory, which has two benefits: tea farmers can bring their tea to the factory, which means it doesn’t spoil on the farms because they can’t get it to point B in time and more employment has also been created just by that tea factory becoming an electrified space.

We keep saying why we know this will make a difference is because energy is a base of human progress.

Corva: There’s no such thing as an energy poor country that’s rich.

Maingi: If you look at the Maslow’s hierarchy of needs, it used to go food, shelter, clothing, but I put energy there. Energy is a basic need. It’s a must have for anybody to actually be allowed to live a decent life. For people to make a decent living, energy has to be in that math.

Corva: Is it true that you’ve recently created software that helps with energy demand response?

Maingi: Yes. We realized that we need to get more proactive in creating real-time demand response. Before, we were either reacting too late or too early to the power available.

Remember we’re the buyer of last resort, so communities come first and small businesses come second. For us to be able to live up to that promise, we had to make sure we weren’t sucking in electricity that was required by somebody else at that time.

So, let me paint a picture. In normal households, people wake up at 6 a.m., so there’s a surge of electricity. At that stage, our software gets a signal and reduces our consumption to meet the demand needed by the grid. Then, at 8 a.m., everybody goes to school and switches off their lights and there’s too much electricity in the grid. That’s when we power more mining machines.

We get the signal, power more machines, suck in the electricity and keep on going until maybe 6 p.m. when people have gotten back home and they need the electricity. Gridless turns down their machines and returns the electricity.

At 10 p.m. they all go to bed, and we power up more machines. This is all done with software we developed internally called Gridless OS. It allows for real-time demand response. It makes it so everybody gets what they need, and it stabilizes the grid.

Corva: Are you setting certain standards with Gridless that others are following in Africa or in other parts of the world?

Maingi: It’s set a trend that people are following. Sometimes you go to conferences and people keep referring to Gridless. That’s when you realize, “My God, this thing is bigger than we thought.” And so you start to understand how this has made a difference, that it doesn’t exist in a vacuum.

At the end of the day, everyone has different ways of mining bitcoin, and there’s a positive impact to the community whichever way you do it. Look at Bigblock Datacenter — Sebastian Gouspillou in the Congo — where they’re using the heat to dry cocoa for chocolate they sell. Think of what that has created for that economy.

Corva: I think Sebastian brought me to tears when I met him, too.

Maingi: What’s exciting for us and other players within this space is that we are the ones who understand our problems, and it’s exciting to see African companies deciding “Not only will I mine bitcoin profitably and decentralize the network, but there’ll be some benefit to our community, as well.”

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential