Bitcoin mining

Bitcoin Mining Shutdown Cause 20% Surge in Electricity Bills

Published

2 months agoon

By

admin

The closure of a Bitcoin mining facility in the Norwegian town of Hadsel has led to a 20% increase in electricity bills for residents. The mine was shut down after the municipality declined to renew its permit due to noise complaints.

Kryptovault operated the mining facility for 20% of local power company Noranett’s revenue. With the loss of its largest customer, Noranett is raising prices for households to compensate.

Locals had complained for years about noise from the mine’s cooling fans. However, due to the closure, residents are now faced with paying several hundred dollars more per year for electricity.

“When such a large individual customer switches off overnight, it has an impact,” said a Noranett manager. The company estimates bills could rise by up to $300 monthly.

While unhappy about the price hikes, Hadsel’s mayor said the municipality must deal with the consequences of losing a major power consumer under the regulations. He said the town will now seek new projects to utilize the excess energy capacity.

The situation highlights how Bitcoin mining can help reduce electricity costs by distributing grid expenses to a larger customer base. Bitcoin mine’s continued operation would have prevented the rate spike for citizens.

The incident has fueled debate in Norway about imposing restrictions on energy-intensive mining. This could force miners to relocate operations abroad and can further lead to an increase in prices for residents.

Source link

You may like

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Bitcoin

Q2 Bitcoin Mining Costs Spike To Nearly $50K

Published

3 weeks agoon

November 4, 2024By

admin

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

analysts

Bitcoin Mining Revenue, Profit Fell in October for a Fourth Consecutive Month: JPMorgan

Published

3 weeks agoon

November 1, 2024By

admin

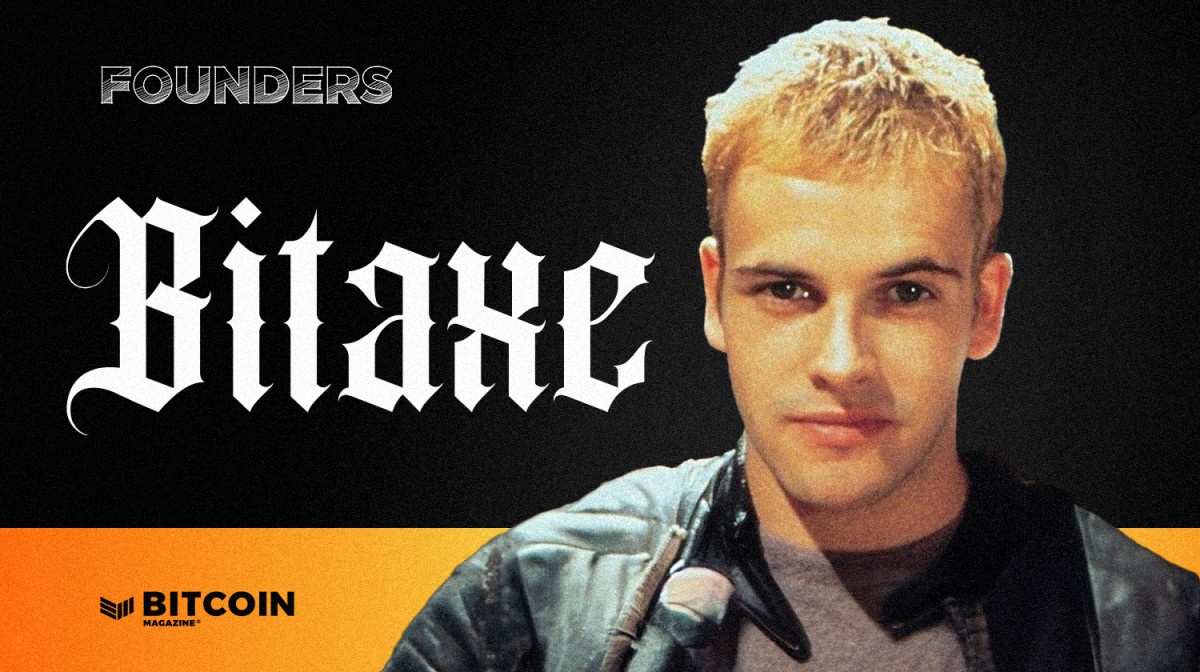

Bitaxe

Bitaxe And The Open-Source Bitcoin Mining Movement

Published

1 month agoon

October 23, 2024By

admin

Company Name: Bitaxe

Founders: Skot

Date Founded: Early 2023

Location of Headquarters: North Carolina + remote team

Amount of Bitcoin Held in Treasury: N/A

Number of Employees: ~12 regular contributors

Website: https://bitaxe.org/

Public or Private? Open-source project (not a company)

Bitaxe’s founder, who goes by the nym Skot, has taken his hobby of tinkering with electronics and not only transformed it into a full-time gig but has catalyzed thousands to follow his lead.

Harnessing his training as electrical engineer and his Bitcoin enthusiasm, Skot began deconstructing Bitmain’s Bitcoin mining machines approximately two years ago. After gaining a better understanding of how they work, he reverse engineered one, creating the blueprint for Bitaxe — the first ever open-source ASIC-based Bitcoin mining machine — in early 2023.

“It was just a technical challenge initially,” Skot told Bitcoin Magazine.

That technical challenge has transformed into something bigger than he ever could have imagined, though. Skot created a low-power and affordable Bitcoin miner that anyone can plug in at home without running up a huge energy bill, while his work also paved the way for others interested in open-source Bitcoin mining to begin contributing to Bitaxe and other open-source mining initiatives like it (and related to it).

“The project has morphed into something that’s bringing mining back to the open source fundamentals of Bitcoin itself,” Skot said.

“I’ve really become convinced that to be truly decentralized, which I think most people understand Bitcoin needs to be, all aspects of the development of Bitcoin needs to be open source,” he added.

“It needs to be open so that anyone who’s even remotely interested can get in.”

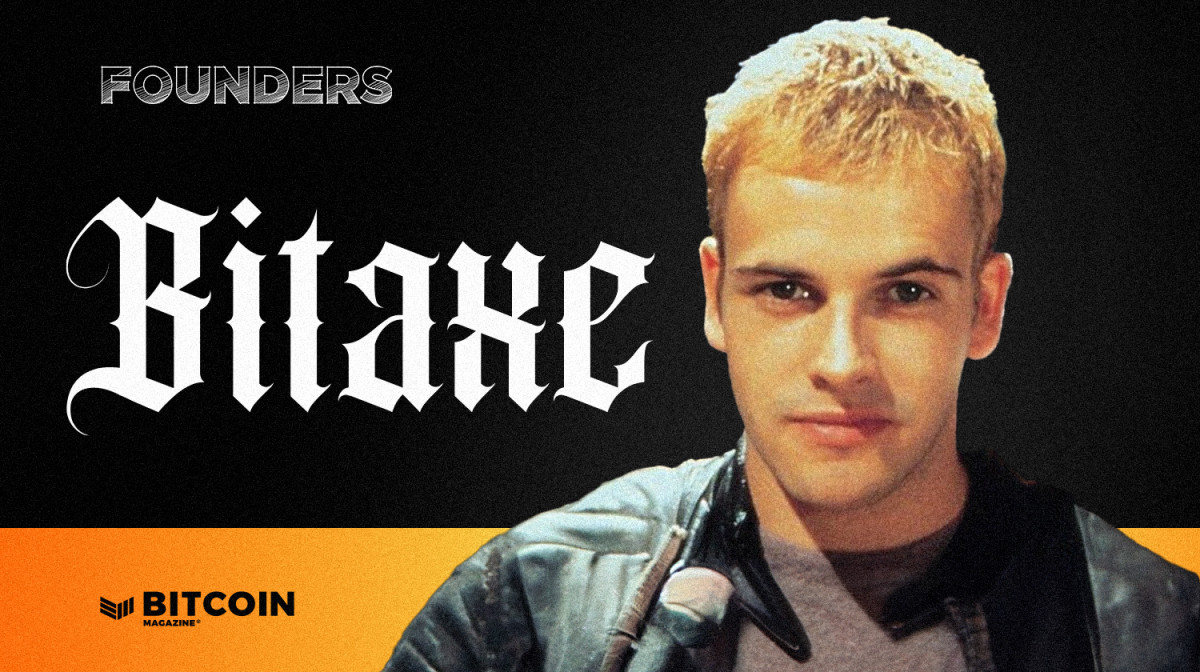

Skot’s Journey To Bitaxe

Years back, while taking liberal arts courses at a community college, Skot stumbled on an issue of Make Magazine, a publication that features tutorials for DIY electronics projects. A switch flipped inside of him as he perused the magazine.

He completed a degree as an electrical engineer and then co-founded a design consultancy for Internet of Things (IOT)-related products, which he ran for 10 years. Skot enjoyed the work, but admitted that the downside was that he was constantly working on other people’s ideas.

In 2011, a friend introduced him to Bitcoin at a party — showing him how to use bitcoin to buy drugs on the now defunct Silk Road. While he was intrigued, it wasn’t enough to get him to buy bitcoin (or drugs) at the time.

Two years later, Skot learned about Bitcoin mining, and, soon after, built his first Bitcoin miner.

“I actually built a FPGA Bitcoin miner,” recalled Skot. “FPGAs were the precursor to ASICs.”

FPGA miners were designed with open-source code, making it easy for Skot to figure out how to construct one.

While he lost all of the bitcoin that he mined in a pool hack, he didn’t become discouraged. In fact, he became more fascinated with this cross section of electronics and the permissionless nature of Bitcoin.

“When I was learning about it, I was like, ‘Well, okay, so these are the rules of how Bitcoin mining works, but who made these rules? Who enforces these rules?’” recounted Skot.

“Learning that no one is at the center of this and no one enforces these rules — or we all do — was mind-blowing. It’s a beautiful thing technically, and that intrigued me,” he added.

A few years later, he dove in deeper and developed the Bitaxe.

What is Bitaxe?

A Bitaxe is technically just open-source code that anyone can use to build a physical mining machine.

Skot has only built about a dozen Bitaxes himself, while thousands have been built and sold. Anyone can build and sell Bitaxe’s under its open-source license.

The circuit board for physical Bitaxes isn’t much bigger than a credit card, while the device’s fan protrudes out about 3 cm from the board. (There are different versions of Bitaxes that vary slightly in size.)

The machine runs on a 5 volt power source and connects to the internet over WiFi. Users interface with Bitaxes via their personal computer or phone. The devices use between 12 and 18 watts of electricity, which is comparable to an iPad charger.

Running a Bitaxe full-time should only increase users’ energy bill by a few dollars per month (this varies based on jurisdiction), and it costs less than what running a Bitcoin node costs to run.

The odds of finding a block with a Bitaxe are infinitesimally low (though, a Bitaxe did find a block this past July), but users can direct the hash power they produce with their Bitaxe to almost any mining pool for smaller payouts.

Ideally, Bitaxes are used to decentralize the hashrate, though this will, in the end, only lead to really meaningful decentralization if mining pool centralization decreases along with it.

“My hope is that by decentralizing the number of brains that are operating these things that enough people will make different decisions,” explained Skot. “If we can exponentially increase the number of different brains and all the crazy ways that they think, I think they will pick different pools.”

Bringing more of these brains in was part of Skot’s motivation creating Bitaxe (which I’ll touch on more in just a moment), while another part of his motivation was simply to bring a new kind of Bitcoin mining machine to market.

Bitaxe vs. Industrial Bitcoin Miners

Most Bitcoin mining equipment is built for the major players in the industry.

“99.9% of the Bitcoin mining hardware that’s out there is designed specifically for being used in an on-grid data center,” said Skot. “They’re all designed to be plugged into the grid and operate full power 24/7 on industrial power.”

Skot explained that while this is great for industrial miners who tend to point their hash power at the big mining pools, it does very little for the Bitcoin enthusiast who wants to contribute to the hashrate.

He also shared that ASIC chips aren’t currently sold independently of Bitmain miners and that it’s difficult to understand how the chips work, because the machines in which they operate are designed with closed-source code.

“We have essentially just one chip maker right now when it really comes down to it — that’s Bitmain,” said Skot.

“They’re really far ahead of the pack, but I don’t think that advantage they have is going to last forever. I think some of these other chip makers will come up,” he added.

While Skot is patiently waiting on the ASIC chip that Jack Dorsey’s Block is developing, which will be able to be used in any mining device, he continues to work on open-sourcing the Bitcoin mining stack so that it’s easier to compete on the ASIC market.

“Let’s open source as much of that stack as we can, because, like we saw with the internet, random people can do cool stuff in their garages that sometimes turns into a market standard,” said Skot.

And he should know, as he created a new standard in Bitcoin mining in his figurative garage with the Bitaxe just over a year and a half ago, which has led to many others following his lead.

“I’ve been doing it for about a year and a half, and it’s growing exponentially,” said Skot. “My goal is to keep up this exponential growth.”

The Open-Source Mining Movement

After receiving a grant from OpenSats early this year, Skot has been able to focus full-time on Bitaxe and the community that’s formed around the project.

“When I first started this, I met some random person on Bitcoin Talk who was like ‘I’m going to start a Discord group, and it’s going to be called Open Source Miners United — you should come check it out,’” explained Skot.

Start this Discord group the gentleman did, and it now has over 4,000 members, all of whom share ideas for how to further Bitaxe and the broader open-source mining movement. But Open Source Miners United (OSMU) has become even bigger than just a group in which people share ideas.

“It’s been set up so that anyone who wants to contribute to the Bitaxe project can do so, whether it’s a random person who wants to donate or the manufacturers of Bitaxe that contribute back to the project,” explained Skot.

“OSMU has this fund, this treasury now that’s growing because we’re selling lots of Bitaxes, and we provide small grants to other people working on open source mining,” he added.

Skot also shared that for every Bitaxe sold, approximately $5 is donated to OSMU, which helps to financially support both himself and OSMU grant recipients. (He stressed in a follow-up email that this practice is totally optional and that he is very appreciative of the manufacturers that choose to do this.)

The Future For Bitaxe and Open-Source Bitcoin Mining

The Bitaxe and open-source mining movement has taken on a life of its own, according to Skot. That is, Skot doesn’t necessarily feel that he’s at the center of it anymore — it’s become decentralized. And while he’s excited about the pace at which the movement is growing, he’s still grounded and mission-focused.

He hasn’t created a roadmap for what comes next for Bitaxe and the community he helped found, though he is quite sure of what the aim of his work is.

“I’ve been so intrigued and motivated to promote this idea that Bitcoin is fundamentally open source,” said Skot.

“This decentralized network needs to be developed in a decentralized way. We can’t have one without the other. So, I think this open-source part is so important,” he added.

“Bitcoin mining has somehow just totally forgotten about the open source ethos of Bitcoin and how important open-source development is. We’ve got to bring this back.”

Source link

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Analyst Who Accurately Predicted Solana Price Rally Shares Next Target

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

SHIB Lead Shytoshi Kusama Hints At TREAT Token Launch

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

5 tokens to consider buying today

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential