Bitcoin mining

Bitcoin Mining Was Never Banned In China

Published

5 months agoon

By

admin

An extraordinary reveal: Mining was never banned in China.

Yes, you read that right. In fact, not only was it not banned, but Chinese miners are leading the world in innovative uses of Bitcoin mining.

But what of this Reuters report and others that says it was banned?

Let’s have a closer look.

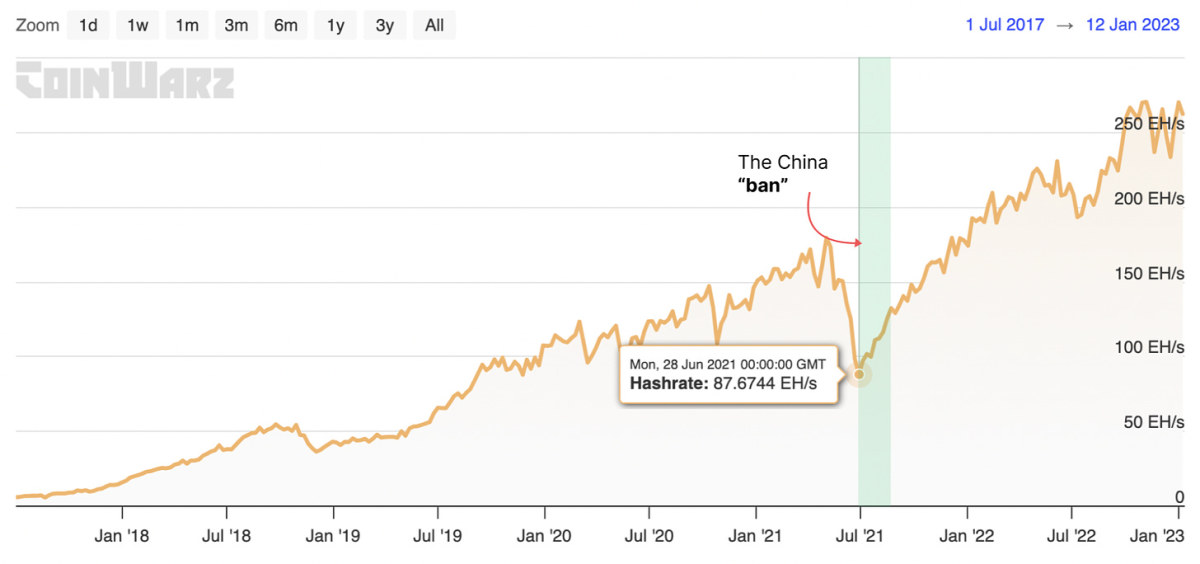

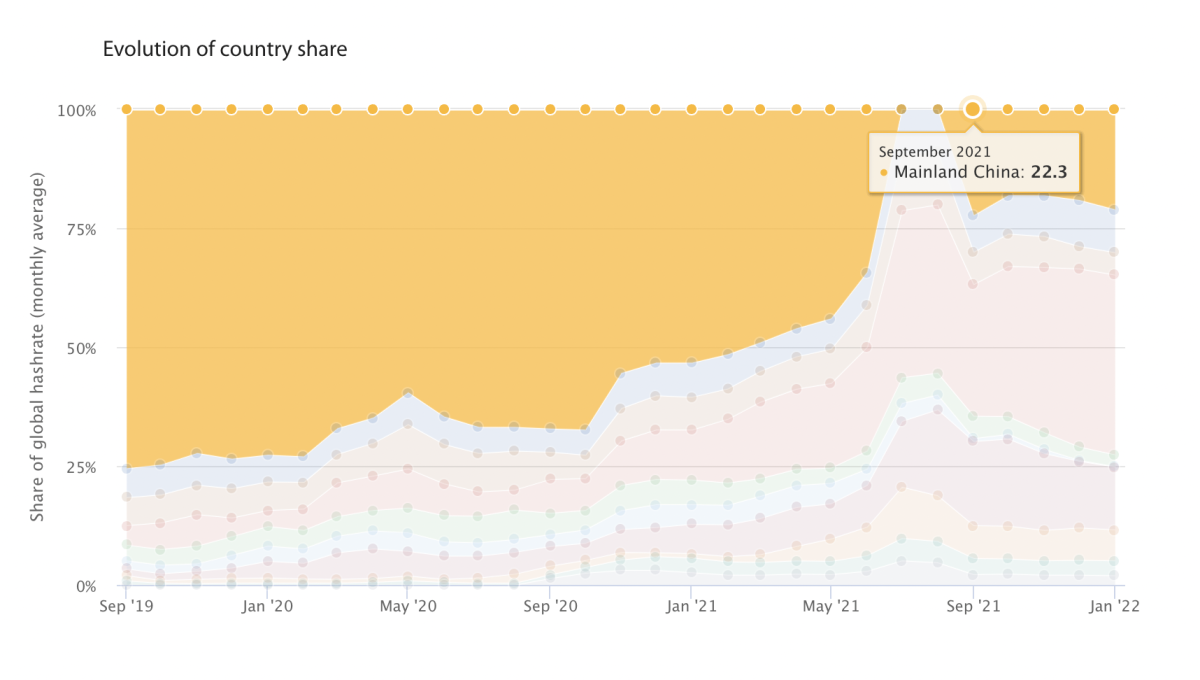

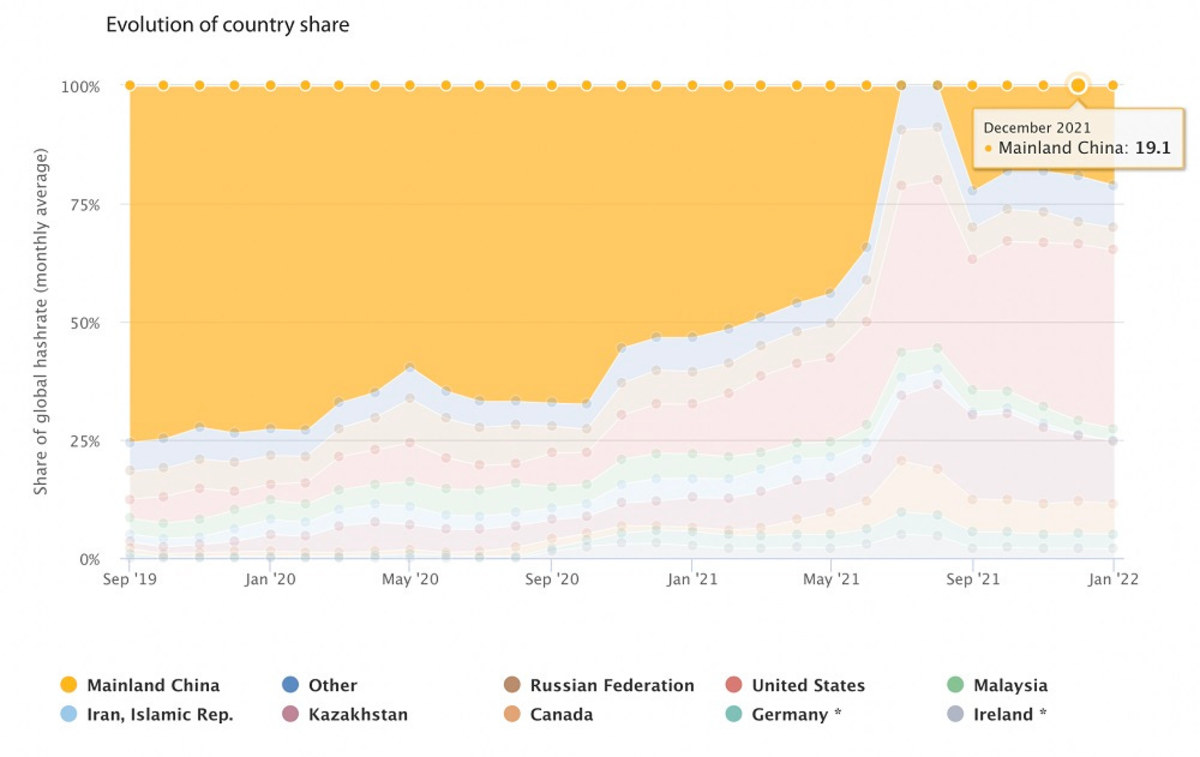

Yes, network hashrate dropped from 179.2 EH/s to 87.7 EH/s (a 51.1% drop) seemingly confirming that China banned mining.

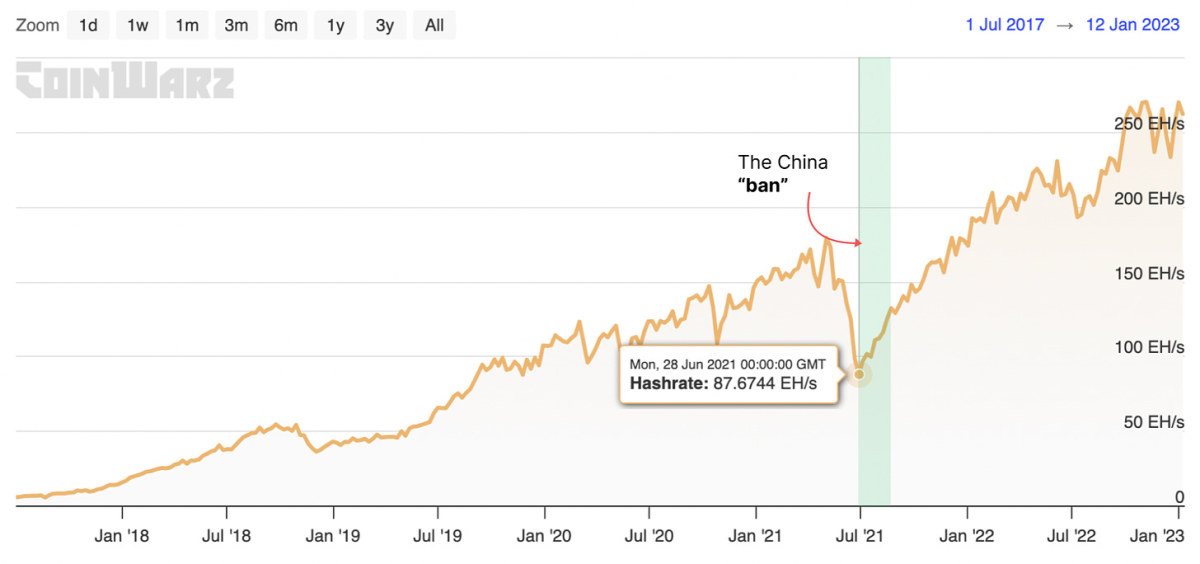

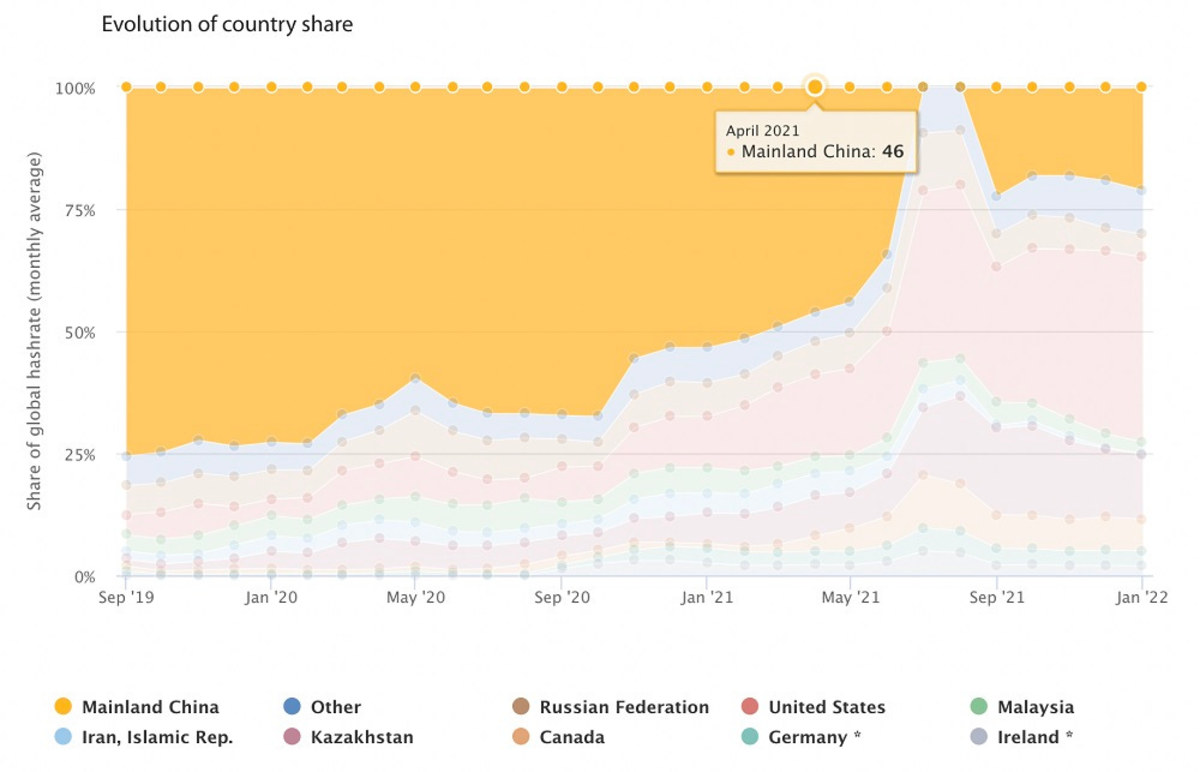

After all, China was according to Cambridge 46% of global hashrate the month prior to the “ban” (April 2021). So the figures roughly tally up with the thesis that “mining has been banned in China.”

But there’s a big gap in this logic. If you are a disruptive student, and the principal sends you away from school, those “days absent from school” don’t mean you’ve been expelled. It could mean you’ve merely been suspended. Turns out that’s exactly what happened in China.

Here’s how we know.

1. Investigative reporting

Let’s start with the mainstream news reports.

First, NBC reported in May 2021 that at least some miners were “unfazed” by the latest “ban”.

The New York Times then reported a “ban” in China in September 2021, citing this policy disclosure from the Chinese Government (more on that later), even though that same month, publicly available data from Cambridge showed that mining activity had already bounced back to 22.3% of global hashrate.

Cambridge data showed that by Dec 2021 China was still at 19.1% of global hashrate.

It wasn’t until May 2022 that CNBC ran a full report on the significant Bitcoin mining hashrate still operating within China, even though this data had been publicly available to all media outlets since September 2021.

Apart from the New York Times piece, the evidence points to mining never being banned, merely suspended. Let’s look more closely then at the New York Times article and the document they cite as evidence for a ban.

2. Our surprising find in Chinese legislation

When I read the document the New York Times used as evidence for a ban, it did not support their interpretation.

The Chinese policy document of 24 September 2021 does not legislate a ban, but rather a moratorium on the establishment of any new mining sites, plus a “signal of intent” (but not a ban) to “at some stage” grandfather existing mining activity (which three years later has still not occurred).

Regarding the statement of intention: the policy says that bitcoin mining sites are something that should be gradually eliminated, because it does not support the Chinese Government’s carbon neutral goals. Other reasons stated are that it is easy to use for money laundering and a high user of electricity.

Cultural factors not taken into account by the New York Times

In China, it is common that policy says one thing, but what is implemented is very different

As a general rule, in the more developed cities, the letter of the law will be carried out literally. However, in smaller cities and regions, this is seldom the case.

For example, officially in China there is a policy where all banks must by law reduce the steps their customers go through to get any legal certified documents.

However, in most cities, private banks don’t follow the regulation, the opposite is practised. For example, if a parent or spouse dies and you need to get the leftover amount in their bank account, the bank can say “your death certificate is not enough”. There have been cases of the bereaved needing to bring the dead body to the bank to prove it. I kid you not.

More developed cities will follow the letter of the law. But in China, most mining activity is now happening in Inner Mongolia, far from the large developed cities. In these regions what matters culturally is not the government regulations but your network. If you have the right network you can do “this and that” to go around the legislation.

So in summary:

1. Mining was never banned, rather there was a moratorium on new mining and unfriendly overtures about grandfathering existing mining facilities at some point.

2. Fossil fuel use was the stated primary reason (though we know from inside sources within the Communist party that while this was definitely a factor, capital control was the primary reason). Energy policy expert Magdalena Gronowska has cross-validated this.

3. Apart from coal-based mining, the moratorium was never implemented in the more secluded regions. There, new mining activity has come online.

4. The New York Times did not accurately portray the Chinese policy document, lacked an appreciation of cultural factors that rendered even the moratorium something that may not be widely enforced, and failed to cross-check publicly available hashrate records which would have told them that mining activity was still occurring on a large scale in China.

This would not be the first time there has been a discrepancy between what is reported and what actually happened in Bitcoin mining ban stories. News reports of “bans” in Paraguay (it wasn’t, it was a clamp-down on power-theft), and New York (it wasn’t, it was a two year moratorium only on new fossil-fuel based mining) were similarly overstated.

Then just this month, numerous media outlets even within the crypto-community reported that Venezuela had banned bitcoin mining “to protect the power-grid”, even referring to the government’s action as “an anti-corruption initiative.”

However, it turns out the source of power outages were due to widespread corruption (theft of power within government) that led to the well documented case of Venezuela’s State Owned energy company PDVSA being unable to deliver enough power to stabilize their own grid. For context: Venezuela is tied for second worst out of 180 nations on Transparency International’s corruption index, over time trending more corrupt not less.

But back to China. Sebastian Gouspillou, CEO of BigBlock who is experienced in mining matters in China, gave permission for us to include his own take on this: “They cut the mining and then started it again after a few weeks. But not everywhere; only where it was useful.”

3. Interviews with players in the bitcoin mining industry

In total, we talked to four independent mining organizations operating in China (HashX_Mining, and three others who wished to remain anonymous). What’s interesting is that none of them say they are “risking it all” as a CNBC news article dramatically suggested, but rather are actively encouraged by Chinese authorities to help solve different energy challenges.

We discovered that Bitcoin mining is not only occurring in China, but miners are actively using the positive environmental externalities of Bitcoin mining, particularly heat recycling and stranded renewable energy monetization.

For context, the first reported examples of heat recycling from Bitcoin mining were in Canada as early as 2018. Since then, heat recycling has emerged as a major way that Bitcoin mining (basically an electric resistance heater that mines Bitcoin) can lessen the need for fossil fuel heating. China has joined the heat recycling party.

One mining distributor confirmed: “With the downturn in the Chinese economy, some heavy industry has left Inner Mongolia and Xinjing province. As a result, there is often an oversupply of electricity.” Chinese authorities have invited Bitcoin mining companies to fill the void, to stop renewable energy being wasted.

These Bitcoin mining operations in Inner Mongolia are typically only 200-500 miners (~1 MW), and all using either hydro, wind or solar energy.

Think of Inner Mongolia as the Texas of China. Like Texas it had a fossil fuel past, but is now pushing for renewable energy solutions faster than any other part of the country (reportedly 57% of the country’s wind farms). And like Texas it has needed and wanted Bitcoin mining to help monetize wasted renewable energy and counterbalance renewable intermittency.

So why did China suspend mining operations in the first place, and why are the ones they let back mostly smaller and renewable energy based?

Capital controls

Large scale bitcoin mining was problematic for China. It offered a way to get money out of China. Large operations turned Yuan into Bitcoin, then Bitcoin into USD. A second reason, but not as important: large operations were often using coal factories. This endangered the government’s emission targets.

The original miner suspension represented a chance to clamp down on capital flows out of the Yuan. By allowing mining companies with 200-500 units to monetize wasted renewable energy, it helps China stabilize grids and monetize wasted renewable energy without the danger of large capital outflows.

Special thanks again to Dan Leslie from @HashX_Mining, Sebastian Gouspillou, CEO of Big Block, Magdalena Gronowska, partner at Metamesh and two Chinese nationals who wished to remain unnamed in compiling this special report.

——-

Additional Context

Other reveals from our interviews with Chinese mining companies.

- While a lot of hashrate migrated to other countries (US initially, Ethiopia more recently), a lot of new hashrate has also come into China since the China “ban”

- No offgrid coal-based mining occurs any more. It’s too easy to spot, it competes for baseload energy and interferes with Central Govt’s emission targets. This has caused a significant reduction of the emission intensity of Chinese mining post-”ban”.

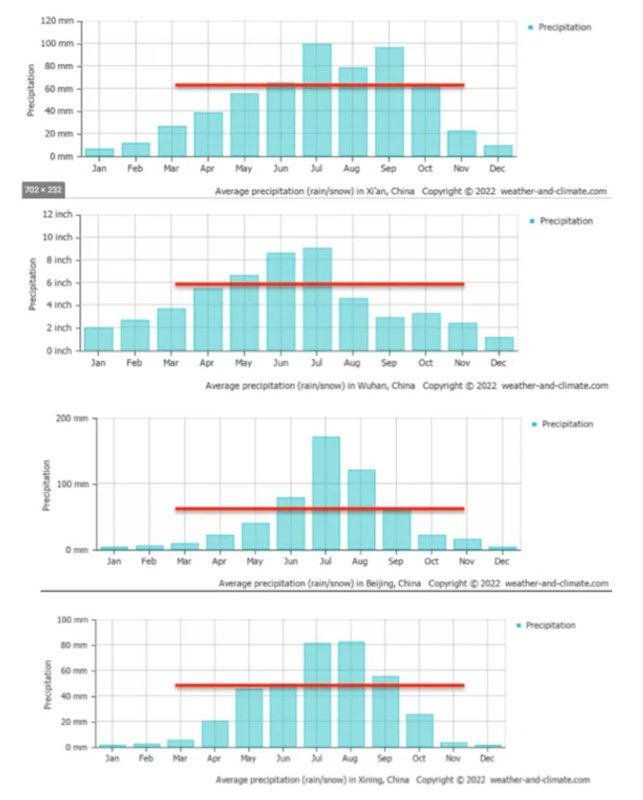

- Mining is mostly hydro, micro-hydro (particularly in the wet season). The areas above the red line are very wet months for 4 regions: Xi’an, Wuhan, Bejing and Xining, where hydro becomes incredibly cheap.

But we also uncovered a lot of ongrid mining and, more surprisingly, a lot of retail ongrid mining.

- Retail ongrid miners mine at a loss, because they pay, well, retail electricity rates. Why would they mine at a loss? Simple: to get money out of China, or out of the Yuan into USD. They convert Chinese Yuan for ASICS and electricity which creates BTC, which gets converted into USD. Many retail miners are happy to take the profitability hit simply to have a way to convert Yuan to USD.

- Local provincial govt often supports what Central Govt does not, because it’s economically advantageous to do so. We heard more than one story where the provincial govt gave an effective “licence to mine” in return for the rights to use their recycled heat.

For example, one 13 MW mining operation, an example of that new hashrate, works in tandem with the Provincial Govt. They buy electricity from them and in return the govt gets the right to use their recycled heat for free. Because 95% of the energy from Bitcoin mining is disbursed through heat, this is almost as effective as getting heating for free. What do they use that (free) heat for? Heating water for fish farms.

Click HERE to download a PDF of “Bitcoin Mining Was Never Banned In China” — report #3 of the “FUD Fighters” series powered by HIVE Digital Technologies Ltd

This is a guest post by Daniel Batten. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

Bitcoin mining

Bitcoin Miner Hut 8 Buys $100M BTC Bringing Total Holdings to $1B

Published

4 days agoon

December 19, 2024By

admin

Another bitcoin miner, Hut 8 (HUT), has decided to pull the trigger on buying bitcoin in the open market, following the likes of MicroStrategy (MSTR) and MARA Holdings (MARA).

The Miami, Florida-based company said it bought about 990 bitcoin for an average price of $101,710 each. The latest purchase will bring the amount of bitcoin held in Hut 8’s reserve to 10,096, or about $1 billion in market value, and make it among the top 10 largest corporate owners of bitcoin, the company said in a statement on Thursday.

The miner is planning to use the reserve through options strategies, pledges, sales or other strategies, according to the statement. Hut 8’s CEO, Asher Genoot, told CoinDesk that his firm will be opportunistic in buying more bitcoin in the open market.

“Today, the market recognizes and values our strategic reserve, which effectively lowers our cost of capital and strengthens our financial position. As long as this market dynamic persists, we will remain opportunistic in expanding our Bitcoin reserve,” Genoot said.

The move follows Hut 8’s announcement earlier this month that it started a new $500 million at-the-market share issuance program. At the time, the firm said some of the proceeds from the fund would be used to buy bitcoin in the open market, among other things.

MicroStrategy, the largest corporate holder of bitcoin on its balance sheet, started the trend of buying bitcoin in the open market. It wasn’t until MARA Holdings’ purchase of bitcoin in the open market this year that this became prominent among the miners. Most recently, peer Riot Platforms (RIOT) bought 667 bitcoin at an average price of $101,135 on Dec. 16.

Buying large amounts of bitcoin in the open market has paid off for miners opening up new avenues of raising funds at a time when the industry is grappling with a profit squeeze after the recent Bitcoin halving event. Last month, MARA was able to raise $1 billion in convertible debts—a financial instrument where investors can convert debt into equity—with zero interest. This means investors are willing to let go of the interest income from the debt for the equities that provide them with exposure to bitcoin.

Hut 8 said holding bitcoin reserve serves as a flexible option for the firm that can help the company grow. “We view our strategic reserve as a dynamic financial asset that can be actively managed to drive returns well beyond simple price appreciation,” Genoot told CoinDesk.

“Together with the significant investments we are making to expand our core operating business—with a clear path to 24 EH/s of self-mining capacity by Q2 2025—strategic Bitcoin purchases in the open market can strengthen our balance sheet and ability to invest thoughtfully in growth,” he said.

Shares of Hut 8 have risen 74% this year, while CoinShares Valkyrie Bitcoin Miners ETF (WGMI) climbed 28%.

Source link

Africa

Gridless Is Mining Bitcoin While Fostering Human Flourishing In Africa

Published

5 days agoon

December 18, 2024By

admin

Company Name: Gridless

Founders: Janet Maingi, Erik Hersman and Philip Walton

Date Founded: August 2022

Location of Headquarters: United States | Operations in Kenya, Malawi and Zambia

Number of Employees: 10

Website: https://gridlesscompute.com/

Public or Private? Private

Gridless doesn’t just mine bitcoin — it helps to facilitate the electrification of rural Africa, which is notably improving the lives of those who previously either didn’t have access to power or couldn’t afford it.

Gridless’ co-founder Janet Maingi explained to Bitcoin Magazine how the company’s facilities, which are based in Kenya, Malawi and Zambia, have a win-win-win effect for the company itself, the Bitcoin network and the communities that benefit from Gridless’ operations.

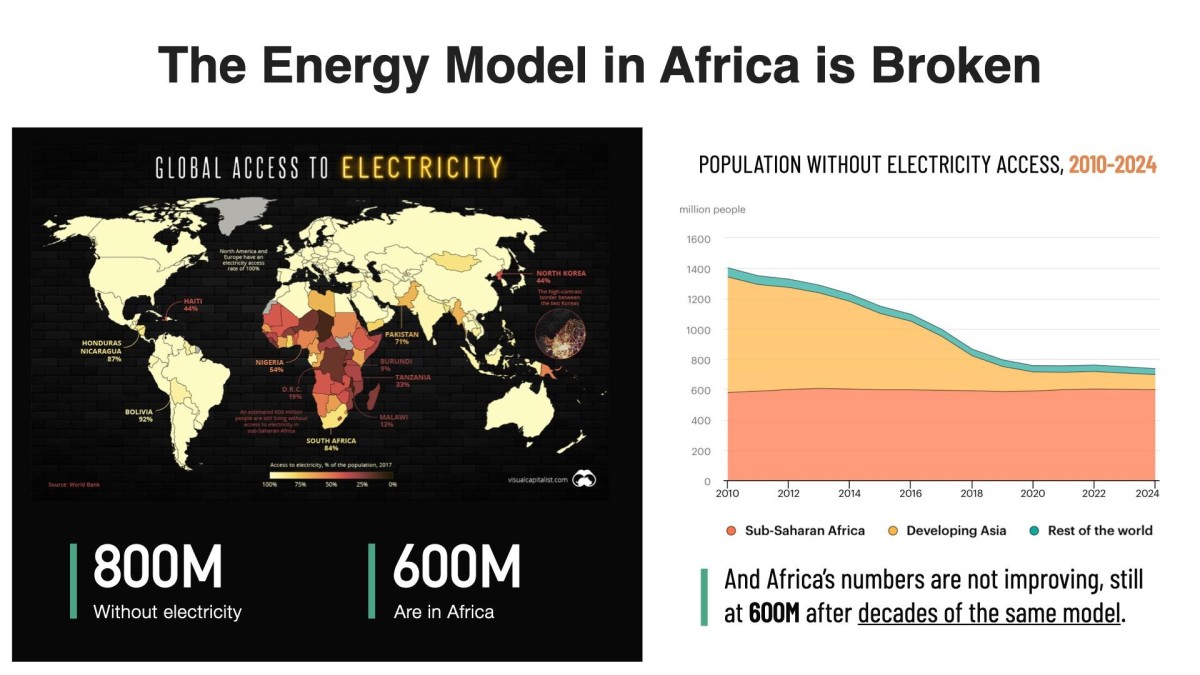

“Our mission is to mine Bitcoin profitably,” Maingi told Bitcoin Magazine. “But as we do this, we also do two other things: we push electrification out to the edge in Africa and we decentralize the Bitcoin network, which has historically been very centralized to North America and China.”

In just over two years, Gridless has set a new standard for the type of impact a Bitcoin mining company can have, showing the world that Bitcoin mining can have a symbiotic relationship with the communities it touches and that it can be a catalyst for human flourishing.

I sat down with Maingi in person in Kenya after this year’s Africa Bitcoin Conference to discuss the work she does and the impact it has on the communities it reaches.

A transcript of our conversation, edited for length and clarity, follows below.

Frank Corva: How does Gridless help to electrify Africa?

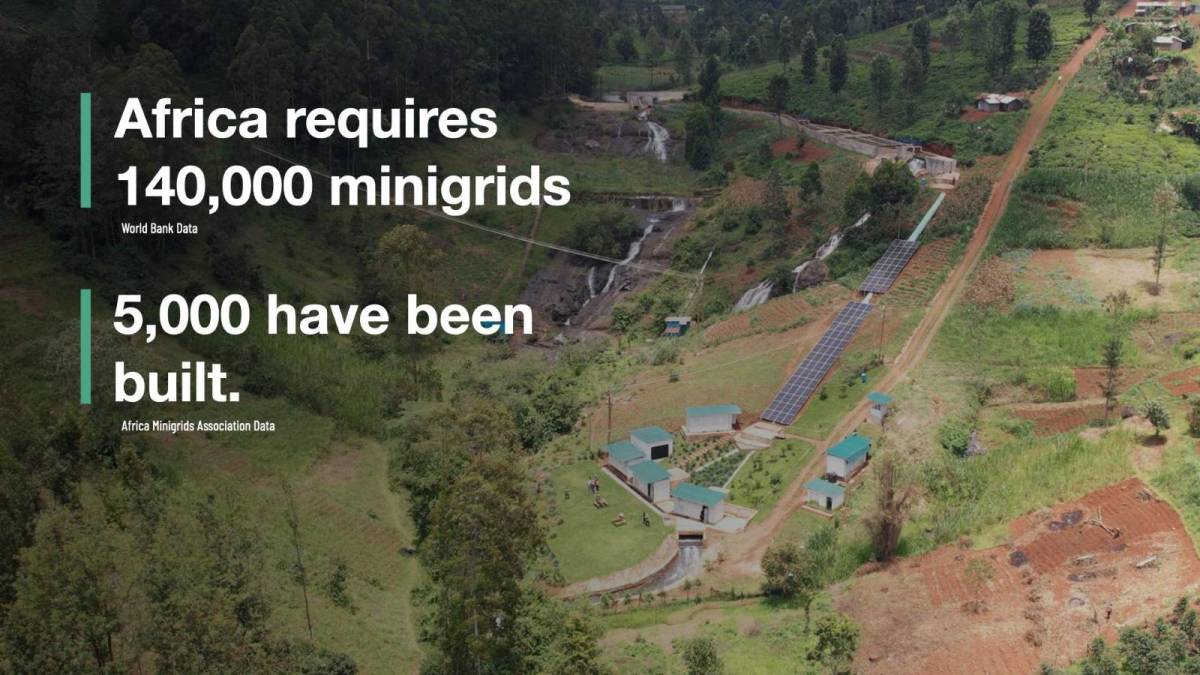

Janet Maingi: About 600 million Africans have no access to electricity. That’s about two-thirds of our population. The private sector has stepped in because the main grids do not reach everyone on the continent.

You’ll find that bigger cities like Nairobi or Mombasa have electricity, but if you go to rural Africa, people have no access to electricity because of distribution challenges.

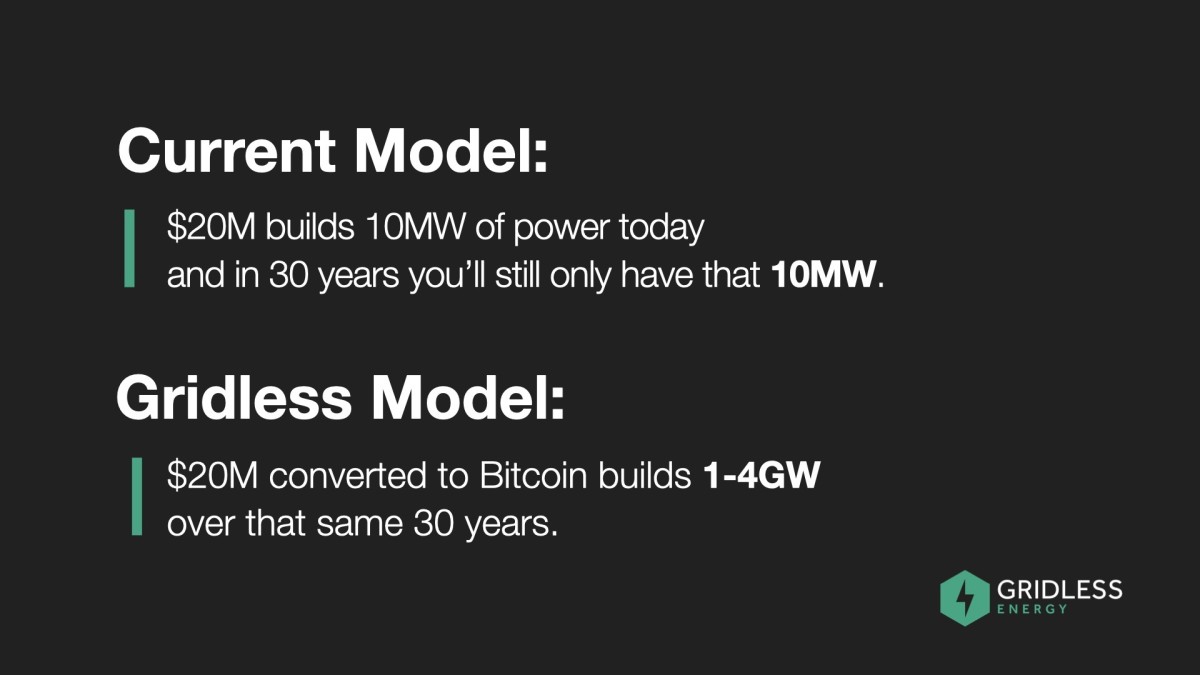

So, the private sector came and started setting up mini-grids. Private companies have done the best they can with these mini-grids. However, they’re very capital intensive, and so there are struggles with fundraising. And even when you actually get them set up, the consumers around your area might not be very wealthy. They’re just living day-to-day. They may have to consider “Do I need electricity or do I need food?”

The companies that construct the mini-grids build power plants that use hydro energy. Let’s say they want to build one that produces one megawatt of energy, but the community only ends up using 200 kilowatts. There’s 800 kilowatts that they generated from the river, but for that 800 kilowatts, they get zero shillings, zero dollars, zero anything.

So, we at Gridless come in and say “That electricity that you’re not able to send to anyone, is what we want.” That’s what you call stranded power or wasted energy, and it’s what we want. So, we become your buyer of last resort.

We come and create an agreement to use that extra electricity, and from a revenue sharing perspective, we work together. It’s a win-win situation. Our data centers use that electricity to mine bitcoin.

But then the catalyzing of electrification comes in. When we’ve used that electricity, it’s become a source of revenue for the energy power plant. They were not making money on that electricity previously, and now they’re profiting from it.

What have we seen as the effect? One, they are able to extend their reach, to distribute electricity further. And secondly, some of them have been able to actually lower their prices. So, consumers who are within their reach but wouldn’t use the electricity because of the cost are suddenly saying, “Hey, hook me up. I can afford to pay for this now.”

Corva: So, in a sense, you’re subsidizing the rate of electricity.

Maingi: Yes, because we come in and use this power, the energy generator is able to give better prices and increase its reach. So, again, what does this mean? More homes getting lit, more small enterprises getting electricity, more factories getting powered and more health centers getting electricity. You can now imagine the upward spiral effect.

However, the challenge is that doing business in Africa is like an extreme sport.

Corva: Why is that?

Maingi: So, let’s start with just getting the equipment. The mining machines come from China, either from Bitmain or MicroBT, or you’ll get them from a company in the U.S., and the process of getting them into Africa can be painful.

We received a batch that came from the U.S. and it took us 60 something days just to get them into the country. This is from putting them on a ship to getting them here. This doesn’t include figuring out the logistics around getting the miners on site and going through pre-shipment inspection to make sure that they meet the Kenyan standards.

It’s a process that takes almost 120 days from start to end. If you’re running a business, and it takes you 120 days to get your product on the ground, it’s painful.

Secondly, these machines are designed to work very well in China or the U.S.

Conditions in Africa are different, though.

Corva: Does this have anything to do with air quality?

Maingi: Air quality, dust, heat. In Kenya, average temperatures range from 20 to 40 degrees Celsius. So, when you power those machines in an environment where the average temperature is 30 degrees Celsius, you can imagine the heat that they have to deal with.

And then there’s dust. When you get a pre-fitted container from China or somewhere, you discover that the designers just focus on inflow and outflow. But we realized we have issues with dust, so we have to put dust filters on the machines.

And then, in 2022, we learned when we set up the first site that, because of the lights on the miners, they attracted bugs. During the rainy season, the bugs could see the lights and flew into the fans and got mashed up — something nobody thought about.

Lastly, the containers initially were going to cost us $100,000 each, which was too much for us to be profitable. The math didn’t math, as we say. So, we sat down and designed our own container.

Corva: Amazing.

Maingi: Right? And that’s what we’ve been deploying at a quarter of the price. And then the advantage that came with being made in Kenya has allowed us to get passage through the COMESA (Common Market for Eastern and Southern Africa) region, without having to pay extra duties or taxes because it’s recognized as a COMESA product.

That also helped because, being made in Kenya, it’s very easy for us to move the containers around the COMESA region without having to pay extra taxes. We get a tax exemption. Even if the containers from China made sense, if we brought them to Kenya and I had to move them to Uganda, I would have to pay taxes to Uganda, too.

Any country you move foreign products to, you have to pay taxes again. So, it’s been hard, but good solutions have come out of the difficulties.

Have you heard of GAMA, the Green Africa Mining Alliance?

Corva: Yes.

Maingi: During the first Africa Bitcoin Mining Summit last year, we released a blueprint of the container we designed. So, anyone who wants to use it to build their own container using our blueprint can feel free to do so.

Where you need our support, we’ll be ready to guide you. That’s the whole thing about GAMA — How do we exploit our synergies? How do we benefit from one another? How do we find a young lady who wants to start mining and walk her through the journey of getting started?

Corva: Incredible. I want to go back to electrification in Africa. You mentioned earlier that you wanted to share some numbers.

Maingi: What I was saying is that there’s a ripple effect when we partner with the energy generator. We’ve been able to see more homes or households getting connections.

If you’ve been in rural Kenya or Africa, then you understand how one bulb can transform a life. I’ll use the example of children coming home from school. They have assignments and use these tiny paraffin lamps to study. The fumes from them are horrible for their health. But this is a child for whom there’s no plan B. The teacher expects this child to come back to school with her assignments completed. Not having electricity is not an excuse.

A guy once told me that sometimes, when his daughter is busy doing an assignment, the paraffin runs out. When the nearest gas station is almost four miles away, who is going to go and look for paraffin at that time? Nobody. Tough luck.

So, the child gets to school and is either in trouble because she didn’t do her assignments or is now lagging behind because now those quote unquote “are yout personal problems.” Because of that one bulb they now have, he was like, “My daughter is performing so well in school.” Then, health wise, all these visits they used to make to the hospital because she was breathing in the paraffin fumes no longer happen.

Corva: It seems you want to make my cry.

Maingi: No, there’s no crying. (Author’s note: This woman doesn’t play.) It’s a reality.

Then, in Zambia, I remember talking to women who were talking about childhood vaccinations. Between zero and three years, there are certain vaccinations recommended by the WHO that your kid needs to get — measles, polio, etc. — but the nearest health center that has them sometimes isn’t close.

So, you do your math, and you’re like, “I can’t afford bus fare to do this.” And so this disease sounds more serious, I’ll get my child the vaccination for that one, while this one I’ll pass on. But really all of them are important for children.

Now, Gridless is coming into Malawi and getting electricity providers to connect more homes in the Bondo area. Health centers are getting powered on, so more vaccines are available in more local health centers.

While before you used to say “Polio sounds serious, I’ll get my child that vaccine, but with measles, I don’t know who has died of that recently, so maybe, I won’t get my child that one,” now more people can get it.

Now, we will have a young generation who, we believe, as we keep doing this, is going to thrive. They’re going to grow. You’ll possibly get rid of childhood mortalities because these rural areas get electrified.

Corva: And bringing energy to these regions also helps support livelihoods I assume.

Maingi: Yes, of course. There’s a tea factory in Muranga, Kenya, which is in the highlands.

We partnered with the energy generator in the area and they were able to give the factory power. Now, their facilities are able to support the tea factory, which has two benefits: tea farmers can bring their tea to the factory, which means it doesn’t spoil on the farms because they can’t get it to point B in time and more employment has also been created just by that tea factory becoming an electrified space.

We keep saying why we know this will make a difference is because energy is a base of human progress.

Corva: There’s no such thing as an energy poor country that’s rich.

Maingi: If you look at the Maslow’s hierarchy of needs, it used to go food, shelter, clothing, but I put energy there. Energy is a basic need. It’s a must have for anybody to actually be allowed to live a decent life. For people to make a decent living, energy has to be in that math.

Corva: Is it true that you’ve recently created software that helps with energy demand response?

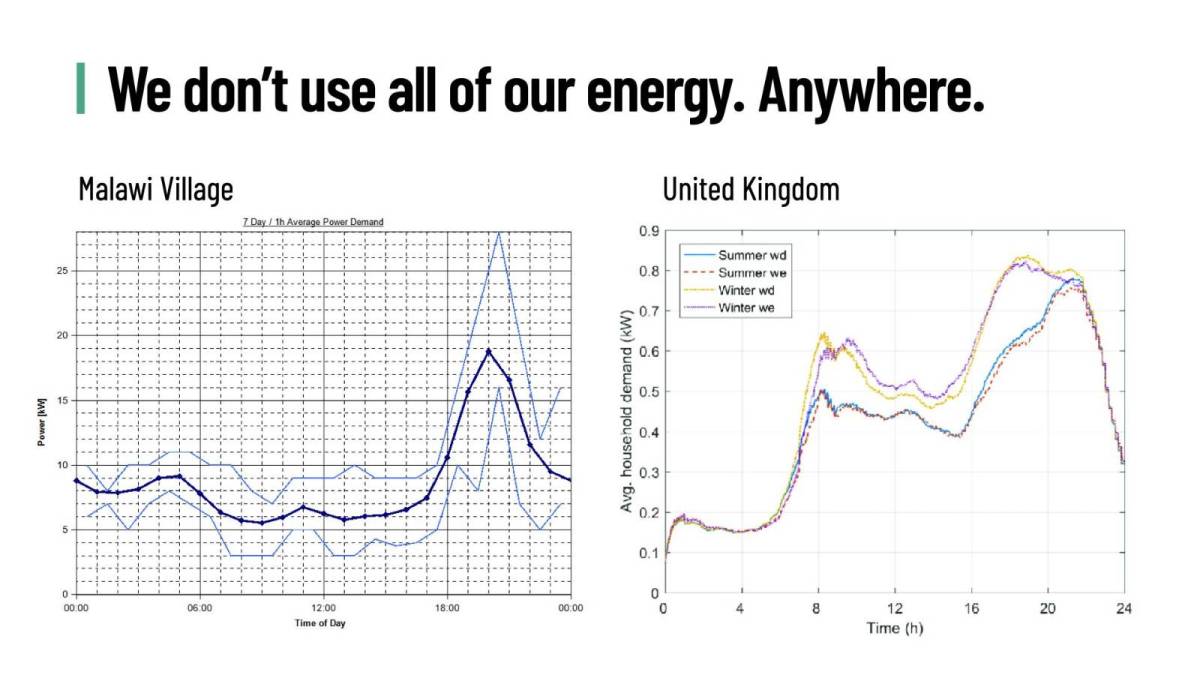

Maingi: Yes. We realized that we need to get more proactive in creating real-time demand response. Before, we were either reacting too late or too early to the power available.

Remember we’re the buyer of last resort, so communities come first and small businesses come second. For us to be able to live up to that promise, we had to make sure we weren’t sucking in electricity that was required by somebody else at that time.

So, let me paint a picture. In normal households, people wake up at 6 a.m., so there’s a surge of electricity. At that stage, our software gets a signal and reduces our consumption to meet the demand needed by the grid. Then, at 8 a.m., everybody goes to school and switches off their lights and there’s too much electricity in the grid. That’s when we power more mining machines.

We get the signal, power more machines, suck in the electricity and keep on going until maybe 6 p.m. when people have gotten back home and they need the electricity. Gridless turns down their machines and returns the electricity.

At 10 p.m. they all go to bed, and we power up more machines. This is all done with software we developed internally called Gridless OS. It allows for real-time demand response. It makes it so everybody gets what they need, and it stabilizes the grid.

Corva: Are you setting certain standards with Gridless that others are following in Africa or in other parts of the world?

Maingi: It’s set a trend that people are following. Sometimes you go to conferences and people keep referring to Gridless. That’s when you realize, “My God, this thing is bigger than we thought.” And so you start to understand how this has made a difference, that it doesn’t exist in a vacuum.

At the end of the day, everyone has different ways of mining bitcoin, and there’s a positive impact to the community whichever way you do it. Look at Bigblock Datacenter — Sebastian Gouspillou in the Congo — where they’re using the heat to dry cocoa for chocolate they sell. Think of what that has created for that economy.

Corva: I think Sebastian brought me to tears when I met him, too.

Maingi: What’s exciting for us and other players within this space is that we are the ones who understand our problems, and it’s exciting to see African companies deciding “Not only will I mine bitcoin profitably and decentralize the network, but there’ll be some benefit to our community, as well.”

Source link

24/7 Cryptocurrency News

Cleanspark To Raise $550 Million In Convertible Notes

Published

1 week agoon

December 14, 2024By

admin

Bitcoin mining and tech firm Cleanspark has announced its intention to raise $550 million in Convertible Senior Notes offering. As the firm revealed, it is pricing the notes at 0% and will only make it available to qualified investors. Cleanspark said the convertible notes will mature in 2030.

Cleanspark Plans Exclude Bitcoin

The update from the firm shows its plans to offer the notes to the initial purchasers for resale in a private offering as securities. The firm said it will cap the initial price of the notes at $24.66 per share of the company’s common stock. Per the filing, this amount represents 100% premium to the closing price of the stock as of December 12, 2024.

As an added allowance, Cleanspark hinted that it can allow up to a 13-day option to repurchase up to $100 million aggregate principal amount of the notes. If investors exercise this extended repurchase option, the Bitcoin mining firm can raise up to $633.6 million.

While fundraise via convertible notes is not uncommon among US firms, the purpose of this funding is different. Despite being a Bitcoin mining firm, Cleanspark will not use the capital to buy additional BTC. Instead, it said it will designate $145 million to repurchase shares from investors who participate in the notes sales.

In addition, Cleanspark said it will deploy some of the funds to settle its line of credit with Coinbase exchange. The remaining capital will go into capital expenditures, acquisitions and general corporate purposes.

The Unusual Twist With Bitcoin Mining Firms

Unlike Cleanspark, other Bitcoin mining firms like Riot Platforms have raised funds by issuing convertible senior notes. However, unlike the former, Riot Platforms used the proceeds to buy 5,113 Bitcoin for $510 million earlier on December 13.

MARA Holdings have also made this move in the past, solidifying the thesis that Bitcoin miners are increasingly adopting BTC beyond the daily mining operations.

These firms are learning from the MicroStrategy Bitcoin playbook. As reported earlier, MicroStrategy has grown its BTC stash to 423,650 units after its latest 21,550 Bitcoin purchase for $2.1 billion. The goal for this firms is that the price of the coin will continue to appreciate against the US Dollar.

With its treasury reserve success, MicroStrategy is now on track for Nasdaq-100 Index inclusion. Why Cleanspark refused to allocate any amount to Bitcoin remain a puzzle in the broader ecosystem.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: