Markets

Bitcoin Price Meets Resistance as Traders Set Sights on Presidential Election

Published

3 months agoon

By

admin

The Bitcoin price flirted with $64,000 during early European trading hours, but met some resistance. Analysts are saying BTC investors seem to be holding their breath to see how the U.S. election shakes out in a month’s time.

At the time of writing, the Bitcoin price has settled around $62,800, up 1.5% on the day, according to data from CoinGecko. The Ethereum price has largely mirrored Bitcoin’s path, rising 1.3% to around $2,450 at the time of writing, per CoinGecko data.

“It seems that the market is waiting for the November elections before committing to a clear direction in price,” wrote Jon Reader, chief investment officer at crypto lending protocol Ledn, in a note shared with Decrypt. “While the consensus is that a Republican victory will be more supportive of digital assets prices than a Democratic win, both parties have been putting forth positive statements towards digital assets, so the upward trend will be in place regardless of the outcome in my opinion.”

The U.S. presidential election sees former president and Republican candidate Donald Trump taking on Vice President Kamala Harris for the Oval Office. Voters will head to the polls on November 5. Currently, users on crypto betting site Polymarket have just shy of $1.4 billion wagered on the outcome.

At the time of writing, 51% of bettors favor Trump to retake the presidency. But it does need to be said that Polymarket, by virtue of a policy that bans on U.S. users to bet on the site, more closely tracks with how non-U.S. citizens feel the election will go.

Ledn’s Reader isn’t the only one saying crypto markets will benefit, if by varying degrees, regardless of who wins in November.

Standard Chartered’s Geoffrey Kendrick, the bank’s global head of digital assets research, has been saying for weeks now that markets will benefit regardless of who wins.

For now, traders seemed to have liked the latest unemployment numbers from last week. Even if the BTC price is currently meeting some resistance on Monday, that doesn’t change the fact that Bitcoin managed to gain roughly 5% over the weekend.

“The lower-than-expected unemployment rate fueled Bitcoin’s weekend rally, creating a fresh momentum with higher lows,” wrote BRN analyst Valentin Fournier in a note shared with Decrypt. “Bitcoin could soon test the upper boundary of its trend at $68,000. While a strong resistance is expected between $65,000 and $67,000, we believe Bitcoin will eventually break through.”

He flagged the upcoming inflation reports in the U.S., like the consumer and producer price indices, as potential catalysts for that upward momentum. The Bureau of Labor Statistics reports are due out on Thursday and Friday this week.

“While it may be too soon to see the effects of interest rate cuts reflected in these numbers, any signs that U.S. inflation is trending back toward 2% will likely have a favorable impact on the market” Valentin added.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Wave 2 And 5 Targets Put XRP At $7 And $13

NEIRO’s success shadowed; Catzilla’s presale sparks new market buzz

3 Key Metrics That Hint Bitcoin Price Will Hit $100K Soon

Macro Guru Raoul Pal Predicts Crypto Market Will Rally ‘Pretty Strongly’ Into Year-End – Here’s His Outlook

Blockchain auditor Hacken launches AI-powered MiCA-compliance tool for crypto firms

Crypto in 2024: A Game-Changing Year for Investors

DeFi

Solana beats Ethereum in a key metric 3 months in a row

Published

24 hours agoon

December 23, 2024By

admin

Solana’s continued doing well in December, as meme coins helped it gain market share against Ethereum and other blockchains.

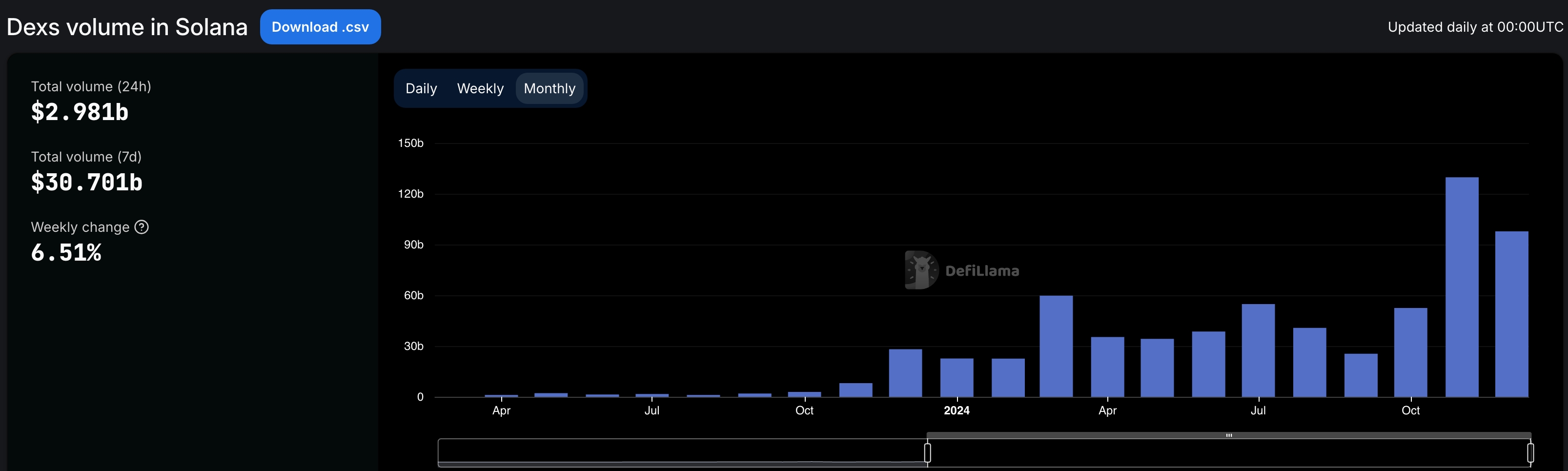

According to DeFi Llama, Solana’s (SOL) protocols in the decentralized exchange industry were the most active in December.

Its volume rose to over $97 billion, much higher than the $22.6 billion it handled in the same period last year.

Notably, it was the third consecutive month that Solana outperformed Ethereum (ETH), which has dominated the industry for years. Ethereum’s protocols had a volume of over $74 billion, while Base and Arbitrum handled $42 billion and $37 billion.

Solana also performed great in November, where its DEX networks had a volume of $129 billion, higher than Ethereum’s $70.6 billion. A month earlier, Solana handled volume of $52 billion, while Ethereum processed $41 billion.

Most of Solana’s DEX volume was because of Raydium (RAY), a network that handled coins worth $65 billion in the last 30 days. Orca handled $24 billion, while Lifinity, Pump, and Phoenix had volumes worth over $5.93 billion.

Solana’s DEX volume has jumped because of the meme coin industry, which has continued doing well this year. Solana has attracted thousands of meme coins this year, helped by the creation of Pump, the biggest token generator. All Solana meme coins have a market cap of over $14.1 billion, led by Bonk, Dogwifhat, Popcat, and Peanut the Squirrel.

This growth has been highly profitable for Solana and its native apps. All Solana native dApps generated a record $365 million in revenue in November, a record high. Similarly, according to TokenTerminal, Solana’s blockchain generated a record $725 million in fees in 2024, making it the third-most profitable chain after Ethereum and Tron.

Developers and users love Solana because of its substantially lower fees and higher throughput.

Base, the layer-2 network launched by Coinbase, has also been a big breakout star in 2024 as its total fees rose to over $82 million. It has become the biggest layer 2 network in the blockchain industry, with its DEX networks handling over $181 billion in assets, while its total value locked soared to $2 billion.

Source link

Crypto exchange

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Published

1 day agoon

December 23, 2024By

admin

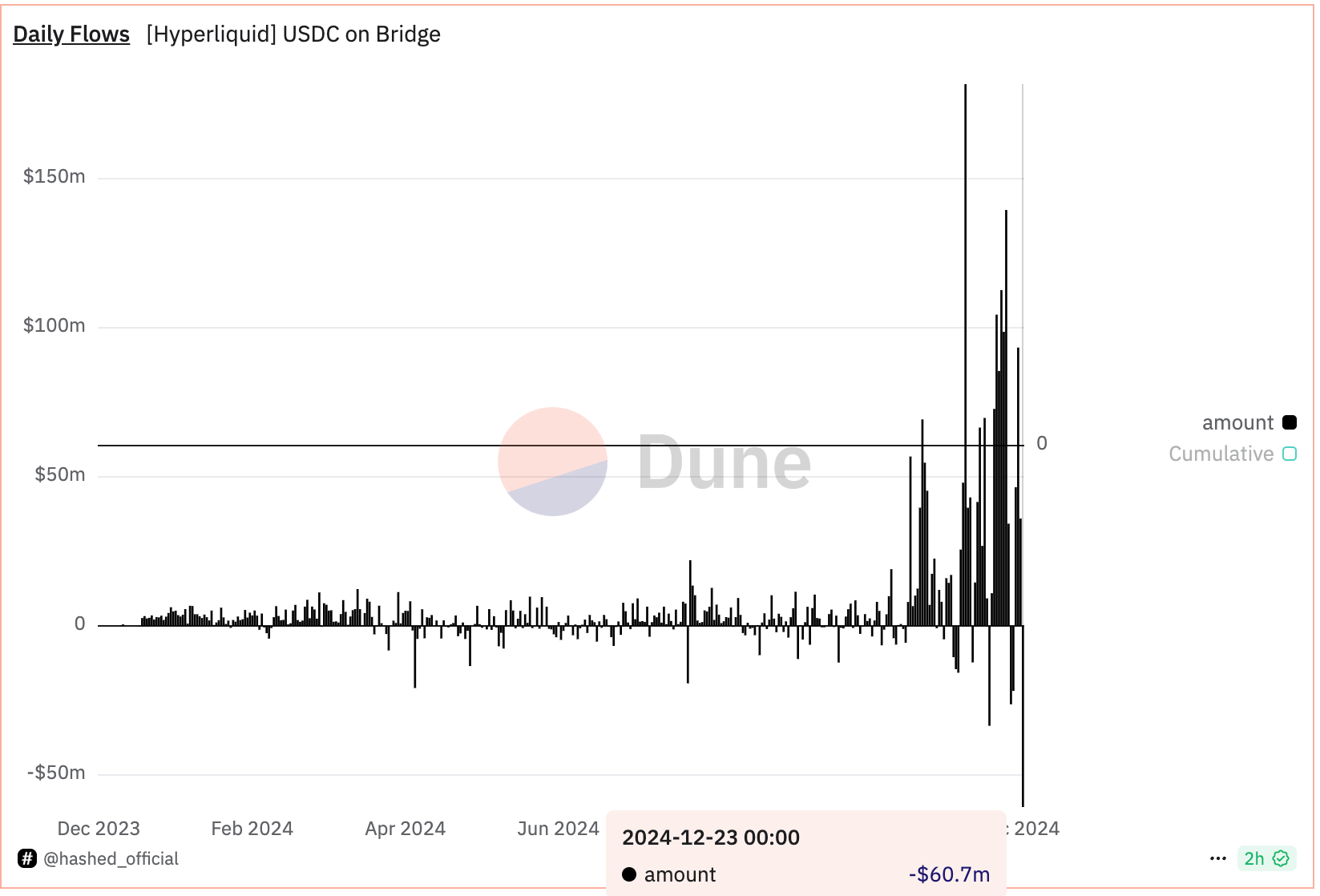

HyperLiquid, a layer-1 blockchain and decentralized exchange for perpetual futures (perps), has experienced a notable outflow of the USDC stablecoin amid speculation North Korean hackers are interacting with the platform, according to a post on X by pseudonymous observer Tay, known for tracking threats posed by to crypto protocols by the country.

A record $60 million of USDC fled the exchange by 10:00 UTC Monday, according to Hashed Official’s Dune-based tracker. USDC, the world’s second-largest dollar-pegged stablecoin, is used as collateral on HyperLiquid. The deposit bridge still holds $2.2 billion in USDC.

Addresses associated with hackers from the Democratic People’s Republic of Korea (DPRK) have accrued losses exceeding $700,000 while trading on HyperLiquid, Tay said. The transactions indicate the hackers are potentially familiarizing themselves with the platform’s inner workings to launch a malicious attack.

“DPRK doesn’t trade. DPRK tests,” Tay said.

CoinDesk contacted HyperLiquid on X for comments on the USDC outflows and potential threat from North Korea.

Tay said they reached out to the platform two weeks ago, offering help in countering a potential threat.

“I really want to emphasize that these are the most sophisticated and rapidly evolving of all of the DPRK threat groups. They are very creative and persistent. They also get their hands on 0days (such as the one Chrome patched today,” Tay’s message to the platform said.

HyperLiquid is the leading on-chain perpetuals exchange, commanding over 50% of the total on-chain perpetuals trading volume, which tallied $8.6 billion in the past 24 hours.

The platform debuted its token HYPE on Nov. 29. Since then, it has

surged over 600% to $28.6, briefly topping $10 billion in market capitalization. As of writing, HYPE was the 22nd largest digital asset in the world, according to Coingecko.

Source link

DeFi

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

Published

2 days agoon

December 22, 2024By

admin

There’s been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market.

Asset manager Hashnote’s USYC token zoomed over $1.2 billion in market capitalization, growing five-fold in size over the past three months, rwa.xyz data shows. It has toppled the $450 million BUIDL, issued by asset management behemoth BlackRock and tokenization firm Securitize, which was the largest product by size since April.

USYC is the token representation of the Hashnote International Short Duration Yield Fund, which, according to the company’s website, invests in reverse repo agreements on U.S. government-backed securities and Treasury bills held in custody at the Bank of New York Mellon.

Hashnote’s quick growth underscores the importance of interconnecting tokenized products with decentralized finance (DeFi) applications and presenting their tokens available as building blocks for other products — or composability, in crypto lingo — to scale and reach broader adoption. It also showcases crypto investors’ appetite for yield-generating stablecoins, which are increasingly backed by tokenized products.

USYC, for example, has greatly benefited from the rapid ascent of the budding decentralized finance (DeFi) protocol Usual and its real-world asset-backed, yield-generating stablecoin, USD0.

Usual is pursuing the market share of centralized stablecoins like Tether’s USDT and Circle’s USDC by redistributing a portion of revenues from its stablecoin’s backing assets to holders. USD0 is primarily backed by USYC currently, but the protocol aims to add more RWAs to reserves in the future. It has recently announced the addition of Ethena’s USDtb stablecoin, which is built on top of BUIDL.

“The bull market triggered a massive inflow into stablecoins, yet the core issue with the largest stablecoins remains: they lack rewards for end users and do not give access to the yield they generate,” said David Shuttleworth, partner at Anagram. “Moreover, users do not get access to the protocol’s equity by holding USDT or USDC.”

“Usual’s appeal is that it redistributes the yield along with ownership in the protocol back to users,” he added.

The protocol, and hence its USD0 stablecoin, has raked in $1.3 billion over the past few months as crypto investors chased on-chain yield opportunities. Another significant catalyst of growth was the protocol’s governance token (USUAL) airdrop and exchange listing on Wednesday. USUAL started trading on Binance on Wednesday, and vastly outperformed the shaky broader crypto market, appreciating some 50% since then, per CoinGecko data.

BlackRock’s BUIDL also enjoyed rapid growth earlier this year, driven by DeFi platform Ondo Finance making the token the key reserve asset of its own yield-earning product, the Ondo Short-Term US Government Treasuries (OUSG) token.

Source link

Wave 2 And 5 Targets Put XRP At $7 And $13

NEIRO’s success shadowed; Catzilla’s presale sparks new market buzz

3 Key Metrics That Hint Bitcoin Price Will Hit $100K Soon

Macro Guru Raoul Pal Predicts Crypto Market Will Rally ‘Pretty Strongly’ Into Year-End – Here’s His Outlook

Blockchain auditor Hacken launches AI-powered MiCA-compliance tool for crypto firms

Crypto in 2024: A Game-Changing Year for Investors

Philippines SEC releases new crypto regulatory framework draft

Another Publicly Traded Firm Just Adopted a Bitcoin Reserve Strategy

MicroStrategy Announces Special Shareholders Meeting to Buy More Bitcoin

These 2 Solana killers have potential turn $1000 into $100k in the next 10 week

BTC Touches $94K, VIRTUAL Soars 35%, ZEC Gains 20%

Trump Makes More Pro-Crypto Appointments

Solaxy presale raises $4.5M for Solana Layer 2 solution

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential