Bitcoin

Bitcoin price to hit all-time high if it stays above $45k: CEO

Published

5 months agoon

By

admin

According to CryptoQuant CEO Ki Young Ju, if Bitcoin’s price stays above $45,000, it could surpass its all-time high within a year.

Bitcoin (BTC) rebounded from a tumultuous weekend, and optimism remains in the crypto market despite some bearish indicators in the financial markets.

On Aug. 5, global financial markets experienced declines as Japan’s benchmark index plummeted over 12%, while the Dow Jones and Nasdaq also saw substantial drops. Tech giants collectively lost $650 billion in market cap. The crypto market was also affected as Bitcoin dropped below $50,000, hitting $49,578.

Young Ju warned on X that the crypto market remains vulnerable. If Bitcoin stays at its current levels for a week or two, recovery seems likely, but prolonged stagnation could signal the onset of a bear market.

As long as the #Bitcoin price stays above $45K, it could break its all-time high again within a year, imo.

Some indicators are showing bearish signals. However, they could still recover with a rebound, so we need to watch if it stays at this level for a week or two.

If it… https://t.co/FnqafcQcjp pic.twitter.com/fJiM2btQeF

— Ki Young Ju (@ki_young_ju) August 6, 2024

Bitcoin must stay above $45,000

Young Ju said that if Bitcoin’s price remained above $45,000, it could hit all-time highs, exceeding this year’s price of $73,737.94.

Young Ju believes that the downturn may resemble the situation of early 2020 rather than late 2021. He attributes this to macroeconomic uncertainties rather than fundamental issues.

A significant trend is the movement of Bitcoin from long-time holders to newer ones and institutional investors, while the involvement of individual investors remains fairly limited. This change could play a key role in supporting the market during periods of economic instability.

Currently, Bitcoin is trading in the $56,000 range, reflecting a 13% increase since the lows of Aug. 5.

Source link

You may like

From DMM Bitcoin to the US Government: Largest Crypto Exploits and Hacks of 2024

Access control exploits account for nearly 80% of all crypto hacks in 2024

Will XRP Price Break All-Time Highs In 2025?

Why it’s a better investment than Solana or Ripple in 2024

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Bitcoin

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

Published

5 hours agoon

December 25, 2024By

admin

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

All six will start operations on the same day, Dec. 31, a condition imposed by the regulator, Calcalist said. Final approval for the funds was granted last week.

The funds will be offered by Migdal Capital Markets, More, Ayalon, Phoenix Investment, Meitav and IBI, with management fees ranging from as high as 1.5% to 0.25%. One of the funds will be actively managed, trying to beat bitcon’s performance. They will initially transact just once a day, though future products will be able to trade continuously, Globes said in a Tuesday report, citing market sources.

The ISA’s approval comes almost a year after the U.S. Securities and Exchange Commission (SEC) greenlighted spot bitcoin exchange-traded funds (ETFs) in the world’s largest economy, during which the world’s largest cryptocurrency has more than doubled to trade near a record high. The U.S. funds have gathered a net $35.6 billion of investor cash.

“The investment houses have been pleading for more than a year for ETFs to be approved and started sending prospectuses for bitcoin funds in the middle of the year. But the regulator marches to its own tune. It has to check the details,” an unidentified senior executive at an investment house told Calcalist.

Source link

Bitcoin

Macro Guru Raoul Pal Predicts Crypto Market Will Rally ‘Pretty Strongly’ Into Year-End – Here’s His Outlook

Published

1 day agoon

December 24, 2024By

admin

Former Goldman Sachs executive Raoul Pal believes that the crypto market will rally heading into the end of 2024.

In a new interview with crypto trader Scott Melker, the macro guru says that based on historic precedence, Bitcoin (BTC) and other digital assets may put up larger gains during the last week and half of December.

A rally at this time of year is often referred to as a Santa Claus rally, a financial term used to describe a calendar effect on traditional equities that historically have gone up on the last five market trading days of the year in December and the first two trading days of the new year.

“Normally, what happens at this phase is we should rally into year-end pretty strongly in everything. But then the real game gets played in first quarter.”

Pal also believes that the most explosive rally of the current market cycle is still to come and that it could occur next year, possibly around the Fed’s meeting in March when rates may be cut.

“I think my next phraseology is going to be the banana singularity, that’s when everything goes bananas…

So we’re not at the banana zone singularity point yet. That will come as well. That’s probably sometime Fed March when it all gets silly.”

However, Pal also warns there may be a temporary correction around the end of the year after a rally due to liquidity tightening. He believes the growing money supply is a catalyst for Bitcoin price, and that when it declines so does the flagship crypto’s price.

“Let’s look at the last [US President Donald] Trump administration. So from September to the end of the year, the dollar rallied. September to the end of the year, rates went up. Same narrative. It was all about tariffs and what’s he going to do and how’s it going to play out.

Almost exactly as the year turned, the dollar went lower, the rates went lower. So I’ve been producing a chart showing that global liquidity tightened and it has a 10-week lead time, and that should mean that at the end of the year, we get a correction.”

Bitcoin is trading for $94,367 at time of writing, down more than 11% in the last seven days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Published

2 days agoon

December 24, 2024By

admin

Japan-based early-stage investment firm Metaplanet continues its Bitcoin (BTC) buying spree. The company announced today that it has purchased 619.7 BTC for $61 million – including fees and other expenses – making it the firm’s largest Bitcoin acquisition to date.

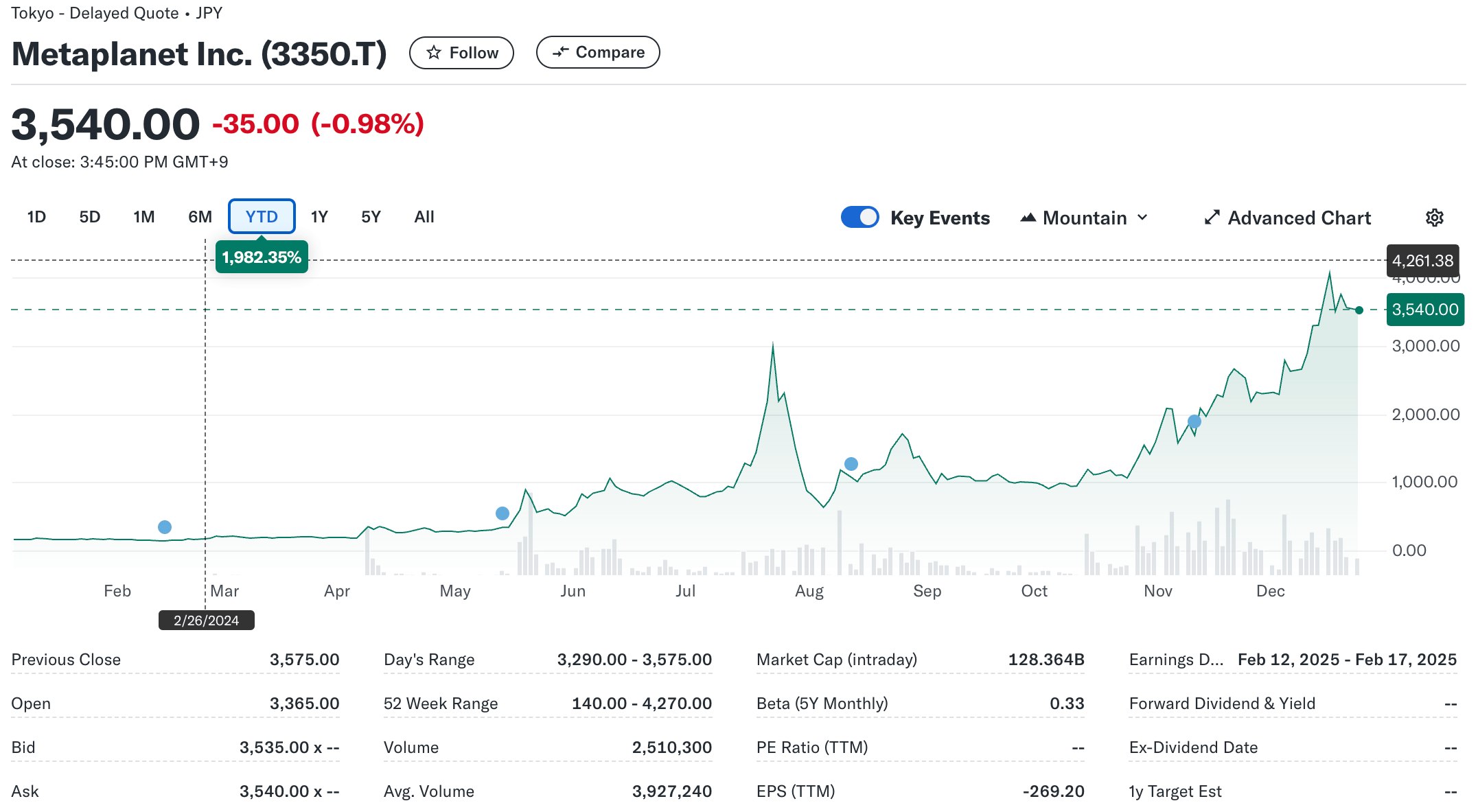

Metaplanet Increases BTC Holdings To 1,762

The recent crypto market downturn from its all-time highs (ATH) does not appear to bother Metaplanet, as the Tokyo-listed firm made its largest BTC purchase to date, buying 619.7 BTC worth $ 61 million at an average price of around $96,000.

Related Reading

To recall, Metaplanet started buying BTC earlier this year in May with a purchase of 97.9 BTC. Since then, the company has purchased BTC every month, barring September, and crossed the 1,000 BTC milestone in November. The latest acquisition has pushed Metaplanet’s total Bitcoin holdings to 1,762, bought at an average price of $75,600 per BTC.

Notably, this $61 million purchase is nearly double the value of Metaplanet’s previous largest acquisition, which occurred in November and was worth close to $30 million. The company’s consistent BTC accumulation has earned it the nickname “Asia’s MicroStrategy,” in reference to the US-based business intelligence firm known for its aggressive Bitcoin buying strategy.

It is worth highlighting that today’s BTC purchase comes a week after Metaplanet raised $60.6 million through two tranches of bond issuance for the purpose of “accelerating BTC purchases.” Metaplanet’s latest purchase also makes its BTC reserves the 12th-largest among publicly listed firms globally.

According to Metaplanet’s official announcement, its BTC Yield – a proprietary metric used to measure the performance of its Bitcoin acquisition strategy – stood at 310% from October 1 to December 23. The firm emphasized that this strategy is designed to be “accretive to shareholders.”

Despite today’s significant BTC purchase, Metaplanet’s stock price saw little movement, closing at $22.5, down 0.98% for the day. However, on a year-to-date basis, the company’s stock has surged by an astounding 1,982%, reflecting the long-term benefits of its Bitcoin-centric strategy.

Bitcoin Supply Crunch To Hasten Adoption?

With Bitcoin’s total maximum supply capped at 21 million, the digital asset has solidified its reputation as an inflation-resistant store of value. A recent report highlights that BTC supply on crypto exchanges has hit multi-year lows, indicating that holders are increasingly withdrawing BTC from exchanges, reducing circulating supply and potentially driving prices higher.

Related Reading

Bitcoin’s scarcity has triggered an unofficial race among corporations – and possibly even governments. For instance, Bitcoin mining firm Hut 8 recently purchased 990 BTC for $100 million, increasing its total holdings to over 10,000 BTC. Similarly, MARA, another Bitcoin mining company, acquired 703 BTC earlier this month, bringing its total holdings to 34,794 BTC.

Speculations surrounding a potential US strategic Bitcoin reserve are further strengthening BTC’s supply crunch narrative, which may fast-track its adoption. At press time, BTC trades at $94,003, down 1.5% in the past 24 hours.

Featured image from Unsplash, charts from Yahoo! Finance and Tradingview.com

Source link

From DMM Bitcoin to the US Government: Largest Crypto Exploits and Hacks of 2024

Access control exploits account for nearly 80% of all crypto hacks in 2024

Will XRP Price Break All-Time Highs In 2025?

Why it’s a better investment than Solana or Ripple in 2024

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Malicious Google ad campaign redirects crypto users to fake Pudgy Penguins website

BlackRock Bitcoin ETF (IBIT) Records Largest-Ever Outflow of $188M

Solana (SOL) Gearing Up: Is a New Surge on the Horizon?

XRP, SOL, NEAR, DOGEN, and DOT poised to explode

Crypto Trader Turned $90 Into $3.25M As Token Skyrockets 5,500%

Here’s a Potential Downside Price Target for Cardano If ADA Sees New Correction, According to Benjamin Cowen

Which crypto will explode in 2025? Expert insights and predictions

XRP Price Pumps 7% On Christmas Eve, Will It Reach Yearly Highs?

XRP firmly above $1, ADA and LCAI to steal the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential