Bitcoin ETF

Bitwise Debuts Option Income ETFs On Bitcoin Treasury Stocks: MSTR, MARA, COIN

Published

5 days agoon

By

admin

Bitwise has introduced three new ETFs that provide yield-seeking investors with exposure to leading Bitcoin treasury companies, using a covered call strategy designed to capitalize on equity volatility while preserving Bitcoin-linked upside.

The funds include:

- $IMST, tracking Strategy (formerly MicroStrategy, ticker: MSTR), which currently holds 528,185 BTC.

- $IMRA, focused on MARA Holdings (MARA), a top-tier Bitcoin miner with 47,600 BTC in treasury.

- $ICOI, offering exposure to Coinbase (COIN), which holds 9,480 BTC and serves as a key on-ramp for institutional and retail Bitcoin adoption.

Each ETF employs an actively managed options overlay, writing out-of-the-money calls on the underlying equity while maintaining a long position. This approach is designed to deliver monthly income distributions—particularly attractive in today’s high-volatility environment—while retaining meaningful upside exposure to Bitcoin-linked companies.

While none of the funds directly hold Bitcoin, all three underlying equities are deeply intertwined with Bitcoin’s performance and trajectory. Strategy and Marathon are among the most prominent corporate holders of BTC, while Coinbase continues to serve as critical infrastructure for the broader ecosystem.

New Tools for Bitcoin-Aligned Capital Allocation

For corporate treasurers and institutional allocators who view Bitcoin as a long-term strategic asset, these new products represent a compelling way to gain indirect exposure while generating yield—especially in balance sheets that can’t yet directly hold BTC.

The rise of equity-based strategies like this is part of a broader shift. More public companies are actively integrating Bitcoin into their financial models, whether through direct holdings or through services and operations tied to Bitcoin mining, custody, or exchange infrastructure.

What Bitwise is offering is not just exposure, but a way to monetize volatility—something that Bitcoin-native companies experience more than most. Whether it’s MSTR stock reacting to Bitcoin’s price swings, MARA stock tracking mining difficulty and rewards, or Coinbase stock responding to changes in trading volume and regulatory sentiment, these equities are increasingly used as BTC proxies by sophisticated investors.

In recent months, institutional interest in Bitcoin ETFs, mining stocks, and companies with Bitcoin treasuries has intensified, and tools like IMST, IMRA, and ICOI provide a new angle on that demand. For companies already on a Bitcoin treasury path—or considering one—this evolution in capital markets infrastructure is notable.

What This Signals for Bitcoin Treasury Strategy

The launch of these ETFs reflects how Bitcoin is no longer just a spot asset—it’s now embedded in public equity strategy, yield generation, and portfolio construction.

Covered call structures won’t be right for every investor or treasury, but the signal is clear: the market is maturing around the idea that Bitcoin isn’t just to be held—it can be actively managed, structured, and monetized in new ways.

These new ETFs won’t replace direct holdings on a corporate balance sheet. But they may complement them—or offer a first step for firms exploring how to position around Bitcoin while still meeting traditional risk, yield, and reporting mandates.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

Source link

You may like

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Bitcoin

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

Published

4 days agoon

April 7, 2025By

admin

Spot Bitcoin exchange-traded funds in the U.S. recorded a negative week once again amid escalating trade tensions following President Donald Trump’s announcement of new tariffs, dubbed ‘Liberation Day’ duties.

According to data from SoSoValue, the 12 spot Bitcoin ETFs reported $172.89 million in net outflows over the past week, snapping a two-week inflow streak that drew in nearly $941 million into the funds.

Notably, these ETFs experienced outflows on four of the five days between March 31 and April 4. Monday saw $71.07 million in outflows, followed by $157.64 million on Tuesday, $99.86 million on Thursday, and $64.88 million on Friday. The only positive day was Wednesday, with $220.76 million in inflows.

The majority of outflows came from Grayscale GBTC, which lost $95.5 million over last week, followed by WisdomTree’s BTCW with $44.6 million per Faside data. Additionally, outflows came from IBIT, BITB, ARKB, and HODL funds that saw $35.5 million, $24.1 million, $22.2 million, and $4.9 million in net redemption, respectively.

However, it wasn’t entirely a bearish week across the board, as Grayscale’s spot Bitcoin Trust, Franklin Templeton’s EZBC, and Fidelity’s FBTC still saw combined inflows of $61.8 million. The remaining BTC ETFs remained flat over the five days.

The drop in investor demand wasn’t limited to Bitcoin ETFs. Ethereum ETFs recorded $49.93 million in outflows last week, marking six straight weeks of withdrawals totaling over $795 million.

These outflows come as Bitcoin posted its worst first-quarter performance since 2018, and investor sentiment weakened due to Trump’s new tariff plans, starting with a flat 10% on all imports and higher rates for certain key trading partners, raising fears of a new global trade war.

At press time, the crypto market was down nearly 10% over the past day. Bitcoin had dropped 9.3%, falling below the $76,500 mark, a level BitMEX co-founder Arthur Hayes previously warned must be held to avoid deeper losses.

Source link

Bitcoin

This Easy Bitcoin ETF Flow Strategy Beats Buy And Hold By 40%

Published

6 days agoon

April 5, 2025By

admin

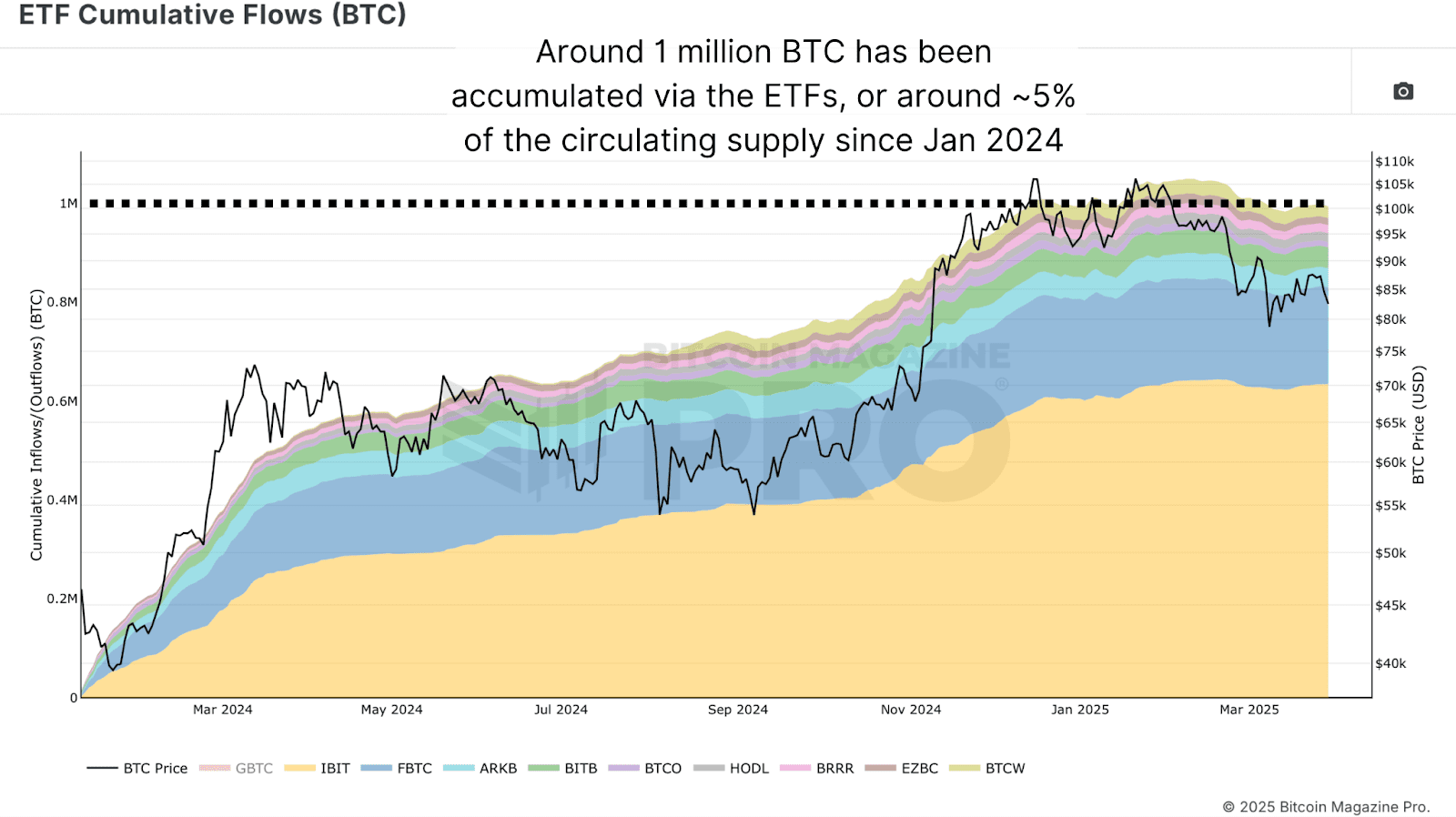

Bitcoin has seen an institutional capital influx on a scale previously unfathomable. Billions of dollars are flowing into Bitcoin ETFs, reshaping the liquidity landscape, inflow-outflow dynamics, and investor psychology. While many interpret this movement as smart money executing complex strategies backed by proprietary analytics, a surprising reality surfaces: outperforming the institutions might not be as difficult as it seems.

For a more in-depth look into this topic, check out a recent YouTube video here:

Outperforming Bitcoin – Invest Like Institutions

Canary In The Bitcoin Coal Mine

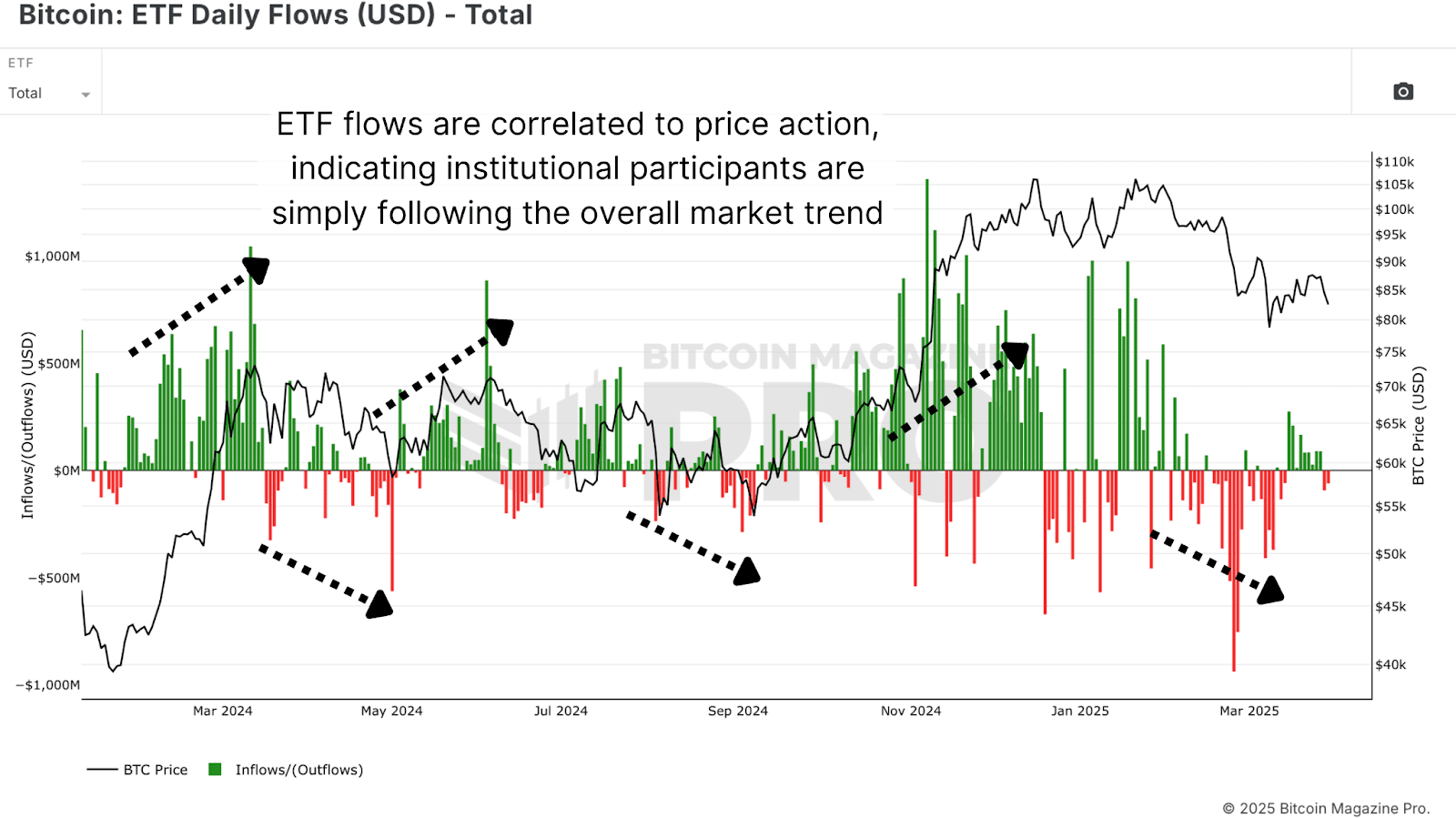

One of the most revealing datasets available today is daily Bitcoin ETF flow data. These flows, denoted in USD, offer direct insight into how much capital is entering or exiting the Bitcoin ETF ecosystem on any given day. This data has a startlingly consistent relationship with short to mid-term price action.

Importantly, while these flows do impact price, they are not the primary movers of a multi-trillion-dollar market. Instead, ETF activity functions more like a mirror for broad market sentiment, especially as retail traders dominate volume during trend inflections.

Surprisingly Simple

The average retail investor often feels outmatched, overwhelmed by the data, and disconnected from the tactical finesse institutions supposedly wield. But institutional strategies are often simple trend-following mechanisms that can be emulated and even surpassed with disciplined execution and proper risk framing:

Strategy Rules:

- Buy when ETF flows are positive for the day.

- Sell when ETF flows turn negative.

- Execute each trade at daily close, using 100% portfolio allocation for clarity.

- No complex TA, no trendlines, just follow the flows.

This system was tested using Bitcoin Magazine Pro’s ETF data starting from January 2024. The base assumption was a first entry on Jan 11, 2024, at ~$46,434 with subsequent trades dictated by flow changes.

Performance vs. Buy-and-Hold

Backtesting this basic ruleset yielded a return of 118.5% as of the end of March 2025. By contrast, a pure buy-and-hold position over the same period yielded 81.7%, a respectable return, but a near 40% underperformance relative to this proposed Bitcoin ETF strategy.

Importantly, this strategy limits drawdowns by reducing exposure during downtrends, days marked by institutional exits. The compounding benefit of avoiding steep losses, more than catching absolute tops or bottoms, is what drives outperformance.

Institutional Behavior

The prevailing myth is that institutional players operate on superior insight. In reality, the majority of Bitcoin ETF inflows and outflows are trend-confirming, not predictive. Institutions are risk-managed, highly regulated entities; they’re often the last to enter and the first to exit based on trend and compliance cycles.

What this means is that institutional trades tend to reinforce existing price momentum, not lead it. This reinforces the validity of using ETF flows as a proxy signal. When ETFs buy, they’re confirming a directional shift that is already unfolding, allowing the retail investor to “surf the wave” of their capital inflow.

Conclusion

The past year has proven that beating Bitcoin’s buy-and-hold strategy, one of the toughest benchmarks in financial history, is not impossible. It requires neither leverage nor complex modeling. Instead, by aligning oneself with institutional positioning, retail investors can benefit from market structure shifts without the burden of prediction.

This doesn’t mean the strategy will work forever. But as long as institutions continue to influence price through these large, visible flow mechanics, there is an edge to be gained in simply following the money.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin ETF

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Published

3 weeks agoon

March 19, 2025By

admin

Bitcoin’s market structure is evolving, and its once-predictable four-year cycles may no longer hold the same relevance. In a recent conversation with Matt Crosby, lead analyst at Bitcoin Magazine Pro, Mitchell Askew, Head Analyst at Blockware Solutions, shared his perspective on how Bitcoin ETFs, mining advancements, and institutional adoption are reshaping the asset’s price behavior.

According to Askew, Bitcoin’s historical pattern of parabolic price increases followed by steep drawdowns is changing as institutional investors enter the market. At the same time, the mining industry is becoming more efficient and stable, creating new dynamics that affect Bitcoin’s supply and price trends.

Bitcoin’s Market Cycles Are Fading

Askew suggests that Bitcoin may no longer experience the extreme cycles of past bull and bear markets. Historically, halving events reduced miner rewards, triggered supply shocks, and fueled rapid price increases, often followed by corrections of 70% or more. However, the increasing presence of institutional investors is leading to a more structured, macro-driven market.

He explains that Spot Bitcoin ETFs and corporate treasury allocations are bringing consistent demand into Bitcoin, reducing the likelihood of extreme boom-and-bust price movements. Unlike retail traders, who tend to buy in euphoria and panic-sell during downturns, institutions are more likely to sell into strength and accumulate Bitcoin on dips.

Askew also notes that since Bitcoin ETFs launched in January 2024, price movements have become more measured, with longer consolidation periods before continued growth. This suggests Bitcoin is beginning to behave more like a traditional financial asset, rather than a speculative high-volatility market.

The Role of Bitcoin Mining in Price Stability

As a mining analyst at Blockware Solutions, Askew provides insight into how Bitcoin mining dynamics influence price trends. He notes that while many assume a rising hash rate is always bullish, the reality is more complex.

In the short term, increasing hash rate can be bearish, as it leads to higher competition among miners and more Bitcoin being sold to cover electricity costs. However, over the long term, a rising hash rate reflects greater investment in Bitcoin infrastructure and network security.

Another key observation from Askew is that Bitcoin’s hash rate growth lags behind price growth by 3-12 months. When Bitcoin’s price rises sharply, mining profitability increases, prompting more capital to flow into mining infrastructure. However, deploying new mining rigs and setting up facilities takes time, leading to a delayed impact on hash rate expansion.

Why Mining Profitability Is Stabilizing

Askew also highlights that mining hardware efficiency is reaching a plateau, which has significant implications for miners and Bitcoin’s supply structure.

If you’re thinking about Bitcoin mining, you MUST watch this clip.

There’s a trend developing in mining hardware that will bode extremely well for miners:

– Longer machine lifespans

– Slowing hashrate growth

– Increased lag between price growth and hashrate growthBitcoin… pic.twitter.com/H0ZjsCm7Rc

— Mitchell

(@MitchellHODL) March 19, 2025

In Bitcoin’s early years, new mining machines offered dramatic efficiency improvements, forcing miners to upgrade hardware every 1-2 years to remain competitive. Today, however, new models are only about 10% more efficient than the previous generation. As a result, mining rigs can now remain profitable for 4-8 years, reducing the pressure on miners to continuously reinvest in new equipment.

Electricity costs remain the biggest factor in mining profitability, and Askew explains that miners are increasingly seeking low-cost power sources to maintain long-term sustainability. Many companies, including Blockware Solutions, operate in rural U.S. locations with stable energy prices, ensuring better profitability even during market downturns.

Could the U.S. Government Start Accumulating Bitcoin?

Another important discussion point raised by Askew is the potential for a U.S. Strategic Bitcoin Reserve (SBR). Some policymakers have proposed that the U.S. government accumulate Bitcoin in the same way it holds gold reserves, recognizing its potential as a global store of value.

Askew explains that if such a reserve were implemented, it could create a massive supply shock, pushing Bitcoin’s price significantly higher. However, he cautions that government action is slow and would likely involve gradual accumulation rather than sudden large-scale purchases.

Even if implemented over several years, such a program could further reinforce Bitcoin’s long-term bullish trajectory by removing available supply from the market.

Bitcoin Price Predictions & Long-Term Outlook

Based on current trends, Askew remains bullish on Bitcoin’s long-term price trajectory, though he believes the market’s behavior is shifting toward more gradual, sustained growth rather than extreme speculative cycles.

- Base Case: $150K – $200K

- Bull Case: $250K+

- Base Case: $500K – $1M

- Bull Case: Bitcoin flips gold’s $20T market cap → $1M+ per BTC

Askew sees several key factors driving Bitcoin’s price over the next decade, including:

He emphasizes that as Bitcoin’s market structure matures, it may become less susceptible to sharp price swings, making it a more attractive long-term asset for institutions.

Conclusion: A More Mature Bitcoin Market

According to Askew, Bitcoin is undergoing a structural shift that will shape its price trends for years to come. With institutional investors reducing market volatility, mining innovations improving efficiency, and potential government adoption, Bitcoin’s market behavior is beginning to resemble that of gold or other long-term financial assets.

While dramatic parabolic runs may become less frequent, Bitcoin’s long-term trajectory appears stronger and more sustainable than ever. Askew’s perspective reinforces the idea that Bitcoin is no longer just a speculative asset—it is evolving into a key financial instrument with increasing global adoption.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Top 4 Altcoins to Sell Before US-China Trade War Extends Beyond 125% Tariffs

OpenAI Countersues Elon Musk, Accuses Billionaire of ‘Bad-Faith Tactics’

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x