Follow-up

Bridge coffer totals $58m, Edge Matrix Chain raises $20m

Published

4 months agoon

By

admin

Venture capitalists are pumping more money into fewer deals.

That’s according to the latest VC report from London-based analytics firm, GlobalData. The trend is especially evident in the U.S. where total VC funding raised by startups improved by 2.4% year-over-year from January to July. However, there was a 41% decline in VC deal volume.

Still, the U.S. “continues to lead the global VC landscape with a significant gap” over its peers (i.e., China, Europe) leading both in deal count and funding value, driven by a surge in deals exceeding $100 million.

Venture rounds in the crypto sector rarely reach that level. This year’s exceptions include Berachain, the bear-themed blockchain platform, which secured $100 million in funding, and Farcaster, a decentralized social protocol, raising $150 million in a series A round.

Still, crypto startups continue to attract plenty of investor love, and this past week was no different. According to crypto fundraising tracker, Crypto Fundraising, over $141 million was raised between Aug. 25 and Aug. 31.

Below we look at a few standouts (not including the funding rounds with undisclosed amounts).

Bridge, $58 million

- Bridge, a global stablecoin payment network, has raised $58 million in funding thus far, including $40 million in fresh capital.

- Sequoia, Ribbit and Index are among its backers, according to Fortune, which broke the story.

- The startup, co-founded by former Square and Coinbase executives Zach Abrams and Sean Yu, now counts Coinbase among its customers — the other being SpaceX.

Edge Matrix Chain, $20 million

- Edge Matrix Chain, which specializes in multi-chain artificial intelligence infrastructure, collected $20 million in a round led by Amber Group and Polygon Venture.

- One Comma, Kapley Judge and Associated Corporations, Cyberrock Venture Fund, Candaq Fintech Group, Hameem Raees Chowdhury also joined the effort.

- Edge Matrix hopes to put the funds toward a Layer 1 blockchain and, ultimately, introduce a new DeFi asset class backed by tokenized real-world GPU resources.

Space and Time, $20 million

- Space and Time, or SxT, nabbed $20 million in a Series A round that included Cypher Capital, Framework Ventures, Lightspeed Faction, Arrington Capital and Hivemind Capital.

- The startup — offering index data for Bitcoin (BTC), Ethereum (ETH) and Polygon (MATIC) ecosystems — raised $50 million in total.

- Other backers include Microsoft’s M12 Ventures, DCG, F-Prime Capital, OKX Ventures, Circle Ventures and Alumni Ventures, Fortune reported.

Solayer, $12 million

- Solayer Labs clinched $12 million in seed funding. Polychain Capital led the round; Big Brain Holdings, Hack VC, Nomad Capital, Race Capital, ABCDE, and Maelstrom also participated.

- The startup is developing a Solana (SOL) restaking protocol.

Gameplay Galaxy, $11.17 million

- Gameplay Galaxy, a web3 video game studio, amassed $11.17 million as part of a seed extension round.

- Blockchain Capital and Merit Circle co-led the round; Several anonymous investors also took part.

Myco io, $10 million

- UAE-based Web3 streaming platform, Myco, completed the first closing of its Series A funding round, which included a $10-million sum.

- Daman Investments, Aptos Labs, B Digital, Mocha Ventures, Art3 Foundation, Ghaf Capital Partners, Mix Media Network, Factor6 Capital Partners, and Enjinstarter joined the campaign along with 88 accredited investors via Republic.com.

Double Jump Tokyo, $10 million

- SBI Investment led a $10-million Series D funding round for Japanese web3 game maker Double Jump.Tokyo, a developer of blockchain games and infrastructures.

- Sony Group, Taisu Ventures, Gate Ventures, TM Capital and Bing Ventures also participated.

Additional funding rounds < $10m

- Quai Network, $5 million

- OneBalance, $5 million

- Chainbound, $4.6 million

- SnakeLite, $4 million

- Nectar AI, $3.9 million

- Level Protocol, $3.6 million

- Echelon Market, $3.5 million

- Time Fun, $3 million

- Verofax, $3 million

- Kredete, $2.25 million

- Legion, $2 million

- Origami Finance, $1.5 million

For last week’s edition of our “Crypto VC roundup,” click here.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Donald Trump

Michael Saylor is willing to advise Trump on the crypto policy

Published

2 days agoon

December 21, 2024By

admin

MicroStrategy Inc. co-founder and executive Chairman Michael Saylor says he is willing to advise Trump on cryptocurrency policy when the crypto advisory council is set.

During the Dec. 18 episode of the Open Interest show on Bloomberg Television, Saylor voiced his willingness to provide his advice on the digital assets policy to President-elect Donald Trump, either publicly or confidently, if he is asked to do so.

Before expressing his willingness to advise Trump on the crypto policy, Saylor admitted that he had already met “with a lot of people” in the incoming administration but declined to specify the personalities nor mentioned if he already met Trump.

Is Saylor fit for a position?

Since the 2020s, Michael Saylor has been one of the key Bitcoin advocates and investors. Saylor is one who puts money where his mouth is, as he personally spent around one billion dollars on BTC. In 2020, Saylor took to X (Twitter at the time) to announce that he personally owns 17,732 bitcoins and that he acquired these coins before MicroStrategy (MSTR) made the first massive purchase of bitcoins. YahooFinance! reports that currently MicroStrategy owns around 440,000 BTC, which is close to a 2% share of the entire BTC supply. MicroStrategy made headlines on the eve of the latest BTC price peak when the company was included in the Nasdaq 100 index.

Michael Saylor names Bitcoin an apex property of the human race and has an insatiable thirst for bitcoins. He compares Bitcoin to the territories like Manhattan or Alaska that were bought by the early colonist administration, specifying that Bitcoin is rather a kind of cyberspace. That’s why MicroStrategy aims to own bitcoins in bulk. According to Saylor, buying as much of this “space” as possible is crucial for the United States. This vision speaks to the statement posted by Donald Trump on the Truth Social platform. “We want all the remaining Bitcoin to be MADE IN THE USA!” the post reads.

Saylor singled out Trump as the most crypto-friendly Republican politician. It seems that Saylor shares the President-elect’s views on Bitcoin. Although not an outright GOP supporter, in September, Saylor made claims that he sees Republicans as a more progressive party when it comes to cryptocurrency regulation. He names regulation pressure decrease, treating crypto as a tool to boost the U.S. economy, and encouraging individuals to pursue their economic aims using digital finance as progressive characteristics of the Republican approach to the crypto industry.

What Do We Know About the Crypto Advisory Council?

Trump proposed the creation of a crypto advisory council during his now famous speech at the Nashville cryptocurrency conference in July 2024. As of December, not much information about the preparations of this council has been made public.

The participating companies’ lineup is not clear yet. However, it has been reported that such brands as Coinbase, Ripple Labs, Paradigm, and Andreessen Horowitz (a16z) are seeking interactions with the incoming administration. Allegedly, an a16z rep was involved in advising the Trump team during the presidential campaign. On December 6, Trump introduced entrepreneur and venture capitalist David O. Sacks as the “White House A.I. and Crypto Czar” via the Truth Social post.

It’s worth saying that, to say the least, before 2024, Trump wasn’t an avid crypto enthusiast. In the past, the President-elect made a series of anti-crypto remarks, calling Bitcoin “not money” and saying that the value of cryptocurrencies is based on thin air.

However, the 2024 Presidential campaign saw a drastic change in Trump’s stance on crypto. He started to take donations in digital currencies, visited a major crypto conference in Nashville where he promised to make America “a crypto capital of the world,” and made several important proposals concerning the cryptocurrency policy.

On top of tax cuts for the U.S. cryptocurrency companies, the removal of Gary Gensler from the SEC, and the creation of the strategic Bitcoin reserve, Trump announced the creation of the advisory body with the leading position granted to the richest man on Earth and his passionate supporter Elon Musk. This unofficial agency is called The Department of Government Efficiency, or simply DOGE, a reference to a legendary memecoin, a notorious soft place of a Tesla CEO. Who knows just what else to expect from Donald Trump when he goes crypto?

Source link

Crypto scam

Meme Coins Die — Bloggers’ Advertising is Ineffective

Published

4 weeks agoon

November 26, 2024By

admin

The vast majority of meme coins promoted by influencers in X end up “dead” — their value drops by 90% or more within three months.

The attention surrounding meme coins has led many famous X personalities to promote these tokens as a quick way to make money. However, the research by CoinWire shows the unpleasant reality: most meme coins have no value, and many investors face heavy losses.

“Our research reveals a sobering truth: most of these meme coins are, in fact, dead, and the majority of investors end up with significant losses.”

CoinWire report

To understand the meme coin situation, the experts analyzed data from over 1,500 tokens endorsed by 377 influential X users. They selected 377 of them with at least 10,000 followers who frequently promote meme coins. They then compiled a list of 1,567 meme coins that were promoted over the past three months.

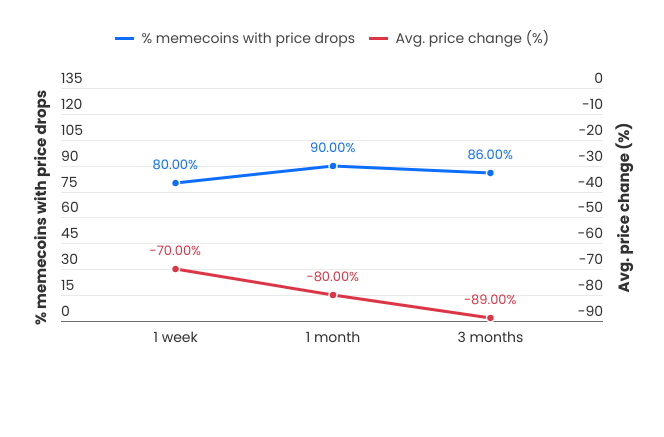

Using Dune Analytics, experts collected information on the price when they were first promoted, the current price, and the price after one week, one month, and three months. A meme coin is considered dead if its current value has fallen by 90% or more compared to the initial promotion.

“76% of Twitter influencers have promoted meme coins that are now dead. Two out of three meme coins they promote are worthless. This means that many influencer-driven promotions essentially set up investors for failure.”

CoinWire report

The real effectiveness of meme coin promotion

The actual situation with meme coins differs significantly from influencers’ positive picture.

Stats show that these projects rarely meet their expectations: after a week, 80% of meme coins promoted by influencers lose 70% of their value.

After a month, about 90% of these tokens lost about 80% in value, and after three months, 86% of them fell in price by 10 times. As analysts note, this trend indicates significant instability and volatility of meme coins backed by influential individuals. In addition, most investors end up facing serious losses, often just a few weeks after investing.

Achieving high returns is almost impossible

One main factor that makes meme coins attractive is their potential to generate significant returns.

However, in reality, this almost never happens. Only 1% of influencers successfully promoted meme coins. Furthermore, only 3% of meme coins promoted by influencers ever achieved such a significant increase.

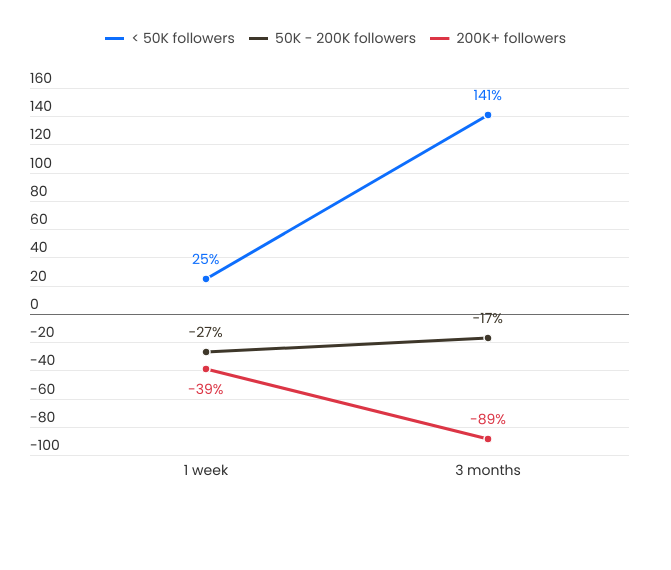

Interestingly, the more followers an influencer has, the worse the performance of the meme coins they promote. Influencers with over 200,000 followers tend to perform the worst, with their meme coin promotions losing 39% of their investment within a week and 89% of their investment within three months.

In contrast to more prominent influencers, those with fewer than 50,000 followers perform better, with 25% of their revenue positive within a week and a 141% increase within three months. This may indicate that smaller influencers are more sincere in their promotional approaches, while larger ones often prioritize financial gain over the quality of the projects they support.

As for influencer earnings from meme coin promotions, analysts used TweetHunter’s X earnings calculator to estimate the potential profit from a sponsored tweet.

While investors often lose money, influencers benefit from promoting meme coins. They earn an average of $399 for each promotional tweet that attracts about 15,000 views. In this way, influencers promote even the most dubious tokens in the hopes of making a high profit.

Influencer promotion is mostly harmful

The data highlights a disturbing reality: meme coin promotion by influencers is mostly doing more harm than good for ordinary investors. 76% of influencers promote tokens without activity, and the probability of getting the desired 10x return is extremely low.

“Investors need to be cautious, questioning the true value behind these promotions and avoiding decisions driven by social media hype alone.”

CoinWire report

A CoinWire study shows that X meme coin hype is good for influencers but almost always disastrous for investors. Most of these tokens quickly lose their value. The chances of serious profits for investors who believe the buzz are minimal.

Source link

Bitcoin

Senator Lummis wants to replenish Bitcoin reserves with gold

Published

4 weeks agoon

November 24, 2024By

admin

Republican Senator Cynthia Lummis says converting gold reserves into Bitcoin could strengthen the U.S. government’s finances.

In an interview with CNBC, Lummis suggested that the Federal Reserve sell some of its gold reserves, which were valued at 1970s prices, and use the proceeds to buy Bitcoin (BTC).

See the clip below.

Lummis, known for her bullish support of cryptocurrency, believes that creating a strategic Bitcoin reserve could strengthen the dollar’s position as the world’s reserve currency and reduce the country’s debt burden.

She also suggested that Bitcoin, which is edging toward $100,000, could provide high returns.

Bitcoin can be considered a “gold standard digital asset” and creating a strategic reserve would be an essential step in its implementation, Lummis explained.

“We have reserves at our 12 Federal Reserve banks, including gold certificates that could be converted to current fair market value. They’re held at their 1970s value on the books. And then sell them into bitcoin, that way we wouldn’t have to use any new dollars in order to establish this reserve.”

Senator Cynthia Lummis

With the Trump administration’s growing interest in cryptocurrencies, Lummis said that legislation for digital assets could begin to be developed in the coming years.

How the Bitcoin reserve works

The creation of the Bitcoin Strategic Reserve Fund is a comprehensive initiative meant to strengthen financial stability and protect the nation’s assets.

Explained: 🇺🇸 The Strategic Bitcoin Reserve

Breaking down the BITCOIN act — the bill introduced by Senator @CynthiaMLummis

– Buy 1m BTC over five years

– HODL for 20 years

– Proof of Reserves

– Protect Bitcoin property rightsTL;DR: 🚀🚀🚀 pic.twitter.com/snnWP59FBc

— Julian Fahrer (@Julian__Fahrer) November 19, 2024

The Bitcoin Strategic Reserve will also act as a secure financial mechanism that allows the government and other agencies to use Bitcoin as a long-term asset.

The reserve will include a decentralized storage network. By creating a decentralized network of secure Bitcoin storage facilities, the U.S. can protect assets from centralized risks and vulnerabilities. Storage facilities will be distributed across different regions, reducing dependence on one location.

Bitcoin purchase program

The government will implement a Bitcoin purchase program, and it is planning to purchase 200,000 BTC per year for five years. The overall goal is to increase Bitcoin’s strategic reserve to 1 million BTC. Purchases will be made regularly to avoid sharp price fluctuations and ensure consistency.

All purchased Bitcoin will be held in the reserve for at least 20 years.

In addition, all Bitcoins currently stored in other government agencies will be transferred to the strategic reserve, which will allow for centralization and efficient asset management. States can voluntarily participate in this reserve by opening segregated accounts to deposit or withdraw their Bitcoin assets as needed.

The initiative will be supported because government agencies cannot confiscate or seize the rights to legally owned Bitcoin assets. This will provide confidence and incentives for Americans to store their Bitcoins independently.

Bitcoin reserves will not solve the U.S. national debt problem

Avik Roy, president of the non-profit think tank Foundation for Research on Equal Opportunity (FREOPP), doubts that creating a strategic reserve in Bitcoin will help the U.S. overcome the debt crisis.

Speaking at the North American Blockchain Summit 2024 in Dallas, Avik Roy said that Lummis’s plan will not help cover the national debt, which has already grown to $35 trillion.

“The Bitcoin reserve is good but does not solve the problem. You still have to actually do the budgetary reforms to get us out of this $2 trillion a year of federal deficits.”

Avik Roy, FREOPP president

According to Roy, even with a Bitcoin reserve, the U.S. would still have to implement budgetary reforms to get the country out of its $2 trillion federal deficit annually.

The political scientist noted that the BTC reserve could ease tensions in the bond market by making it feel like the U.S. is not going broke. Roy is also concerned that the U.S. could abandon its BTC reserves in the future, similar to what happened with gold in the 1970s.

The argument against Lummis

Bitcoin as a reserve asset points to several other challenges, with the biggest being volatility. Bitcoin’s price fluctuations make it a risky reserve asset compared to stable options like gold.

After all, Bitcoin has experienced several notable crashes throughout its history.

- In June 2011, when the Mt. Gox exchange was hacked. Bitcoin’s price dropped from $32 to $0.01 in a single day, a nearly 99.9% collapse.

- December 2017 to February 2018: After hitting a peak of nearly $20,000, Bitcoin lost over 56% of its value within months.

- March 2020: During the onset of the COVID-19 pandemic, Bitcoin’s price fell nearly 46% in less than a month, dropping from $10,300 to about $5,600.

- May 2021: Bitcoin dropped over 40% in two weeks, from $58,000 to $34,700.

- November 2022: Following the collapse of the FTX exchange, Bitcoin experienced a 14% dip in a short period

Bitcoin is also typically associated with illicit activities and discreet purchases, which raises concerns about integrating it into national financial systems. Critics say it could also enable countries like Russia to bypass international sanctions, undermine global financial stability and create geopolitical tensions.

Trump’s crypto advisory board to create promised reserve

A number of cryptocurrency companies, including Ripple, Kraken, and Circle, are seeking a seat on President Donald Trump‘s promised crypto advisory board, as Reuters reports. They are eager to participate in his plans to overhaul U.S. policy.

During his campaign at a Bitcoin conference in Nashville in July, Trump promised to create a new council as part of a pro-crypto administration. Trump’s team is discussing how to organize and staff the council and which companies should be included.

Potential members include venture capital firm Paradigm and the crypto arm of venture giant Andreessen Horowitz, known as a16z.

“It’s being fleshed out, but I anticipate the leading executives from America’s bitcoin and crypto firms to be represented.”

David Bailey, CEO of Bitcoin Magazine

According to sources, the team is expected to advise on digital asset policy, work with Congress on cryptocurrency legislation, create the Bitcoin reserve promised by Trump, and collaborate with agencies like the Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Treasury Department. One source said law enforcement officials and former lawmakers may also be on the board.

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential