24/7 Cryptocurrency News

BTC & Altcoins Rebound, ORDI Soars 20%

Published

4 months agoon

By

admin

Cryptocurrency Prices Today (September 3): The current market state has ignited considerable investor optimism globally. Bitcoin (BTC) price regained a pumping movement to trade above the $59K level, whereas Ethereum (ETH), Solana (SOL), and XRP gained roughly 3%-5% today. Simultaneously, the global crypto market cap rose 3.29% over the past day to $2.08 trillion. Also, the total crypto market volume jumped 3.44% over the past day to $57.03 billion.

Here’s a collection of some of the top cryptocurrencies by market cap and their price movements today, September 3.

Cryptocurrency Prices Today: Market Rebound Sparks Optimism

Following a waning movement witnessed recently, today’s price rebound comes as optimistic news for the broader market. Bitcoin topped $59K, while Ethereum traded above $2,500. Similarly, Solana and XRP prices reversed previous slumps.

Bitcoin Price Today

BTC price illustrated a nearly 3% increase in value over the past day and is currently trading at $59,156. The flagship crypto’s 24-hour lows and highs were $57,398.98 and $59,815.06, respectively.

This pumping movement primarily aligns with U.S. spot Bitcoin ETFs halting their outflow journey as of September 2, as the market was closed. Moreover, the futures OI rose 2.20% in the past 24 hours to $30.35 billion, aligning with the gaining movement.

It’s also worth mentioning that a smart whale was recorded bagging 1,100 BTC from Binance recently. This accumulation hints at bolstered movements for the cryptocurrency ahead.

Meanwhile, Bitcoin’s dominance stood at 56.30%, a 0.04% fall over the day. The crypto’s market cap was evaluated as $1.17 trillion.

Ethereum Price Today

Simultaneously, ETH price jumped 3% in the past 24 hours and is currently sitting at $2,519. The coin’s intraday lows and highs were $2,434.43 and $2,563.09, respectively.

Nonetheless, a recent ETH price analysis by CoinGape Media suggests that the second-largest crypto by market cap risks a 22% downside momentum. This is primarily attributable to rising exchange supply and death cross formation.

Also, ETH futures OI surged 2.5% to $10.65 billion, further falling in line with today’s price upswing.

Solana Price Today

The crypto SOL witnessed a nearly 5% pump in value to trade at $135 today. Solana’s intraday lows and highs were $127.27 and $137.14, respectively.

SOL’s futures OI jumped nearly 3% to reach $2.08 billion today. Solana’s market cap rested at $63.33 billion.

XRP Price Today

XRP price gained 3% over the day to trade at $0.5669. Its 24-hour lows and highs were $0.5455 and $0.5721, respectively. Despite massive XRP whale dumps recorded over the past day, the Ripple-backed cryptocurrency witnessed a price rebound today.

Meme Coins Prices Today

Simultaneously, Dogecoin (DOGE) price gained over 4% and is trading at $0.09959. Also, Shiba Inu (SHIB) price saw a 3% uptick in value and is sitting at $0.00001371.

Even PEPE, WIF & BONK Soared 5%-12% today, leading the meme coins sector gains.

Top Cryptocurrency Gainers Prices Today

ORDI

ORDI price’s intraday gains totaled a whopping 20% today. The token traded at $32, with 24-hour lows and highs being $26.17 and $32.41, respectively.

SATS

1000SATS price soared 14% over the past day to reach $0.0003108. The coin’s 24-hour lows and highs were $0.0002693 and $0.0003163, respectively.

Dogwifhat

WIF price pumped 14% in the past 24 hours and is currently trading at $1.61. Its intraday lows and highs were $1.39 and $1.63, respectively.

Top Cryptocurrency Losers Prices Today

The top losers list consisted of only two coins.

TRON

TRX price slipped 1% over the past day, defying the broader market trend. TRX rested at $0.1541, with its intraday lows and peaks at $0.1538 and $0.1569, respectively.

Immutable

IMX price waned 0.6% over the past day to trade at $1.27. Its intraday lows and highs were $1.24 and $1.29, respectively.

Besides, the hourly time frame charts sparked further speculations on the cryptocurrency prices today. BTC price slipped 0.27%, whereas ETH slipped 0.45%, piquing investor interest globally.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Solaxy presale raises $4.5M for Solana Layer 2 solution

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

24/7 Cryptocurrency News

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Published

1 hour agoon

December 24, 2024By

admin

Elon Musk xAI has raised $6 billion in its latest funding round, according to a filing with the U.S. Securities and Exchange Commission. This round adds to the $6 billion raised earlier this year, bringing the company’s total funding to $12 billion. The capital injection positions xAI to expand its generative AI initiatives and enhance its competitive edge.

Elon Musk xAI Achieves $12B Total Funding After Latest $6B Round

According to a recent report, Elon Musk xAI has successfully secured $6 billion from investors, including Andreessen Horowitz, BlackRock, Fidelity, Nvidia, and others. This latest funding round exclusively involved previous investors, many of whom had supported Musk’s acquisition of X (formerly Twitter).

The funds bring xAI total capital raised to $12 billion. The company plans to use this funding to accelerate the development of its generative AI model, Grok, and expand its ecosystem. This substantial financial backing positions the firm to compete with industry leaders such as OpenAI and Anthropic.

Moreover, the Grok AI model, developed by xAI, powers a range of features on X, including a chatbot available to premium and free users in select regions. Known for its functionality, Grok can generate images through the Flux generator, analyze visuals, and summarize trending news.

In October, xAI launched an API allowing developers to integrate Grok into third-party apps and platforms. The company also introduced a standalone iOS app for testing, further extending its generative Artificial Intelligence capabilities.

Memphis Data Center and Infrastructure Upgrades

To support its ambitious goals, Elon Musk xAI operates a Memphis data center equipped with 100,000 Nvidia GPUs. The facility, constructed in just 122 days, currently relies partly on diesel generators. According to the blog post, the company has plans to double the center’s capacity in 2025, securing approval for additional power.

The upgraded infrastructure will also benefit Tesla, with plans to integrate xAI’s developments into autonomous driving technologies. This expansion reflects Elon Musk’s vision to enhance AI applications across industries.

While Elon Musk’s xAI has made rapid advancements, it continues to face fierce competition. Rivals such as Anthropic and OpenAI have also secured billions in funding.

Following the growing competition, earlier this month, the Tesla CEO filed a lawsuit against OpenAI and Microsoft, accusing them of anti-competitive practices. The lawsuit alleges that OpenAI coerced investors to avoid supporting rivals like Musk’s xAI. Musk’s legal team claims that Microsoft’s $13 billion investment in OpenAI led to conflicts of interest and market manipulation

In addition, Meta CEO Mark Zuckerberg emphasized the need for stricter oversight to prevent nonprofit entities from exploiting their status for financial gain. Joining Elon Musk, Zuckerberg called for a formal investigation into OpenAI’s transition, highlighting potential misuse of tax-exempt donations and resources.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

Published

5 hours agoon

December 23, 2024By

admin

Multinational financial technology firm Moonpay is reportedly in talks to buy Helio as it looks to bolster its crypto service offerings. According to a scoop shared by Fox Business journalist Eleanor Terrett, the Helio deal is worth about $150 million. If successful, this will mark the largest acquisition made by the Miami-based firm since its inception.

Moonpay and Helio as the Power Duo

While much detail has not emerged regarding the terms of the deal, many in the ecosystem are already weighing the potential. Notably, Helio will enable Moonpay to compete directly with Coinbase Commerce as a self-service crypto payments outfit.

Helio enables content creators and ecommerce merchants to get paid for their products and services using crypto. Among the available products includes Solana Pay, the payments engine powering the DexScreener platform. As Terrett highlighted, the Solana Pay outfit is also integrated into Shopify.

🚨SCOOP: @FoxBusiness has learned that #crypto payment services provider @moonpay is in talks to acquire @helio_pay for an estimated $150 million. This would be MoonPay’s largest acquisition to date.

Helio is a Coinbase Commerce alternative providing a self-service crypto…

— Eleanor Terrett (@EleanorTerrett) December 23, 2024

Moonpay occupies a unique role in the crypto ecosystem. It currently powers a lot of crypto payments services with an extensive partnerships record. As reported by Coingape in October, it landed a Venmo partnership to enable crypto access to 60 million users worldwide.

With crypto adoption growing, the need for more merchant integrations have grown considerably. Moonpay is among the infrastructure firms benefitting from these growth and Helio might help amplify this.

Growing Corporate Investments in Crypto

Since the victory of Donald Trump as president-elect last month, the corporate alignment has increased. Suddenly, companies are beginning to revamp their investment strategies in a bid to benefit from the potential incoming pro-crypto administration.

From Justin Sun investing $30 million into World Liberty Financial to Tether’s latest $775 million investment in Rumble, firms are largely diversifying their portfolios.

While M&A activities beyond the potential Moonpay deal might appear too formal, the presence of Bitcoin and Ethereum-based ETF products is removing entry barriers for firms.

BlackRock invests in IBIT, setting a precedent for state pension funds to also join the trend. Asset management firms are doubling down on other crypto ETF products to grant firms more access to gain exposure to the crypto industry.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

5 Tokens Ready For A 20X After Solana ETF Approval

Published

9 hours agoon

December 23, 2024By

admin

The US Securities and Exchange Commission (SEC) looks likely to approve a Solana exchange-traded fund (ETF) under Donald Trump’s administration. With this Solana ETF approval looking imminent, there are tokens that are ready to enjoy a 5x price increase once this happens.

5 Tokens That Could 20x After A Solana ETF

Bloomberg analysts recently suggested that a Solana ETF could launch at some point next year, although the exact timing remains uncertain due to some complex legal issues. Ahead of this potential launch, these are 5 tokens that could witness a significant price increase after the SEC approves a Solana ETF.

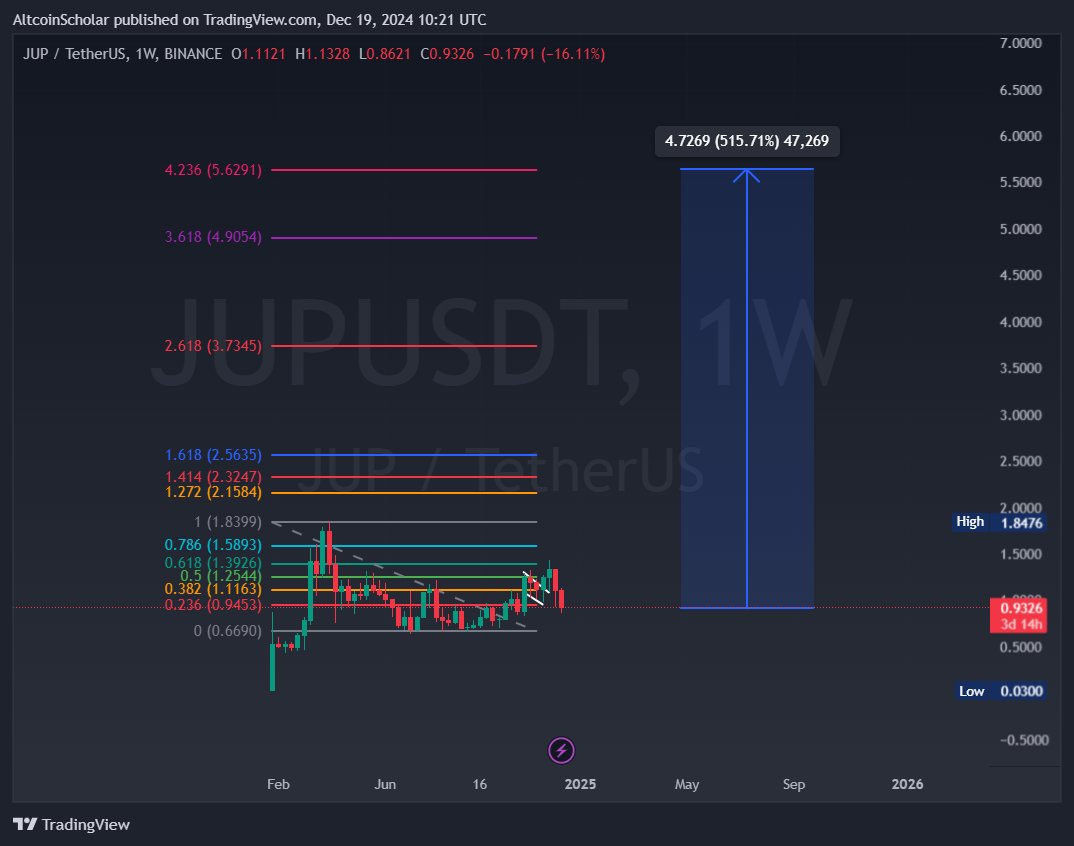

Jupiter (JUP)

Jupiter (JUP) is one of the tokens that is ready for a 20x price increase after a Solana ETF approval. The JUP price is in a good position to benefit from such bullish development, considering its status as one of the top Solana coins.

As such, the DeFi token will likely witness a parabolic surge on the back of an ETF approval. Crypto analyst Altcoin Scholar predicted that JUP could rally to $10 or higher in this bull run.

NebulaStride Token (NST)

NebulaStride Token (NST) is in a good position to witness a significant price increase after a Solana ETF approval. This ETF approval provides a bullish outlook for the crypto and NST, as a newer token, could enjoy one of the most gains.

As a newer token, NST could even record more than a 20x price increase since it has more room to run to the upside than these older coins. the token’s fundamentals also provides a bullish outlook for its as NebulaStride is revolutionizing the finance space.

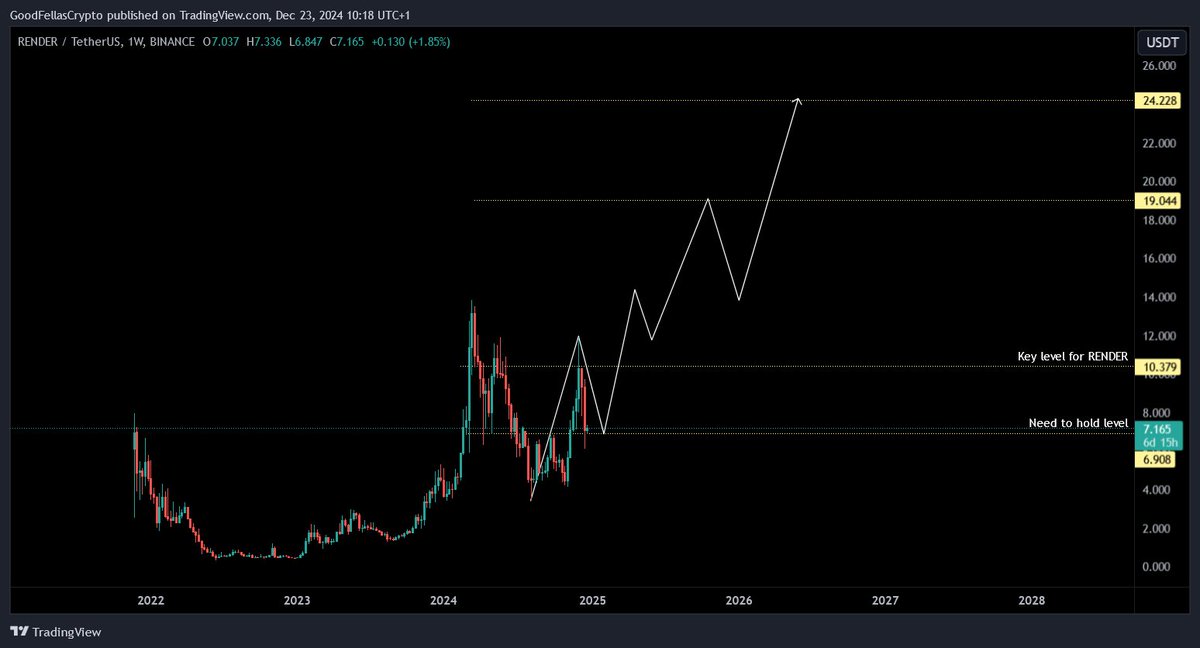

Render (RENDER)

Render (RENDER) is another top Solana coin that is ready for a 20x price increase after a SOL ETF approval. The token already boasts a bullish outlook based on its ties to the artificial intelligence (AI) narrative.

Meanwhile, from a technical analysis perspective, crypto analysts have suggested that RENDER is well primed for a parabolic surge. In an X post, crypto analyst Exotrader predicted that the AI coin couuld rally to as high as $24 as long as it holds the $6.9 support level on the weekly close.

Bonk (BONK)

Bonk (BONK) has become more than just a meme coin in the Solana ecosystem. The top meme coin has gained several use cases and even boasts an exchange-traded product (ETP).

Meanwhile, it is worth mentioning the upcoming BONK token burn with 1 trillions coins set to be burnt. With this 1 trillion token burn on the horizon, the meme coin eyes a $0.11 price target.

XRP

XRP looks like an obvious play if the SEC were to approve a Solana ETF, especially if this approval comes before the one for an XRP ETF. In a scanario where a SOL ETF gets approved an XRP ETF, XRP will likely witness a 20x price increase as traders anticipate the XRP ETF next.

Moreover, crypto analysts have already provided a bullish outlook for the XRP price. One of these analysts is Dark Defender who predicted that XRP could rally to as high as $18 in this market cycle.

Conclusion

A Solana ETF approval is undoubtedly bullish for JUP, NST, RENDER, BONK, and XRP. These coins, most especially NST, are ready to enjoy a 20x price increase once these SEC approves the SOL ETF.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Solaxy presale raises $4.5M for Solana Layer 2 solution

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: