bybit

Bybit x Block Scholes report

Published

5 months agoon

By

admin

Ethereum has outpaced Bitcoin over the past week as the cryptocurrency market continues to show a bullish outlook.

In their latest derivatives analytics report, Bybit and Block Scholes highlighted Ethereum’s (ETH) strong performance compared to Bitcoin (BTC) this past week. Bybit is a global crypto exchange that’s the world’s second-largest by volume, while Block Scholes is a London-based advanced research and data analytics company.

A collaborative report by the two companies notes that perpetual swaps for Ethereum shows a steady rise in open interest. In contrast, open interest for BTC slowed after the flagship cryptocurrency retreated off highs near $100,000 reached last week.

Ethereum price rose more than Bitcoin during this period, Bybit and Block Scholes noted in the report. A look at crypto.news market data shows ETH is up more than 8% this past week – compared to Bitcoin’s -1.6%. This follows news that U.S. Securities and Exchange Commission Chair Gary Gensler will exit the agency on January 20, 2025.

Cryptocurrencies, including XRP, Cardano and Stellar and Polkadot have outperformed during this time, with Gensler’s resignation fueling optimism across the sector.

“This trend reflects investor optimism, with many anticipating a shift in the SEC’s leadership by January 25, 2025, which could bring a more favorable stance toward cryptocurrencies,” the report reads in part.

Ethereum reached a weekly high of $3,682 on Nov. 28, while Bitcoin’s price retreated to $90,911 after peaking at an all-time high of $99,531.

The decline from the area near the $100K mark sees the money volatility structure constrained, and short-tenor options have crossed below 60%.

According to the report, this reflects the pattern witnessed since the U.S. election, with price dropping amid lower realized volatility. Despite OI in calls and puts remaining unchanged, demand for short-term BTC options has waned over the week.

ETH options, on the other hand, continue to see increased interest in call options, while the altcoin leads the rest of the market in trading volumes and open interest.

Source link

You may like

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

bybit

NFT industry in trouble as activity slows, market collapses

Published

1 week agoon

April 6, 2025By

admin

As the crypto market prepares for turbulence amid the tariff wars, the NFT market seems to be in a worse position.

Trading volumes are declining and marketplaces shutting down.

The once-hyped world of non-fungible tokens, which analysts once boldly projected could balloon to over $264 billion by 2032, now seems to be limping along. Weekly trading volumes have been falling like dominoes for weeks, scaring off capital and dragging the market back to levels not seen since its explosive 2020 debut.

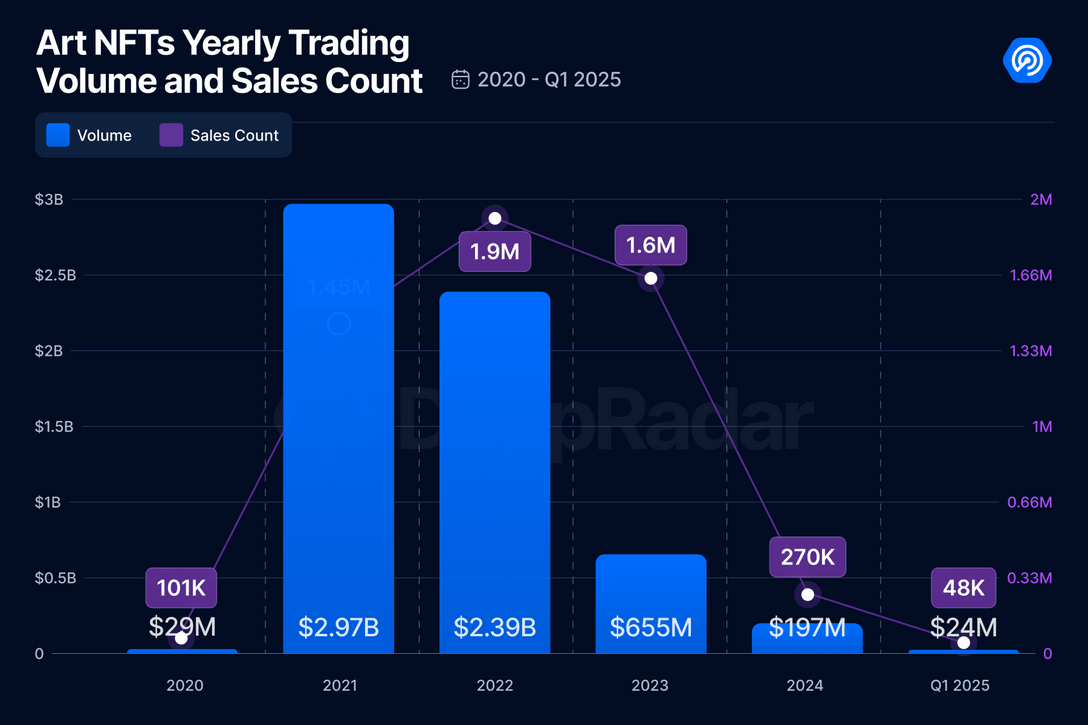

Blockchain analytics firm DappRadar shows that trading volumes in 2021 were riding high, hitting nearly $3 billion.

Fast-forward to the first quarter of 2025. That figure has nosedived 93% to just $23.8 million as “active traders have vanished,” blockchain analyst Sara Gherghelas noted.

“This rapid growth coincided with global shifts driven by the COVID-19 pandemic, accelerating the adoption of digital platforms and pushing artists to explore innovative methods of engaging with their audiences. However, three years later, the hype around Art NFTs has significantly decreased.”

Sara Gherghelas

The data backs her up. In 2024, trading volume dropped nearly 20% from the year prior, while total sales declined 18%. As Gherghelas put it in her 2025 research, it was “one of the worst-performing years since 2020.”

Still speculative assets

In an interview with crypto.news, OutsetPR’s legal officer Alice Frei implied that regulation is still a mess as “governments are still undecided on how to classify NFTs.”

In the U.S., they’re often treated like securities, meaning platforms must walk a legal tightrope. In the U.K., they’re seen more like collectibles under intellectual property law.

“These are examples of leading countries with clear cryptocurrency regulations; in many other countries, the situation is even more uncertain. This lack of regulatory clarity creates an environment that is ripe for fraud and erodes investor confidence. Until there is more consistency, NFT adoption will remain stagnant.”

Alice Frei

Frei also highlighted a deeper issue: beyond the worlds of cryptocurrency and gaming, NFTs are still “trying to prove that they offer real value.”

“In theory, they could revolutionize several industries — think concert tickets that prevent scalping, digital IDs for online verification, or property deeds stored on the blockchain. But in practice, most NFTs are still largely speculative assets.”

Alice Frei

Speaking of gaming, where NFTs have the most potential for mainstream use, their adoption is also struggling, Frei pointed out, recalling that Ubisoft’s Project Quartz, an attempt to integrate NFTs into AAA games, was met with “resistance from players, forcing the company to shut it down.”

Frei notes that gamers are “hesitant about digital assets that feel more like currency than a genuine addition to their experience.”

Revolving door

If the data wasn’t already bleak, March brought more bad news: a string of marketplace shutdowns added fuel to the fire. Among them, South Korean tech giant LG shut down its LG Art Lab, which was launched just three years ago at the height of the NFT mania. The company didn’t share detailed reasons, only saying that “it is the right time to shift our focus and explore new opportunities.”

Just a week later, X2Y2 — a former OpenSea rival that once boasted $5.6 billion in lifetime volume — also ceased its operations, citing a “90% shrinkage of NFT trading volume from its peak in 2021” and struggles to remain competitive in the space.

Then came Bybit. The crypto exchange, still reeling from a $1.46 billion theft linked to North Korea-affiliated hackers, quietly closed its platform.

Emily Bao, head of web3 at Bybit, said the decision would allow the company to “enhance the overall user experience while concentrating on the next generation of blockchain-powered solutions.”

Amid the wave of closures, Frei says the NFT market now “feels like a revolving door.”

“Take Bored Ape Yacht Club, for example – once the pinnacle of NFT status, its prices have dramatically dropped. At the peak, a single Bored Ape sold for $400,000, but now some are barely fetching $50,000. The problem lies in the fact that many NFT projects rely on hype rather than actual utility. If people cannot see long-term value, they are unlikely to return.”

Alice Frei

Last hope

Coinbase, too, seems to be pulling back. While it hasn’t officially shut down its NFT platform, all signs suggest it’s shifting focus. During an earnings call in early 2023, President and COO Emilie Choi indicated that the company sees “medium and long-term opportunities” in NFTs. But its real focus seems to be behind Base, its layer-2 blockchain network.

Coinbase declined to comment on its position as NFT activity continues to decline, despite multiple requests from crypto.news.

The OutsetPR legal officer thinks that with the market’s current trajectory, smaller platforms are unlikely to weather the storm. “Smaller platforms will continue to shut down, leaving only a few dominant players like OpenSea and Blur,” she said.

She explained that the shift is being driven by two major forces. First, tighter regulations are on the horizon, which will likely bring an end to the “Wild West days of NFTs.” Second, the gaming sector may offer NFTs a lifeline—but it’s still a narrow one. As Frei puts it, gaming may be NFTs’ “last hope,” though developers will still need to avoid “pay-to-win mechanics that could turn players away.”

“The hype is over. If NFTs are to survive, they will need to prove that they offer more than just expensive pictures on the blockchain,” Frei concluded.

Source link

bybit

Bybit taps Standard Chartered-backed Zodia Custody following Safe Wallet controversy

Published

2 weeks agoon

April 3, 2025By

admin

Bybit has entered a partnership with crypto custodian Zodia Custody to segregate its custody for institutional clients.

Cryptocurrency exchange Bybit announced in a press release on Thursday a new partnership with Zodia Custody to provide institutional clients with segregated custody, along with off-venue settlement solutions.

In an April 3 press release, Bybit said that thanks to the partnership, its institutional arm, Bybit Institutional, which targets larger investors, wants to provide transparent fees and reduce the risk of exposure for its clients.

Zodia Custody, founded in 2020, offers crypto custody services and is supported by big names like Standard Chartered and SBI Holdings. The key benefit of the latest partnership, as Bybit puts it, is “Independent Custody,” where investors can trade on Bybit while keeping assets held with Zodia Custody, ensuring “full segregation and eliminating co-mingling via the Interchange solution.”

This allows institutional clients to trade on Bybit while keeping assets held with Zodia Custody, ensuring “full segregation and eliminating co-mingling via the Interchange solution,” the press release reads. Additionally, Bybit also claims that thanks to Zodia, institutitonal clients no longer need to pre-fund exchange accounts, which “minimizing exposure to exchange-side vulnerabilities and improving capital efficiency.”

In late February, North Korean hackers targeted Bybit, stealing around $1.46 billion worth of crypto in a highly sophisticated heist. The attack was reportedly carried out by compromising the computer of an employee at Safe, Bybit’s technology provider. Less than two weeks after the breach, Bybit’s CEO Ben Zhou stated that around 20% of the stolen funds had become untraceable, due to the hackers’ use of mixing services. Later on, Zhou indicated that 88% of the stolen funds from the exchange is still traceable

Source link

bybit

Bybit Shuts Down Its NFT Marketplace As Crypto Sector Struggles To Recover

Published

2 weeks agoon

April 1, 2025By

admin

Cryptocurrency exchange Bybit announced Tuesday it will close its non-fungible token (NFT) marketplace on April 8 as the company refocuses on its core trading services.

The decision comes after a February security breach that cost the company $1.46 billion in stolen digital assets, which is believed to be the biggest known heist of all time.

Bybit has instructed users to transfer their NFTs to external wallets before the closure date to avoid potential losses.

The move comes during a broader cooling of the NFT market, with trading volumes declining significantly across major platforms in recent months.

However, many in the crypto industry are still bullish on NFTs.

Canary Capital filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a new NFT-focused exchange-traded fund (ETF) in late March.

The ETF would invest directly in Pudgy Penguins NFTs and PENGU, the project’s utility token, and it would also hold other crypto assets, like Ethereum (ETH) and Solana (SOL), that “are necessary or incidental to the purchase, sale and transfer” of those tokens, per the filing.

In December, Raoul Pal said that NFTs might flourish due to fiat currency debasement and the growing popularity of digital assets among younger generations.

Despite the NFT marketplace closure, Bybit reaffirmed its commitment to blockchain technology advancement, promising enhanced security protocols following the February breach.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x