Markets

Can the XRP price realistically jump to $10 in 2024?

Published

5 months agoon

By

admin

The XRP price has staged a strong recovery this month, making it one of the best-performing top ten cryptocurrencies.

Ripple (XRP) peaked at $1.6305 last week, rising 324% from its lowest point this year and pushing its market cap to over $81 billion. This valuation surpasses major global firms like Deutsche Bank, Marriott International, and BP.

With XRP’s bullish trajectory, analysts have shared optimistic forecasts. Edo Farina, a long-term Ripple supporter, predicted in an X post that the coin could surge to $10 during this bull run.

He cited fundamental catalysts, including expectations that Donald Trump’s victory could resolve Ripple’s ongoing conflict with the Securities and Exchange Commission will be over next year.

Meanwhile, Ripple and Archax have partnered to launch a tokenized fund on the XRP Ledger, signaling renewed activity on the network

Additionally, Ripple is developing RLUSD, a stablecoin intended to compete with Tether (USDT) PayPal USD, and USD Coin (USDC).

There are also rumors of Ripple launching an Initial Public Offering (IPO) in the coming years. A January CNBC report suggested the company postponed its IPO plans due to SEC challenges, a situation that could shift next year.

Can the XRP price jump to $10?

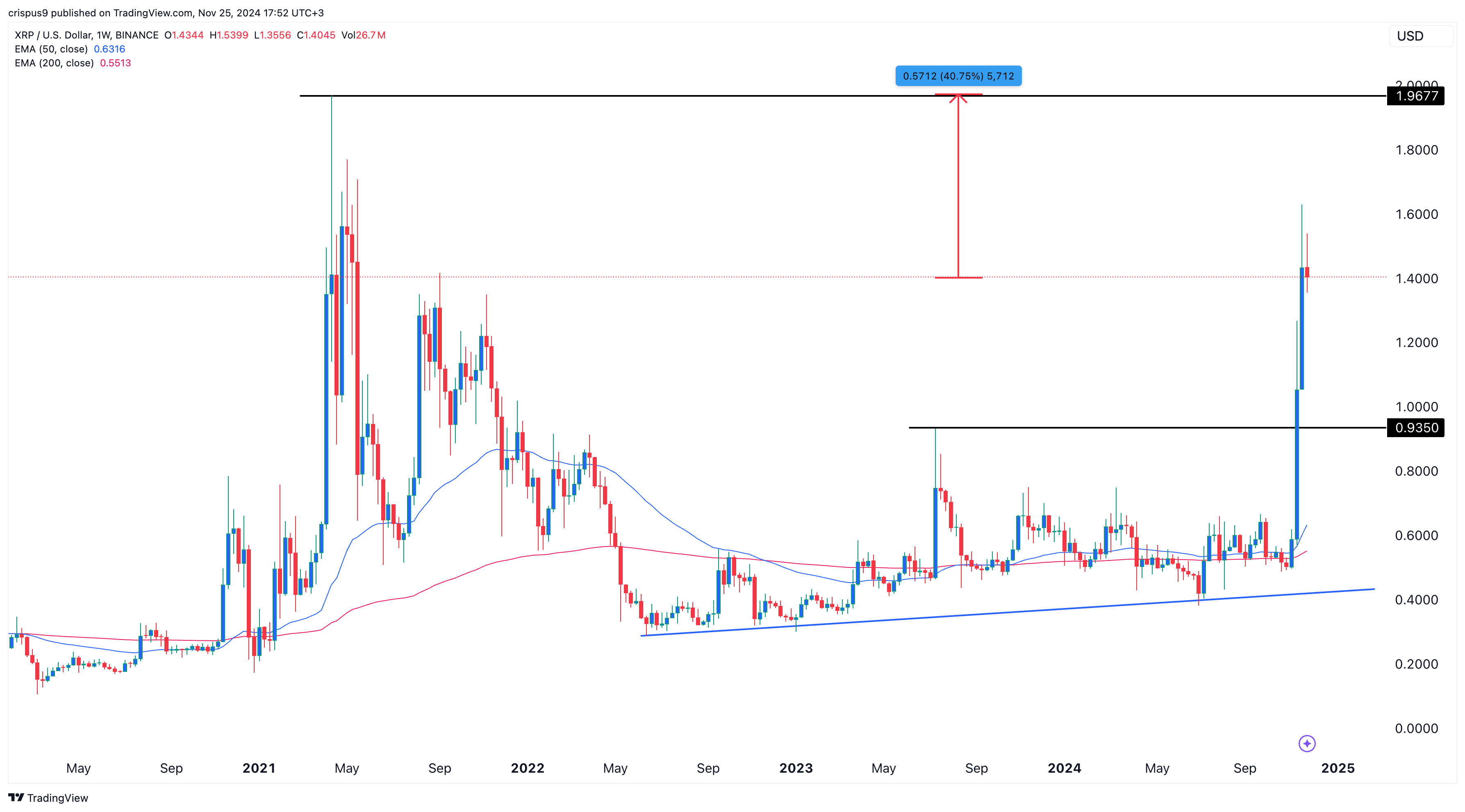

The price of Ripple traded at $1.4381 on Nov. 25, requiring a 600% increase to reach $10. Such a move would exceed its recent performance but aligns with past trends, like its 1,800% jump from 2020 lows to its all-time high in 2021.

The weekly chart shows that Ripple broke the significant resistance level of $0.9350, the neckline of a slanted triple-bottom pattern. The coin has moved above the 50-week and 200-week Exponential Moving Averages, suggesting positive momentum. There are also indications of a bullish pennant pattern forming.

While XRP may continue climbing, potentially reaching its all-time high of $1.96 and further to $5, a leap to $10 in 2024 remains unlikely.

Source link

You may like

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

5 Biggest Ripple (XRP) Price Predictions for April 2025

Tokenization Firm Securitize Acquires MG Stover’s Digital Asset Fund Administration Unit

CleanSpark to start selling Bitcoin in ‘self-funding’ pivot

Dogecoin Whales Buy 800 Million DOGE in 48 Hours – Smart Money Or Bull Trap?

President Trump Executive Director Says U.S. Could Use Tariff Revenue To Build Strategic Bitcoin Reserve

The U.S. dollar index remains under pressure as Donald Trump’s tariffs push investors to other currencies.

The DXY index was trading at $99.95 on Tuesday, down by 9.20% from its highest level this year. It has also been hovering at its lowest point since July 2023, and a death cross it formed points to more downside in the coming months.

The US dollar index could crash further

More technical signals show that the U.S. dollar index has further downside potential. It has formed an inverse cup and shoulders pattern whose depth is about 9%. Measuring the same distance from the lower side of the cup points to further downside to $91.

Further, a key survey of institutional investors shows that most of them are bearish on the currency as the trade war continues. Sixty-one percent of respondents in Bank of America’s Global Fund Manager Survey see the greenback falling in the next 12 months. This is the most bearish these fund managers have been since 2006.

These investors are concerned about Trump’s policies and their economic impact. The most urgent fear is tariffs, which analysts expect will affect the economy. Many fund managers believe the U.S. will sink into a recession this year.

While Trump has walked back some tariffs, those on China remain at uncomfortable levels. Most Chinese goods flowing to the United States will receive a 145% tariff, affecting goods worth hundreds of billions of dollars. On Tuesday, Beijing announced that it would block Boeing purchases by its airlines.

Further, the U.S. dollar index has dropped as Congress negotiates Trump’s funding bill, which includes $4.5 trillion in tax cuts.

A falling US dollar could benefit Bitcoin and most altcoins

A deteriorating US dollar index could benefit Bitcoin (BTC) and altcoins for three reasons. First, most of these coins are traded in Tether, a stablecoin backed by the U.S. dollar. As such, a weakening greenback makes Bitcoin and these altcoins more affordable.

Second, the ongoing dollar weakness is likely due to concerns about the American economy and the impact of tariffs. As such, there is a likelihood that the Federal Reserve will intervene and slash interest rates. Some Fed officials, like Christopher Waller and Susan Collins, have confirmed that the bank is ready to act in the event of a recession.

Third, Bitcoin and altcoins could benefit as the U.S. dollar index falls because they are often considered safe havens. While Bitcoin’s price has dropped this year, it has performed better than the stock market.

Source link

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

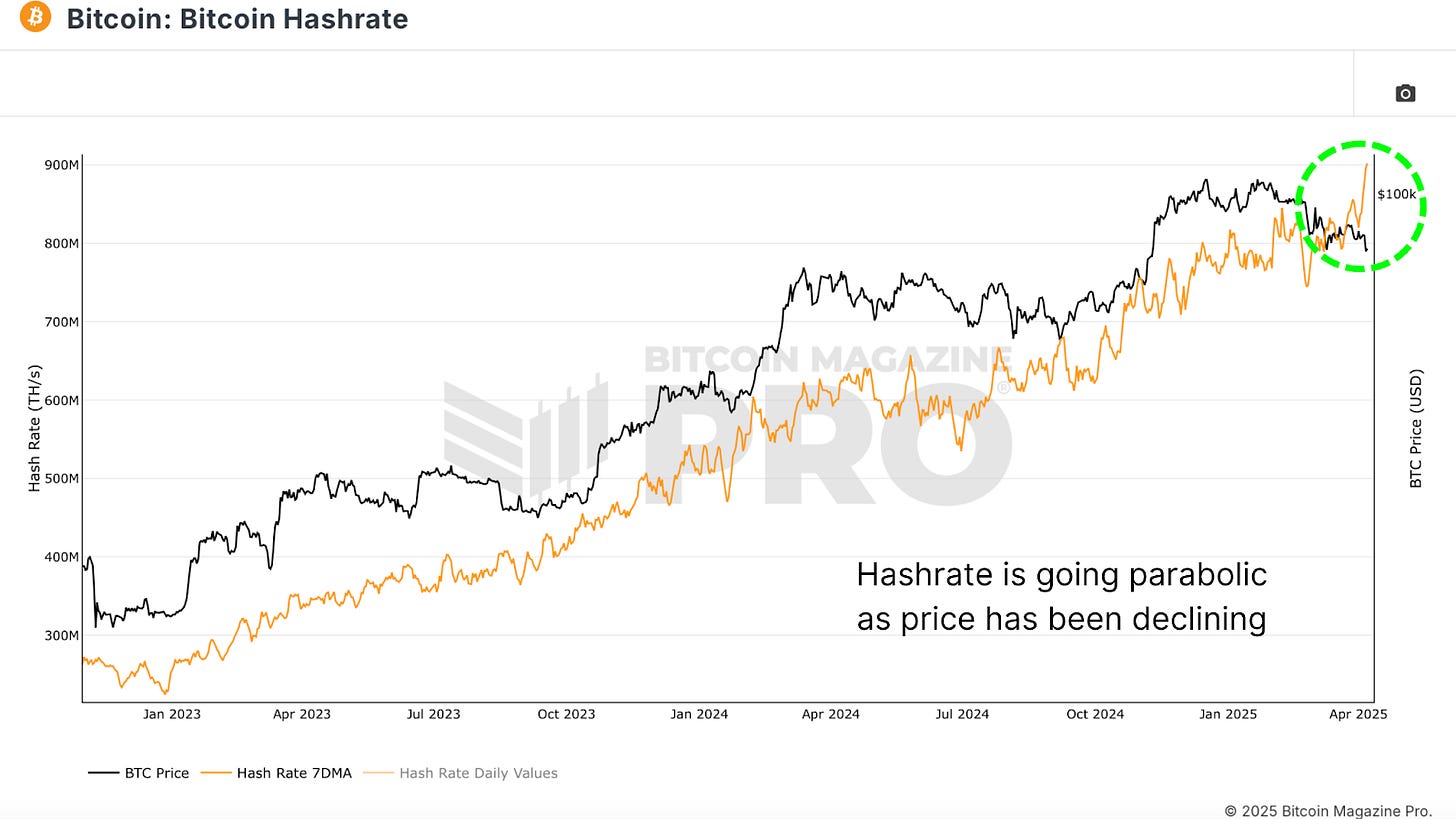

Bitcoin Hash Rate Going Parabolic

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

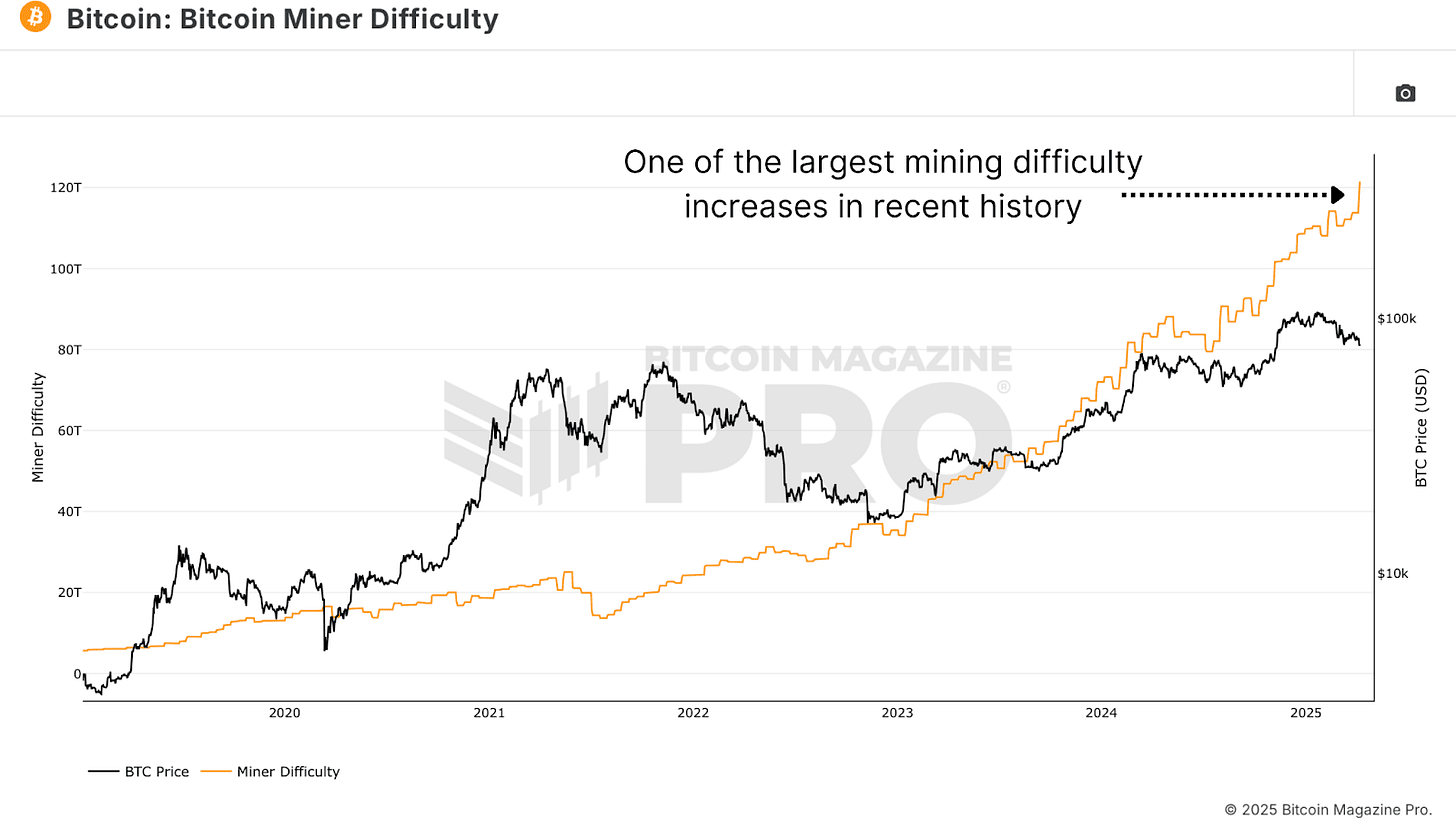

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

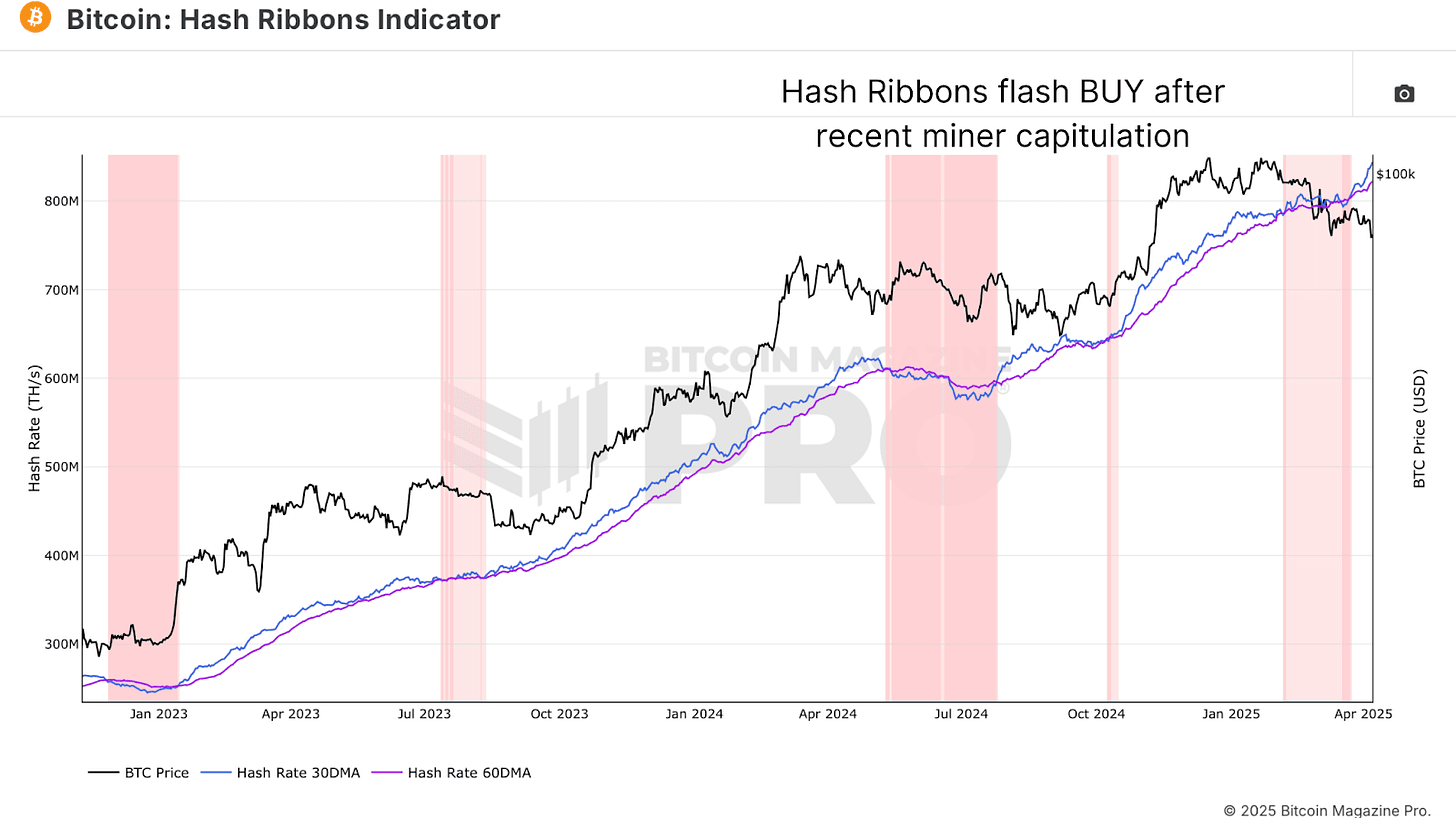

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

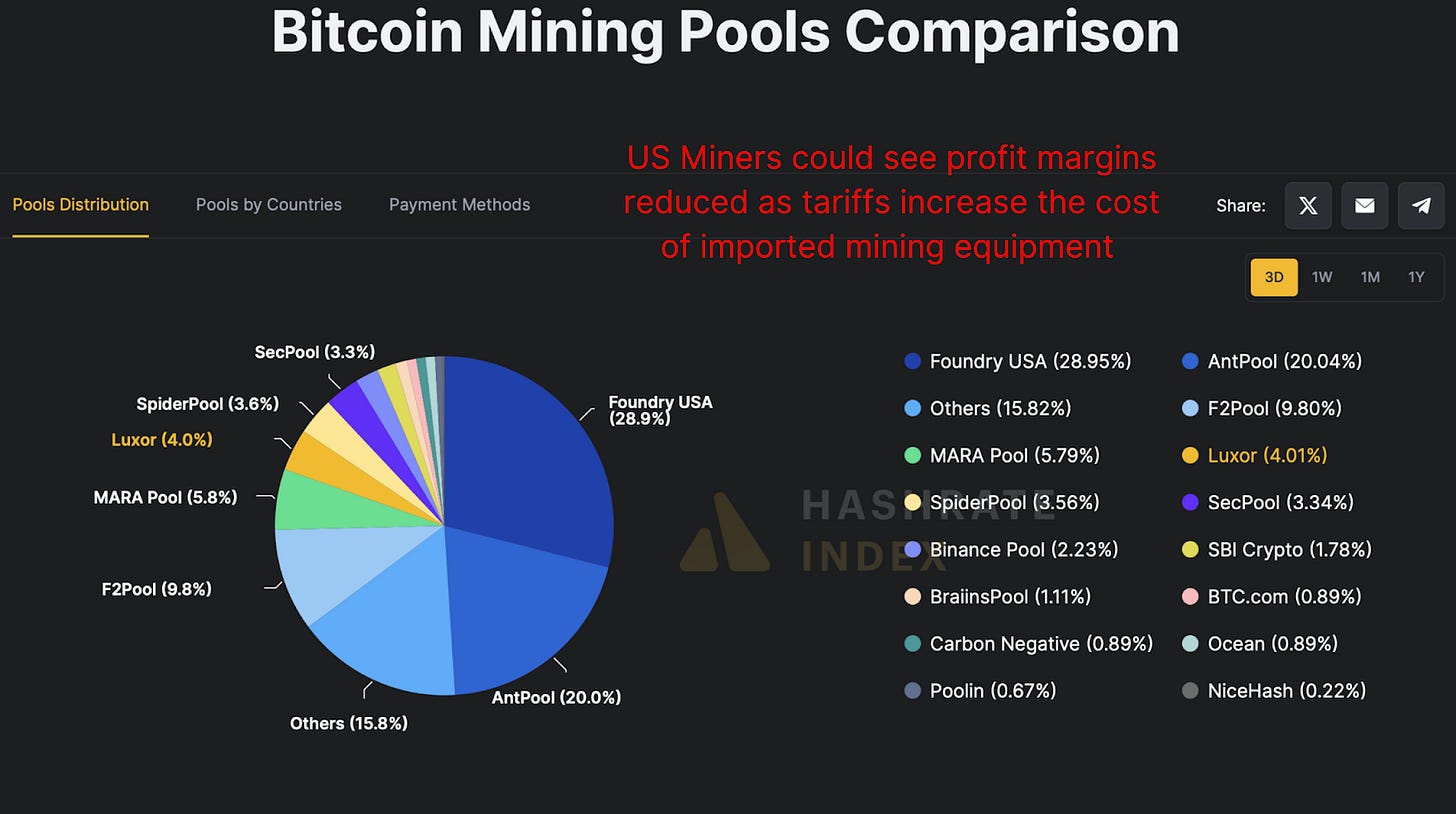

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

Bitcoin Miners Keep Mining

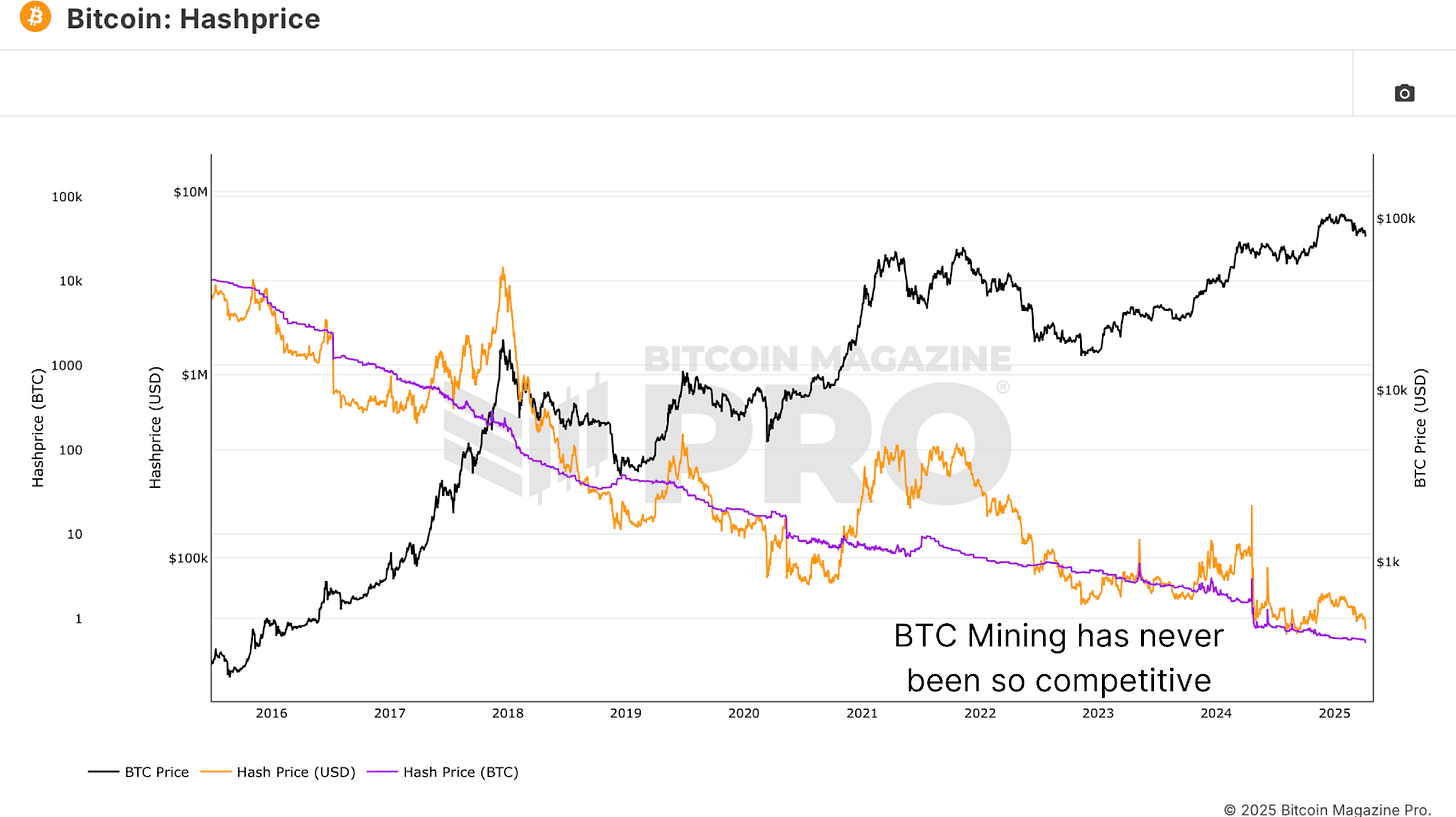

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Markets

Dogecoin Slumps 3%, Bitcoin Steady Around $85K as Traders Fear U.S. Recession

Published

20 hours agoon

April 15, 2025By

admin

Dogecoin shed 3% while bitcoin (BTC) and ether (ETH) remained flat in the past 24 hours as tariff concerns gradually subsided among traders, though fears of a U.S. recession increased in betting markets.

“Prominent financial figures have started to warn that the US is heading into an imminent recession, with betting markets placing 40% to 60% odds of one happening in 2025,” Augustine Fan, head of insights at SignalPlus, told CoinDesk in a Telegram message. “Our view is that it probably doesn’t matter, as sentiment often frames reality, not the other way around.”

“As such, crypto has benefited from the recent shake-out, as equities have been realizing higher volatility than Bitcoin through the risk-off move. A beggar-thy-neighbour policy with tariffs has pushed spot gold to ATHs, with BTC finally regaining some of its long-lost ‘store of value’ narrative,” Fan added.

Crypto majors tracked by the broad-based CoinDesk 20 (CD20) slid nearly 2%, data shows, with DOGE leading losses. Solana’s SOL, tron (TRX) and Cardano’s ADA lost as much as 2.5%, BNB Chain’s BNB and xrp (XRP) were little changed as bitcoin clung to the $85,000 level.

Mantra’s OM token showed a 20% rise over the past 24 hours to trade at 63 cents in Asian morning hours Tuesday, following a bizarre sell-off that saw it lose 90% within an hour late Sunday. A recovery plan is in the works, its CEO said in an interview following the plunge, though market watchers remain sceptical of any promises.

Elsewhere, Story Protocol’s IP dumped 20%, then jumped more than 30% within hours late Monday, with early fears of an OM-like sell-off among crypto circles.

Meanwhile, VeThor’s VTHO zoomed 37% as UFC CEO Dana White joined the protocol as a strategic advisor, boosting hopes for mainstream adoption — and recognition — of the RWA-focused token.-

https://x.com/vechainofficial/status/1911817066887197012

Meanwhile, Singapore-based QCP Capital said in a Telegram broadcast that BTC risk reversals remained skewed in favour of puts until June, suggesting that markets are still mildly cautious in the near term.

“That said, the tone further out is turning more constructive. On Saturday, we observed aggressive buying of 800x BTC-27MAR26-100k-C. BTC continues to consolidate within the $80k-$90k range and could continue trading sideways, adopting a “wait and see” approach to the tariff situation,” QCP said.

However, the $100,000 call option has become the most favored bet among traders in the mid-term, as CoinDesk noted Monday, with a notional open interest of nearly $1.2 billion.

Meanwhile, some traders say that sell-offs related to tariffs may be well behind and hope for improved sentiment in the days ahead.

“The current upward trend was further bolstered by the Federal Reserve’s assurance that it stands ready to intervene and stabilize markets in the event of a crisis triggered by the tariffs,” Jupiter Zheng, partner of liquid fund and research at HashKey Capital, told CoinDesk.

“As the US engages in trade negotiations with other nations, we remain hopeful that the most turbulent period may be behind us,” Zheng ended.

Source link

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

5 Biggest Ripple (XRP) Price Predictions for April 2025

Tokenization Firm Securitize Acquires MG Stover’s Digital Asset Fund Administration Unit

CleanSpark to start selling Bitcoin in ‘self-funding’ pivot

Dogecoin Whales Buy 800 Million DOGE in 48 Hours – Smart Money Or Bull Trap?

President Trump Executive Director Says U.S. Could Use Tariff Revenue To Build Strategic Bitcoin Reserve

Man Faces Six Years in Prison After Omitting $12,302,115 in CryptoPunk NFT Sales From Tax Filing

will this boost Bitcoin and altcoins?

Yen Surge, Soaring Bond Yields Could Threaten Bitcoin as BOJ Weighs Policy Shift

Ripple Whale Moves $63M As XRP Tops List for Spot ETF Approval

Bitcoin Cash (BCH) Gains 1% as Index Trades Flat

Crypto’s debanking problem persists despite new regulations

XRP To Explode? Expert Says ETFs Could Ignite Surge To $15

Bitcoin Miners Are Doubling Down

$227,000,000 Worth of OM Tokens Moved to Crypto Exchanges Prior to 90% Price Collapse of Mantra: On-Chain Data

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x