Altcoin

Cardano price ‘seeing most bearishness’ as altcoins rebound

Published

5 months agoon

By

admin

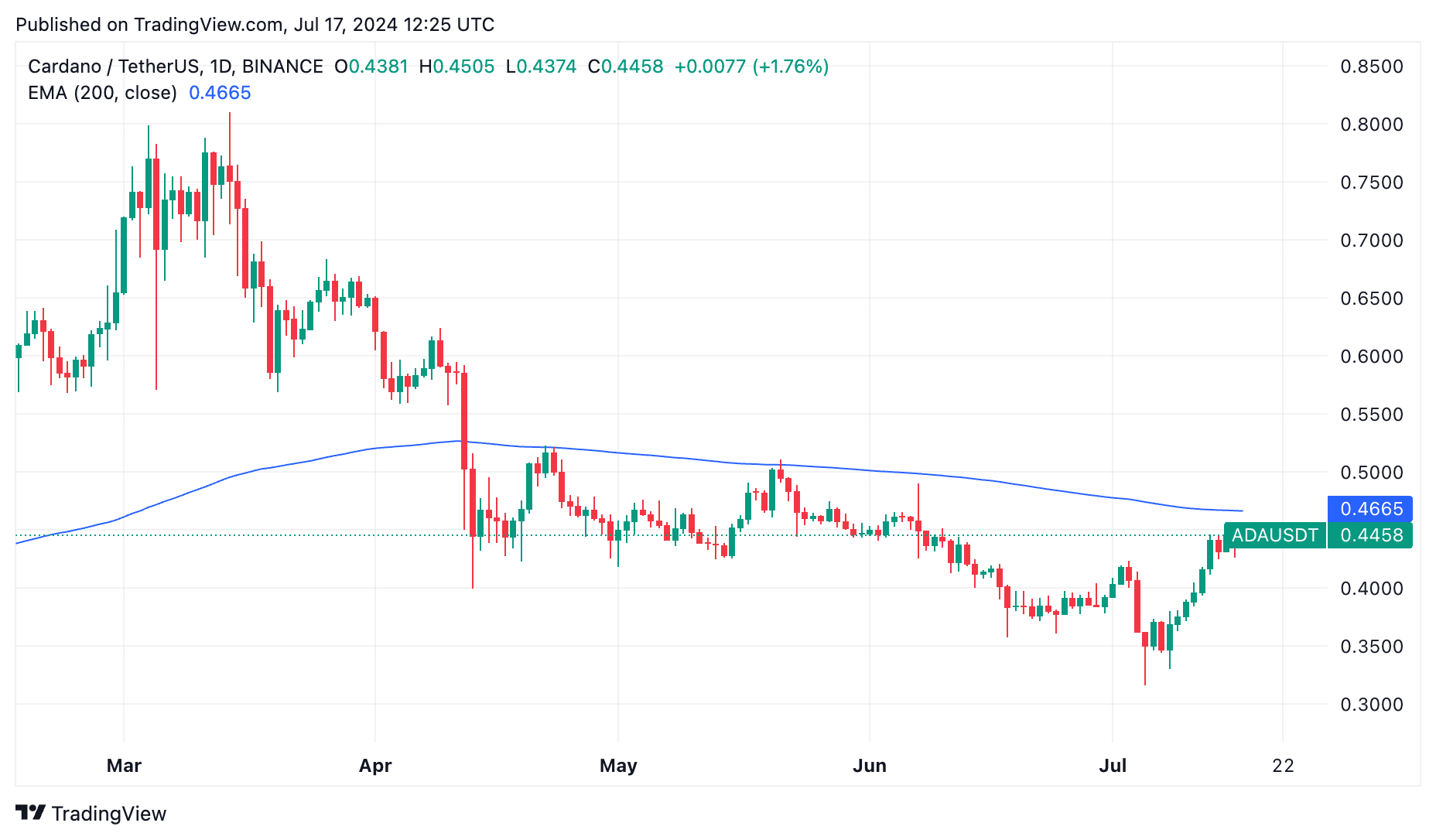

Cardano has risen after bottoming at $0.3174 earlier this month

Cardano (ADA) has has bounced back by 40% from its lowest point this month but remains 45% below its highest point this year. Despite being one of the largest cryptocurrencies, Cardano has faced intense pressure in recent months, with its market cap falling from over $90 billion in 2021 to $15.9 billion on Wednesday.

External data indicates that Cardano’s interest among developers and investors has waned recently. According to DeFi Llama, the number of monthly developer commits dropped from 3,380 in May to 3,300 in June, and currently stands at less than 2,000 this month.

Additionally, the amount of money locked in Cardano’s DeFi applications has decreased from a record high of 633 million ADA in December 2023 to 538 million ADA on Wednesday. Its TVL of $247 million is much smaller compared to newer blockchains like Base, Blast, Sui, Mode, and Aptos.

Unlike Solana, BNB Chain, and Ethereum, Cardano has no major meme coin or decentralized exchange (DEX). Minswap, its biggest DEX, handled less than $1 million in transactions in the past 24 hours, whereas Solana’s Raydium processed $851 million.

Cardano also has a limited market share in the declining NFT market as it handled sales worth $1.6 million in the last 30 days. The number of Cardano addresses has dropped to less than 30k, and the amount of stablecoins is less than $20 million.

Cardano’s sentiment is waning

Sentiment among traders has been falling recently. The daily volume of Cardano has remained below $500 million since July 5th. In contrast, smaller meme coins like Pepe and Dogwifhat are handling over $700 million daily. The same trend is observed in the futures market.

Data by Santiment shows that interest among traders has dropped to the lowest level in months. Most traders are mostly concerned about the coin’s underperformance and lack of developer activity.

🥳😱 Trader sentiment is following the price action. With XRP making an emergence this week, bullish narratives have erupted. On the other end of the spectrum, Cardano is seeing the most bearishness in over a year. Counter-trading the crowd’s consensus could prove profitable. pic.twitter.com/yin7ZeRYqC

— Santiment (@santimentfeed) July 17, 2024

Cardano also has one of the lowest staking yields in the market. Data by StakingRewards shows that it has a staking yield of less than 3%.

Technically, Cardano remains below the 200-day moving average, suggesting that the ongoing recovery may be short-lived.

On a positive note, the crypto fear and greed index is about to flash green as hopes of a Federal Reserve rate cut rise. Therefore, ADA price will likely rise if Bitcoin sustains its rally and crosses the year-to-date high of $73,400.

Source link

You may like

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Altcoin

Goldman Sachs Considering Bitcoin is Exactly How Best Wallet Is Slated to Reach $4.4bn of the Non-Custodial Market

Published

2 weeks agoon

December 11, 2024By

admin

Sentiment from the head of a Wall Street giant signals good news for the cryptocurrency economy. Goldman Sachs CEO David Solomon has said that the investment banking major would evaluate trading cryptocurrencies should US regulations permit the bank to do so.

“At the moment, as a regulated banking institution, we’re not allowed to own a cryptocurrency like Bitcoin as a principal,” he said at a Reuters Next conference, held on Tuesday, 10 December.

“We give our clients advice around a variety of these technologies and these issues, and will continue to do that. But for the moment our ability to act in these markets is extremely limited from a regulatory perspective.”

Interestingly, Goldman Sachs disclosed in its recent US Securities and Exchange Commission (SEC) 13F filing that the company holds more than $700M in eight Bitcoin ETFs, as of September 20, 2024.

So, it would appear that at long last, corporate attitudes to crypto are finally changing. Even US President-elect Donald Trump has positioned himself as a champion of cryptocurrency. The launch of a strategic national crypto stockpile was among the promises made by Trump in the run-up to the 2024 election. Removing Gary Gensler – the nemesis of crypto companies due to his aggressive approach to crypto regulation – from his position as SEC Chairman was another.

A Green Light for Ripple’s Stablecoin Means Meme Coins Pump

The big news for the cryptocurrency economy keeps on rolling, as Ripple CEO Brad Garlinghouse recently announced that its $RLUSD stablecoin has been approved by the New York Department of Financial Services to go live. Pegged to the US dollar at a 1:1 ratio, $RLUSD will be supported by a combination of US dollar reserves, short-term US Treasury securities, and other liquid assets, mirroring Tether’s approach to backing. $RLUSD is set to be launched on the XRP ledger in Ethereum.

In all, the latest developments are great news for the economy, cryptocurrency holders, and the likes of Best Wallet. Powered by Best Wallet’s $BEST token – currently in presale with an impressive $3.34M already raised – Best Wallet plans to capture 40% of the crypto wallet market share by end-2026.

Best Wallet is mobile-first, fully non-custodial app supports thousands of cryptocurrencies, including the best meme coins, across 50 major blockchains. But it’s that non-custodial aspect that sets Best Wallet apart.

Most crypto wallets are controlled by centralized companies or exchanges, whereas Best Wallet gives users full control over their wallet. And that’s in addition to reduced transaction fees, early access to presales, and airdrops. It’s also the first crypto wallet to use Fireblocks’ MPC-CMP wallet technology, which adds high security, zero counterparty risk, and multi-blockchain support.

All things considered, we believe $BEST is worthwhile looking into. Investors have just under two days to secure $BEST at its current price of $0.23075 before the next price increase. Bear in mind, though, this article does not constitute financial advice, and it’s always important to DYOR.

Source link

Altcoin

Bitcoin Flash Crash Drags Meme Coins Down: Doge, Shiba, Pepe

Published

2 weeks agoon

December 11, 2024By

admin

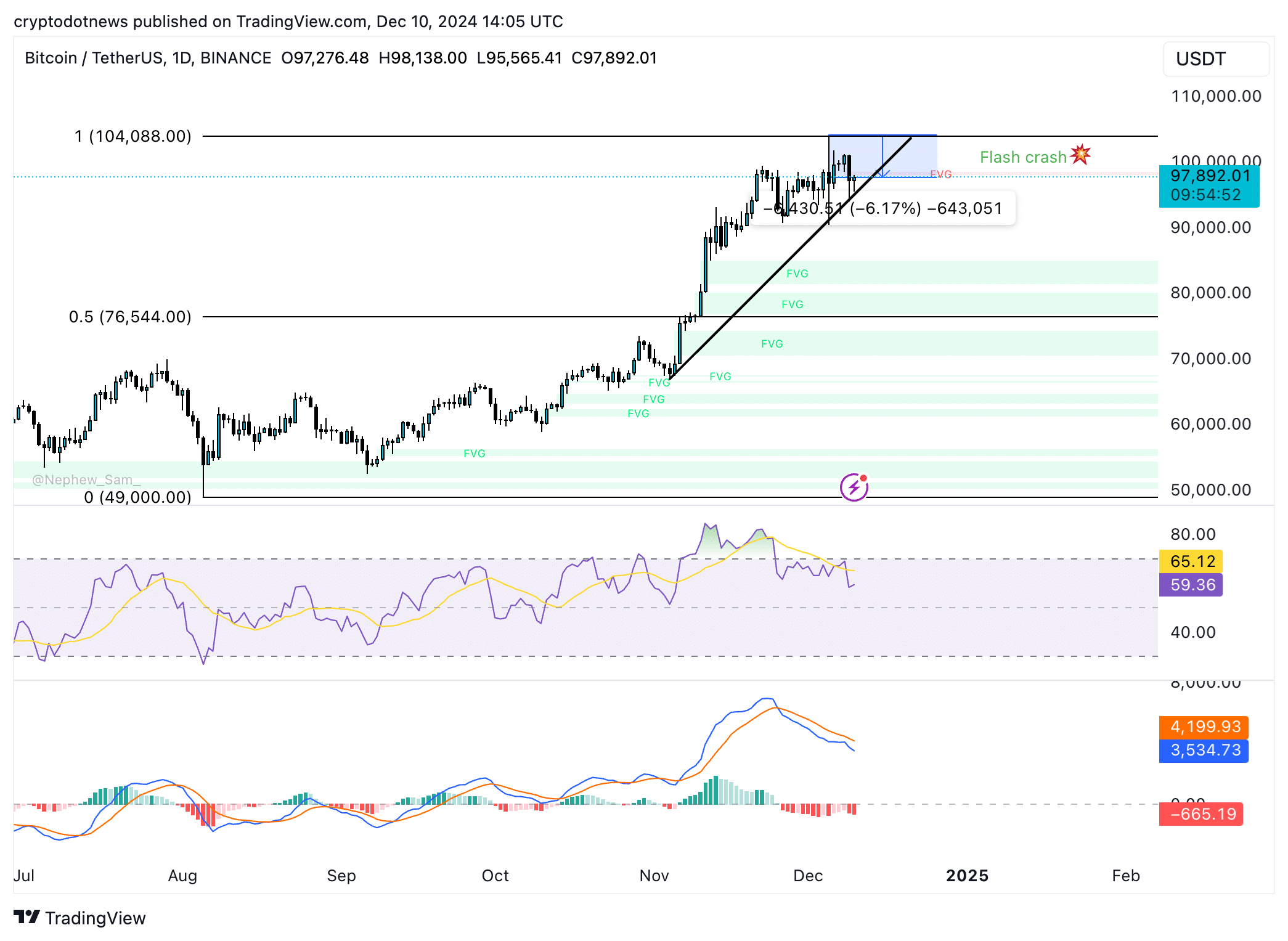

Bitcoin crashed nearly 10% below its all-time high of $104,088 to a low of $94,150 on Monday. The flash crash was short-lived, but it dragged down altcoins and meme coins like Dogecoin, Shiba Inu, Pepe, Dogwifhat and Bonk.

The top 10 meme coins ranked by market capitalization noted nearly double-digit losses in the past 24 hours. As altcoin season ends abruptly, it remains to be seen whether meme coins can recover from their recent losses and hit their cycle bottom.

Bitcoin correction and meme coin price trend

Bitcoin trades nearly 6% below its all-time high on Tuesday. The largest cryptocurrency’s flash crash ended the altcoin season. The blockchain centre altcoin season index reads 65 on a scale from 0 to 100, meaning the alt season has ended.

Technical indicators show mixed signals on where the BTC price is headed; the relative strength index reads 59 and is sloping upwards. However, moving average convergence divergence shows underlying negative momentum in the Bitcoin price trend.

Further correction in Bitcoin does not bode well for meme coins as a decline in the largest cryptocurrency ushers mass liquidation in meme coins and altcoins across derivatives exchanges.

Meme coins have suffered a steep decline in the past 24 hours, and while the tokens have started a recovery in the past hour, there have been double-digit corrections across the top 10 tokens.

The meme category erased nearly 15% in market capitalization in the past 24 hours, down to $128.26 billion.

Meme coins and Santa rally

While meme coins led gains this altcoin season, it remains to be seen whether the “seasonal” gains will push prices higher. Typically, during the Christmas holidays, altcoins tend to rally, this is a result of less activity across crypto exchanges and a relatively lower volume of trades.

Both factors make it easier for the market to move and prices to fluctuate against lower liquidity.

Meme coin price charts show tokens have rallied ahead of Christmas on previous instances, if history repeats meme tokens lead by Dogecoin could recover lost ground and make a comeback before the end of 2024.

DOGE has rallied nearly 350% year-to-date. In the same timeframe, SHIB, PEPE, WIF and BONK gained 160%, 1,860%, 145% and 180% respectively.

Despite the recent pullback in meme coin prices, each of the tokens in the top five has yielded over three-digit gains for hodlers in 2024. This supports a thesis of price recovery and year-end rally for the category.

Trump correlation and bullish drivers

The incoming U.S. President Donald Trump and his Department of Government Efficiency D.O.G.E, led by tech giant Elon Musk and fellow Presidential candidate Vivek Ramaswamy have acted as key drivers of the meme coin rally this cycle.

Elon Musk’s comments and D.O.G.E’s incorporation are top market movers for DOGE, other factors like capital rotation from altcoins and altcoin season drove meme coin prices higher in the past four weeks.

While several meme coins rank among trending tokens every day, DOGE, SHIB, PEPE, WIF and BONK have earned the reputation of blue-chip meme coins. The tokens have a market capitalization of between $1.21 billion and $15.33 billion, per CoinGecko data.

Even as top five cryptocurrencies compete with each other, Solana battles XRP and Ethereum for market share, meme coins play a crucial role in the narrative. A report by 21Shares published earlier this week states meme coins contributed to a majority of the trade volume across Solana-based decentralized exchanges.

Data from the Artemis Terminal shows that as of November 27, meme coins have achieved a 261% year-to-date growth, making them the second-best-performing sector in the crypto space, trailing only Real-world assets.

LBank, a cryptocurrency exchange platform, identified the top 10 meme coins of 2024 that include tokens that are not considered blue-chip but outperformed the sector.

Technical analysis and price targets

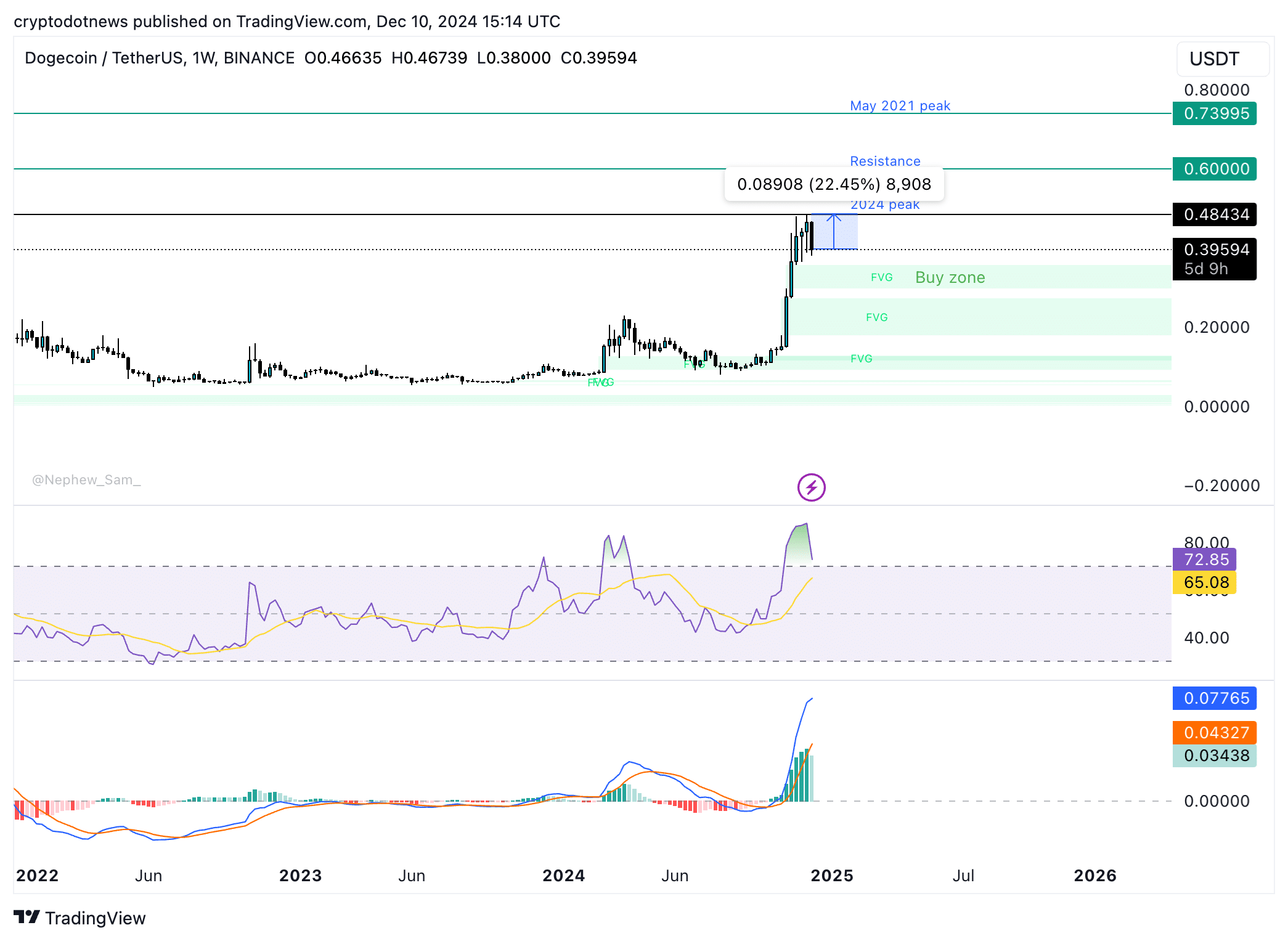

Dogecoin is currently trading 22% below its 2024 peak of $0.48434, as seen in the DOGE/USDT weekly price chart. The target for the cycle is the May 2021 peak of $0.73995, and a key resistance on the path is at $0.60000.

RSI shows DOGE is currently overvalued, and typically, this is considered a sell signal. A short-term correction could send the meme coin to the buy zone between $0.29874 and $0.35740.

MACD indicates an underlying positive momentum in the DOGE price trend.

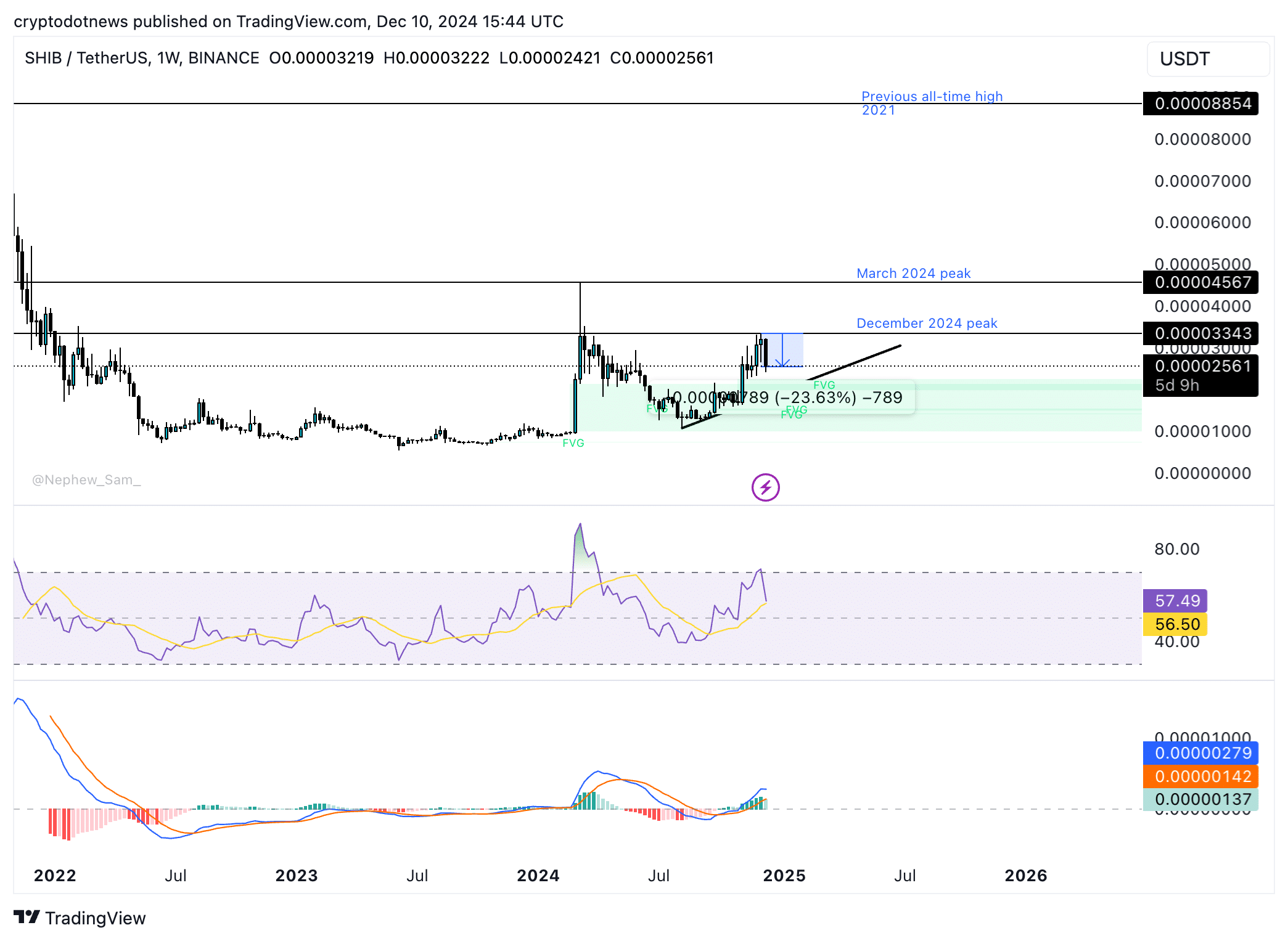

Shiba Inu declined nearly 23% from its December 2 top of $0.00003343. The momentum indicator MACD shows an underlying positive momentum in the SHIB price trend.

The target for the cycle is a March 2024 peak of $0.00004567, nearly 40% above the current price. The buy zone for Shiba Inu is between $0.00001983 and $0.00002259.

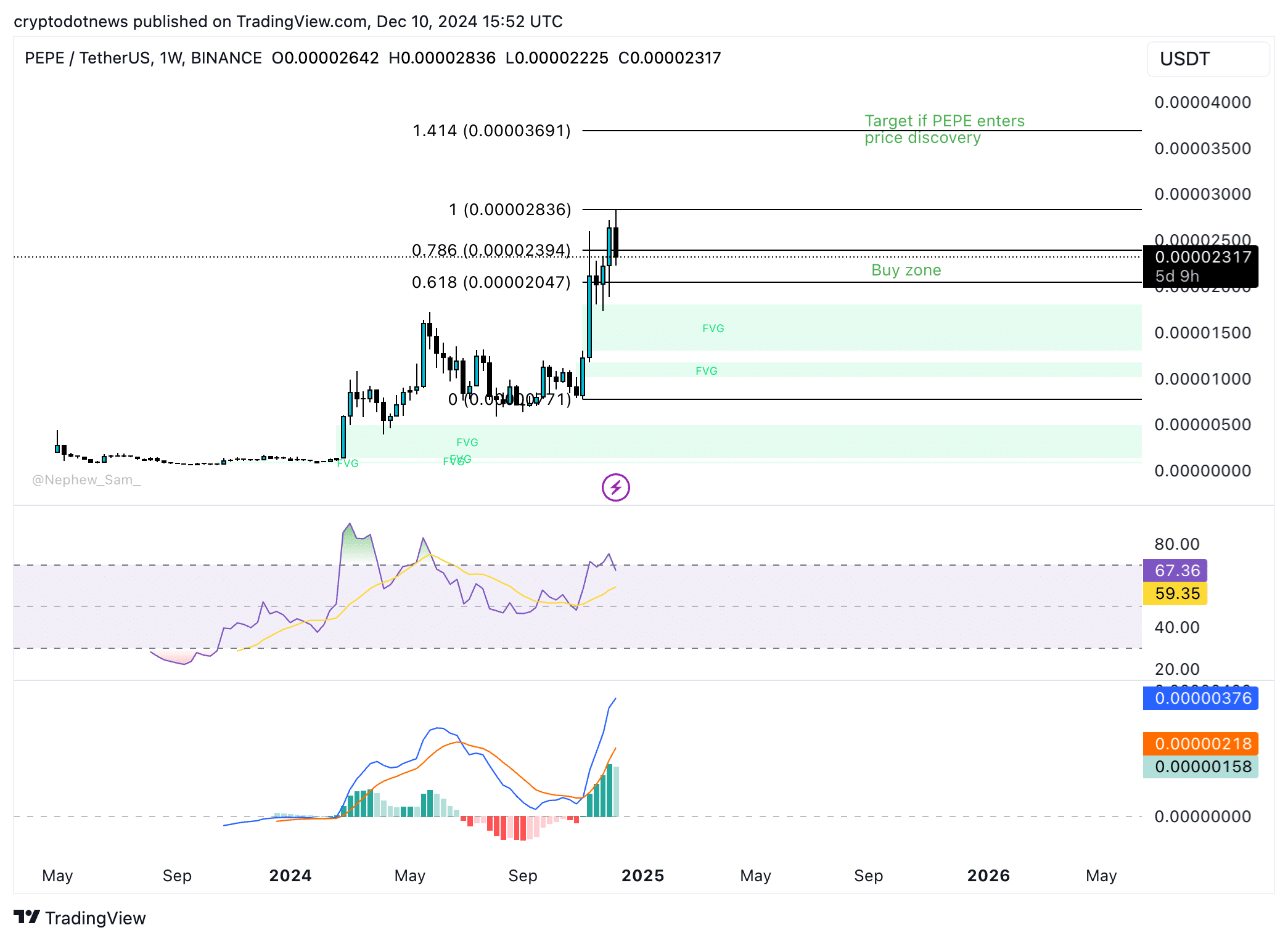

PEPE is currently within the buy zone, marked by the 61.8% and 78.6% Fibonacci retracement levels of the rally from the November 4 low of $0.00000771 and the December 9 peak of $0.00002836.

The target for the cycle is 141.4% Fibonacci retracement level at $0.00003691.

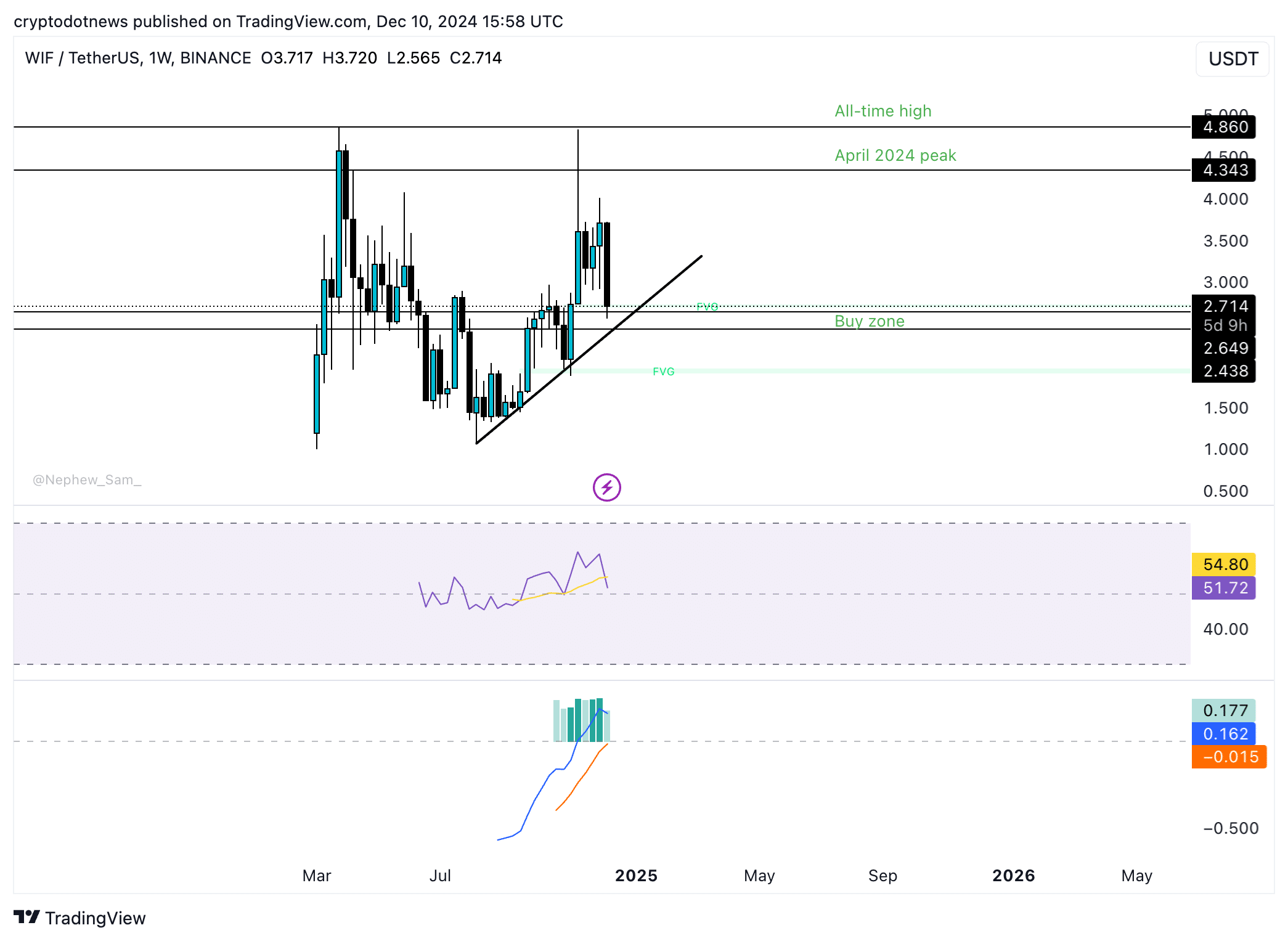

WIF’s target for the cycle is the all-time high of $4.860, the resistance is the April 2024 peak of $4.343. The buy zone for sidelined trades is between key support levels at $2.438 and $2.649.

MACD supports a thesis of further gains in WIF price this cycle, traders need to keep their eyes peeled for trend reversal as RSI is sloping downward.

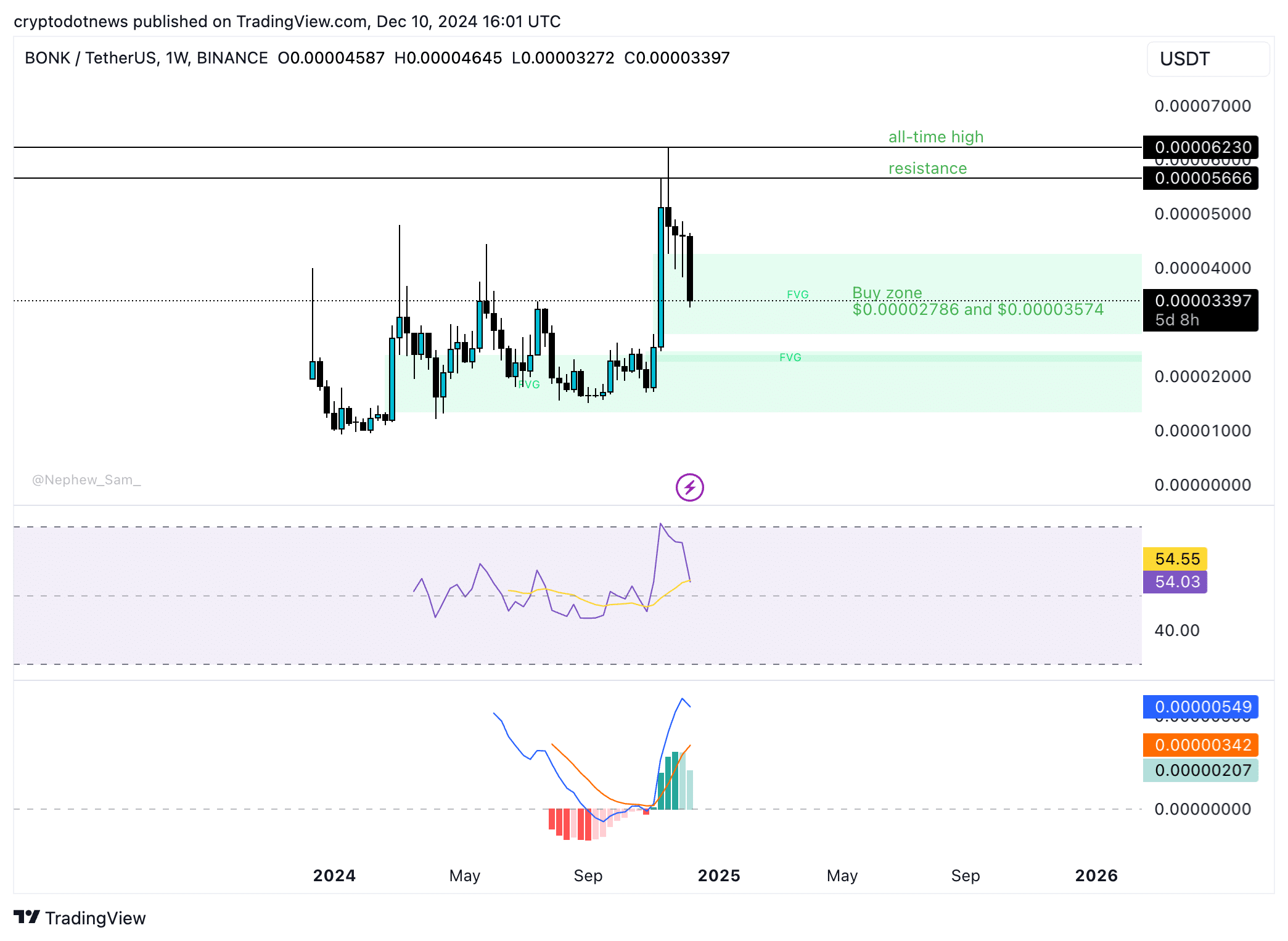

BONK is currently within its buy zone between $0.00002786 and $0.00003574. BONK’s target is at an all-time high of $0.00006230, and resistance is at $0.00005666. MACD supports a bullish thesis for BONK price.

RSI is sloping downward and reads 54, close to the neutral level. BONK could observe a short-term correction prior to its recovery and rally towards its cycle top.

Strategic consideration

Bitcoin’s steep price decline pushed the meme coin category nearly 15% lower in market capitalization. Meme tokens typically react negatively to corrections in Bitcoin price. Traders need to watch the BTC price trend closely for drops in meme coin prices this cycle.

Altcoin season has ended, and meme coins no longer lead gains among different crypto token categories. Traders need to pick meme coins with strong community, liquidity and relatively high market capitalization to protect against rug pull incidents and unprecedented losses.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Altcoin

XRP and TRON could rally even as BTC under $100k

Published

2 weeks agoon

December 6, 2024By

admin

Ripple and TRON posted over 50% weekly gains and the two altcoins could continue their climb in the altcoin season. As Bitcoin slips under the $100,000 level, it dragged altcoins down with a market-wide correction on Friday.

XRP (XRP) and TRON (TRX) could recover and extend the rally next week, according to on-chain and technical indicators.

Bitcoin erases recent gains, slips under $100,000

Bitcoin’s rally to a new all-time high above the $100,000 milestone, at $104,088 was fueled by consistent institutional capital inflows to Spot BTC ETFs, and pro-crypto developments in the U.S (BTC).

The largest cryptocurrency pulled back shortly after, down nearly 6% from its all-time high. Altcoins reacted to the development, and a market-wide correction followed. Most alts in the top 20 erased between 1 and 5% of their value within a 24-hour period.

Analysts at Crypto Finance, a part of the Deutsche Börse Group, believe that the catalyst for the surge in BTC was Fed Chair Jerome Powell’s remarks at the DealBook Summit, where he compared bitcoin to gold rather than the US dollar.

XRP and TRON could extend rally as altcoin season persists

The altcoin season index at Blockchain center signals that it is “altcoin month.” Altcoin season persists as 75% of the top 50 altcoins continue to outperform Bitcoin over a 90-day time period. The indicator reads 86 on a scale of 0 to 100.

XRP and TRON gained nearly 50% on the weekly timeframe, per TradingView data. The two altcoins could extend their gains as the altcoin season persists.

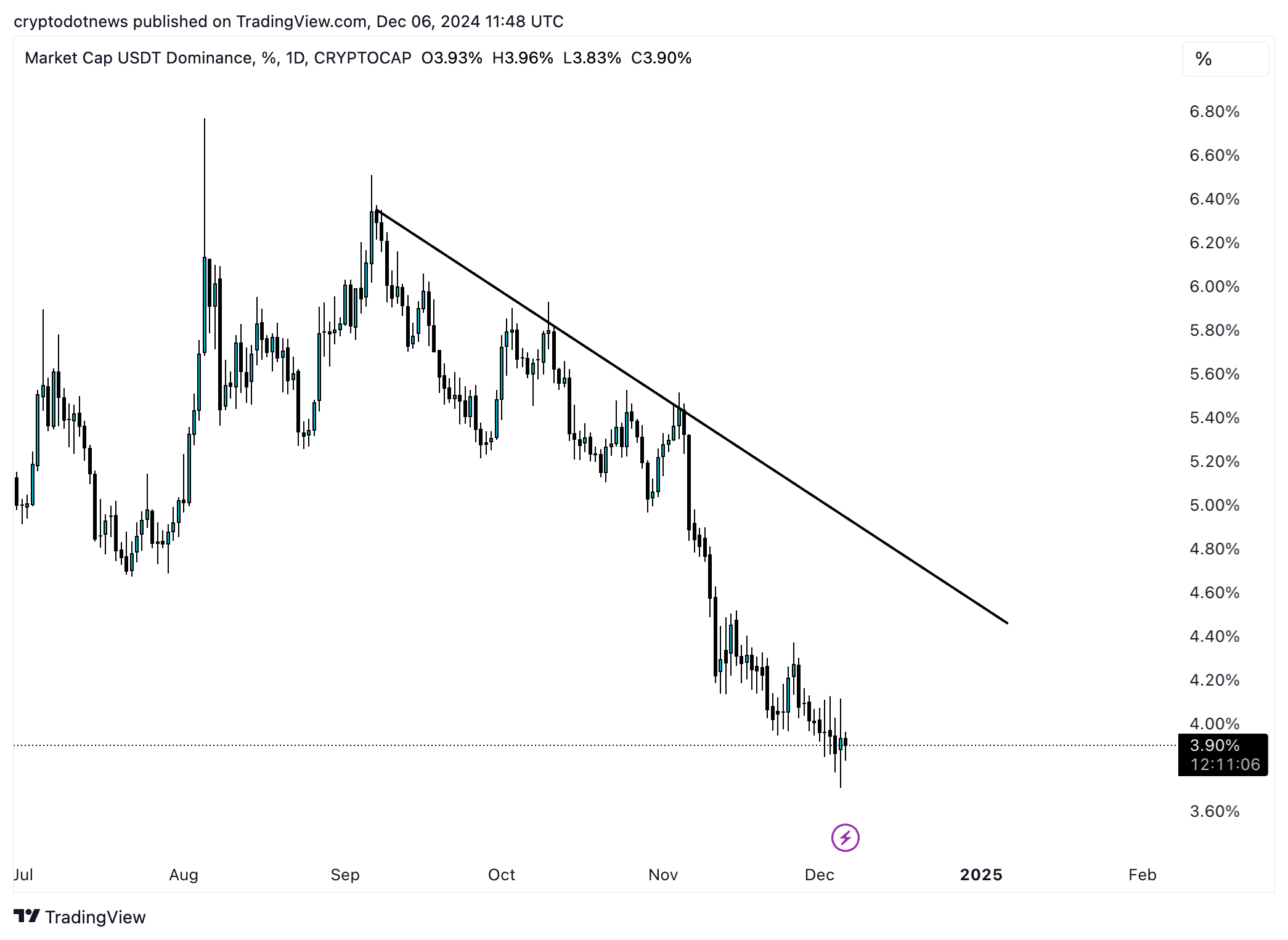

Tether (USDT) dominance is at 3.91%, meaning traders are likely rotating their capital from stablecoins to cryptocurrencies and altcoins. USDT dominance has been in a downward trend since September 2024.

Traders need to watch the USDT dominance chart closely for signs of a trend reversal or consolidation. If USDT dominance starts climbing again, it could signal a surge in profit-taking or capital flowing out of Bitcoin and altcoins.

On-chain and technical analysis

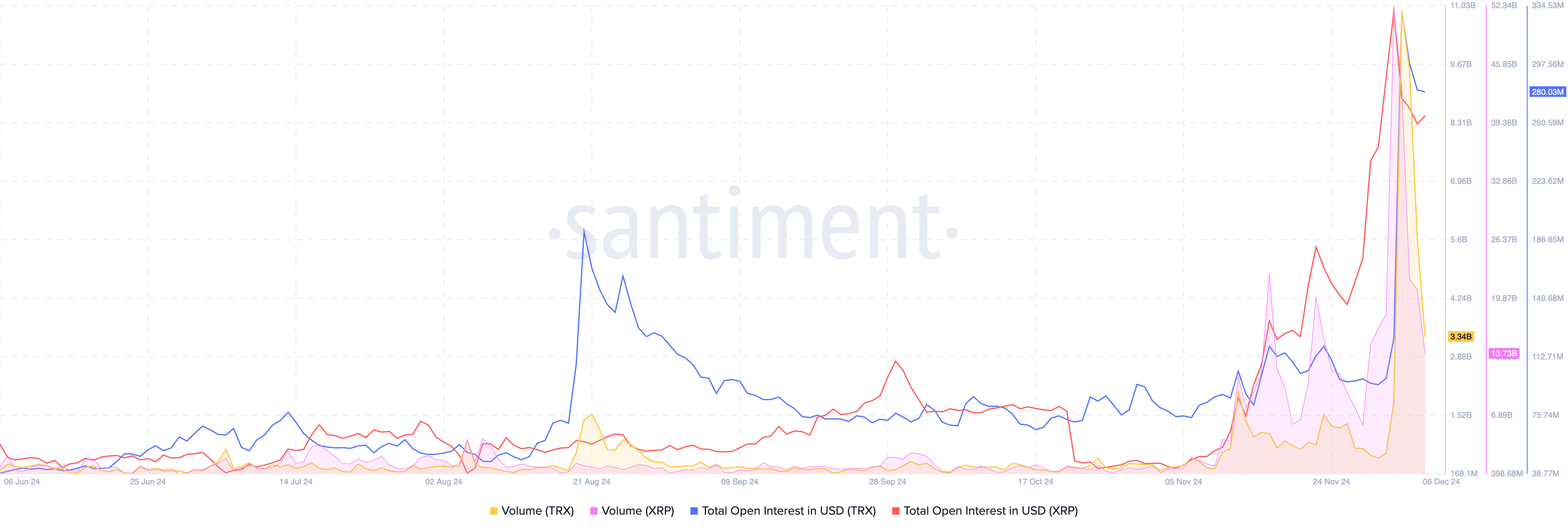

The total open interest in both XRP and TRON was noted to spike earlier this week. Open interest tracks the active positions in the token across derivatives exchanges. A spike in the metric was followed by above-average open interest as of Friday, December 6, per Santiment data.

The volume in both altcoins is above average, with positive spikes in early December, as seen in the Santiment chart below. This shows demand and relevance among traders on crypto exchange platforms.

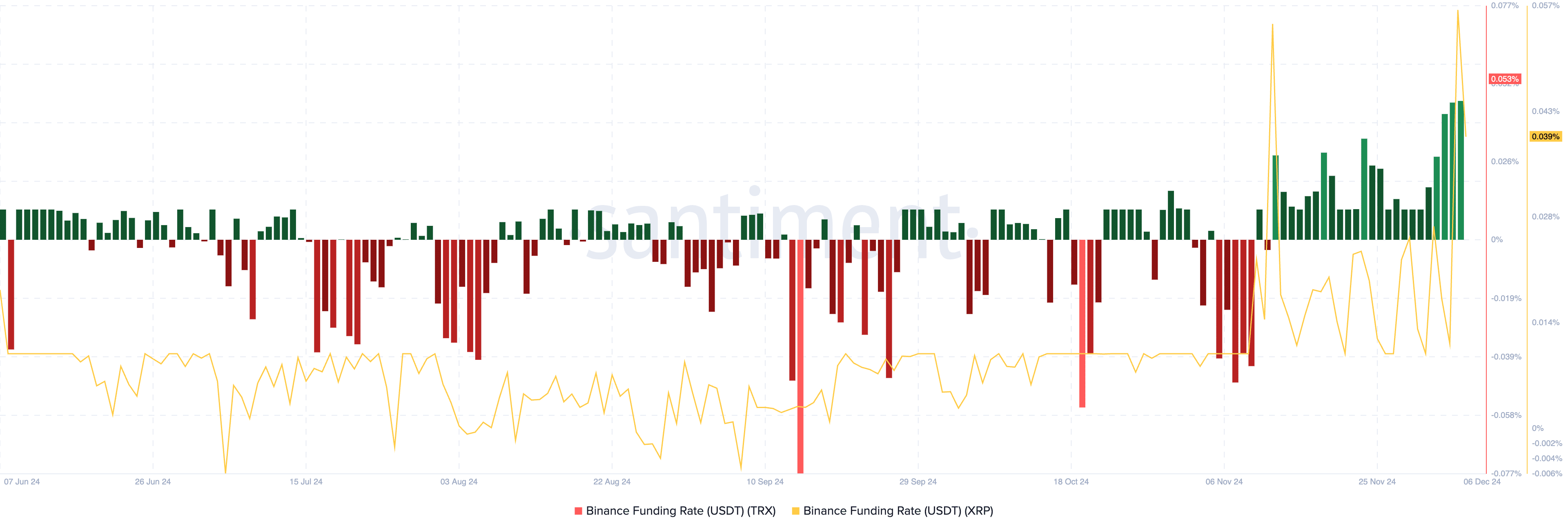

For both altcoins, the funding rate has been positive since November 12. A positive funding rate is indicative of bullish market sentiment among XRP and TRON traders on derivatives exchanges.

XRP and TRON price forecast

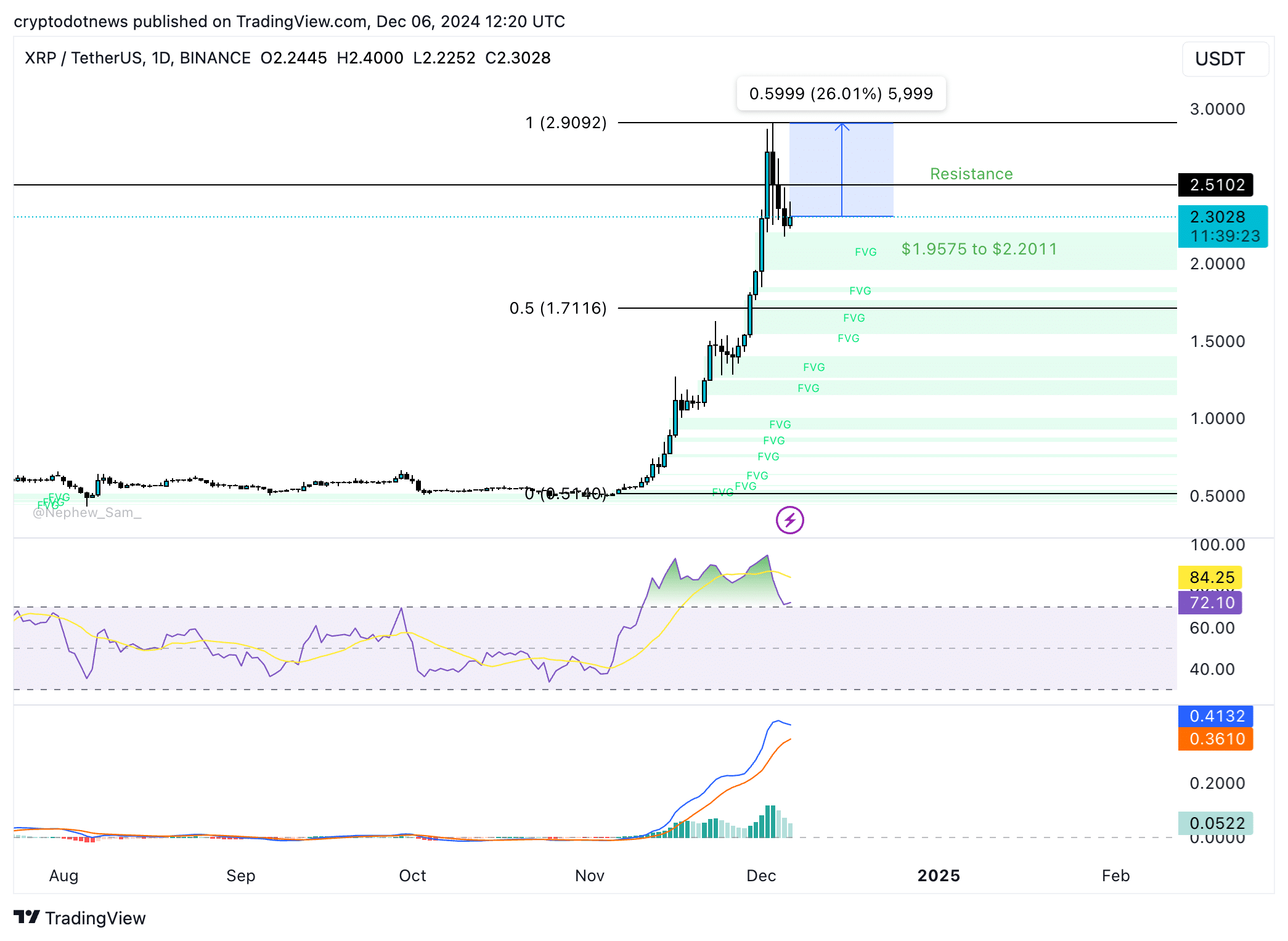

XRP trades at $2.3028 early on Friday. The altcoin’s technical indicators, Relative strength index and moving average convergence divergence are supportive of gains in XRP price.

XRP faces resistance at $2.5102, and the target is the December 2024 peak of $2.9092. A correction could send XRP to collect liquidity in the imbalance zone between $1.9575 and $2.2011.

Once the inefficiency is filled, XRP could attempt to regain lost ground and target a 26% price rally to the target.

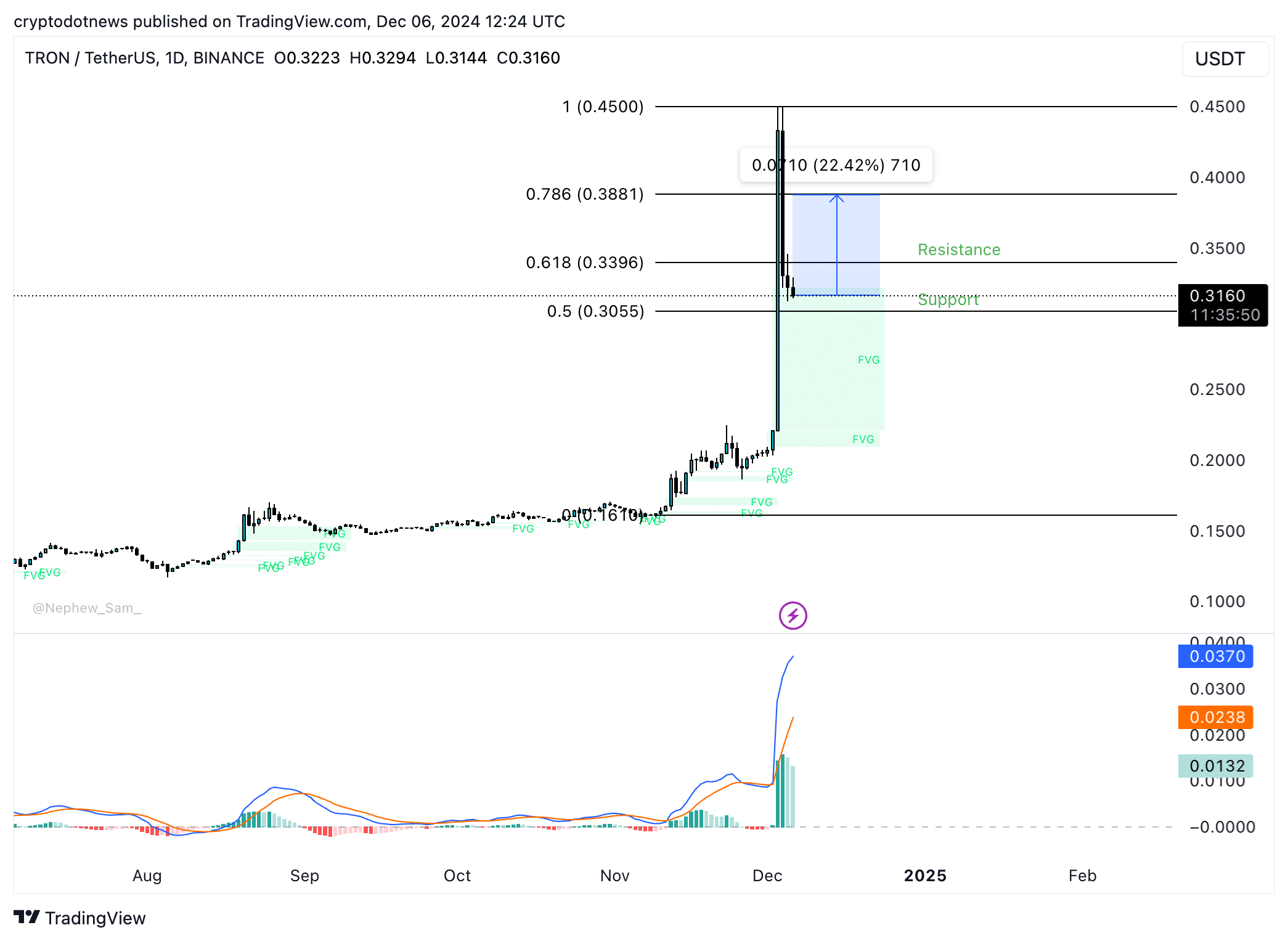

TRON trades close to support at $0.3160 on Friday. The closest support is $0.3055, the 50% Fibonacci retracement of the rally from the November 9 low to the December 4 peak of $0.4500.

TRON could rally 22.42% and target the 78.6% Fib retracement at $0.3881. The altcoin faces resistance at $0.3396, the 61.8% Fib retracement level, as seen on the daily price chart.

The momentum indicator, MACD supports a thesis of gains in TRON as it flashes green histogram bars above the neutral line.

Strategic considerations

Bitcoin’s price trend is key, and traders need to watch BTC closely for an impulsive correction. A steep decline could usher a pullback in altcoins; therefore, sidelined buyers and traders adding to their long position need to watch BTC price.

XRP and TRON both have observed a decline in their open interest across derivatives exchanges in the past 24 hours, per Coinglass data. This is likely a reaction to Bitcoin’s decline under the $100,000 level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential