24/7 Cryptocurrency News

Cathie Wood’s Ark Invest Loads Coinbase (COIN) Stock After Trump-Harris Debate

Published

2 months agoon

By

admin

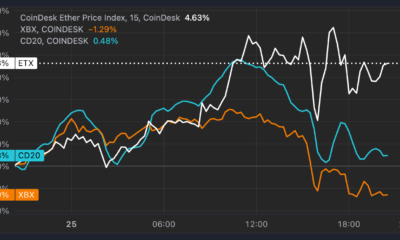

Cathie Wood’s Ark Investments recently made a fresh purchase of the Coinbase stock following the dip to $150 levels on Wednesday. Ark Invest made the most of the dip opportunity as crypto stocks slumped in the early trading hours on Wednesday following the Trump-Harris debate a day before.

Ark Invest Buys 53708 Coinbase Stock

As per the filing submitted by Ark Investments, the asset manager purchased a total of 53708 COIN stocks, worth more than $8 million, on Wednesday, September 11. The investment happened via three different Ark ETFs where the ARK Innovation ETF (ARKK) purchased 38,475 COIN shares.

On the other hand, the ARK Next Generation Internet ETF (ARKW) purchased 9,349 COIN shares while the Ark Fintech Innovation ETF (ARKF) purchased a total of 5,884 COIN shares.

Cathie Wood and Ark Invest’s trade activity from today 9/11$ARKK

Buy: $COIN $TEM

Sell: $PLTR $TTD $VCYT pic.twitter.com/LWyBbBNmr0— Ark Invest Daily (@ArkkDaily) September 12, 2024

Cathie Wood was one of the biggest holders of the Coinbase stock since its IPO times. However, following a massive runup in 2023, the asset manager has been offloading its COIN holdings for some profit booking, around $250 levels.

Now that the COIN stock has gone major retracement of over 40% from the highs of $265 in July, Ark Invest is exploring fresh opportunities with the latest purchase. After dropping to the $150 level in the early trading hours on Wednesday, the COIN stock closed the day at $157.15.

Last week, the COIN stock was also under some selling pressure following Judge Katherine Polk Failla siding with the regulator in the ongoing Coinbase vs SEC lawsuit.

Last week, the British banking giant Barclays upgraded the COIN stock from underweight to equal weight. The banking giant added that Coinbase can benefit from a favorable regulatory environment as both Presidential candidates adopted a supportive stance toward the digital asset industry. It also added that the approval of several spot crypto exchange-traded funds (ETFs) will boost the company’s prospects.

In another development, Coinbase resumed the trading of Polygon POL token on Wednesday, after the recent migration from MATIC.

Paul Grewal Slams FDIC

Previously, the crypto exchange requested the court to release some major documents relating to the case. Coinbase Chief Legal Officer Paul Grewal recently criticized the Federal Deposit Insurance Corporation (FDIC) for withholding key communications.

He further cited the agency’s justification as an attempt to hide details of how it pressured banks to cut ties with crypto firms. Grewal stated that the FDIC is afraid that the communication would reveal too much about the agency.

And here’s the crux of @FDICgov’s excuse to the Court for cloaking its communications: they provide too much detail on how exactly we pressured the banks to debank crypto. https://t.co/ibCYD2biwS https://t.co/OAN8yiWzxG

— paulgrewal.eth (@iampaulgrewal) September 12, 2024

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

You Can Now Invest In Bitcoin And Open-source Companies

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

24/7 Cryptocurrency News

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Published

27 mins agoon

November 26, 2024By

admin

Asset management firm Hashdex has made further progress toward launching a cryptocurrency-focused exchange-traded fund (ETF) in the United States. According to an announcement on Nov. 25, the company has submitted its second amended S-1 application with the U.S. Securities and Exchange Commission (SEC).

Hashdex Second Amendment for Nasdaq Crypto Index US ETF

Hashdex’s latest filing represents another step in its ongoing efforts to secure regulatory approval for the Nasdaq Crypto Index US ETF. The ETF aims to provide investors with exposure to a diversified portfolio of cryptocurrencies.

Initially, the fund will include Bitcoin (BTC) and Ether (ETH), the only two assets currently listed in the Nasdaq Crypto US Index. However, the filing noted that the portfolio could expand to include other digital currencies over time.

The amended filing comes after Hashdex’s initial S-1 application was modified in October when the SEC sought additional time to review the proposal. The SEC has historically been cautious in approving cryptocurrency-related products, and the amended filings demonstrate Hashdex’s ongoing compliance efforts to meet regulatory requirements. Despite the US SEC’s stance, firms have continued to file for Spot exchange-traded fund (ETF) like the latest one by WisdomTree for an XRP ETF.

Growing Interest in Crypto Index ETFs

Crypto index ETFs have emerged as a key area of focus for asset managers as demand for diversified investment products grows. Industry observers compare these ETFs to traditional index funds, such as those tracking the S&P 500, which provide investors with broad market exposure.

“Index ETFs are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” said Katalin Tischhauser, head of investment research at Sygnum, a cryptocurrency-focused financial institution.

Hashdex is not alone in its pursuit of a cryptocurrency index ETF. Other asset managers, such as Franklin Templeton and Grayscale, are also seeking approval for similar products. The Franklin Crypto Index ETF would track the CF Institutional Digital Asset Index, which, like the Nasdaq Crypto US Index, currently focuses on Bitcoin and Ethereum. Grayscale’s Digital Large Cap Fund, which holds a basket of cryptocurrencies including Bitcoin, Ethereum, Solana (SOL), and XRP, has also applied for conversion to an ETF.

Potential Regulatory Changes and Market Implications

The regulatory landscape for cryptocurrency ETFs in the United States could shift significantly in the coming months. The SEC’s current Chair, Gary Gensler, has announced plans to step down on Jan. 20, 2025. This timeline coincides with the start of Donald Trump’s second presidential term. Trump, who has expressed a pro-crypto stance, has previously criticized Gensler’s strict approach to cryptocurrency regulation and promised reforms aimed at fostering growth in the sector.

Regulatory analysts suggest that the leadership transition at the SEC may impact the approval process for cryptocurrency-related financial products. Bloomberg ETF analyst James Seyffart stated that approval for index ETFs holding altcoins like XRP and Solana may depend on whether the SEC considers these smaller assets compliant with existing rules.

“Regulatory concerns about altcoins in index ETFs could be reduced if most of the allocation remains in Bitcoin and Ethereum,” Seyffart explained. He added that while there is optimism about these products, the ultimate decisions will likely hinge on the incoming SEC administration’s priorities and approach.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Published

5 hours agoon

November 25, 2024By

admin

Pro-XRP lawyer John Deaton has questioned the relationship between U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler and FTX founder Sam Bankman-Fried (SBF). Deaton’s comments came in response to the SEC’s announcement of record-breaking financial remedies in its fiscal year 2024 enforcement actions.

John Deaton Accuses SEC of Favoritism Toward Sam Bankman-Fried

In a recent post on X, John Deaton criticized Gary Gensler for holding private meetings with FTX’s Sam Bankman-Fried while denying similar access to U.S.-based crypto executives such as Coinbase CEO Brian Armstrong and Kraken’s Jesse Powell. These actions according to John Deaton demonstrated favoritism by the SEC.

Deaton also pointed to the $10m contribution by Bankman-Fried to politicians as another reason that may have enabled FTX to enter the regulatory talks. The lawyer criticized Gary Gensler, he posed that this financial connection must have been behind the courtesy given to the offshore crypto exchange.

The Pro-XRP lawyer’s criticism comes as SEC Chair Gary Gensler announced he will step down from his position on January 20, 2025. The announcement, made via an SEC press release and confirmed by Gensler in a post on X, coincides with the inauguration of Donald Trump as the 47th president of the United States

SEC Reports Record $8.2 Billion in Financial Remedies

Additionally, the SEC announced it had secured $8.2 billion in financial remedies during fiscal year 2024. This was highest amount recorded by the regulatory body in its history. Despite this achievement, the Commission reported a 26% decline in total enforcement actions compared to the previous fiscal year, filing 583 cases. Of these, 431 were classified as “stand-alone” actions, representing a 14% drop from fiscal year 2023.

Notably, $4.6 billion of the financial remedies stemmed from the SEC’s case against Terraform Labs and its founder, Do Kwon. The judgment accounted for over half of the year’s total recoveries.

Meanwhile, John Deaton has used the SEC’s recent actions to renew his calls for regulatory reform. The pro-XRP lawyer argued recently that the agency’s approach relies on outdated laws to regulate emerging technologies.

In addition, following Gensler’s expected resignation, Deaton has endorsed Brad Bondi as a potential replacement for Gensler. John Deaton cited the need for a clear and fair regulatory framework that fosters innovation in the blockchain.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Robinhood Lists Dogwifhat, WIF Price To $5?

Published

9 hours agoon

November 25, 2024By

admin

Robinhood has added Dogwifhat (WIF), a Solana-based meme coin, to its cryptocurrency trading options, generating considerable excitement among traders and investors. Known for its limited crypto offerings, Robinhood’s inclusion of WIF signals the growing acceptance of meme coins within mainstream trading platforms. Following the announcement, WIF price surged by over 13% within an hour, reaching a weekly high of $3.655 before consolidating.

Dogwifhat WIF Price Could Hit $5 as Robinhood Expands Crypto Offerings

Following a recent announcement, Dogwifhat (WIF) on Robinhood’s platform has sparked optimism regarding the meme coin’s future price trajectory. This marks a notable expansion in Robinhood’s crypto portfolio, which has historically included only a few carefully selected cryptocurrencies. WIF is the second meme coin added by Robinhood this month, following the listing of Pepe, another highly popular project.

The WIF price reached a peak of $3.655 after the announcement, reflecting increased trading activity and market interest. Experts suggest that if WIF breaks key resistance levels around $3.75, it could see further growth. If the bullish sentiment persists, market analysts project a potential rise to $5.

Data from CoinMarketCap indicates that Dogwifhat experienced a 50% rise in trading volume within 24 hours of the Robinhood announcement. This surge in activity reflects heightened interest among investors and traders. The coin’s open interest also climbed by 9%, signaling strong participation in futures and options markets.

Technical Indicators Support The Possibility of Further Growth

The Stochastic RSI on the chart indicates that the asset recently experienced overbought conditions near 80 and has since dropped to the 11-12 range, signaling oversold levels. This suggests a potential for a bullish reversal with current momentum.

The Bull and Bear Power (BBP) indicator also shows positive momentum at 0.2377, suggesting bulls maintain control despite recent corrections. The bullish histogram reflects strong buying interest.

Robinhood’s decision to list Dogwifhat highlights the evolving role of top meme coins in the cryptocurrency market. Meme tokens like WIF have historically attracted new investors during bullish market conditions. With growing cryptocurrency options, Robinhood’s endorsement of WIF indicates increasing confidence in the meme coin sector.

Dogwifhat’s market capitalization is now $3.3 billion, making it the fifth-largest meme coin by valuation. This follows a recent analysis that highlights WIF price potential to hit its all-time high (ATH) this week.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

You Can Now Invest In Bitcoin And Open-source Companies

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

Robinhood Lists Dogwifhat, WIF Price To $5?

MicroStrategy Adds 55,500 More BTC To Its Portfolio For $5.4 Billion

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Can the XRP price realistically jump to $10 in 2024?

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: