Cardano Price

Chainlink, DexSceener, Metamask Support ADA, Cardano Price Eyes 28% Gains

Published

4 months agoon

By

admin

Cardano price has been steadily moving down a falling channel over the last 145 days. In the last 24 hours, ADA price has performed exceptionally well despite global crypto and traditional markets facing a major downturn. Meanwhile, since the Chang hard fork upgrade on September 1, the Cardano network has been on the front page of crypto news. In the latest coverage, the blockchain has received support from Chainlink, DexScreener, and Metamask.

Cardano Price to Surge as Chainlink Integrates Network

Chainlink announced the integration of its data streams for the Cardano blockchain to provide low-latency, secure market data, which will be key for decentralized exchanges (DEX) such as Minswa, Dexhunter, and Saturn Swap on the network.

New assets supported by #Chainlink Data Streams ↓

ADA – @Cardano

ILV – @illuviumio

INJ – @injective

JTO – @jito_sol

LDO – @LidoFinance

ONDO – @OndoFinance

SUI – @SuiNetwork pic.twitter.com/hTXjpTtJtC— Chainlink (@chainlink) August 30, 2024

The chainlink data streams will help deliver real-time market data with high frequency, a feature particularly beneficial for DEXs since it establishes more precise pricing and reduces slippage.

Is Meme Coin Season Coming to Cardano?

On September 3, Metamask announced they would support Wallet Snap, a Cardano wallet built by NuFi.

👌 Cardano Wallet Snap, built by @nufiwallet, enables MetaMask users to create @Cardano accounts, connect to Cardano dapps, manage ADA, tokens, NFTs, and more.https://t.co/dzg7i9FswO

— MetaMask Developer (@MetaMaskDev) September 3, 2024

This integration will allow MetaMask users to create Cardano accounts, connect to dApps, and manage assets on the chain. This is a big step further in bringing Cardano into the fold, as it has long been the ‘black sheep’ of blockchains.

Speculation has it that DexScreener, the leading real-time DEX analytics platform, may be in contact with Minswap, Dexhunter, and Saturn Swap in preparations for onboarding the Cardano network to the platform.

So it’s confirmed @dexscreener is definitely integrating Cardano and they are now in contact with Minswap, Dexhunter and Saturn swap as far as I know.

Cardano community made this happen and the algo community gave us a hand.

This is a W for onboarding people to $ADA

— EL (@TheUnpopularEL) September 3, 2024

Additionally, Snek.fun, a Pump.fun iteration on the Cardano blockchain, is launching tomorrow, prompting investors to speculate that Cardano meme coin season may be closing in quickly.

September 5th 🎉 pic.twitter.com/yrZmb9LGJO

— snek.fun (@snekdotfun) September 3, 2024

The ADA price dropped 0.8% in the last 24 hours to trade at $0.3222. These developments set a precedent for a surge in Cardano price, as it was observed in Tron (TRX), which jumped by two spots to enter the top 10 largest crypto assets by market cap.

Cardano Price Eyes 28% Surge Could Overtake DOGE For 9th Spot

Cardano price has been in a downtrend within a descending channel since April 2024, with support around $0.3050 and resistance near $0.3500 and $0.4000.

Looking at the recent candlesticks formation near the support level indicates a potential reversal as a double bottom could be forming with the neckline, coinciding with the $0.4000 resistance level. The long lower wick suggests buying pressure, a bullish signal.

If the price breaks above the resistance at $0.4000 with strong volume, it could signal the end of the downtrend and the start of a new uptrend. This would constitute a 28% uptick in price that would catapult Cardano to a $14 billion market cap, just above Dogecoin in the 9th spot on CoinGecko ranking.

Conversely, a break below $0.3050 could trigger a continuation of the downtrend, and it would be prudent to reassess positions.

Cardano is an undermined underdog that may surprise many, similar to Tron (TRX). A sudden influx of ‘degen’ volume and users to the network may see its price surge back to previously untouched levels.

Frequently Asked Questions (FAQs)

Chainlink has integrated its data streams into the Cardano blockchain to provide low-latency and secure market data. This integration is critical for decentralized exchanges (DEXs) such as Minswap, Dexhunter, and Saturn Swap, as it delivers real-time, high-frequency market data, helping to improve pricing accuracy and reduce slippage.

DexScreener, a leading DEX analytics platform, is rumored to be in discussions with Cardano-based decentralized exchanges like Minswap, Dexhunter, and Saturn Swap. This potential onboarding of the Cardano network to DexScreener could bring improved real-time analytics for Cardano’s decentralized exchanges, further boosting liquidity and user engagement.

With the launch of Snek.fun, a Pump.fun iteration on the Cardano blockchain, there is speculation that a meme coin season may be approaching for Cardano. The excitement around this could drive an influx of volume and new users to the network, potentially impacting the ADA price in the short term.

Related Articles

Evans Karanja

Evans Karanja is a content writer and scriptwriter with a focus on crypto, blockchain, and video gaming. He has worked with various startups in the past, helping them create engaging and high-quality content that captures the essence of their brand. Evans is also an avid crypto trader and investor, and he believes that blockchain will revolutionize many industries in the years to come. When he is not writing, you can find him playing video games or chasing waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

ADA

Will Cardano Price Reach ATH If It Mirrors Its 2021 Rally?

Published

1 week agoon

December 13, 2024By

admin

Cardano price, a proof-of-stake cryptocurrency, has recently witnessed a significant price increase amid a broader market rally. The altcoin’s upward momentum reflects heightened investor interest, paralleling gains in other cryptocurrencies. With December promising further potential, ADA enthusiasts are speculating whether its price could revisit all-time highs, mirroring its impressive 2021 rally

Is Cardano Price to Reclaim Its ATH From the 2021 Bull Run?

Cardano price is regaining traction as bullish sentiment returns to the cryptocurrency market. The top altcoin shows signs of recovery, with its price reclaiming $3.10 and sparking optimism among investors. The market now watches closely as ADA aims to surpass its previous cycle’s all-time high.

Cardano’s all-time high was $3.10 on September 2, 2021. At the time of reporting, the cryptocurrency is still 63.71% below this peak. However, recent price movements suggest a growing potential for a breakout.

Market analysts attribute the renewed bullish momentum to the broader crypto rally. Several key altcoins, including Cardano, are benefiting from increased investor confidence. With the current trajectory, ADA could move closer to reclaiming its 2021 high if market conditions persist.

Crypto Analyst Eyes Bullish Break Out For ADA

A crypto analyst recently shared an intriguing insight on X post, highlighting Cardano’s potential growth trajectory. The tweet emphasized that ADA may soon achieve $3, $7, and $14 milestones, aligning with a broader market “super cycle.”

The post included a chart showcasing ADA’s significant price levels, framing the $14 mark as a pivotal milestone. It also highlighted a $500 billion market capitalization benchmark, suggesting a bullish perspective on Cardano’s future growth.

The Cardano milestones of $3, $7, and $14 do not look far at all when you open up a daily chart.

Super. Cycle. pic.twitter.com/NvSw0p7z4o

— Dan Gambardello (@cryptorecruitr) December 13, 2024

At the time of writing, the ADA price is trading at $1.08, marking a 3.66% decline in daily performance. Despite the dip, technical indicators suggest pivotal movements ahead for the Cardano token.

If the bullish trend gains momentum, the top altcoin could rally to the $2 mark, fueled by increasing trading activity and strong investor sentiment. A continuation of this bullish trajectory might propel the price to $3.10, mirroring its 2021 all-time high. However, if bearish forces dominate, ADA could retrace further to $1, potentially erasing recent gains.

The MACD indicator highlights a bearish crossover, with the signal line at 0.1209 and the MACD line at 0.0912. The Chaikin Money Flow (CMF) remains positive at 0.11, pointing to sustained buying interest despite price declines. This suggests that market participants are still optimistic about ADA’s long-term potential.

While Cardano’s recent momentum hints at the potential for a bullish breakout, its ability to reclaim the 2021 ATH will depend on sustained market confidence and overcoming bearish resistance.

Frequently Asked Questions (FAQs)

Cardano’s all-time high price is $3.10, reached on September 2, 2021.

Cardano’s price could potentially revisit its ATH if market conditions remain favorable.

If bullish momentum continues, Cardano could reach $2, potentially revisiting $3.10.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Cardano Price Eyes Rally To $4 If ADA Maintain This Support, Top Analyst Says

Published

2 weeks agoon

December 10, 2024By

admin

The recent dip in Cardano price to near $1 has sparked discussions in the broader crypto market, especially after the recent strong rally. It appears that the dip comes amid a retreat noted in the broader crypto market, indicating that investors are taking a pause ahead of the crucial economic releases. However, despite the recent dip, a top expert predicts ADA to hit $4 in the coming days if it holds a key support level.

Top Analyst Predicts Cardano Price To Hit $4

The crypto market saw its biggest liquidation recently, with traders liquidating $1.76 billion in the last 24 hours. This has triggered immense selling pressure on the broader crypto market, with Bitcoin and the top altcoins taking the biggest hits.

There was no exception for Cardano price as well, which saw a slump of nearly 10% during writing. However, despite the recent dip, top crypto market experts appear to have remained bullish on the future trajectory of the crypto.

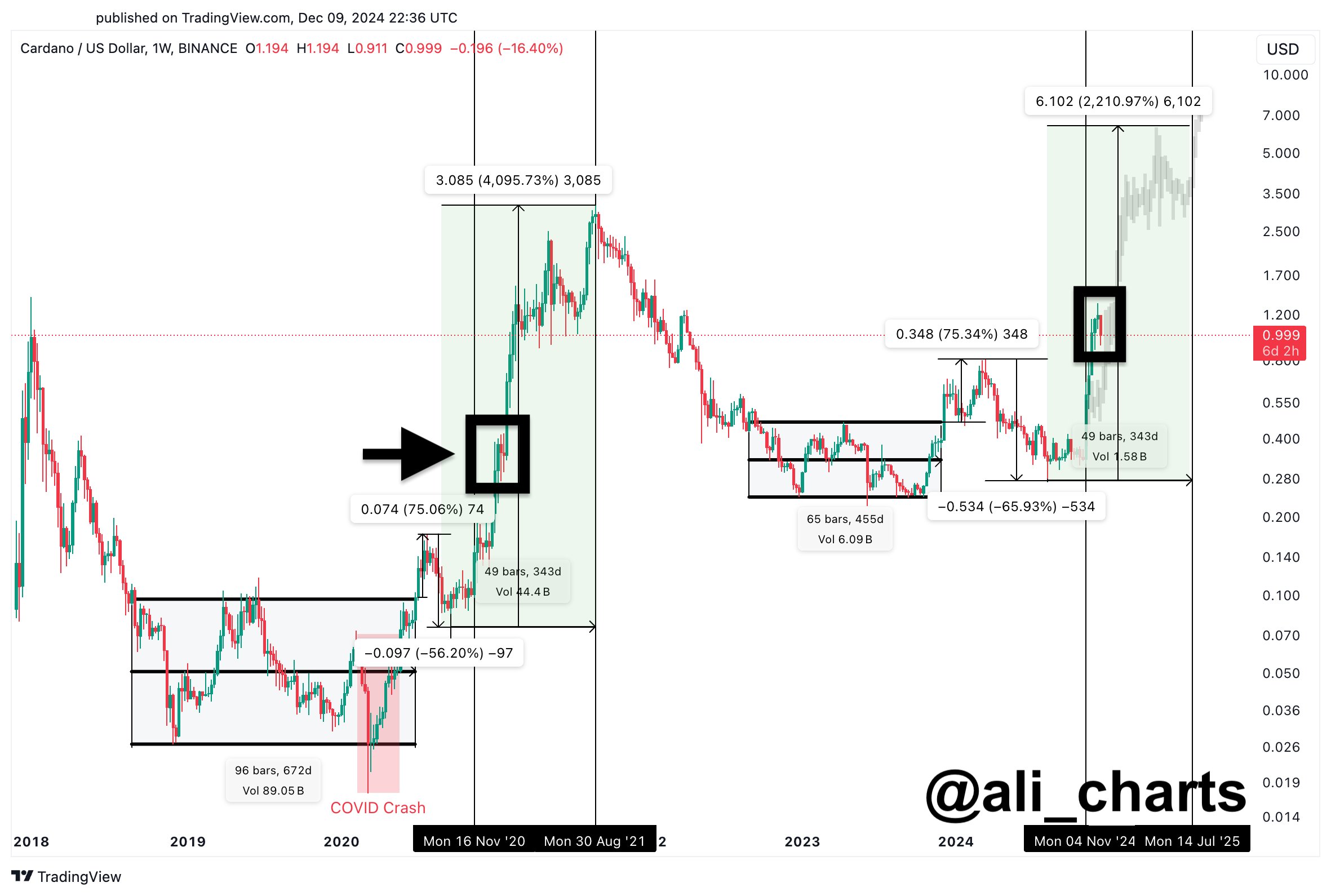

For context, Ali Martinez, a prominent figure in the crypto space, recently shared a price chart of ADA, citing its historical trends. The analyst has compared the recent price swings to its 2020 performance, saying that he would continue to accumulate ADA even if the price continue to slump.

In addition, Martinez also hinted that the crypto is poised to hit $4 or even $6, which would allow traders to book profit. In his recent X post, he stated:

“Even if it dips down to $0.76, I’m buying more and plan to book profits between $4 and $6.”

What’s Next For ADA?

ADA price today was down nearly 10% during writing and exchanged hands at $1.01. However, the crypto’s trading volume has rocketed 122% to $3.88 billion at the same time. Notably, the crypto has touched a 24-hour high of $1.15, while noting a monthly gain of 75%.

Besides, CoinGlass data showed that Cardano Futures Open Interest slumped 25% amid a broader crypto market crash, indicating a waning risk-bet appetite of the investors. However, the Relative Strength Index for ADA at 53 suggests a neutral stance for the crypto. This indicates that the crypto could witness further gains.

Additionally, Martinez has highlighted a key trend for Cardano price, saying that the crypto has slipped below the “critical $1.20 support level.” He noted that around 93,000 addresses had purchased 2.54 billion ADA at this level. Besides, he also said that the next demand zone for the crypto stands at $1 now.

In addition, the Cardano Foundation X handle was hacked recently, which has also sparked concerns in the market. The hackers have promoted a false token, saying that it would stop ADA withdrawals due to the US SEC crackdown. However, the team was quick to address the issues, which has boosted the market spirit.

On the other hand, a recent analysis hints at a potential ADA rally to $2. Also, the analysis showed that the Cardano price trajectory remains bullish as long as it holds above the $0.644 support level, indicating that the crypto could witness further rally in the coming days.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Cardano Price

Which are some of the top altcoins to avoid selling?

Published

3 weeks agoon

December 5, 2024By

admin

The altcoin season index (ASI) has jumped to 82, pointing to a more favorable outlook for cryptocurrencies, aka altcoins in the next few weeks. Crypto markets often do well when the ASI and the crypto fear and greed are rising. With this optimistic outlook here are top 4 altcoins to avoid selling in December with huge upside potential.

Don’t Sell These Four Altcoins

The rising altcoin season index has led to fears that most cryptocurrencies will suffer a harsh reversal. Here are some of the top altcoins not to sell in December.

Sui (SUI)

Sui price has done well this year as it jumped to a record high of $4.038. It has risen by 415% from its January lows, helped by the strong performance of its ecosystem.

On the daily chart, the coin is attempting to move above the key resistance at $3.9356, its highest level in November. Flipping that level will invalidate a double-top pattern that has been forming. A double-top is formed when an asset forms two peaks and a neckline, which is, in this case at $2.9834.

The Murrey Math Lines show that the Sui price has more room to run to get to the extreme overshoot level at $7.8. Therefore, the coin has a near 100% upside from the current level. You should only sell the Sui altcoin if it drops below the double top’s neckline at $2.98.

Aureal One (DLUME)

Aureal One is another altcoin that has significant potential. It is currently in a presale that has attracted thousands of traders.

Aureal One aims to create the first metaverse blockchain for gaming, an industry that is expected to do well in the next decade. It will be a rival to Immutable X and have superior speeds and low transaction costs.

Interestingly, Aureal One’s price is increasing periodically, meaning that earlier buyers get a discount. The next price will jump by almost 30%. Therefore, there is a likelihood that the coin will do well ahead and after its mainnet launch.

Cardano (ADA)

Cardano is another top altcoin to avoid selling in this crypto bull run. ADA price has already jumped by 270% from its lowest level this year.

Cardano’s Average Directional Index (ADX) has risen to 60, a sign that it has a bullish momentum. The ADX is a popular indicator used to measure the strength of an asset’s rally.

Cardano price also remains above the 50-day and 200-day moving averages. Using the trend-following principles, there are odds that the ADA price will jump to $2 in this cycle.

The risk for Cardano is that it has formed a rising wedge chart pattern, which could lead to a reversal.

Tron (TRX)

Tron price has done well this year, and on Wednesday, it jumped to a record high of $0.4485. The coin’s rally is mostly because of its strong technicals and fundamentals. For example, data by TokenTerminal shows that Tron is the third-most profitable networks in the crypto industry.

Tron was trading at $0.3378 on December 5, down by 25% from its highest level this week. This pullback will likely be short-lived as the coin has multiple catalysts that will push it higher in the next few weeks.

Tron’s bull run will remain as long as it is above the 50 Weighted Moving Average (WMA) at $0.20.

Summary of the top crypto to hold

We have looked at some of the top crypto to hold selling as the altcoin season index rises. The other top coins to avoid selling are Hedera Hashgraph, Pepe, Shiba Inu, and Chainlink.

Frequently Asked Questions (FAQs)

Coins like Tron, Cardano, and SUI have potential for more upside in the near term, which makes it risky to sell them now.

The other altcoins to consider are the likes of Dogecoin, Shiba Inu, Pepe, and Hedera Hashgraph.

Aureal One has a bright future because of its focus on the gaming and metaverse industries.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: