Altcoins

Chainlink (LINK) Continues To Witness More Development Activity Than Any Other ERC-20 Project: Santiment

Published

2 months agoon

By

admin

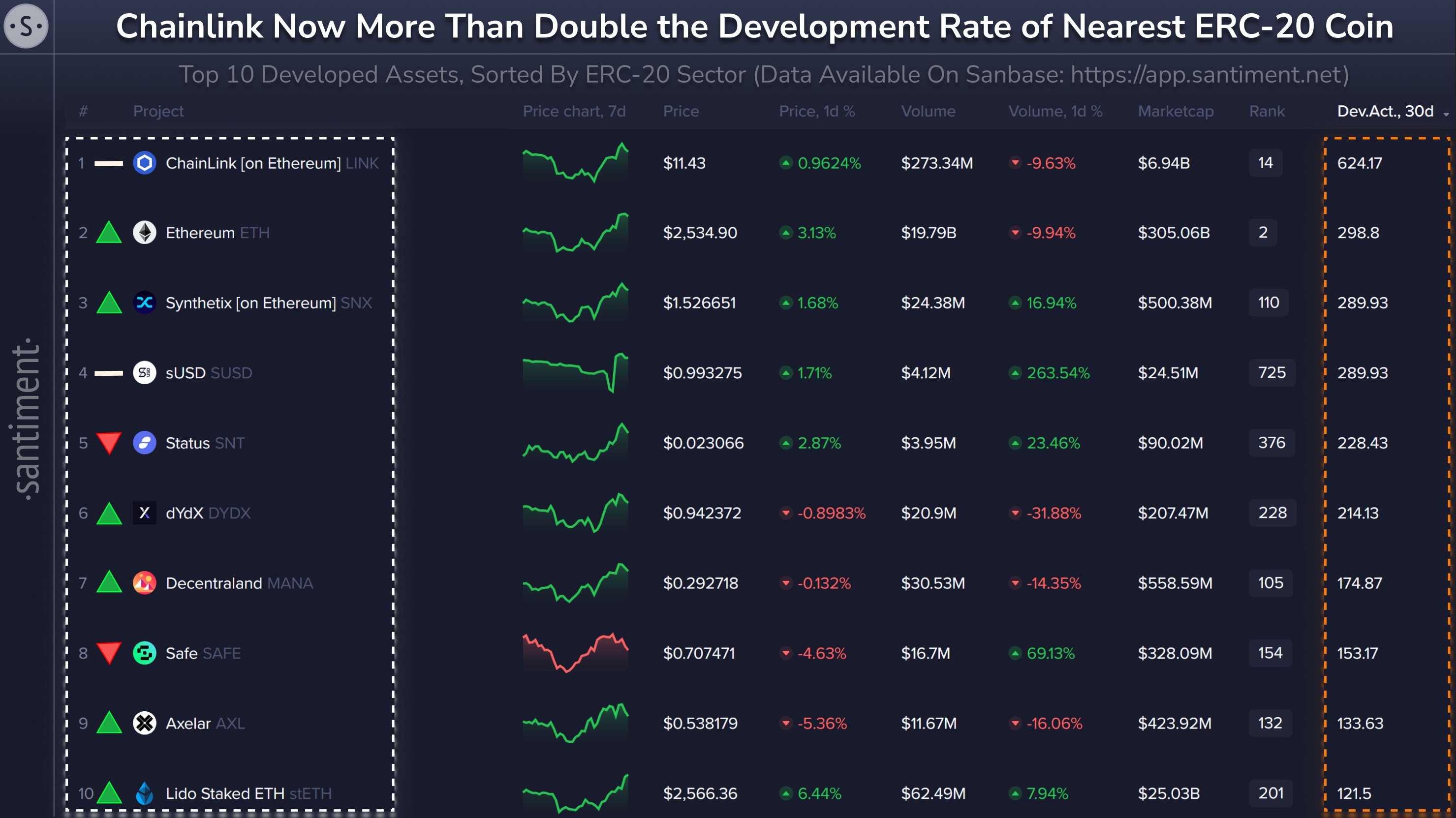

The decentralized oracle network Chainlink (LINK) continues to outpace all other ERC-20 projects in terms of development activity, according to the crypto analytics firm Santiment.

Santiment notes on the social media platform X that Chainlink registered 624.17 notable GitHub events in the past 30 days, more than double the number of the second-ranked project, Ethereum (ETH), which clocked 298.8.

The oracle project also topped the list in June and August.

The decentralized finance (DeFi) protocol Synthetix (SNX) came in third with 289.93 notable GitHub events.

An ERC-20 project is a standard that developers use to issue tokens on the Ethereum blockchain and virtual machine.

Santiment notes that it doesn’t count routine updates and utilizes a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project indicates developers believe in the protocol. Development activity also suggests that the project is less likely to be an exit scam.

LINK is trading at $11.39 at time of writing. The 18th-ranked crypto asset by market cap is up 1.6% in the past 24 hours.

ETH is trading at $2,575 at time of writing and is up nearly 4% in the past day.

Synthetix’s native asset, SNX, is trading at $1.58 at time of writing. The 130th-ranked crypto asset by market cap is up more than 6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

Altcoin Season To Face Challenges Ahead, CryptoQuant CEO Predicts

Altcoins

Santa Rally Incoming? Top Crypto Trader Predicts Upside Bursts for Dogecoin, PEPE and One Solana-Based Altcoin

Published

2 days agoon

December 2, 2024By

admin

A crypto strategist known as a “Master Trader” on the digital asset exchange Bybit believes three altcoins are gearing up for more rallies.

Pseudonymous analyst Bluntz tells his 299,900 followers on the social media platform X that Dogecoin (DOGE) looks poised to witness fresh bursts to the upside after respecting support at around $0.36.

“You didn’t get bored of DOGE and leave to go chase the newest shiny thing did you?

Things are about to get fun again, in my opinion.”

At time of writing, DOGE is trading for $0.432, a 3.45% increase in the past 24 hours.

Turning to fellow memecoin Pepe (PEPE), Bluntz believes that the altcoin is back to bullish mode after breaching its diagonal resistance.

“PEPE downtrend memeline officially broken.”

At time of writing, PEPE is worth $0.0000209, a 2.7% surge in the past day.

As for the native asset of the Solana (SOL)-based decentralized exchange (DEX) aggregator Jupiter (JUP), the crypto strategist thinks the altcoin is primed to move higher after shattering a diagonal resistance.

“JUP breaking out, the Santa rally is gonna be lit this year.”

At time of writing, JUP is trading at $1.14, a marginal decrease in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Crypto Strategist Says One Catalyst Could Enable Massive Influx of Money Into Altcoins, Set Off Major Rallies

Published

3 days agoon

November 30, 2024By

admin

A closely followed crypto analyst says one catalyst could send the altcoin market soaring for months.

The analyst pseudonymously known as Rekt Capital tells his 100,000 YouTube subscribers that if Ethereum (ETH) breaks through a key resistance level “the next few months are going to be life-changing.”

“Breaking out would enable a massive influx of money flow into smaller altcoins. And Ethereum breaking out to new all-time highs would be a major catalyst on a technical side in making all these other altcoins rally quite substantially.”

According to the trader, ETH needs to break through $4,000 to ignite massive altcoin rallies.

“It’s weekly closes and successful retests [at the $4,000 level] that have enabled moves to essentially new all-time highs. So $4,500 would occur once we actually managed a weekly close inside here and retest this [$4,000 level] as support. That would enable a revisit of old all-time highs, and probably upon breaking $4,500, rally into essentially new all-time highs and price discovery.”

Ethereum is trading for $3,595 at time of writing.

He also shares an OTHERS chart, which depicts the total crypto market cap excluding the top ten coins to gauge altcoin market strength, and suggests that alts may surge like they did in 2021.

“Now we’re seeing a weekly close and retest here, and a successful retest here would enable upside from $315 billion to $425 billion…

When we weekly closed and retested this region [in 2021], we saw expansion in altcoin market cap to new all-time highs, essentially…

If we’re able to hold here for a few weeks, that would enable a move into $425 billion.”

?

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

‘Very Promising Start’: Top Analyst Says Ethereum Headed Higher Against Bitcoin – Here Are His Targets

Published

4 days agoon

November 29, 2024By

admin

A top analyst who accurately called the end of the 2022 crypto bull market thinks Ethereum (ETH) is poised to rally in both its Bitcoin (ETH/BTC) and US dollar pairs.

Pseudonymous analyst Pentoshi tells his 826,200 followers on the social media platform X that ETH/BTC looks good after respecting its support at 0.30 BTC.

According to the crypto strategist, ETH/BTC may bounce to as high as 0.4597 BTC.

“Very promising start.

Let’s see if we can get to the target.”

At time of writing, ETH/BTC is trading for 0.0373 BTC worth $3,563.

As for Ethereum against the dollar, Pentoshi thinks it is within the realm of possibility for ETH to surge above $4,000.

“No reason this doesn’t challenge this year’s highs, or higher in my opinion.

Which likely has confluence with the ETH/BTC target posted.”

He also thinks that the rally will be driven by investors allocating hundreds of millions of dollars in capital to ETH-based exchange-traded funds (ETFs).

“Starting to become more consistent for ETH.

We could see a few $250-$500 million days at some point too in the near future for this [BlackRock ETH] ETF. Had a $91 million day just in the last week.

Probability of that you have to assume is very high and not far stretched at all.”

Pentoshi is also keeping a close watch on the native asset of the graphics processing unit (GPU) rendering network Render (RENDER). The analyst says RENDER looks bullish after flipping a key resistance level at $8.10 as support.

“Was a very short wait, RENDER flipped it, retested, and confirmed on the four-hour [chart].

Structurally a great looking chart.”

At time of writing, RENDER is worth $8.61, up over 8% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DreamStudio

Source link

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

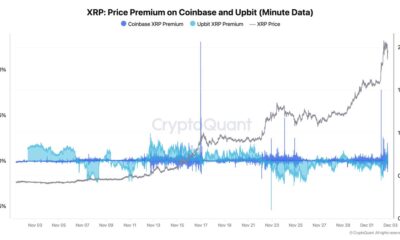

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

Altcoin Season To Face Challenges Ahead, CryptoQuant CEO Predicts

Crypto, Stocks and ‘Everything Bubble’ Still Has Room To Run, According to Analyst Jason Pizzino

This Cardano alternative expected to reach $1 in 2025, currently priced at $0.0259

Binance To Delist These Crypto In BTC Trading Pairs, What’s Next?

Polymarket Retains Loyal User Base a Month After Election, Data Shows

Coinbase CEO Brian Armstrong Sends Strong Message to Anti-Crypto Law Firms

Elon Musk’s $56 Billion Tesla Pay Deal Struck Down Again: Details

Bitcoin to Enter Final Bull Phase? Key Indicator Hints at Major Price Movement

Fantom Price Jumps 8% As Sonic Labs Unveils Genesis Block

Ripple CTO Calls on US Government To End All Indirect Regulation Including Alleged Debanking of Tech Founders

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential