Circle

Circle exec expects ‘huge shift’ in EU market post-MiCA

Published

3 months agoon

By

admin

Patrick Hansen, Circle’s European strategy director, predicted major leaps in the EU’s crypto and stablecoin market by late 2025.

At the European Blockchain Convention in Barcelona, Hansen shared expectations of advancements in the crypto market structure across the European Union. The bloc’s Markets in Crypto-Assets Regulation, known as Markets in Crypto-Assets Regulation, would be the primary catalyst for this growth, said Hansen during a panel titled “What is Going on Behind the Scenes – Post MiCA?”

MiCA signaled a shift in the EU’s crypto regulatory strategy, providing comprehensive guidelines for governments, institutions, and investors regarding digital assets.

Indeed, MiCA outlined requirements for crypto exchanges and thresholds for stablecoin reserves. Circle (USDC) was one of the first stablecoin beneficiaries of this new regime and snagged MiCA’s inaugural stablecoin license.

Hansen disclosed that MiCA compliance and the eventual regulatory approval involved a process different from those in other regions. For instance, USDC’s issuer liaised with regulators for up to 24 months before obtaining approval.

Circle also applied for its Electronic Money Institution license in France, which was accepted by the Autorité de Contrôle Prudentiel et de Résolution, the French banking watchdog.

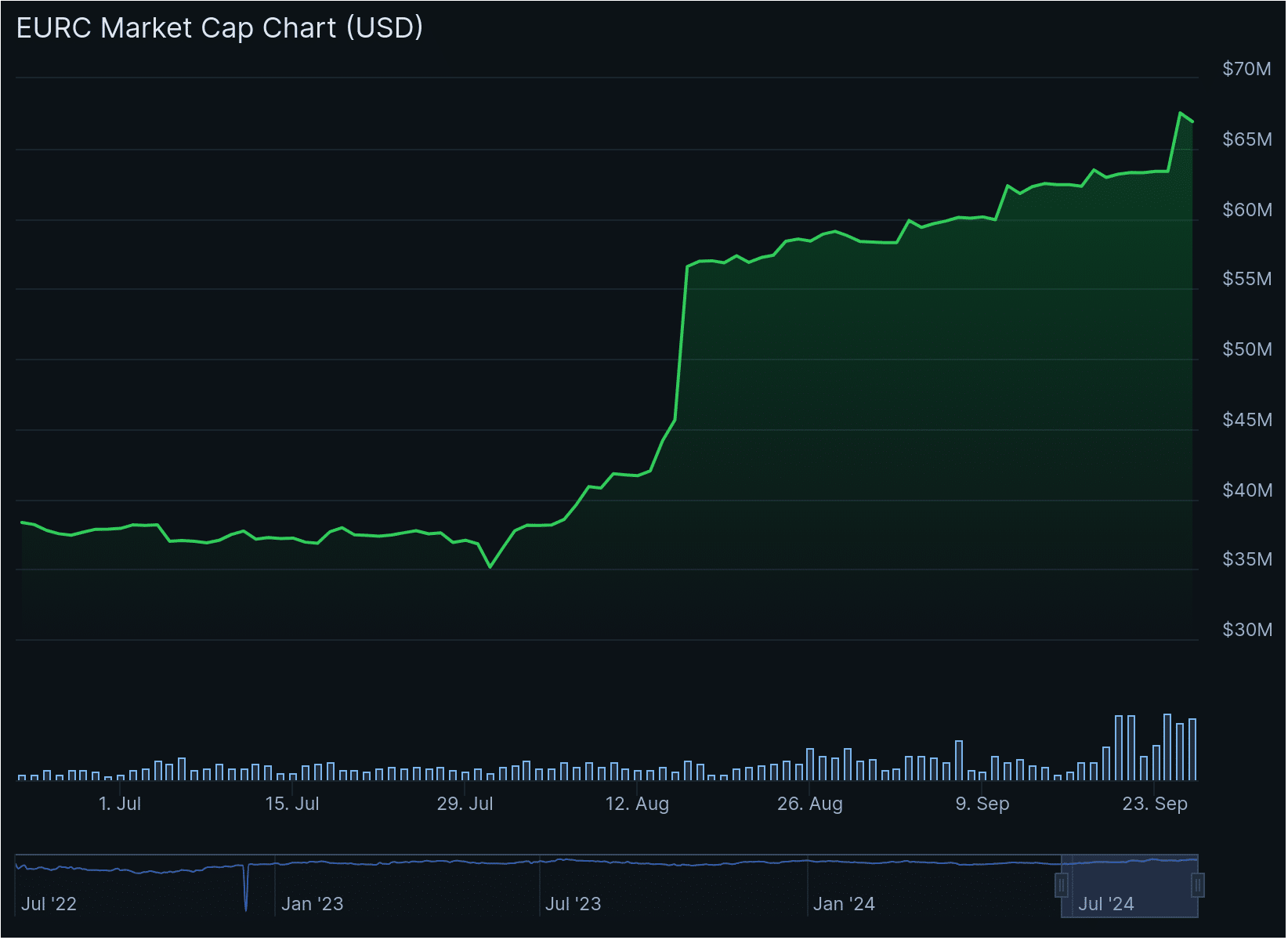

According to Hansen, the firm’s euro-pegged stablecoin, EURC, has jumped 60-70% since July when approval was issued. The token now boasts over 67 million euros in market cap. Hansen foresees continued growth for EURC and other stablecoins in the EU, driven by MiCA’s rules.

We believe that in the European Union, for our euro stablecoin, but for euro stablecoins overall, we can expect at least significant growth in the next 12 months.

Patrick Hansen, Circle’s EU senior director, strategy & policy

As the USDC operator solidified its European foothold, CEO Jeremy Allaire advanced plans for an initial public offering in the U.S. The digital payment provider relocated its global headquarters to the heart of New York City as part of a roadmap to go public. Circle’s new office is located in the One World Trade Center, alongside some of Wall Street’s biggest names like Goldman Sachs.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Altcoins

USDC Becomes First Stablecoin To Gain Compliance With New Canadian Crypto Asset Requirements

Published

2 weeks agoon

December 6, 2024By

admin

Circle announced this week that USDC became the first stablecoin to gain compliance with new Canadian digital asset regulations.

Canada’s new regulations call for delisting noncompliant stablecoins after December 31st.

Circle’s compliance means USDC, which aims to maintain a 1:1 peg with the US dollar, can trade on crypto exchanges in the Canadian market, according to a new press release.

Dante Disparte, chief strategy officer and head of global policy at Circle, says the new development underscores the stablecoin issuer’s regulatory efforts.

“The Canadian Securities Administrators’ proactive approach in providing a digital asset regulatory framework reinforces the integrity of digital asset markets, while ensuring continued reliance on USDC across Canada’s burgeoning ecosystem.”

The announcement comes as Circle launched a new wave of layoffs, Bloomberg reports. A company spokesperson tells the news outlet the downsizing was routine and represented less than 6% of the firm’s workforce.

“Circle regularly reviews our investments and expenses. This includes investing in teams and operational infrastructure that need to grow, while marginally reducing spend and some roles in other areas of the business.”

This summer, USDC and Circle’s euro-pegged stablecoin EURC also achieved compliance with the European Union’s Markets in Crypto Assets (MiCA) regulations.

MiCA is upcoming EU legislation that will provide rules covering the supervision, consumer protection and environmental safeguards of crypto assets.

The law includes measures that aim to reduce financial crimes including market manipulation, money laundering and terrorist financing, and it places stablecoin issuers under the European Banking Authority while requiring them to hold sufficient liquid reserves.

It’s also scheduled to take effect in December 2024.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Circle plans to bolster its presence in Southeast Asia, with Hong Kong’s stablecoin roadmap incentivizing the firm’s proposed business expansion.

Circle, the world’s second-largest stablecoin issuer USDC (USDC), intends to hire more employees in Hong Kong and establish additional business relationships in the region, according to local media reports on Nov. 4.

Circle’s operator reportedly views Hong Kong as a key market for stablecoins. This news aligns with previous coverage from crypto.news, which quoted Circle CEO Jeremy Allaire’s remarks on Hong Kong’s upcoming stablecoin strategy.

In late October, Allaire stated that USDC and other stablecoins play a vital role in Hong Kong’s trading practices. These comments followed a July consultation paper from the Hong Kong Monetary Authority (HKMA) concerning a stablecoin framework.

The HKMA aims to implement clear regulations and standards for stablecoins by 2025, integrating these fiat-pegged cryptocurrencies into the region’s financial system.

Local companies have already embraced stablecoins ahead of formal regulatory guidelines. First Digital Trust activated its FDUSD token on Solana last month, adding to existing support on BNB Chain and Ethereum.

Hong Kong has emerged as one of Asia’s leading crypto-friendly jurisdictions despite close ties to China, an anti-Bitcoin (BTC) nation. Some experts suggest that Hong Kong acts as an extension of China’s financial ecosystem, providing a space for crypto and other innovations.

In Circle-related updates, the USDC issuer published a whitepaper for its Confidential ERC-20 standard. The company stated that the new token design aims to preserve user privacy while enhancing regulatory compliance at the smart contract level.

Circle also relocated its global headquarters to New York, with plans to launch an initial public offering and list its shares on Wall Street.

Source link

Altcoins

BlackRock in Talks With Crypto Exchanges About Using Its BUIDL Token As Derivatives Collateral: Report

Published

2 months agoon

October 19, 2024By

admin

Asset management titan BlackRock is reportedly in talks with numerous crypto exchange platforms about using its proprietary token BUIDL as collateral for derivatives contracts.

According to a new report by Bloomberg, anonymous people familiar with the matter say the world’s largest asset manager is exploring the idea of utilizing BUIDL – the crypto asset related to the firm’s tokenized mutual fund – as collateral for trading derivatives contracts.

BUIDL, which launched in March of this year and stands for BlackRock USD Institutional Digital Liquidity Fund, is a tokenized money-market fund designed to offer a stable value of $1 per token built on the Ethereum (ETH) blockchain that offers blue-chip traders yields.

Bloomberg says the crypto exchanges BlackRock is in talks with include Binance, the world’s largest crypto exchange by volume, as well as OKX and Deribit.

Previously, it was reported that the fund invests in cash, US Treasury Bills, and repurchase agreements and sends dividends directly to investors’ wallets as new tokens every month.

As stated by Robert Mitchnick, BlackRock’s head of digital assets, in a press release issued by Securitize, BlackRock’s brokerage partner,

“[BUIDL] is the latest progression of our digital assets strategy. We are focused on developing solutions in the digital assets space that help solve real problems for our clients.”

In April, stablecoin issuer Circle launched a new smart contract function that permits holders of BUIDL to convert their tokens into USDC. At the time, Circle chief executive Jeremy Allaire said that the new functionality would allow “investors to move out of tokenized assets at speed, lowering costs and removing friction.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential