meme coin

Coffeezilla calls out Andrew Tate for bogus crash promotions

Published

2 months agoon

By

admin

YouTuber Coffeezilla is in a back-and-forth spat with Andrew Tate over the latter’s flip-flop from crypto critic to meme coin promoter.

The YouTuber, whose real name is Stephen Findeisen, ran a clip of Tate, who previously portrayed himself as a crypto skeptic. Coffeezilla also pulled a quote from Tate where he seemingly expressed having no interest in launching coins or exploiting his fans.

“I just like to f— with crypto Twitter because crypto Twitter are full of the biggest degenerate losers on the planet,” Tate once said, saying crypto has “zero” benefit to society. See below.

“Crypto is the only scenario I can think of where you can make a whole bunch of money while benefiting society zero,” Tate stated.

Tate, who prides himself on being a misogynist, has over 10 million followers on X.

Coffeezilla takes a closer look

Coffeezilla’s investigation reveals that Tate has since promoted several meme coins that ultimately crashed.

One of those projects was called “ROOST,” which saw a 90% decline after Tate’s endorsement. The YouTuber also mentions Tate’s promotion of “F Madonna token,” which similarly performed poorly.

These actions are completely different from Tate’s earlier statements against “gambling” and “rug pulls” in the crypto space.

The investigation particularly focuses on Tate’s involvement with the “Real World Token,” linked to his online course formerly known as Hustler’s University.

The YouTuber describes the token’s structure, as explained by Tate, as resembling a pyramid scheme. Subscribers reportedly earn “PowerPoints” that can be converted into tokens representing a share of the school’s profits.

In 2022, Tate was arrested in Romania on charges related to human trafficking and organized crime, which further fueled his notoriety.

He and his brother Tristan have maintained their innocence, and his legal case has remained a subject of international interest.

Coffeezilla tried reaching out to Tate

Coffeezilla, in a YouTube video shared with 3.8 million subscribers, stated that he attempted to get Tate’s response to these findings.

However, he claims that instead of answering the inquiries, Tate leaked his email address and encouraged his followers to harass him.

In one of his recent tweets, Tate stated that having the power to randomly pump any coin on the chart is super fun. Additionally, in a separate tweet, he noted that he wants to pump everyone’s bags and give everyone money.

Having the power to randomly pump any coin on the chart is super fun.

— Andrew Tate (@Cobratate) October 19, 2024

Tate also questions why more famous people don’t help everyone win. As of now, whatever claims that Coffeezilla made haven’t been proven and remain as allegations.

In the past, Coffeezilla investigated several crypto scandals, including the Save the Kids Token, a charity promoted by members of the Los Angeles-based FaZe Clan.

Coffeezilla has called out a number of alleged schemes, including BitConnect, SafeMoon and various “financial gurus,” such as Grant Cardone and Tai Lopez.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Dapps

Meme coins drive Solana DApp revenue to $365m record

Published

5 days agoon

December 18, 2024By

admin

Decentralized application revenue on Solana reached a new record high, mainly generated from meme coin-related transactions and tools.

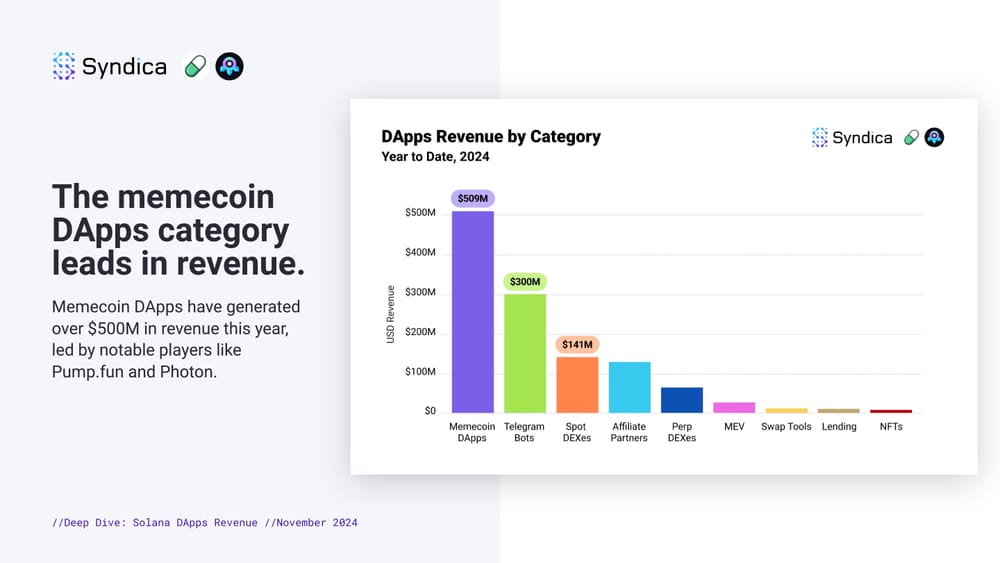

According to Syndica’s research, Solana (SOL) native DApps garnered $365 million in revenue during November 2024, a new monthly high for the popular layer-1 blockchain network.

Solana’s decentralized finance ecosystem was the leading port of call for revenue. SOL DeFi comprised almost 84% of cash raised last month, compared to wallets and infrastructure, which attracted less than 15%.

Among DeFi activity, meme coins and meme-supportive protocols dominated SOL revenue. Meme coin DApps monthly revenue surged 305-fold in 2024, raking in over $500 million. Pump.fun, crypto’s most popular meme token launch pad, led Solana protocol revenue last month with $106 million, a first for the young project.

Telegram bots solidified their presence within SOL’s ecosystem. The category has amassed the second biggest revenue stream after meme coin DApps, recording over $300 million this year. Meme traders regularly tap bots like Trojan, Banana Gun, and BONKbot to invest in new trendy launches directly from Pavel Durov’s private messaging platform.

Meme coins and meme coin DApps may be Solana’s main characters, but the ecosystem rapidly expanded to include several active players. Syndica’s research reported a parabolic jump in “high-quality players” within SOL’s ecosystem. Researchers noted an increase in protocols earning over $10,000 to $10 million monthly revenue.

The report highlighted SOL’s Decentralized Physical Infrastructure as a major sector in the early stages of revenue generation. DePIN, as crypto natives call it, refers to maintaining and providing real-world services like servers using individual blockchain resources.

Protocols such as Render, Nosana, Helium, and Hivemapper have recently seen strong demand for their services, driving notable revenue growth. Render’s decentralized compute network is currently the largest revenue driver in the DePIN sector.

Syndica report

Source link

Markets

GOUT spikes 70%, Stacks and MAD trend as Ethereum inches to $4,000

Published

1 week agoon

December 15, 2024By

admin

The price of GOUT has surged over 70% as Ethereum shows signs of reclaiming the $4,000 level.

According to CoinGecko data, the price of GOUT has pumped from a 24-hour low of $0.0003233 to as high as $0.0005573 at press time.

The meme coin has also seen its price go up by over 140% in the last seven days.

Apart from the general meme coin volatility, GOUT has released its independent research and development task platform, which could have bolstered the price.

In addition, GOUT was selected as the first project by the BNB Chain for their 33 BNB daily meme coin airdrop.

The meme coin project has also been actively donating, with one of the recent donations going to help stray dog families around the world.

Stacks and MAD trends on CMC

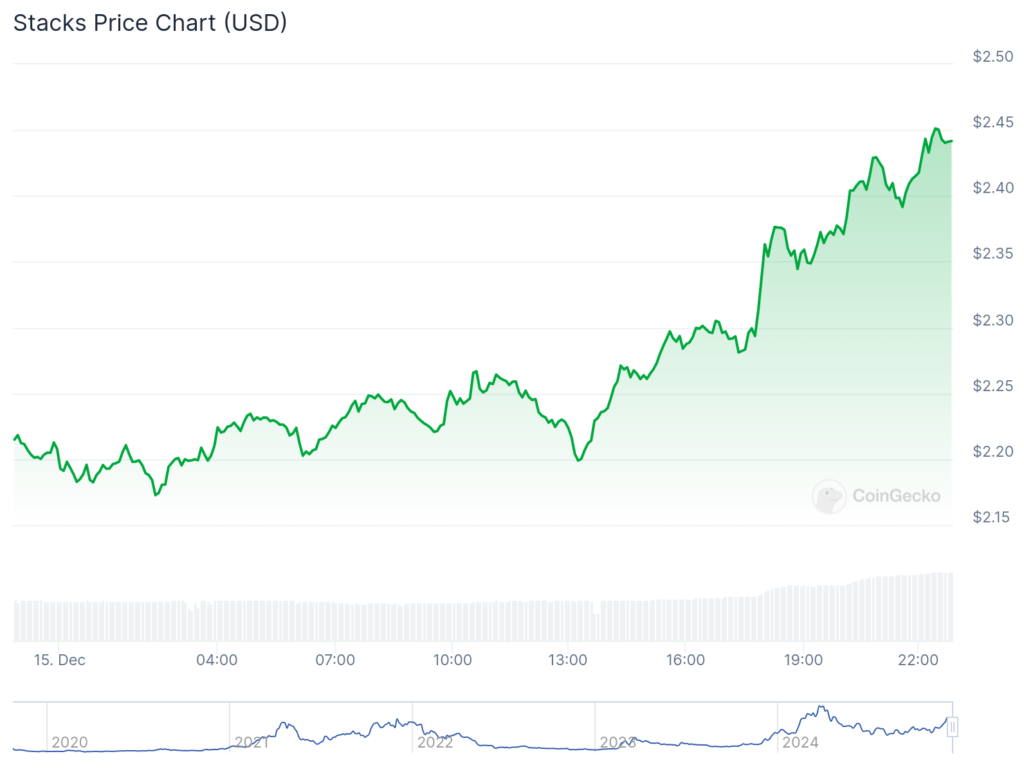

Stacks has risen as the second-top gainer out of the top 100 altcoins. The coin price has seen its price rise from $2.17 to as high as $2.45 in the last 24 hours.

Stacks has announced that they will unlock Stack’s BTC in the next week, where users can receive free Bitcoin (BTC) rewards. In addition, they have announced five days of sBTC giveaways and a partnership with Hex Trust.

Another Solana (SOL)-based meme coin, MAD, has been trending on CMC. One of the visible reasons for the extended visibility of the coin is most likely the recent Gate.io trading competition. The exchange had announced a $36,000 MAD prize pool for its trading competition.

The meme coin was also recently listed on the Phemex exchange. MAD hasn’t shown a major price change in the last 24 hours. However, it has risen close to 20% in the last seven days.

The surge in the value of these coins is happening as BTC reclaimed the $103,000 level and Ethereum (ETH) is inching closer to the $4,000 level.

Source link

Blockchain

Dogeson, Shiro Neko, Orbit among Saturday’s largest gainers

Published

1 week agoon

December 15, 2024By

admin

Three coins have risen to the top of the leaderboard: The Dogeson, a playful nod to Elon Musk, his son and Dogecoin; Shiro Neko, a cat-themed token tied to gaming and NFTs; and Orbit, a space-inspired coin.

These tokens topped the gainers’ charts on Saturday night. Here’s a closer look at each.

Dogeson

The Dogeson (DOGESON), a Doge-inspired coin named after an edited photo Elon Musk posted of himself and his son, X Æ A-12, is up more than 90% at last check Saturday.

With a market cap reaching $146.6 million, the token is built on the Ethereum blockchain and has garnered attention for its narrative of a “space-bound Doge” — meshing humor with a decentralized finance (DeFi) theme.

Details about The Dogeson’s founding team or developers were not immediately clear.

Shiro Neko

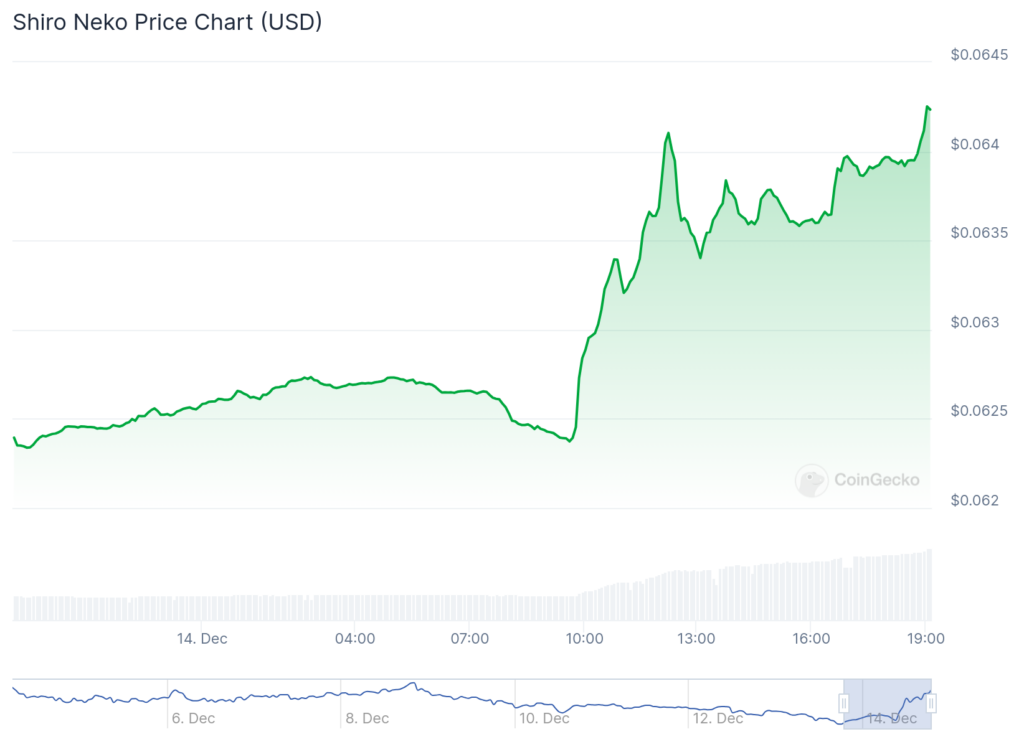

Shiro Neko (SHIRO) is a new cryptocurrency project that blends blockchain technology with play-to-earn (P2E) gaming.

Its ecosystem is built around a native token that can be used for in-game purchases, staking, and governance.

It’s up over 83% at last check, with a market cap of about $441 million.

The project emphasizes a community-driven approach, immersive gaming experiences, and collectible in-game assets, including NFTs. It aims to attract both gamers and crypto enthusiasts through competitive challenges and real-world rewards

Shiro Neko is also building on Shibarium, the Layer 2 blockchain for the Shiba Inu ecosystem, further anchoring itself in a popular crypto community. Additionally, the project is venturing into entertainment by launching an animated series featuring “Shiro” the cat.

The token recently had its Initial Exchange Offering (IEO) on Gate.io, with 88 billion tokens available for sale, representing 0.01% of its total supply of 1 quadrillion tokens.

This reflects a focus on early adoption and community-building in the crypto-gaming landscape.

Orbit

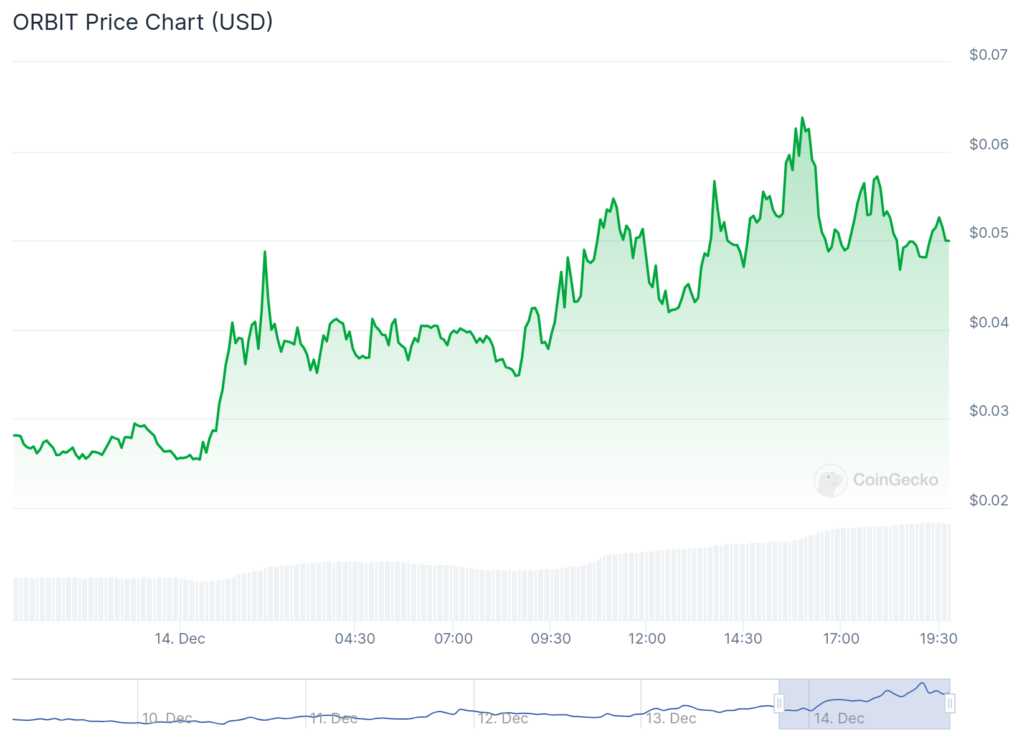

Orbit (ORBIT) was up 77.6% at last check Saturday, with a market cap of roughly $44 million.

Built on the Blast Chain, the native utility token of the Orbit Protocol serves multiple purposes including facilitating governance, incentivizing participants, and enabling staking for rewards.

The protocol also boasts a Total Value Locked (TVL) of over $6.4 million and a fixed total supply of 100 million.

As of now, ORBIT’s market performance shows significant price fluctuations, with a 24-hour range of $0.02543 and $0.06379.

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential