Donald Trump

Crypto has a leadership problem: What can regulators do?

Published

2 months agoon

By

admin

Crypto cons are frequent, and the sector’s loudest and most well-known leaders have faced substantial legal trouble in recent years.

You know the names:

- Sam Bankman-Fried, sentenced to 25 years

- Changpeng Zhao, released after four months

- Nader Al-Naji, arrested and (if convicted) faces a maximum sentence of 20 years in prison

- Arthur Hayes, six months of home confinement

- Do Kwon, arrested and could potentially face significant jail time

- Mark Karpeles, arrested in Japan over Mt. Gox legal trouble

- Alex Mashinsky, arrested in 2023 and is currently on trial

- Charlie Shrem, pleaded guilty in 2015 and served a year in prison

Crypto.news collected some commentary about whether the crypto industry has a serious leadership problem, or simply suffers from a few bad apples. At a glance, it does seem like fertile ground for shady goings-on.

But then again, “is it worse than anything else that’s out there?” asks Anthony Scaramucci, founder of SkyBridge Capital.

“You could say there are bad apples in other parts of finance,” Scaramucci told us via Saxo. “I would maintain it’s not worse than anything else. I would say that we’re in the process of cleaning this up.”

Biden was ‘overly aggressive’

Scaramucci, whose hedge fund embraced Bitcoin (BTC) as an offering in 2020, has a prolific career in finance, having spent seven years at Goldman Sachs.

He was also a former White House communications director for 11 days under ex-President Donald Trump.

Scaramucci has since soured on Trump and endorsed Vice President Kamala Harris for the 2024 presidential election. He even revealed at the TOKEN2049 conference in Singapore that he and other cryptocurrency advocates are collaborating with the Harris campaign to shape more industry-friendly policies should she win on Election Day, Nov. 5.

For crypto investors, it’s exactly what they’re looking for: an inside man who knows the industry and can carve inroads with Washington, D.C. Up until now, their big gripe is with the Biden administration and the current leadership within the U.S. Securities and Exchange Commission (SEC).

In 2023, SEC Chair Gary Gensler, a Biden appointee, brought 46 cryptocurrency-related enforcement actions. That’s up 53% from 2022, according to Cornerstone Research.

Lawmakers were perhaps “embarrassed” by FTX founder Bankman-Fried, Scaramucci adds. Bankman-Fried was convicted of embezzling an estimated $10 billion of his customer’s deposits (Scaramucci’s SkyBridge suffered a hit when FTX collapsed).

Since then, the SEC has grown more strict. Gensler has taken action against major players such as Binance, Coinbase, Ripple, and Terraform Labs. This has sparked numerous legal battles and high-profile cases.

Most cryptocurrency tokens qualify as securities under U.S. law and, as a result, fall under SEC oversight.

“I thought that they [the Biden administration] were overly aggressive in terms of their anti-crypto positioning,” Scaramucci says. “It was unnecessary to be that aggressive.”

Other crypto pros share a similar sentiment. Tim Kravchunovsky, founder and CEO of decentralized telecommunications company Chirp, argues that those enforcement actions by the SEC felt more like attacks rather than constructive oversight.

“Crypto investors were met with confusion, inconsistent policies, and outright hostility at times,” Kravchunovsky said of the past four years. “Instead of fostering innovation or providing clarity, the [Biden] administration’s actions raised anxiety, leaving investors guessing about the future of the space.”

Trump does a 180

Crypto’s public relations nightmare continued last week when U.S. prosecutors brought charges against 15 people across four companies: Gotbit, ZM Quant, CLS Global and MyTrade.

The firms engaged in fraudulent practices designed to manipulate the market, according to the FBI.

But scenarios like this “don’t represent all of crypto,” Kravchunovsky insists.

“The industry doesn’t have a leadership problem — it has a trust problem,” he says. “Every time someone like Sam Bankman-Fried makes headlines for fraud, the media paints the entire industry with the same brush. But remember, in any sector where money flows, so do opportunists and criminals. It’s not unique to crypto.”

Indeed, crime permeates all corners of finance. In 2023, more than three trillion dollars in illicit funds reportedly flowed through the global financial system. This trend is expected to continue, driven largely by the rise in digital technologies, which provide new avenues for criminals.

“It’s unfortunate that there has been a growing list of arrests and charges amongst high-profile crypto leaders,” David Morrison, Senior Market Analyst at Trade Nation, says. “Some have clearly been bad actors who have bamboozled and defrauded their customers, broken regulations deliberately for their own gain, and so on. But this is not unusual where new technologies and money collide.”

It’s a bad look, but one Morrison expects to improve “should regulation continue to develop in ways helpful to the sector as a whole.”

“That will require regulators and policymakers with a genuine interest and understanding of cryptos, valuing its importance while welcoming its potential,” he said.

It’s no wonder the industry looks to Trump’s possible re-election as a silver lining. The 78-year-old candidate saw an opportunity to court a passionate portion of the electorate that had grown frustrated with the Biden administration. Gemini co-founders Tyler and Cameron Winklevoss are two of his biggest donors.

Once a crypto skeptic, the twice-impeached Trump is now amongst the industry’s most ardent cheerleaders. He’s even gearing up for the public sale of his own token under the banner of World Liberty Financial, a firm he launched with his three sons, starting Tuesday, Oct. 15.

Polymarket, a platform that allows users to gamble on real-world events using crypto, has him currently leading Harris in a 2024 presidential prediction by more than eight percentage points.

But in an industry marred by illegalities, is Trump — the first former U.S. president to be convicted of felony crimes — crypto’s best bet? Even the Republican’s most staunch supporters have a bad feeling about World Liberty Financial.

“Whether you like Trump or not, his World Liberty Financial venture shows he’s not shying away from crypto,” Kravchunovsky says. “Say what you will about the hype, but at least he’s not trying to kill the industry with endless regulations.”

Advice for Harris

Crypto is one area where Harris, 59, deviates from Biden. Last month, at an event in Manhattan, the Democratic nominee stated that she wants to embrace “innovative technologies” like digital assets while also protecting consumers and investors.

Billionaires Mark Cuban and Ben Horowitz are both on board; so is Ripple co-founder Chris Larsen, who made his first recorded cryptocurrency donation to her campaign.

Should Harris win the election, Morrison offered some advice on behalf of his crypto peers: “If Ms. Harris wins next month, then please don’t relegate cryptocurrencies to the ‘Can’t be bothered’ bucket.”

Crypto has the potential to help the unbanked and “boost entrepreneurship in some of the poorest and most neglected places on our planet,” he adds. “Don’t write it off just because Donald Trump talks about it so much.”

Kravchunovsky agrees.

“If Harris takes office, she needs to understand that crypto isn’t just about speculation—it’s a transformative technology that could redefine industries,” he said. “But here’s the thing: She’s got to listen to people who actually understand blockchain, not just the hype artists or the bureaucrats who think in terms of control. This isn’t about shutting it down, it’s about creating a healthy environment for it to thrive responsibly. The U.S. can’t afford to let fear or misinformation drive policy.”

As for Scaramucci, the former Trump advisor turned Harris advisor, doesn’t seem too worried about this burgeoning asset class.

“The best days for crypto are still ahead,” he says.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Donald Trump

Michael Saylor is willing to advise Trump on the crypto policy

Published

2 days agoon

December 21, 2024By

admin

MicroStrategy Inc. co-founder and executive Chairman Michael Saylor says he is willing to advise Trump on cryptocurrency policy when the crypto advisory council is set.

During the Dec. 18 episode of the Open Interest show on Bloomberg Television, Saylor voiced his willingness to provide his advice on the digital assets policy to President-elect Donald Trump, either publicly or confidently, if he is asked to do so.

Before expressing his willingness to advise Trump on the crypto policy, Saylor admitted that he had already met “with a lot of people” in the incoming administration but declined to specify the personalities nor mentioned if he already met Trump.

Is Saylor fit for a position?

Since the 2020s, Michael Saylor has been one of the key Bitcoin advocates and investors. Saylor is one who puts money where his mouth is, as he personally spent around one billion dollars on BTC. In 2020, Saylor took to X (Twitter at the time) to announce that he personally owns 17,732 bitcoins and that he acquired these coins before MicroStrategy (MSTR) made the first massive purchase of bitcoins. YahooFinance! reports that currently MicroStrategy owns around 440,000 BTC, which is close to a 2% share of the entire BTC supply. MicroStrategy made headlines on the eve of the latest BTC price peak when the company was included in the Nasdaq 100 index.

Michael Saylor names Bitcoin an apex property of the human race and has an insatiable thirst for bitcoins. He compares Bitcoin to the territories like Manhattan or Alaska that were bought by the early colonist administration, specifying that Bitcoin is rather a kind of cyberspace. That’s why MicroStrategy aims to own bitcoins in bulk. According to Saylor, buying as much of this “space” as possible is crucial for the United States. This vision speaks to the statement posted by Donald Trump on the Truth Social platform. “We want all the remaining Bitcoin to be MADE IN THE USA!” the post reads.

Saylor singled out Trump as the most crypto-friendly Republican politician. It seems that Saylor shares the President-elect’s views on Bitcoin. Although not an outright GOP supporter, in September, Saylor made claims that he sees Republicans as a more progressive party when it comes to cryptocurrency regulation. He names regulation pressure decrease, treating crypto as a tool to boost the U.S. economy, and encouraging individuals to pursue their economic aims using digital finance as progressive characteristics of the Republican approach to the crypto industry.

What Do We Know About the Crypto Advisory Council?

Trump proposed the creation of a crypto advisory council during his now famous speech at the Nashville cryptocurrency conference in July 2024. As of December, not much information about the preparations of this council has been made public.

The participating companies’ lineup is not clear yet. However, it has been reported that such brands as Coinbase, Ripple Labs, Paradigm, and Andreessen Horowitz (a16z) are seeking interactions with the incoming administration. Allegedly, an a16z rep was involved in advising the Trump team during the presidential campaign. On December 6, Trump introduced entrepreneur and venture capitalist David O. Sacks as the “White House A.I. and Crypto Czar” via the Truth Social post.

It’s worth saying that, to say the least, before 2024, Trump wasn’t an avid crypto enthusiast. In the past, the President-elect made a series of anti-crypto remarks, calling Bitcoin “not money” and saying that the value of cryptocurrencies is based on thin air.

However, the 2024 Presidential campaign saw a drastic change in Trump’s stance on crypto. He started to take donations in digital currencies, visited a major crypto conference in Nashville where he promised to make America “a crypto capital of the world,” and made several important proposals concerning the cryptocurrency policy.

On top of tax cuts for the U.S. cryptocurrency companies, the removal of Gary Gensler from the SEC, and the creation of the strategic Bitcoin reserve, Trump announced the creation of the advisory body with the leading position granted to the richest man on Earth and his passionate supporter Elon Musk. This unofficial agency is called The Department of Government Efficiency, or simply DOGE, a reference to a legendary memecoin, a notorious soft place of a Tesla CEO. Who knows just what else to expect from Donald Trump when he goes crypto?

Source link

China

China May Be On the Verge of Ending Its Bitcoin Ban

Published

5 days agoon

December 18, 2024By

admin

Look, I think it’s only a matter of time before China pulls a complete 180 on its Bitcoin ban. Yes, they outlawed trading and mining back in 2021, but honestly, a lot has changed since then — especially this year. Bitcoin’s momentum globally has been insane.

We’ve seen US President-Elect Donald Trump calling to stockpile Bitcoin; Bitcoin ETFs get approved, Fed Chair Jerome Powell calling Bitcoin “digital gold,” Larry Fink flipping pro-Bitcoin, and even Putin saying nice things about it. With all of this happening, I wouldn’t be shocked if China has already started quietly stacking sats (buying bitcoin).

Here’s why I think that: China doesn’t like to announce what it’s doing beforehand — it’s just not how they operate. Former Binance CEO CZ talked about this recently at the Bitcoin MENA conference in Abu Dhabi, saying that while the US loves to make big public statements about upcoming policies (like Trump announcing Bitcoin plans to court voters), Asian countries prefer to move in silence.

And let’s not forget China doesn’t have elections. They don’t need to win over public opinion like Trump does. If they’re making moves with Bitcoin, they’ll do it quietly — and we’ll find out when they’re ready to make it official.

Now, with Trump’s big push for Bitcoin and crypto, I can’t see China sitting on the sidelines for too long. This is turning into a global race, and if China wants to stay competitive, they can’t afford to miss the Bitcoin train. My gut tells me they’re already planning to unban Bitcoin and crypto — and I wouldn’t be surprised if it happens as early as Q1 next year, especially if Trump takes office.

Another big hint? Hong Kong. China has a long history of using Hong Kong as a sandbox to test things before rolling them out on the mainland. And this year, we’ve seen Hong Kong make major moves — approving Bitcoin and crypto ETFs and greenlighting more crypto exchanges. Let’s be real: this isn’t a coincidence. They are planning to eliminate crypto taxes for institutions. I think China is watching carefully, and these are early steps toward a broader shift.

In my opinion, China has likely been quietly accumulating bitcoin all along. When the time is right, they’ll unban it — and not just to compete with the US, but to lead. Watch this space. I think it’s going to happen much sooner than most people expect.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Sell-Off Likely When This Metric Reaches 4%, Analyst Explains

Published

1 week agoon

December 14, 2024By

admin

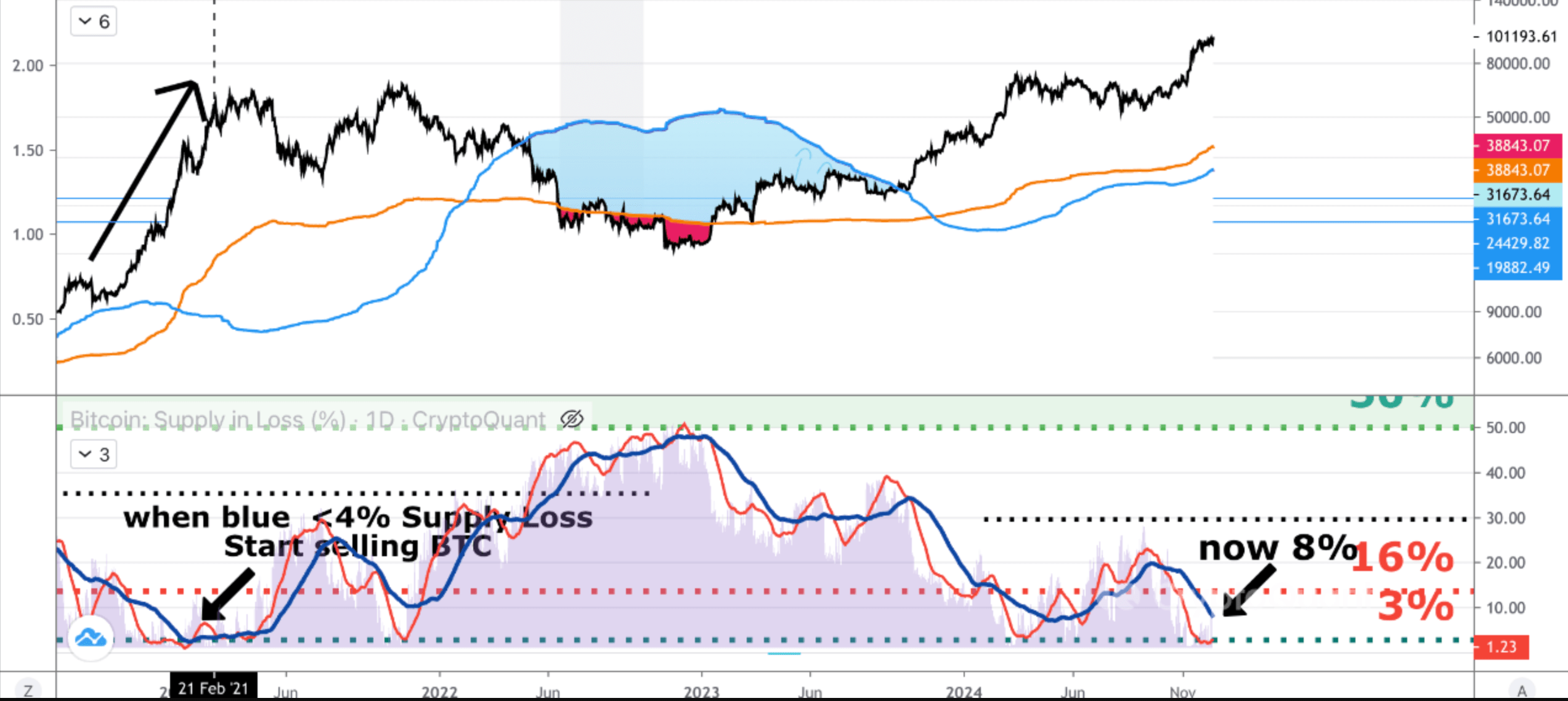

While Bitcoin (BTC) fluctuates around the critical $100,000 price level, some investors may seek the ideal opportunity to take profits and exit the market. In this context, a CryptoQuant analysis highlights a key BTC metric that can serve as a valuable tool for crafting an exit strategy.

Have Profits In Bitcoin? Keep An Eye On This Indicator

In a Quicktake blog post published today, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC during the current bull market. The analyst emphasized the importance of the Bitcoin supply in loss metric, noting its potential to signal when to start exiting the market to preserve profits.

Related Reading

For those unfamiliar with Bitcoin, the supply in loss measures the percentage of BTC held at a loss based on its last moved price. A low percentage of supply in loss typically indicates peak market euphoria and serves as a warning to secure profits before a bear market correction begins.

According to the CryptoQuant analysis, when BTC supply in loss drops below 4%, it signals a good time for investors to consider dollar-cost averaging (DCA) out of their BTC holdings and wait for the next bear market lows. Currently, the BTC supply in loss sits at 8.14%.

DCA is an investment strategy where investors allocate a fixed amount of money to an asset at regular intervals, regardless of its price. This method helps reduce the impact of market volatility and lowers the average cost per unit over time. The analyst adds:

Why? Below 4% means a lot of people are in a profit this is the peak bullrun phase. Trust me you don’t want to be bagholding because you thought we will never see a bear market again. Be fearful when others are greedy.

Analysts Confident Of Further Upside In BTC Price

While tracking the BTC supply in loss metric can help investors safeguard their profits, recent forecasts from crypto analysts suggest there might still be room for further upside before this indicator becomes crucial.

Related Reading

According to crypto analyst Ali Martinez, BTC forms a classic cup and handle pattern on the weekly chart. The premier cryptocurrency looks poised to break out of the bullish formation, with targets as high as $275,000.

Similarly, Donald Trump’s victory has brought fresh optimism in the crypto industry. In the recently concluded Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign chairman, Paul Manafort, noted that BTC investors can “expect more than $100,000” during the ongoing market cycle.

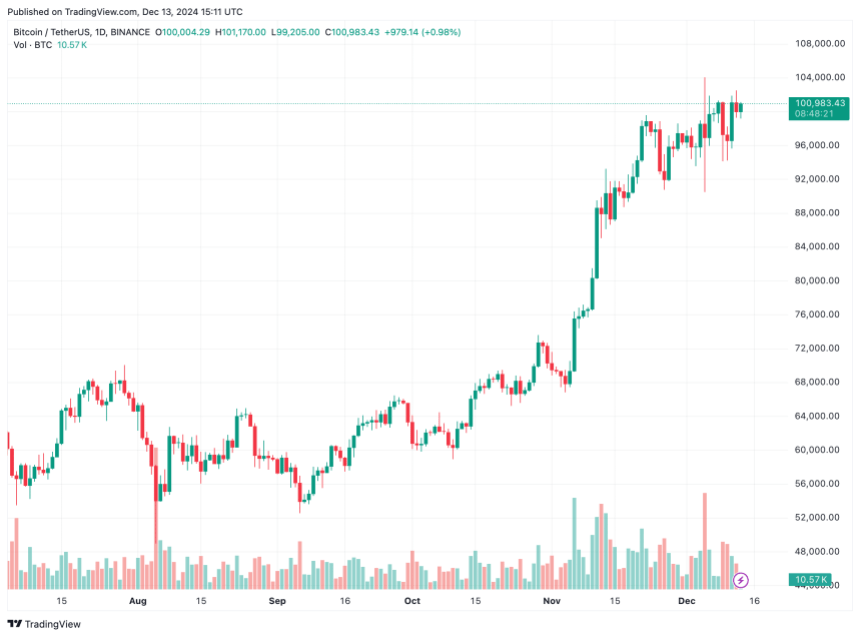

Other forecasts remain equally bullish. Tom Dunleavy, Chief Investment Officer at MV Global, projects BTC to reach $250,000, while Ethereum (ETH) might climb to $12,000 during this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% in the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential