CEX

Crypto-native platforms need on-ramps to grow and leap forward

Published

3 months agoon

By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Crypto was once a self-contained industry. The average user only heard about it at the Bitcoin (BTC) price peaks and was reluctant to invest in this new asset class. Those passionate about crypto found their way through with limited options to convert their digital coins into fiat and back.

But those days are gone. As crypto products grow in popularity, many platforms, previously entirely confined to web3, are integrating fiat bridges to open their doors to new users.

Disruption that doesn’t benefit users

Imagine a common type of web3 product that wants to disrupt its niche and make its service go mainstream. It describes its solution and how blockchain revolutionizes the traditional way of doing things. Then, it says: connect your web3 wallet and make sure you have enough Ethereum (ETH) to pay gas fees. If you don’t have any, set up an account on a centralized exchange and buy some.

This path is ridiculously long and bumpy for a regular non-crypto user. Centralized exchanges are still the most common way to convert fiat money into crypto, but their cumbersome interface often leaves newcomers feeling dizzy. Even for experienced users, CEXes as a gateway are not always convenient—withdrawing funds to an external platform involves multiple confirmations and extra fees. All of this creates a great deal of friction, complicating the user’s journey into web3.

Why would a DEX need a fiat gateway?

One could argue that web3 projects aiming to go mainstream and blockchain-native platforms mostly focused on the crypto audience are different—in the sense that crypto protocols don’t really need fiat. For example, decentralized exchanges that let enthusiasts swap various L1 and L2 tokens earned in airdrops, bounty campaigns, and other activities confined to the blockchain realm.

Is that really the case? In practice, that’s not quite so. For instance, Uniswap introduced its fiat-to-crypto bridge back in December 2022 and has since partnered with various providers to expand opportunities for its users. This is a good example of how a DeFi project realized that it couldn’t reach the next level without opening a channel for inflows from the traditional economy. The move also strengthened the project’s value proposition, giving people more opportunities to safely trade in a decentralized environment.

Memecoins are another example. As the memecoin frenzy unfolded in 2024, this asset class became well-known to a wider audience, catching the attention of traditional investors. While many of them turned to centralized exchanges due to a lack of other options, the Shiba Inu (SHIB) memecoin integrated a fiat on-ramp, offering users the ability to purchase the token directly into their wallet. Investors gained an easy way to buy the asset, and the project increased the value and utility of its token.

The efforts of top crypto platforms to integrate on- and off-ramps highlight the user demand. However, they also indicate that the infrastructure for fiat-to-crypto bridges is now ready. Today, setting up an on-ramp can take just a few days using pre-built software that supports dozens of countries, payment methods, and national currencies. Good gateways are fully licensed in many regions, freeing their clients from compliance issues.

Some argue that crypto-native platforms don’t really need fiat bridges because not many people have used them so far. But what if that was the case simply because there were far too few bridges available?

We constantly think of how to make crypto more accessible. But it often doesn’t require us to reinvent the wheel—it’s about removing the friction faced by those who want to use their fiat in the crypto world. There was a time when fiat and blockchain realms barely intersected. However, as they continue to converge, only tighter integration between traditional and digital currencies will facilitate faster adoption of crypto.

Konstantins Vasilenko

Konstantins Vasilenko is a co-founder of Paybis, a pioneering fintech startup in the Baltic States, which has become a leader in the digital and cryptocurrency exchange business. Konstantin is a seasoned IT expert with over 20 years of experience spanning enterprise IT project management, CRM systems, blockchain technology, digital payments, and cryptocurrencies. Prior to Paybis, Konstantin honed his skills at Accenture. His career reflects a strong commitment to innovation and digital transformation, driving the bridge between traditional finance and the crypto economy.

Source link

You may like

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

CEX

Ethereum DEX networks are enjoying major increase in volume

Published

4 months agoon

September 9, 2024By

admin

Transaction volume in Ethereum decentralized exchanges bounced back even as cryptocurrency prices retreated.

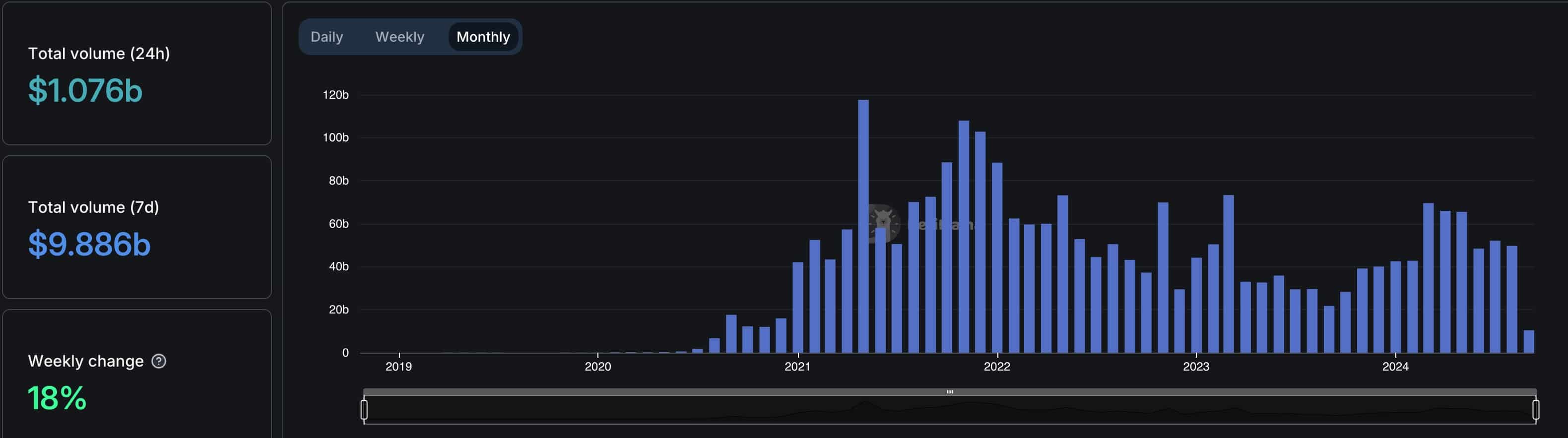

Ethereum DEX had robust activity

According to DeFi Llama, the volume in Ethereum (ETH) rose by 18% to $9.88 billion as that in other chains retreated. Solana (SOL) DEX volume retreated by 8% while Base, BNB Smart Chain, Arbitrum, and Polygon fell by 4%, 14%, and 10%, respectively.

The worst-performing chain was Tron (TRX) whose volume fell by 52% to over $642 million. This decline happened as the popularity of the recently launched SunPump meme coins eased. According to CoinGecko, most of the SunPump tokens like Sundog, Tron Bull, and Muncat have retreated from their all-time highs.

Most DEX networks in Ethereum’s network had a big increase in volume. Uniswap’s volume rose by 14.2% to $5.7 billion after the company settled with the Commodity Futures Trading Commission over its margin products. It agreed to pay a $175,000 fine and stop offering these solutions in the US.

Curve Finance’s volume jumped by 68% to over $1.48 billion while Balancer’s, Hashflow, and Pendle rose by 68%, 196%, and 85%, respectively.

Bitcoin and most altcoins tumbled

This volume happened in a difficult week for the crypto industry as most assets dived. Bitcoin dropped to $52,550, its lowest point since Aug. 5 and 26% below its all-time high. Ethereum also dropped below $2,200, down by over 44% from its highest point this year. The total market cap of all coins dropped below $2 trillion for the first time in months.

There is a risk that the sell-off will continue as a sense of fear has spread in the market as the crypto fear and greed index has dropped to the fear zone of 34. Cryptocurrencies tend to see more weakness when investors are fearful.

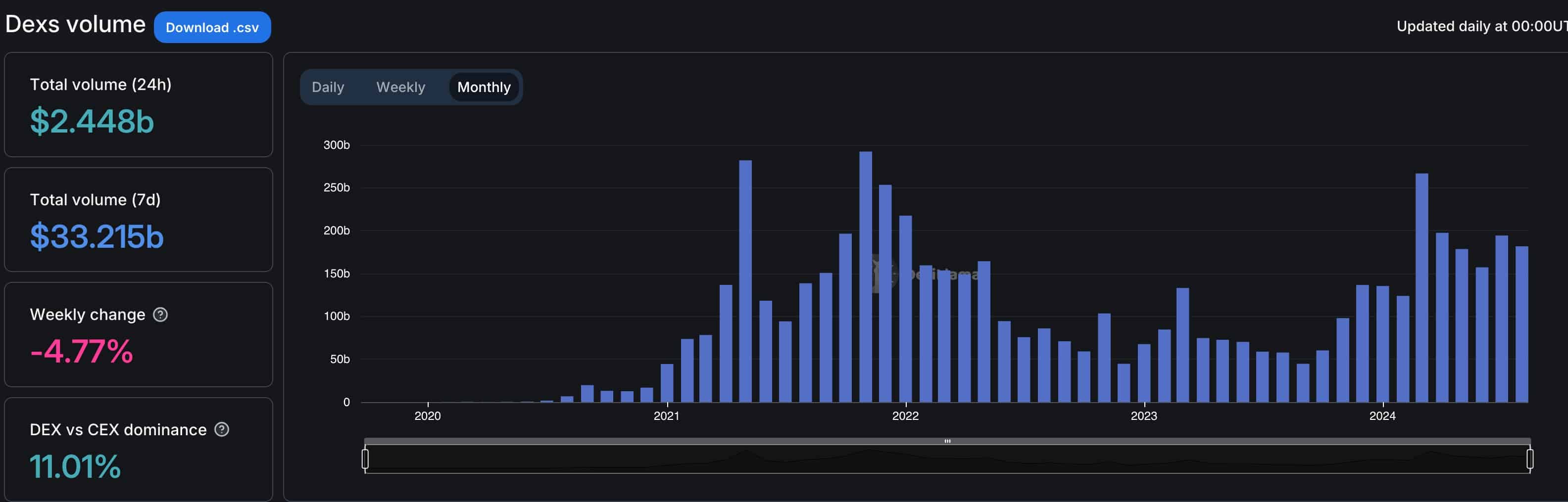

DEX and CEX exchanges also experience weak volume in periods when cryptocurrencies are falling. According to DeFi Llama, the volume in Ethereum DEX platforms dropped to $49.5 billion in August from a high of $69 billion in March as most coins jumped.

The same happened across other DEX platforms as volume fell from over $257 billion in March to $240 billion in August.

Looking ahead, cryptocurrencies may benefit from the upcoming start of interest rate cuts by the Federal Reserve. Data released on Friday showed that the unemployment rate fell slightly in August to 4.2% while the economy created 142k jobs. Risky assets tend to bounce back when the Fed is cutting rates.

Source link

The volume of cryptocurrencies traded in decentralized exchanges dropped in August.

According to DeFi Llama, DEX platforms handled cryptocurrency worth over $181 billion in August, down from $198 billion in July.

The monthly volume of activity on DEX platforms peaked in March when they handled over $260 billion as most cryptocurrencies jumped.

Ethereum (ETH) was the most active chain for DEX platforms in August, handling over $52.5 billion. Solana (SOL) and Arbitrum (ARB) followed, with DEX platforms processing tokens worth $42.5 billion and $22.3 billion, respectively.

Tron (TRX) was the most improved chain in the DEX platforms, helped by the recently launched SunPump meme coin generator. SUN, the biggest DEX platform in its ecosystem, handled $3.2 billion worth of coins.

Uniswap was the most active DEX platform in August followed by Solana’s Raydium and BNB Chain’s PancakeSwap.

Solana’s DEX volume dropped because of the performance of meme coins in the ecosystem like Bonk, Book of Meme, and Dogwifhat. Bonk has dropped by over 64% from its highest point this year while Dogwifhat and Book of Meme have slipped by more than 70% from the year-to-date high.

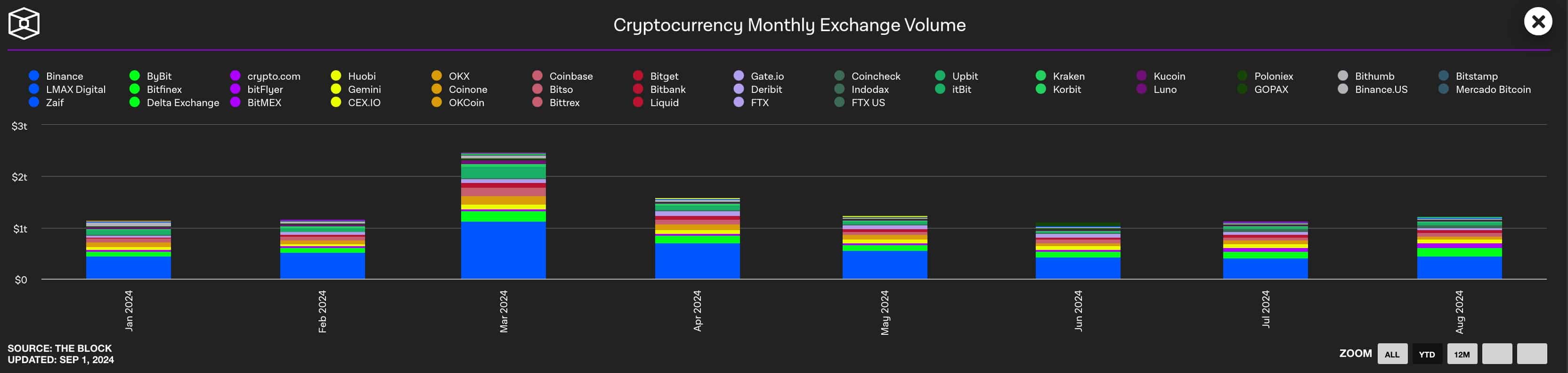

Binance maintained its lead among CEX exchanges

Meanwhile, Centralized Exchanges had a better performance in August. Data shows that these exchanges handled $1.2 trillion during the month, higher than the $1.1 trillion they processed in the previous month. Like DEX platforms, CEX exchanges’ volume peaked at $2.48 trillion in March as Bitcoin and other altcoins soared.

Binance maintained its lead, handling over $448 billion followed by Bybit, Crypto.com, Huobi, and Coinbase.

Additional data shows that the open interest of cryptocurrencies in the futures market fell during the month. Bitcoin’s futures interest stood at $30 billion on Aug. 31, down from the monthly high of $37 billion.

Cryptocurrencies had another difficult month in August. Most of them initially dropped on Aug. 5 as the fear of the unwinding of the Japanese yen carry trade pushed most assets downwards.

While most coins bounced back from their monthly lows, they remained significantly below their highest levels this year.

Bitcoin remains 18% below the year-to-date high while Ethereum has dropped by almost 40% below its March highs.

As we wrote on Friday, some analysts cite the underperformance to the falling liquidity in the crypto market and the rising fear that some governments will start selling their coins.

Source link

Adoption

Hybrid crypto exchanges will inevitably reign in the market

Published

4 months agoon

August 17, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

As we start to see renewed interest in crypto—with prices hovering near their all-time highs and prominent people and institutions discussing the industry—building a robust crypto exchange is essential.

Crypto traders’ standards for an exchange are higher than ever. They are looking for a sleek user experience, architecture that supports high throughput and low latency, and top-notch security. The latter is especially important given the industry is still recovering from the implosion of FTX and the domino effect it had on other businesses in the space.

While centralized exchanges excel at building beautiful user interfaces and intuitive user experiences, they operate at speed by custodying users’ funds for them. As the industry has seen many times throughout crypto’s history, funds that the users themselves don’t control can be mismanaged by fraudulent actors. Additionally, CEXs possess the authority to limit access to accounts, such as freezing funds or halting withdrawals. As the crypto adage goes: Not your keys, not your coins.

Decentralized exchanges, on the other hand, grant users complete control over their funds with self-custody. They leverage blockchain technology and smart contracts to execute trustless trade and settlement. However, this architecture can be clunky and complex for users to navigate. It comes with trade-offs in throughput and latency, the absence of advanced trading features (like advanced order types and conditions), and can also deal out significant fees to pay gas for settlement on a blockchain.

A new crop of crypto entrepreneurs is thinking about exchange architecture differently. They are looking to combine aspects of a centralized and decentralized exchange with building on the best of both worlds. Enter hybrid crypto exchange.

A better trading engine for a better crypto trader

CEXs from the last cycle, including Coinbase and Binance, built their businesses by copying the UI of broker platforms and mimicking the mechanics of broker platforms and the UI of fintech apps. They focused on user-friendly UI, robust mobile apps, competitive fees, and an extensive selection of coins and tokens.

The centralized trading infrastructure offers high throughput and low latency, which is what the world demands for crypto trading. Going deeper, high throughput and low latency enable better liquidity, as market makers can reprice quicker. They also allow for more efficient margin usage, as a centralized risk engine enables the exchange to offer higher leverage. Centralization enables advanced trading features and logic, such as advanced order types and conditions.

Aside from performance, it allows exchanges to have more control over compliance. CEXs control what customers have access to their platform and can manage the access of those users by implementing robust blockchain analysis, fincrime, and compliance programs. In the wake of FTX, lawmakers and enforcement agencies have been clamping down on the industry, dishing out huge fees and even jail time to businesses and entrepreneurs that are found to be skirting regulations.

So, to sum up, that’s why the hybrid exchange model inherits the bright side of centralization. The trading architecture is kept centralized to a large extent. UX is also inherited from CEX because DEXs simply lack features, such as simple account creation, which eliminates the need for users to already have a wallet before interacting with the exchange. DEXes are also limited in their on- and off-ramps, fee abstraction, and advanced trading analytics. Especially as another batch of crypto traders enters the space during what appears to be the beginning of a bull run, a powerful feature set on top of a polished user experience is critical.

It all sounds like a flawless victory for centralization so far. The question is, what do hybrid exchanges inherit from decentralized ones? The answer is simple: The essential feature that enables trust in crypto trading. And centralization has a dark side.

Give users the keys

Hybrid exchanges still pull from DEX concepts by utilizing blockchain technology to secure funds. Users self-custody their funds, and trades are settled on the blockchain at various periods. Another crucial trait is the on-chain validation of the trading logic, which will prevent operator fraud. As such, trust is provable, and transparency is immutable.

Operator fraud is one of the most significant risks in crypto. CEX’s control over funds is beneficial for compliance reasons; however, it grants the authority to limit access to accounts, such as freezing funds or halting withdrawals. The collapse of FTX certainly heightened concerns over an operator’s access to user funds. Yet, FTX wasn’t the first or only exchange to mishandle user funds and call into question the CEX model. One of the first-ever crypto exchanges, MtGox, completely shut down and filed for bankruptcy in early 2014 because of an undetected theft over many years that drained the exchange of more than 850,000 Bitcoin (BTC). In 2018, Canadian exchange QuadrigaCX went dark and was later revealed to be a Ponzi scheme, causing the loss of roughly $190 million in user funds.

These continued instances highlight the importance of self-custody and trustless on-chain settlement, whereby users hold the keys to their own coins instead of trusting a centralized entity that isn’t fully transparent to retain their keys.

Scaling tech for cutting costs

In the derivatives market, traders often transact in large volumes, which can accrue significant fees. There is no feeless trading. CEXs and DEXs charge fees for trading, but DEX users have an additional cost to settle all their trades on a blockchain. These fees fluctuate depending on the overall usage of the blockchain at any given period. Earlier this year, in March, Ethereum transaction costs skyrocketed to nearly a two-year high due to increased speculation in meme tokens.

The hybrid exchange approach simplifies the fee structure because trading is centralized and relies on layer-2 technology to boost scalability while keeping transaction fees low. Rollups are one such scalability solution that processes transactions on a separate network before bundling the transaction data into batches to submit and settle to the main chain.

Now’s the time to go hybrid

Blending features from centralized and decentralized exchange architecture is an obvious choice in a market that’s becoming more mature and competitive.

The speed, usability, and design of CEX help users of all levels of technical know-how trade crypto easily. And the security provided by implementing aspects of DEX will create an ecosystem of trust and reliability that gives users peace of mind.

The hybrid crypto exchange is poised to be the winning business model in the next bull run, highlighting that it’s not always about reinventing the wheel as much as it’s about creatively putting the pieces together. It’s not a one-size-fits-all industry; it won’t have a one-size-fits-all solution.

Ruslan Fakhrutdinov

Ruslan Fakhrutdinov is an ex-McKinsey consultant and former Head of Crypto Operations at Revolut. Ruslan played a significant role in the development of numerous crypto products. He had P&L responsibility for one of the company’s largest and most profitable departments, which generated £220 million in gross profit in 2021. In 2023, Ruslan left the fintech giant to launch his own venture, X10, a hybrid crypto exchange.

Source link

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential