bull market

Crypto turns green as Bitcoin flirts with $73k

Published

2 months agoon

By

admin

Most cryptocurrencies are trading in the green in the past 24 hours, as Bitcoin price rose to $73,000 to push the global crypto market cap to $2.45 trillion.

This happens as Bitcoin (BTC), the flagship digital asset, topped $73,000 on Oct. 29. This is the highest level for BTC since bulls hit the all-time high in March2024.

Per crypto.news data, BTC price rose to highs of $73,001 across major exchanges, with a 5.7% surge in 24 hours. This meant bulls touched the psychological $73,000 mark again. While Bitcoin trades just below $72,930 at the time of writing, crypto analysts suggest bulls may not be done yet.

In an Oct. 28 interview with CNBC, VanEck head of digital assets Matthew Sigel said the current market, including the Nov. 5 vote, offers a very bullish setup for Bitcoin.

Veteran trader Peter Brandt also added to the bullish projection, suggesting BTC is headed to $94k.

B I T C O I N $BTC

There are numerous ways to determine targets. One variable is whether semi-log or linear scale is used

Target of 94,000 is measured move of triangle projected from breakout level on semi-log

⬇️ 🧵 1/3 pic.twitter.com/VI0n7OAvia— Peter Brandt (@PeterLBrandt) October 29, 2024

Some analysts expect a breakout past the ATH will invite a breather as likely profits attract bids. However, the more bullish perspective is that the market is set to continue higher in coming months.

This sentiment has helped push most altcoins higher. Ethereum (ETH) is above $2,650, BNB (BNB) above $607 and Solana (SOL) $181. Sui (SUI) is up 24% to $2.03, while meme coins have also pumped, led by Popcat (POPCAT).

However, there are sectors that have outpaced the rest and could continue to dominate.

According to crypto analyst Miles Deutscher, memes with +219% year-to-date are the top performing sector. However, also outpacing the rest of the market have been artificial intelligence, real-world assets, Bitcoin ecosystem and decentralized physical infrastructure network.

Per the analyst, AI tokens are up 217% YTD as are BRC-20 tokens, while RWA (+134%) and DePIN (+73%) have topped amid the 2024 bull cycle.

But not all sectors are enjoying an uptick year-to-date. While coins in social finance, zero-knowledge and metaverse have nudged higher in recent weeks, SocialFi is down 57%, ZK -36% and metaverse -30% to rank among worst performing sectors. Governance tokens and layer-2 tokens are also in this category, with -25% and -16% YTD returns respectively.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

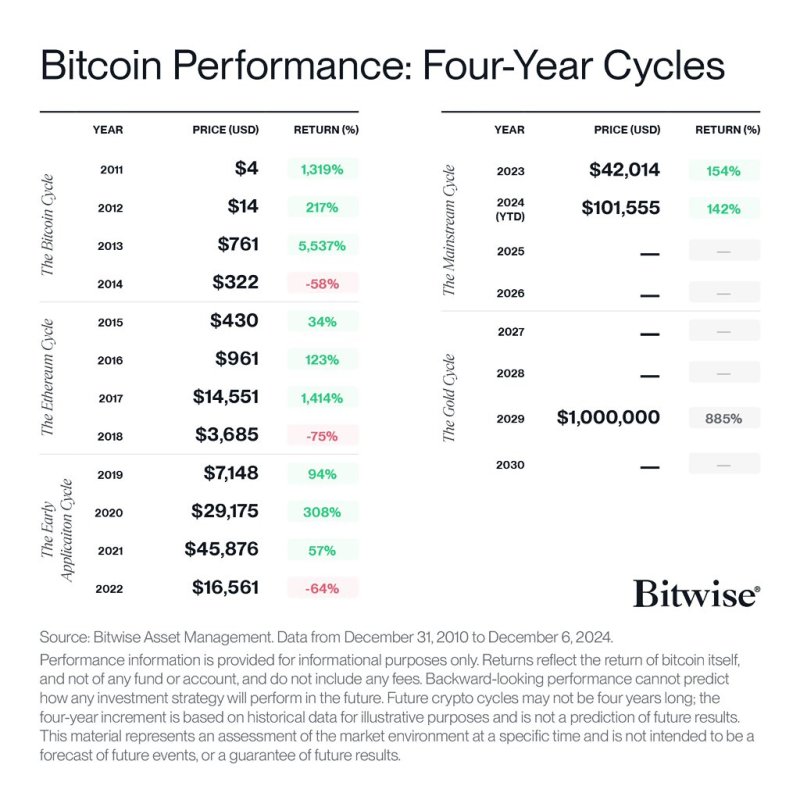

Cathie Wood, who is the CEO and chief investment officer of Ark Investment, made a prediction during an interview with Bloomberg, suggesting that Bitcoin will hit a price of $1 million by 2030.

In the conversation on Dec. 20, Cathie Wood pointed towards Bitcoin’s (BTC) fixed supply of 21 million cap as the key denominator which will drive the asset’s value. She brought to light the scarcity of BTC as more than 19.5 million BTCs have already been mined, which she says have increased the institutional investor’s hunger for the asset.

“Bitcoin is really the first of a new asset class, and it will be the largest opportunity of them all,” Wood stated. As a result of this increasing institutional adoption and supply-demand dynamic, she argues that the likelihood of BTC reaching $1 million is now considerably higher. Referencing Ark Investment’s Big Ideas 2023 research report, Wood highlighted the asset’s inherent scarcity as a key driver of its growing demand.

Responding to criticism of BTC’s speculative character, Wood drew parallel to gold, with both acting as stores of value. Also, she noted that BTC’s annual supply growth rate has recently fallen to 0.9%, lower than gold’s long-term average supply growth rate of 1%, meaning that BTC is more scarce than gold.

Wood said that while gold could lead to increasing supply in a rising price environment, BTC cannot due to its decentralized mechanism. “Like gold, Bitcoin is secured by its scarcity, but unlike gold it’s backed by the largest computing system in the world, making it the most secure network in the world,” she explained. It is this mathematical scarcity along with its decentralized and rules-based design that differentiates BTC as a radically new era financial asset, Wood claimed.

Wood largely credits the sudden boom in digital asset adoption to the COVID-19 pandemic, which she says has “turbocharged” a period of financial self-education by younger investors whose personal standards for accreditation traditionally fall short. This change has been also documented in statistics; where 63% of people invested in cryptocurrency in 2021 during the pandemic, with the bulk of adopters being millennials and Gen Z.

Source link

American HODL

Buying Bitcoin Is Easy, HODLing Is the Hard Part

Published

5 days agoon

December 18, 2024By

admin

HODLing bitcoin is so simple, yet it’s one of the most difficult and challenging things to do.

HODLing bitcoin is a choice. You have to wake up every day and choose to continue HODLing BTC. When you have every reason to sell bitcoin, you have to continue HOLDing. This is where most people fail.

The anxiety of losing money kicks in. The fear of being wrong becomes a cloud over your head and you start to wonder if you’re wasting your time and ruining your future by HOLDing bitcoin.

It really isn’t for the weak, so I understand why so many people could not fathom holding onto an asset this volatile, this early into its existence. It makes sense why most people were not ready to go all in on bitcoin, but those who did were highly rewarded for their efforts.

This American HODL thread sums up HODLing bitcoin perfectly.

Here’s a story for $106,600 per Bitcoin.

6 years ago in 2018 I stacked cash all year knowing I would rebuy bitcoin at the “bottom”.

We spent 3 months or so consolidating around $6,600.

I got impatient and was like fuck it this is my moment and deployed half my stack.…

— AMERICAN HODL 🇺🇸 (@americanhodl8) December 17, 2024

I remember what it was like back in 2018 when the price of bitcoin dropped by 50%. Only at the time, I was a young college student working in physical therapy. I was in a position to take on as much risk as possible because taking care of myself was my only responsibility, so that giant drop did not affect me mentally too much. But for American HODL, as well as many other Bitcoiners who had wives and children to take care of, the stakes here were raised significantly.

Many Bitcoiners want the price to drop lower, so they can accumulate cheaper BTC. But for many Bitcoiners who have already accumulated bitcoin at cheaper prices, it can be soul crushing to watch the price of bitcoin drop by 70-80% in the bear markets. Bitcoiners, after all, are in this for wealth preservation and to increase their purchasing power. So when bitcoin dramatically drops in price, many feel like it’s a punch in the gut. Losing money sucks.

However, if you can withstand the brutal bear markets, the bull markets reward those who sheltered the storm, those who put in the effort to understand this asset and why it has these intense drops and rises. Historically, the price of bitcoin rises for three years in a row, then dumps for one year.

HODLing bitcoin is not easy. It is normal and human to feel the depression of the bear market and the euphoria of the bull. So when bitcoin inevitably dumps in the future after the bull market, be prepared to HODL.

Don’t put yourself in a position where you cannot withstand a 70-80% correction.

Understand the asset you got into and realize this is normal and everything is OK. If you can do that, you will make it out of the bear market alive, and be in prime position to take advantage of the next bull market.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Sell-Off Likely When This Metric Reaches 4%, Analyst Explains

Published

1 week agoon

December 14, 2024By

admin

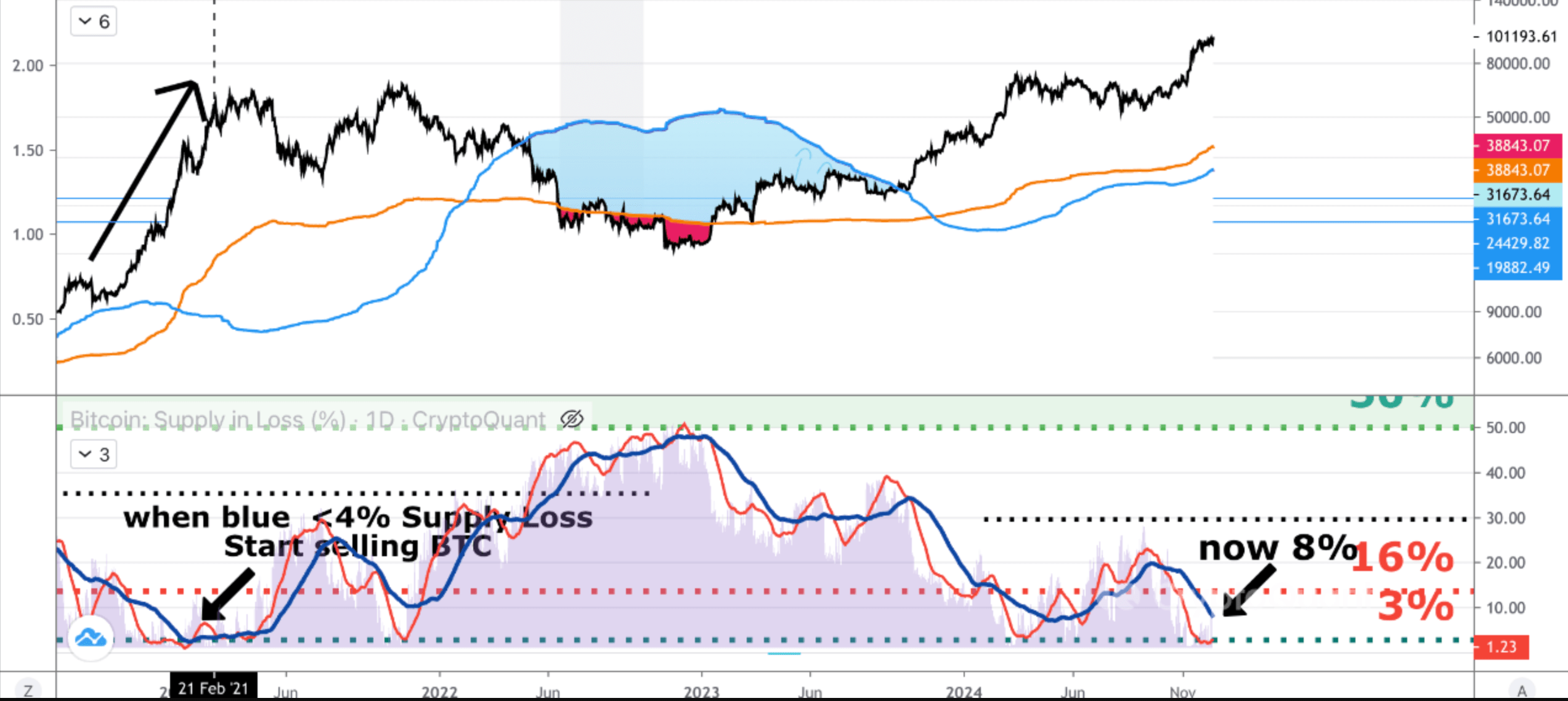

While Bitcoin (BTC) fluctuates around the critical $100,000 price level, some investors may seek the ideal opportunity to take profits and exit the market. In this context, a CryptoQuant analysis highlights a key BTC metric that can serve as a valuable tool for crafting an exit strategy.

Have Profits In Bitcoin? Keep An Eye On This Indicator

In a Quicktake blog post published today, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC during the current bull market. The analyst emphasized the importance of the Bitcoin supply in loss metric, noting its potential to signal when to start exiting the market to preserve profits.

Related Reading

For those unfamiliar with Bitcoin, the supply in loss measures the percentage of BTC held at a loss based on its last moved price. A low percentage of supply in loss typically indicates peak market euphoria and serves as a warning to secure profits before a bear market correction begins.

According to the CryptoQuant analysis, when BTC supply in loss drops below 4%, it signals a good time for investors to consider dollar-cost averaging (DCA) out of their BTC holdings and wait for the next bear market lows. Currently, the BTC supply in loss sits at 8.14%.

DCA is an investment strategy where investors allocate a fixed amount of money to an asset at regular intervals, regardless of its price. This method helps reduce the impact of market volatility and lowers the average cost per unit over time. The analyst adds:

Why? Below 4% means a lot of people are in a profit this is the peak bullrun phase. Trust me you don’t want to be bagholding because you thought we will never see a bear market again. Be fearful when others are greedy.

Analysts Confident Of Further Upside In BTC Price

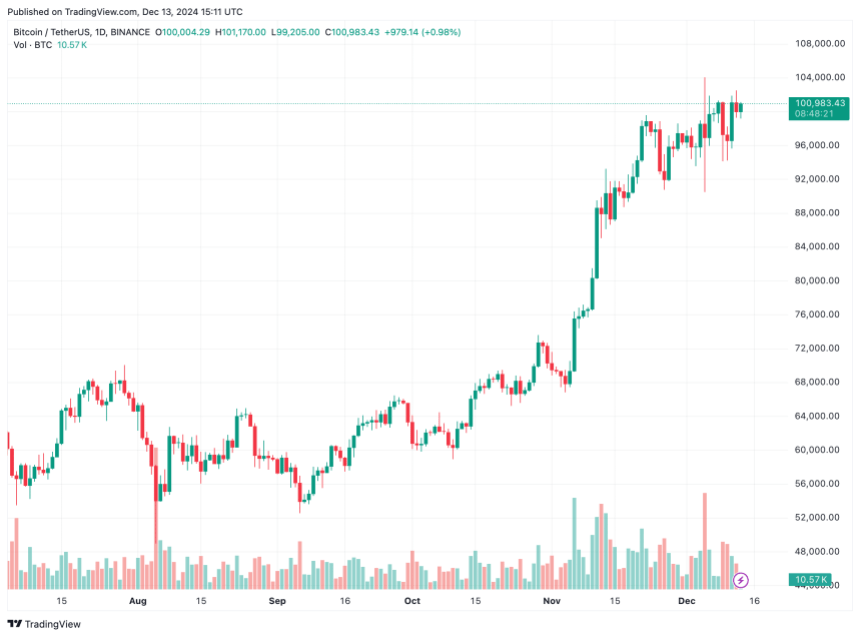

While tracking the BTC supply in loss metric can help investors safeguard their profits, recent forecasts from crypto analysts suggest there might still be room for further upside before this indicator becomes crucial.

Related Reading

According to crypto analyst Ali Martinez, BTC forms a classic cup and handle pattern on the weekly chart. The premier cryptocurrency looks poised to break out of the bullish formation, with targets as high as $275,000.

Similarly, Donald Trump’s victory has brought fresh optimism in the crypto industry. In the recently concluded Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign chairman, Paul Manafort, noted that BTC investors can “expect more than $100,000” during the ongoing market cycle.

Other forecasts remain equally bullish. Tom Dunleavy, Chief Investment Officer at MV Global, projects BTC to reach $250,000, while Ethereum (ETH) might climb to $12,000 during this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% in the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential