Blockchain

Crypto’s transparency and speed diminish any speculation

Published

3 months agoon

By

admin

Vibhu Norby, CEO of DRiP, suggested in a recent talk that blockchain technology reduces speculation due to its transparency and rapid information flow.

Speaking to an audience at Solana Breakpoint, Norby used a simple prop, a bag with a purple wig, to illustrate how knowing what’s inside eliminates speculation.

He compared this transparency to blockchain technology technology, where all participants have access to the same information.

“A blockchain is a system where everybody knows all of the information at all times. It’s very hard to argue that there isn’t speculation happening, because, again, anyone can speculate on anything at any time.”

Vibhu Norby

Norby pointed out that speculation arises when people don’t fully understand a situation. In traditional markets, investors often guess the value of assets based on incomplete information.

Blockchain, however, operates differently — making every transaction visible on a public ledger limits the need for speculation.

Blockchain speculation

To further his point, Norby elaborated on the concept of loans in blockchain and DeFi.

In traditional lending, loans are often based on credit and opaque valuations, leaving room for speculation. On-chain lending, on the other hand, requires full collateralization — meaning the loan is fully backed by the asset’s value, which is publicly visible and verifiable.

This, Norby argued, makes it much less speculative.

While the rapid rise and fall of token prices may appear speculative, Norby explained that this is simply the market quickly discovering the real value of tokens. He suggested that faster blockchains like Solana (SOL) reduce speculation even further by enabling nearly instantaneous price discovery.

According to Norby, many tokens rapidly lose value because the market immediately identifies their lack of underlying worth. Though speculation can never be entirely eliminated, Norby believes blockchain’s transparency and speed make it inherently anti-speculative.

Source link

You may like

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Blockchain

Horizen spikes 60% to lead gainers as BTC, ETH bounce

Published

3 days agoon

December 20, 2024By

admin

Horizen price spiked more than 60% in 24 hours as the cryptocurrency market looked to recover from a massive dump that saw top altcoins crash to key support levels.

On Dec. 20, as Bitcoin (BTC) traded to above $97k and Ethereum (ETH) bulls pushed above $3,400, the price of Horizen (ZEN) surged to highs of $26.34. The cryptocurrency, which rallied sharply following a recent Grayscale Investments announcement, reached a multi-year high and ranked among the top gainers in the 500 largest cryptocurrencies by market cap.

ZEN traded at lows of $14.55 on Dec. 19. However, despite the broader crypto crash and the staggering $1.4 billion liquidations, the altcoin’s price hovered above $26 in early trading during the U.S. trading session.

According to crypto.news price data, Horizen recorded a 24-hour trading volume of over $397 million, with its market cap exceeding $407 million. These metrics reflected increases of 294% and 62%, respectively, in the past 24 hours. While ZEN has surged nearly 200% over the past month, its current levels are still more than 84% below the all-time high of $168 reached in May 2021.

If the broader crypto market continues to rebound, ZEN bulls may aim for March 2022 highs near $50.

The positive momentum has benefited from Grayscale opening of the Grayscale ZEN Trust to qualified investors. Prices of the altcoin rose as the digital asset manager unveiled the fund to offer exposure to Horizen for qualified investors.

Earlier this month, Horizen’s native token underwent its final halving, which came as the project geared for a key change in its tokenomics. ZEN will not see any further halvings as the new network mechanism enables a declining emission rate.

That’s because Horizen, is shifting from the proof of work mining model that mirrored Bitcoin’s halving cycle to a new proof of stake mechanism in 2025. Horizen’s last halving occurred on Dec. 12, 2024.

New tokenomics for Horizen will come into effect in the first half of 2025.

Source link

Alpha

World’s Largest Crypto Exchange Rolls Out ‘Binance Alpha’ Feature to Spot Early-Stage Projects With Potential

Published

5 days agoon

December 17, 2024By

admin

Binance, the largest crypto exchange in the world by volume, is launching a new wallet feature aimed at shining a spotlight on nascent crypto projects.

According to a new Binance announcement, Binance Alpha is “a new platform within the Binance Wallet that shines a spotlight on early-stage crypto projects with the potential to grow within the Web3 ecosystem.”

The press release says the platform is committed to enhancing transparency in Binance’s token listing process by prioritizing projects that showcase strong community engagement, substantial traction, and alignment with key crypto trends.

Binance Alpha is part of Binance’s broader effort to promote innovation and expand the Web3 ecosystem by connecting users with promising blockchain projects at an early stage, per the announcement.

Binance says the new system includes the following features:

“Spotlight on Innovation: Explore tokens gaining traction in Web3, providing a deeper understanding of projects that matter in the evolving crypto landscape.

Quick Access: Seamlessly purchase tokens through the Quick Buy feature directly from the Binance Wallet. It optimizes the existing Swap functionality, resulting in a higher successful transaction rate and better prices compared to other DEXs or trading bots…

Educational Insight: Learn about emerging projects, their use cases, and the narratives driving their popularity within the blockchain ecosystem.

Expert Curation: Featured tokens are selected using Binance’s advanced insights and observation list, ensuring they align with market trends and community interests. While there is no guarantee, some tokens may be considered for listings on Binance Exchange in the future.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Blockchain

Solana gains top spot in daily net inflows with $12M, beating all other blockchains

Published

7 days agoon

December 16, 2024By

admin

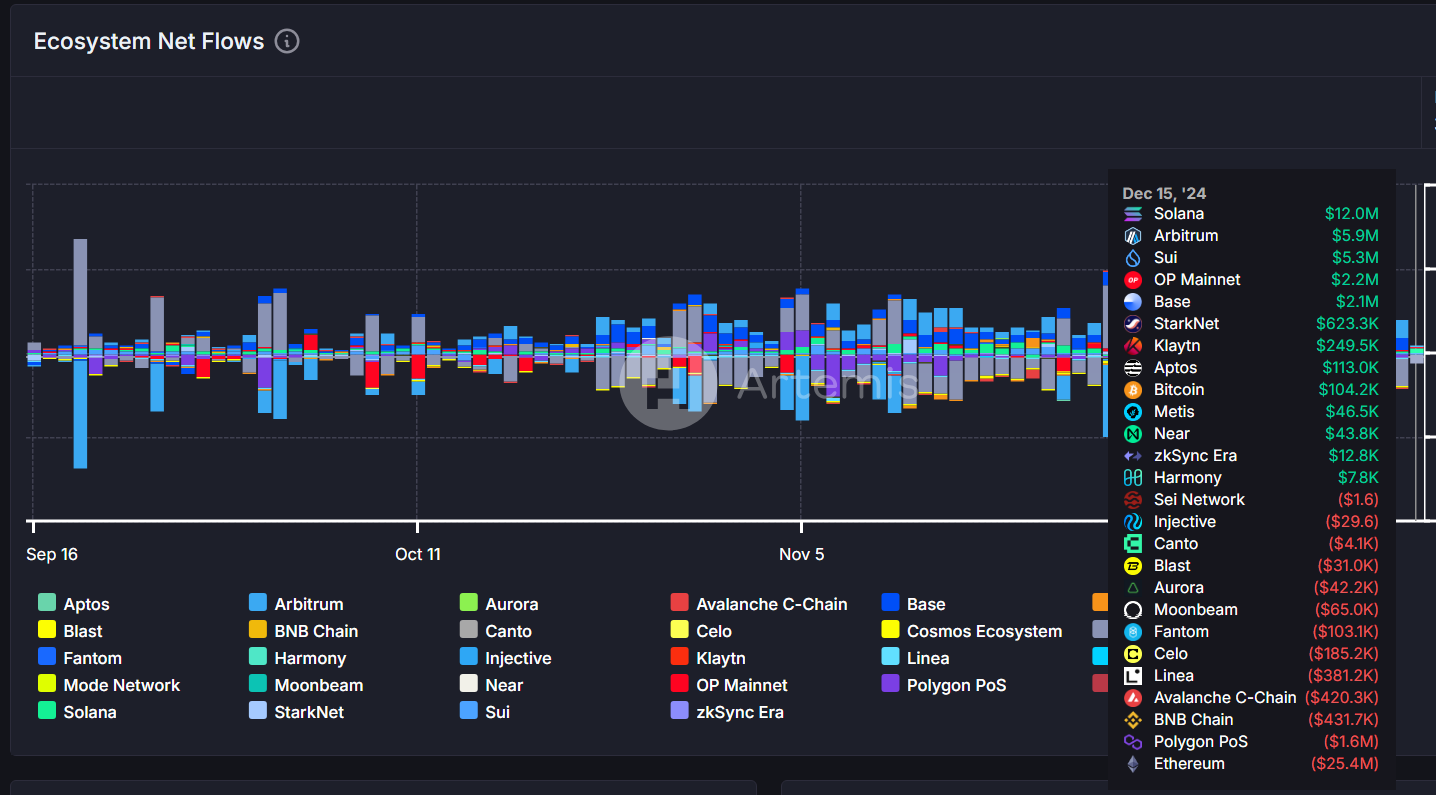

Solana’s daily net inflows have surpassed all other major blockchains, including Sui, Base, Arbitrum and Ethereum. On Dec. 15, the Solana network accumulated net inflows of $12 million.

According to data from Artemix.XYZ, Solana (SOL) recorded the highest number of daily net inflows among the top 20 major blockchains on Dec. 15. Solana’s net inflow of $12 million was larger than the other two blockchains in the top 3, Arbitrum (ARB) and Sui (SUI), combined.

Solana regained the top spot a month after the blockchain last held it on Nov. 17 with $17.6 million. On Dec. 15, Solana dethroned Arbitrum, yesterday’s reigning champion, which held the number two spot with a daily net inflow of $5.9 million.

In third place, Sui accumulated a daily net inflow of $5.3 million, followed by OP Mainnet with $2.2 million and Base with $2.1 million. At the very bottom of the list is the Ethereum (ETH) blockchain with a net outflow of $25.4 million.

A recent surge in Solana revenue is often linked with a similar surge in the meme coin sector, specifically from pump.fun, a launchpad site for Solana-based meme coins. But that is not the case this time around.

According to data from Dune analytics, pump.fun saw its daily revenue dip slightly by 6% from $2.67 million on Dec. 14 to $2.51 million on Dec. 15. Pump.fun’s revenue peaked on Nov. 23 with $14.3 million, but has failed to pass the $5 million mark ever since.

Solana’s end-of-year sprint

In the past few months, Solana has achieved quite a few milestones as the year is nearing its end. As previously reported by crypto.news on Dec. 13, Solana was deemed the fastest-growing blockchain, with an annual growth of up to 83%. Solana even surpassed the largest blockchain in the world, Ethereum.

In November, Solana’s monthly decentralized exchange trading volume reached $109.73 billion, surpassing the $100 billion threshold for the first time in crypto history. The leap in Solana’s trading volume came a few days after Solana’s price went beyond $200 for the first time in seven months of trading after a 8.69% rise. The token later reached an all-time high of $263.21 on Nov. 23.

At the time of writing, Solana is currently trading hands at $220.76, having gone up by nearly 2% in the past 24 hours of trading, according to data on crypto.news. Solana has a market cap of around $105 billion and a fully diluted valuation which stands at more than $130 billion.

Source link

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential