DYDX

DeFi Giant dYdX Says Its v3 Platform Is Compromised – Just as It's Reportedly Up for Sale

Published

5 months agoon

By

admin

DeFi Giant dYdX Says Its v3 Platform Is Compromised – Just as It's Reportedly Up for Sale

Source link

You may like

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

consenSys

Two Crypto Firms Announce New Layoffs: What’s Happening?

Published

2 months agoon

October 31, 2024By

admin

Two crypto companies, dYdX and ConsenSys, have announced a new round of layoffs. What’s happening, and why are American regulators being blamed for this?

Antonio Juliano, the CEO of the decentralized derivatives exchange dYdX, announced a 35% layoff. He thanked the former employees for their work and explained the layoffs as the need to “revitalize” the exchange since, in its current form, it is “different from the company dYdX must be.”

“I have seen this over and again, and it will continue. What we are building is much larger than just a company, and this you will always be a part of.”

Notably, the layoffs at dYdX came shortly after ConsenSys cut its staff by 20%. ConsenSys CEO Joseph Lubin cited unfavorable macroeconomic conditions, uncertainty over crypto regulation in the U.S., and the cost of a legal battle with the Securities and Exchange Commission (SEC).

1/5

The broader macroeconomic conditions over the past year and ongoing regulatory uncertainty have created broad challenges for our industry, especially for US-based companies.

— Joseph Lubin (@ethereumJoseph) October 29, 2024

At the same time, Lubin called the company’s financial position stable.

According to him, ConsenSys will focus on its core revenue drivers, which aligns with its previously adopted strategy. The company’s flagship products, MetaMask and Linea, the second-layer Ethereum network, will serve as the basis for further development.

In addition, ConsenSys CEO said that the laid-off employees will receive support after leaving the company, namely, severance pay depending on the length of service, assistance with future employment, and expanded health benefits.

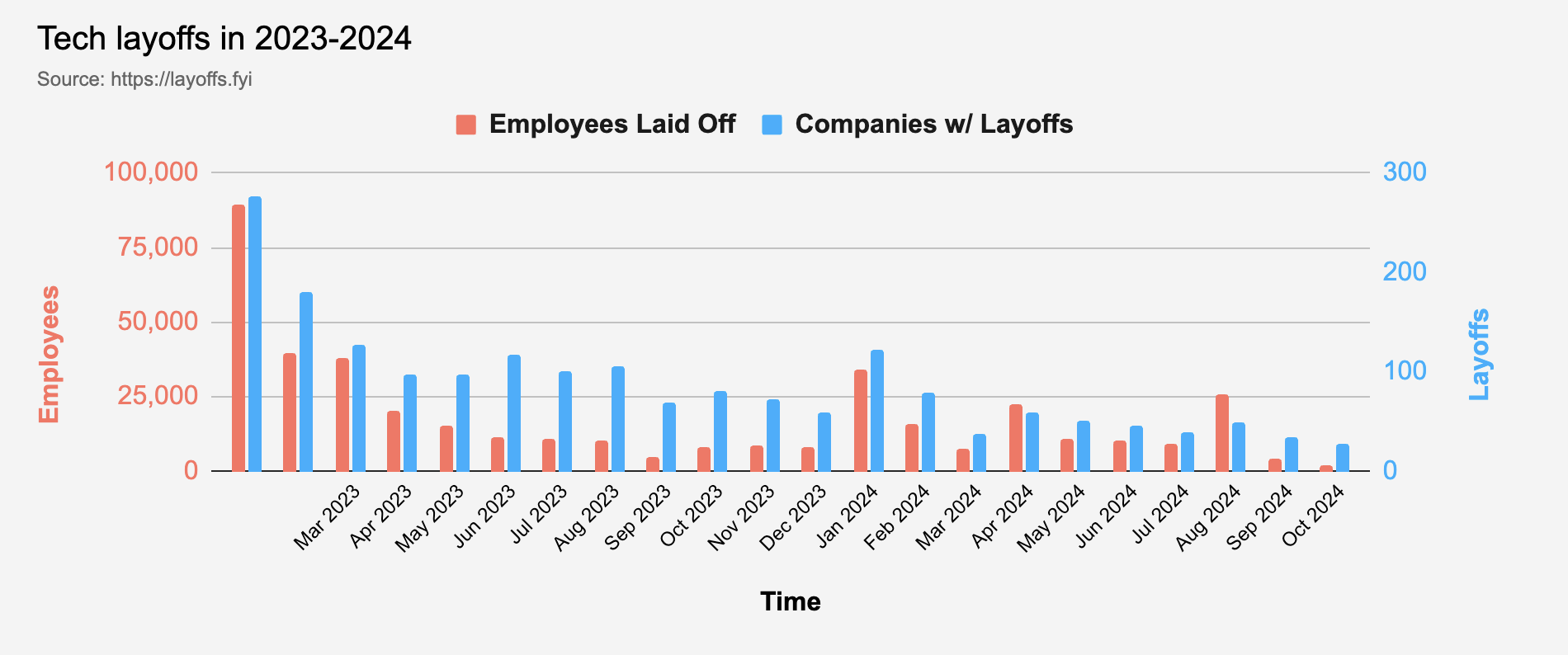

Lubin also told Fortune that the layoffs will affect about 162 of the 828 employees working from all divisions at Consensys. Now, ConsenSys has now become the leader in layoffs in 2024, according to layoffs.fyi.

Why the SEC is again the culprit of all the worst?

In the layoff statement, Lubin cited the SEC as one of the reasons why he will cut staff. In June, the regulator sued the developer of the MetaMask wallet, noting that the company violated the law through the MetaMask Staking service.

The lawsuit comes shortly after ConsenSys filed a lawsuit against the SEC and five of its unnamed employees over its “oversight of ETH,” asking the court to formally approve language that would not classify the asset as a security.

As a result, the SEC’s Division of Enforcement closed its investigation into Ethereum 2.0. The agency took this step after the organization sent a letter asking for clarification on the asset class when approving the spot Ethereum ETF. However, the lawsuit over the SEC’s allegations is ongoing, leaving ConsenSys facing legal costs.

The layoffs come at a time when the market is bucking trends

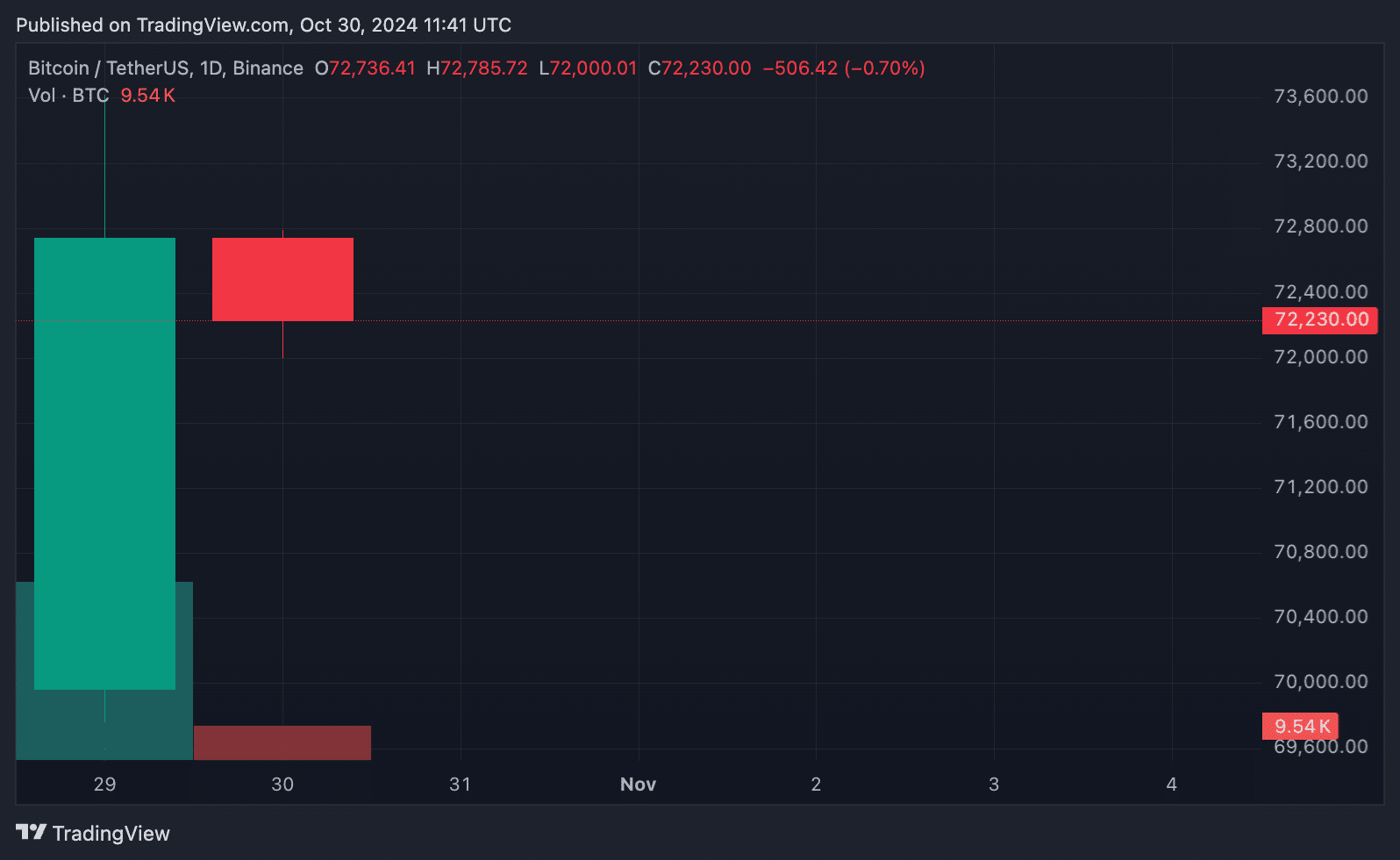

Notably, the crypto market was booming at the time of the layoff announcement, which is generally considered a good time for crypto companies. Thus, on Oct. 29, the Bitcoin (BTC) rate grew from $70,000 to just over $73,600, approaching the historical maximum of $73,777. Since the beginning of the month, the cryptocurrency’s value has grown by 12%. Analysts associate this trend with forecasts for the U.S. presidential election.

Interestingly, the growth of Bitcoin is also explained by the situation in the U.S., which the CEO of ConsenSys previously complained about, explaining the layoffs.

The growth in the price of Bitcoin is due to several factors. In particular, interest in Bitcoin ETFs from large companies such as BlackRock is increasing, which attracts significant investments. Recently, the U.S. saw an influx of $2.7 billion into Bitcoin ETFs, which helped attract new investors and raise the price.

In addition, the desire to protect against inflation significantly impacts the market. Against a weakening dollar and rising inflation, many investors are turning to limited assets such as Bitcoin to preserve their savings.

dYdX cuts staff while competitors gain momentum

Since the beginning of the year, the crypto market has been recovering from a long crypto winter, with many exchanges ramping up their growth. According to Bloomberg, Crypto.com, Binance, Coinbase, Gemini, and Kraken are hiring as cryptocurrencies like Bitcoin rise—not dYdX, though.

When announcing the staff reduction, Juliano mentioned that in its current form, the exchange is different from what it should be, without specifying what exactly he meant. However, further development will require human capital capable of reviving the platform. Therefore, announcing a 35% staff reduction against the backdrop of crypto exchanges trying to get the most out of the current rally looks illogical, to say the least, but Juliano is hardly worried about FOMO.

How the dynamics of layoffs in the crypto industry have changed?

According to layoffs.fyi, Q1 2023 was the peak in layoffs since 2020, when more than 167,000 employees lost their jobs. However, in 2024, the situation looks much better: the peak of layoffs occurred in Q1, with 57,000 employees who lost their jobs. There were even fewer layoffs in the second and third quarters – 43,000 and 38,000, respectively.

Thus, the story of dYdX and ConsenSys has become more of an exception to the rule than a typical trend for 2024. After massive layoffs in 2022 and 2023, the blockchain job market seems to be recovering.

Source link

Aave

Top Best Ethereum DEX Tokens to Buy in 2024 as Aave Rallies 40%

Published

4 months agoon

August 24, 2024By

admin

Ethereum-based decentralized exchanges (DEXs) are gaining traction and offering innovative solutions for trading digital assets. With Aave recently rallying by 40%, the spotlight is on other promising DEX tokens that could grow substantially in 2024.

This article explores the top Ethereum DEX tokens to consider, including RCOF, UNI, and dYdX. We highlight their potential and what makes them stand out in the competitive crypto market.

1.RCO Finance

RCO Finance is a next-generation decentralized trading platform that harnesses the power of blockchain and artificial intelligence to transform the crypto trading experience. Operating on the Ethereum network, it features a groundbreaking feature known as the robo-advisor, which utilizes advanced machine learning and AI algorithms.

This innovative tool analyzes complex market data to offer personalized trading strategies. It guides investors on when to enter, exit, or adjust their portfolios based on their unique risk profiles.

By evaluating real-time market conditions, the robo advisor assists users in making informed decisions about buying, selling, or reallocating their digital assets, particularly during market volatility, thereby mitigating risk.

This AI-powered feature equips traders with data-driven insights, enhancing their ability to navigate the crypto markets more confidently and precisely.

The robo advisor’s ability to deliver customized, automated strategies makes RCO Finance appealing to experienced and novice investors. Its machine-learning capabilities enable it to adapt to individual investor behavior, providing strategic recommendations without human intervention.

In addition to its state-of-the-art robo advisor, RCO Finance offers a versatile platform that supports trading across multiple asset classes, with options for leveraging positions to maximize potential returns.

2.Uniswap

Uniswap is the first mainstream decentralized exchange (DEX) on the Ethereum blockchain. With its native token, UNI, Uniswap has set the standard in the DeFi space as one of the early pioneers. Its innovative use of the Automated Market Maker (AMM) model, which eliminates order books in favor of liquidity pools, ensures consistent liquidity for trading regardless of market conditions.

Uniswap continues to innovate, with notable features such as Concentrated Liquidity introduced in Uniswap version 3. This allows liquidity providers to focus their assets within specific price ranges, enhancing capital efficiency and potential returns.

Additionally, Uniswap offers multiple fee tiers, providing flexibility for liquidity providers. The platform’s governance is decentralized and democratic, allowing UNI token holders to propose and vote on protocol changes, ensuring an open and evolving community.

Meanwhile, according to Coinmarketcap data, UNI’s price has dropped slightly recently. UNI is currently trading at $6.20, a 2.32% decline from last week.

Despite this decline, some experts foresee an uptrend for UNI due to recent positive signals from the RSI and SMA technical indicators. Hence, UNI could surge to $8.70 soon.

3.dYdX

dYdX is a decentralized exchange that trades crypto perpetual futures contracts, distinguishing itself from automated market maker (AMM) platforms like Uniswap.

Unlike AMM-based exchanges, dYdX relies on a centralized entity, dYdX Trading Inc., to manage its order books. In 2021, the exchange introduced its perpetual trading platform, dYdX v3, on an Ethereum Layer 2 chain utilizing StarkWare’s StarkEx scalability engine.

According to Coinmarketcap data, DYDX has been quite sluggish in recent weeks. DYDX is trading at $1.08, a marginal 0.44% rise from last week.

Nonetheless, some analysts are bullish about DYDY due to its recent positive momentum. Also, the Moving Average Convergence Divergence (MACD) technical indicator shows a potential bullish breakout. As such, DYDX could rise to $1.60 in a few weeks.

RCOF Poised for a 1,500% Surge as Investors Rush to Its Presale!

RCOF, the native token of the RCO Finance ecosystem, has gained momentum during its ongoing public presale. The token’s growth is driven by its strong utility within the RCO Finance platform and robust tokenomics. RCOF is designed with a supply cap of 800 million tokens and incorporates a deflationary mechanism, adding to its appeal.

Moreover, SolidProof has audited RCOF’s smart contract to ensure that everything is in perfect order. This thorough audit has bolstered investor confidence, contributing to RCOF’s impressive $1.46 million in funding.

RCOF has advanced to Stage 2 of its pre-sale, with the token priced at $0.0344. This price is set to rise to $0.0558 as RCOF enters Stage 3. Investors participating in Stage 2 can anticipate a 62% return on investment (ROI) as the token progresses to the next stage. This ROI could skyrocket to 1,500% when RCOF reaches its listing price of $0.40 to $0.60.

Don’t miss out on this opportunity—join the RCO Finance pre-sale now and position yourself for significant returns as the project continues to shape the future of the crypto market.

For more information about the RCO Finance Presale:

Join The RCO Finance Community

The post Top Best Ethereum DEX Tokens to Buy in 2024 as Aave Rallies 40% first appeared on BTC Wires.

Source link

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential