Bitcoin

El Salvador Ends Bitcoin Legal Tender Experiment—What Went Wrong?

Published

2 months agoon

By

admin

El Salvador, the first country to adopt Bitcoin as legal tender in 2021, recently reversed its decision after pressure from the IMF. What led to this change, and what were the outcomes of its nearly four-year crypto experiment?

The curious case of El Salvador

The 2021 law in El Salvador made Bitcoin (BTC) legal tender, meaning it became not just legal but mandatory for transactions. Merchants were required to accept Bitcoin, and the government started collecting payments such as taxes and fees in Bitcoin.

To facilitate this, the country launched the Chivo wallet, a government-backed mobile app designed to help Salvadorans transact with Bitcoin. The app allowed users to send, receive, and store Bitcoin, and even offered an incentive of $30 in Bitcoin for those who downloaded it.

However, the law didn’t affect the status of the U.S. dollar, which had been the official currency of El Salvador from 2001 to 2021. This meant Salvadorans who didn’t want to use Bitcoin could still use USD for all transactions. Polls from 2021 showed that only 15% of the population trusted Bitcoin, and 70% of respondents opposed its adoption.

Despite President Nayib Bukele’s media campaign and public relations efforts, the law failed to convince many Salvadorans of its value.

Protesters in San Salvador set alight a Bitcoin ATM which had just been installed by the government.

The protest was called to oppose the El Savador government’s decision to make Bitcoin legal tender. pic.twitter.com/PyW2AWbkiw

— Radical Graffiti (@GraffitiRadical) September 19, 2021

While the international crypto community lauded the El Salvadoran law, the residents of the country protested the law on the streets, and many in the financial world criticized the legislation’s flaws.

One key issue was that many merchants across the country were not equipped to accept Bitcoin, and the law did not address this gap.

Furthermore, a large portion of the population lacked bank accounts, and many businesses still only accepted cash payments. Many merchants were also reluctant to accept Bitcoin due to its volatility, fearing that its fluctuating value could lead to losses.

What are the results of the El Salvador Bitcoin experiment?

The nearly four-year period during which Bitcoin was legal tender in El Salvador has yielded mostly negative results, though there are a few positives to note.

On the positive side, the 2021 Bitcoin adoption helped expose more people to cryptocurrencies. A measurable outcome was the boom in tourism. The announcement of Bitcoin’s adoption piqued international interest, leading to a 20% increase in tourist arrivals in 2024 compared to 2023, with growth also seen in previous years.

However, the broader impact has been largely negative. Bitcoin failed to serve as a hedge against inflation in El Salvador. Issues such as its extreme volatility and technical difficulties with the Chivo wallet are often cited as reasons for the public’s reluctance to use Bitcoin.

Additionally, multiple hacking incidents involving the Chivo wallet further eroded trust in the cryptocurrency, leading to its limited use.

The Bitcoin law also fell short of significantly improving financial inclusion. In 2021, approximately 70% of Salvadorans were unbanked, and an even larger percentage had never used Bitcoin.

In fact, most people in the country largely ignored the digital currency. By 2024, a report from The Central American Group indicated that 92% of Salvadorans did not use Bitcoin for transactions.

While Bitcoin was intended to facilitate cross-border payments, it had little impact in this regard. In 2023, only 1.3% of remittances were made using Bitcoin. A 2022 survey also revealed that 86% of local businesses had no Bitcoin transactions, and 91.7% of respondents said Bitcoin adoption had not affected them. Only 3.6% reported an improvement in sales.

One of the key flaws in the Bitcoin adoption strategy was the timing. The law was enacted in 2021, a year following a major crypto rally fueled by Bitcoin’s halving.

Historically, bull markets are followed by downturns, and the law was passed just before another crypto winter began. The sharp Bitcoin crash in 2022 only served to further discourage Salvadorans from using the currency.

How did the El Salvador Bitcoin experiment end?

Since 2022, the International Monetary Fund has urged El Salvador to amend its Bitcoin law. On January 30, 2025, the Salvadoran Congress took action, agreeing to revise the law in exchange for a $1.4 billion loan from the IMF.

One key condition for securing the loan was the removal of Bitcoin’s legal tender status in the country. The loan agreement stipulates that “public sector engagement in Bitcoin-related economic activities, transactions, and purchases will be limited.”

While reports suggest that Bitcoin will remain legal for trade among Salvadorans, it will no longer be accepted for taxes or other government payments, and businesses will have the right to refuse Bitcoin payments.

The requirement for all businesses to accept Bitcoin had faced stark criticism due to the BTC’s volatility and the public’s limited understanding of digital currencies. The new legislative reform also addresses these concerns by giving businesses the option to choose whether or not to accept Bitcoin

However, the full scope of these restrictions is yet to be fully determined, and further details are expected soon.

Good morning!

We are now in DAY FIVE since El Salvador rescinded Bitcoin as legal tender, at the request of the IMF

There continues to be a lot of misunderstanding about what happened on Wednesday, so it might be worth giving a brief overview

In 2021 El Salvador made history… pic.twitter.com/s6td9ju0kA

— John Dennehy (@jdennehy_writes) February 3, 2025

The IMF loan will be disbursed over a period of 40 months, meaning these restrictions will be enforced over a three-year span, potentially leading to a long-term decline in Bitcoin’s role in the country.

Despite the shift in policy to secure the IMF loan, El Salvador’s government appears to maintain its pro-crypto stance. On Feb. 4, El Salvador’s Bitcoin Office reported purchasing a total of 12 BTC through two separate transactions.

The first acquisition involved 11 BTC, purchased for approximately $1.1 million, at an average price of $101,816 per Bitcoin. The second purchase added 1 BTC at a price of $99,114, just hours later.

These recent acquisitions bring the country’s total Bitcoin reserves to 6,068 BTC, valued at over $592 million at the time of writing. El Salvador has continued to accumulate Bitcoin steadily, having added 60 BTC over the past month alone.

Source link

You may like

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Bitcoin

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Published

14 hours agoon

March 27, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A prominent crypto pundit has outlined a compelling case for the Bitcoin price outlook, predicting a surge to a target as high as $260,000 this bull cycle. However, a critical invalidation level stands in the way of this bullish scenario, threatening Bitcoin’s projected rally if breached.

On March 26, Gert van Lagen, a well-known crypto analyst on the X social media platform, predicted that the Bitcoin price could hit a bullish target between $200,000 and $300,000. The analyst’s chart suggests that Bitcoin’s price action in the past few years has closely followed a classic market cycle structure, moving through the Accumulation, Redistribution, Re-accumulation, and Distribution phases.

Bitcoin Price Eyes New ATH Above $260,000

Related Reading

After consolidating for seven months in mid-2023 – early 2024, Bitcoin formed a range, allowing the market to absorb supply before another price breakout. Notably, this trend continued in 2025, with BTC breaking out of a seven-month re-accumulation phase.

Based on the trajectory of Lagen’s price chart, Bitcoin’s next leg up is a sharp rise to $240,000, followed by a brief correction before rallying to a price peak between $290,000 and $300,000. After hitting this ATH, the analyst predicts that Bitcoin will decline and undergo a period of choppy trading, experiencing price fluctuations between $220,000 and $260,000.

Interestingly, Bitcoin’s projected rise to an ATH and the following sideways trading are expected to occur during its distribution phase, which is typically characterized by increased sell-offs and market volatility. Once BTC experiences a final surge to $260,000, Lagen predicts a price crash toward $148,000 – $136,000, marking the possible end of the bull rally and the start of the bear market.

Key Invalidation Level Threatening BTC’s Rally

Lagen’s optimistic price forecast for Bitcoin is being threatened by a key invalidation level, which could halt the cryptocurrency’s potential surge to $200,000 – $300,000. Although Bitcoin’s bullish structure remains intact, the analyst warns that a weekly close below the 40-week LSMA would invalidate its breakout.

Related Reading

As of writing, the Bitcoin price is consolidating above this key invalidation level at $73,900. As long as it holds above this level, Lagen believes that its bullish trajectory will be sustained. However, a drop below $73,900, which already represents a 15% decline from BTC’s current market price, could postpone the projected surge or cancel it altogether.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

Bitcoin

Bitcoin faces 70% odds of another drop as April tariff fears shake markets, Nansen says

Published

18 hours agoon

March 27, 2025By

admin

As the risk of tariff-related uncertainty persists into the second quarter, the crypto market could face another dip following the recent correction in March, analysts at Nansen say.

As the industry heads into April, Bitcoin (BTC) and the wider crypto market could be staring down another dip as uncertainty surrounding tariffs and U.S. trade policy might cause further volatility.

According to Nansen’s analysts, there’s a chance that the market may face another correction in the weeks after April 2. In fact, the researchers believe there’s a 70% likelihood that another price dip will occur after this date.

President Donald Trump had earlier promised to roll out new tariffs on April 2, calling it a key moment for the economy just weeks after the last round shook up markets and sparked recession worries.

In a recent interview with crypto.news, Aurelie Barthere, principal research analyst at Nansen, shared her outlook on the market, stating that after a brief correction following April 2, she expects the market to stabilize and pave the way for future growth.

“In my main scenario, 70% subjective likelihood, I expect another leg down in crypto prices after April 2 after we reached a local bottom in mid-March. After this second correction, I expect we will be bottoming for the rest of the year (continuation of the bull market and revisit of the ATHs for BTC).”

Aurelie Barthere

However, it’s not all doom and gloom for the crypto market. While another dip isn’t ruled out, Barthere suggests that after that correction, Bitcoin could rebound, benefiting from a supportive macro environment, including the growing adoption of crypto in the U.S. and a lack of recession signals. Still, Barthere remains cautious as for the remaining 30% “it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto,” she said.

“For the remaining 30%: it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto (in case of a recession, which is not my base case, I think the U.S. is just slowing from 3% to 1.5-2% growth).”

Aurelie Barthere

Uncertainty may last well into Q2

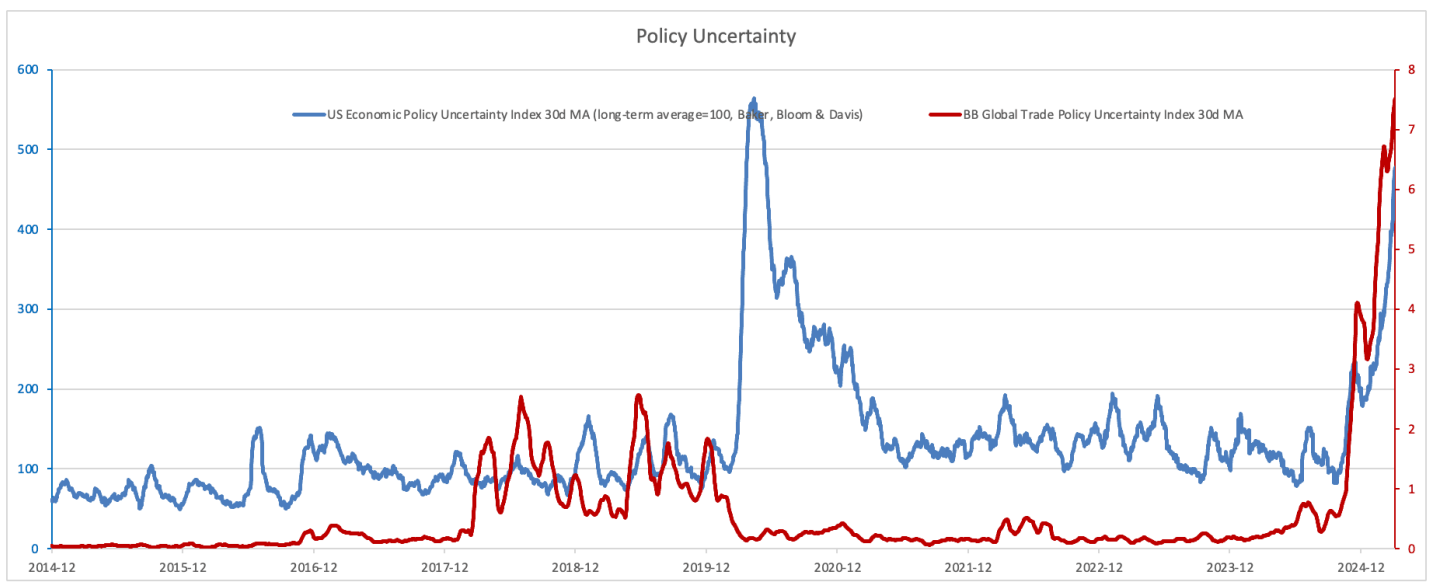

The tariff situation has been a significant driver of market volatility, with the U.S. policy uncertainty index reaching new highs. Trade discussions have become a key source of investor anxiety, but Nansen believes that uncertainty could peak soon.

As Treasury Secretary Bessent recently noted, many of the U.S. trading partners are already negotiating to lower their own trade barriers, which has helped to calm some fears. Even Trump recently hinted at potential tariff “exemptions” in certain circumstances. But as Barthere pointed out, while these talks may result in long-term growth benefits for the U.S., the lingering uncertainty may last well into Q2.

“Right now, I think that we are experiencing corrections within a crypto bull market. Why I see this as a bull market still: 1) Ongoing progress on crypto regulation and crypto institutionalization in the U.S., and 2) U.S. real growth has slowed but is not flashing ‘recession.’ Of course, this is my only main scenario, and I will continue to watch data and markets for signs that this is the correct reading.”

Aurelie Barthere

As Barthere put it, there’s a “50/50 chance that we’ve passed the peak of trade policy uncertainty,” adding that the true impact of these tariff negotiations might not be fully clear until mid-year. “We still see this peak uncertainty as more likely between April and June, especially with the start of U.S. tax cut package discussions,” she wrote in the research report.

The uncertainty, according to Nansen’s research, could trigger another short-term correction in both Bitcoin and U.S. equities.

No evidence of recession

Still, there’s reason for optimism. The report mentions that technicals are showing encouraging signs. “The dip is being bought, for BTC and for U.S. equities,” Barthere says, adding that spot Bitcoin ETFs recorded a “seven-day streak of net inflows, a first since crypto prices peaked.”

One way or the other, it’s clear that the market remains cautious. A lot of people are questioning whether the crypto bull run is still going strong or if we’re getting close to a peak. If history is any indication, times of economic uncertainty have often lined up with market downturns, making investors even more cautious.

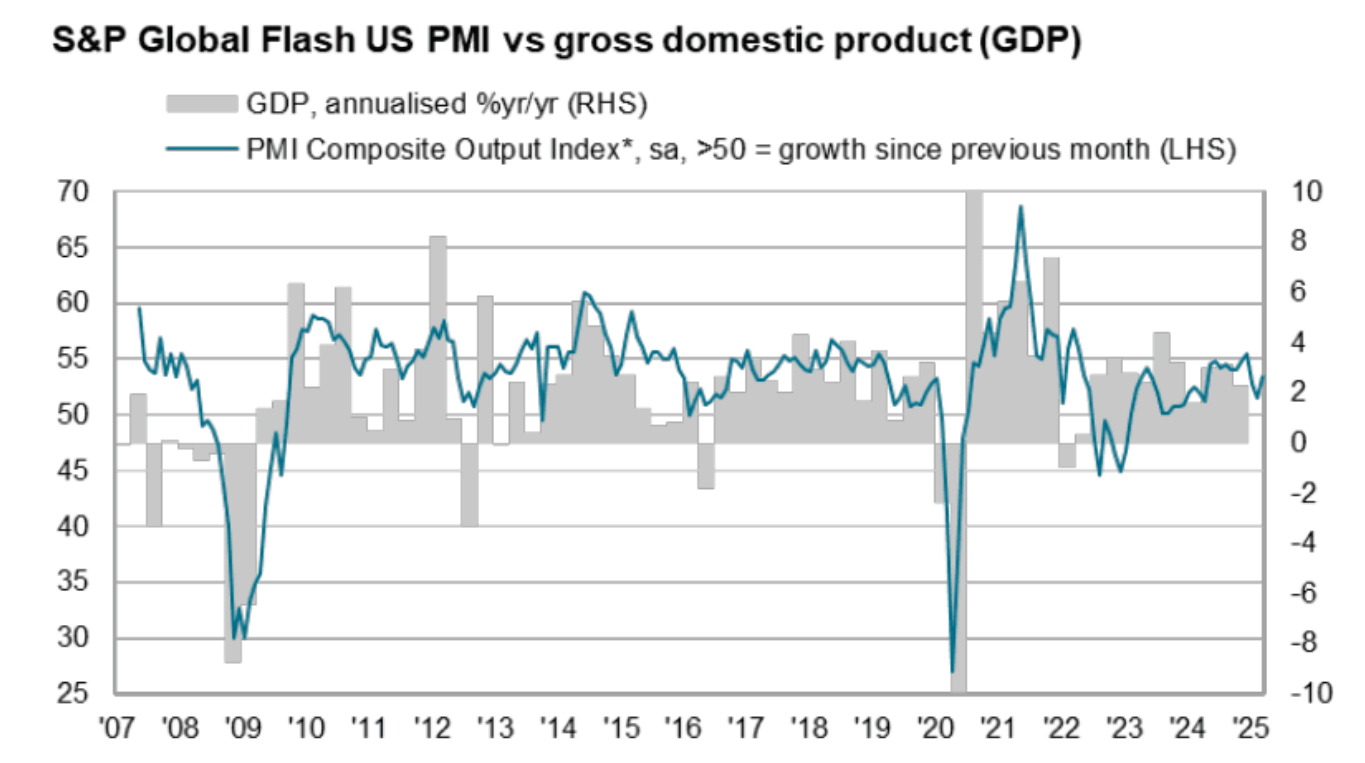

After market sentiment hit extreme fear last week, with some investment banks raising the U.S. recession probability to 40% this year, hard economic data has eased these concerns. The latest U.S. March flash PMI report shows a 53.5 score, the highest in three months, suggesting a 1.9% annual growth rate. However, the growth for the whole quarter is lower at 1.5% due to weaker data in January and February.

Barthere emphasized that so far, there’s no hard evidence of a recession as “most of the data weakness has been in sentiment indicators, while hard economic data has held up.” She added that “there is no evidence of recession at this stage, so no evidence that we have transitioned to a bear market.”

While the coming months may bring more ups and downs, Nansen’s report suggests that the overall bull market is still in play. As Barthere puts it, the market is “likely to see a correction, but then we’ll bottom out for the rest of the year and head towards new highs.”

Source link

Bitcoin

GameStop’s Bitcoin Move Looks Bold—But It Might Be Brilliant

Published

24 hours agoon

March 27, 2025By

admin

This week, GameStop quietly updated its investment policy to include Bitcoin as a treasury reserve asset. With approximately $4.78 billion in cash—nearly 37% of its $12.9 billion market cap—this move marks more than just a diversification of reserves.

JUST IN: @GameStop updates its investment policy to add #Bitcoin as a treasury reserve asset.

The company holds ~40% of its $11B market cap in cash reserves—that’s $4.62 BILLION of capital looking for a new home. pic.twitter.com/o62rrdwpKo

— Bitcoin For Corporations (@BitcoinForCorps) March 25, 2025

It’s a signal that corporate treasury strategy is evolving. That excess cash on the balance sheet can—and perhaps should—be more than idle. And that new asset classes are gaining legitimacy in the boardroom, not just on message boards. GameStop’s move may not be typical. But it is highly strategic—and increasingly relevant for CFOs evaluating how to preserve capital and unlock value in a shifting macro landscape. For companies with material cash holdings, the erosion of purchasing power is no longer theoretical—it’s measurable. Over the past decade, the U.S. dollar has declined in real terms by more than 25%, driven by inflation, expansionary monetary policy, and global fiscal uncertainty. Bitcoin presents a compelling counterweight to this degradation, particularly for balance sheets with the flexibility to tolerate mark-to-market volatility in pursuit of long-term strategic payoff. Consider its defining characteristics: For CFOs thinking in 3-, 5-, or 10-year increments, the case for allocating even a small portion of excess cash to Bitcoin is no longer fringe—it’s prudent exploration. Until recently, many finance teams ruled out Bitcoin simply due to unfavorable accounting treatment. Under legacy GAAP standards, Bitcoin had to be impaired when its price dropped, but could not be revalued when it recovered—an asymmetric model that distorted true economic value and discouraged adoption. In late 2024, that barrier was removed. The Financial Accounting Standards Board (FASB) approved new rules that now allow companies to measure Bitcoin at fair market value. Beginning in 2025, companies can: This change addresses one of the most common objections from CFOs and audit committees alike. It brings Bitcoin into compliance with modern reporting standards—making it viable not just for speculation, but for responsible treasury management. Every company has a unique capital structure, investor base, and operational profile. GameStop’s decision to allocate to Bitcoin wasn’t just bold—it was structurally appropriate. This doesn’t mean Bitcoin is a fit for every public company. But for those with excess reserves and a forward-looking treasury mindset, it deserves serious consideration. GameStop’s move is part of a broader rethinking of the traditional treasury reserve model. For decades, companies stored value in cash, short-term bonds, and dollar-denominated equivalents. But in today’s environment, those instruments may preserve nominal value while degrading purchasing power. Bitcoin introduces an alternative—and the macro backdrop is increasingly supportive. These tailwinds create space for CFOs to begin allocating conservatively—without needing to commit to a radical overhaul of reserve strategy. GameStop’s move didn’t come with a flashy press conference or social media fanfare. It came through a formal policy update—exactly how strategic treasury decisions are typically made. The signal it sends is simple but important: “We believe excess capital should be protected—and positioned for asymmetric upside.” Bitcoin is not a cure-all. But it is now, for the first time, auditable, liquid, and institutionally viable. For CFOs with flexibility and foresight, exploring Bitcoin is no longer about being first—it’s about preparing for what’s next. Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities. Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025 Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist Aptos Leverages Chainlink To Enhance Scalability and Data Access Bitcoin Could Rally to $80,000 on the Eve of US Elections Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals Crypto’s Big Trump Gamble Is Risky Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500xWhy Bitcoin—and Why Now?

Accounting Clarity Unlocks Strategic Action

Why GameStop Was a Natural Fit

The Bigger Picture: What It Means for Other Companies

A Quiet Signal to the Market

Source link

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

$16.5B in Bitcoin options expire on Friday — Will BTC price soar above $90K?

$5,000,000,000,000 Asset Manager Fidelity To Launch a USD-Pegged Stablecoin: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending