Arthur Hayes

Era of US Treasuries and Stocks As Global Reserve Assets Now Over As Gold and Bitcoin Take Over: Arthur Hayes

Published

1 week agoon

By

admin

BitMEX founder and crypto investor Arthur Hayes says gold and Bitcoin (BTC) are effectively replacing US Treasuries and equities as the predominant global reserve assets.

In a post on the social media platform X, Hayes says that President Trump was partially elected by Americans who feel that they didn’t share in the alleged “prosperity” stemming from going off the gold standard in 1971.

Hayes says that if the White House follows through on reducing its debt and current account deficit, then other countries will be forced to finance their economies by selling their US stocks and bonds, creating a permanent change in the global financial order since finance ministers around the world won’t take a chance that Trump will change his mind.

“THE END: Of US Treasuries and, to a lesser extent, US stocks as the global reserve asset. If the US current account deficit is eliminated, then foreigners do not have dollars to buy bonds and stocks. If foreigners have to juice up their own nations’ economies, they will sell what they own, US bonds and stocks, to fund their nation-first policies.”

The crypto investor also notes that he believes gold and Bitcoin will emerge as the winners of a shifting global financial order.

“THE RETURN:

Of gold as the neutral reserve asset. The dollar will still be the reserve currency, but nations will hold reserves in gold to settle global trade. Trump hinted at this because gold is tariff-exempt! Gold must flow freely and cheaply in the new world monetary order.

A lot of those who had it good are in the denial stage, and share a delusion that somehow things will return to ‘normal’…

For those who want to adapt to a return to pre-1971 trade relationships, buy gold, gold miners and BTC.”

Hayes also suggests that the Trump-induced economic shockwaves may have finally broken the correlation between BTC and the Nasdaq.

“BTC hodlers need to learn to love tariffs, maybe we finally broke the correlation with Nasdaq, and can move onto the purest form of a fiat liquidity smoke alarm.”

At time of writing, BTC is trading at $83,322.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

24/7 Cryptocurrency News

Arthur Hayes Predicts 70% Bitcoin Dominance as BTC Whales Hit Peak Accumulation

Published

6 days agoon

April 7, 2025By

admin

Bitcoin bull and former BitMEX CEO Arthur Hayes has shared that Bitcoin’s dominance in the cryptocurrency market will continue to rise.

Hayes revealed in a recent tweet that he has been avoiding altcoin investments despite their decreasing prices.

Arthur Hayes Predicts Bitcoin Dominance Increase

Arthur Hayes has taken a clear stance on the current market situation. He is actively adding to his Bitcoin position while avoiding altcoin investments. Hayes also spoke about a potential interest rate cut in the U.S. and explained how it could happen in one of his recent tweets.

In his recent tweet, the former BitMEX CEO stated: “Been nibbling on $BTC all day, and shall continue. Shitcoins are getting in our strike zone but I think #bitcoin dominance keeps zooming towards 70%.”

Been nibbling on $BTC all day, and shall continue. Shitcoins are getting in our strike zone but I think #bitcoin dominance keeps zooming towards 70%. So we are not gorging at the shitcoin supermarket. Remember, money printing is the only answer they have.

— Arthur Hayes (@CryptoHayes) April 7, 2025

Arthur Hayes specifically pointed to monetary policy as the driving factor behind his bullish Bitcoin outlook. He added: “So we are not gorging at the shitcoin supermarket. Remember, money printing is the only answer they have.” This comment suggests Hayes believes central bank policies will continue to favor Bitcoin as a hedge against inflation and currency devaluation.

The 70% dominance target is a substantial increase from Bitcoin’s current market share. Such a shift would imply major capital flows from altcoins back into Bitcoin.

Whale Accumulation Reaches Peak Levels

On-chain analytics firm Glassnode has identified a pattern of Bitcoin accumulation among the largest holders. According to their data, Bitcoin whales holding more than 10,000 BTC reached a nearly perfect accumulation score of approximately 1.0 at the month’s turn. This means that there is intense buying activity over a 15-day period.

Whales holding >10K $BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month, reflecting intense 15-day buying. The score has since eased to ~0.65, still signaling steady accumulation.

Meanwhile, cohorts from <1 $BTC up to 100 $BTC have intensified their… https://t.co/cEo3F7Paid pic.twitter.com/7udA7G8nSM— glassnode (@glassnode) April 7, 2025

While this peak accumulation score has since moderated to around 0.65, it still shows continued steady buying from these major market participants. This level of whale accumulation stands in stark contrast to the behavior of smaller Bitcoin holders.

Glassnode noted: “Meanwhile, cohorts from <1 $BTC up to 100 $BTC have intensified their distribution, all trending toward 0.1–0.2. A clear and widening divergence between small and large holders.”

This difference in behavior between large and small holders often precedes major market movements. Historically, periods where whales accumulate while retail sells have preceded bullish phases in the Bitcoin market cycle.

Bitcoin Establishes support at $74,000

Bitcoin price appears to have established a support level around $74,000, according to data shared by Glassnode. Their analysis comes at a time when Bitcoin and altcoins have lost double-digit value in the last 24 hours.

The data shows this price point aligns with “the first major supply cluster below $80K – over 50K $BTC at $74.2K.” This supply zone is primarily composed of investors who were active in the market for approximately five months.

The strength of this support level will be important for Bitcoin’s short-term price action as the market moves through its current volatility. If this support holds, it could be a foundation for a potential recovery toward previous highs.

OKX partner Ted has highlighted a key technical level that could decide Bitcoin’s next directional move. “BTC is trying to reclaim the weekly 50-EMA level. This has acted as a bull/bear line for BTC,” Ted noted on X.

$BTC is trying to reclaim the weekly 50-EMA level.

This has acted as a bull/bear line for BTC.

If BTC fails to reclaim it, expect a correction towards $69K-$70K (2021 highs), and even the $67K (Saylor average entry) level could be retested.

In case BTC reclaims this level, a… pic.twitter.com/CtsyZ7q3FH

— Ted (@TedPillows) April 7, 2025

According to his analysis, failure to reclaim this moving average could trigger further downside. He mentioned potential correction targets at “$69K-$70K (2021 highs) and even the $67K (Saylor average entry) level.” Conversely, successfully reclaiming the 50-EMA could spark a “relief rally.”

Ted’s analysis also comes at a time when the crypto liquidations breached $600 million and Bitcoin fell below the important $80,000 level.

Vignesh Karunanidhi

Vignesh Karunanidhi is a seasoned crypto journalist with nearly 7 years of experience in the cryptocurrency industry. He has contributed to numerous publications, including WatcherGuru, BeInCrypto, Milkroad, and authored over 10,000 articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Arthur Hayes

President Trump Pardons Arthur Hayes, 3 Other BitMEX Co-Founders and Employee

Published

2 weeks agoon

March 29, 2025By

admin

Arthur Hayes, the former CEO of crypto exchange BitMEX, has been granted a pardon by U.S. President Donald Trump, a White House official confirmed Friday.

Trump also pardoned Hayes’ co-founders at BitMEX, Samuel Reed and Benjamin Delo, as well as senior employee Greg Dwyer and BitMEX’s operating entity, HDR Global Trading, a BitMEX spokesperson said. CNBC first reported the pardons, which the White House said were signed on Thursday.

In 2020, the U.S. Department of Justice (DOJ) brought charges against BitMEX, its three co-founders, and its first employee, Dwyer, accusing them of violating the Bank Secrecy Act (BSA). Prosecutors alleged BitMEX advertised itself as a place where customers could use its platform virtually anonymously, without providing basic know-your-customer (KYC) information. All four individuals eventually pleaded guilty and were sentenced to fines and probationary sentences. The exchange itself pleaded guilty to violating the BSA last year.

Hayes faced two years of probation; Delo spent 30 months on probation and Reed 18 months on probation. Dwyer got 12 months of probation.

In a statement, Delo said he and his colleagues had been “wrongfully targeted.”

“This full and unconditional pardon by President Trump is a vindication of the position we have always held — that BitMEX, my co-founders and I should never have been charged with a criminal offense through an obscure, antiquated law,” he said. “As the most successful crypto exchange of its kind, we were wrongfully made to serve as an example, sacrificed for political reasons and used to send inconsistent regulatory signals. I’m sincerely grateful to the President for granting this pardon to me and my co-founders.”

Hayes just said “thank you” on X (formerly known as Twitter).

The Commodity Futures Trading Commission ordered BitMEX to pay $100 million for violating the Commodity Exchange Act and other CFTC regulations in 2021, separately from its DOJ settlements.

Attorneys representing Hayes, Delo and Reed did not immediately return requests for comment.

The reported pardons come just a day after Trump granted a pardon to Trevor Milton, the former CEO of Nikola Motors who was previously convicted of fraud in 2022. In January, Trump made good on long-standing promises to pardon Silk Road creator Ross Ulbricht, who was 11 years into a draconian sentence of double life in prison plus 40 years, with no possibility of parole. Since Ulbricht’s pardon, former FTX CEO and convicted fraudster Sam Bankman-Fried has been angling for his own pardon, attempting to curry favor with the Trump administration and appearing on Tucker Carlson in an unauthorized jailhouse interview that landed him in solitary confinement.

Former Binance CEO Changpeng “CZ” Zhao, who pleaded guilty to the same charge as Hayes and served four months in prison last year — making him not only the richest person to ever go to prison in the U.S., but also the only person to ever serve jail time for violating the BSA — has denied reports that he, too, is seeking a pardon from President Trump.

But, Zhao admitted in a recent X post that “no felon would mind a pardon, especially being the only one in US history who was ever sentenced to prison for a single BSA charge.”

UPDATE (March 28, 2025, 20:40 UTC): Adds Delo statement and White House official.

UPDATE (March 28, 21:06 UTC): Adds Hayes.

UPDATE (March 29, 04:15 UTC): Adds Dwyer and HDR.

Source link

Arthur Hayes

Bitcoin Price Risks Further Crash As S&P Monthly LMACD Turns Bearish, Why Bulls Have Only 20 Days

Published

1 month agoon

March 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

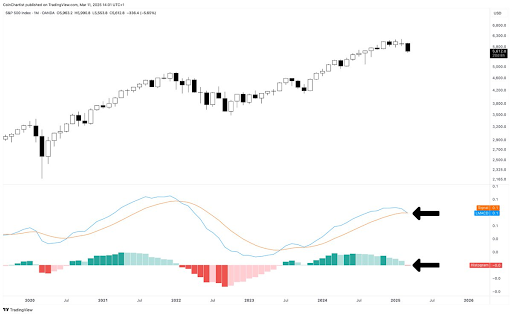

Crypto analyst Tony Severino has warned that the Bitcoin price risks a further crash. This came as he revealed a critical technical indicator, which has turned bearish for the flagship crypto, although he noted that BTC bulls can still invalidate this current bearish setup.

Bitcoin Price At Risk Of Further Crash As S&P Monthly LMACD Turns Bearish

In an X post, Severino indicated that the Bitcoin price could crash further as the S&P 500 monthly LMACD has begun to cross bearish and the histogram has turned red. This development is significant as IntoTheBlock data shows that BTC and the stock market still have a strong positive price correlation.

Related Reading

The crypto analyst stated that BTC bulls can turn this bearish setup for the Bitcoin price in the next 20 days, as diverging would lead to a bullish setup instead. However, the Bulls’ failure to turn this around for Bitcoin could lead to a massive decline for the flagship crypto, worse than it has already witnessed.

Severino stated that a confirmation of this bearish setup at the end of the month could kick off a bear market or Black Swan type event similar to what happened when the last two crossovers occurred. It is worth mentioning that BTC has already crashed to as low as $76,000 recently, sparking concerns that the bear market might already be here.

However, crypto experts such as BitMEX co-founder Arthur Hayes have suggested that the bull market is still well in play for the Bitcoin price. Hayes noted that BTC has corrected around 30% from its current all-time high (ATH), which he remarked is normal in a bull run. The BitMEX founder predicts that the flagship crypto will rebound once the US Federal Reserve begins to ease its monetary policies.

BTC Still Looking Good Despite Recent Crash

Crypto analyst Kevin Capital has suggested that the Bitcoin price still looks good despite the recent crash. In his latest market update, he stated that BTC remains the best-looking chart and that everything is going according to plan for the flagship crypto. The analyst predicts that Bitcoin could still come down and test the range between $70,000 and $75,000, which he claims would still be completely fine.

Related Reading

Kevin Capital remarked that the Bitcoin price could remain afloat if it holds a key market structure and the 3-day MACD resets. He added that some decent macro data could help the flagship crypto stay above key support levels. The US CPI data will be released today, which could provide some relief for the market if it shows that inflation is slowing. The analyst is confident that one good inflation report and the FOMC can help turn the tides.

At the time of writing, the Bitcoin price is trading at around $81,860, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: