CryptoQuant

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Published

3 months agoon

By

admin

Amid a general crypto market price fall in the past week, Ethereum (ETH) recorded a price correction of over 19.5% finding support at a local bottom of $3,100. Since then, the prominent altcoin has only shown slight resilience rising by over 5% in the past two days. However, recent data on wallet activity provides much cause to be bullish on Ethereum’s long-term future.

Ethereum HODL Addresses Increase Supply Dominance To 16%

In a recent QuickTake post, CryptoQuant analyst MAC_D shared some positive insights on the Ethereum market.

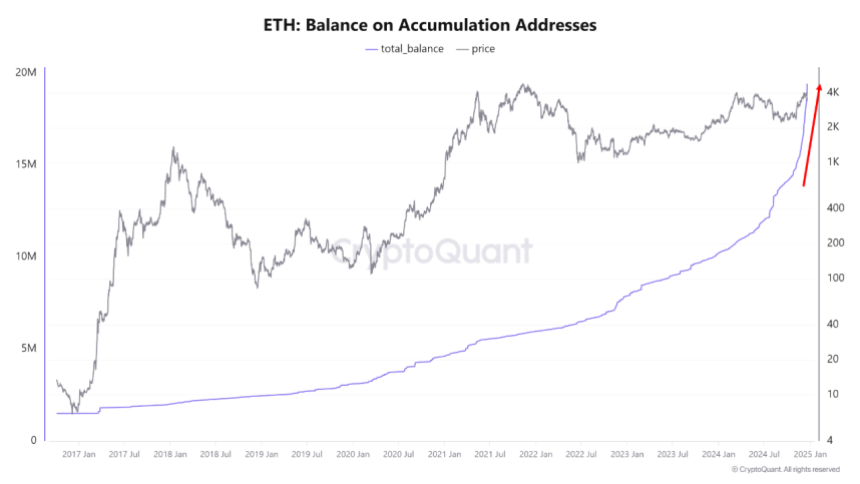

The crypto market expert reports that the balance of Ethereum Accumulation Addresses has surged by a remarkable 60% from August to December. During this time, these HODL wallets have boosted their portion of ETH supply from 10% to 16% i.e. 19.4 million ETH of 120 million ETH.

To explain, the Accumulation Addresses are wallets that hold Ethereum but rarely move or sell their holdings. They are considered a measure of long-term investment and confidence.

According to MAC_D, the rapid increase in these Ethereum HODL wallets’ holdings is a new development absent from previous bull cycles. The analyst attributed this massive accumulation rate to investors’ bullish expectations of the incoming Donald Trump administration in the US.

These expectations include more favorable regulations on the DeFi industry which represents a major sector of the Ethereum ecosystem. Therefore, regardless of Ethereum’s current price movement, these long-holding wallets are likely to keep increasing their holdings in anticipation of future price growth.

In addition, MAC_D emphasizes the importance of these Accumulation Addresses in that the price of Ethereum has never slipped below their realized price. Therefore, a continuous purchase by these wallets provides a high potential for a long-term price gain.

What’s Next For ETH?

In regards to Ethereum’s immediate movement, MAC_D warns that macroeconomic factors are likely to exert a stronger influence on ETH’s price in the short-term as illustrated by the recent price crash induced by potential reduced interest rate cuts in 2025.

At the time of writing, the altcoin trades at $3,352 following a 3.07% decline in the past 24 hours. In tandem, ETH’s daily trading volume is down by 53.25% and valued at $31.15 billion.

Following recent price falls, Ethereum also presents a negative performance on larger charts with losses of 14.74% and 1.05% in the past seven and thirty days, respectively. On a positive note, the asset’s price remains far above its initial price point ($2,397) at the start of the post-US elections price rally, indicating that long-term sentiment remains positive.

With a market cap of $401 billion, Ethereum continues to rank as the second-largest cryptocurrency and largest altcoin in the digital asset market.

Source link

You may like

Toncoin Takes A Hit With 12% Correction After Failing To Break $4.34, More Pain?

Bitcoin sentiment falls to 2023 low, but ‘risk on’ environment may emerge to spark BTC price rally

Crypto Trader Says Dogecoin Is at a Critical ‘Make-or-Break’ Level, Updates Outlook on Solana and Avalanche

Bitcoin Covenants: CHECKSIGFROMSTACK (BIP 348)

Illinois State Senator’s Bill Seeks to Claw Back $163 Million Lost to Crypto Fraud

Here’s why Bitcoin, altcoins, and the stock market continued falling on Friday

Bitcoin

Bitcoin Price Struggling but Short-Term Holders Might Be Setting the Stage for $150K

Published

2 days agoon

April 2, 2025By

admin

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

Source link

Bitcoin

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Published

2 weeks agoon

March 22, 2025By

admin

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies.

Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking” is a rather simple way to describe analyzing and interpreting various price patterns and chart formations. However, it appears that is not Opeyemi’s favorite part – in fact, far from it.

Being able to connect what happens on a price chart to on-chain movements and blockchain activities is what keeps Opeyemi ticking. “This emphasizes the intricacies of blockchain technology and the cryptocurrency market,” he would say. Most importantly, Opeyemi thinks of any market insights as the gospel, while recognizing that he is only a messenger.

When he is not clicking away at his keyboard, Opeyemi is most definitely listening to music, playing games, reading a book, or scrolling through X. He likes to think he is not loyal to a particular genre of music, which can be true on many days. However, the fast-rising Afrobeats genre is a staple in Opeyemi’s Spotify Daily Mix.

Meanwhile, Opeyemi is a voracious reader who enjoys a wide category of books – ranging from science fiction, fantasy, and historical, to even romance. He believes that authors like George R. R. Martin and J. K.

Rowling are the greatest of all time when it comes to putting pen to paper. Opeyemi believes his reading of the Harry Potter series twice is proof of that.

Indeed, Opeyemi enjoys spending most of his time within the four walls of his home. However, he also sometimes finds solace in the company of his friends at a bar, a restaurant, or even on a stroll. In essence, Opeyemi’s ambivert (haha! been searching for an opportunity to use the word to describe myself) nature makes him a social chameleon who is able to quickly adapt to different settings.

Opeyemi recognizes the need to constantly develop oneself in order to stay afloat in a competitive and ever-evolving market like crypto. For this reason, he is always in learning mode, ready to pick up the slightest lesson from every situation. Opeyemi is efficient and likes to deliver all that is required of him in time – he believes that “whatever is worth doing at all is worth doing well.” Hence, you will always find him striving to be better.

Ultimately, Opeyemi is a good writer and an even better person who is trying to shed light on an exciting world phenomenon – cryptocurrency. He goes to bed every day with a smile of satisfaction on his face, knowing that he has done his bit of the holy assignment – spreading the crypto gospel to the rest of the world.

Source link

Bitcoin

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Published

2 weeks agoon

March 22, 2025By

admin

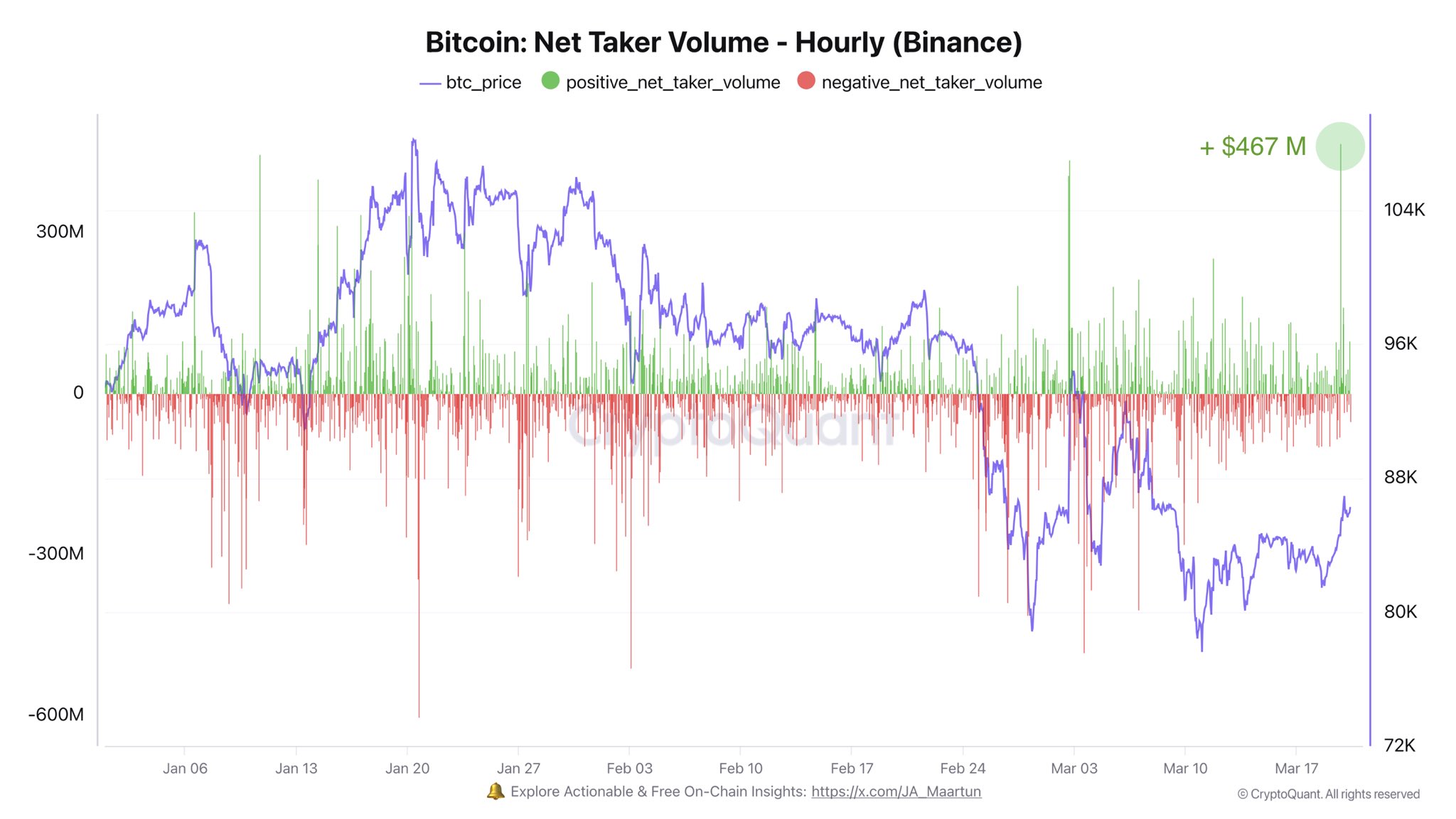

Bitcoin continues to trade just below the $84,000 mark, reflecting a broader slowdown in upward momentum. Despite attempts to reclaim higher levels, the cryptocurrency has remained under the $90,000 mark for over two weeks.

This current range-bound activity comes nearly two months after Bitcoin touched its all-time high in January, indicating a period of uncertainty as traders assess macroeconomic conditions and upcoming Federal Reserve policy decisions.

In the midst of the stagnation from BTC’s price, on-chain data is offering contrasting signals on where the market might be headed next. Analysts have pointed to fluctuations in buying and selling pressure on major exchanges, particularly Binance, as key indicators of short-term market sentiment.

Surge in Binance Net Taker Volume

CryptoQuant analyst Darkfost recently highlighted a notable spike in net taker volume on Binance, the world’s largest centralized crypto exchange. According to Darkfost, net taker volume surged by $467 million in a single hour—marking the highest level recorded in 2025 so far.

This metric, which measures the difference between aggressive market buys and sells, is often used to gauge the immediate sentiment of active traders. A positive value indicates stronger buying activity and has historically signaled short-term bullishness.

Darkfost emphasized that this uptick in taker volume occurred just prior to the recent FOMC meeting, suggesting that some traders may be positioning for favorable policy outcomes.

While the data only reflects an hourly time frame and may not imply long-term directional change, the movement could signal a broader shift in sentiment among active participants, especially given Binance’s influential position in global crypto markets.

Buying pressure from Binance traders might be back.

— Binance is the CeX with the highest trading volume, making it particularly relevant for data analysis. —

The net taker volume is a powerful metric for gauging trader sentiment, as it measures the volume of market buys and… pic.twitter.com/enI1VMAixf

— Darkfost (@Darkfost_Coc) March 20, 2025

Bitcoin Whale Activity Returns as Exchange Ratios Spike

Meanwhile, another CryptoQuant analyst, EgyHash, provided a more cautious interpretation of recent activity. According to his analysis, the Bitcoin Exchange Whale Ratio—defined as the share of total exchange inflows coming from the top 10 largest addresses—has surged to its highest point in over a year.

This ratio is closely monitored because spikes often precede increased selling pressure, especially when large holders move funds to exchanges. While not a definitive indicator of immediate liquidation, the rise in whale-driven deposits suggests that some major players may be preparing for reallocation or profit-taking.

Combined with stagnant price action, this metric implies that Bitcoin’s current price level may be approaching a decision point, where the market direction will be determined by the balance between new demand and potential supply from large holders.

Featured image created with DALL-E, Chart from TradingView

Source link

Toncoin Takes A Hit With 12% Correction After Failing To Break $4.34, More Pain?

Bitcoin sentiment falls to 2023 low, but ‘risk on’ environment may emerge to spark BTC price rally

Crypto Trader Says Dogecoin Is at a Critical ‘Make-or-Break’ Level, Updates Outlook on Solana and Avalanche

Bitcoin Covenants: CHECKSIGFROMSTACK (BIP 348)

Illinois State Senator’s Bill Seeks to Claw Back $163 Million Lost to Crypto Fraud

Here’s why Bitcoin, altcoins, and the stock market continued falling on Friday

Bitcoin Falls Back to $83K, XRP, SOL, DOGE Surrender Gains as China Announces 34% Tariffs on All U.S. Goods

BTC Holds $84K, ATOM & FIL Become Top Gainers

Analysts Eye 20% Breakout If This Level Is Reclaimed

AI and blockchain — A match made in heaven

‘We’re Still in Danger Territory’: Crypto Analyst Unveils Bearish Setup for Bitcoin – Here Are His Targets

Bitcoin Startups Raised Nearly $1.2 Billion

Illinois to End Lawsuit Against Coinbase Over Staking Program: Report

Justin Sun takes legal action against FDUSD issuer

Not a Meme! DePIN Can Take Crypto Mainstream

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x